Centralized FX risk hedging to a base currency in SAP Treasury

Implementing a hedging strategy to hedge against one common currency (the “base” currency) in SAP Treasury may be a daunting task, but in isolating and focusing on the individual building blocks required to bring this strategy to life, the challenge may not be as difficult as first anticipated.

Corporate treasuries have multiple strategic options to consider on how to manage the FX risk positions for which SAP’s standard functionality efficiently supports the activities such as balance sheet hedging and back-to-back economic hedging.

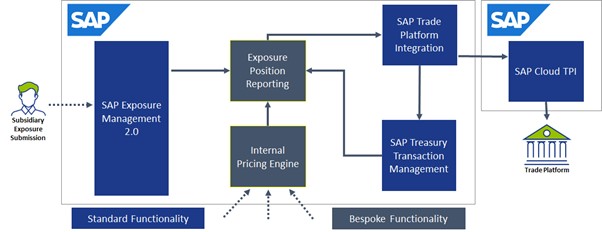

These requirements can be accommodated using applications including “Generate Balance Sheet Exposure Hedge Requests”, and the SAP Hedge Management Cockpit which efficiently joins SAP Exposure Management 2.0, Transaction Management and Hedge Accounting functionality, to create an end to end solution from exposure measurement to hedge relationship activation.

The common trait of these supported strategies is that external hedging is executed using the same currency pair as the underlying exposure currency and target currency. But this is not always the case.

Many multi-national corporations that apply a global centralized approach to FX risk management will choose to prioritize the benefits of natural offsetting of netting exposures over other considerations. One of the techniques frequently used is base currency hedging, where all FX exposures are hedged against one common currency called the “base” currency. This allows the greatest level of position netting where the total risk position is measured and aggregated according to only one dimension– per currency. The organization will then manage these individual currency risk positions as a portfolio and take necessary hedging actions against a single base currency determined by the treasury policy.

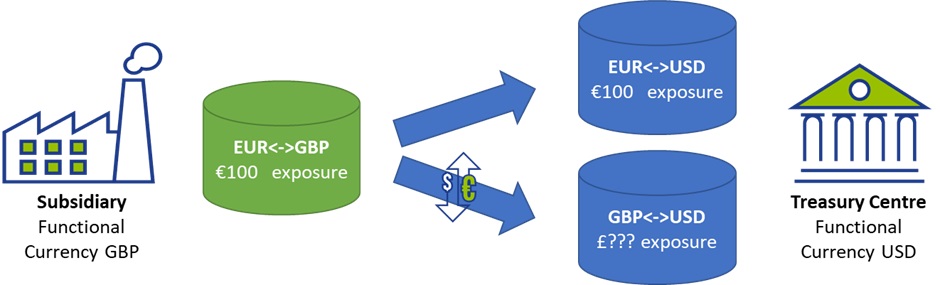

For any exposure that is submitted by a subsidiary to the Treasury Center, there are two currency risk components – the exposure currency and the target urrency. The value of the exposure currency is the “known” value, while the target currency value is “unknown”.

The immediate question that rises from this strategy is: How do we accurately record and estimate the target currency value to be hedged if the value is unknown?

To begin the journey, we first need to collect and then record the exposures into a flexible database where we can further process the data later. Experience tells us that the collection of exposures is normally done outside of SAP in a purpose-built tool, third party tool or simply an excel collection template that is interfaced to SAP. However after exposure collection, the SAP Exposure Management 2.0 functionality is capable of handling even the most advanced exposure attribute categorizations and aggregation, to form the database from which we can calculate our positions.

Importantly at this step, we need record the exposure from the perspective of the subsidiary, recording both the exposure currency and value, but also the target currency in the exposure, which at this point is unknown in value.

Internal price estimation

When we consider that for a centralized FX risk management strategy, the financial tool or contract to transfer the risk from the subsidiary to the Treasury Center is normally made through an internal FX forward or some other variation of it. At the point where both the exposure currency and target currency values are fixed according to the deal rate, we can say that it is this same rate we are to use to determine the forecasted target currency value based on the forecasted exposure currency value.

The method to find the internal dealing rate would be agreed between the subsidiary and Treasury Center and in line with the treasury policy. Examples of internal rate pricing strategies may use different sources of data with each presenting different levels of complexity:

- Spot market rates

- Budget or planning rates

- Achieved external hedge rates from recent external trading

- Other quantitative methods

Along with the question of how to calculate and determine the rate, we also need to address where this rate will be stored for easy access when estimating target currency exposure value. For most cases it may be suitable to use SAP Market Data Management tables but may also require a bespoke database table if a more complex derivation of the rate already calculated is required.

Although the complexity of the rate pricing tool may vary anywhere from picking the spot market rate on the day to calculating more complex values per subsidiary agreement, the objective remains the same – how do we calculate the rate, and where do we store this calculated rate for simple access to determine the position.

Position reporting

With exposures submitted and internal rate pricing calculated, we can now estimate our total positions for each participating currency. This entails both accessing the existing exposure data to find the exposure currency values, but also to estimate the target currency values based on the internal price estimation and fixing for each submitted exposure.

Although the hedging strategy may still vastly differ between different organizations on how they eventually cover off this risk and wish to visualize the position reports, the same fundamental inputs apply, and their hedging strategy will mostly define the layout and summarization level of the data that has already been calculated.

These layouts cannot be achieved through standard SAP reports, however by approaching the challenge as shown above, the report is simply an aggregation of the data already calculated into a preferred layout for the business users.

As a final thought, the external FX trades in place can easily be integrated into the report as well, providing more detail about the live hedged and unhedged open positions, even allowing for automatic integration of trade orders into the SAP Trade Platform Integration (TPI) to hedge the open positions, providing a controlled end to end FX risk management solution with Exposure Submission -> Trade Execution straight through processing.

SAP Trade Platform Integration (TPI)

The SAP TPI solution offers significant opportunities, not only for the base currency hedging approach, but also all other hedging strategies that would benefit from a more controlled and dynamic integration to external trade platforms. This topic deserves greater attention and will be discussed in the next edition of the SAP Treasury newsletter.

Conclusion

At first inspection, it may seem that the SAP TRM offering does not provide much assistance to implementing an efficient base currency hedging process. However, when we focus on these individual requirements listed above, we see that a robust solution can be built with highly effective straight through processing, while still benefiting from largely standard SAP capability.

The key is the knowledge of how these building blocks and foundations of the SAP TRM module can be used most effectively with the bespoke developments on internal pricing calculations and position reporting layouts to create a seamless integration between standard and bespoke activities.