Average Rate FX Forwards and their processing in SAP

Zanders add-on for SAP TRM – An Average Rate FX Forward (ARF) can be a very efficient hedging instrument when the business margin needs to be protected. It allows the buyer to hedge the outright rate in a similar way as with a regular forward. However, as the cash settlement amount is calculated against the average of spot rates observed over an extended period, the volatility of the pay-out is much reduced.

The observation period for the average rate calculation is usually long and can be defined flexibly with daily, weekly or monthly periodicity. Though this type of contract is always settled as non-delivery forward in cash, it is a suitable hedging instrument in certain business scenarios, especially when the underlying FX exposure amount cannot be attributed to a single agreed payment date. In case of currencies and periods with high volatility, ARF reduces the risk of hitting an extreme reading of a spot rate.

Business margin protection

ARF can be a very efficient hedging instrument when the business margin needs to be protected, namely in the following business scenarios:

- Budgeted sales revenue or budgeted costs of goods sold are incurred with reliable regularity and spread evenly in time. This exposure needs to be hedged against the functional currency.

- The business is run in separate books with different functional currencies, FX exposure is determined and hedged against the respective functional currency of these books. Resulting margin can be budgeted with high degree of reliability and stability, is relatively small and needs to be hedged from the currency of the respective business book to the functional currency of the reporting entity.

Increased complexity

Hedging such FX exposure with conventional FX forwards would lead to a very high number of transactions, as well as data on the side of underlying FX exposure determination, resulting in a data flood and high administrative effort. A hedge accounting according the IFRS 9 rules is almost impossible due to high number of hedge relationships to manage. The complexity increases even more if treasury operations are centralized and the FX exposure has to be concentrated via intercompany FX transactions in the group treasury first.

If the ARF instruments are not directly supported by the used treasury management system (TMS), the users have to resort to replicating the single external ARF deal with a series of conventional FX forwards, creating individual FX forwards for each fixation date of the observation period. As the observation periods are usually long (at least 30 days) and rate fixation periodicity is usually daily, this workaround leads to a high count of fictitious deals with relatively small nominal, leading to an administrative burden described above. Moreover, this workaround prevents automated creation of deals via an interface from a trading platform and automated correspondence exchange based on SWIFT MT3xx messages, resulting in a low automation level of treasury operations.

Add-on for SAP TRM

Currently, the ARF instruments are not supported in SAP Treasury and Risk management system (SAP TRM). In order to bridge the gap and to help the centralized treasury organizations to further streamline their operations, Zanders has developed an add-on for SAP TRM to manage the fixing of the average rate over the observation period, as well as to correctly calculate the fair value of the deals with partially fixed average rate.

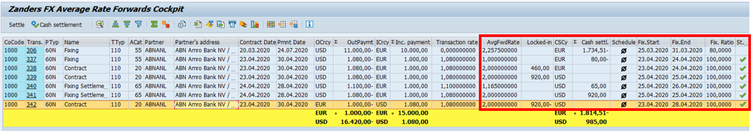

The solution consists of dedicated average rate FX forward collective processing report, covering:

- Particular information related to ARF deals, including start and end of the fixation period, currently fixed average rate, fixed portion (percentage), locked-in result for the fixed portion of the deal in the settlement currency.

- Specific functions needed to manage this type of deals: creation, change, display of rate fixation schedule, as well as creating final fixation of the FX deal, once the average rate is fully calculated through the observation period.

Figure 1 Zanders FX Average Rate Forwards Cockpit and the ARF specific key figures

The solution builds on the standard SAP functionality available for FX deal management, meaning all other proven functionalities are available, such as payments, posting via treasury accounting subledger, correspondence, EMIR reporting, calculation of fair value for month-end evaluation and reporting. Through an enhancement, the solution is fully integrated into market risk, credit risk and, if needed, portfolio analyser too. Therefore, correct mark-to-market is always calculated for both the fixed and unfixed portion of the deal.

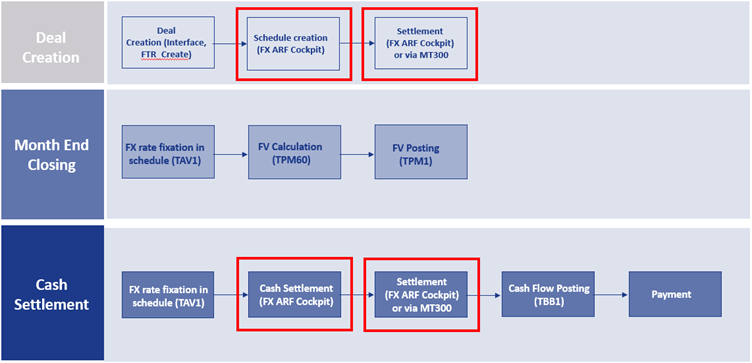

Figure 2 Integration of Zanders ARF solution into SAP Treasury Transaction manager process flow

The solution builds on the standard SAP functionality available for FX deal management, meaning all other proven functionalities are available, such as payments, posting via treasury accounting subledger, correspondence, EMIR reporting, calculation of fair value for month-end evaluation and reporting. Through an enhancement, the solution is fully integrated into market risk, credit risk and, if needed, portfolio analyser too. Therefore, correct mark-to-market is always calculated for both the fixed and unfixed portion of the deal.

Zanders can support you with the integration of ARF forwards into your FX exposure management process. For more information do not hesitate to contact Michal Šárnik.