A Treasury Technology Roadmap to S/4HANA

The need to formulate a treasury technology roadmap for your organization has never been more critical.

This is particularly relevant for large complex organizations that are running SAP. The SAP S/4HANA move is complex and presents great opportunities and challenges. For the treasury within these large complex organizations it does not make sense to wait for the enterprise to formulate a roadmap as then the likelihood of the treasury requirements not being properly prioritized are high.

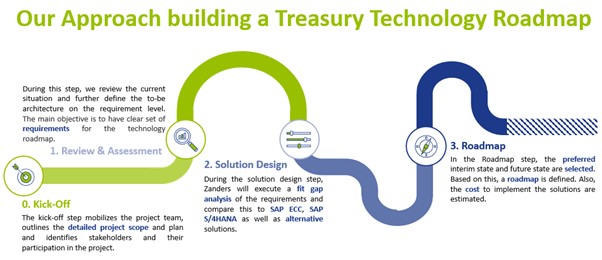

It is in this context that Zanders provides the option to help your organization formulate a treasury technology roadmap. Driven by 27 years of experience we have built a best practice framework for treasury transformation projects. The approach we have formulated for the treasury technology roadmap ensures that we start by focusing efforts on establishing a clear set of requirements for the treasury organization and processes. Here too we have built up a sound catalogue of strategic treasury requirements which are mapped to a solid treasury business process framework, and it is against this foundation that we engage with the treasury organization to ensure we emerge with an accurate view of the specific treasury requirements. In the process we ensure these requirements are categorized according to priority and evaluated relative to current available functionality.

Enablers for core treasury activities

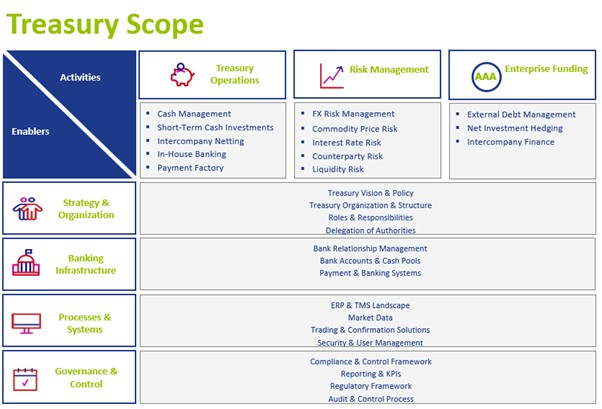

We also establish a clear scope for the roadmap based on the activities to be covered which in effect defines the processes in scope. The Zanders framework uses three core treasury activities being Treasury Operations, Risk Management and Enterprise Funding with the associated 15 underlying sub-processes that support these.

The Zanders framework then has four enablers that support these core treasury activities. These are:

- Strategy and organization

- Banking Infrastructure

- Processes and systems

- Governance and controls

Typically for a treasury technology roadmap engagement, the focus is on the processes and systems enabler, but we will also take into the strategy and organization in formulating the scope of the assessment here the geographic and organizational scope is established and confirmed. For banking infrastructure, the banks, bank accounts and payment type scope is established.

Figure 1: Treasury Roadmap; Driven by 27 years of experience we have built a best practice framework for Treasury Transformation projects. Based on this framework and considering what has been requested by clients, we propose the following approach to build a well-defined Treasury Technology Roadmap.

Figure 2 – Treasury scope; The starting point for kicking off the roadmap is defining the functional scope in line with the three core Treasury activities (Treasury Operations, Risk Management, Enterprise Funding) and the relevant underlying 15 sub-activities.

Fit-gap analysis of requirement

The next step in the process is solution design where we perform a fit-gap analysis of requirement and compare this to the existing and proposed treasury technology platforms. This analysis can be tailored to exclusively focus on SAP treasury solutions or include suitable alternative technology platforms. In addition, with the increase in available add-on solutions in the market this analysis can also be expanded to explore and expose the relevant technology solutions that fit the unique treasury requirements based on the prioritization established.

Where the first step of the process ensured an accurate understanding of the organization’s treasury requirements, this step ensures that the treasury organization is exposed to a focused set of relevant solutions that meet these requirements.

A further important consideration is on which SAP system within the organization the treasury requirements will be implemented. Here the many available deployment options need to be considered and evaluated including S/4 HANA side car options (Cloud or On Premise), deployment in a single central instance and the likes of Central Finance architecture and approach.

Meeting all objectives

Finally, the roadmap step is where the analysis is brought together to settle on relevant alternative options that meet both treasury and the broader enterprise’s strategic long-term objectives. For these viable technology options realistic implementation timeframes are estimated and a framework for total cost of ownership is established. This ensures that the basis for the business case is established and the parameters for the various options are clearly articulated.

In such a way the treasury organization is able to help lead rather than follow at this crucial time and hence ensure that the treasury technology requirements are included in the overall enterprise technology roadmap and a measure of order and clarity is brought into the formulation of the enterprise transformation plans.