Challenges and how to address them

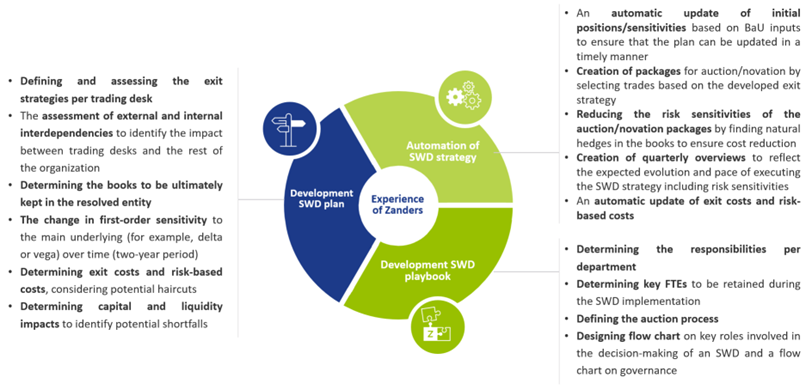

Creating a streamlined process to update the SWD plan

One of the larger challenges is to create a streamlined process that enables an update of all exposures and exit strategies for the entire trading book within five working days, which is a steady-state requirement. Since information is usually gathered from various data sources, it can be difficult to update the SWD plan in a timely manner. Therefore, smart tooling should be developed that can assign exit strategies and priorities to certain types of trades to plan the unwinding in the two-year window.

Winding down complex books

Banks with complex or structured books, with positions falling under level 3 of the IFRS13 accounting standards7, could face difficulties unwinding these positions (from a process or cost perspective). These more complex products are usually less liquid, because inputs required to determine the market value are unobservable (by definition, or for example due to low market activity). Banks should provide evidence that they are aware of this complexity and should be able to come up with a reasonable estimate of the costs of unwinding, for example by using the bid/offer spread (if available) and a haircut.

No access to the OTC markets for hedging purposes

One of the assumptions set by the SRB is that the bank has failed to maintain, establish, or re-establish market confidence. Under this assumption, banks cannot continue using the bilateral OTC markets. Consequently, only listed products can be used for hedging purposes. This could result in imperfect hedges and possibly higher exit costs when selling or auctioning trades (please note that trades are often auctioned in groups, i.e. auction packages are created). Additionally, a bank must show how it expects the exit and risk-based costs to evolve during the solvent wind-down period, taking into consideration the changes in the composition of its trading book. To tackle the above two challenges, banks could find ‘natural’ hedges with offsetting risks in the trading books to reduce the risk sensitivity of auction packages. Packages with lower risks are expected to have lower exit costs. In turn, the bank can calculate the exit and risk-based costs for each package in each quarter of the active wind-down phase.

Measuring the impact on RWAs for market risk

Banks are expected to include the potential impact of winding down their portfolios on sensitivities, costs (exit, risk-based and operational), liquidity and RWAs (for market, credit and operational risks) in the SWD plan. This impact analysis must be presented, at least quarterly, during the two-year wind-down period. To measure the impact on the RWAs for market risk, banks are challenged to add the hedges that they want to use during the resolution period in their system. Subsequently, banks should be able to age their portfolio: i.e. banks need to calculate the impact of maturing, terminating, and auctioning of trades in their trading books during the entire wind-down period. If this functionality is not readily available, banks may need to use an alternative method to determine the impact. A possibility to tackle this challenge is to create ‘test’ books, which include listed/cleared trades that will be used for hedging purposes during the active wind-down period.

Liquidity gaps

Finally, the SWD plan should contain an analysis of the impact on liquidity. As banks are in resolution, major cash shortfalls could occur. A thorough analysis of outflows and inflows is necessary to identify potential future cash flow mismatches. One important assumption is that the bank in resolution will lose its investment grade or experience a downgrade of its credit rating, likely resulting in significant collateral/margin calls and potentially creating liquidity gaps. These gaps need to be identified and explained. Banks could prioritize the auction/novation of trades with credit support annexes (CSAs) that have high collateral requirements to close the CSA and free up capital.

Outlook for the future

Over time, the SRB is likely to amend the guidance on SWD of trading books. The most recent publication date (at the time of writing) is December 2021. We expect that more granular reporting will be required in the future. Additionally, we expect that banks will be required to perform stress testing on their trading books, which may be challenging to incorporate. Nonetheless, no changes to the guidance are expected in 2023.

In conclusion

Creating a solvent wind-down strategy can be very complex and introduce many challenges to banks. A large variety of trading books, interdependencies between trading desks and departments, and a diverse data landscape can all provide difficulties to develop a streamlined process.

The development of a strong SWD plan and playbook can help to tackle these challenges. On top of that, a strong SWD plan also gives a more detailed insight into the activities conducted by the various trading desks as risks and returns of the different trading activities are analyzed. The clear trade-off between risk and return could therefore also be used for strategic decision-making such as:

- Operational efficiency: a more accurate understanding of cost and return may be achieved, as every desk is analyzed during the development of the SWD plan and playbook. This information could help management to remove operational inefficiencies.

- Generating liquidity: as banks are expected to analyze the impact on liquidity during the wind-down period they must also identify ways to cover any potential liquidity gaps. This knowledge may also be useful in case the bank needs to improve their liquidity position in a BaU situation.

- Reducing RWAs: banks are expected to analyze the impact on RWAs when winding-down their trading books. As a result, banks can use the results of the solvent wind-down analysis to strategically reduce their RWA, as the impact on RWA is readily available.