A guide to optimize SAP Treasury business partner design and maintenance

In SAP Treasury, business partners represent counterparties with whom a corporation engages in treasury transactions, including banks, financial institutions, and internal subsidiaries.

Additionally, business partners are essential in SAP for recording information related to securities issues, such as shares and funds.

The SAP Treasury Business Partner (BP) serves as a fundamental treasury master data object, utilized for managing relationships with both external and internal counterparties across a variety of financial transactions; including FX, MM, derivatives, and securities. The BP master data encompasses crucial details such as names, addresses, contact information, bank details, country codes, credit ratings, settlement information, authorizations, withholding tax specifics, and more.

Treasury BPs are integral and mandatory components within other SAP Treasury objects, including financial instruments, cash management, in-house cash, and risk analysis. As a result, the proper design and accurate creation of BPs are pivotal to the successful implementation of SAP Treasury functionality. The creation of BPs represents a critical step in the project implementation plan.

Therefore, we aim to highlight key specifics for professionally designing BPs and maintaining them within the SAP Treasury system. The following section will outline the key focus areas where consultants need to align with business users to ensure the smooth and seamless creation and maintenance of BPs.

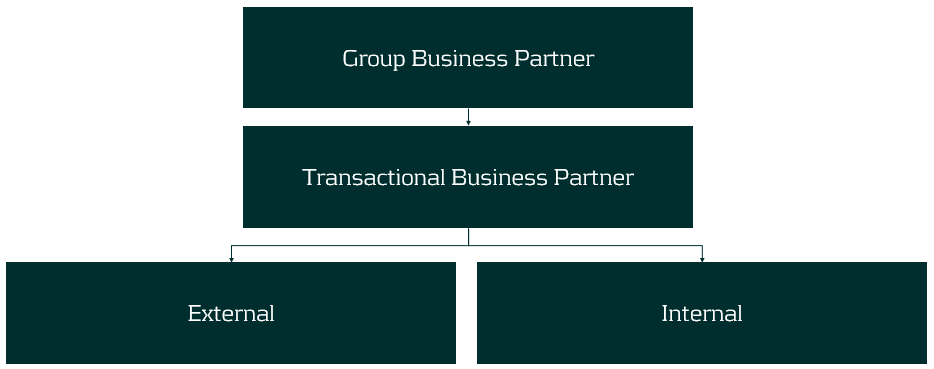

Structure of the BPs:

The structure of BPs may vary depending on a corporation's specific requirements. Below is the most common structure of treasury BPs:

Group BP – represents a parent company, such as the headquarters of a bank group or corporate entity. Typically, this level of BP is not directly involved in trading processes, meaning no deals are created with this BP. Instead, these BPs are used for: a. reflecting credit ratings, b. limiting utilization in the credit risk analyzer, c. reporting purposes, etc.

Transactional BP – represents a direct counterparty used for booking deals. Transactional BPs can be divided into two types:

- External BPs – represent banks, financial institutions, and security issuers.

- Internal BPs – represent subsidiaries of a company.

Naming convention of BPs

It is important to define a naming convention for the different types of BPs, and once defined, it is recommended to adhere to the blueprint design to maintain the integrity of the data in SAP.

Group BP ID: Should have a meaningful ID that most business users can understand. Ideally, the IDs should be of the same length. For example: ABN AMRO Group = ABNAMR or ABNGRP, Citibank Group = CITGRP or CITIBNK.

External BP ID: Should also have a meaningful ID, with the addition of the counterparty's location. For example: ABN AMRO Amsterdam – ABNAMS, Citibank London – CITLON, etc.

Internal BP ID: The main recommendation here is to align the BP ID with the company code number. For example, if the company code of the subsidiary is 1111, then its BP ID should be 1111. However, it is not always possible to follow this simple rule due to the complexity of the ERP and SAP Treasury landscape. Nonetheless, this simple rule can help both business and IT teams find straightforward solutions in SAP Treasury.

The length of the BP IDs should be consistent within each BP type.

Maintenance of Treasury BPs

1. BP Creation:

Business partners are created in SAP using the t-code BP. During the creation process, various details are entered to establish the master data record. This includes basic information such as name, address, contact details, as well as specific financial data such as bank account information, settlement instructions, WHT, authorizations, credit rating, tax residency country, etc.

Consider implementing an automated tool for creating Treasury BPs. We recommend leveraging SAP migration cockpit, SAP scripting, etc. At Zanders we have a pre-developed solution to create complex Treasury BPs which covers both SAP ECC and most recent version of SAP S/4 HANA.

2. BP Amendment:

Regular updates to BP master data are crucial to ensure accuracy. Changes in addresses, contact information, or payment details should be promptly recorded in SAP.

3. BP Release:

Treasury BPs must be validated before use. This validation is carried out in SAP through a release workflow procedure. We highly recommend activating such a release for the creation and amendment of BPs, and nominating a person to release a BP who is not authorized to create/amend a BP.

BP amendments are often carried out by the Back Office or Master Data team, while BP release is handled by a Middle Office officer.

4. BP Hierarchies:

Business partners can have relationships as described, and the system allows for the maintenance of these relationships, ensuring that accurate links are established between various entities involved in financial transactions.

5. Alignment:

During the Treasury BP design phase, it is important to consider that BPs will be utilized by other teams in a form of Vendors, Customers, or Employees. SAP AP/AR/HR teams may apply different conditions to a BP, which can have an impact on Treasury functions. For instance, the HR team may require bank details of employees to be hidden, and this requirement should be reflected in the Treasury BP roles. Additionally, clearing Treasury identification types or making AP/AR reconciliation GL accounts mandatory for Treasury roles could also be necessary.

Transparent and effective communication, as well as clear data ownership, are essential in defining the design of the BPs.

Conclusion

The design and implementation of BPs require expertise and close alignment with treasury business users to meet all requirements and consider other SAP streams.

At Zanders, we have a strong team of experienced SAP consultants who can assist you in designing BP master data, developing tools to create/amend the BPs meeting strict treasury segregation of duties and the clients IT rules and procedures.