7 Steps to Treasury Transformation

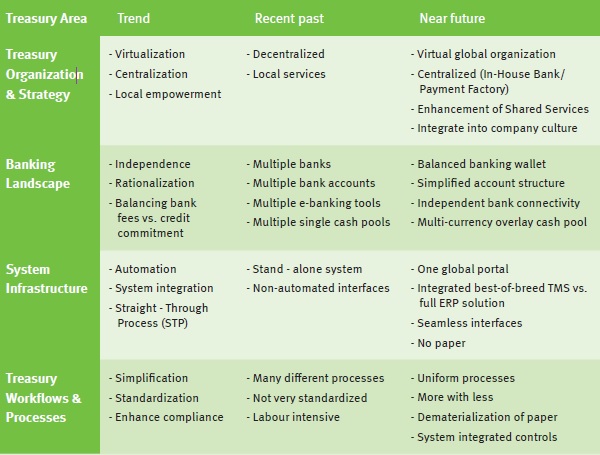

Treasury transformation refers to the definition and implementation of the future state of a treasury department. This includes treasury organization & strategy, the banking landscape, system infrastructure and treasury workflows & processes.

Treasury transformation refers to the definition and implementation of the future state of a treasury department. This includes treasury organization & strategy, the banking landscape, system infrastructure and treasury workflows & processes.

Introduction

Zanders has witnessed first-hand a treasury transformation trend sweeping global corporate treasuries in recent years and has seen an elite group of multinationals pursue increased efficiency, enhanced visibility and reduced cost on a grand scale in their respective finance and treasury organizations.

Triggers for treasury transformations

Why does a treasury need to transform? There comes a point in an organization’s life when it is necessary to take stock of where it is coming from, how it has grown and especially where it wants to be in the future.

Corporates grow in various ways: through the launch of new products, by entering new markets, through acquisitions or by developing strong pipelines. However, to sustain further growth they need to reinforce their foundations and transform themselves into stronger, leaner, better organizations.

What triggers a treasury organization to transform? Before defining the treasury transformation process, it is interesting to look at the drivers behind a treasury transformation. Zanders has identified five main triggers:

1. Organic growth of the organization Growth can lead to new requirements.

As a result of successive growth the as-is treasury infrastructure might simply not suffice anymore, requiring changes in policies, systems and controls.

2. Desire to be innovative and best-in-class

A common driver behind treasury transformation projects is the basic human desire to be best-in-class and continuously improve treasury processes. This is especially the case with the development of new technology and/or treasury concepts.

3. Event-driven

Examples of corporate events triggering the need for a redesign of the treasury organization include mergers, acquisitions, spin-off s and restructurings. For example, in the case of a divestiture, a new treasury organization may need to be established. After a merger, two completely different treasury units, each with their own systems, processes and people, will need to find a new shape as a combined entity.

4. External factors

The changing regulatory environment and increased volatility in financial markets have been major drivers behind treasury transformation in recent years. Corporate treasurers need to have a tighter grasp on enterprise risks and quicker access to information.

5. The changing role of corporate treasury

Finally the changing role of corporate treasury itself is a driver of transformation projects. The scope of the treasury organization is expanding into the fi nancial supply chain and as a result the relationship between the CFO and the corporate treasurer is growing stronger. This raises new expectations and demands of treasury technology and organization.

Treasury transformation – strategic opportunities for simplification

A typical treasury transformation program focuses on treasury organization, the banking landscape, system infrastructure and treasury workflows & processes. The table below highlights typical trends seen by Zanders as our clients strive for simplified and effective treasury organizations. From these trends we can see many state of the art treasuries strive to:

- be centralized

- outsource routine tasks and activities to a financial shared service centre (FSSC)

- have a clear bank relationship management strategy and have a balanced banking wallet

- maintain simple and transparent bank account structures with automatic cash concentration mechanisms

- be bank agnostic as regards bank connectivity and formats

- operate a fully integrated system landscape

Figure 1: Strategic opportunities for simplification

The seven steps

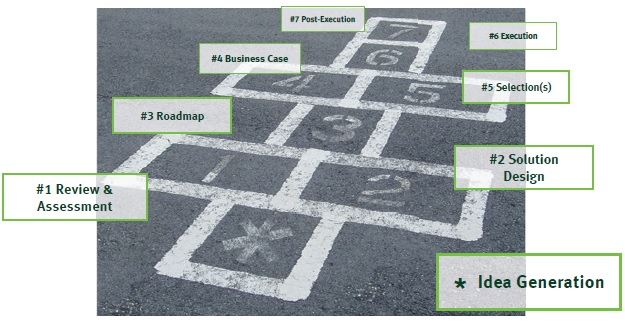

Zanders has developed a structured seven-step approach towards treasury transformation programs. These seven steps are shown in Figure 2 below

Figure 2: Zanders seven steps to treasury transformation projects

Step 1: Review & Assessment

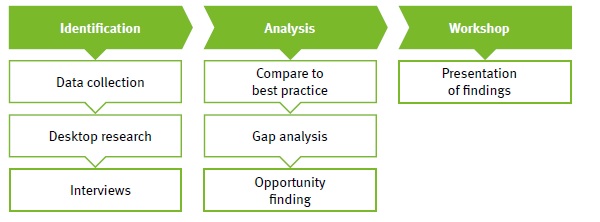

Review & assessment, as in any business transformation exercise, provides an in-depth understanding of a treasury’s current state. It is important for the company to understand their existing processes, identify disconnects and potential process improvements.

The review & assessment phase focusses on the key treasury activities of treasury management, risk management and corporate finance. The first objective is to gain an in-depth understanding of the following areas:

- organizational structure

- governance and strategy policies

- banking infrastructure and cash management

- financial risk management

- treasury systems infrastructure

- treasury workflows and processes

Figure 3: Example of data collection checklist for review & assessment

Based on the review and assessment, existing short-falls can be identified as well as where the treasury organization wants to go in the future, both operationally and strategically.

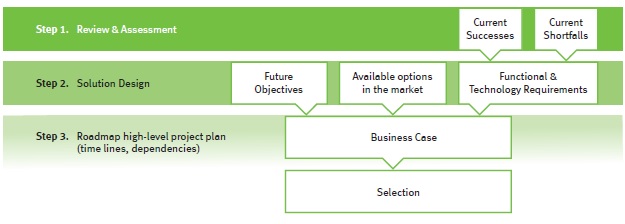

Figure 4 shows Zanders’ approach towards the review and assessment step.

Figure 4: Review & assessment break-down

Typical findings

Based on Zanders’ experience, common findings of a review and assessment are listed below:

Treasury organization & strategy:

- Disjointed sets of policies and procedures

- Organizational structure not sufficiently aligned with required segregation of duties

- Activities being done locally which could be centralized (e.g. into a FSSC), thereby realizing economies of scale

- Treasury resources spending the majority of their time on operational tasks that don’t add value and that could be automated. This prevents treasury from being able to focus sufficiently on strategic tasks, projects and fulfilling its internal consulting role towards the business.

Banking landscape:

- Mismatch between wallet share of core banking partners and credit commitment provided

- No overview of all bank accounts of the company nor of the balances on these bank accounts

- While cash management and control of bank accounts is often highly centralized, local balances can be significant due to missing cash concentration structures

- Lack of standardization of payment types and payment processes and different payment fi le formats per bank

System infrastructure:

- Considerable amount of time spent on manual bank statement reconciliation and manual entry of payments

- The current treasury systems landscape is characterized by extensive use of MS Excel, manual interventions, low level of STP and many different electronic banking systems

- Difficulty in reporting on treasury data due to a scattered system landscape

- Manual up and downloads instead of automated interfaces

- Corporate-to-bank communication (payments and bank statements processes) shows significant weaknesses and risks with regard to security and efficiency

Treasury workflows & processes:

- Monitoring and controls framework (especially of funds/payments) are relatively light

- Paper-based account opening processes

- Lack of standardization and simplification in processes

The outcome of the review & assessment step will be the input for step two: Solution Design.

Step 2: Solution Design

The key objective of this step is to establish the high-level design of the future state of treasury organization. During the solution design phase, Zanders will clearly outline the strategic and operational options available, and will make recommendations on how to achieve optimal efficiency, effectiveness and control, in the areas of treasury organization & strategy, banking landscape, system infrastructure and treasury workflows & processes.

Using the review & assessment report and findings as a starting point, Zanders highlights why certain findings exist and outlines how improvements can be implemented, based on best market practices. The forum for these discussions is a set of workshops. The first workshop focuses on “brainstorming” the various options, while the second workshop is aimed at decision-making on choosing and defining the most suitable and appropriate alternatives and choices.

The outcome of these workshops is the solution design document, a blueprint document which will be the basis for any functional and/or technical requirements document required at a later stage of the project when implementing, for example, a new banking landscape or treasury management system.

Step 3: Roadmap

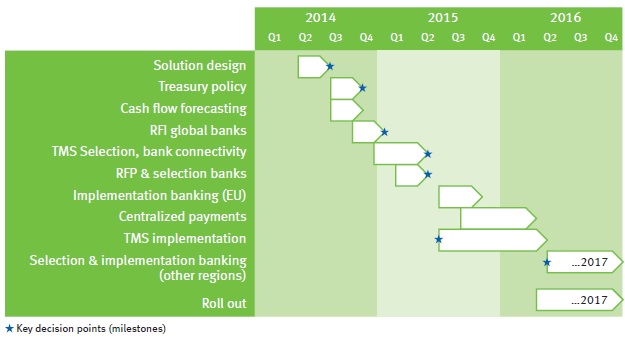

The solution design will include several sub-projects, each with a different priority, some more material than others and all with their own risk profile. It is important therefore for the overall success of the transformation that all sub-projects are logically sequenced, incorporating all inter-relationships, and are managed as one coherent program.

The treasury roadmap organizes the solution design into these sub-projects and prioritizes each area appropriately. The roadmap portrays the timeframe, which is typically two to five years, to fully complete the transformation, estimating individually the duration to fully complete each component of the treasury transformation program.

“A Program is a group of related projects managed in a coordinated manner to obtain benefits and control not available from managing them individually”.

Zanders

Figure 5: Sample treasury roadmap

Step 4: Business Case

The next step in the treasury transformation program is to establish a business case.

Depending on the individual organization, some transformation programs will require only a very high-level business case, while others require multiple business cases; a high level business case for the entire program and subsequent more detailed business cases for each of the sub-projects.

Figure 6: Building a business case

The business case for a treasury transformation program will include the following three parts:

- The strategic context identifies the business needs, scope and desired outcomes, resulting from the previous steps

- The analysis and recommendation section forms the significant part of the business case and concerns itself with understanding all of the options available, aligning them with the business requirements, weighing the costs against the benefits and providing a complete risk assessment of the project

- The management and controlling section includes the planning and project governance, interdependencies and overall project management elements

Notwithstanding the financial benefits, there are many common qualitative benefits in transforming the treasury. These intangibles are often more important to the CFO and group treasurer than the financial benefits. Tight control and full compliance are significant features of world-class treasuries and, to this end, they are typically top of the list of reasons for embarking on a treasury transformation program. As companies grow in size and complexity, efficiency is difficult to maintain. After a period of time there may need to be a total overhaul to streamline processes and decrease the level of manual effort throughout the treasury organization. One of the main costs in such multi-year, multi-discipline transformation programs is the change management required over extended periods.

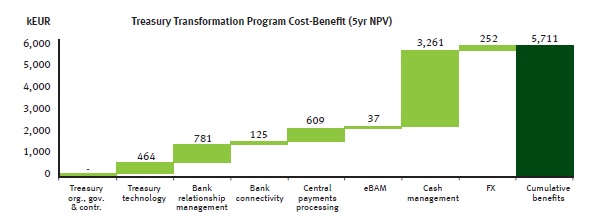

Figure 7: Sample cost-benefit

Figure 7 shows an example of how several sub-projects might contribute to the overall net present value of a treasury transformation program, providing senior management with a tool to assess the priority and resource allocation requirements of each sub-project.

Step 5: Selection(s)

Based on Zanders’ experience gained during previous treasury transformation programs, key evaluation & selection decisions are commonly required for choosing:

- bank partners

- bank connectivity channels

- treasury systems

- organizational structure

Zanders has assisted treasury departments with selection processes for all these components and has developed standardized selection processes and tools.

Selection process for bank partners

Common objectives for including the selection of banking partners in a treasury transformation program include the following:

- to align banks that provide cash and risk management solutions with credit providing banks

- to reduce the number of banks and bank accounts

- to create new banking architecture and cash pooling structures

- to reduce direct and indirect bank charges

- to streamline cash management systems and connectivity

- to meet the service requirements of the business; and

- to provide a robust, scalable electronic platform for future growth/expansion.

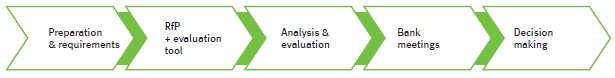

Zanders’ approach to bank partner selection is shown in Figure 8 below.

Figure 8: Bank partner selection process

Selection process for bank connectivity providers or treasury systems (treasury management systems, in-house banks, payment factories)

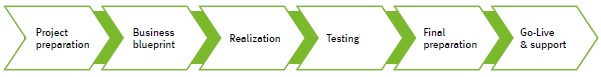

The selection of new treasury technology or a bank connectivity provider will follow the selection process depicted in Figure 9.

Figure 9: Treasury technology selection process

Organizational structure

If change in the organizational structure is part of the solution design, the need for an evaluation and selection of the optimal organizational structure becomes relevant. An example of this would be selecting a location for a FSSC or selecting an outsourcing partner. Based on the high-level direction defined in the solution design and based on Zanders’ extensive experience, we can advise on the best organization structure to be selected, on a functional, strategic and geographical level.

Step 6: Execution

The sixth step of treasury transformation is execution. In this step, the future-state treasury design will be realized. The execution typically consists of various sub-projects either being run in parallel or sequentially.

Zanders’ implementation approach follows the following steps during execution of the various treasury transformation sub-projects. Since treasury transformation entails various types of projects, in the areas of treasury organization, system infrastructure, treasury processes and banking landscape, not all of these steps apply to all projects to the same extent.

For several aspects of a treasury transformation program, such as the implementation of a payment factory, a common and tested approach is to go live with a number of pilot countries or companies first before rolling out the solution across the globe.

Figure 10: Zanders’ execution approach

Step 7: Post-Execution

The post-execution step of a treasury transformation is an important part of the program and includes the following activities:

6-12 months after the execution step:

– project review and lessons learned

– post implementation review focussing on actual benefits realized compared to the initial business case

On an ongoing basis:

– periodic benchmark and continuous improvement review

– ongoing systems maintenance and support

– periodic upgrade of systems

– periodic training of treasury resources

– periodic bank relationship reviews

Zanders offers a wide range of services covering the post-execution step.

Importance of a structured approach

There are many internal and external factors that require treasury organizations to increase efficiency, effectiveness and control. In order to achieve these goals for each of the treasury activities of treasury management, risk management and corporate finance, it is important to take a holistic approach, covering the organizational structure and strategy, the banking landscape, the systems infrastructure and the treasury workflows and processes. Zanders’ seven steps to treasury transformation provides such an approach, by working from a detailed as-is analysis to the implementation of the new treasury organization.

Why Zanders?

Zanders is a completely independent treasury consultancy f rm founded in 1994 by Mr. Chris J. Zanders. Our objective is to create added value for our clients by using our expertise in the areas of treasury management, risk management and corporate finance. Zanders employs over 130 specialist treasury consultants who are the key drivers of our success. At Zanders, our advisory team consists of professionals with different areas of expertise and professional experience in various treasury and finance roles.

Due to our successful growth, Zanders is a leading consulting firm and market leader in independent consulting services in the area of treasury and risk management. Our clients are multinationals, financial institutions and international organizations, all with a global footprint.

Independent advice

Zanders is an independent firm and has no shareholder or ownership relationships with any third party, for example banks, accountancy firms or system vendors. However, we do have good working relationships with the major treasury and risk management system vendors. Due to our strong knowledge of the treasury workstations we have been awarded implementation partnerships by several treasury management system vendors. Next to these partnerships, Zanders is very proud to have been the first consultancy firm to be a certified SWIFTNet management consultant globally.

Thought leader in treasury and finance

Tomorrow’s developments in the areas of treasury and risk management should also have attention focused on them today. Therefore Zanders aims to remain a leading consultant and market leader in this field. We continuously publish articles on topics related to development in treasury strategy and organization, treasury systems and processes, risk management and corporate finance. Furthermore, we organize workshops and seminars for our clients and our consultants speak regularly at treasury conferences organized by the Association of Financial Professionals (AFP), EuroFinance Conferences, International Payments Summit, Economist Intelligence Unit, Association of Corporate Treasurers (UK) and other national treasury associations.

From ideas to implementation

Zanders is supporting its clients in developing ‘best in class’ ideas and solutions on treasury and risk management, but is also committed to implement these solutions. Zanders always strives to deliver, within budget and on time. Our reputation is based on our commitment to the quality of work and client satisfaction. Our goal is to ensure that clients get the optimum benefit of our collective experience.