Blog

IFRS 18: What Treasury Needs to Know Now

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out more

To help banks manage climate risk over a more relevant time horizon, the NGFS has introduced scenarios focused on the next three to five years.

With extreme weather events becoming more frequent and climate policy tightening across jurisdictions, banks are under increasing pressure to understand how climate change will impact their portfolios. Previously, most climate scenario analyses have focused on long-term trajectories, stretching out to 2050 or beyond. However, these long-term analyses have often been far too abstract for day-to-day risk management.

The new NGFS short-term scenarios investigate the impact of climate risks over the next five years, offering a more practical solution. By isolating the individual impacts from physical and transition risk, and by providing better granularity at both temporal and sectoral levels, the new scenarios provide a new and valuable tool for climate risk modelling.

In this article, we explore what makes these scenarios unique, their benefits and limitations, their impact on future macroeconomic and market trends, and importantly, how banks can utilize them to fulfil regulatory requirements.

The short-term scenarios capture four possible futures, each reflecting a different mix of physical and transition risks. The scenarios show how varying levels of climate policy and climate-related events could shape the economic and financial outcomes over the next 5 years. The four scenarios are summarized in the figure below.

Figure 1: The four NGFS short-term scenarios.

The scenarios offer several benefits, including a more practical time horizon and better isolation of physical and transition risks. However, they also come with inherent limitations that should be acknowledged when being used. Below, we summarise the main benefits and limitations of the new scenarios.

Benefits

Limitations

While the NGFS short-term scenarios aim to address near-term climate-related risks, even shorter time horizons may be necessary for accurate and practical modelling in both credit and, in particular, market risk. More granular timeframes, such as a quarterly projection interval, would support banks to rapidly react to policy changes, market reactions, or acute physical climate events, which can unfold within weeks or months and not years.

In some cases, the results show limited differentiation between sectors and regions. This can make it difficult to accurately capture sector-specific or country-specific vulnerabilities. For example, countries with significant geographical and socioeconomic differences, such as Switzerland, Iceland, and Ukraine, are grouped together under the region "Rest of Europe". Similarly, the sector "Market Services" includes a wide range of distinct industries, such as Real Estate, Telecommunications, and Waste and Water Collection.

Accurately capturing physical climate risk within a short-term horizon remains methodologically challenging. Acute events like floods or wildfires are based on the estimation of tail risks (e.g. return periods) which can be difficult to model accurately. In addition, physical risks exhibit high spatial variability. For instance, coastal areas can be more vulnerable to hurricanes than inland areas, even if they are in the same country. Therefore, aggregating scenario data on the country or regional level can potentially underestimate the risks in specific areas.

Policy pathways in the short-term scenarios tend to assume smooth, linear implementation and immediate effectiveness. In reality, climate policies often face political, social, and economic frictions that delay or prolong their impact. Hence, these assumptions may lead to the underestimation of transition shocks, particularly where abrupt or uncoordinated policy actions could trigger market volatility.

To take a look at the NGFS short-term scenarios in action, we can examine the impact of the scenarios on key macroeconomic variables. Figure 2 shows the behavior of GDP and carbon price (with respect to baseline values) within Europe and Asia for all four scenarios. There are clear negative shocks which are seen in the GDP for all the scenarios. Similarly, we see a positive spike in the carbon price for both regions, however the effect in Asia is much greater than in Europe. Asia experiences a sharper percentage increase in carbon prices because it starts from a much lower baseline compared to Europe, where carbon prices are already high and policies have been in place for years. Additionally, in general, Asia is more emissions-intensive and heavily reliant on fossil fuels (particularly coal) which means more aggressive changes to carbon pricing are required to reduce emissions.

Figure 2: Top – YoY change in GDP (compared to baseline). Bottom – change in carbon price (compared to baseline).

Although the impact to variables such as macroeconomic indicators, emissions trends, and shifts in production offer essential context, they are usually only the first step in climate risk modelling. Ultimately, we are interested in how these variables translate into changes in market-based metrics, such as corporate bond spreads or PDs, which directly affect portfolio valuation. For example, for stress testing purposes, macro and sectoral outputs must be mapped onto these market-based metrics to assess potential losses and capital impacts.

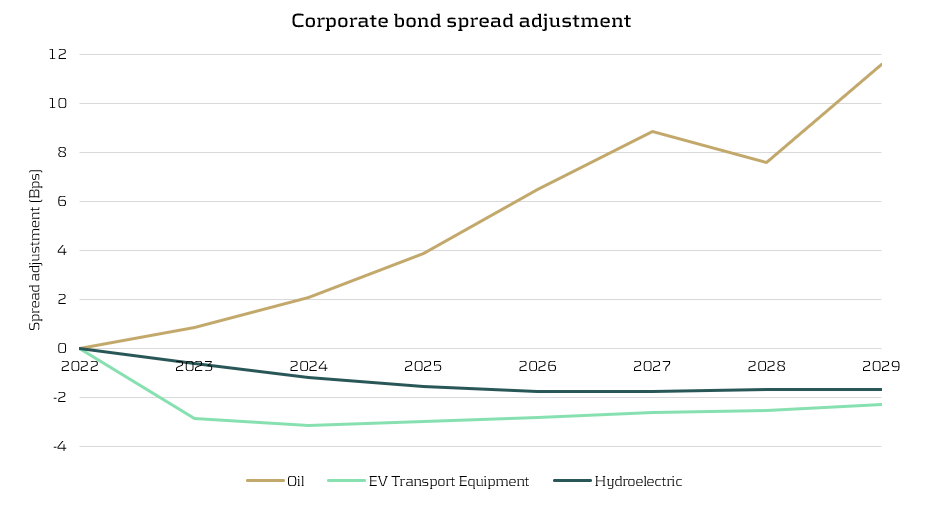

Figure 3 compares the corporate bond spread adjustments for the Oil, EV Transport Equipment, and Hydroelectric sectors under the HWTP scenario. The results illustrate a shifting investor sentiment in the corporate bond market. The Oil sector experiences a significant increase in spread adjustments over the time horizon due to an increase in perceived risk and a decline in investor favorability. In contrast, the EV Transport Equipment and Hydroelectric sectors maintain negative spread adjustments, highlighting that they are viewed more favorably. Overall, these results capture a market preference for cleaner and more sustainable industries and the scenarios clearly distinguish between sectors that are carbon-intensive and those aligned with low-carbon technologies.

Figure 3: Adjustment to corporate bond spreads for the Oil, EV Transport Equipment, and Hydroelectric sectors (HWTP scenario).

Although the five-year horizon of the new scenarios is still somewhat too long for direct application to market risk modelling (where exposures fluctuate on much shorter timescales), it aligns far better with the lifecycle of most credit products, especially those with relatively short maturities such as personal loans. Banks should utilise the scenarios as starting points for modelling the effects of near-term climate shocks on the performance of their credit products. However, the new scenarios can still provide valuable insights for market risk modelling. The scenarios can help identify sectoral sensitivities, adjust volatility and correlation assumptions, and enrich the narratives of existing scenarios.

The scenarios also help to standardise climate stress testing by providing a consistent set of assumptions, variables, and modelling frameworks that financial institutions can use as a common reference. This alignment reduces discrepancies in inputs and methodologies, enabling more comparable results across banks and jurisdictions. As a result, institutions and supervisors can more effectively benchmark climate-related risks, identify outliers, and support coordinated regulatory responses, ultimately improving the credibility and usefulness of climate stress tests.

Importantly, the new scenarios are well-suited to meet the needs of regulatory frameworks like the Internal Capital Adequacy Assessment Process (ICAAP), which typically considers a 3-to-5-year horizon. This makes them far more applicable than traditional long-term scenarios, which typically look out to 2050. Similarly, the ECB climate stress testing framework requires banks to use a variety of time horizons and both physical and transition risk scenarios. With ever-growing regulatory expectations, such as the recent CP10/25 consultation paper from the PRA on managing climate-related risks, the new short-term scenarios provide a timely and relevant tool for banks.

The new NGFS short-term scenarios are an important addition to climate risk modelling frameworks, offering a direct focus on the next five years – a time period which is far more aligned with capital planning, liquidity assessments, and regulatory stress. However, the scenarios are not intended to replace existing long-term scenarios. Rather, they complement them by providing a near-term view of climate risk that is highly relevant for all banks.

For more information on how Zanders can support you to understand the impact of climate risk on your business, please contact Steyn Verhoeven and Polly Wong.

IFRS 18 introduces significant changes to FX classification and reporting requirements by January 2027. Despite that this adoption date still feels quite far away, there is quite some time

Find out moreBuilding on the June 2024 launch of the new EU AML/CFT framework and the creation of the Anti-Money Laundering Authority (AMLA), SupTech (short for Supervisory Technology) now stands as a key

Find out moreAs the European Union increasingly emphasizes robust digital resilience within the financial sector as of January 17th 2025, the Digital Operational Resilience Act (DORA) has become a critical

Find out moreManaging banking book risk remains a critical challenge in today’s financial markets and regulatory environment. There are many strategic decisions to be made and banks are having trouble

Find out moreOn July 2nd, the European Banking Authority (EBA) published a Consultation Paper proposing amendments to its 2016 Guidelines on the application of the definition of default (DoD). As part of the

Find out moreArtificial intelligence (AI) is advancing rapidly, particularly with the emergence of large language models (LLMs) such as Generative Pre-trained Transformers (GPTs). Yet, in quantitative risk

Find out moreIn an industry where growth is often measured in multiples, and value creation is expected to be both scalable and repeatable, operational excellence is no longer a supporting function—it’s

Find out moreWith the introduction of CRR3, effective from January 1, 2025, the ‘extra’ guarantee on Dutch mortgages – known as the Dutch National Mortgage Guarantee (NHG) – will no longer be

Find out moreAccording to the IFRS 9 standards, financial institutions are required to model probability of default (PD) using a Point-in-Time (PiT) measurement approach — a reflection of present

Find out moreInflows from open reverse repos In May 2024 the EBA stated1 that inflows from open reverse repos cannot be recognised in LCR calculations unless the call option has already been

Find out moreThis article is intended for finance, risk, and compliance professionals with business and system integration knowledge of SAP, but also includes contextual guidance for broader audiences. 1.

Find out moreOur team at Zanders has been at the forefront of implementing BACS AUDDIS (Automated Direct Debit Instruction Service) with SAP S/4HANA, helping clients to streamline their direct debit

Find out moreThailand's e-Withholding Tax (e-WHT) system officially launched on October 27, 2020, in collaboration with 11 banks, marking a significant digital transformation with far-reaching benefits for

Find out moreIn today’s rapidly evolving financial landscape, fortifying the Financial Risk Management (FRM) function remains a top priority for CFOs. Zanders has identified a growing trend among

Find out moreEmergence of Artificial Intelligence and Machine Learning The rise of ChatGPT has brought generative artificial intelligence (GenAI) into the mainstream, accelerating adoption across

Find out moreIntroduction In December 2024, FINMA published a new circular on nature-related financial (NRF) risks. Our main take-aways: NRF risks not only comprise climate-related risks,

Find out moreAs mid-sized corporations expand, enhancing their Treasury function becomes essential. International growth, exposure to multiple currencies, evolving regulatory requirements, and increased

Find out moreIndustry surveys show that FRTB may lead to a 60% increase in regulatory market risk capital requirements, placing significant pressure on banks. As regulatory market risk capital requirements

Find out moreFirst, these regions were analyzed independently such that common trends and differences could be noted within. These results were aggregated for each region such that these regions could be

Find out more

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Fintegral.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired RiskQuest.

In a continued effort to ensure we offer our customers the very best in knowledge and skills, Zanders has acquired Optimum Prime.

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

More Information