Debt Capacity Made Easy with our Latest Transfer Pricing Solution

Introducing the Debt Capacity module: a powerful new addition to Zanders’ Transfer Pricing Suite, enabling fast, accurate, and scalable debt capacity testing for multinational entities.

In the ongoing efforts to enhance tax transparency for multinational corporations, tax authorities have progressively increased scrutiny on intercompany financial transactions. While the interest rates on intra-group loans have long been a focus of regulatory attention, recent administrative guidelines have shifted the spotlight toward the level of indebtedness of borrowers. For instance, the German Federal Ministry of Finance recently issued new guidelines mandating a debt capacity test for intercompany financial transactions1.

Although many multinational entities already have compliant solutions in place to determine arm’s length interest rates, the same cannot be said for debt capacity tests. Historically, verifying the level of indebtedness for subsidiaries has relied on complex, manual analyses conducted in Excel spreadsheets. These methods, while tailored, often lack efficiency and scalability.

Today, we are thrilled to announce the launch of a new addition to our Transfer Pricing Suite: the Debt Capacity module. This innovative tool allows clients to build on their pricing analyses by quickly and accurately testing the debt capacity of borrower entities. Staying true to the essence of our Transfer Pricing Suite, the module is user-friendly yet delivers best-in-class support for tax compliance.

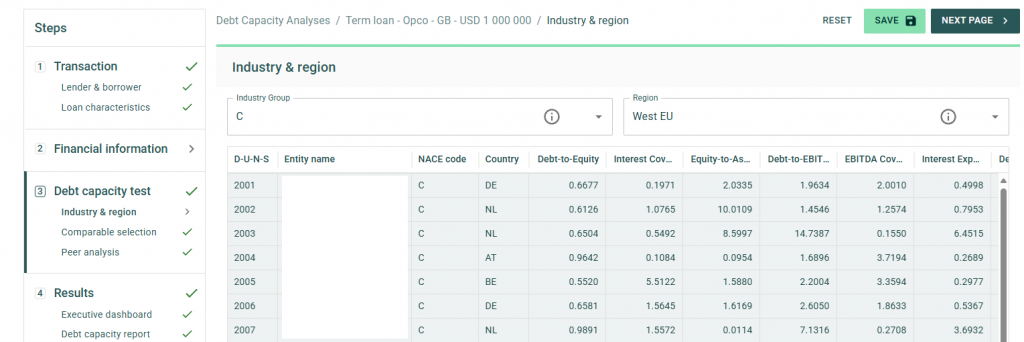

To streamline your in-house workflow, the standard package includes access to comparable data for a wide variety of borrowers. Within seconds, the application can automatically generate 40 comparable peers based on the borrower’s size, country, and industry through our connection with Dun & Bradstreet. Additionally, users can adjust and amend the list of comparable peers to ensure robust and tailored debt capacity tests for any scenario.

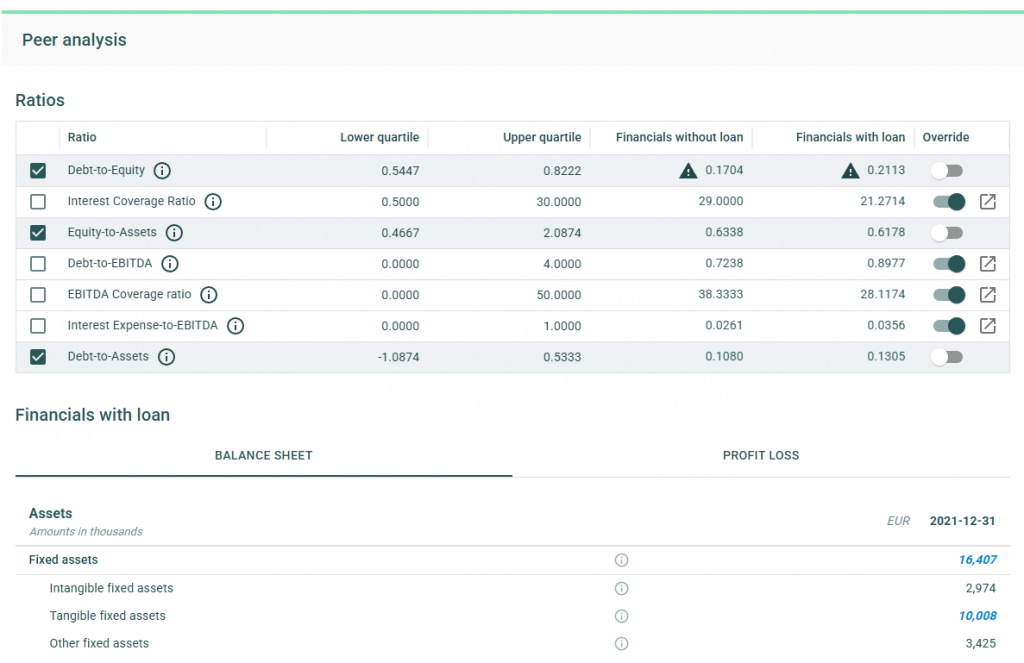

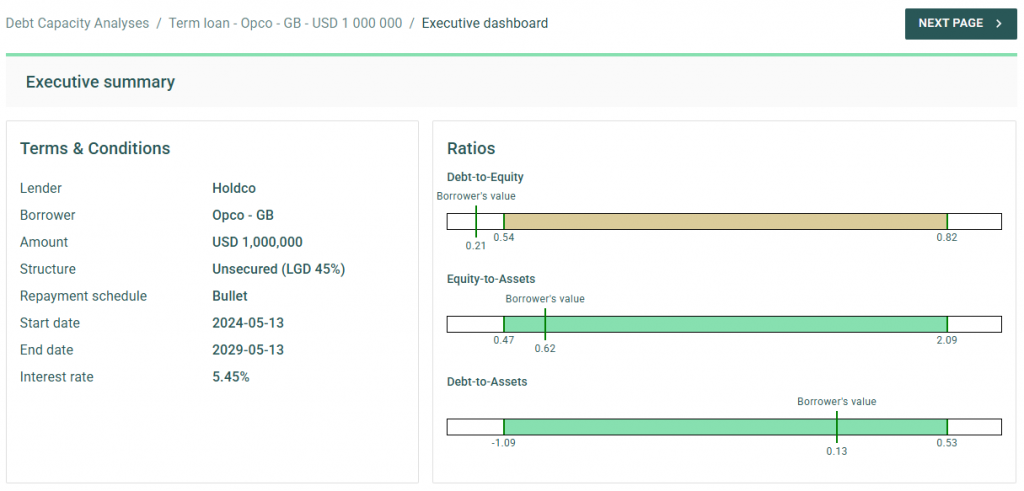

The debt capacity test leverages a flexible framework of financial ratios, which can be customized on a case-by-case basis. Our financial models dynamically adjust a borrower’s ratios to account for the impact of new loans on the balance sheet. With financial data for comparable entities readily available in the application, users receive feedback on debt capacity tests in under a minute.

Upon completing the analysis, the application offers the option to generate a comprehensive report, available in Word or PDF formats. This detailed report outlines the methodology and underlying data used in the analysis, serving as an excellent complement to existing pricing reports and providing critical compliance support when it matters most.

After releasing the initial version of the Debt Capacity module to clients, we will work on continuing to improve our applications. For example, by further supporting the debt capacity test through the inclusion of a dedicated cash flow forecast and an increase in comparable companies. If you’re interested in learning more, we invite you to contact our Transfer Pricing team to schedule a demo or trial the new module within your Zanders Inside environment.

Zanders Transfer Pricing Solution

As tax authorities intensify their scrutiny, it is essential for companies to carefully adhere to the recommendations outlined above. Does this mean additional time and resources are required? Not necessarily.

Technology provides an opportunity to minimize compliance risks while freeing up valuable time and resources. The Zanders Transfer Pricing Suite is an innovative, cloud-based solution designed to automate the transfer pricing compliance of financial transactions.

With over seven years of experience and trusted by more than 80 multinational corporations, our platform is the market-leading solution for intra-group loans, guarantees, and cash pool transactions.

Our clients trust us because we provide:

- Transparent and high-quality embedded intercompany rating models.

- A pricing model based on an automated search for comparable transactions.

- Automatically generated, 40-page OECD-compliant Transfer Pricing reports.

- Debt capacity analyses to support the quantum of debt.

- Legal documentation aligned with the Transfer Pricing analysis.

- Benchmark rates, sovereign spreads, and bond data included in the subscription.

- Expert support from our Transfer Pricing specialists.

- Quick and easy onboarding—completed within a day!

Learn more, and discover the key compliance challenges for intra-group loan transfer pricing in 2025.

Citations

- See our blog on Transfer Pricing best practices 2025 for more information. ↩︎