Roundtable ‘Climate Scenario Design & Stress Testing’ recap

On Thursday 15 June 2023, Zanders hosted a roundtable on ‘Climate Scenario Design & Stress Testing’. This article discusses our view on the topic and highlights key insights from the roundtable.

On Thursday 15 June 2023, Zanders hosted a roundtable on ‘Climate Scenario Design & Stress Testing’. In our head office in Utrecht, we welcomed risk managers from several Dutch banks. This article discusses our view on the topic and highlights key insights from the roundtable.

In recent years, many banks took their first steps in the integration of climate and environmental (C&E) risks into their risk management frameworks. The initial work on climate-related risk modeling often took the form of scenario analysis and stress testing. For example, as part of the Internal Capital Adequacy Assessment Process (ICAAP) or by participating in the 2022 Climate Stress Test by the European Central Bank (ECB). To comply with the ECB’s expectations on C&E risks, banks are actively exploring methodologies and data sources for adequate climate scenario design and stress testing. The ECB requires that banks will meet their expectations on this topic by 31 December 2024.

Our view

We believe that banks should start early with climate stress testing, but in a manageable and pragmatic way. Banks can then improve their methodologies and extend their scope over time. This allows for a gradual development of knowledge, data and methodologies within all relevant Risk teams. Zanders has identified the following steps in the process of climate scenario design and stress testing:

- Step 1: Scenario selection

A bank has to select appropriate (climate) scenarios based on the bank’s climate risk materiality assessment. Important to consider in this phase is the purpose for which the scenarios will be used, whether the scenarios are in line with scientific pathways, and whether they account for different policy outcomes (like an early or late transition to a sustainable economy).

- Step 2: Scope and variable definition

An appropriate scope must then be selected and appropriate variables defined. For example, banks need to determine which portfolios to take in scope, which time horizons to include, select the granularity of the output, the right level of stress, and which climate- and macro-economic variables to consider.

- Step 3: Methodology

Then, the bank needs to develop methodologies to calculate the impact of the scenarios. There are no one-size-fits-all approaches and often a combination of different qualitative and quantitative methodologies is needed. We recommend that the climate stress test approach be initially simple and to focus on material exposures.

- Step 4: Results

It is important to use the results of the scenario analysis in the relevant risk and business processes. The results can be used for the bank’s risk appetite and strategy. The results can also help to create awareness and understanding among internal stakeholders, and support external disclosures and compliance.

- Step 5: Stress testing framework

Finally, banks should establish minimum standards for climate scenario design and stress testing. This framework should include, amongst others, policies and processes for data collection from different sources, how adequate knowledge and resources are ensured, and how the scenarios are kept up-to-date with the latest market developments.

Key insights

Prior to the roundtable, participants filled in a survey related to the progress, scope and challenges on climate risk stress testing. The key insights presented below are based on the results of this survey, together with the outcomes of the discussion thereafter.

The financial sector has advanced with several aspects around integrating climate risks in risk management over the past year. This was recognized by all participants, as they had all performed some form of climate risk stress testing. The scope of the stress testing, however, was relatively limited in some cases. For example, all participants considered credit risk in their climate risk scenario with many also including market risk. Only a limited number of participants took other risk types into account.

Furthermore, all participants assessed the short-term impact (up to 3 years) of the climate scenarios, whereas only around 40% and 10% assessed the impact on the medium term (3 to 10 years) and long term (>10 years), respectively. This is probably related to the fact that all participants used climate scenarios in their ICAAP, which typically covers a three-year horizon. The second most mentioned use for the climate scenarios, after the ICAAP, was the risk identification & materiality analysis. A smaller percentage of participants also used the climate scenarios for business strategy setting, ILAAP and portfolio management.

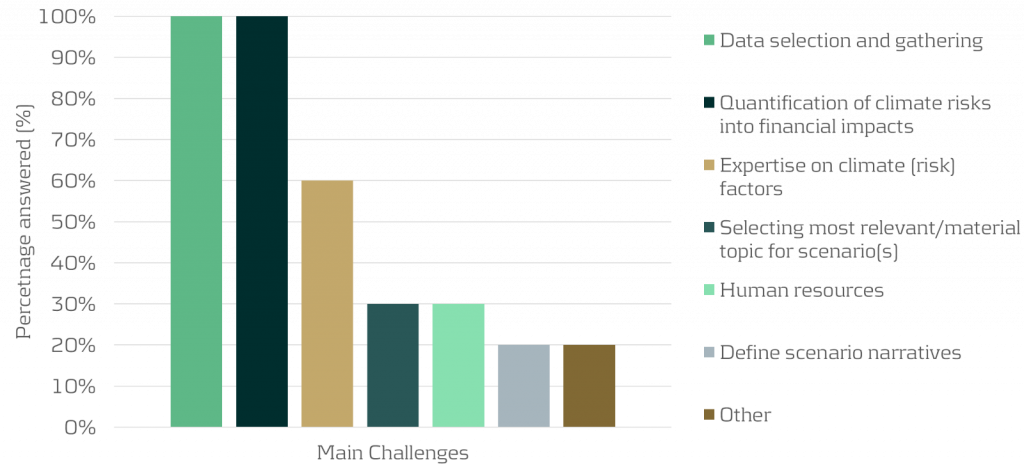

The two topics that were unanimously mentioned as the main challenges in climate risk stress testing are data selection and gathering, and the quantification of climate risks into financial impacts, as shown in the graph below:

- Insight 1: Assessing impact of climate risk beyond the short-term very much increases the complexity and uncertainty of the exercise

The participants indicated that climate stress testing beyond the short-term horizon (beyond 3 to 5 years) is very difficult. Beyond that horizon, the complexity of the (climate) scenarios increases materially due to uncertainties of clients’ transition plans, the bank’s own transition plan and climate strategy (e.g., related to pricing and client acceptance policies), and climate policies and actions from governments and regulators. Taking the transition plans of clients into account on a granular level is especially difficult when there is a large number of counterparties. There are no clear solutions to this. Some ideas that take longer-term effects into account were floated, such as adjusting the current valuation of various assets by translating future climate impact on assets into a net present value of impact or by taking climate impacts into account in the long-term macro-economic scenarios of IFRS9 models.

- Insight 2: Whether to use a top-down or bottom-up approach depends on the circumstances

It was discussed whether a bottom-up stress test for climate scenarios is preferable to a top-down stress test. The consensus was that this depends on the circumstances, for example:- Physical risks are asset- and location-specific; one street may flood but not the next. So, in that case a bottom-up assessment may be necessary for a more granular approach. On the other hand, for transition risks, less granularity might be sufficient as transition policies are defined on national or even supranational level, and trends and developments often materialize on sector-level. In those cases, a top-down type of analysis could be sufficient.

- If the climate stress test is used to get a general overview of where risks are concentrated, a top-down analysis may be appropriate. However, if it is used to steer clients, a more granular, bottom-up approach may be needed.

- A bottom-up approach could also be more suitable for longer-term scenarios as it allows to include counterparty-specific transition plans. For more short-term scenarios, a sector average may be sufficient, considering that there will be less transition during this period.

- Insight 3: Translating the results of climate risk stress testing into concrete actions is challenging

The results of the stress test can be used to further integrate climate risk into risk management processes such as materiality assessment, risk appetite, pricing, and client acceptance. Most participants, however, were still hesitant to link any binding actions to the results, such as setting risk limits (e.g., limiting exposures to a certain sector), adjusting client acceptance, or amending pricing policies. However, the ECB does require banks to consider climate impacts in these processes. The most mentioned uses of the climate risk stress testing results were risk identification & materiality assessments and risk monitoring.

Conclusion

Most banks have taken first steps in relation to climate scenario design and stress testing. However, many challenges still remain, for example around data selection and quantification methodologies. Efforts by banks, regulators and the market in general are required to overcome these challenges.

Zanders has already supported several banks with climate scenario design and stress testing. This includes the creation of a climate scenario design framework, the definition of climate scenarios, and by quantifying climate risk impacts for the ICAAP. Next to that, we have performed research on modeling approaches that can be used to quantify the impact of transition and physical risks. If you are interested to know how we can help your organization with this, please reach out to Marije Wiersma.