Why developing a non-maturing deposit model should be the top priority for banks in the Nordics

Last year marked a radical change in the status-quo that existed within the financial market, affecting the way banks manage the risks in their banking books.

First and foremost, the long period of low and even negative swap rates was followed by strongly rising rates and a volatile market, which impacted the behavior of both customers and banks themselves. At the same time, regulatory developments, initiated by EBA’s new IRRBB guidelines, have shifted the banks’ focus to managing their earnings and earnings risk, rather than economic value risks.

Non-maturing deposits (NMDs) are of particular interest in this respect, given the uncertainty regarding the future pricing strategy and volume developments involved in these products. Moreover, as NMDs are generally modeled with a rather short maturity, the portfolio plays a significant role in the stability of the NII, making this portfolio even more relevant to evaluate in light of the newly introduced Supervisory Outlier Test (SOT) limits on earnings risk (more specific NII), or the local equivalent.

How does this affect IRRBB management at banks?

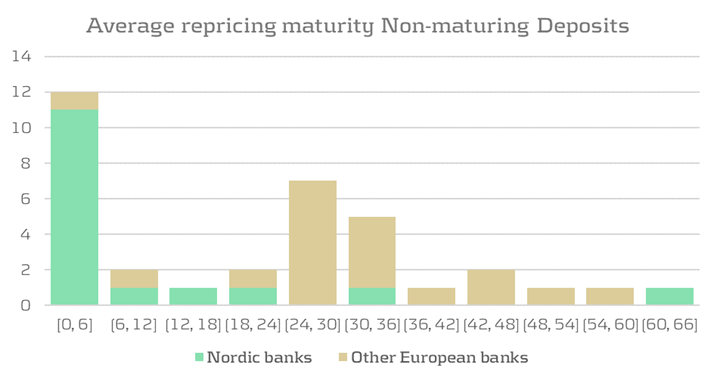

The exact impact of these developments is also heavily dependent on the bank’s local market, and corresponding laws and regulation, as well as the balance sheet composition of the bank. In Nordics countries, banks are affected more heavily, given that loans and mortgages generally have shorter maturities, as compared to other Western European countries like Germany and the Netherlands. This yields a smaller maturity mismatch with on-demand deposits at the liability side, such that a natural hedge exists to some extent within the balance sheet. Earlier on, this effect, combined with the rather stable markets, made active ALM, including IRRBB management, less urgent. The incentive to accurately model NMDs was therefore limited, so most banks simply replicate this funding overnight, while banks in other European countries tend to use a longer maturity, as illustrated by figure 1.

{Figure 1: Difference in average repricing maturity of NMDs between Nordic banks and other European banks, based on Pillar 3 IRRBBA and IRRBB1 disclosures from 2022 annual reports}

While the natural hedge already (partially) mitigates the risks from a value perspective to a large extent, investing the full NMDs portfolio overnight leads to relatively high NII volatility, thereby potentially violating regulatory limitations. The return on overnight investments will directly reflect any changes in the market rates, while deposit rates in reality are usually somewhat slower to include such developments. Although the resulting asymmetry between the investment return and deposit rate to be paid to customers yields a positive result under rising interest rates, it can reduce profits when interest rates start to fall.

Historically, banks in the Nordics experienced less flexibility in the modeling of NMDs, due to regulatory guidelines being somewhat stricter than EBA guidelines. For instance, Sweden’s Finansinspektionen (FI) required banks to replicate these positions overnight. However, relatively recently, the FI updated its regulations (FI dnr 19-4434), allowing banks to somewhat extend the duration of the investment profile, for a limited portion of the portfolio, and up to a maturity of one year. This results in flexibility to update the investment profile to better reflect the expected repricing speed of deposit rates, which could lead to improved NII stability. Additionally, besides applying these revised NMD models for managing banking book risks, they can, when approved, also be used for effective and consistent capital charge calculations under Pillar 2.

How can these developments be properly managed?

Even though the recent market developments create additional challenges in IRRBB management for banks, they also provide opportunities. The margin on deposit products for banks is currently improving, since only part of the interest rate rises is passed through to customers. The increased interest rates also mean that more advanced NMD models, with longer maturity profiles, can have a positive impact on the P&L, while simultaneously improving the interest rate risk management.

In such a rare win-win situation, it is more advantageous than ever to prioritize NMD modeling. In reassessing the interest rate risk management approach towards NMDs, banks should explicitly balance the tradeoff between value and earnings stability when making conceptual choices. These conceptual choices should align with the overall IRBBB strategy, as well as the intended use of the model, to ensure the risk in the portfolio is properly managed.

In weighing these conceptual alternatives, it is essential to take portfolio-specific characteristics into account. This requires an analysis of historical behavior, and an interpretation of how representative this information is. If behavior is expected to change, a common approach is to supplement historical data with expert expectations of forward-looking scenarios to develop a model that reflects both. Periodically reassessing the conceptual choices ensures a proper model lifecycle of NMD portfolios. This is crucial for accurate measurement of interest rate risk as well as for staying competitive in the current market environment.

Would you like to hear more? Contact Bas van Oers for questions on developing a non-maturing deposit model.