Financial institutions spend billions per year in their fight against fraud.

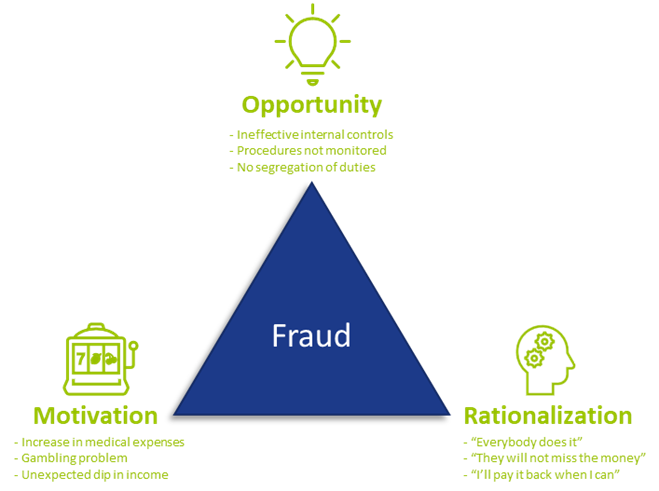

With every improvement, fraudsters look for and find new opportunities to exploit. When the opportunity arises, some people see a big incentive or pressure to commit fraud, and most will be able to justify to themselves why it is acceptable to commit fraud (as shown in the Fraud triangle – Figure 1). Unfortunately, the impact of fraud on organizations, individuals and society in general is substantial.

In a recent report by the Association of Certified Fraud Examiners (ACFE), Occupational Fraud 2022: A report to the nations, it is estimated that organizations lose about 5% of their revenue each year due to employees committing fraud against their employer. It is estimated that more than USD 4.7 trillion is lost worldwide to occupational fraud. Of these, most cases were identified through a tip to a hotline and most were not detected until 12 to 18 months later. The longer the fraud was undetected, the higher the loss. But organizations do not only fight fraud internally; external threats are also on the rise. As businesses evolve and processes are automated and digitalized, fraud activities become much more complex.

Data and modeling approach to fraud prevention

To effectively prevent fraud, it first needs to be identified. Traditionally, employees are trained to identify anomalies or inconsistencies in their daily work environment. It is still crucial that your employees know what to look for and how to spot suspicious activities. But due to the complexities and vast amounts of information available, and because fraudsters are becoming more sophisticated, it becomes much more difficult to determine whether a potential customer is a fraudster or a real client.

The good news is that digitalization and increased data availability provides the opportunity for data analytics. It is important to note here that it does not completely replace your current processes; it should be used in addition to your traditional prevention and/or detection methods to be more effective to proactively identify and prevent fraud in your organization.

Benefits of data analytics

Traditionally, sampling was done on a population to test for fraud instances, but this may not be as effective because it only looks at a small population. Because fraud numbers reported usually being small (but with a large monetary impact), it is possible to overlook valuable insights if only samples of populations are investigated. Ideally, all data should be included to identify trends and potential fraudulent activities, and with data analytics that is possible. By analyzing large amounts of data, organizations can identify patterns and trends that may indicate fraudulent activity. It can help to improve the accuracy of fraud detection systems, as they can be trained to recognize these patterns.

Data analytics can increase efficiency by reducing false positives and false negatives and assists organizations to automate parts of the fraud detection processes, which can save time and resources. This allows the business to focus on other important strategic objectives and tasks such as customer service and product development.

By using data analytics to identify and prevent fraudulent activity, organizations can help to protect their customers against financial losses and other harm. Customer trust and loyalty are built when organizations show they are serious about the welfare and safety of their customers.

Detecting and preventing fraud

Reality is that preventing fraud upfront or in an early stage is much more economical and beneficial than having to detect fraud after the fact, as investigations are time-consuming and the fraud is not always easy to proof in court. Moreover, by the time it is detected, a loss may have already been incurred. Using data analytics to identify fraudsters and fraudulent activities earlier, can protect the bottom line by reducing financial losses and improving the organization’s overall financial performance.

By using analytics to detect and prevent fraud, organizations can demonstrate to regulatory bodies that they are taking compliance seriously. Reporting suspicious transactions and activities to regulatory bodies is a key component of complying with anti-money laundering and counter-terrorism financing legislation, and analytics can assist with identifying these transactions and activities more effectively.

Data analytics can be used to prevent fraud at onboarding, detect it in the existing customer base, and to make your operational processes more efficient. More specifically, data analytics can be used and leveraged as follows:

- Identifying outlier trends and hidden patterns can highlight areas and/or transactions that are more vulnerable to fraud.

- Automating identification of exceptions removes manual intervention and makes the identification criteria more consistent.

- Traditional physical reviews using limited resources to investigate is time-consuming. Data analytics can be used to prioritize the ones with the highest impact and risk, e.g. investigate the suspicious transactions with the highest value first.

- Combining data from different data sources to feed into a model provides a more holistic view of a customer or scenario than looking at individual transactions or applications in isolation.

- Both structured and unstructured data can be used to prevent and detect fraud.

- Fraud propensity model scoring can run automatically and generate results to be reviewed and investigated in real-time or near real-time.

- Analyzing relationships between various entities and customers using Social Network Analysis (SNA). Traditionally, networks/links were identified by the investigator while building a case. By using analytics, less time is needed to identify these relationships. Also, it identifies valuable links previously unknown, as additional levels of relationships can be examined.

- Specific modus operandi identified by the organization’s internal fraud team can be translated into data models to automate identification of similar cases. (See Case study below)

- Applying a fraud model to the organization’s bad debt book can assist with your collections strategy. Fraudsters never intended to pay and focusing your collection efforts on them wastes time and valuable resources. Most efforts should be on those cases where money can be collected.

Case study

The Zanders data analytics team has experience with applying data analytics within a company to identify customers who create synthetic profiles at point of application. By working closely with investigators, a model was developed in which one out of every three applications referred for investigation was classified as fraudulent.

The benefit of introducing analytics was twofold – from an onboarding- and existing customer point of view. The number of fraudsters identified before onboarding increased, preventing (potential) losses. Using the positive identified frauds at point of application, and checking the profile against the existing book, helped to identify areas that were more vulnerable where investigation should be prioritized.

The project proved that:

- Data analytics is valuable and combining it with insights from the operational teams is powerful.

- The buy-in from the stakeholders made the model more effective. If the team investigating the alert does not trust the model or does not know what to look for, there will be resistance in investigating the alerts.

- Taking your internal fraud team on a data and analytics journey is a must. They need to understand the impact that their decisions and captured outcomes can have on future models.

- Challenges with false positives (within business appetite and investigation capacity) are a reality, but having a model is better than searching for a needle in a haystack. Learning from the results and outcomes of the investigations, even if they were false positives, will enhance your next model.

- One size does not fit all. Fraud models need to be tailored to the business’ needs.

Conclusion

While using data analytics to identify fraudulent activities is an investment, organizations need to outweigh the benefit of incorporating data analytics in their current processes against the potential losses. Fraud not only results in monetary losses, it can lead to reputational damage and have an impact on the organization’s market share as customers will not do business with an organization where they don’t feel protected. Your customers also expect great customer service and implementing proactive fraud prevention measures increases confidence in your organization.

How can Zanders help your organization?

Did you find this article helpful but do you still have questions or need additional assistance? Our team of experts is ready to assist you in finding the solutions you need. Please feel free to reach out to us to discuss your needs in more detail. Whether you’re looking for advice on a specific project or just need someone to exchange ideas with, we are here to assis

In turbulent markets, enhancing VaR models with volatility scaling can improve their responsiveness to market changes and reduce capital charges due to backtesting failures.

Challenges with VaR models in a turbulent market

With recent periods of market stress, including COVID-19 and the Russia-Ukraine conflict, banks are finding their VaR models under strain. A failure to adhere to VaR backtesting requirements can lead to pressure on balance sheets through higher capital requirements and interventions from the regulator.

VaR backtesting

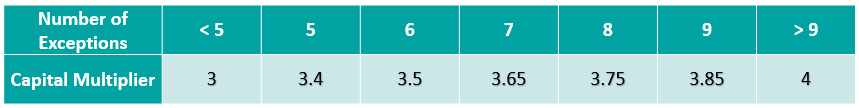

VaR is integral to the capital requirements calculation and in ensuring a sufficient capital buffer to cover losses from adverse market conditions. The accuracy of VaR models is therefore tested stringently with VaR backtesting, comparing the model VaR to the observed hypothetical P&Ls. A VaR model with poor backtesting performance is penalised with the application of a capital multiplier, ensuring a conservative capital charge. The capital multiplier increases with the number of exceptions during the preceding 250 business days, as described in Table 1 below.

Table 1: Capital multipliers based on the number of backtesting exceptions.

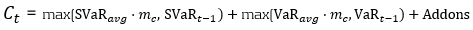

The capital multiplier is applied to both the VaR and stressed VaR, as shown in equation 1 below, which can result in a significant impact on the market risk capital requirement when failures in VaR backtesting occur.

Pro-cyclicality of the backtesting framework

A known issue of VaR backtesting is pro-cyclicality in market risk. This problem was underscored at the beginning of the COVID-19 outbreak when multiple banks registered several VaR backtesting exceptions. This had a double impact on market risk capital requirements, with higher capital multipliers and an increase in VaR from higher market volatility. Consequently, regulators intervened to remove additional pressure on banks’ capital positions that would only exacerbate market volatility. The Federal Reserve excluded all backtesting exceptions between 6th – 27th March 2020, while the PRA allowed a proportional reduction in risks-not-in-VaR (RNIV) capital charge to offset the VaR increase. More recent market volatility however has not been excluded, putting pressure on banks’ VaR models during backtesting.

Historical simulation VaR model challenges

Banks typically use a historical simulation approach (HS VaR) for modeling VaR, due to its computational simplicity, non-normality assumption of returns and enhanced interpretability. Despite these advantages, the HS VaR model can be slow to react to changing markets conditions and can be limited by the scenario breadth. This means that the HS VaR model can fail to adequately cover risk from black swan events or rapid shifts in market regimes. These issues were highlighted by recent market events, including COVID-19, the Russia-Ukraine conflict, and the global surge in inflation in 2022. Due to this, many banks are looking at enriching their VaR models to better model dramatic changes in the market.

Enriching HS VaR models

Alternative VaR modeling approaches can be used to enrich HS VaR models, improving their response to changes in market volatility. Volatility scaling is a computationally efficient methodology which can resolve many of the shortcomings of HS VaR model, reducing backtesting failures.

Enhancing HS VaR with volatility scaling

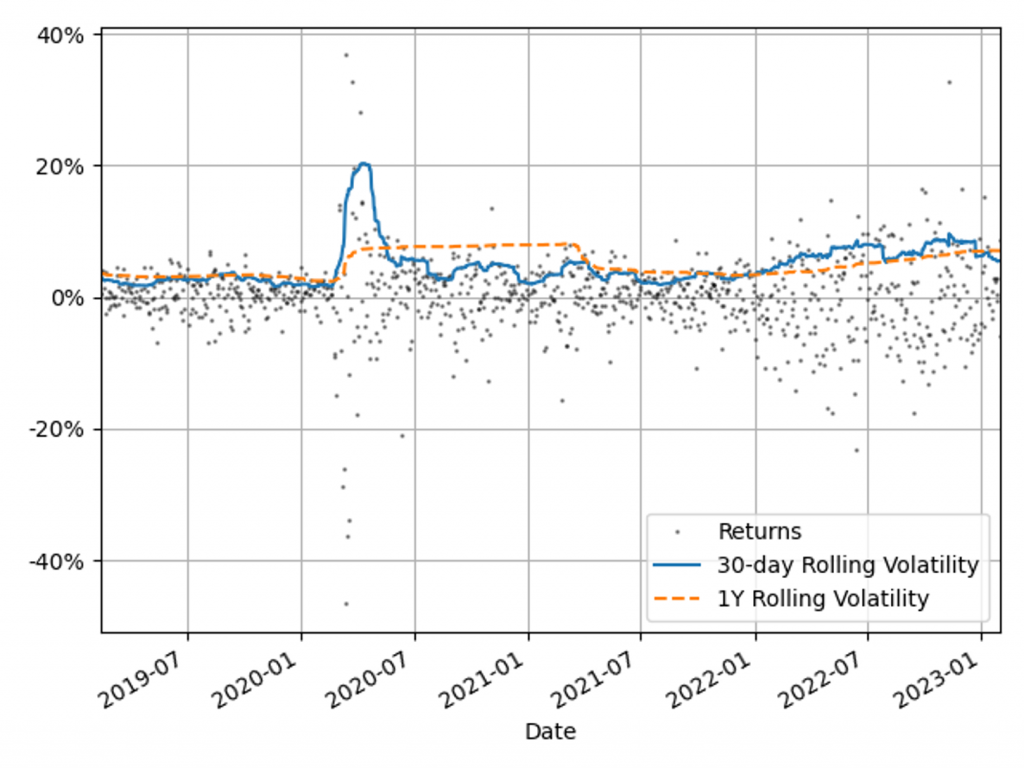

The Volatility Scaling methodology is an extension of the HS VaR model that addresses the issue of inertia to market moves. Volatility scaling adjusts the returns for each time t by the volatility ratio σT/σt, where σt is the return volatility at time t and σT is the return volatility at the VaR calculation date. Volatility is calculated using a 30-day window, which more rapidly reacts to market moves than a typical 1Y VaR window, as illustrated in Figure 1. As the cost of underestimation is higher than overestimating VaR, a lower bound to the volatility ratio of 1 is applied. Volatility scaling is simple to implement and can enrich existing models with minimal additional computational overhead.

Figure 1: The 30-day and 1Y rolling volatilities of the 1-day scaled diversified portfolio returns. This illustrates recent market stresses, with short regions of extreme volatility (COVID-19) and longer systemic trends (Russia-Ukraine conflict and inflation).

Comparison with alternative VaR models

To benchmark the Volatility Scaling approach, we compare the VaR performance with the HS and the GARCH(1,1) parametric VaR models. The GARCH(1,1) model is configured for daily data and parameter calibration to increase sensitivity to market volatility. All models use the 99th percentile 1-day VaR scaled by a square root of 10. The effective calibration time horizon is one year, approximated by a VaR window of 260 business days. A one-week lag is included to account for operational issues that banks may have to load the most up-to-date market data into their risk models.

VaR benchmarking portfolios

To benchmark the VaR Models, their performance is evaluated on several portfolios that are sensitive to the equity, rates and credit asset classes. These portfolios include sensitivities to: S&P 500 (Equity), US Treasury Bonds (Treasury), USD Investment Grade Corporate Bonds (IG Bonds) and a diversified portfolio of all three asset classes (Diversified). This provides a measure of the VaR model performance for both diversified and a range of concentrated portfolios. The performance of the VaR models is measured on these portfolios in both periods of stability and periods of extreme market volatility. This test period includes COVID-19, the Russia-Ukraine conflict and the recent high inflationary period.

VaR model benchmarking

The performance of the models is evaluated with VaR backtesting. The results show that the volatility scaling provides significantly improved performance over both the HS and GARCH VaR models, providing a faster response to markets moves and a lower instance of VaR exceptions.

Model benchmarking with VaR backtesting

A key metric for measuring the performance of VaR models is a comparison of the frequency of VaR exceptions with the limits set by the Basel Committee’s Traffic Light Test (TLT). Excessive exceptions will incur an increased capital multiplier for an Amber result (5 – 9 exceptions) and an intervention from the regulator in the case of a Red result (ten or more exceptions). Exceptions often indicate a slow reaction to market moves or a lack of accuracy in modeling risk.

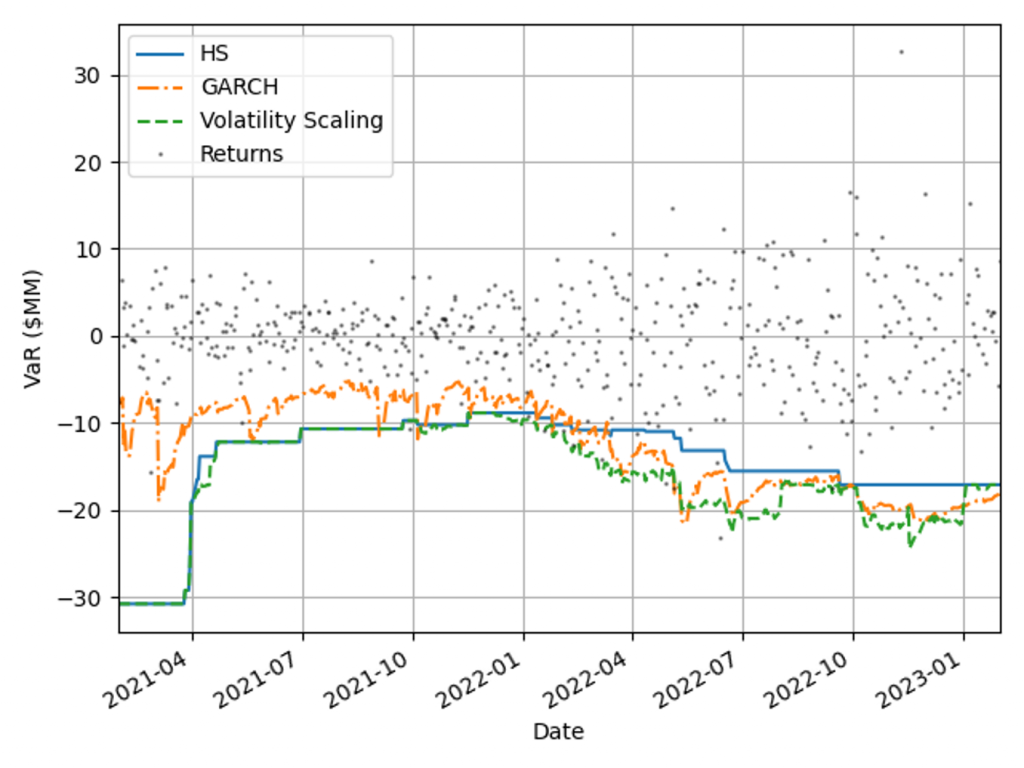

VaR measure coverage

The coverage and adaptability of the VaR models can be observed from the comparison of the realised returns and VaR time series shown in Figure 2. This shows that although the GARCH model is faster to react to market changes than HS VaR, it underestimates the tail risk in stable markets, resulting in a higher instance of exceptions. Volatility scaling retains the conservatism of the HS VaR model whilst improving its reactivity to turbulent market conditions. This results in a significant reduction in exceptions throughout 2022.

Figure 2: Comparison of realised returns with the model VaR measures for a diversified portfolio.

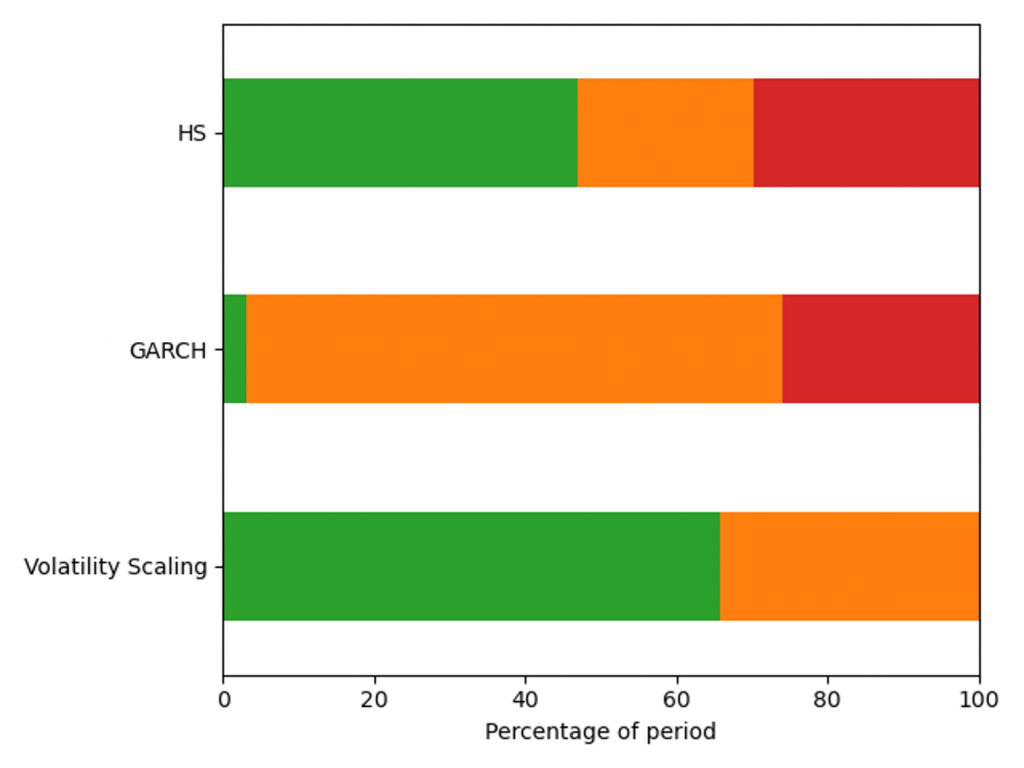

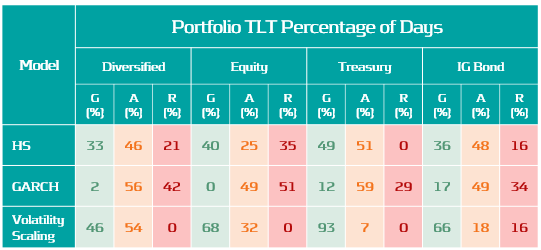

VaR backtesting results

The VaR model performance is illustrated by the percentage of backtest days with Red, Amber and Green TLT results in Figure 3. Over this period HS VaR shows a reasonable coverage of the hypothetical P&Ls, however there are instances of Red results due to the failure to adapt to changes in market conditions. The GARCH model shows a significant reduction in performance, with 32% of test dates falling in the Red zone as a consequence of VaR underestimation in calm markets. The adaptability of volatility scaling ensures it can adequately cover the tail risk, increasing the percentage of Green TLT results and completely eliminating Red results. In this benchmarking scenario, only volatility scaling would pass regulatory scrutiny, with HS VaR and GARCH being classified as flawed models, requiring remediation plans.

Figure 3: Percentage of days with a Red, Amber and Green Traffic Light Test result for a diversified portfolio over the window 29/01/21 - 31/01/23.

VaR model capital requirements

Capital requirements are an important determinant in banks’ ability to act as market intermediaries. The volatility scaling method can be used to increase the HS capital deployment efficiency without compromising VaR backtesting results.

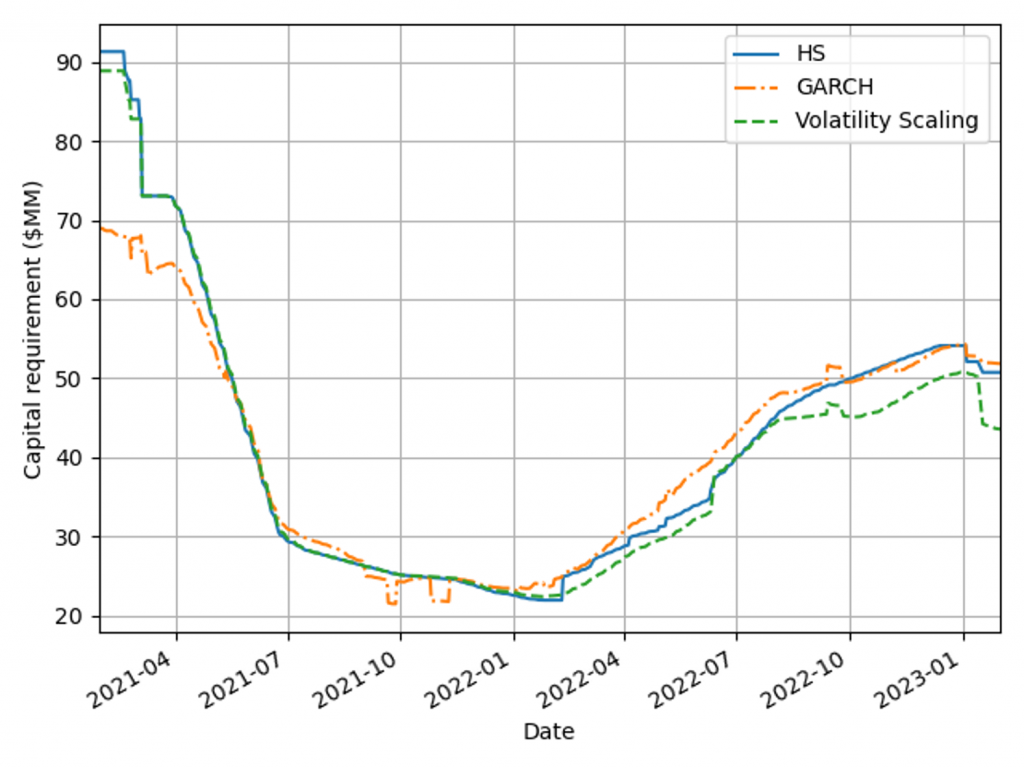

Capital requirements minimisation

A robust VaR model produces risk measures that ensure an ample capital buffer to absorb portfolio losses. When selecting between robust VaR models, the preferred approach generates a smaller capital charge throughout the market cycle. Figure 4 shows capital requirements for the VaR models for a diversified portfolio calculated using Equation 1, with 𝐴𝑑𝑑𝑜𝑛𝑠 set to zero. Volatility scaling outperforms both models during extreme market volatility (the Russia-Ukraine conflict) and the HS model in period of stability (2021) as a result of setting the lower scaling constraint. The GARCH model underestimates capital requirements in 2021, which would have forced a bank to move to a standardised approach.

Figure 4: Capital charge for the VaR models measured on a diversified portfolio over the window 29/01/21 - 31/01/23.

Capital management efficiency

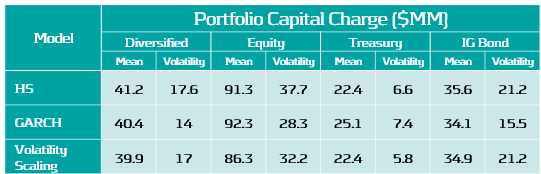

Pro-cyclicality of capital requirements is a common concern among regulators and practitioners. More stable requirements can improve banks’ capital management and planning. To measure models’ pro-cyclicality and efficiency, average capital charges and capital volatilities are compared for three concentrated asset class portfolios and a diversified market portfolio, as shown in Table 2. Volatility scaling results are better than the HS model across all portfolios, leading to lower capital charges, volatility and more efficient capital allocation. The GARCH model tends to underestimate high volatility and overestimate low volatility, as seen by the behaviour for the lowest volatility portfolio (Treasury).

Table 2: Average capital requirement and capital volatility for each VaR model across a range of portfolios during the test period, 29/01/21 - 31/01/23.

Conclusions on VaR backtesting

Recent periods of market stress highlighted the need to challenge banks’ existing VaR models. Volatility scaling is an efficient method to enrich existing VaR methodologies, making them robust across a range of portfolios and volatility regimes.

VaR backtesting in a volatile market

Ensuring VaR models conform to VaR backtesting will be challenging with the recent period of stressed market conditions and rapid changes in market volatility. Banks will need to ensure that their VaR models are responsive to volatility clustering and tail events or enhance their existing methodology to cope. Failure to do so will result in additional overheads, with increased capital charges and excessive exceptions that can lead to additional regulatory scrutiny.

Enriching VaR Models with volatility scaling

Volatility scaling provides a simple extension of HS VaR that is robust and responsive to changes in market volatility. The model shows improved backtesting performance over both the HS and parametric (GARCH) VaR models. It is also robust for highly concentrated equity, treasury and bond portfolios, as seen in Table 3. Volatility scaling dampens pro-cyclicality of HS capital requirements, ensuring more efficient capital planning. The additional computational overhead is minimal and the implementation to enrich existing models is simple. Performance can be further improved with the use of hybrid models which incorporate volatility scaling approaches. These can utilise outlier detection to increase conservatism dynamically with increasingly volatile market conditions.

Table 3: Percentage of Green, Amber and Red traffic Lights test results for each VaR model across a range of portfolios for dates in the range: 13/02/19 - 31/01/23.

Zanders recommends

Banks should invest in making their VaR models more robust and reactive to ensure capital costs and the probability of exceptions are minimised. VaR models enriched with a volatility scaling approach should be considered among a suite of models to challenge existing VaR model methodologies. Methods similar to volatility scaling can also be applied to parametric and semi-parametric models. Outlier detection models can be used to identify changes in market regime as either feeder models or early warning signals for risk managers

In March 2021, the European Banking Authority (EBA) was mandated through Article 501c of the Capital Requirements Regulation (CRR) to “assess […] whether a dedicated prudential treatment of exposures related to assets or activities associated substantially with environmental and/or social objectives would be justified”.

More simply put, the EBA was asked to investigate whether the current prudential framework properly captures environmental and social risks. In response, the EBA published a Discussion Paper (DP) [1] in May 2022 to collect input from stakeholders such as academia and banking professionals.

After briefly presenting the DP, this article reviews the current Pillar 1 Capital (P1C) requirements. We limit ourselves to the P1C requirements for credit risk as this is by far the largest risk type for banks. Furthermore, we only discuss the interaction of the P1C with climate change risks (as opposed to broader environmental and/or social risk types). After establishing the extent to which the prudential framework takes climate change risks into account, possible amendments to the framework will be considered.

Key take-aways of this article:

- The current prudential framework includes several mechanisms that allow the reflection of climate change risks into the P1C.

- The interaction between P1C and climate change risks is limited to specific parts of the portfolio, and in those cases, it remains to be seen to what extent this is properly accounted for at the moment.

- Amendments to the prudential framework can be considered, but it is important to avoid double counting issues and to take into account differences in time horizons.

- The EBA is expected to publish a final report on the prudential treatment of environmental risks in the first half of this year.

- Financial institutions that are using the internal ratings-based approach are advised to start with the incorporation of climate change risks into PD and LGD models.

EBA’s Discussion Paper

In the introduction of the DP, the EBA mentions the increasing environmental risks – and their interaction with the traditional risk types – as the trigger for the review of the prudential framework. One of the main concerns is whether the current framework is sufficiently capturing the impact of transition risks and the more frequent and severe physical risks expected in the coming decades. In this context, they stress the special characteristics of environmental risks: compared to the traditional risk types, environmental risks tend to have a “multidimensional, non-linear, uncertain and forward-looking nature.”

The EBA also explains that the P1C requirements are not intended to cover all risks a financial institution is exposed to. The P1C represents a baseline capital requirement that is complemented by the Pillar 2 Capital requirement, which is more reflective of a financial institution’s specific business model and risks. Still, it is warranted to assess whether environmental risks are appropriately reflected in the P1C requirements, especially if these lead to systemic risks.

Even though the DP raises more questions than it provides answers, some starting points for the discussion are introduced. One is that the EBA takes a risk-based approach. Their standpoint is that changes to the prudential framework should reflect actual risk differentials compared to other risk types and that it should not be a tool to (unjustly) incentivize the transition to a sustainable economy. The latter lies “in the remit of political authorities.”

The DP also discusses some challenges related to environmental risks. One example is the lack of high-quality, granular historical data, which is needed to support the calibration of the prudential framework. The EBA also mentions the mismatch in the time horizon for the prudential framework (i.e., a business cycle) and the time horizon over which the environmental risks will unfold (i.e., several decades). They wonder whether “the business cycle concepts and assumptions that are used in estimating risk weights and capital requirements are sufficient to capture the emergence of these risks.”

Finally, the EBA does not favor supporting and/or penalizing factors, i.e., the introduction of adjustments to the existing risk weights based on a (green) taxonomy-based classification of the exposures1. They are right to argue that there is no direct relationship between an exposure’s sustainability profile and its credit risk. In addition, there is a risk of double counting if environmental risk drivers have already been reflected in the current prudential framework. Consequently, the EBA concludes that targeted amendments to the framework may be more appropriate. An example would be to ensure that environmental risks are properly included in external credit ratings and the credit risk models of financial institutions. We explain this in more detail in the following paragraphs.

Pillar 1 Capital requirements

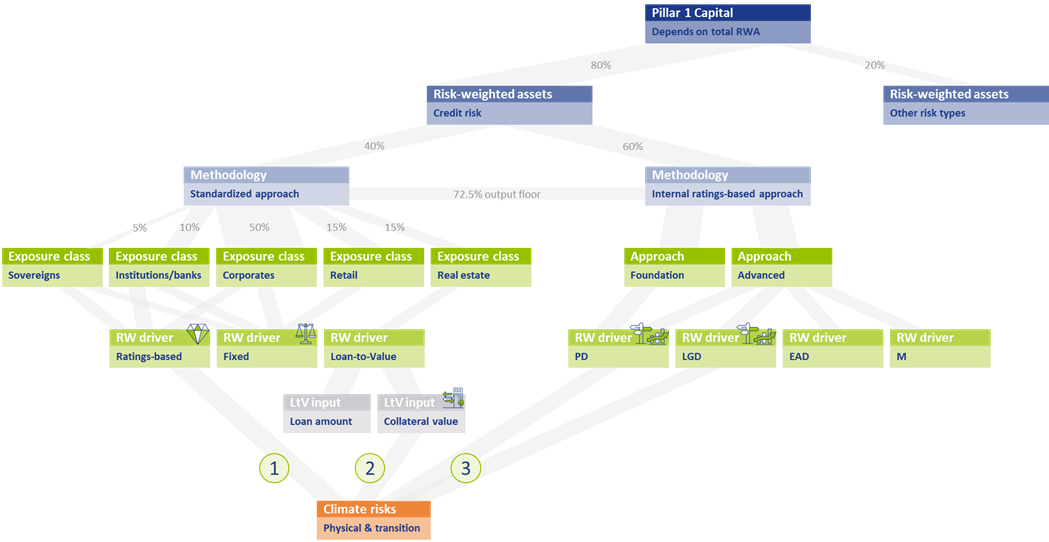

The assessment to what extent climate change risks are properly captured in the current prudential framework requires at least a high-level understanding of the framework. Figure 1 presents a schematic overview of the P1C requirements.

The P1C (at the top of Figure 1) depends on the total amount of Risk-Weighted Assets (RWAs; on the row below)2. RWAs are determined separately for each (traditional) risk type. As mentioned, we only focus on credit risk in this article. The RWAs for credit risk are approximately 80% of the average bank’s total RWAs3. Financial institutions can choose between two methodologies for determining their credit risk RWAs: the Standardized Approach (SA)4 and the internal ratings-based (IRB) approach5 . In Europe, on average 40% of the total RWAs for credit risk are based on the SA, while the rest is based on the IRB approach6 :

Figure 1 – Schematic overview of the P1C requirements and the interaction with climate change risks

Standardized Approach

In the SA, risk weights (RWs) are assigned to individual exposures, depending on their exposure class. About 50% of the RWAs for credit risk in the SA stem from the Corporates exposure class7. Generally speaking, there are three possible RW drivers: the RWAs depend on the external credit rating for the exposure, a fixed RW applies, or the RW depends on the Loan-to-Value8 (LtV) of the (real estate) exposure. The RW for an exposure to a sovereign bond for example, is either equal to 100% if no external credit rating is available (a fixed RW) or it ranges between 0% (for an AAA to AA-rated bond) and 150% (for a below B-rated bond).

Internal Ratings-Based Approach

Within the IRB approach, a distinction is made between Foundation IRB (F-IRB) and Advanced IRB (A-IRB). In both cases, a financial institution is allowed to use its internal models to determine the Probability of Default (PD) for the exposure. In the A-IRB approach, the financial institution in addition is allowed to use internal models to determine the Loss Given Default (LGD), Exposure at Default (EAD), and the Effective Maturity (M).

Interaction with climate change risks

The overview of the P1C requirements introduced in the previous section allows us to investigate the interaction between climate change risks and the P1C requirement. This is done separately for the SA and the IRB approach.

Standardized Approach

In the SA, there are two elements that allow for interaction between climate change risks and the resulting P1C. Climate change risks could be reflected in the P1C if the RW depends on an external credit rating, and this rating in turn properly accounts for climate change risks in the assessment of the counterparty’s creditworthiness (see 1 in Figure 1). The same holds if the RW depends on the LtV and in turn, the collateral valuation properly accounts for climate change risks (see 2 in Figure 1). This raises several concerns:

First, it can be questioned whether external credit ratings are properly capturing all climate change risks. In a report from the Network for Greening the Financial System (NGFS) [3], which was published at the same time as EBA’s DP, it is stated that credit rating agencies (CRAs) have so far not attempted to determine the credit impact of environmental risk factors (through back-testing for example). Also, the lack of high-quality historical data is mentioned as an explanation that statistical relationships between environmental risks and credit ratings have not been quantified. Further, a paper published by the ECB [4] concludes that, given the current level of disclosures, it is impossible for users of credit ratings to establish the magnitude of adjustments to the credit rating stemming from ESG-related risks. Nevertheless, they state that credit rating agencies “have made significant progress with their disclosures and methodologies around ESG in recent years.” The need for this is supported by academic research. An example is a study [5] from 2021 in which a correlation between credit default swap (CDS) spreads and ESG performance was demonstrated, and a study from 2020 [6] which demonstrated that high emitting companies have a shorter distance-to-default.

Secondly, the EBA has reported in the DP that less than 10% of the SA’s total RWAs is derived based on external credit ratings. This implies that a large share of the total RWAs is assigned a fixed RW. Obviously, in those cases there is no link between the P1C and the climate change risks involved in those exposures.

Finally, climate change risks only impact the P1C maintained for real estate exposures to the extent that these risks have been reflected in collateral valuations. Although climate change risks are priced in financial markets according to academic literature, many papers and institutions indicate that these risks are not (yet) fully reflected. In a survey held by Stroebel and Wurgler in 2021 [7], it is shown that a large majority of the respondents (consisting of finance academics, professionals and public sector regulators, among others) is of the opinion that climate change risks have insufficiently been priced in financial markets. A nice overview of this and related literature is presented in a publication from the Bank for International Settlements (BIS) [8]. The EBA DP itself lists some research papers in chapter 5.1 that indicate a relationship between a home’s sales price and its energy efficiency, or with the occurrence of physical risk events. It is unclear though if climate change risks are fully captured in the collateral valuations. For example, research is presented that information on flood risk is not priced into residential property prices. Recent research by ABN AMRO [9] also shows this.

Internal Ratings-Based Approach

In the IRB approach, financial institutions have more flexibility to include climate change risks in their internal models (see 3 in Figure 1). In the F-IRB approach this is limited to PD models, but in the A-IRB approach also LGD models can be adjusted.

A complicating factor is the forward-looking nature of climate change risks. In recent years, the competent authorities have pressured financial institutions to use historical data as much as possible in their model calibration and to back-test the performance of their models. As climate change risks will unfold over the next couple of decades, these are not (yet) reflected in historical data. To incorporate climate change risk, expert judgement would therefore be required. This has been discouraged over the past years (e.g., through the ECB’s Targeted Review of Internal Models (TRIM)) and it will probably trigger a discussion with the competent authorities. A possible deterioration of model performance (due to higher estimated risks compared to historically observations) is just one example that may attract attention.

Another complicating factor is that under the IRB approach, the PD of an obligor is estimated based on long-run average one-year default rates. While this may be an appropriate approach if there are no clear indications that the overall risk level will change, this does not hold if climate change risks increase in the future, and possibly increase systemic risks. By continuing to base a PD model on historical data only, especially for exposures with a time to maturity beyond a couple of years, the credit risk may be understated.

Are amendments to the prudential framework needed?

We have explained that there are several mechanisms in the prudential framework that allow environmental risks to be included in the P1C: the use of external credit ratings, the valuation of collateral, and the PD and LGD models used in the IRB approach. We have also seen, however, that it is questionable whether these mechanisms are fully effective. External credit ratings may not properly reflect all environmental risks and these risks may not be fully priced in on capital markets, leading to incorrect collateral values. Finally, a large share of the RWAs for credit risk depends on fixed RWs that are not (environmentally) risk-sensitive.

Consequently, it can be argued that amendments or enhancements to the prudential framework are needed. One must be careful, however, as the risk of double counting is just around the corner. Therefore, the following amendments or actions should be considered:

- Further research should be undertaken to investigate the relationship between climate change risk and the creditworthiness of counterparties. If there is more clarity on this relationship, it should also be assessed to what extent this relationship is sufficiently reflected in external ratings. Requiring more advanced disclosures from credit rating agencies could help to understand whether these risks are sufficiently captured in the prudential framework. One should be cautious to amend the ratings-based RWs in the SA, since credit rating agencies are continuously working on the inclusion of environmental risks into their credit assessments; there would be a real risk of double counting.

- The potential negative impact of climate change risks on collateral value should be further investigated. Financial institutions are already required by the ECB9 to consider environmental risks in their collateral valuations but this is not at a sufficient level yet. It will be important to consider the possibility of sudden value changes due to transition risks like shifting consumer sentiment or awareness.

- To improve the risk-sensitivity of the framework, a dependency on the carbon emissions of the counterparty could be introduced in the fixed RWs, possibly only for the most carbon-intensive sectors. It could be argued that there are other factors that have a more significant relationship with the default risk of a certain counterparty that could be included in the SA. Climate change risks, however, differ in the sense that they can lead to a systemic risk (as opposed to an idiosyncratic risk) that is currently not captured in the overall level of the RWs.

- In the SA, a distinction could be introduced based on the exposure’s time to maturity. For relatively short-term exposures, the current calibrations are probably fine. For longer-term exposures, however, the risks stemming from climate change may be underestimated as these are expected to increase over time.

- In the IRB approach, a reflection of climate change risk would require the regulator to allow for forward-looking expert judgment in the (re)calibration of PD and LGD models. Further guidance from the competent authorities on the potentially negative impact on model performance based on historical data would also be useful.

Conclusion

Based on the schematic overview of the P1C requirements and the (potential) interaction with climate change risks, we conclude that several mechanisms in the prudential framework allow for climate change risks to be incorporated into the P1C. At the same time, we conclude that this interaction is limited to specific parts of the portfolio, and that in those cases it remains to be seen to what extent this is properly accounted for. To remedy this, amendments to the prudential framework could be considered. It is important, however, to avoid double counting issues and to be mindful of time horizon differences.

It is expected that the EBA will publish a final report on the prudential treatment of environmental risks in the first half of this year. However, especially financial institutions that are using the IRB approach should not take a wait-and-see approach. Given the complexity of modeling climate change risks, it is prudent to start incorporating climate change risks into PD and LGD models sooner rather than later.

With Zanders’ extensive experience covering both credit risk modeling and climate change risk, we are well suited to support with this process. If you are looking for support, please reach out to us.

1 Supporting factors are currently in place for SMEs and infrastructure projects, but the EBA advocated their removal.

2 See RBC20.1 in the Basel Framework.

3 See for example the results from the EBA’s EU-wide transparency exercise. This is reflected in Figure 1 by the percentage in the grey link between P1C and RWAs for credit risk.

4 See CRE20 to CRE22 in the Basel Framework.

5 See CRE30 to CRE36 in the Basel Framework.

6 In the Netherlands, less than 20% of the total RWAs is based on the SA. See the EBA’s EU-wide transparency exercise for more information. The percentages in the grey link between ‘Risk-weighted assets’ and ‘Methodology’ in Figure 1 are based on the European average.

7 See the EBA’s Risk assessment of the European banking system [2]. The percentages in the grey link between ‘Standardized Approach’ and the ‘Exposure class’ in Figure 1 reflect the share of RWAs in the SA for each of the different exposure classes.

8 The LtV is defined as the ratio between the loan amount and the value of the property that serves as collateral.

9 See expectation 8.3 in the ECB’s Guide on climate-related and environmental risks.

References

- The role of environmental risks in the prudential framework, European Banking Authority, Discussion Paper, 2 May 2022

- Risk assessment of the European banking system, European Banking Authority, December 2022

- Capturing risk differentials from climate-related risks, Network for Greening the Financial System, Progress Report, May 2022

- Disclosure of climate change risk in credit ratings, European Central Bank, Occasional Paper Series, No. 303, September 2022

- Pricing ESG risk in credit markets, Federated Hermes, March 2021

- Climate change and credit risk, Capasso, Gianfrate, and Spinelli, Journal of Cleaner Production, Volume 266, September 2020

- What do you think about climate finance?, Stroebel and Wurgler, Journal of Financial Economics, vol 142, no 2, November 2021

- Pricing of climate risks in financial markets, Bank for International Settlements, Monetary and Economic Department, December 2022

- Is flood risk already affecting house prices?, ABN AMRO, 11 February 2022

- Guide on climate-related and environmental risks, European Central Bank, November 2020

Climate change presents risks to the banking system.

These risks stem from the transition towards a low carbon economy and from the physical risks of damages due to extreme weather events. To address climate-related financial risks within the banking sector, the Basel Committee on Banking Supervision (BCBS) established a high-level Task Force on Climate-related Financial Risks in 2020. It contributes to the BCBS’s mandate to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial stability.

Both the BCBS’s Core principles for effective banking supervision1 and the Supervisory Review and Evaluation Process (SREP) within the existing Basel Framework are considered sufficiently broad and flexible to accommodate additional supervisory responses to climate-related financial risks. It was felt, however, that supervisors and banks could benefit from the publication of the Principles for the effective management and supervision of climate-related financial risks2. Through this publication, the BCBS seeks to promote a principles-based approach to improving risk management and supervisory practices regarding climate-related financial risks. The document contains principles directed to banks and principles directed to supervisory authorities. In this article, we present an overview of the principles directed to banks.

The BCBS published a draft of their Principles in November 2021. During the consultation phase, which lasted until February 2022, banks and supervisors could provide feedback. The BCBS incorporated their feedback in the final version of the Principles that were published in June 2022.

Principles for the management of climate-related financial risks

In total, twelve bank-focused principles are presented and grouped in eight categories. Each of the eight categories is briefly discussed below:

Corporate governance – Principles 1 to 3

The principles related to corporate governance state that banks first need to understand and assess the potential impact of climate risks on all fields they operate in. Subsequently, appropriate policies, procedures and controls need to be implemented to ensure effective management of the identified risks. Furthermore, roles and responsibilities need to be clearly defined and assigned throughout the bank. To successfully manage climate-related risks, banks should ensure an adequate understanding of climate-related financial risks and as well as adequate resources and skills at all relevant functions and business units within the bank. Finally, the board and senior management should ensure that all climate-related strategies are consistent with the bank’s stated goals and objectives.

Internal control framework – Principle 4

The fourth principle within the internal control framework subcategory requires banks to include clear definitions and assignment of climate-related responsibilities and reporting lines across all three lines of defense. Further requirements are then presented for each line of defense.

Capital and liquidity adequacy – Principle 5

After the identification and quantification of the climate-related financial risks, these risks need to be incorporated into banks’ Internal Capital (and Liquidity) Adequacy Assessment Process (ICLAAP). Banks should provide insights in which climate-related financial risks affect their capital and liquidity position. In addition, physical and transition risks relevant to a bank’s business model assessed as material over relevant time horizons, should be incorporated into their stress testing programs in order to evaluate the bank’s financial position under severe but plausible scenarios. Furthermore, the described incorporation in the ICLAAP to handle such financial risks, should be done iteratively and progressively, as the methodologies and data used to analyze these risks continue to mature over time.

Risk management process – Principle 6

The sixth principle connects to the previous one, as it states that a bank needs to identify, monitor and manage all climate-related financial risks that could materially impair their financial condition, including their capital resources and liquidity positions. The bank’s risk management framework should be comprehensive with respect to the (material) climate-related financial risks they are exposed to. Clear definitions and thresholds should be set for materiality. These need to be monitored closely and adjusted, if necessary, as climate-related risks are evolving.

Management monitoring and reporting – Principle 7

After ensuring that the risk framework is comprehensive, banks need to implement the monitoring and reporting of climate-related financial risks in a timely manner to facilitate effective decision-making. To achieve such reporting, a good data infrastructure should be in place at the bank. This allows it to identify, collect, cleanse, and centralize the data necessary to assess material climate-related financial risks. Furthermore, banks should actively collect additional data from clients and counterparties in order to develop a better understanding of their client’s transition strategies and risk profiles.

Management of credit, market, liquidity, operational risk – Principles 8 to 11

Banks should understand the impact of climate-related risk drivers on their credit risk profiles, market positions, liquidity risk profiles and operational risks. Clearly articulated credit policies and processes to identify, measure, evaluate, monitor, report and control or mitigate the impacts of material climate-related risk drivers on banks’ credit risk exposures should be in place. From a market risk perspective, banks should consider the potential losses in their portfolios due to climate-related risks. On the business operation and strategy side of banking activities, the impact of climate-related risks also plays a large role. For example, physical risks have to be taken into account when drafting business continuity plans. After understanding the different risks and their impacts, a range of risk mitigation options to control or mitigate climate-related financial risks need to be considered.

Scenario analysis – Principle 12

The final principle states that banks need to use scenario analysis to assess the resilience of their business models and strategies to a range of plausible climate-related pathways, and to determine the impact of climate-related risk drivers on their overall risk profile. Scenario analysis should reflect the overall relevant climate-related financial risks for banks, including both physical and transition risks. This analysis should be performed for different time horizons, both short- and long-term, and should be highly dynamic.

Changes to the BCBS risk framework draft and related publications

The final Principles have not changed much compared to the November 2021 consultation document. The most important changes are that the first principle, concerning corporate governance of banks, and the fifth principle, concerning capital and liquidity adequacy, have been extended. The corporate governance principle, for example, now also includes that banks should ensure that their internal strategies and risk appetite statements are consistent with any publicly communicated climate-related strategies and commitments. The capital and liquidity adequacy principle now includes a section requiring banks to incorporate material climate-related financial risks in their stress testing programs.

These twelve bank-focused principles, providing banks guidance on effective risk management of climate-related financial risks, can also be linked to the initiatives of other regulators such as the ECB. In November 2020, for example, the ECB provided a guide that describes how it expects institutions to consider climate-related and environmental risks, when formulating and implementing their business strategy, governance and risk management frameworks (the ECB expectations). These ECB expectations are in line with the BCBS Principles (and often more elaborate).

Zanders has gained relevant experience in implementing the ECB expectations at several Dutch banks. This experience ranges from risk identification and materiality assessments to the quantification of climate-related risks, ESG data frameworks, model validations, and scenario analysis. Please reach out to us if your bank is seeking support in implementing the BCBS Principles.

References

1) Basel Committee on Banking Supervision (2012). Core Principles for Effective Banking Supervision.

2) Basel Committee on Banking Supervision (2022). Principles for the effective management and supervision of climate-related financial risks.

With the recent avalanche of ESG-related guidance and regulations, it is easy to lose track of the corresponding timelines.

In the below overview, we present an overview of the main ESG-related publications from the European Commission (EC), the European Central Bank (ECB), and the European Banking Authority (EBA).

This is complemented by the most important timelines that are stipulated in these regulations and guidelines. Additional regulations and guidelines that are expected for the next couple of years are also highlighted.

If you want to discuss any of them, don’t hesitate to reach out to our subject matter experts.

At the beginning of January 2020, various media reported that the negotiations between health insurers and hospitals were proceeding with difficulty and were therefore not yet completed. For a number of years this went reasonably well, but due to conflicting interests this problem has returned.

It is clear that the outline agreement 2018 (Hoofdlijnen Akkoord 2018) is starting to crack. Slowing down the growth of medical-specialist care expenses to zero percent has not yet proved feasible in practice. Demographic developments, among other things, are causing demand for care to rise, but the parties are unable to realize the intended transition from hospital care to primary care at the same pace. In the mean time, however, insurers want to stick to the zero percent goal while hospitals do not want to turn patients away. In some arrangements, particularly those involving “effective care”, care provided in excess of the agreed amount is still (partly) reimbursed.

NECESSARY INVESTMENTS

As for the hospitals, in addition to the increase in demand for care, more money is needed. The recent CAO agreements are not covered by the regular agreements with the health insurer. Furthermore, it is common knowledge that the level of investment has lagged behind in recent years. Hospitals cannot continue to postpone the necessary investments in renovation, electronic patient files and further automation. Room must be created in operations to be able to bear the extra financing costs (interest and depreciation) in the long run.

"The hospital’s business case, with a projection of new investments, can no longer be made on the basis of the outcome of the negotiations with the health insurer."

Delivering care for the right remuneration has therefore become an increasingly delicate balancing act. The question is how the hospital will succeed in doing this within its operations and continue to comply with its financing ratios. The transition does not result in any cuts. Savings must come from the application of new concepts that lead to greater efficiency and a lower demand for second-line care. However, these developments take place at a slower pace than desired. Until then, hospitals feel, health insurers should step in. At least, as mentioned above, by reimbursing “effective care” above the agreed amount. The alternative is to raise the rates where there is still some room. So P or Q.

FINANCIAL BUSINESS CASE

The hospital’s business case, with a projection of new investments, can no longer be made on the basis of the outcome of the negotiations with the health insurer. Instead, during the negotiation process the person who controls the multi-year budget model – the treasurer – must be involved in the process. This gives the hospital more insight into the financial consequences. Sharing these insights with the health insurer can better substantiate the hospital’s arguments and thus provide more insight during negotiations. This way, the insurer becomes more directly involved in the long-term prognosis and the long-term financial health of the hospital. It thereby becomes a joint objective to achieve affordable care in the long term.

An important part of the financial business case is shaped during negotiations with the insurer. During the negotiations, the hospital wants to be able to steer the long-term impact of the outcomes. This is the only way to ensure that a proposition emerges that is financeable for banks and secure for the WfZ (Guarantee Fund for the Health Care Sector), and that the hospital is able to comply with the financing ratios in the long term. It will remain a balancing act, but one with a more solid basis.

The financial health of public institutions has been in the spotlight more prominently since the financial crisis. A healthy institution can meet its financial obligations in both the short and long term. This is reflected in good ratio developments, such as solvency, Loan-to-Value (LtV) and the Debt Service Coverage Ratio (DSCR). However, having healthy ratios does not automatically mean that you will have sufficient funds available quickly in case of incidental financial setbacks.

Financial setbacks can occur due to, for example, higher construction costs, inability to invoice due to IT problems, or production falling behind due to staff shortages. Savings, also called liquidity buffer, give you some time in such situations to take measures to resolve the incidents. If these temporary liquidity shortfalls cannot be compensated in time, this may translate into structural problems, deterioration of cash flow ratios, higher risk premiums on loans and, in the long term, perhaps even bankruptcy. A buffer therefore seems logical, but the design of a liquidity buffer is not that easy. After all, how is the amount and form of the buffer determined?

BUFFERING! (OR IS IT?)

Maintaining a liquidity buffer requires reserving available funds, but may be seen as unnecessary and socially undesirable. After all, there seems to be enough liquidity available to compensate setbacks and the public money could be better spent on social purposes. In practice, however, it happens that additional liquidity is not routinely or immediately available, or it is difficult to release funds quickly, or the additional liquidity is insufficient to temporarily compensate deficits.

Banks are also less likely to provide money to cover shortfalls during difficult times. In addition, the application process at a bank can take a relatively long time. To ensure the financial continuity of an institution in both good and bad times, many healthcare and educational institutions therefore feel the need to keep extra liquidity on hand, often encouraged by the accountant or the supervisory board. Next to that, bodies such as the WFZ (Guarantee Fund for the Health Care Sector), the Education Inspectorate and banks also stress the importance of a healthy liquidity buffer.

An important consideration is that the comfort of a liquidity buffer in the event of financial setbacks is only temporary. After all, you can only spend the money set aside once. If liquidity shortages continue and thus become structural in nature, you will have to look at long-term measures. However, using the liquidity buffer for structural deficits can give you more time to take a considered decision on the measures to be taken.

THE THICKER THE PIGGY BANK, THE BETTER?

An unequivocal answer to this question cannot be given. The starting points used differ per sector and per institution. In educational institutions, for example, we often see the current ratio as a yardstick for the buffer to be maintained. The current ratio indicates the relationship between the current assets and the current liabilities. The Education Inspectorate uses a current ratio of at least 0.5 for institutions in higher education and intermediate vocational education, and at least 0.75 for institutions in primary education, as a signaling value. However, many administrators and supervisory boards are comfortable with a higher standard and aim for a minimum ratio of 1.0 or higher.

An advantage of this methodology is that the current ratio does not yet take into account any room under the current account facility. This means that any current account facility can serve as an extra buffer in difficult times. A disadvantage is that the current ratio is generally a snapshot of the end of the year; no account is taken of intra-year developments. In case of an institution with volatile cash flows, guiding buffers by means of the current ratio can also lead to a yearly varying available buffer.

An alternative is to keep the amount of the liquidity buffer constant by steering towards an absolute norm. The WFZ, for example, advises healthcare institutions to use twice their turnover per month as the standard, but states that this is not a universal, objective standard. Zanders also sees many institutions using a standard of twice the monthly salary or 1.5 months' turnover. One point to note is that these standards are often quite high.

Our general advice is to gear the amount of the buffer to the liquidity development in both the short and long term, the risks and factors that play a role in your sector and in your institution. In addition, we recommend that the development of your long-term budget in the event of negative developments, also referred to as scenario analyses, be included in the consideration. Comfort can also play an important role. After all, it is up to you to determine which liquidity buffer is most appropriate and offers most comfort in daily operations.

DIFFERENT COMPONENTS OF YOUR BUFFER

Decisions must be made not only about the amount, but also about how to build up the liquidity buffer. Banks often offer the option of maintaining a liquidity buffer in the form of a current account facility, where the borrower pays commitment fees on the unused proportion and is charged a variable interest rate plus mark-up on the used portion. Generally, the amount of the current account is tailored to the institution's liquidity forecasts.

When deploying the current-account credit, it is important to determine whether it is committed or uncommitted. With an uncommitted overdraft, the bank can unilaterally cancel the facility daily - this is an availability risk. With a committed facility, there is the 'certainty' that the bank may not withdraw the facility during the agreed term. Also for this service, a commitment fee must be paid on the unused portion and the bank may ask for a higher mark-up during bad years when using the current account. In addition, there may be contractual terms that still allow the bank to unilaterally cancel the unused portion.

"An important consideration is that the comfort of a liquidity buffer in the event of financial setbacks is only temporary. After all, you can only spend the money set aside once."

From a risk perspective, it could therefore be argued that credit balances are safer than current account facilities. After all, this money cannot be cancelled unilaterally and there is no commitment fee on the unused portion or interest charges on the used portion. However, due to the low interest rates in recent years, the savings interest rate on credit balances has fallen to such a low level that it is currently even negative. For some banks this means that interest is no longer received on positive balances, but that from a certain size of credit balance onward, interest may have to be paid, also called negative interest. As a result, financing must then also be attracted in order to maintain the liquidity buffer, so there are double costs. In this case you not only pay interest on the credit balance, but also the regular financing costs.

Some institutions see their investment portfolio as an emergency pool they can use in difficult times. The advantage of invested money is that you do not suffer from negative interest rates or commitment fees. You also have a monthly stream of investment income. However, not every institution is allowed to invest money due to laws and regulations. Furthermore, you have to deal with counterparty risk, price risk in case of interim sales, and risk of negative returns. Moreover, the question is whether you can liquidate your investments fast enough to make payments.

The above options provide institutions with the room to have additional funds available during financially challenging times. However, the question remains as to which is the best option. Each option has advantages and disadvantages, and to make the choice even more difficult, a combination of the above options could also be a good solution for you.

CUSTOMIZATION, CUSTOMIZATION, CUSTOMIZATION...

Many institutions see the need to maintain a liquidity buffer either from a risk perspective, because of regulatory requirements, or for having comfort in operational execution. However, there is no simple answer to what the optimum level of a liquidity buffer is and how exactly it should be built. Each institution has its own risks and factors that must be taken into account. Setting up a liquidity buffer therefore requires a thorough analysis of cash flow development in the short and long term, key figures, costs, risks and options available from banks while adhering to legislation and regulations. In short, setting up a liquidity buffer is and remains custom work!

Monitoring the development of liquidity might be regarded as a purely operational matter in your organization too. But if you look further, you will realize that liquidity has an important strategic component and is a good performance indicator.

When a positive operating cash flow is realized, it is easier for a company to invest in acquisitions, fixed assets and innovation, for example. On the other hand, a negative operating cash flow can be an indication that the survival of an organization in the long term may be at risk. Therefore, a reliable cash flow forecast is of strategic importance for every organization and deserves attention at board level as well.

In one of our other articles about cash flow forecasting, we focus on information, processes and systems that are needed to come to an accurate cash flow forecast. In this article, we focus on the strategic side; which stakeholders, agreements and steering possibilities play a role to keep a grip on the cash flows in the long run?

STAKEHOLDERS

Having sufficient liquidity in the long run ultimately means continuity for the company. Internally, not only management (Board of Directors) but also the Supervisory Board (SB) is responsible for this. Large investments often have to be approved by both. They will therefore want to be informed well and in time about the expected development of the liquidity position in the short and longer term. After all, if a cash shortage threatens, directors' liability comes into play. The management board may not enter into any new obligations if it can reasonably assume that the current creditors cannot be paid (in the short term).

In some cases there may be a public shareholder. For them, insight into cash flows and the development of liquid assets is of great importance. After all, if a cash shortage is imminent, the shareholder is often the first to be approached to supplement this.

A company also has to deal with external stakeholders. The most important are often the financiers and the auditor. Financiers can be banks, but also ministries (through treasury banking) or care offices (funding). The financiers usually monitor the financial health of the company using various ratios and covenants. The liquidity position is very relevant here because, among other things, it gives an indication of the extent to which the organization is able to repay the outstanding loan(s).

Finally, the auditing external accountant follows the liquidity position with above-average interest, because when auditing the financial statements he must issue a continuity statement, among other things. This is only possible if there are sufficient liquid assets to meet current liabilities for at least 18 months in advance.

APPOINTMENTS

Internal agreements focus mainly on the frequency, timing and type of cash flow forecast. In calm, predictable times with an ample liquidity buffer the demands are different from those in uncertain, turbulent times. This therefore requires a different set-up of the organization. During predictable times and when there are no major investment plans, a good understanding of the liquidity position is still important, because it affects the amount of funding to be raised or the deployment of funds, for example.

However, in that case the frequency of forecasting does not have to be weekly, the timing is less strict and the indirect method suffices (in which the cash flows originate from the P&L account and the balance sheet. This method therefore also includes the cash effects of balance sheet changes). Reporting to management board members also takes place less frequently. However, if the company is in dire straits, this will not be sufficient and the frequency of the forecast and the reports will have to be increased. Moreover, the time horizon will be longer.

"In addition to making arrangements to make cash flows transparent, it is equally important to know what tools a director has to prevent a cash shortage."

The ability to attract additional funding is largely determined by the extent to which the organization is able to provide the necessary insight into, and correct substantiation of, the cash flows, assuming sufficient repayment capacity. This means that extra attention must be paid to the design of the processes, the mutual communication and the quality of the available data. Although these are matters that must be arranged in the operational process, this often does not happen automatically. It is therefore desirable for directors to keep a close eye and at least discuss the progress made in this area with the responsible manager(s).

It is also good for directors to be aware of the most important agreements in the financing contracts. For example: when must the (un)audited annual figures or the calculation of the bank covenants be submitted; what are the consequences of breaching the covenants; what conditions apply to obtaining a waiver? Although there is a whole process involved, it is good to realize that, worst case, failure to meet certain obligations in the contract can lead to an event of default and ultimately even a loan falling due.

CONTROL OPTIONS

In addition to making agreements to provide insight into cash flows, it is at least as important to know which instruments a director has to prevent a shortage of liquid assets. Before discussing this with financiers or possible shareholders, experience shows that they will often first demand that costs and revenues be closely scrutinized. Furthermore, outside the organization additional financing can be sought from banks or a ministry.

If available, a shareholder can be asked for additional capital. Which one should be approached first, again depends on the situation. In times of uncertainty, or when the financiers have financed a large amount (this can be determined using the net debt/EBITDA or Loan to Value), it is common to approach the potential shareholders first.

After all, because of the uncertainty about the future or the size of their current exposure, financiers will be reluctant to put extra money into the company. It is important to inform shareholders during good times and to keep them informed in the regular reporting cycle. To avoid being taken by surprise, they should be informed immediately of any development that could have a major impact. If the company is doing well and investments are needed to facilitate growth, for example, the financiers can be consulted first. Whether they are prepared to provide additional financing depends on several factors (such as the nature of the investment plans and the robustness of the forecasts provided), but the basic attitude will often be positive.

CONCLUSION

The importance of understanding the development of cash flows is not purely an operational matter. Cash flows play an important role in the continuity and flexibility of the business, the ability to invest, the timely identification of risks and the determination of the value of the business. For these reasons cash flows deserve attention at board level. To obtain good insights, the relationship with internal and external stakeholders, the agreements made with financiers and the measures to adjust play an important role. In all these matters, timeliness, predictability and accuracy are key to continuity and therefore important for a director. It is advisable to continuously invest in and pay attention to these issues.

Within an organization, important choices are made based on the current and expected liquidity position. It is therefore of great importance that the liquidity position is accurately portrayed and regularly updated.

During uncertain times, making a forecast requires extra effort and poses a greater challenge. For example, due to uncertainty, it may be decided to update the liquidity forecast(s) more frequently. The question raised then is what frequency is appropriate and how to deal with the assumptions underlying forecasts made during an economically sound period. In this article we discuss the information, processes and systems that are important for getting (and keeping) a good grip on the development of cash flows. Ultimately, as an organization you want to have a reliable picture at all times of the expected development of the liquidity in the short, medium and long term.

AVAILABILITY OF THE RIGHT INFORMATION

In order to obtain the best possible picture of the liquidity position, the quality of the underlying information is of great importance. The realized and projected profit and loss account, balance sheet, investment plans and transactions form an important part of the input. From a theoretical point of view, there are two methods to translate this input into the calculation of the (expected) cash flows; the direct and the indirect method.

- Under the direct method, cash flows are based on individual incoming and outgoing transactions, such as accounts receivable receipts, accounts payable payments, investments and interest payments.

- Cash flows under the indirect method arise from the P&L account and the balance sheet. Thus, under this method, the cash effects of balance sheet changes are also included.

Which method is appropriate depends in part on the length of the specific forecast. Actual bank movements (or an accurate estimate of these), on which the direct method is based, are often available for a relatively short period of time. This makes this method suitable for a short-term forecast. With the indirect method, the cash flows are derived from the projected P&L account and balance sheet. Because of this combination, this method is ideal for medium and long-term forecasts.

The most appropriate methodology depends partly on the length of the liquidity forecasts. In order to obtain a good picture of the liquidity position in the short, medium and long term, various forecasts must be prepared. These forecasts differ in terms of time units (week, month, quarter and year) and length (quarter, year and > 1 year). The matrix below shows the different time lines again, with the different forecasts shown vertically. To the right of the matrix, the appropriate methods for each forecast are shown.

Here, it is often the case that the longer the period over which the forecast is made, the less accurate the forecast. The choices regarding time units and length of the forecast are related to the phase in which the organization finds itself and the type of sector in which the organization operates. For example, in times of economic uncertainty (such as the current pandemic) or in the case of a weak financial position, it is often chosen - sometimes imposed by external financial stakeholders (e.g. special management of a bank) - to produce a short term forecast on a weekly basis. This should ensure that the financial position is brought into focus on a weekly basis, thereby increasing the grip on cash flows.

"In order to get a good picture of the liquidity position in the short, medium and long term, various forecasts need to be made."

However, this does not mean that the financial position is more accurately portrayed by creating more forecasts of different lengths. Indeed, too many (different) forecasts generate a constant time investment that is too great to keep updating them.

When an organization is in a "quiet" period, a monthly forecast for 12 months rolling, combined with a multi-year (annual) forecast for 5 years rolling, may be sufficient. However, consistency between forecasts is crucial. The inputs provided should be consistent across the different forecasts, and the time units of the different forecasts should overlap. For example, if a 13-week forecast (quarterly) is chosen, it will logically align with the liquidity forecast of at least 12 months rolling on a quarterly basis.

EMBEDDING IN SYSTEMS

One of the tools needed to process and update all information is a system that brings together all cash flow information. In practice, a treasury module in the existing ERP system or an Excel file is regularly used. If Excel is used without a clear format, it often turns out to be too complex, confusing and prone to errors. With a clear format, Excel can certainly be a suitable tool. In addition, one can choose to largely automate the forecasting process by means of an application.

The format of the chosen system will act as a means of creating consensus among internal stakeholders on the approach and principles of forecasting. In addition, it will create clarity towards external stakeholders. In order to maintain an overview, it is advisable to subdivide the cash flows into a limited number of items. The following three types of cash flows provide the basis for this:

- Operating cash flow: all cash flows resulting from operations.

- Investing cash flow: consisting of the investments in fixed assets, investments in the form of acquisitions or revenue sales.

- Financing cash flow: all expenditures and income from financing activities (a different choice can be made with respect to interest).

TREASURYnxt provides organizations with a flexible way to create liquidity forecasts for the above cash flows. To learn more about TREASURYnxt , click here.

GETTING A GRIP ON CASH THROUGH THE RIGHT PROCESSES

Besides information and systems, processes will need to be established within the organization to really get a grip on the cash position. Fixed processes bring structure to the preparation, comparison and updating of forecasts. It must always be possible to answer the question of why a particular cash flow differs from a previously prepared forecast.

It is important to be able to explain the difference between two liquidity forecasts of different times. A clear format can help with this. The challenge lies in constantly updating and reconciling these forecasts. If, for example, an investment is postponed, this will have to be reflected immediately in the investment cash flows of the forecasts. Here, clear communication is crucial. This starts with internal communication, by means of regular meetings or calls (so-called cash calls). By scheduling regular cash calls, during which the cash position and expectations are discussed and analyzed, the forecasts remain up-to-date. It is preferable to align the frequency of these cash calls with the frequency of the relevant forecast. In communications with external stakeholders, it is particularly important to provide insight into the risks and opportunities of the forecasts that have been prepared.

Finally, it is essential to compare the actual realization of the cash flows with the forecast that was prepared for the cash flows. The deviations and insights arising from this must be taken into account in the forecast for the subsequent period. After processing this realization, the length of the relevant forecast will have to remain unchanged, a so-called rolling forecast.

Ultimately, grip on the cash position can only be realized through the combination of information, systems and processes. A clear vision on this helps to structure this interplay.

Low interest rates, decreasing margins and regulatory pressure: banks are faced with a variety of challenges regarding non-maturing deposits. Accurate and robust models for non-maturing deposits are more important than ever. These complex models depend largely on a number of modeling choices. In the savings modeling series, Zanders lays out the main modeling choices, based on our experience at a variety of Tier 1, 2 and 3 banks.

The low or even negative market rates in many Western European countries significantly affect banks’ pricing and funding strategy. Many banks hesitate to offer negative rates on non-maturing deposits (NMD) to retail customers. In some markets, like in Belgium, regulatory restrictions impose a lower limit on the savings rate that a bank can offer. The adverse impact of these developments is that current funding margins for many banks are under pressure.