ISO 20022 XML (Pain.001.001.09) – Introduction of the Structured Address

The SWIFT MT-MX migration is now underway, with a primary focus on a select number of MT messages within the interbank messaging space.

However, possibly the most important point for corporates to be aware of is the planned move towards explicit use of the structured address block. In this second article in the ISO 20022 series, Zanders experts Eliane Eysackers and Mark Sutton provide some valuable insights around this industry requirement, the challenges that exists and an important update on this core topic.

What is actually happening with the address information?

One of the key drivers around the MT-MX migration are the significant benefits that can be achieved through the use of structured data. E.g., stronger compliance validation and support STP processing. The SWIFT PMPG1 (Payment Market Practice Group) had advised that a number of market infrastructures2 are planning to mandate the full structured address with the SWIFT ISO migration. The SWIFT PMPG had also planned to make the full structured address mandatory for the interbank messages – so effectively all cross-border payments. The most important point to note is that the SWIFT PMPG had also advised of the plan to reject non-compliant cross border payment messages from November 2025 in line with the end of the MT-MX migration. So, if a cross border payment did not include a full structured address, the payment instruction would be rejected.

What are the current challenges around supporting a full structured address?

Whilst the benefits of structured data are broadly recognised and accepted within the industry, a one size approach does not always work, and detailed analysis conducted by the Zanders team revealed mandating a full structured address would create significant friction and may ultimately be unworkable.

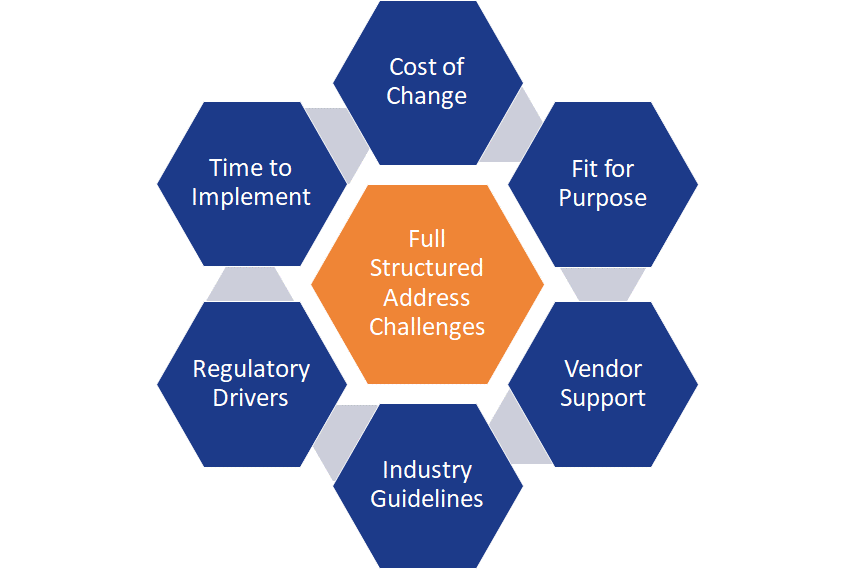

Diagram 1: Challenges around the implementation of the full structured address.

From the detailed analysis performed by the Zanders team, we have identified multiple problems that are all interconnected, and need to be addressed if the industry is to achieve its stated objective of a full structured address. These challenges are summarized below:

- Cost of change: The 2021 online TMI poll highlighted that 70% of respondents confirmed they currently merge the building name, building number, and street name in the same address line field. The key point to note is that the data is not currently separated within the ERP (Enterprise Resource Planning) system. Furthermore, 52% of these respondents highlighted a high impact to change this data, while 26% highlighted a medium impact. As part of Zanders’ continued research, we spoke to two major corporates to gain a better sense of their concerns. Both provided a high-level estimate of the development effort required for them to adapt to the new standard: ½ million euros.

- Fit for Purpose: From the ISO 20022 expert group discussions, it was recognized that the current XML Version 9 message would need a significant re-design to support the level of complexity that exists around the address structure globally.

- Vendor Support: Whilst we have not researched every ERP and TMS (Treasury Management System) system, if you compare the current structured address points including field length in the XML Version 9 message with the master data records currently available in the ERP and TMS systems, you will see gaps in terms of the fields that are supported and the actual field length. This means ERP and TMS software vendors will need to update the current address logic to fully align with the ISO standard for payments – but this software development cannot logically start until the ISO address block has been updated to avoid the need for multiple software upgrades.

- Industry Guidelines: Whilst industry level implementation guidelines are always a positive step, the current published SWIFT PMPG guidelines have primarily focused on the simpler mainstream address structures for which the current address structure is fine. By correctly including the more complex local country address options, it will quickly highlight the gaps that exist, which mean compliance by the November 2025 deadline looks unrealistic at this stage.

- Regulatory Drivers: At this stage, there is still no evidence that any of the in-country payments regulators have actually requested a full structured address. However, we have seen some countries start to request minimum address information (but not structured due to the MT file format), such as Canada and US.

- Time to Implement: We must consider the above dependencies that need to be addressed first before full compliance can logically be considered, which means a new message version would be required. Whilst industry discussions are ongoing, the next ISO maintenance release is November 2023, which will result in XML version 13 being published. If we factor in time for banks to adopt this new version (XML Version 13), time for software vendors to develop the new full structured address including field length and finally, for the corporates to then implement this latest software upgrade and test with their banking partners, the November 2025 timeline looks unrealistic at this point in time.

A very important update

Following a series of focused discussions around the potential address block changes to the XML Version 9 message, including the feedback from the GLEIF3 the ISO payment expert group questioned the need to support a significant redesign of the address block to enable the full structured address to be mandated. The Wolfsberg Group4 also raised concerns about scale of the changes required within the interbank messaging space.

Given this feedback, the SWIFT PMPG completed a survey with the corporate community in April. The survey feedback highlighted a number of the above concerns, and a change request has now been raised with the SWIFT standards working group for discussion at the end of June. The expectation is that the mandatory structured address elements will now be limited to just the Town/City, Postcode, and country, with typical address line 1 complexity continuing to be supported in the unstructured address element. This means a blended address structure will be supported.

Is Corporate Treasury Impacted by this structured address compliance requirement?

There are a number of aspects that need to be considered in answering this question. But at a high level, if you are currently maintaining your address data in a structured format within the ERP/TMS and you are currently providing the core structured address elements to your banking partners, then the impact should be low. However, Zanders recommends each corporate complete a more detailed review of the current address logic as soon as possible, given the current anticipated November 2025 compliance deadline.

In Summary

The ISO 20022 XML financial messages offer significant benefits to the corporate treasury community in terms more structured and richer data combined with a more globally standardised design. The timing is now right to commence the initial analysis so a more informed decision can be made around the key questions.

Notes:

- The PMPG (payment market practice group) is a SWIFT advisory group that reports into the Banking Services Committee (BSC) for all topics related to SWIFT.

- A Market Infrastructure is a system that provides services to the financial industry for trading, clearing and settlement, matching of financial transactions, and depository functions. For example, in-country real-time gross settlement (RTGS) operators (FED, ECB, BoE).

- Global Legal Entity Identifier Foundation (Established by the Financial Stability Board in June 2014, the GLEIF is tasked to support the implementation and use of the Legal Entity Identifier (LEI).

- https://www.wolfsberg-principles.com/sites/default/files/wb/pdfs/wolfsberg-standards/1.%20Wolfsberg-Payment-Transparency-Standards-October-2017.pdf

Grip on your EVE SOT

The SWIFT MT-MX migration is now underway, with a primary focus on a select number of MT messages within the interbank messaging space.

Over the past decades, banks significantly increased their efforts to implement adequate frameworks for managing interest rate risk in the banking book (IRRBB). These efforts typically focus on defining an IRRBB strategy and a corresponding Risk Appetite Statement (RAS), translating this into policies and procedures, defining the how of the selected risk metrics, and designing the required (behavioral) models. Aspects like data quality, governance and risk reporting are (further) improved to facilitate effective management of IRRBB.

Main causes of volatility in SOT outcomes

The severely changed market circumstances evidence that, despite all efforts, the impact on the IRRBB framework could not be fully foreseen. The challenge of certain banks to comply with one of the key regulatory metrics defined in the context of IRRBB, the SOT on EVE, illustrates this. Indeed, even if regularities are assumed, there are still several key model choices that turn out to materialize in today’s interest rate environment:

- Interest rate dependency in behavioral models: Behavioral models, in particular when these include interest rate-dependent relationships, typically exhibit a large amount of convexity. In some cases, convexity can be (significantly) overstated due to particular modeling choices, in turn contributing to a violation of the EVE SOT criterium. Some (small and mid-sized) banks, for example, apply the so-called ‘scenario multipliers’ and/or ‘scalar multipliers’ defined within the BCBS-standardized framework for incorporating interest rate-dependent relationships in their behavioral models. These multipliers assume a linear relationship between the modeled variable (e.g., prepayment rate) and the scenario, whereas in practice this relationship is not always linear. In other cases, the calibration approach of certain behavioral models is based on interest rates that have been decreasing for 10 to 15 years, and therefore may not be capable to handle a scenario in which a severe upward shock is added to a significantly increased base case yield curve.

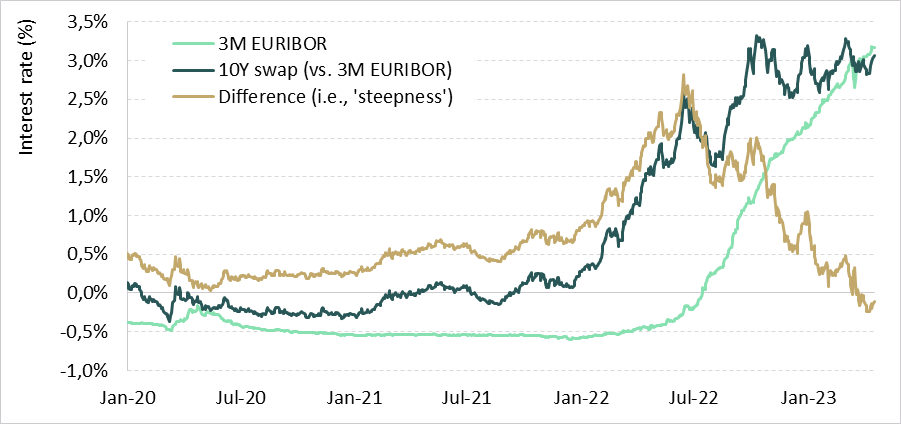

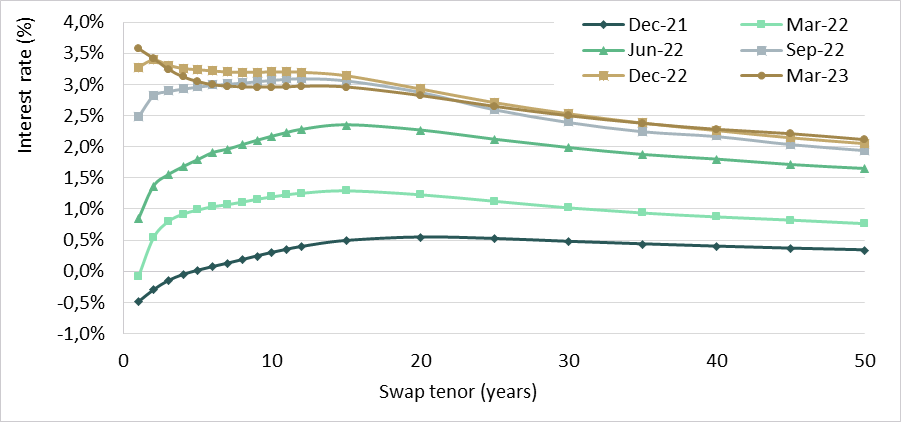

- Level and shape of the yield curve: Related to the previous point, some behavioral models are based on the steepness (defined as the difference between a ‘long tenor’ rate and a ‘short tenor’ rate) of the yield curve. As can be seen in Figure 1, the steepness changed significantly over the past two years, potentially leading to a high impact associated with the behavioral models that are based on it. Further, as illustrated in Figure 2, the yield curve has flattened over time and recently even turned into an inverse yield curve. When calculating the respective forward rates that define the steepness within a particular behavioral model, the downward trend of this variable that results due to the inverse yield curve potentially aggravates this effect.

Figure 1: Development of 3M EURIBOR rate and 10Y swap rate (vs. 3M EURIBOR) and the corresponding 'Steepness'

Figure 2: Development of the yield curve over the period December 2021 to March 2023.

- Hidden vulnerability to ‘down’ scenarios: Previously, the interest rates were relatively close to, or even below, the EBA floor that is imposed on the SOT. Consequently, the ‘at-risk’ figures corresponding to scenarios in which (part of) the yield curve is shocked downward, were relatively small. Now that interest rates have moved away from the EBA floor, hidden vulnerability to ‘down’ scenarios become visible and likely the dominating scenario for the SOT on EVE.

- Including ‘margin’ cashflows: Some banks determine their SOT on EVE including the margin cashflows (i.e., the spread added to the swap rate), while discounting at risk-free rates. While this approach is regulatory compliant, the inclusion of margin cashflows leads to higher (shocked) EVE values, and potentially leads to, or at least contributes to, a violation of the EVE threshold.

What can banks do?

Having identified the above issues, the question arises as to what measures banks should consider. Roughly speaking, two categories of actions can be distinguished. The first category encompasses actions that resolve an inadequate reflection of the actual risk. Examples of such actions include:

- Identify and re-solve unintended effects in behavioral models: As mentioned above, behavioral models are key to determine appropriate EVE SOT figures. Next to revisiting the calibration approach, which typically is based on historical data, banks should assess to what extent there are unintended effects present in their behavioral models that adversely impact convexity and lead to unrepresentative sensitivities and unreliably shocked EVE values.

- Adopt a pure IRR approach: An obvious candidate action for banks that still include margins in their cashflows used for the EVE SOT, is to adopt a pure interest rate risk view. In other words, align the cashflows with its discounting. This requires an adequate approach to remove the margin components from the interest cashflows.

The second category of actions addresses the actual, i.e., economic, risk position of bank. One could think of the following aspects that contribute to steering the EVE SOT within regulatory thresholds:

- Evaluate target mismatch: As we wrote in our article ‘What can banks do to address the challenges posed by rising interest rates’, a bank’s EVE is most likely negatively affected by the rise in rates. The impact is dependent on the duration of equity taken by the bank: the higher the equity duration, the larger the decline in EVE when rates rise (and hence a higher EVE risk). In light of the challenges described above, a bank should consider re-evaluating the target mismatch (i.e. the duration of equity).

- Consider swaptions as an additional hedge instrument: Convexity, in essence, cannot be hedged with plain vanilla swaps. Therefore, several banks have entered into ‘far out of the money’ swaptions to manage negative convexity in the SOT on EVE. From a business perspective, these swaptions result in additional, but accepted costs and P&L volatility. In case of an upward-sloping yield curve, the costs can be partly offset since the bank can increase its linear risk position (increase duration), without exceeding the EVE SOT threshold. This being said, swaptions can be considered a complex instrument that presents certain challenges. First, it requires valuation models – and expertise on these models – to be embedded within the organization. Second, setting up a heuristic that adequately matches the sensitivities of the swaptions to those of the commercial products (e.g., mortgages) is not a straightforward task.

How can Zanders support?

Zanders is thought leader in supporting banks with IRRBB-related topics. We enable banks to achieve both regulatory compliance and strategic risk goals, by offering support from strategy to implementation. This includes risk identification, formulating a risk strategy, setting up an IRRBB governance and framework, policy or risk appetite statements. Moreover, we have an extensive track record in IRRBB and behavioral models, hedging strategies, and calculating risk metrics, both from a model development as well as a model validation perspective.

Are you interested in IRRBB related topics? Contact Jaap Karelse, Erik Vijlbrief (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.

CEO Statement: Why Our Purpose Matters

CEO Laurens Tijdhof explains the origins and importance of the Zanders group’s purpose.

The Zanders purpose

Our purpose is to deliver financial performance when it counts, to propel organizations, economies, and the world forward.

Recently, we have embarked on a process to align more effectively what we do with the changing needs of our clients in unprecedented times. A central pillar of this exercise was an in-depth dialogue with our clients and business partners around the world. These conversations confirmed that Zanders is trusted to translate our deep financial consultancy knowledge into solutions that answer the biggest and most complex problems faced by the world's most dynamic organizations. Our goal is to help these organizations withstand the current macroeconomic challenges and help them emerge stronger. Our purpose is grounded on the above.

"Zanders is trusted to translate our deep financial consultancy knowledge into solutions, answering the biggest and most complex problems faced by the world's most dynamic organizations."

Laurens Tijdhof

Our purpose is a reflection of what we do now, but it's also about what we need to do in the future.

It reflects our ongoing ambition - it's a statement of intent - that we should and will do more to affect positive change for both the shareholders of today and the stakeholders of tomorrow. We don't see that kind of ambition as ambitious; we see it as necessary.

The Zanders’ purpose is about the future. But it's also about where we find ourselves right now - a pandemic, high inflation and rising interest rates. And of course, climate change. At this year's Davos meeting, the latest Disruption Index was released showing how macroeconomic volatility has increased 200% since 2017, compared to just 4% between 2011 and 2016.

So, you have geopolitical volatility and financial uncertainty fused with a shifting landscape of regulation, digitalization, and sustainability. All of this is happening at once, and all of it is happening at speed.

The current macro environment has resulted in cost pressures and the need to discover new sources of value and growth. This requires an agile and adaptive approach. At Zanders, we combine a wealth of expertise with cutting-edge models and technologies to help our clients uncover hidden risks and capitalize on unseen opportunities.

However, it can't be solely about driving performance during stable times. This has limited value these days. It must be about delivering performance despite macroeconomic headwinds.

For over 30 years, through the bears, the bulls, and black swans, organizations have trusted Zanders to deliver financial performance when it matters most. We've earned the trust of CFOs, CROs, corporate treasurers and risk managers by delivering results that matter, whether it's capital structures, profitability, reputation or the environment. Our promise of "performance when it counts" isn't just a catchphrase, but a way to help clients drive their organizations, economies, and the world forward.

"For over 30 years, through the bears, the bulls, and black swans, financial guardians have trusted Zanders to deliver financial performance when it matters most."

Laurens Tijdhof

What "performance when it counts" means.

Navigating the current changing financial environment is easier when you've been through past storms. At Zanders, our global team has experts who have seen multiple economic cycles. For instance, the current inflationary environment echoes the Great Inflation of the 1970s. The last 12 months may also go down in history as another "perfect storm," much like the global financial crisis of 2008. Our organization's ability to help business and government leaders prepare for what's next comes from a deep understanding of past economic events. This is a key aspect of delivering performance when it counts.

The other side of that coin is understanding what's coming over the horizon. Performance when it counts means saying to clients, "Have you considered these topics?" or "Are you prepared to limit the downside or optimize the upside when it comes to the changing payments landscape, AI, Blockchain, or ESG?" Waiting for things to happen is not advisable since they happen to you, rather than to your advantage. Performance when it counts drives us to provide answers when clients need them, even if they didn't know they needed them. This is what our relationships are about. Our expertise may lie in treasury and risk, but our role is that of a financial performance partner to our clients.

How technology factors into delivering performance when it counts.

Technology plays a critical role in both Treasury and Risk. Real-time Treasury used to be an objective, but it's now an imperative. Global businesses operate around the clock, and even those in a single market have customers who demand a 24/7/365 experience. We help transform our clients to create digitized, data-driven treasury functions that power strategy and value in this real-time global economy.

On the risk management front, technology has a two-fold power to drive performance. We use risk models to mitigate risk effectively, but we also innovate with new applications and technologies. This allows us to repurpose risk models to identify new opportunities within a bank's book of business.

We can also leverage intelligent automation to perform processes at a fraction of the cost, speed, and with zero errors. In today's digital world, this combination of next generation thinking, and technology is a key driver of our ability to deliver performance in new and exciting ways.

"It’s a digital world. This combination of next generation of thinking and next generation of technologies is absolutely a key driver of our ability to deliver performance when it counts in new and exciting ways."

Laurens Tijdhof

How our purpose shapes Zanders as a business.

In closing, our purpose is what drives each of us day in and day out, and it's critical because there has never been more at stake. The volume of data, velocity of change, and market volatility are disrupting business models. Our role is to help clients translate unprecedented change into sustainable value, and our purpose acts as our North Star in this journey.

Moreover, our purpose will shape the future of our business by attracting the best talent from around the world and motivating them to bring their best to work for our clients every day.

"Our role is to help our clients translate unprecedented change into sustainable value, and our purpose acts as our North Star in this journey."

Laurens Tijdhof

Increase confidence in your organization with proactive fraud prevention measures

CEO Laurens Tijdhof explains the origins and importance of the Zanders group’s purpose.

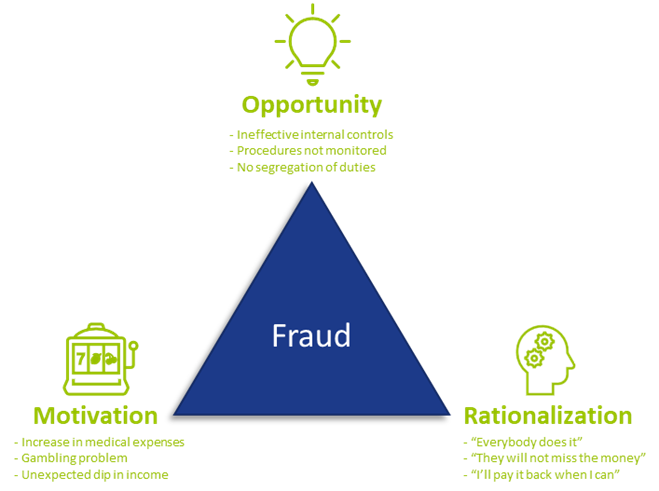

With every improvement, fraudsters look for and find new opportunities to exploit. When the opportunity arises, some people see a big incentive or pressure to commit fraud, and most will be able to justify to themselves why it is acceptable to commit fraud (as shown in the Fraud triangle – Figure 1). Unfortunately, the impact of fraud on organizations, individuals and society in general is substantial.

In a recent report by the Association of Certified Fraud Examiners (ACFE), Occupational Fraud 2022: A report to the nations, it is estimated that organizations lose about 5% of their revenue each year due to employees committing fraud against their employer. It is estimated that more than USD 4.7 trillion is lost worldwide to occupational fraud. Of these, most cases were identified through a tip to a hotline and most were not detected until 12 to 18 months later. The longer the fraud was undetected, the higher the loss. But organizations do not only fight fraud internally; external threats are also on the rise. As businesses evolve and processes are automated and digitalized, fraud activities become much more complex.

Data and modeling approach to fraud prevention

To effectively prevent fraud, it first needs to be identified. Traditionally, employees are trained to identify anomalies or inconsistencies in their daily work environment. It is still crucial that your employees know what to look for and how to spot suspicious activities. But due to the complexities and vast amounts of information available, and because fraudsters are becoming more sophisticated, it becomes much more difficult to determine whether a potential customer is a fraudster or a real client.

The good news is that digitalization and increased data availability provides the opportunity for data analytics. It is important to note here that it does not completely replace your current processes; it should be used in addition to your traditional prevention and/or detection methods to be more effective to proactively identify and prevent fraud in your organization.

Benefits of data analytics

Traditionally, sampling was done on a population to test for fraud instances, but this may not be as effective because it only looks at a small population. Because fraud numbers reported usually being small (but with a large monetary impact), it is possible to overlook valuable insights if only samples of populations are investigated. Ideally, all data should be included to identify trends and potential fraudulent activities, and with data analytics that is possible. By analyzing large amounts of data, organizations can identify patterns and trends that may indicate fraudulent activity. It can help to improve the accuracy of fraud detection systems, as they can be trained to recognize these patterns.

Data analytics can increase efficiency by reducing false positives and false negatives and assists organizations to automate parts of the fraud detection processes, which can save time and resources. This allows the business to focus on other important strategic objectives and tasks such as customer service and product development.

By using data analytics to identify and prevent fraudulent activity, organizations can help to protect their customers against financial losses and other harm. Customer trust and loyalty are built when organizations show they are serious about the welfare and safety of their customers.

Detecting and preventing fraud

Reality is that preventing fraud upfront or in an early stage is much more economical and beneficial than having to detect fraud after the fact, as investigations are time-consuming and the fraud is not always easy to proof in court. Moreover, by the time it is detected, a loss may have already been incurred. Using data analytics to identify fraudsters and fraudulent activities earlier, can protect the bottom line by reducing financial losses and improving the organization’s overall financial performance.

By using analytics to detect and prevent fraud, organizations can demonstrate to regulatory bodies that they are taking compliance seriously. Reporting suspicious transactions and activities to regulatory bodies is a key component of complying with anti-money laundering and counter-terrorism financing legislation, and analytics can assist with identifying these transactions and activities more effectively.

Data analytics can be used to prevent fraud at onboarding, detect it in the existing customer base, and to make your operational processes more efficient. More specifically, data analytics can be used and leveraged as follows:

- Identifying outlier trends and hidden patterns can highlight areas and/or transactions that are more vulnerable to fraud.

- Automating identification of exceptions removes manual intervention and makes the identification criteria more consistent.

- Traditional physical reviews using limited resources to investigate is time-consuming. Data analytics can be used to prioritize the ones with the highest impact and risk, e.g. investigate the suspicious transactions with the highest value first.

- Combining data from different data sources to feed into a model provides a more holistic view of a customer or scenario than looking at individual transactions or applications in isolation.

- Both structured and unstructured data can be used to prevent and detect fraud.

- Fraud propensity model scoring can run automatically and generate results to be reviewed and investigated in real-time or near real-time.

- Analyzing relationships between various entities and customers using Social Network Analysis (SNA). Traditionally, networks/links were identified by the investigator while building a case. By using analytics, less time is needed to identify these relationships. Also, it identifies valuable links previously unknown, as additional levels of relationships can be examined.

- Specific modus operandi identified by the organization’s internal fraud team can be translated into data models to automate identification of similar cases. (See Case study below)

- Applying a fraud model to the organization’s bad debt book can assist with your collections strategy. Fraudsters never intended to pay and focusing your collection efforts on them wastes time and valuable resources. Most efforts should be on those cases where money can be collected.

Case study

The Zanders data analytics team has experience with applying data analytics within a company to identify customers who create synthetic profiles at point of application. By working closely with investigators, a model was developed in which one out of every three applications referred for investigation was classified as fraudulent.

The benefit of introducing analytics was twofold – from an onboarding- and existing customer point of view. The number of fraudsters identified before onboarding increased, preventing (potential) losses. Using the positive identified frauds at point of application, and checking the profile against the existing book, helped to identify areas that were more vulnerable where investigation should be prioritized.

The project proved that:

- Data analytics is valuable and combining it with insights from the operational teams is powerful.

- The buy-in from the stakeholders made the model more effective. If the team investigating the alert does not trust the model or does not know what to look for, there will be resistance in investigating the alerts.

- Taking your internal fraud team on a data and analytics journey is a must. They need to understand the impact that their decisions and captured outcomes can have on future models.

- Challenges with false positives (within business appetite and investigation capacity) are a reality, but having a model is better than searching for a needle in a haystack. Learning from the results and outcomes of the investigations, even if they were false positives, will enhance your next model.

- One size does not fit all. Fraud models need to be tailored to the business’ needs.

Conclusion

While using data analytics to identify fraudulent activities is an investment, organizations need to outweigh the benefit of incorporating data analytics in their current processes against the potential losses. Fraud not only results in monetary losses, it can lead to reputational damage and have an impact on the organization’s market share as customers will not do business with an organization where they don’t feel protected. Your customers also expect great customer service and implementing proactive fraud prevention measures increases confidence in your organization.

How can Zanders help your organization?

Did you find this article helpful but do you still have questions or need additional assistance? Our team of experts is ready to assist you in finding the solutions you need. Please feel free to reach out to us to discuss your needs in more detail. Whether you’re looking for advice on a specific project or just need someone to exchange ideas with, we are here to assis

Are climate change risks properly captured in the prudential framework?

CEO Laurens Tijdhof explains the origins and importance of the Zanders group’s purpose.

More simply put, the EBA was asked to investigate whether the current prudential framework properly captures environmental and social risks. In response, the EBA published a Discussion Paper (DP) [1] in May 2022 to collect input from stakeholders such as academia and banking professionals.

After briefly presenting the DP, this article reviews the current Pillar 1 Capital (P1C) requirements. We limit ourselves to the P1C requirements for credit risk as this is by far the largest risk type for banks. Furthermore, we only discuss the interaction of the P1C with climate change risks (as opposed to broader environmental and/or social risk types). After establishing the extent to which the prudential framework takes climate change risks into account, possible amendments to the framework will be considered.

Key take-aways of this article:

- The current prudential framework includes several mechanisms that allow the reflection of climate change risks into the P1C.

- The interaction between P1C and climate change risks is limited to specific parts of the portfolio, and in those cases, it remains to be seen to what extent this is properly accounted for at the moment.

- Amendments to the prudential framework can be considered, but it is important to avoid double counting issues and to take into account differences in time horizons.

- The EBA is expected to publish a final report on the prudential treatment of environmental risks in the first half of this year.

- Financial institutions that are using the internal ratings-based approach are advised to start with the incorporation of climate change risks into PD and LGD models.

EBA’s Discussion Paper

In the introduction of the DP, the EBA mentions the increasing environmental risks – and their interaction with the traditional risk types – as the trigger for the review of the prudential framework. One of the main concerns is whether the current framework is sufficiently capturing the impact of transition risks and the more frequent and severe physical risks expected in the coming decades. In this context, they stress the special characteristics of environmental risks: compared to the traditional risk types, environmental risks tend to have a “multidimensional, non-linear, uncertain and forward-looking nature.”

The EBA also explains that the P1C requirements are not intended to cover all risks a financial institution is exposed to. The P1C represents a baseline capital requirement that is complemented by the Pillar 2 Capital requirement, which is more reflective of a financial institution’s specific business model and risks. Still, it is warranted to assess whether environmental risks are appropriately reflected in the P1C requirements, especially if these lead to systemic risks.

Even though the DP raises more questions than it provides answers, some starting points for the discussion are introduced. One is that the EBA takes a risk-based approach. Their standpoint is that changes to the prudential framework should reflect actual risk differentials compared to other risk types and that it should not be a tool to (unjustly) incentivize the transition to a sustainable economy. The latter lies “in the remit of political authorities.”

The DP also discusses some challenges related to environmental risks. One example is the lack of high-quality, granular historical data, which is needed to support the calibration of the prudential framework. The EBA also mentions the mismatch in the time horizon for the prudential framework (i.e., a business cycle) and the time horizon over which the environmental risks will unfold (i.e., several decades). They wonder whether “the business cycle concepts and assumptions that are used in estimating risk weights and capital requirements are sufficient to capture the emergence of these risks.”

Finally, the EBA does not favor supporting and/or penalizing factors, i.e., the introduction of adjustments to the existing risk weights based on a (green) taxonomy-based classification of the exposures1. They are right to argue that there is no direct relationship between an exposure’s sustainability profile and its credit risk. In addition, there is a risk of double counting if environmental risk drivers have already been reflected in the current prudential framework. Consequently, the EBA concludes that targeted amendments to the framework may be more appropriate. An example would be to ensure that environmental risks are properly included in external credit ratings and the credit risk models of financial institutions. We explain this in more detail in the following paragraphs.

Pillar 1 Capital requirements

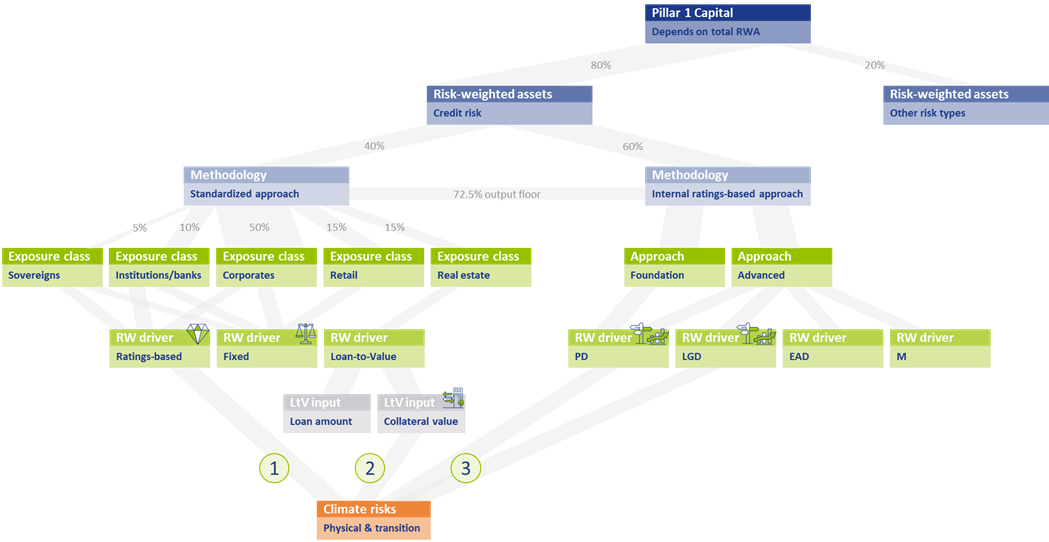

The assessment to what extent climate change risks are properly captured in the current prudential framework requires at least a high-level understanding of the framework. Figure 1 presents a schematic overview of the P1C requirements.

The P1C (at the top of Figure 1) depends on the total amount of Risk-Weighted Assets (RWAs; on the row below)2. RWAs are determined separately for each (traditional) risk type. As mentioned, we only focus on credit risk in this article. The RWAs for credit risk are approximately 80% of the average bank’s total RWAs3. Financial institutions can choose between two methodologies for determining their credit risk RWAs: the Standardized Approach (SA)4 and the internal ratings-based (IRB) approach5 . In Europe, on average 40% of the total RWAs for credit risk are based on the SA, while the rest is based on the IRB approach6 :

Figure 1 – Schematic overview of the P1C requirements and the interaction with climate change risks

Standardized Approach

In the SA, risk weights (RWs) are assigned to individual exposures, depending on their exposure class. About 50% of the RWAs for credit risk in the SA stem from the Corporates exposure class7. Generally speaking, there are three possible RW drivers: the RWAs depend on the external credit rating for the exposure, a fixed RW applies, or the RW depends on the Loan-to-Value8 (LtV) of the (real estate) exposure. The RW for an exposure to a sovereign bond for example, is either equal to 100% if no external credit rating is available (a fixed RW) or it ranges between 0% (for an AAA to AA-rated bond) and 150% (for a below B-rated bond).

Internal Ratings-Based Approach

Within the IRB approach, a distinction is made between Foundation IRB (F-IRB) and Advanced IRB (A-IRB). In both cases, a financial institution is allowed to use its internal models to determine the Probability of Default (PD) for the exposure. In the A-IRB approach, the financial institution in addition is allowed to use internal models to determine the Loss Given Default (LGD), Exposure at Default (EAD), and the Effective Maturity (M).

Interaction with climate change risks

The overview of the P1C requirements introduced in the previous section allows us to investigate the interaction between climate change risks and the P1C requirement. This is done separately for the SA and the IRB approach.

Standardized Approach

In the SA, there are two elements that allow for interaction between climate change risks and the resulting P1C. Climate change risks could be reflected in the P1C if the RW depends on an external credit rating, and this rating in turn properly accounts for climate change risks in the assessment of the counterparty’s creditworthiness (see 1 in Figure 1). The same holds if the RW depends on the LtV and in turn, the collateral valuation properly accounts for climate change risks (see 2 in Figure 1). This raises several concerns:

First, it can be questioned whether external credit ratings are properly capturing all climate change risks. In a report from the Network for Greening the Financial System (NGFS) [3], which was published at the same time as EBA’s DP, it is stated that credit rating agencies (CRAs) have so far not attempted to determine the credit impact of environmental risk factors (through back-testing for example). Also, the lack of high-quality historical data is mentioned as an explanation that statistical relationships between environmental risks and credit ratings have not been quantified. Further, a paper published by the ECB [4] concludes that, given the current level of disclosures, it is impossible for users of credit ratings to establish the magnitude of adjustments to the credit rating stemming from ESG-related risks. Nevertheless, they state that credit rating agencies “have made significant progress with their disclosures and methodologies around ESG in recent years.” The need for this is supported by academic research. An example is a study [5] from 2021 in which a correlation between credit default swap (CDS) spreads and ESG performance was demonstrated, and a study from 2020 [6] which demonstrated that high emitting companies have a shorter distance-to-default.

Secondly, the EBA has reported in the DP that less than 10% of the SA’s total RWAs is derived based on external credit ratings. This implies that a large share of the total RWAs is assigned a fixed RW. Obviously, in those cases there is no link between the P1C and the climate change risks involved in those exposures.

Finally, climate change risks only impact the P1C maintained for real estate exposures to the extent that these risks have been reflected in collateral valuations. Although climate change risks are priced in financial markets according to academic literature, many papers and institutions indicate that these risks are not (yet) fully reflected. In a survey held by Stroebel and Wurgler in 2021 [7], it is shown that a large majority of the respondents (consisting of finance academics, professionals and public sector regulators, among others) is of the opinion that climate change risks have insufficiently been priced in financial markets. A nice overview of this and related literature is presented in a publication from the Bank for International Settlements (BIS) [8]. The EBA DP itself lists some research papers in chapter 5.1 that indicate a relationship between a home’s sales price and its energy efficiency, or with the occurrence of physical risk events. It is unclear though if climate change risks are fully captured in the collateral valuations. For example, research is presented that information on flood risk is not priced into residential property prices. Recent research by ABN AMRO [9] also shows this.

Internal Ratings-Based Approach

In the IRB approach, financial institutions have more flexibility to include climate change risks in their internal models (see 3 in Figure 1). In the F-IRB approach this is limited to PD models, but in the A-IRB approach also LGD models can be adjusted.

A complicating factor is the forward-looking nature of climate change risks. In recent years, the competent authorities have pressured financial institutions to use historical data as much as possible in their model calibration and to back-test the performance of their models. As climate change risks will unfold over the next couple of decades, these are not (yet) reflected in historical data. To incorporate climate change risk, expert judgement would therefore be required. This has been discouraged over the past years (e.g., through the ECB’s Targeted Review of Internal Models (TRIM)) and it will probably trigger a discussion with the competent authorities. A possible deterioration of model performance (due to higher estimated risks compared to historically observations) is just one example that may attract attention.

Another complicating factor is that under the IRB approach, the PD of an obligor is estimated based on long-run average one-year default rates. While this may be an appropriate approach if there are no clear indications that the overall risk level will change, this does not hold if climate change risks increase in the future, and possibly increase systemic risks. By continuing to base a PD model on historical data only, especially for exposures with a time to maturity beyond a couple of years, the credit risk may be understated.

Are amendments to the prudential framework needed?

We have explained that there are several mechanisms in the prudential framework that allow environmental risks to be included in the P1C: the use of external credit ratings, the valuation of collateral, and the PD and LGD models used in the IRB approach. We have also seen, however, that it is questionable whether these mechanisms are fully effective. External credit ratings may not properly reflect all environmental risks and these risks may not be fully priced in on capital markets, leading to incorrect collateral values. Finally, a large share of the RWAs for credit risk depends on fixed RWs that are not (environmentally) risk-sensitive.

Consequently, it can be argued that amendments or enhancements to the prudential framework are needed. One must be careful, however, as the risk of double counting is just around the corner. Therefore, the following amendments or actions should be considered:

- Further research should be undertaken to investigate the relationship between climate change risk and the creditworthiness of counterparties. If there is more clarity on this relationship, it should also be assessed to what extent this relationship is sufficiently reflected in external ratings. Requiring more advanced disclosures from credit rating agencies could help to understand whether these risks are sufficiently captured in the prudential framework. One should be cautious to amend the ratings-based RWs in the SA, since credit rating agencies are continuously working on the inclusion of environmental risks into their credit assessments; there would be a real risk of double counting.

- The potential negative impact of climate change risks on collateral value should be further investigated. Financial institutions are already required by the ECB9 to consider environmental risks in their collateral valuations but this is not at a sufficient level yet. It will be important to consider the possibility of sudden value changes due to transition risks like shifting consumer sentiment or awareness.

- To improve the risk-sensitivity of the framework, a dependency on the carbon emissions of the counterparty could be introduced in the fixed RWs, possibly only for the most carbon-intensive sectors. It could be argued that there are other factors that have a more significant relationship with the default risk of a certain counterparty that could be included in the SA. Climate change risks, however, differ in the sense that they can lead to a systemic risk (as opposed to an idiosyncratic risk) that is currently not captured in the overall level of the RWs.

- In the SA, a distinction could be introduced based on the exposure’s time to maturity. For relatively short-term exposures, the current calibrations are probably fine. For longer-term exposures, however, the risks stemming from climate change may be underestimated as these are expected to increase over time.

- In the IRB approach, a reflection of climate change risk would require the regulator to allow for forward-looking expert judgment in the (re)calibration of PD and LGD models. Further guidance from the competent authorities on the potentially negative impact on model performance based on historical data would also be useful.

Conclusion

Based on the schematic overview of the P1C requirements and the (potential) interaction with climate change risks, we conclude that several mechanisms in the prudential framework allow for climate change risks to be incorporated into the P1C. At the same time, we conclude that this interaction is limited to specific parts of the portfolio, and that in those cases it remains to be seen to what extent this is properly accounted for. To remedy this, amendments to the prudential framework could be considered. It is important, however, to avoid double counting issues and to be mindful of time horizon differences.

It is expected that the EBA will publish a final report on the prudential treatment of environmental risks in the first half of this year. However, especially financial institutions that are using the IRB approach should not take a wait-and-see approach. Given the complexity of modeling climate change risks, it is prudent to start incorporating climate change risks into PD and LGD models sooner rather than later.

With Zanders’ extensive experience covering both credit risk modeling and climate change risk, we are well suited to support with this process. If you are looking for support, please reach out to us.

1 Supporting factors are currently in place for SMEs and infrastructure projects, but the EBA advocated their removal.

2 See RBC20.1 in the Basel Framework.

3 See for example the results from the EBA’s EU-wide transparency exercise. This is reflected in Figure 1 by the percentage in the grey link between P1C and RWAs for credit risk.

4 See CRE20 to CRE22 in the Basel Framework.

5 See CRE30 to CRE36 in the Basel Framework.

6 In the Netherlands, less than 20% of the total RWAs is based on the SA. See the EBA’s EU-wide transparency exercise for more information. The percentages in the grey link between ‘Risk-weighted assets’ and ‘Methodology’ in Figure 1 are based on the European average.

7 See the EBA’s Risk assessment of the European banking system [2]. The percentages in the grey link between ‘Standardized Approach’ and the ‘Exposure class’ in Figure 1 reflect the share of RWAs in the SA for each of the different exposure classes.

8 The LtV is defined as the ratio between the loan amount and the value of the property that serves as collateral.

9 See expectation 8.3 in the ECB’s Guide on climate-related and environmental risks.

References

- The role of environmental risks in the prudential framework, European Banking Authority, Discussion Paper, 2 May 2022

- Risk assessment of the European banking system, European Banking Authority, December 2022

- Capturing risk differentials from climate-related risks, Network for Greening the Financial System, Progress Report, May 2022

- Disclosure of climate change risk in credit ratings, European Central Bank, Occasional Paper Series, No. 303, September 2022

- Pricing ESG risk in credit markets, Federated Hermes, March 2021

- Climate change and credit risk, Capasso, Gianfrate, and Spinelli, Journal of Cleaner Production, Volume 266, September 2020

- What do you think about climate finance?, Stroebel and Wurgler, Journal of Financial Economics, vol 142, no 2, November 2021

- Pricing of climate risks in financial markets, Bank for International Settlements, Monetary and Economic Department, December 2022

- Is flood risk already affecting house prices?, ABN AMRO, 11 February 2022

- Guide on climate-related and environmental risks, European Central Bank, November 2020

BCBS Principles for the effective management of climate-related financial risks

CEO Laurens Tijdhof explains the origins and importance of the Zanders group’s purpose.

These risks stem from the transition towards a low carbon economy and from the physical risks of damages due to extreme weather events. To address climate-related financial risks within the banking sector, the Basel Committee on Banking Supervision (BCBS) established a high-level Task Force on Climate-related Financial Risks in 2020. It contributes to the BCBS’s mandate to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial stability.

Both the BCBS’s Core principles for effective banking supervision1 and the Supervisory Review and Evaluation Process (SREP) within the existing Basel Framework are considered sufficiently broad and flexible to accommodate additional supervisory responses to climate-related financial risks. It was felt, however, that supervisors and banks could benefit from the publication of the Principles for the effective management and supervision of climate-related financial risks2. Through this publication, the BCBS seeks to promote a principles-based approach to improving risk management and supervisory practices regarding climate-related financial risks. The document contains principles directed to banks and principles directed to supervisory authorities. In this article, we present an overview of the principles directed to banks.

The BCBS published a draft of their Principles in November 2021. During the consultation phase, which lasted until February 2022, banks and supervisors could provide feedback. The BCBS incorporated their feedback in the final version of the Principles that were published in June 2022.

Principles for the management of climate-related financial risks

In total, twelve bank-focused principles are presented and grouped in eight categories. Each of the eight categories is briefly discussed below:

Corporate governance – Principles 1 to 3

The principles related to corporate governance state that banks first need to understand and assess the potential impact of climate risks on all fields they operate in. Subsequently, appropriate policies, procedures and controls need to be implemented to ensure effective management of the identified risks. Furthermore, roles and responsibilities need to be clearly defined and assigned throughout the bank. To successfully manage climate-related risks, banks should ensure an adequate understanding of climate-related financial risks and as well as adequate resources and skills at all relevant functions and business units within the bank. Finally, the board and senior management should ensure that all climate-related strategies are consistent with the bank’s stated goals and objectives.

Internal control framework – Principle 4

The fourth principle within the internal control framework subcategory requires banks to include clear definitions and assignment of climate-related responsibilities and reporting lines across all three lines of defense. Further requirements are then presented for each line of defense.

Capital and liquidity adequacy – Principle 5

After the identification and quantification of the climate-related financial risks, these risks need to be incorporated into banks’ Internal Capital (and Liquidity) Adequacy Assessment Process (ICLAAP). Banks should provide insights in which climate-related financial risks affect their capital and liquidity position. In addition, physical and transition risks relevant to a bank’s business model assessed as material over relevant time horizons, should be incorporated into their stress testing programs in order to evaluate the bank’s financial position under severe but plausible scenarios. Furthermore, the described incorporation in the ICLAAP to handle such financial risks, should be done iteratively and progressively, as the methodologies and data used to analyze these risks continue to mature over time.

Risk management process – Principle 6

The sixth principle connects to the previous one, as it states that a bank needs to identify, monitor and manage all climate-related financial risks that could materially impair their financial condition, including their capital resources and liquidity positions. The bank’s risk management framework should be comprehensive with respect to the (material) climate-related financial risks they are exposed to. Clear definitions and thresholds should be set for materiality. These need to be monitored closely and adjusted, if necessary, as climate-related risks are evolving.

Management monitoring and reporting – Principle 7

After ensuring that the risk framework is comprehensive, banks need to implement the monitoring and reporting of climate-related financial risks in a timely manner to facilitate effective decision-making. To achieve such reporting, a good data infrastructure should be in place at the bank. This allows it to identify, collect, cleanse, and centralize the data necessary to assess material climate-related financial risks. Furthermore, banks should actively collect additional data from clients and counterparties in order to develop a better understanding of their client’s transition strategies and risk profiles.

Management of credit, market, liquidity, operational risk – Principles 8 to 11

Banks should understand the impact of climate-related risk drivers on their credit risk profiles, market positions, liquidity risk profiles and operational risks. Clearly articulated credit policies and processes to identify, measure, evaluate, monitor, report and control or mitigate the impacts of material climate-related risk drivers on banks’ credit risk exposures should be in place. From a market risk perspective, banks should consider the potential losses in their portfolios due to climate-related risks. On the business operation and strategy side of banking activities, the impact of climate-related risks also plays a large role. For example, physical risks have to be taken into account when drafting business continuity plans. After understanding the different risks and their impacts, a range of risk mitigation options to control or mitigate climate-related financial risks need to be considered.

Scenario analysis – Principle 12

The final principle states that banks need to use scenario analysis to assess the resilience of their business models and strategies to a range of plausible climate-related pathways, and to determine the impact of climate-related risk drivers on their overall risk profile. Scenario analysis should reflect the overall relevant climate-related financial risks for banks, including both physical and transition risks. This analysis should be performed for different time horizons, both short- and long-term, and should be highly dynamic.

Changes to the BCBS risk framework draft and related publications

The final Principles have not changed much compared to the November 2021 consultation document. The most important changes are that the first principle, concerning corporate governance of banks, and the fifth principle, concerning capital and liquidity adequacy, have been extended. The corporate governance principle, for example, now also includes that banks should ensure that their internal strategies and risk appetite statements are consistent with any publicly communicated climate-related strategies and commitments. The capital and liquidity adequacy principle now includes a section requiring banks to incorporate material climate-related financial risks in their stress testing programs.

These twelve bank-focused principles, providing banks guidance on effective risk management of climate-related financial risks, can also be linked to the initiatives of other regulators such as the ECB. In November 2020, for example, the ECB provided a guide that describes how it expects institutions to consider climate-related and environmental risks, when formulating and implementing their business strategy, governance and risk management frameworks (the ECB expectations). These ECB expectations are in line with the BCBS Principles (and often more elaborate).

Zanders has gained relevant experience in implementing the ECB expectations at several Dutch banks. This experience ranges from risk identification and materiality assessments to the quantification of climate-related risks, ESG data frameworks, model validations, and scenario analysis. Please reach out to us if your bank is seeking support in implementing the BCBS Principles.

References

1) Basel Committee on Banking Supervision (2012). Core Principles for Effective Banking Supervision.

2) Basel Committee on Banking Supervision (2022). Principles for the effective management and supervision of climate-related financial risks.

Regulatory timelines ESG Risk Management

CEO Laurens Tijdhof explains the origins and importance of the Zanders group’s purpose.

In the below overview, we present an overview of the main ESG-related publications from the European Commission (EC), the European Central Bank (ECB), and the European Banking Authority (EBA).

This is complemented by the most important timelines that are stipulated in these regulations and guidelines. Additional regulations and guidelines that are expected for the next couple of years are also highlighted.

If you want to discuss any of them, don’t hesitate to reach out to our subject matter experts.

Impact of EU Sustainable Finance Action Plan on Risk Management – Round-table Summary

The SWIFT MT-MX migration is now underway, with a primary focus on a select number of MT messages within the interbank messaging space.

This topic is gaining momentum because of the European Commission’s Sustainable Finance Action Plan and associated regulatory changes.

One of the new requirements is that asset managers must incorporate sustainability risks in their risk management and reporting as of August 2022. This means that these risks must be measured, assessed and mitigated. However, this is not an easy task due to a lack of uniformity in risk management approaches and lagging data quality.

This prompted AF Advisors and Zanders to organize a round-table session on the subject. The large session turnout showed the importance of managing sustainability risks for the asset management sector. Parties that manage a total of no less than EUR 2.5 trillion in assets joined the session, including a broad selection of the largest asset managers active in the Netherlands. This attendance led to good, in-depth discussions. The discussion was preceded and inspired by a presentation from one of the expertized asset managers in the field of sustainability on how they mitigate, assess and monitor sustainability risks. Two hours of lively discussion is difficult to summarize but we would like to share a few interesting takeaways. Note that these takeaways do not necessarily represent the views of all the participants, though are merely an overview of the topics that were discussed.

Key takeaways

Financial risk management departments increasingly in the lead

While a few years ago, sustainability risks and the management of these risks were still the task of responsible investing teams in many organizations, this task is increasingly being taken up by financial risk managing departments as these are increasingly capable to quantify sustainability risks. This shift leads to new techniques and new requirements for data. Where previously exclusions were an important method for many parties, an integrated portfolio approach is emerging.

Lack of uniformity in the assessment of sustainability risks

The two main problems in managing sustainability risks are a lack of uniformity in approaches and a limited data quality or availability. Limited data quality is a well-known topic, especially for alternative asset classes. Specialized data vendors will be required to address these issues.

Important to realize, however, is that sustainability risk is such a broad and young concept that it is open to many interpretations. This means that the way in which sustainability risks are assessed can still differ considerably between parties. The benefit is that the different approaches help to speed up the evolvement of this new area. In the longer term it is expected that the assessments converge to a best market practice. Until then, there will be little standardization and different use of terminology. This is especially problematic in a multi-client environment with varying clients’ needs. Enforced communication by the regulator can therefore lead to outcomes that are hard to compare and interpret for clients. Listing definitions used and an explanation of the methodologies used is vital in communication on sustainability risks to clients.

ESG risk ratings are most popular concept despite drawbacks

The most frequently mentioned way in which sustainability risks are monitored is by means of environmental, social and governance (ESG) risk ratings. For example, by comparing a portfolio’s ESG scores with the scores of a corresponding benchmark and by limiting deviations. By using these ratings, environmental, social and governance factors are included. The major drawback of this approach is that it is partly backward-looking. Participants agreed, due to the long horizon over which most risks materialize, traditional (backward-looking) risk models may not be the most suited.

Most forward-looking data is available for climate risks. In addition to the use of ESG scores, a climate risk methodology is therefore desirable.

Not only European legislation matters

Next to European regulation, it is also important to consider emerging global initiatives and other regulation and reporting frameworks. US regulations such as US SDR can impact organizations and the approaches to sustainability risks to some extent. Global initiatives such as TCFD and TNFD are likely to influence and affect organizations’ risk management processes as well. Potential overlap must be analyzed so that an asset managers can face the challenges efficiently.

Internal organization

Sustainability risks can be defined and monitored at various levels of an organization. Portfolio managers should take them into account in the selection of investments. Second line monitoring and independent assessments must be in place. It is important to realize that this is not a topic that only affects the investment and risk management teams. The legislation explicitly places responsibility for managing sustainability risks on the board level and requires internal reporting, controls and sufficient internal knowledge of the topic.

Conclusion

Sustainability risk management is an important topic that asset managers will need to be working on in the coming years. It is expected that this field will evolve over time, it was even referred to as a ‘journey’. The deadline of MiFID, AIFMD and UCITS in August 2022 – date on which amendments of these regulations to incorporate sustainability risks come into effect – is an important first regulatory milestone but will certainly not be the last. With the organization of the round table, we hope to have assisted parties in getting a better understanding of the topic and to have contributed to their journey.

The ESG data challenge

The SWIFT MT-MX migration is now underway, with a primary focus on a select number of MT messages within the interbank messaging space.

But to seize the opportunities ESG must become an integrated part of a bank’s strategy, risk management and disclosure regimes. High-quality data is instrumental to identify and measure ESG risks, but it can be lacking. FIs need to improve their internal data and use of external private and public vendors like Moody’s or the IMF, while developing a framework that plugs any data gaps.

The lack of appropriate ESG data is considered one of the main challenges for many FIs, but proxies, such as using a building’s energy rating to work out its carbon emissions, can be used.

FIs need climate change-related data that isn’t always available if you don’t know where to look. This article will give you an overview of the most relevant data vendors and provide suggestions on how to treat missing data gaps in order to get a comprehensive ESG framework for the green future where carbon measurement, assessment, reporting and trading will be vital

The data challenge

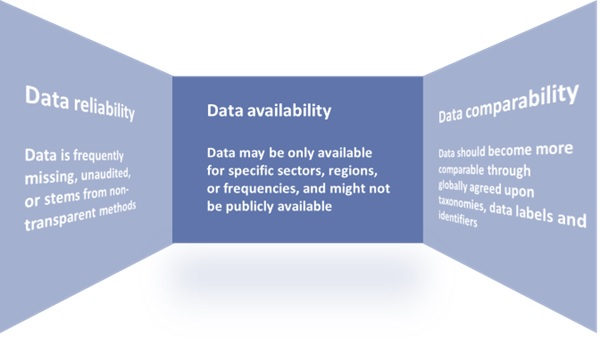

In May 2021, the Network for Greening the Financial System (NGFS) published a ‘Progress report on bridging data gaps’. In this report, the NGFS writes that meeting climate-related data needs is a challenge that can be described along the following three dimensions:

- data availability,

- reliability,

- & comparability.

A further breakdown of the challenges related to these dimensions can be found in Figure 1.

Figure 1: The dimensions of the climate-related data challenge.

Source: Graphic adapted by Zanders from a NGFS report entitled: ‘Progress report on bridging data gaps’ (2021).

Key financial metrics

The NGFS writes that a mix of policy interventions is necessary to ensure climate-related data is based on three building blocks:

- Common and consistent global disclosure standards.

- A minimally accepted global taxonomy.

- Consistent metrics, labels, and methodological standards.

EU Taxonomy, CSRD & EBA’s 3 ESG risk disclosure standards

Several initiatives have started to ignite these needed policy interventions. For example, the EU Taxonomy, introduced by the European Commission (EC), is a classification system for environmentally sustainable activities. In addition, the recently approved Corporate Sustainability Reporting Directive (CSRD) provides ESG reporting rules for large listed and non-listed companies in the EU, including several FIs. The aim of the CSRD is to prevent greenwashing and to provide the basis for global sustainability reporting standards. Another example of a disclosure standard is the binding standards on Pillar 3 disclosures on ESG risks developed by the European Banking Authority (EBA).

Even though policy, law and regulation makers have a big part to play in the data challenge, there are also steps that individual institutions could and should take to improve their own ESG data gaps. Regulatory bodies such as the EBA and the European Central Bank (ECB) have shared their expectations and recommendations on the management of ESG data with FIs.

To illustrate, the EBA recommends FIs “[identify] the gaps they are facing in terms of data and methodologies and take remedial action” and the ECB expects institutions to “assess their data needs in order to inform their strategy-setting and risk management, to identify the gaps compared with current data and to devise a plan to overcome these gaps and tackle any insufficiencies”

Collecting data

Collecting ESG data is a challenging exercise. A distinction can be made between collecting data for large market cap companies, and small cap companies and retail clients. Although large cap companies tend to be more transparent, the data often is dispersed over multiple reports – for example, corporate sustainability reports, annual reports, emissions disclosures, company websites, and so on.

For small cap companies and retail clients, the data is more difficult to acquire. Data that is not publicly available could be gathered bilaterally from clients. For example, one European bank has developed an annual client questionnaire to collect data from its clients.

Gathering data from various reports or bilaterally from clients might not always be the best option, however, because it is time consuming or because the data is not available, reliable, or comparable. Two alternatives are:

- Use tools to collect the data. For example, using open-source tooling from the Two Degrees Investing Initiative (2DII) to calculate Paris Agreement Capital Transition Assessment (PACTA) portfolio alignment.

- Collect data from other external data sources, such as S&P Global.

This could be forward-looking external data on macro-economic expectations, international climate scenarios, financial market data or sectoral climate developments. Below we discuss some sources for external ESG and climate change-related data.

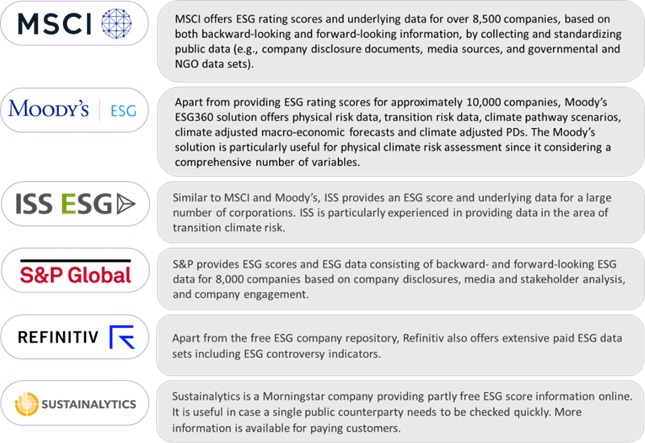

External data

Some of Zanders’ clients resort to vendor solutions for acquiring their ESG data. The most commonly observed solutions, in random order, are:

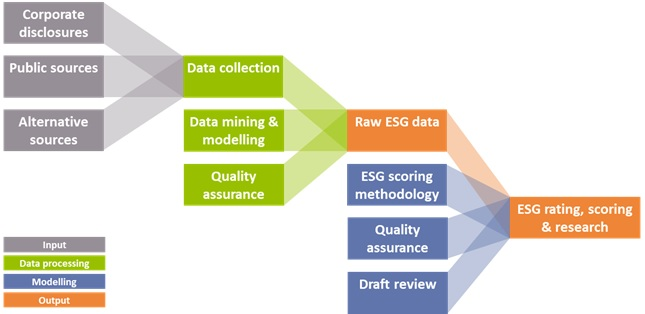

All the solutions above provide an aid to determine if climate related performance data is lacking, or can assist in reporting comparable and reliable data. They all apply a similar process of collecting the data and determining ESG scores, which is illustrated in Figure 2.

Figure 2: Data collection process for ESG data solutions (Source: Zanders).

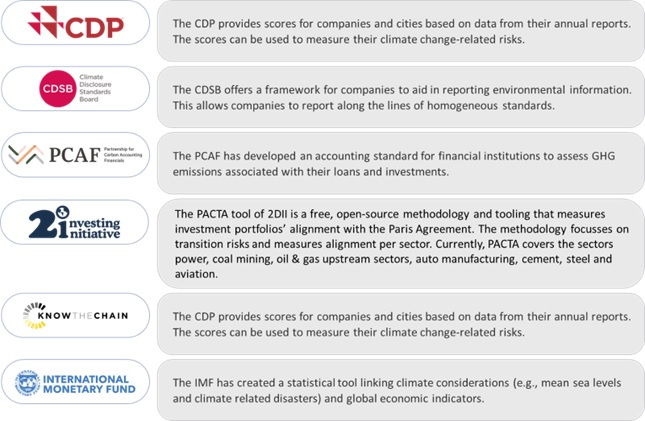

Additionally, public and non-commercial data and solution providers are available, such as:

Missing data

Given the data challenges, it is nearly impossible to create a complete data set. Until that is possible, there are several (temporary) methods to deal with missing data:

- Find a comparable loan, asset, or company for which the required data is available.

- Distribute sector data based on market share of individual companies. For example, assign 10% of the estimated emission of sector X to company Y based on its market share of 10%.

- Find a proxy, comparable or second-best metric. For example, by taking the energy label as a proxy for CO2 emission related to properties, or by excluding scope 3 emissions and focusing on scope 1 and 2 emissions.

- Change the granularity level. For example, by gathering data on sector level rather than on individual positions.

- Fill in the gaps with statistical or machine learning techniques.

Conclusion

The increased attention to integrating ESG risks into existing risk frameworks has led to a need for FIs to collect and disclose meaningful data on ESG factors. However, there is still a lack of data availability, reliability, and comparability.

Several regulatory and political efforts are ongoing to tackle this data challenge, such as the EU taxonomy. More policy interventions, however, are required. Examples are additional mandatory disclosure requirements, an audit and validation framework for ESG data, and social and governance taxonomies that classify economic activities that contribute to social and governance goals.

In the meantime, FIs have to find ways to produce meaningful insights and comply with regulatory requirements related to ESG risks. Zanders has experienced that there is no one-size-fits-all solution for defining, selecting, implementing, and disclosing relevant data and metrics. It is dependent on the composition of the asset and loan portfolio, the use of the data, and the data that is (already) available. Regardless of how the lack of data is solved, it is important that FIs are transparent about their choices and methodologies, and that the related metrics and scorings are explainable and intuitive.

Sources:

https://www.ngfs.net/sites/default/files/medias/documents/progress_report_on_bridging_data_gaps.pdf

https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-sustainable-activities_en

https://www.europarl.europa.eu/news/en/press-room/20220620IPR33413/new-social-and-environmental-reporting-rules-for-large-companies

https://zandersgroup.com/en/insights/blog/ebas-binding-standards-on-pillar-3-disclosures-on-esg-risks

https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Reports/2021/1015656/EBA%20Report%20on%20ESG%20risks%20management%20and%20supervision.pdf

https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202011finalguideonclimate-relatedandenvironmentalrisks~58213f6564.en.pdf

https://2degrees-investing.org/resource/pacta/

The ECB published the results of its climate risk stress test

The SWIFT MT-MX migration is now underway, with a primary focus on a select number of MT messages within the interbank messaging space.

In total 104 banks participated in the stress test that was intended as a learning exercise, for the ECB and the participating banks alike. In this article we provide a brief overview of the main results.

The ECB’s goal with the climate risk stress test was to assess the progress banks have made in developing climate risk stress-testing frameworks and the corresponding projections, as well as understanding the exposures of banks with respect to both transition and physical climate change risks. The stress test therefore consisted of three modules: 1) a qualitative questionnaire to assess the bank’s climate risk stress testing capabilities, 2) two climate risk metrics showing the sensitivity of the banks’ income to transition risk and their exposure to carbon emission-intensive industries, and 3) constrained bottom-up stress test projections for four scenarios specified by the ECB1. The third module only had to be completed by 41 directly supervised banks to limit the burden for some of the smaller banks included in the climate risk stress test.

An understatement of the true risk

The constrained bottom-up stress test projections show that the combined market and credit risk losses for the 41 banks in the sample amount to approximately EUR 70 billion in the short-term disorderly transition scenario. The ECB emphasizes that this probably is an understatement of the true risk, because it does not consider the scenarios underlying the stress test to be ‘adverse’. Second round economic effects from climate risk changes have, for example, not been factored in. Furthermore, only a third of the total exposures of the 41 banks were in scope and, on top of that, the ECB considers the banks’ modeling capabilities to be ‘rudimentary’ in this stage: they report that around 60% of the banks do not yet have a well-integrated climate risk stress testing framework in place, and they expect that it will take several years before banks achieve this. Even though banks are not meeting the ECB’s expectations yet, the ECB does conclude that banks have made considerable progress with respect to their climate stress testing capabilities.

Be aware of clients’ transition plans

A further analysis of the results shows that the share of interest income related to the 22 most carbon-intensive industries amounts to more than 60% of the total non-financial corporate interest income (on average for the banks in the sample). Interestingly, this is higher than the share of these sectors (around 54%) in the EU economy in terms of gross added value. The ECB argues that banks should be very much aware of the transition plans of their clients to manage potential future transition risks in their portfolio. The exposure to physical risks is much more varied across the sample of banks. It primarily depends on the geographical location of their lending portfolios’ assets.

The ECB points out that only a few banks account for climate risk in their credit risk models. In many cases, the credit risk parameters are fairly insensitive to the climate change scenarios used in the stress test. They also report that only one in five banks factor climate risk into their loan origination processes. A final point of attention is data availability. In many cases, proxies instead of actual counterparty data have been used to measure (for example) greenhouse gas emissions, especially for Scope 3. Consequently, the ECB is also promoting a higher level of customer engagement to improve in this area.

Many deficiencies, data gaps and inconsistencies