As AI transforms business at record speed, treasurers can now harness its power to automate one of their most complex tasks: intercompany loan pricing.

The interest in AI has been increasing at record pace, with new technology releases every month and an impressive number of new use cases for chatbots or agents. However, many treasurers still struggle to translate this hype into value-added implementations for their business. These upcoming blog series explore practical use cases for AI that delivers concrete value to treasurers. This article specifically shares an implementation of AI agents to automate the pricing, review and documentation of intercompany loans.

The challenge

One of the core functions for many treasury departments is the distribution of cash in their group. Intra-group loans are one of the tools used by treasurers to distribute cash, but their use comes with challenges. The interest rate on intercompany loans has a significant impact on the tax expense incurred by the subsidiary and taxable income received by the head-office and therefore should be based on an arm's length approach.

Arm’s length pricing of intercompany loans requires a detailed analysis of the credit standing of the borrower, the influence of the group on the borrower’s credit risk, and a review of the debt market to determine a price. Due to the tax implications, this process should be documented in detail including sources and models. Regulations surrounding transfer pricing of financial transactions have been expanding in many countries in the past years, posing greater challenges for treasury teams to perform a complex process with high compliance requirements. As a result, many have resorted to advisors or build complex Excel models to perform the recurring pricing analyses.

The solution

The main challenge when automating the pricing of intercompany loans is the access to data and models. A compliant process relies on the periodic retrieval of benchmark transactions to set an interest rate – for example with bonds, loans, or a Credit Default Swap (CDS). On the other hand, an objective calculation of the credit risk requires a model that is explainable and is filled with company data.

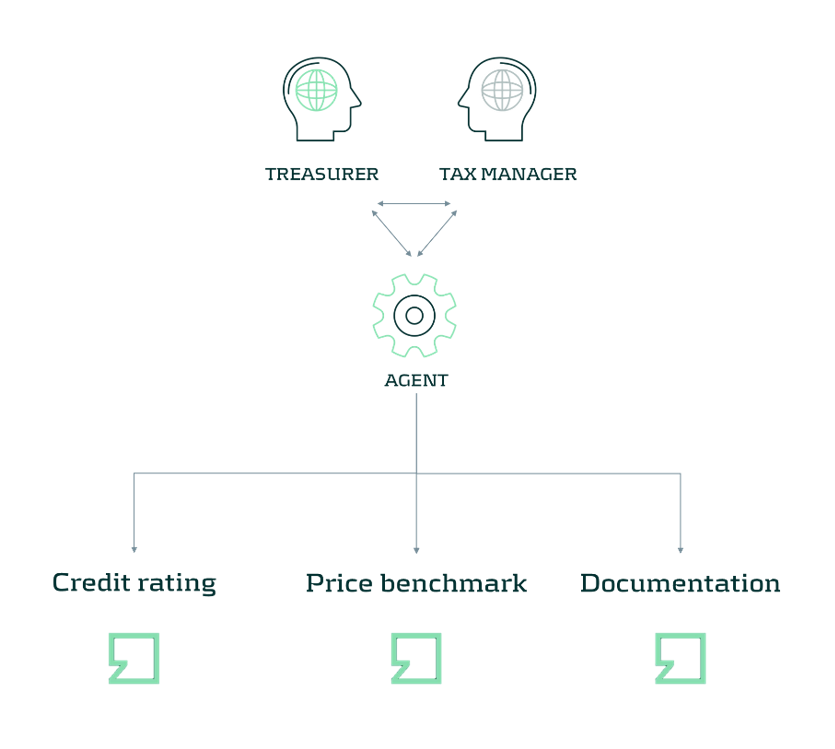

AI Agents are a powerful tool that can be used to automate the retrieval of data and execution of tools in a complex process with changing inputs. In the diagram below, an AI Agent is coupled with a credit rating model, a tool to gather benchmarking data, and a documentation method. In our implementation, we have used the modules in the Zanders Transfer Pricing Solution to provide this functionality to the agent. Next to the tools, it is important to provide the Agent with sufficient context on what role it should play and how it should execute a pricing analysis. The agent should understand the compliance requirements and the tools before it can reliably run the process. For this use case, this is done through context engineering by providing example cases, differences in methods, and checks that the agent should perform.

In the resulting setup, the Agent can automate the full pricing step: identifying entities, calculating a credit rating, and running a pricing benchmark. As a result, the Agent provides a report that is generated according to our template.

With the same tools, we can extend the system even further, by reviewing past calculations versus policies and tax regulations to spot high risk cases or evaluating the credit position of entities to set borrowing limits or update credit ratings. By automating these processes, treasurers can move away from the operational hassle of pricing intercompany loans and instead focus on managing the funding mix of their group. Agents take care of automatic handling of loans and the importing or exporting of data, where treasurers set the objectives of the pricing approach and funding.

AI in Treasury is no longer a futuristic possibility - it's a practical, high-impact technology that Treasury teams can start leveraging today. Do you want to explore intercompany pricing? Let us know in this contact form below.

If you are interested in more use cases, read more here.

Explore intercompany pricing

Get in touch to talk to us about intercompany loan pricing and how we can help.

Contact us

On July 2nd, 2025, the European Banking Authority (EBA) published its consultation paper on the proposed Guidelines on the methodology institutions shall apply for their own estimation and application of Credit Conversion Factors (CCF) under the Capital Requirements Regulation (CRR).

As part of the consultation process, open until 29 October 2025, the credit risk specialists at Zanders share our perspective on the proposed guidelines levering on our extensive expertise in credit risk modeling.

Building on existing EBA guidelines on PD and LGD estimation, the new CCF guideline aims to strengthen consistency across all IRB risk parameters. The proposed guideline provides clearer direction and changes on topics such as:

- Level of modeling: facility-level realized CCFs are required, where aggregation possibilities are limited, and fully drawn facilities are explicitly included in scope.

- Realized CCF: a methodology is provided to determine the CCF based on the level of utilisation.

In addition, the guidelines simplify regulatory expectations compared to the Guidelines on PD and LGD estimation such as:

- Representativeness: model performance outweighs representativeness constraints.

- Risk quantification: the long-run average should be the facility-weighted average of realized CCFs.

- Downturn adjustments: only the extrapolation approach is permitted.

- In-default CCF estimation: the methodology for non-defaulted exposures also applies to defaulted exposures.

- Non-retail exposures: under certain conditions a simplified approach allows using the same CCFs for non-defaulted and defaulted exposures, where estimated drawings for unresolved defaults are omitted.

Recognizing the smaller scope of CCF and data availability compared to PD and LGD, the proposed guidelines introduce a more proportionate and pragmatic approach for CCF estimation.

This article highlights these developments, focusing on the level of modeling, the determination of realized CCF, and the simplified approaches to representativeness, risk quantification, and downturn estimation.

Level of Modeling and Application

Under Article 4(1)(56) of the CRR3, institutions are required to calculate the realized CCF at the level of each individual facility for every default. The EBA’s proposed guidelines enforce this requirement by mandating a separate realized CCF for each facility, allowing exceptions only when several revolving limits stem from related contracts linked through an overarching agreement (i.e. umbrella facility with a shared debt ceiling) and have comparable characteristics.

This represents a clear difference from the flexibility allowed under ECB’s Guide to Internal Models (EGIM) paragraphs 259 and 316, which do not require comparability of characteristics. Under EGIM it is allowed to aggregate at a higher level than the individual facility irrespective of product characteristics, such as aggregation when LGD is estimated at a higher level. The proposed EBA guidelines therefore tightens the existing framework by explicitly prohibiting the aggregation of contracts with very different characteristics.

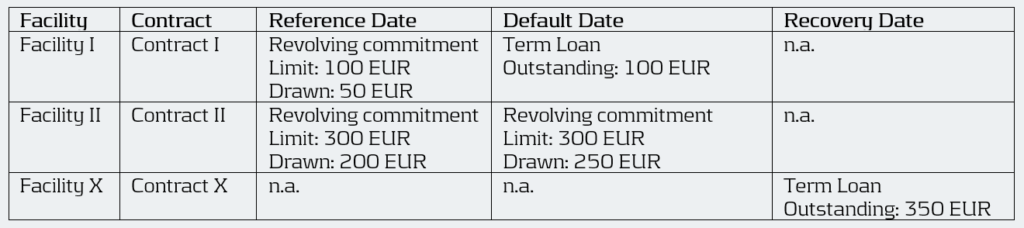

For institutions, this means developing a deeper understanding of the customer’s product structure and closely monitoring changes in the product mix during the twelve months leading up to a default. A facility is in scope of the CCF model if it contains a revolving contract at the reference date. Contracts that become revolving or non-revolving after a restructuring within the same facility are therefore also included. However, repayments on term loans should not impact the CCF, meaning term loans at the reference date should effectively be excluded. Therefore, institutions must continue to track the exposure as part of the original commitment. This can lead to complex situations, as illustrated below. The brown-highlighted contracts (originating from term loans) are out of scope, while the green-highlighted contracts are in scope. The new contract III is considered in scope because it can be interpreted as an increase in the facility limit.

The realized CCF for this facility is calculated as the difference between the drawn amount at the default date (100 + 50) and the drawn amount at the reference date (50) divided by the undrawn amount at the reference date (50) of the contracts in scope. As a result, the realized CCF is ( (100+50)-50) / (100 – 50) = 200%.

Example:

Moreover, when several facilities are backed by the same collateral, they are often combined into a single recovery account during the recovery process (see example below). In such cases, these facilities can be grouped for LGD. Under the EGIM framework, there was flexibility to also aggregate them for CCF modeling. However, the new guidelines require institutions to precisely allocate outstanding amounts to each specific revolving facility that existed at the reference date. This can create inconsistencies between LGD and CCF modeling and adds complexity to the modeling process. As a result, institutions will need to improve their systems to consistently identify, link, allocate, and manage facilities across their portfolios.

Example:

An obligor has an overarching collateral securing two different facilities I and II. Both facilities consist of revolving off-balance sheet exposures, but have different characteristics. During the recovery process, they are combined into a single recovery account. Therefore, all these facilities are grouped for LGD.

Under EGIM it was permitted to calculate the CCF at the LGD aggregation level, resulting in a realized CCF of ((100 + 250) – (50 + 200)) / ((100+300) – (50+200)) = 66.7%. Under the proposed guidelines, however, the realized CCF must be calculated separately for each facility, giving a CCF of 100% for Facility I (i.e. (100 – 50) / (100 – 50)) and 50% for Facility II (i.e. (250 – 200) / (300 – 200)).

Calculation of Realized CCF

The proposed EBA guidelines introduce two key changes in how institutions determine the realized CCF.

While EGIM paragraph 317 could be interpreted as fully drawn facilities are out of scope, the first change explicitly brings fully drawn revolving commitments into the scope of IRB-CCF modeling, marking another key difference between the two frameworks. EBA’s proposed guidelines now distinguishes between three levels of facility utilization for CCF estimation:

- Fully drawn facilities.

- Near-fully drawn facilities, which fall within the so-called Region of Instability (RoI). For example, a facility with a EUR 1000 limit and EUR 995 drawn at the reference date. If an additional EUR 30 is drawn between the reference date and default, the CCF would be: (1020-995)/(1000-995) = 500%.

- Partially drawn facilities.

The realized CCF is in general determined by the difference in drawn amount at default and the reference date as a percentage of the undrawn amount at the reference date. Since fully drawn facilities have no undrawn part at the reference date, institutions must use an alternative calculation method that expresses the drawn amount at default as a percentage of the committed limit at the reference date. Facilities that are in the RoI, have a very small undrawn amount, which can result in unstable and unreliable realized CCF estimates. Although Basel III describes three possible methods to handle such cases, the guidelines recommend applying the same approach used for fully drawn facilities when predictive accuracy or discriminatory power is limited. They highlight that consistency in applying the chosen approach is essential. Moreover, institutions are expected to define clear thresholds that identify these cases, where it is essential to balance the need to capture outliers without including an excessive number of cases.

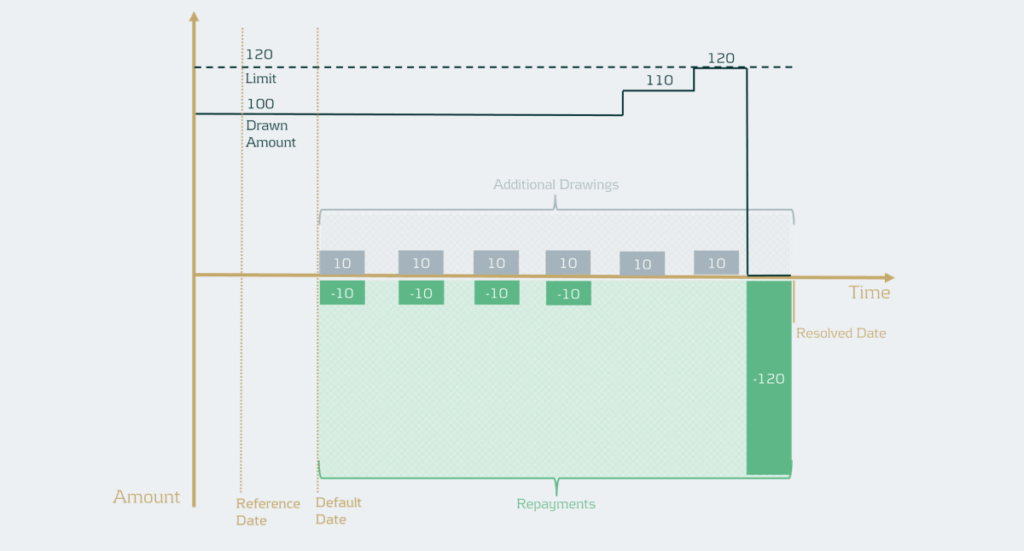

The second change concerns the treatment of additional drawings. For retail exposures, institutions retain the flexibility to include additional drawings either in the LGD or in the CCF estimation. For non-retail exposures, additional drawings must still be incorporated into the CCF estimates. In situations where the additional drawings are considered in the CCF all observed drawings should be considered. However, if there are many drawings and repayments, realized CCFs can in practice be very high and LGDs very low (see example below).

Example

The facility has a drawn amount of EUR 100 and a limit of EUR 120, meaning there is an undrawn amount of EUR 20. If the additional drawings would simply be summed, this would lead to a total drawn amount of EUR 60 and a total recovery amount of EUR 160. As a result, ignoring discounting, this would mean the CCF is EUR 60 / EUR 20 = 300% and the LGD would be ((EUR 100 + EUR 60) – EUR 160) / (EUR 100 + EUR 60) = 0%.

To address this, institutions should now calculate the realized CCF by increasing the drawn amount at default by the positive difference between the highest drawn amount after default and the drawn amount at default. Then the CCF would be (drawn amount at default + additional drawings during default – drawn amount at the reference date) / (limit at reference date – drawn amount at reference date). In the example, the facility has EUR 100 drawn and EUR 20 undrawn at default (and at the reference date for simplicity). The highest drawn amount during default is EUR 120, meaning EUR 20 of additional drawings instead of EUR 60 in the example. Ignoring discounting, this gives a CCF of ((100 + 20) – 100 ) / (120 – 100) =100%. This method uses outstanding balances rather than transaction-level data. It therefore differs from the transaction-based approach typically used in LGD modeling1. The drawn amounts used in the realized CCF and realized LGD should be consistent, meaning that if an institution currently applies a different method, the LGD model may need to be redeveloped.

Representativeness

While earlier guidelines placed heavy emphasis on ensuring representativeness in the development phase, the proposed guideline focusses on how well the model performs in terms of discriminatory power and homogeneity in rating grades or pools.

However, representativeness remains essential for the data used for developing, testing, and quantifying the CCF models, meaning institutions must still confirm that the data used reflects the characteristics of the application portfolio across different time periods, jurisdictions, and data sources. If the development or testing samples are not representative and this negatively affects model performance or its assessment, they must be redeveloped or adjusted. For the quantification sample, institutions should assess whether any lack of representativeness introduces bias in realized CCFs and apply appropriate adjustments or margins of conservatism where needed, without lowering CCF estimates. Compared to the previous Guidelines on PD and LGD estimation, the new guidelines therefore introduce a simpler approach focused on the performance of the model.

Risk Quantification

Under the EGIM framework, CCF quantification depends on whether the historical observation period is representative of the LRA. If it is, institutions should use the arithmetic average of yearly realized CCFs. If not, adjustments are made to account for underrepresentation or overrepresentation of bad years. The proposed guidelines, however, require a single arithmetic average of all realized CCFs weighted by the number of facilities. It is no longer allowed to use averages based on a subset of observations such as yearly averages. Therefore, potential recalibration is required.

Downturn

The downturn CCF guideline builds on the principles of downturn LGD estimation but introduces several simplifications. The haircut method is removed, as it is considered unsuitable for CCF estimation. Instead, institutions may apply an extrapolation approach at the overall CCF level to capture the direct link between economic factors and CCFs. When no observed or estimated downturn impact is available, a 15%-point add-on is maintained and the105% LGD-cap is removed. Additionally, institutions may apply downturn components estimated for non-defaulted facilities to defaulted ones, eliminating the need for separate downturn estimation and simplifying implementation.

The clarity provided by the new guideline on this topic supports the simplifications aimed to make the framework more pragmatic.

Conclusion

The EBA’s consultation on the new CCF modeling guidelines introduces notable simplifications compared to the previous framework, aiming to enhance consistency across all IRB parameters. While these changes support greater harmonization in credit risk modeling, they also may carry significant implications for institutions, particularly in the areas of level of modeling, realized CCF determination, and long-run average estimation. Adapting effectively to these developments will be essential for maintaining compliance and ensuring robust risk management practices.

The deadline for institutions to submit feedback to the EBA is next week October 29th 2025. Zanders therefore encourages institutions to evaluate the potential impact on their modeling practices and share insights based on their practical experience.

Reach out to John de Kroon, Dick de Heus, or Louise Schriemer if you are interested in getting a better understanding of what the proposed guidelines mean for your credit risk portfolio.

Citations

- Transactions can be derived from differences in outstanding balances and vice-versa. Therefore, this change is not blocking but usually requires some additional steps. ↩︎

The stakes are high: financial institutions collectively spend billions each year on combating financial crime.

In the Netherlands alone, more than €1.4 billion is spent annually on money laundering prevention, with an additional €1 billion in administrative burdens for companies and individuals1. These costs highlight not only the scale of the challenge, but also the urgent need for technological solutions, such as AI, that are both effective and efficient.

With the rapid rise of artificial intelligence (AI) and increasingly complex regulatory expectations, the field is changing at an unprecedented pace. Keeping up with new developments demands both the right technology and a solid grasp of its principles to maintain fairness, transparency, and effectiveness.

To explain the new developments and how to effectively integrated those, we’re launching a new blog series on the future of FCP: to explore how organizations can balance innovation with responsibility. We will explore the dive into the most pressing challenges in FCP modeling and show how AI and machine learning are shaping its development. Along the way, we’ll share insights on building trust and reliability in next-generation models, along with practical tips, discussion points, and industry perspectives for those working with these emerging technologies.

What to Expect

Each blog post in this series of 4 will focus on a specific topic that is crucial to the present and future of the FCP domain. The posts will follow the typical lifecycle of model development – starting with the development and concluding with validation:

- Bias and Fairness: AI models are powerful, but they don’t always treat everyone equally, as seen during the “Toeslagenaffaire” in the Netherlands or COMPAS case in the United States. In high-stakes domains like FCP such consequences can be just as severe. In the rush to make AI models “fair”, many organizations fall into the trap of chasing strict statistical parity at the expense of performance and context. In FCP, this tension is especially acute: regulators push for ever-higher recall, while fairness requirements demand balanced precision across different groups. The result? Conflicting objectives, artificial “levelling down,” and potential compliance risks under GDPR. The conventional bias-mitigation mindset is challenged, where a more mature, context-aware approach to fairness is advocated for.

- Explainability: AI and ML models go hand in hand with the challenge of explainability. These technologically advanced models are frequently described as black boxes: powerful, yet difficult to interpret In practice, model developers outsource the responsibility for model interpretability to SHAP or similar feature-importance methods – and call the job done. But does this really provide meaningful insight into how a model behaves? In FCP, explainability must go beyond technical metrics; it should focus on the people who use these models every day. The real value of AI in this space often lies in how it supports analysts – helping them interpret alerts, make informed decisions, and justify their actions. This article explores how shifting from model-centric to human-centric explainability can transform AI from a black box into a trusted, collaborative partner in the fight against financial crime.

- Model Drift and Data Drift: The financial world is always in movement. As technologies evolve and customer behaviour shifts, models built to detect financial crime can quickly become outdated. This article explores the importance of monitoring data drift (changes in input patterns) and modeldrift (changes in the relationships between inputs and outcomes). From building models that can withstand shifting behaviour to setting smart thresholds and review cycles, it highlights how banks can keep their FCP models relevant and reliable.

- The Model Validation Process: Model validation in FCP has long followed the same framework as credit risk – a framework often characterized by manual, time-consuming, and inflexible processes. With criminals constantly adapting their tactics and regulators becoming ever more demanding, this traditional approach is no longer sustainable. This article explores how generative AI can transform model validation without replacing human expertise. When implemented with care and oversight, AI elevates validators, ensuring their skills are applied where they matter most and keeping FCP programs agile in a rapidly evolving landscape.

By progressing through these topics in order – from identifying risks of bias, to ensuring transparency, to monitoring drift, and finally to examining validation frameworks – a clear narrative is created that links principles to practice. Responsible innovation is not just about ticking boxes on a regulatory checklist, it’s about creating an FCP framework that people can trust. These blogs offer insights and perspectives for making this happen.

Looking Ahead

This series of upcoming blog posts is just the beginning. Each topic opens the door to deeper discussions, case studies, and practical applications. Whether you’re a risk manager, data scientist, compliance officer, or executive, the series provides insights into the challenges and practical approaches that financial institutions can take to address them.

Citations

- Grootbanken voorzien verlies van duizenden banen bij witwascontroles - Financieel Dagblad, October 2nd ↩︎

As ESG regulation moves from voluntary disclosure to in-depth integration, European banks must adapt their ways of working to establish credible transition plans.

Over the past decade, regulatory expectations on European banks’ ESG frameworks have evolved from voluntary disclosure initiatives to detailed operational requirements. While certain regulations such as CSRD and CSDDD have been watered down as part of the Omnibus Directive, EUs climate goals and Climate Law remain intact. The EBA Guidelines on the management of ESG risks will come into force in January 2026, mandating all but the smallest banks to submit annual plans demonstrating how they will reduce their portfolio emissions in time to meet internal and external targets.

Ironically, amidst a slower-than-expected decarbonization in society in general, and with several American and international banks retreating from their climate commitments (and the ensuing collapse of the Net Zero Banking Alliance), it is European banks that are exposed to the largest compliance and reputational risks.

In our experience, many banks may have underestimated the far-reaching impact of the new Guidelines. Unlike previous regulatory guidance, including ECBs Guide on climate-related and environmental risks, what is now required is the complete integration of ESG risks and targets into banks’ ways of working: risk management, client engagement, operations, pricing, and business strategy.

Below we outline the four areas we think will prove the most challenging for banks to implement.

Key challenges

- Data availability and processes

Banks are required to have in place a structured data environment to enable assessment of ESG risks, with the explicitly stated aim that most of the data should be sourced at the client- and asset level. The Guidelines list a number of metrics that large institutions must define and monitor, including:

- Financed emissions (Scope 1-3)

- Portfolio metrics of clients that are, or are projected to be, misaligned with emission targets

- A breakdown of portfolios secured by real estate according to the level of energy efficiency

- Metrics related to dependencies and impacts on ecosystem services, in particular water

- Metrics related to ESG-related reputational and legal risks (via the banks’ exposures)

Some of these data are already collected and reported by banks, such as financed emissions. But even those metrics rely largely on proxies and assumptions. Even among PCAF member banks the variation in reported emission intensities is significant - and in many cases inexplicable. For many other metrics the data to construct them is either missing or has not even been defined.

Banks need to accelerate their ESG data strategy and decide, for the short- and medium, which data to collect directly from clients andwhich to source from external providers, and the data gaps for which there are no viable alternatives but to use proxies. In turn, for each of these categories there will be many choices to make with implications for quality, timeliness, and costs. In parallel, but informed by the data strategy, the bank needs to decide on – and invest in - their future data infrastructure, which may take years to realize. One obvious case is the need to connect real estate characteristics, such as LTV, flood exposure, energy rating, and insurance coverage with clients’ financial data as well as outputs from climate scenario models.

2. Models and Methods

The Guidelines require banks to map ESG risk drivers to traditional risk categories and – if they are material - embed the risks in several processes: collateral valuation, ICAAP, stress testing, underwriting, and pricing.

The first step in this exercise is to determine which risk drivers are material, and for which risk types. In the end, for most banks, physical and transition risks stemming from climate change will likely prove the most material for credit risk, but ECBs expectations as to the rigor of the materiality assessment - to substantiate such a conclusion - are increasing. For example, banks need to have methodologies in place to assess how and whether social and governance failures in client firms may result in both financial as well as reputational and legal risks.

Even for key risk drivers such as flood risk, banks face a significant challenge in quantifying how and with which probability this will translate into credit risk. It necessitates a number of assumptions such as the response in real estate prices and insurance costs/availability, as well as government policy and disaster funds, flood protection work, and much more. Limited or absent historical data together with the changing nature of risks related to climate change make this kind of model development very different from traditional risk modeling in banks (such as IRB model) and necessitates new expertise.

And while there are several useful publicly available models, in particular by the Net Greening of the Financial System, there is still a lot of work to be done to adapt those scenarios to individual banks’ portfolios and business models.

3. Client engagement and risk assessment

EBA expects climate and environmental risks to be factored into client selection, due diligence, covenants and pricing based, for a start, on an evaluation of counterparties’ transition readiness and resilience to physical risks. Even for large clients that are reporting under CSRD, a lot of the data required to perform these assessments will have to be collected directly as part of the onboarding process.

Although many banks have separate ESG advisory units that support client executives, these are often there to identify opportunities for sustainable products and loans and are not trained to assess and quantify clients’ risks. In the end, it is client executives and credit committees that must stand over the ESG risk assessment and its impact on credit scores, pricing and loan conditions. To save costs and time for client-facing staff, they should be equipped with practical and user-friendly tools and systems that support them in collecting and organizing relevant ESG data.

Worse, for most SME and retail customers there is no dedicated account manager, the on-boarding and credit process is largely automated. Banks should develop a risk-based sourcing strategy that, at least initially, uses sector-level proxies for the majority of firms while collecting individual data from those that have been designated as high-risk clients. Again, a number of choices have to be made when developing such a framework to ensure it is purposeful.

4. Governance and steering

What we deem most pressing for banks is to decide on their governance to triage and drive progress on the vast array of requirements. It will require strong leadership and a project committee with sufficient seniority to make crucial, and potentially costly decisions. Elaborate RACIs will be of little use if those assigned ownership are found too low in the bank’s hierarchy.

While the exact division of responsibilities will depend on each bank’s structure and governance model, it is clear that the actual transition plan(s) should be owned by the first line (and subsequently validated by second line), and tie into existing business planning and strategic process. At the same time, the transition plan will be part of the annual ICAAP submission, which is a second-line responsibility, and the bank’s ESG strategy should be reflected in the business resilience test . Hence, these first- and second-line processes must be aligned.

The Board and CEO should set the bank’s ESG strategy and ensure that these expectations are actionable. Little progress is to be expected if C-suite members do not have clear KPIs and KRIs tied to the delivery of the bank’s transition plan. Quantitative targets may be based on, in addition to financed emissions, the energy efficiency profile of the mortgage book, sustainability-linked bond issuance, and the funding of low-carbon power production. Such targets may necessitate difficult trade-offs, including tighter origination criteria, off-boarding of high-risk clients, and larger discounts for green loans.

Purposeful implementation strategy

To succeed in this potentially daunting endeavour banks should adopt a pragmatic implementation approach, balancing costs against compliance risks. The ECB and local supervisors are fully aware that banks need considerable time to get all prerequisites in place, and the scope and detail of transition plans must be allowed to evolve over years.

However, while early transition plans cannot be expected to present the ultimate answers to either data, methodological or governance challenges, , banks should be able to demonstrate their capacity to achieve essential climate and environmental objectives. Quantitative targets, in particular regarding a bank’s financed emissions, must be achievable.

Finally, underscored by recent legal cases, any claims related to the bank’s “green” credentials must be based on evidence. The heightened compliance and legal risks mean that it is timely to review the bank’s public as well as non-public ESG commitments, benchmark them against peers, and make an honest assessment of the costs and resources necessary to fulfil them.

Want to find out more about how Zanders can assist your bank in developing your ESG strategy and meet regulatory expectations?

Reach out to our Partner Lars Frisell, our ESG and risk management expert, for tailored guidance.

As the Swift MT-MX co-existence phase ends in November 2025 and ISO 20022 becomes the new standard, this major milestone highlights that while message formats are evolving, many challenges in cross-border payments still remain.

November 2025 marks the end of the Swift MT-MX co-existence phase, which will see the adoption of ISO 20022 XML messaging in the interbank space for cross border payments. Whilst this Swift migration represents possibly the most significant disruption to traditional global cross border payments since Swift first introduced electronic financial messaging back in 1977, ultimately this is just a message format change, which still fails to address some of the key challenges around cross border payments. In this latest article from Eliane Eysackers and Mark Sutton, they provide a recap on the remaining challenges with cross border payments in addition to focusing on the rapidly evolving payments landscape, which will redefine what is possible.

Background

Whilst the evolution of the payments industry over the past twenty years has been significant, both in terms of the number of available payment methods and how payments can now be made, the intensity of focus increased significantly when the G20 endorsed the Roadmap for Enhancing Cross-border Payments1 in 2020. The G20 made enhancing cross-border payments a priority – specifically making cross-border payments, including remittances, faster, cheaper, more transparent and inclusive.

Friction will remain with the legacy Correspondent Banking Model

Post the Swift MT-MX migration, the correspondent banking model will remain an essential part of the cross border payments flows. Underpinned through a foundation of bilateral agency agreements, whereby one bank maintains a physical bank account (and deposits) with another (correspondent) bank, corporate treasury will continue to experience friction in the following areas:

| High Costs | The cost of a cross-border wire payment extends beyond the charges of the originating bank. Under the correspondent banking model, each bank involved in the cross-border payment processing chain can apply a fee, including the beneficiary bank. |

| Slow Processing | Whilst Swift GPI is a significant enhancement that provides tracking of the cross-border payment status, this merely highlights that in some cases, a cross border payment can still take 24 hours to reach the beneficiary bank account. |

| Principle Amount | Whilst the Swift message design allows for the originating customer to specify if the beneficiary should receive the full principle (payment) amount, a significant number of corporates still encounter challenges where at least one bank in the payment chain deducts their fees from the principal payment amount. This means the beneficiary receives less money, creating reconciliation challenges and customer dissatisfaction. |

| Settlement Risks | Banks worldwide need to hold significant balances in reserve to cover the risk of correspondent bank default because many cross-border payments take a day or more – sometimes weeks – to complete. CLS, which was launched in 2002 to mitigate this risk, only covers a small number of the world’s currencies, leaving large sectors of the global economy badly exposed to correspondent banking’s overnight risk problem |

The Digitization of Money – Taking Cross Border Payments to the Next Level

The race is now on as the rapid evolution of technology provides the opportunity for greater speed, transparency and efficiency within the cross-border payments domain. There are a number of projects at different stages of maturity that leverage distributed ledger technology to support the digitisation of cross border transactions:

- BIS Project m-Bridge (2021-2024)

Originally launched by the Bank for International Settlements (BIS) in collaboration with the central banks of China, Hong Kong, and the United Arab Emirates, this project aimed to create a multi-central bank digital currency (m-CBDC) platform that addressed key inefficiencies in cross-border payments, including high costs, low speed and operational complexities. Furthermore, this platform would be fully compliant with jurisdiction-specific policy and legal requirements. However, the 2024 BRICS summit also included Egypt, Ethiopia, Iran, and the United Arab Emirates as members2, with the agenda including a discussion around the creation of a BRICS Bridge which would be based on m-bridge technology. Recognising that a BRICS Bridge offered the potential for some independence against US supervised financial systems and the current restrictions to Swift, the BIS announced in October 2024 that mBridge had reached the minimum viable product (MVP) stage in mid-2024 and that it was now handing over to the participating central banks to carry the project forward.

With the technology proven and China at the helm, we are now hearing some news about Chinese banks executing cross border payments using mBridge3. We should expect transactional volumes to increase through 2025 and assuming this project is viewed as a success, an expansion across parts of Asia and possibly the Middle East Region given the participating central banks4.

- Project Agorá (2024 - now)

Commencing in April 2024, Project Agorá is the BIS Innovation Hub’s largest and most complex project in geographical scope and number of participants. The project’s main objective is to demonstrate how a unified ledger could enhance the efficiency of business and regulatory processes in correspondent banking payment chains, thereby reducing transaction times and costs, enhancing payment transparency, and mitigating risks for banks involved in cross-border payments.

The project aims to build a technical prototype to test wholesale cross-border payments to demonstrate the following:

- The ability to represent tokenised commercial and wholesale central bank money on a unified ledger that meets technical and business requirements.

- Atomic cross-border transactions between currency areas leveraging a single currency pair or a vehicle currency in a way that preserves depositor-bank relationships.

- The ability to streamline pre-validation efforts, e.g. reducing duplication of efforts, in the payment chain without changing existing standards and requirements.

- Improved efficiencies in complying with sanctions screening as well as anti-money laundering and rules on countering the financing of terrorism.

This project brings together seven central banks5 which will work in partnership with 42 financial services companies6 and convened by the Institute of International Finance (IIF)7. Project Agorá aims to go beyond proof of concept and deliver a prototype to test a range of potential current and future use cases. The lessons learned during the project may set out a path for a new type of financial market infrastructure tailored to cross-border payments based on new technology.

The project is currently in its final design phase, which will then allow the BIS to issue an RFP to choose a technology partner. A project report is expected to be published by the end of 2025.

- Partior (2021 - now)

Singapore based Partior is a blockchain-based fintech, which is offering a next-generation atomic settlement network for cross-border wholesale payments. Founded in 2021, it was announced as the winner of the 2022, G20 Indonesia Techsprint challenge on CBDCs. Backed by DBS Bank, J.P. Morgan, Standard Chartered, Temasek, and Peak XV, it processed over USD 1 billion in transaction value in November 20248, marking a significant milestone in the company's journey to deliver instant cross-border transactions for financial institutions.

Banks either using or partnering with Partior include its founders DBS Bank, JP Morgan, and Standard Chartered, along with Deutsche Bank, Emirates NBD, and Nonghyup Bank, who are using it to facilitate real-time, cross-border payments and settlement, often involving tokenized commercial bank money to address inefficiencies like settlement delays, limited transparency, and high operating costs in the global financial market by removing intermediaries.

Whilst Partior's platform currently supports USD, EUR, and SGD, there are plans to integrate additional currencies combined with expanding its network across the Americas, EMEA, and Asia.

- Regulated Liability Network (2021 - now)

With origins dating back to the 2021 Monetary Authority of Singapore (MAS) global CBDC solutions challenge, the evolution continued in 2024 with UK Finance announcing work on a new UK Regulated Liability Network (RLN) experimentation phase with eleven of its members9. This was completed during Q3 2024 and explored the possible benefits of tokenisation, distributed ledger technology (DLT), and programmable money.

The focus earlier this year was on the technology build, test, and delivery for a pilot phase. Developing the technology framework included the orchestration layer, associated tokenised deposit and shared ledger systems. The objective is to build a regulated financial market infrastructure using distributed ledger technology (DLT) to enable new digitised payment and settlement capabilities. In September 2025, UK Finance issued a press release10 confirming a pilot will run until mid-2026 with the objective of demonstrating tangible benefits to customers, businesses and the wider UK economy.

- J.P. Morgan launches USD Deposit Token, JPMD (June 2025)

In addition to the various industry collaborations, we are also seeing commercial banks developing solutions that will address the current friction in the cross-border payments space as well as enhancing existing payment capabilities. J.P. Morgan introduced the JPMD deposit token in a proof-of-concept launch on the 24th of June, 2025, on the Base public blockchain, developed by Coinbase11. The JPMD token serves as a digital representation of commercial bank money and is an alternative to stablecoins for J.P. Morgan's institutional clients. Whilst Deposit Tokens and stablecoins can be applied to similar use cases, Deposit Tokens differ from stablecoins in key areas including, interest payouts, and deposit treatment.

What are the Benefits of Digitized Cross Border Payments?

Harnessing new digitised cross border payment rails that are underpinned with distributed ledger technology and smart contracts will address the legacy frictions arising from the separation of messaging, clearing and settlement. Benefits include the following:

- Atomic settlement: Has emerged with the advent of blockchain technology and distributed ledger systems. Whilst the legacy settlement processes often involves multiple intermediaries and can take days to complete - which expose participants to counterparty and settlement risks, atomic settlement enables instant and simultaneous completion of a series of transactions, ensuring instant and irrevocable value transfers, importantly eliminating settlement risk.

- Faster processing speed: Industry analysis of Swift versus RippleNet highlighted RippleNet settles payments in 3–5 seconds using XRP, while Swift can takes days due to the use of intermediaries. Swift only handles messaging; the actual fund movement depends on multiple banks and currencies.

- Reduced cost: Fewer intermediaries are involved in the cross-border payment processing chain.

Lastly, these new digitised payment rails will support programmable payments, enabling the contingent performance of actions through smart contracts, for example only release payment when the goods have been received.

Conclusion

The world is witnessing significant growth in cross-border payments, which has been driven by the globalization of trade, capital and migration flows. Global payments are expected to increase from USD 190 trillion in 2023 to USD 290 trillion by 203012. Streamlining international transactions by reducing settlement times, certainty, cost and risk is now becoming a strategic imperative.

However, the above selected projects represent just a few of the initiatives underway at the moment as the digital payments landscape continues to evolve. Whilst it does look like a fragmented digital payments landscape will be the ultimate outcome, what is clear is that programmable payments and smart contracts can enable new ways of atomic settlement, unlocking new value-added solutions that are simply not possible or practical under current payment rails. These new digital payment rails will eliminate the legacy inefficiencies that exist today with cross border payments, reducing costs, and providing atomic settlement. The future of cross border payments is now looking faster and smarter.

Take the next step in optimizing cross-border payments

Get in touch with usCitations

- https://www.fsb.org/2020/10/enhancing-cross-border-payments-stage-3-roadmap/ ↩︎

- BRICS+ refers to the expanded group comprising Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates. ↩︎

- mBridge cross border CBDC project enters next phase in China - Ledger Insights - blockchain for enterprise ↩︎

- Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the People’s Bank of China, the Hong Kong Monetary Authority and Saudi Central Bank. ↩︎

- Bank of France (representing the Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England and the Federal Reserve Bank of New York. ↩︎

- AMINA Bank, Banco Santander, Banorte, Banque Cantonale Vaudoise, Basler Kantonalbank, BBVA, BNP Paribas, BNY, CaixaBank, Citi, Crédit Agricole CIB, Deutsche Bank AG, Eurex Clearing AG, Euroclear S.A./N.V., FNBO, Groupe BPCE, Hana Bank, HSBC, IBK, Intercam Banco, JPMorgan Chase Bank N.A., KB Kookmin Bank, Lloyds Banking Group, Mastercard, Mizuho Bank, Monex, MUFG Bank Ltd, NatWest Group, NongHyup Bank, PostFinance Ltd, Santander, SBI Shinsei Bank Ltd, Shinhan Bank, SIX Digital Exchange (SDX), Standard Chartered, Sumitomo Mitsui Banking Corporation, Swift, Sygnum Bank, TD Bank N.A., UBS, Visa, Woori Bank ↩︎

- Institute of International Finance | IIF ↩︎

- Partior Welcomes Deutsche Bank as Strategic Investor | Partior ↩︎

- Barclays, Citi, HSBC, Lloyds Banking Group, Mastercard, NatWest, Nationwide, Santander, Standard Chartered, Virgin Money and VISA. They are being supported by EY and Linklaters and a technology team of R3, Quant, DXC and Coadjute. ↩︎

- UK Finance announces live pilot phase to deliver tokenised sterling deposits | Insights | UK Finance ↩︎

- Kinexys Pilots First USD-Denominated Deposit Tokens ↩︎

- FXC Intelligence, Cross-border payments market sizing data. ↩︎

From 1 January 2026, amendments to IFRS 9 Financial Instruments will require companies to derecognize both financial assets and liabilities on the settlement date only. This is the date when the beneficiary’s bank receives the funds, rather than when a payment instruction is initiated.

For treasury and finance teams, this isn’t merely an accounting tweak. It changes how liabilities, assets, and liquidity are presented at reporting cut-offs, with considerable implications for system configuration and investor perception.

What has changed?

Under past practice, liabilities typically were removed from the balance sheet as soon as payment instructions were sent to a bank. Under the updated standard, such derecognition is no longer permitted unless settlement has actually occurred and funds are in the hands of the counterparty.

This change aligns accounting more faithfully with economic reality: until settlement occurs, the liability remains and cannot be considered discharged.

In SAP, liabilities are often cleared at the payment run step, with postings to a cash-in-transit (“CIT”) account.

Example: SAP F110 + CIT vs Settlement-Date

| Steps | Old Practice (Instruction Date / CIT) | New Requirement (Settlement Date) |

| 31 Dec, Payment run executed in SAP F110 | Dr AP CR CIT (Liability Cleared, cash-in-transit posted) | Liability remains in AP no derecognition yet |

| 1–2 Jan, Funds in transit supplier not yet paid | Liability already derecognised; balance sits in CIT (classified as cash) | Liability still shown as outstanding in AP |

| 2 Jan, Bank statement import confirms settlement | Dr CIT CR Bank | DR AP CR Bank Liability cleared at settlement |

Impact: Under the old method, liabilities disappeared prematurely and cash was overstated, creating distorted liquidity positions. Under IFRS 9, derecognition only happens when settlement is confirmed by the bank.

The same timing challenge applies in in-house bank (IHB) scenarios, where intercompany positions are often cleared in SAP before external settlement has actually taken place.

This change aligns accounting more faithfully with economic reality: until settlement occurs, the liability remains and cannot be considered discharged.

Why the IASB stepped in

The previous method often led to distorted liquidity positions. Liquidity, as shown on the face of the financials, could appear stronger than warranted while liabilities looked lower. The IASB’s concern lay in classification, timing, and how external users interpret financial statements.

The effect can be seen in the example below:

| Approach | Current Assets | Current Liabilities | Current Ratio |

| Settlement-date accounting | €100,000 | €10,500 | 9.5 |

| Instruction-date accounting | €90,000 | €500 | 180.0 |

In the table above, we can see that the economic position under both approaches remains identical, the supplier is unpaid and the cash is still in the bank. The difference lies in the presentation. Under instruction-date accounting, liabilities appear lower, making liquidity look stronger than it truly is. Under settlement-date accounting, liabilities remain on the balance sheet until cash is received by the counterparty. This provides a more faithful representation of the company’s financial position and addresses the IASB’s concern that inconsistent reporting reduces comparability and distorts how investors perceive liquidity and risk.

The Exemption

For financial liabilities only, IFRS 9 allows an optional policy election, companies may derecognise at the instruction date but only for payment systems (e.g. CHAPS or SEPA) that meet stringent criteria. Derecognition at instruction date is permitted only if:

- the payment instruction is irrevocable

- the entity cannot access or redirect the cash after initiation

- settlement risk is insignificant

- settlement is expected to occur within a very short timeframe

If this exemption is elected, it must be applied consistently within that payment system. Companies can choose different approaches for different systems for example, applying the exemption to SEPA but not to CHAPS.

While this option can provide operational relief and reduce the need for immediate system changes, it may also increase configuration complexity where multiple payment systems are used.

For example in SAP this choice needs to be reflected in payment method configuration, house bank integration, and clearing logic. While the exemption may reduce the need for immediate system changes, it can add a high level of complexity where multiple payment systems are used. The exemption also requires clear disclosure under IFRS 7.

What companies should do now

The degree of impact will vary. Entities with high volumes of electronic payments, in-house bank models, or complex treasury workflows are likely to be most affected.

For SAP users, the priority is to map where liabilities are currently being derecognised before settlement and focus on updating configuration in the following key system areas:

- Payment run (F110): Review clearing logic and postings to CIT. Ensure liabilities remain in AP until the bank statement import (EBS) confirms settlement.

- Bank statement processing (EBS): Confirm settlement recognition logic, including how postings flow from house banks to AP and cash accounts.

- Cash and liquidity reporting (Fiori apps): Validate whether Cash Position and Liquidity Forecast details reflect settlement date logic and align with IFRS 9 reporting.

- Payment method & House Bank configuration: If the IFRS 9 exemption is applied, ensure configuration is consistent at the payment system level, and correctly applied to exemptions only.

- Accounting configuration: Review and update how cash-in-transit (CIT) postings are set up in SAP.

Aligning SAP configuration across these areas is essential to ensure management reporting and statutory reporting remain consistent and to avoid distorted liquidity views at reporting cut-offs.

For many companies, these changes are not just a simple adjustment to accounting treatment they will require extensive configuration updates across SAP treasury and banking processes. Delaying the review could leave year-end reporting out of step with IFRS 9.

How we can help

These amendments reshape how liquidity and financial strength are communicated to stakeholders. With the effective date approaching, companies should act pre-emptively: assess exposure, evaluate options, and prepare systems and processes for change. Our team combines IFRS expertise with deep SAP treasury and technology knowledge, helping organizations translate regulatory change into practical implementation. To explore how the IFRS 9 amendments may affect your reporting, SAP configuration, or liquidity metrics, please get in touch with our advisory team, Jordan James, or Deepak Aggarwal.

Zanders has conducted the annual report study for IFRS 9 results across the Dutch banking sector.

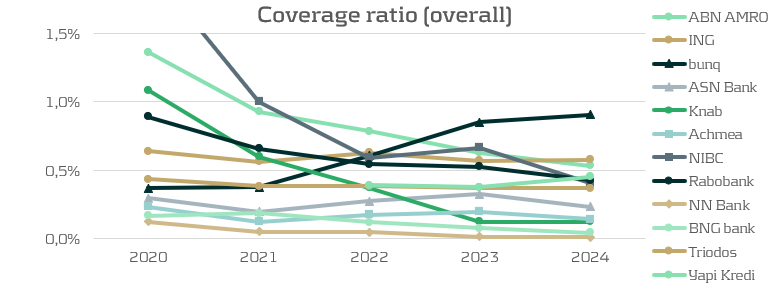

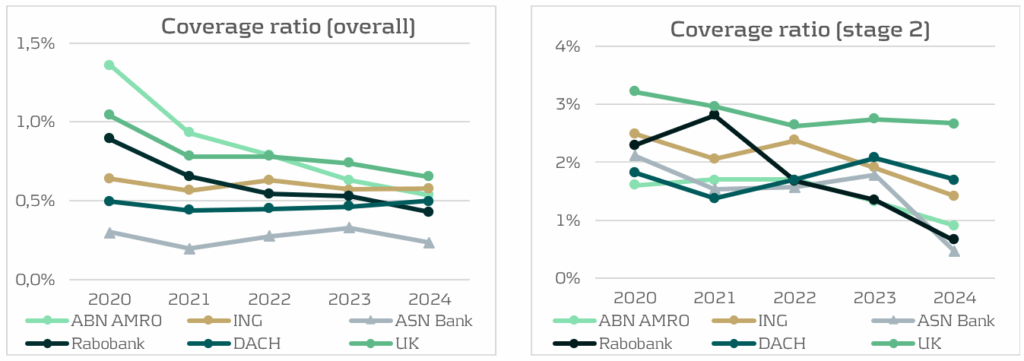

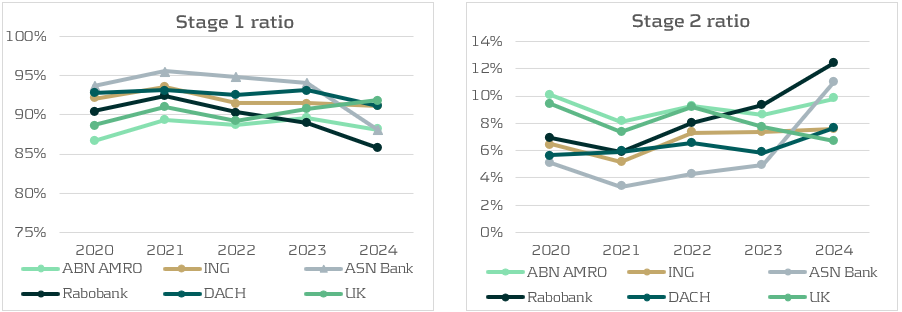

This article first analyzes trends in coverage ratios among 13 Dutch banks1, and puts the results of the largest Dutch banks in international context. Furthermore, this article builds on previous annual studies (2023 and 2024). For this purpose, coverage ratios and stage exposures from the four largest Dutch banks are compared with the five largest UK2 and DACH3 banks as benchmarks. Next, macroeconomic outlooks from a group of Dutch banks are discussed. Finally, the application of management overlays by all Dutch banks is discussed as well.

In general, the results show continuation of a decreasing trend in the coverage ratio for Dutch banks, which is a persistent trend since 2020. From a bank’s perspective, this is a positive development: lower coverage ratios are driven by improved macroeconomic conditions, reduced manual overlays and healthier portfolios, and therefore leading to lower Expected Credit Losses (ECL). Especially Stage 2 coverage ratios are lower in 2024, as changes in macroeconomic outlooks have a stronger effect on these loans because ECL for Stage 2 are determined over the lifetime of the loans. The transfer of loans from Stage 1 to Stage 2 also happened persistently over the last couple of years. This could be seen together with the EBA monitoring report (IFRS 9 implementation by EU institutions) which called for a more conservative and broader definition of Stage 2. The increase in Stage 2 ratios is a counterintuitive finding when paired with the decrease in coverage ratios. As Stage 2 reflects a Significant Increase in Credit Risk (SICR), credit loss provisions are expected to be higher. However, it follows that the effects driving the coverage ratios down outweigh the increase in Stage 2 exposure.

Coverage Ratios: a Decreasing Trend

The Dutch banks are expecting lower credit losses compared to previous years, resulting in lower coverage ratios. There are three main drivers for this. Firstly, several banks (e.g. ASN Bank) mention a significantly more positive macroeconomic outlook. The second driver is not forward-looking but is a realization of higher-than-expected increases in house prices in 2024. As mentioned by ABN Amro and Rabobank, the Dutch house price index (HPI) was expected to rise around 2% in 2024, while this turned out to be 9%. Higher house prices improve collateral values and therefore lower the future Loss Given Default (LGD) in case of a mortgage default in the IFRS 9 models. The third driver behind lower ECL is that many banks decreased the management overlays to the model outcomes in 2024 compared to 2023. Combining these three drivers pushes coverage ratios down.

In international context, the largest Dutch banks are well positioned compared to banks in the UK and DACH regions. The coverage ratio of UK banks is relatively high but is decreasing due to improvements in economic outlooks and a decrease in inflation. The coverage ratios of DACH banks are comparable to those of the Dutch banks. However, the coverage ratio of the DACH banks did increase slightly compared to 2023, driven by a weak German economy and the increased geopolitical risk of US trading wars. Although the expectation of a trading war has worldwide implications, there are several reasons why the German economy would suffer more from this than the Dutch or English economies. Firstly, Germany is the most reliant on export out of these three countries, with over 50% of its GDP allocated to exports. Secondly, German banks lend heavily to autos, machinery, and chemicals, exactly the industries most exposed to US tarrifs. In contrast, Dutch banks rely more on agriculture, mortgages and domestic real estate. UK banks are more globally diversified, giving them a smaller exposure to US trade wars. For these reasons, the effect of potential US trade wars is weighed more heavily into the macroeconomic IFRS 9 scenarios for German banks.

Stage Ratios: Counterintuitive Movements

Another development in 2024 is the increase in Stage 2 exposures at Dutch banks. Rabobank, ASN Bank, and ABN Amro all reported more Stage 2 loans, largely the result of framework updates and stricter Significant Increase in Credit Risk (SICR) definitions. At Rabobank, an ECB regulation and Risk Based Strategy approach was implemented in the Stage 2 framework for residential mortgages, raising the allowances for ECL. The increase is predominantly related to mortgage clients who have not voluntarily provided updated financial income information. Hence, the increase in Stage 2 ratio is not caused by an increase in the risk of default but because the framework required a risk-based treatment of missing data. Combined with a decrease in Stage 1 exposures, it is concluded that these loans transferred from Stage 1 to Stage 2. ASN Bank also confirms this trend by a large transfer of interest-only mortgages from Stage 1 to Stage 2.

Even though more loans are classified as having a SICR, there is no negative impact on coverage ratios. The overall coverage ratios decrease and the Stage 2 coverage ratios decrease sharply. When macroeconomic outlooks improve, this has a significantly larger impact on Stage 2 coverage ratios than on Stage 1 coverages due to the lifetime ECL estimation of Stage 2 loans. The more conservative design of the Stage 2 framework has been noted by the ECB, who reported an increase in the share of Stage 2 loans without a significant increase in default rates (Same but different: credit risk provisioning under IFRS 9). This trend is empowered by the EBA, who encouraged banks in their previously mentioned report to be more conservative and shift more assets to Stage 2.

Outside of the Netherlands, the trend of increasing Stage 2 exposures at the expense of Stage 1 is also visible in the DACH region, where for the five largest banks the Stage 2 ratio increased from 6% to 8%. This increase is also paired with a decrease in the Stage 2 coverage ratio. Conversely, the UK banks do not show this trend and even report decreasing Stage 2 ratios paired with increasing Stage 1 ratios. As the UK banks do not fall under ECB supervision or EBA authority, they are not subject to the same trends observed for EU banks.

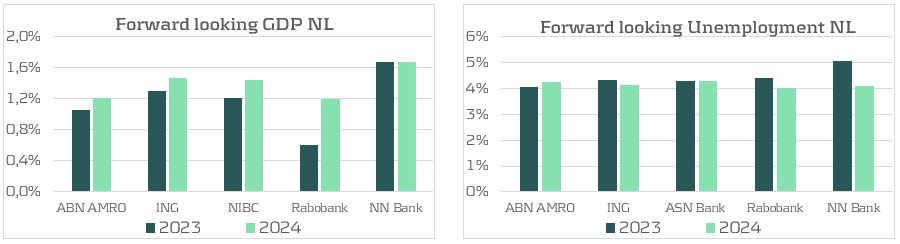

Improved macroeconomic outlooks

For the analysis of macroeconomic outlooks, the focus is on the Dutch banks as these outlooks are often for the national economy and thus not comparable between countries. In practice, most Dutch banks define three scenarios (base, up, down) and the average allocation is 50% to the base scenario, with the remaining 50% skewed to the downside (32%) rather than the upside (18%). Although the probabilities have not been skewed positively, the outlook of all scenarios has improved compared to 2023. The five Dutch banks reporting their forward looking GDP figures all show improvements, with only NN Bank holding the prediction from last year. At the same time, the predicted unemployment has decreased for most banks reporting this figure. Both of these signal the improved macroeconomic conditions that lead to lower ECL.

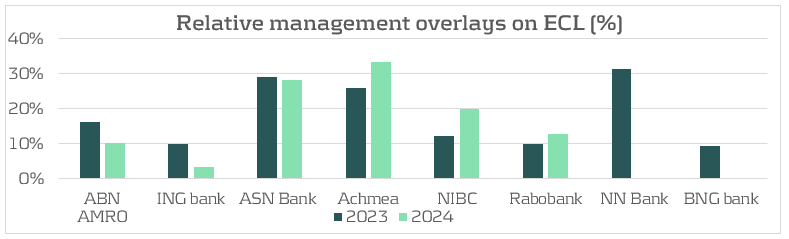

Reduction in Management Overlays

The second driver behind the lower coverage ratios is the decrease in management overlays, which most banks reduced in 2024 compared to 2023. Overlays remain an important tool to capture risks not covered by the models, as also highlighted by the ECB in 2024 (IFRS 9 overlays and model improvements for novel risks). While the ECB welcomes the use of overlays to capture novel risks, it also warns for misuse. Specifically, the ECB would like to see overlays applied at the parameter level, and not at the total ECL level, as most Dutch banks do. According to the report there is still room for a lot of improvements in the use of overlays in IFRS 9 modeling. Amongst the Dutch banks, the average overlay decreased from 11% in 2023 to 8% in 2024. ABN Amro discontinued the overlay for geopolitical risk and decreased the overlay for nitrogen reducing measures on livestock farming business. ING decided to fully abandon the management overlays in place for the Covid-19 support program, which had been in place for several years. Other overlays like those for climate transition risk, mortgage portfolio adjustments and inflation and interest rate increases were reduced but are still in place. Some other banks, like BNG and NN Bank completely discontinued all management overlays. For NN Bank, the previous overlay was in place related to rising interest rates and high inflation. As for BNG, the overlay was meant to account for an increased risk for the healthcare sector. After a thorough evaluation of the sector, BNG has concluded that the models now correctly reflect the risks in the healthcare sector and the overlay is no longer required.

Most management overlays are applied to cover macroeconomic risks, such as interest rate risk, inflation risk and geopolitical risk. After the EBA concluded in the previously mentioned report that climate and environmental risks were covered insufficiently, some banks have also started applying more overlays regarding this area. Other banks, like BNG, have started improving the modeling to account for climate-related matters in ECL calculations. These model improvements have not been completed yet. Additionally, some banks do recognize and investigate climate and environmental (C&E) risks but do not quantify these risks in their IFRS 9 frameworks, such as NN Bank.

What can Zanders offer?

The results from the annual report study of 2024 show that approaches and results between banks for the IFRS 9 framework still differ greatly and there remain many modeling improvements to be made. These differences do not stem from the model itself, but rather from how models are applied. Key drivers include the composition of loan portfolios, the SICR frameworks, and the design and weighing of macroeconomic scenarios. It is worthwhile to investigate how Dutch banks can learn from each other in modeling ECL. For any bank, it is useful to assess their current IFRS 9 framework and critically evaluate whether it is line with the actual expectations on future credit losses.

As Zanders has a focus on the Dutch market but also has a presence in the UK and DACH regions, we are in constant contact with many of the active banks in these regions. This makes us the best strategic partner to help you with improving your IFRS 9 modeling.

If you need help with your IFRS 9 models or want to learn more about these IFRS 9 results to see how your results fit in, please contact Kasper Wijshoff.

Citations

- The Dutch banks used for this analysis are ABN Amro, ING, ASN Bank, Rabobank, Bunq, Knab, Achmea Bank, NIBC, NN Bank, BNG Bank, Triodos, and Yapi Kredi. . ↩︎

- The UK banks used for this analysis are HSBC, Barclays, Natwest, Lloyds, and Standard Chartered. ↩︎

- The DACH banks used for this analysis are Deutsche Bank, Commerzbank, KfW, DZ Bank, and UBS. ↩︎

As regulators raise the bar on climate risk management, banks are now facing a new and complex expectation: climate reverse stress testing.

We’ve spoken to many banks recently, and the message is clear: developing and implementing a climate reverse stress testing (RST) framework will be a significant challenge, particularly as it is a completely new regulatory expectation for climate risk from the PRA. Most banks are already familiar with RST in the context of credit, market, and liquidity risks. But extending this practice to climate introduces a different level of complexity.

Until now, climate quantitative analysis has centered on standard stress testing and scenario analysis, asking what could happen under different climate pathways. Reverse stress testing flips the question: what climate pathway could push your business model to the point of failure?

You may have already fallen into the trap of believing these common myths; if so, it’s time to rethink your position:

- “Our institution is not exposed to climate risk.” The PRA is unlikely to accept this - climate risk is systemic. It manifests as transition risk (such as carbon taxes or shifts in consumer expectations) and physical risk (both acute climate events and chronic changes). These drivers affect almost every portfolio: credit exposures like commercial loans and mortgages, market positions in bonds and equities, and even operational resilience. Hence, it is highly likely that your institution is already exposed to climate risk factors, directly or indirectly.

- “Rain alone could never cause us to fail.” This could be true if it weren’t for the fact that risks don’t occur in isolation. Rainfall, carbon prices, GDP slowdown, and interest rate rises can interact in complex and non-linear ways to push an institution towards failure. Although a single risk factor might need to reach an extreme tail event to cause failure, multiple risk factors acting together don’t need to be extreme to push a firm to the brink. Plausible domino effects can occur - for example, in a mortgage portfolio, heavier rainfall increases flood risk, lowering property values and weakening collateral. At the same time, a rise in carbon prices lifts household energy bills, cutting disposable income and pushing up default probabilities. Higher PDs, combined with weaker collateral driving LGDs higher, can accelerate capital erosion towards the failure point.

- “The failure points are so extreme, there’s no benefit in analyzing them.” A failure point doesn’t have to mean the bank has collapsed entirely. In practice, it could be something completely plausible, such as the CET1 falling below 11% or liquidity buffers dropping under regulatory requirements. These are thresholds that banks already monitor as part of business-as-usual.

- “What’s the benefit of RST? We already run standard stress tests.” RST forces firms to confront and explore extreme, and yet plausible, critical scenarios they might otherwise avoid. It can uncover vulnerabilities that remain hidden in conventional stress testing.

We recommend that you should prepare for the following key challenges:

- Defining failure points: Deciding exactly what a failure would look like is not straightforward and is the first challenge. Most firms will base the breaking point on a regulatory capital measure such as CET1. From there, they need to identify the internal drivers (PD, LGD, credit spreads, liquidity buffers etc) that would cause it to erode.

- Deriving transmission channels: The next critical step is mapping which climate variables (such as carbon price, rainfall, and temperature shocks) could realistically impact those internal drivers. For example, in mortgage portfolios, heavier rainfall could reduce property values and raise insurance costs, leading not only to higher LGDs but also higher PDs.

- Developing supporting models: In many cases, deriving the relationships between the different drivers requires additional supporting models. For example, firms may need to develop models to measure and assess the relationship between rainfall and LGD/PD.

- Quantification of the narrative: Over time, the PRA is likely to require qualitative insights to evolve into quantified relationships between climate drivers, bank risk factors, and failure points. It’s not just about establishing a link between rainfall or carbon prices and LGD/PD, but defining potential levels of the risk factors that could push the bank to failure.

- Embedding outcomes: RST results need to feed into firm-wide processes and systems, including governance, reporting, and ongoing monitoring. At this stage, RST stops being just a regulatory expectation and becomes a proactive tool for managing risk.

At Zanders, we can support you in developing climate RST frameworks that are:

- Proportionate: from plausible qualitative narratives to quantification models, aligned to your portfolio exposure to climate risk.

- Scalable: solutions that evolve along with your firm’s climate risk journey.

- Strategic: we guide you through achieving regulatory compliance while always keeping an eye on your long-term business objectives.

How far are you with planning and self-assessment for climate RST at your firm? Our advice: don’t wait until the updated Supervisory Statement is published by the PRA to planning (or start putting in place a plan for) for a climate RST framework. Starting early will make the process smoother and ensure you are well-positioned and prepared when regulatory scrutiny will inevitably materialize.

We would be delighted to share our insights and discuss how we can support your climate risk journey. Please reach out to the Zanders UK climate risk modeling team (Polly Wong, Nikolas Kontogiannis, Hardial Kalsi, Paolo Vareschi).

Japan is leading ISO 20022 Implementation with its November 2025 deadline, read our steps for corporates worldwide to start preparing.

The International Organization for Standardization (ISO) sets global standards to improve quality, safety, and efficiency across industries. ISO 20022, in particular, is transforming financial communications. It provides a universal framework for structured, data-rich messages, improving interoperability between institutions and enabling innovation in payments, securities, and foreign exchange.

Globally, ISO 20022 is replacing older messaging standards, such as SWIFT MT messages, with XML-based messaging. While the worldwide adoption deadline has been extended to November 2026 , Japan is sticking to its original November 2025 timeline—especially for cross-border payments.

Japan’s Transition: Zengin and Cross-Border Payments

Japan’s domestic payment system, Zengin, handles interbank transfers. While the domestic Zengin format remains unchanged, the cross-border Zengin format is being phased out. Japanese banks now require cross-border payments to follow the ISO 20022 XML standard, specifically the “pain.001” message type.

This shift affects corporates as well. Banks are encouraging clients to submit payments in XML format rather than converting older MT101 or cross-border Zengin messages which means Treasury Management Systems (TMS) and ERP systems may need updates.

Opportunities and Challenges for Corporates

ISO 20022 requires structured data, particularly for beneficiary addresses. While Treasury payments to a limited number of counterparties may be manageable, handling tens of thousands of global vendors is far more complex. Many corporates face inconsistent or outdated vendor data, which may not meet ISO standards.

Tools for master data cleanup, like those which can proposed by Zanders, will automate validation and ensure compliance, helping corporates navigate this transition efficiently.

Taking Action Now

Even though Japan is leading with its November 2025 deadline, corporates worldwide are encouraged to start preparing. Steps include:

- Assessing current processes and systems

- Updating ERP and TMS inputs for hybrid or fully structured address formats

- Leveraging master data validation tools

Conclusion

Japan’s commitment to ISO 20022 is a pivotal moment for cross-border financial transactions. Corporates must act quickly, adopting structured data practices to ensure compliance and maintain operational efficiency. With the right tools and preparation, businesses can turn this regulatory shift into an opportunity to standardize and modernize their financial messaging. Zanders can provide support to companies, offering high-end solutions and expert guidance to navigate the complexities of ISO 20022 adoption.

The ECB’s revised guide to internal models introduces stricter standards for credit risk, reshaping how banks approach PD, LGD and CCF calibration.

On July 28th, the European Central Bank (ECB) published its revised guide to internal models ECB publishes revised guide to internal models. On top of changes necessary for alignments with CRR3, the ECB improves their guidelines based on supervisory experience with the aim of harmonized and transparent internal modeling practices at credit institutions.

In this article, we share our perspective on the changes in the credit risk chapter, focusing on the impact on PD, LGD and CCF modeling:

1- PD: Institutions must use at least five years of default data and demonstrate a meaningful correlation between default rates and macroeconomic indicators for LRA DR calibration.

2- LGD: The ECB will benchmark calibration windows against the 2008–2018 period. Downturn LGD calibration must cover all relevant components and include yearly elevated LGDs, even if they don’t perfectly match downturn periods. The LGD reference value is now an active challenge in model validation, requiring consistent calculation and action if weaknesses appear.

3- CCF: For CCF modeling, risk drivers must use data exactly 12 months before default, 0% CCFs for non-retail exposures are no longer allowed, and negative CCFs must be floored at zero, while high CCFs remain uncapped.

The following chapters elaborate on these three proposed amendments in more detail.

1 PD

1.1 Minimum requirements historical data

The ECB now specifies data requirements for the representativeness analysis referenced in paragraphs 82 and 83 of the EBA Guidelines on PD and LGD estimation (EBA/GL/2017/16), which assess whether the PD calibration dataset reflects a balanced mix of "good" and "bad" years.

According to paragraph 236(A) of the revised EGIM, institutions must use a minimum of 5 years of historical data as of the calibration date. Additionally, they must have enough one-year default rates to calculate a statistically meaningful correlation between default rates and relevant (macro)economic indicators.

If an institution lacks the required data (either the 5 years or enough data for meaningful correlation), paragraph 236(B) states the period is automatically deemed not representative, and the institution must apply adjustments and quantify a Margin of Conservatism (MoC). However, paragraph 236(C) allows that if an institution has enough data but cannot find significant correlations with macroeconomic indicators, the historical period may still be considered representative if it includes both the minimum and maximum of the institution’s internal one-year default rates.

1.2 LRA DR reference value

The ECB introduces a reference calibration level for LRA DR in paragraph 237, based on the period January 2008 to December 2018, which is considered to be representative of a full economic cycle. Institutions must calculate this reference LRA DR and use it as an anchor value. If an institution proposes a lower LRA DR based on a different time period, it must justify why that period is more representative. Although not a strict floor, the reference LRA DR serves as an anchor value for ECB assessment. Even without sufficient default data, institutions must estimate the reference LRA DR using the accounting definition of default (DoD) as an approximation for the prudential definition.

2 LGD

For the loss given default (LGD) risk parameter, the ECB now sets out clearer expectations on two areas: the estimation of downturn LGD based on observed impact and the calculation and use of the LGD reference value.

2.1 Calibration of downturn LGD based on observed impact

The revised EGIM retains flexibility in how downturn LGD is calibrated but introduces stricter requirements for the analyses underpinning the calibration based on observed impact. Zanders expects that most institutions already conduct these analyses and may only need to refine their application.

The ECB emphasizes that all analyses1 required under paragraph 27(a) of the EBA guidelines must be conducted. If calibration is done at the component level (e.g., secured vs. unsecured), these analyses should be done separately for each component, with results aggregated into a total downturn LGD. At minimum, the most impactful component must be included; others may be needed if it doesn't capture downturn effects sufficiently.