As we rapidly approach SWIFT’s fifty-year anniversary, March 20th this year witnessed possibly one of the most significant changes in global financial payment and reporting messaging.

The start of the migration from the SWIFT FIN format to the new ISO 20022 XML format, which is a banking industry migration that must be completed by November 2025.

Whilst at this stage the focus is primarily on the interbank space, there will be some impact on corporate treasury within this migration period. Zanders experts Eliane Eysackers and Mark Sutton demystify what is now happening in the global financial messaging space, including the possible impacts, challenges and opportunities that could now exist.

What is changing?

The SWIFT MT-MX migration is initially focused on a limited number of SWIFT FIN messages within the cash management space – what are referred to as category 1 (customer payments and cheques), 2 (financial institution transfers) and 9 (cash management and customer status) series messages. This can translate to cross border payments (e.g., MT103, MT202) in addition to the associated balance and transaction reporting (e.g., MT940, MT942) within the interbank messaging space.

Is corporate treasury impacted during the migration phase?

This is an interesting and relevant question. Whilst the actual MT-MX migration is focused on the interbank messaging space, which means existing SWIFT SCORE (Standardised Corporate Environment), SWIFT MACUGs (member administered closed user groups) and of course proprietary host to host connections should not be impacted directly, there could be a knock-on effect in the following key areas:

- The first issue pertains to cross-border payments, which are linked to the address data required in interbank payments. As the financial industry is looking to leverage more structured information, this could create a friction point as both the MT101 and MT103 SWIFT messages that are used in the corporate to bank space only supports unstructured address data. This problem will could also exist where a legacy bank proprietary file format is being used, as these have also typically just offered unstructured address data. This could mean corporates will need to update the current address logic and possibly the actual file format that is being used in the corporate to bank space.

- Secondly, whilst banking partners are expected to continue providing the MT940 end of day balance and transaction report post November 2025, there is now a risk where a corporate is using a proprietary bank statement consolidation service. Today, a global corporate might prefer not to connect directly to its local in-country banking partners as payment volumes are low. Under these circumstances the local in-country banks might be sending the MT940 bank statement to the core banking partner, who will then send this directly to the corporate. However, after November 2025, these local in-country banks will not be able to send the MT940 statement over the SWIFT interbank network, it will only be possible to send the camt.053 xml bank statement to the core banking partner. So from November 2025, if the core banking partner cannot back synchronise the camt.053 statement to the legacy MT940 statement, this will require the corporate to also migrate onto the camt.053 end of day bank statement or consider other alternatives.

- Finally, from November 2025, the camt.053 xml bank statement will be the defacto interbank statement format. This provides the opportunity for much richer and more structured statement as the camt.053 message has almost 1,600 fields. There is therefore an opportunity cost if the data is force truncated to be compatible with the legacy MT940 statement format.

So, what are the benefits of moving to ISO20022 MX migration

At a high level, the benefits of ISO 20022 XML financial messaging can be boiled down into the richness of data that can be supported through the ISO 20022 XML messages. You have a rich data structure, so each data point should have its own unique xml field. Focusing purely on the payment’s domain, the xml payment message can support virtually all payment types globally, so this provides a unique opportunity to both simplify and standardise your customer to bank payment format. Moving onto reporting, the camt.053 statement report has almost 1,600 fields, which highlights the richness of information that can be supported in a more structured way. The diagram below highlights the key benefits of ISO20022 XML messaging.

Fig 1: Key benefits of ISO20022 XML messaging

What are the key challenges around adoption for corporate treasury?

Zanders foresees several challenges for corporate treasury around the impact of the SWIFT MT to MX migration, primarily linked to corporate technical landscape and system capabilities, software partner capabilities and finally, partner bank capabilities. All these areas are interlinked and need to be fully considered.

What are my next steps?

ISO20022 is now the de-facto standard globally within the financial messaging space – SWIFT is currently estimating that by 2025, 80% of the RTGS volumes will be ISO 20022 based with all reserve currencies either live or having declared a live date.

However, given the typical multi-banking corporate eco-system, Zanders believes the time is now right to conduct a more formal impact assessment of this current eco-system. There will be a number of key questions that now need to be considered as part of this analysis, including:

- Considering the MT-MX migration will be using the xml messages from the 2019 ISO standards release, what are my partner banks doing around the adoption of these messages for the corporate community?

- If I am currently using XML messages to make payments, do I need to change anything?

- Do I currently use a statement reporting consolidator service and how will this be impacted?

- How is my address data currently set-up and does my existing system support a structured address?

- What are my opportunities to drive greater value out this exercise?

In Summary

The corporate treasury community can reap substantial benefits from the ISO 20022 XML financial messages, which offer more structured and comprehensive data in addition to a more globally standardized format. Making the timing ideal for corporates to further analyse and assess the positive impact ISO 20022 can have on the key questions proposed above

What is the impact of a disruption caused by a vessel blocking a canal on a company’s working capital and its direct liquidity needs?

In today’s world, supply chain disruptions are consequences of operating in an integrated and highly specialized global economy. Along with affecting the credit risk of impacted suppliers, these disruptions are demanding Treasuries to operate with increased working capital.

In March 2021, a vessel was forced aground due to intense winds at Egypt’s Suez Canal, creating a bottleneck involving 100 ships. Given that the Suez Canal accommodates 12% of global trade and the fact that one-tenth of the daily total global oil consumption was caught in the bottleneck, it was no surprise that the international oil market was rattled, and numerous supply chains were affected.1

A butterfly effect

This is reminiscent of a concept known as butterfly effect, where a minor fluctuation such as a butterfly flapping its wings proves to have an effect, however small, on the path a tornado takes on the other side of the globe.

To further complicate matters, this disruption transpired when the global shipping industry was already destabilized due to the coronavirus pandemic.2 This pandemic affected the global economy and supply chains in particular like no other event in the past several decades. Entire cities were locked down and many businesses were at a standstill. It may be impossible to predict black swan events that disrupt global supply chains. However, it is possible to reach fairly accurate assumptions about certain supply chains based on knowledge at hand.

Leveraging supply chains

The Russian invasion of Ukraine will no doubt impact the industries that have suppliers in Ukraine. Another lockdown in China will have repercussions for the supply chains intertwined there. With these types of constraints on the supply chains, procurement divisions are stocking up on inventory and raw materials, which in turn further aggravates the inflation problem the global economy is currently facing. Issues like these are demanding many treasurers to operate with increased working capital, along with affecting the credit risk of impacted suppliers. Treasurers around the world should act fast to take advantage of the financial benefits that today’s global economy is bestowing on organizations that are quick to adapt to the constantly changing business environment. Treasurers can even start leveraging supply chains to work in their favor by utilizing Supply Chain Finance (SCF) solutions.

Decreasing the DSO

What does the concept of SCF mean and what are its implications? Let’s start with the different parties involved in a typical SCF transaction, like reverse factoring. We have the supplier, the buyer, and the bank. Let’s suppose the buyer enters an agreement to purchase goods from the supplier. In most cases, the supplier will ship the goods to the buyer on credit. The payment terms may vary from 10 days to 60 or more days. The average number of days it takes a company to receive payment for a sale is known as days sales outstanding (DSO). The objective of companies is to keep the DSO as low as possible. This implies that the supplier is receiving its payments quickly from the buyer and has a positive effect on the cash conversion cycle (CCC) of the supplier. The CCC indicates how many days it takes a company to convert cash into inventory and back into cash during the sales process. Unfortunately, many companies struggle with a high DSO, which suggests they are either experiencing delays in receiving payments or have long payment terms. A high DSO can lead to cash flow problems, but implementing a SCF solution might be wise response. Having a healthy working capital is a cornerstone to building a successful business, especially for growing and/or leveraged companies.

Why cash flow is crucial

American billionaire businessman Michael Dell once acknowledged: “We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.3

A company may be profitable, but if it has poor cash flow, it will struggle to meet its liabilities or properly invest its excess cash. Because cash is a crucial element to a successful business, companies will strategically hold onto it as long as possible. If their credit terms indicate that they have 30 days to pay an invoice, it is quite likely that they will wait as close to the deadline as possible before they make the payment.

Furthermore, a buyer with a strong credit rating and powerful brand recognition may demand more generous credit terms. These considerations affect a financial ratio known as days payable outstanding (DPO). The DPO indicates the average time that a company takes to pay its invoices. A higher DPO implies that a company can maximize its working capital by retaining cash for a longer duration. This cash can be used for short-term investments or other purposes that a company determines will optimize its finances. However, a high DPO can also indicate that the company is struggling to meet its financial obligations.

An example

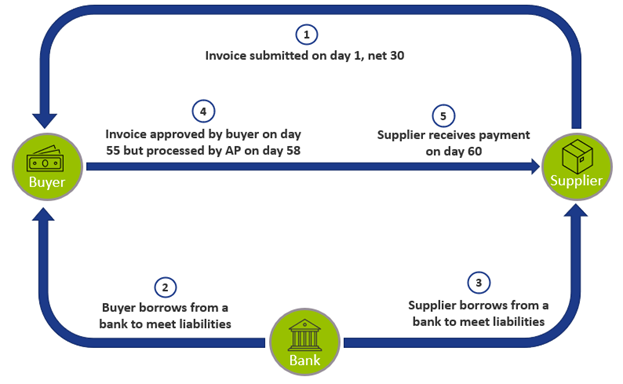

The diagram below depicts a scenario where the supplier invoices the buyer, hoping to receive payment in 30 days. Unfortunately, the buyer needs funds for its operating activities, and furthermore must borrow from the bank to meet its liabilities. It is also possible that the buyer pays late so it can hold onto cash longer or due to roadblocks in the invoice approval process. In the meantime, the supplier is also experiencing cash flow challenges, and it too borrows from the bank. (Of course, both the buyer and the supplier could also use a revolving credit line to access capital, but to simplify this example, we will assume they are borrowing from the bank). The buyer eventually approves the invoice for payment on day 55 and the supplier receives the payment on day 60. The buyer has a high DPO at the expense of the supplier also having a high DSO.

Figure 1: A scenario of a supplier hoping to receive payment in 30 days.

Reverse factoring

What can a company do if it is struggling with its working capital? Suppose a supplier has a dozen buyers, some which pay on time, but others unfortunately are facing their own cash flow problems and are not able to pay within the agreed terms. Wouldn’t it be nice to receive payment within a week from some of the buyers to avoid having a cash flow problem? SCF offers a solution.

To help illustrate this concept, let’s explore a more familiar financial concept known as factoring. With factoring, a company sells its accounts receivable to a third party. SCF is sometimes knowns as ‘reverse factoring’, because a supplier will leverage a buyer’s strong credit rating and select certain invoices to be paid early by a third-party financier, typically a bank. The buyer would then be responsible for paying the bank. In certain types of SCF arrangements, instead of paying an invoice in 30 days, the bank will offer the buyer to pay in, let’s say, 60 days – but for a fee. This could potentially increase the buyer’s DPO.

The supplier, on the other hand, receives its payment sooner from the bank – reducing its DSO – than it would have from the buyer, but at a discount. It is important to note that the discount should be less than the interest the supplier would have incurred if it had borrowed from the bank. This is possible because the discount is calculated based on the creditworthiness of the buyer, instead of the supplier. Many suppliers who lack credit or have poor credit would find this an advantageous option to access cash. However, not all suppliers may be able to reap the benefits of an SCF agreement. For them, borrowing from a bank or factoring receivables are additional options they can explore.

Dynamic discounting

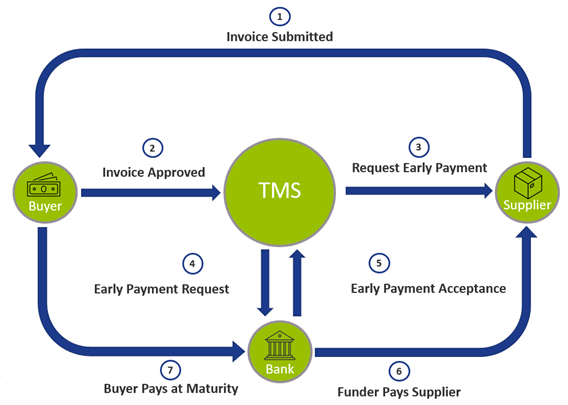

Another term often used when discussing these types of financing options is dynamic discounting. This is similar to reverse factoring in that a supplier receives early payment on an invoice at a discount. However, unlike SCF, dynamic discounting is financed by the buyer as opposed to a third-party financier. Due to the complexity of SCF arrangements between the suppler, the buyer, and the bank, a company often uses the expertise of banks or the capability of a Treasury Management System (TMS). Below is a diagram of what an SCF solution would look like utilizing a TMS:

Whether a company should implement a TMS, which vendor it should utilize, and determining if SCF is a viable solution for that organization are complex questions. Furthermore, because of the globalized environment that companies operate in and the impact of crises like the coronavirus pandemic or a bottleneck at a major canal, an increasing number of organizations are turning to the expertise of consultants to help navigate these intricate matters.

Zanders’ SCF solutions

Zanders is a world-leading consultancy firm specializing in treasury, risk, and finance. It employs over 250 professionals in 9 countries across 4 continents. Powered by almost 30 years of experience and driven by innovation, Zanders has an extensive track record of working with corporations, financial institutions, and public sector entities. Leveraging this extensive background, Zanders can evaluate the assorted options that organizations are exploring to enhance their treasury functions.

With its unique market position, Zanders is able to engage in projects ‘from ideas to implementation’. Whether organizations are trying to stay afloat in today’s challenging global economy or seeking to stay ahead of the curve, they should reap the benefits of modern technology and various SCF solutions that are currently being offered in today’s dynamic business environment. Amid a rapidly changing world being transformed by technological advancement, Zanders welcomes the opportunity to assist clients achieve their treasury and finance objectives.

If you’re interested in learning more about Supply Chain Finance and how your Treasury can properly anticipate disruptions in global supply chains, please reach out to Arif Ali via +1 6467703875.

Footnotes:

[1] https://www.nytimes.com/2021/03/24/world/middleeast/suez-canal-blocked-ship.html

Recovery and resolution plans have emerged as a key supervisory tool since the global financial crisis.

Large systemic financial institutions have to show that they are resolvable during times of great stress. In this article, we discuss a specific requirement for resolution planning: the solvent wind-down (SWD) of trading books. We explain the requirements, discuss our findings and highlight key challenges during the development of the SWD plan and playbook.

Solvent wind-down (SWD) is regulated by the European Bank Recovery and Resolution Directive (BRRD) and supervised by the Single Resolution Board (SRB). Banks must demonstrate, by means of an SWD plan that they can exit their trading activities in an orderly manner while avoiding posing risks to the stability of the financial system. The SWD guidance1 sets out the necessary steps and initiatives for banks to take, structured along seven dimensions2 from the Expectations for Banks publication3, to ensure they are resolvable and to demonstrate their preparedness for a potential resolution.

Winding down requirements

Banks with material trading books4 are expected to develop a granular plan to prove their capability to wind-down their trading books. Winding down trading books requires careful planning and analytical capabilities, including:

- An SWD plan outlining the different segments5 and associated exit strategies for its trading activities and the potential financial implications. The plan should include an initial snapshot (taken ‘today’) providing a description of the trades and desks as the starting point of the wind-down period and a target snapshot providing positions targeted for the ‘rump’ portfolio, i.e. the positions that remain in the trading book after the wind-down period. Furthermore, the plan should determine the exit, risk-based and operational costs, and assess the impact on liquidity and risk-weighted assets (RWA).

- Information provision on SWD planning, such as the capacity to update the plan on a regular basis and in a timely manner, using business as usual (BaU) tools, systems, and infrastructures as much as possible.

- Constructing an SWD playbook that focusses on governance, HR and communication as defined in the Financial Stability Board’s (FSB) discussion paper. The FSB paper6 sets out considerations related to the solvent wind-down of the derivative portfolio activities of a G-SIB that may be relevant for authorities and firms for both recovery and resolution planning. The playbook should provide clarity on the necessary steps and actions taken during the wind-down period, including, identification of the parties involved in the decision-making, their responsibilities and communication with relevant stakeholders.

The SWD plan outlines the technical aspects of winding down the trading book while the SWD playbook describes the process of how to execute the exit strategy. Banks are expected to initially provide the day-one requirements for the SWD plan and playbook. Thereafter, the SWD plan and playbook need to be expanded and improved to meet the steady-state requirements. This entails a comprehensive upgrade, providing a more granular analysis and the ability to update the exit strategies based on the latest balance sheet within five working days. Note that the bank management could decide to wind down only a few desks. The SWD plan could therefore include multiple scenarios in which different parts of the trading book are wound down.

By 2021, all G-SIBs received instructions from the SRB to work on SWD planning as a Resolution Planning Cycle (RPC) 2022 priority. Other banks have been identified and approached by the SRB in the course of 2022 following a further assessment of the significance of their trading books, to work on SWD planning as an RPC 2023 priority.

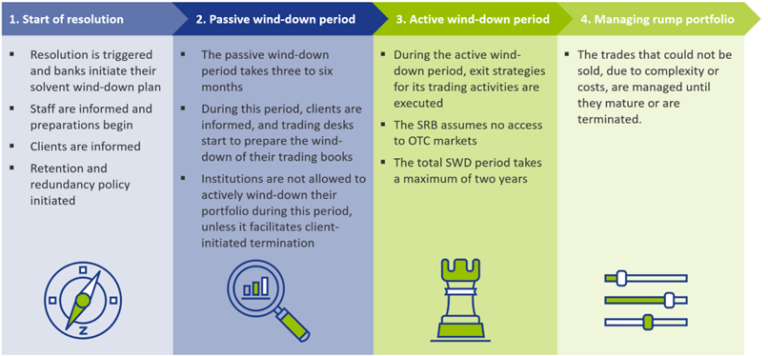

SWD of the trading books

When resolution is triggered, the bank must execute its SWD plan which consists of the four phases indicated in Figure 1. During the first phase, staff and clients are informed and the SWD plan is updated based on the latest trading book status. Then, during the passive wind-down period, trading desks start the preparations to wind down their trading books. During this period, no active trading is allowed, unless specifically requested by the client. During the active wind-down period, exit strategies are executed, while not being able to access the over-the-counter (OTC) market. The bank is required to update their sensitivities (Greeks), costs of winding down, operational costs, and impact on liquidity and RWAs on a quarterly frequency for the full wind-down period. Finally, after two years, most of the trading activities should have been wound down and the few remaining trades that could not be sold, are managed until they mature or are terminated.

Challenges and how to address them

Creating a streamlined process to update the SWD plan

One of the larger challenges is to create a streamlined process that enables an update of all exposures and exit strategies for the entire trading book within five working days, which is a steady-state requirement. Since information is usually gathered from various data sources, it can be difficult to update the SWD plan in a timely manner. Therefore, smart tooling should be developed that can assign exit strategies and priorities to certain types of trades to plan the unwinding in the two-year window.

Winding down complex books

Banks with complex or structured books, with positions falling under level 3 of the IFRS13 accounting standards7, could face difficulties unwinding these positions (from a process or cost perspective). These more complex products are usually less liquid, because inputs required to determine the market value are unobservable (by definition, or for example due to low market activity). Banks should provide evidence that they are aware of this complexity and should be able to come up with a reasonable estimate of the costs of unwinding, for example by using the bid/offer spread (if available) and a haircut.

No access to the OTC markets for hedging purposes

One of the assumptions set by the SRB is that the bank has failed to maintain, establish, or re-establish market confidence. Under this assumption, banks cannot continue using the bilateral OTC markets. Consequently, only listed products can be used for hedging purposes. This could result in imperfect hedges and possibly higher exit costs when selling or auctioning trades (please note that trades are often auctioned in groups, i.e. auction packages are created). Additionally, a bank must show how it expects the exit and risk-based costs to evolve during the solvent wind-down period, taking into consideration the changes in the composition of its trading book. To tackle the above two challenges, banks could find ‘natural’ hedges with offsetting risks in the trading books to reduce the risk sensitivity of auction packages. Packages with lower risks are expected to have lower exit costs. In turn, the bank can calculate the exit and risk-based costs for each package in each quarter of the active wind-down phase.

Measuring the impact on RWAs for market risk

Banks are expected to include the potential impact of winding down their portfolios on sensitivities, costs (exit, risk-based and operational), liquidity and RWAs (for market, credit and operational risks) in the SWD plan. This impact analysis must be presented, at least quarterly, during the two-year wind-down period. To measure the impact on the RWAs for market risk, banks are challenged to add the hedges that they want to use during the resolution period in their system. Subsequently, banks should be able to age their portfolio: i.e. banks need to calculate the impact of maturing, terminating, and auctioning of trades in their trading books during the entire wind-down period. If this functionality is not readily available, banks may need to use an alternative method to determine the impact. A possibility to tackle this challenge is to create ‘test’ books, which include listed/cleared trades that will be used for hedging purposes during the active wind-down period.

Liquidity gaps

Finally, the SWD plan should contain an analysis of the impact on liquidity. As banks are in resolution, major cash shortfalls could occur. A thorough analysis of outflows and inflows is necessary to identify potential future cash flow mismatches. One important assumption is that the bank in resolution will lose its investment grade or experience a downgrade of its credit rating, likely resulting in significant collateral/margin calls and potentially creating liquidity gaps. These gaps need to be identified and explained. Banks could prioritize the auction/novation of trades with credit support annexes (CSAs) that have high collateral requirements to close the CSA and free up capital.

Outlook for the future

Over time, the SRB is likely to amend the guidance on SWD of trading books. The most recent publication date (at the time of writing) is December 2021. We expect that more granular reporting will be required in the future. Additionally, we expect that banks will be required to perform stress testing on their trading books, which may be challenging to incorporate. Nonetheless, no changes to the guidance are expected in 2023.

In conclusion

Creating a solvent wind-down strategy can be very complex and introduce many challenges to banks. A large variety of trading books, interdependencies between trading desks and departments, and a diverse data landscape can all provide difficulties to develop a streamlined process.

The development of a strong SWD plan and playbook can help to tackle these challenges. On top of that, a strong SWD plan also gives a more detailed insight into the activities conducted by the various trading desks as risks and returns of the different trading activities are analyzed. The clear trade-off between risk and return could therefore also be used for strategic decision-making such as:

- Operational efficiency: a more accurate understanding of cost and return may be achieved, as every desk is analyzed during the development of the SWD plan and playbook. This information could help management to remove operational inefficiencies.

- Generating liquidity: as banks are expected to analyze the impact on liquidity during the wind-down period they must also identify ways to cover any potential liquidity gaps. This knowledge may also be useful in case the bank needs to improve their liquidity position in a BaU situation.

- Reducing RWAs: banks are expected to analyze the impact on RWAs when winding-down their trading books. As a result, banks can use the results of the solvent wind-down analysis to strategically reduce their RWA, as the impact on RWA is readily available.

Zanders’ experience in SWD

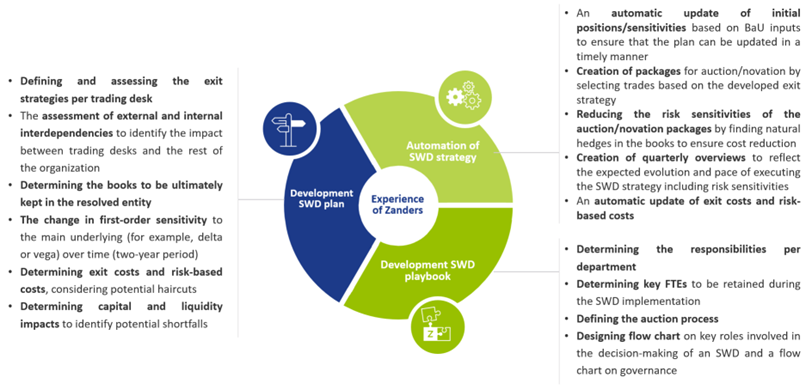

In the course of 2022, Zanders successfully helped one of the Global Systemically Important Banks (G-SIBs) with the development of a SWD plan and SWD playbook. After working on the day-one requirements, extensive time and effort was spent on optimizing the wind-down process to meet the steady-state requirements. Our support was provided on the points shown in Figure 2.

Figure 2: Support provided by Zanders on SWD of trading books.

With our experience across all aspects of the solvent wind-down requirements, we can help you to comply with this regulation. For questions or more information on solvent wind-downs, do not hesitate to contact Jaap Stolp or Ilse Schepers via +31 88 991 02 00.

Footnotes

[1] Latest guidance on SWD of trading books published by the SRB: 2021-12-01_Solvent-wind-down-guidance-for-banks.pdf (europa.eu)

[2] The seven dimensions for assessing resolvability include governance, loss absorbing and recapitalization capacity, liquidity and funding in resolution, operational continuity and access to Financial Market Infrastructure (FMI) services, information systems and data requirements, communication, and separability and restructuring. These dimensions describe the steps banks are expected to take to become resolvable.

[3] The Expectations for Banks by the SRB: EXPECTATIONS FOR BANKS (europa.eu)

[4] The SRB will define banks with material trading books based on, for example, exposures and the complexity of the books.

[5] The SRB encourages banks to provide information on a granular level. Banks should aim for the desk level. However, banks are also allowed to apply a different segmentation if this is more appropriate. For example, a business unit level is allowed if banks have their own internal segmentation of activities.

[6] Discussion paper of the FSB on Solvent Wind-down of Derivatives and Trading Portfolios: Solvent Wind-down of Derivatives and Trading Portfolios: Discussion Paper for Public Consultation (fsb.org). The FSB is established to coordinate at the international level the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies.

[7] Under IFRS13 accounting standards, a ‘fair value hierarchy’ is used for defining the fair value of positions. Fair value measurements are categorized as level 3 of the fair value measurements are categorized as level 3 of the fair value hierarchy if the inputs are unobservable (for example due to low market activity).

A column about the multifaceted nature of ESG.

A 19th century book on Indian proverbs1 contains a story about a man who went on a journey with his son:

“He came to a stream. As he was uncertain of its depth, he proceeded to sound it; and having discovered the depth to be variable, he struck an average. The average depth being what his son could ford, he ordered him, unhesitatingly, to walk through the stream, with the sad consequence that the boy […] drowned.”

Averages can be useful metrics if you want to understand the changes over time in a certain population or data set, like housing prices, consumer confidence, or the indebtedness of corporates. The above story, however, shows – in a rather harsh way – that an average isn’t always the best metric to go by. The increasing use of ESG ratings2 seems to suggest that this lesson is not sufficiently understood.

In recent years, sustainability has taken center stage in the financial sector. Triggered by (among others) the European Commission’s Green Deal, to fight the threats from climate change and environmental degradation, in November 2020, the European Central Bank published clear expectations on the way banks should manage climate-related and environmental risks. Another example is the introduction of the Sustainable Finance Disclosure Regulation (SFDR) that requires banks and asset managers to disclose information on how they integrate sustainability risks and potential adverse sustainability impacts in their investment process.

To put these new expectations and regulations into practice, extensive use is being made of ESG ratings. These aim to measure the performance of a company on Environmental, Social, and Governance (ESG) aspects; a bit like how credit ratings measure a company’s Probability of Default (PD). Stemming from the breadth of ESG topics, the number of indicators underlying an ESG rating typically dwarfs the number of indicators used to determine credit ratings. More than 100 indicators is not exceptional. These can range from environmental indicators like the company’s level of greenhouse gas emissions, water usage, and pollution, to social and governance indicators like the number of accidents in the workplace, the use of child labor, and the presence of anti-corruption policies. Not surprisingly, academic literature shows that ESG ratings differ considerably between rating providers.3

In practice, an ESG rating often is the (weighted) average of all individual indicators. This may not give the best indication of the ‘depth of the river’: Tesla Inc. may score rather well on certain environmental aspects, being the frontrunner in electric vehicles. From a social and governance perspective, however, it may not be considered best-in-class. Consequently, averaging the scores over the E, S, and G pillars does not lead to a proper understanding of the sustainability risks involved in this company. Or think of it this way: is child labor (negative score) less of a problem if a company’s employees enjoy freedom of association (positive score)?4

The issue also surfaces within the three ESG pillars as a wide range of indicators will be considered to determine a company’s performance for any of the three pillars. As an example, a Kuwait-based oil drilling company will likely score not so well on greenhouse gas emissions, but may obtain a good score on deforestation (given the lack of trees in the desert to begin with). Again, blindly averaging all environmental indicators will not lead to a very useful metric for the environmental performance of the company, nor will it help understanding to what climate risks a company is exposed to.

To truly understand a company’s sustainability risk profile, it is therefore important to assess all (material) indicators individually. Only in this way it is possible to properly address the multifaceted nature of ESG. Those who use only the aggregated ESG rating risk drowning.

Footnotes:

1 “Behar proverbs” – Classified and arranged by John Christian – 1891 – page 120

2 In this column, an ESG rating is defined as a single (aggregated) measure for the performance of a company with respect to environmental, social, and governance factors.

3 “Aggregate confusion: the divergence of ESG ratings” – Berg et. al – 15 April 2022

4 Freedom of association grants employees the right to join a trade union.

Zanders recognizes the need to keep up with emerging technologies and provide innovative solutions as well as consulting to our clients.

With the potential of Blockchain technology to transform businesses, we aim to guide our clients through the complexities of this technology and help them leverage it to improve their operations.

We’re excited to announce that Zanders, the leading consulting firm specializing in treasury, risk and finance, is expanding its services to include Blockchain consulting. As the world of finance rapidly evolves, we recognize the need to keep pace with emerging technologies. This prompts us to offer innovative blockchain technology consulting and solutions to Corporates and Financial Institutions to help them stay competitive in their market.

Disruption of the financial sector

Blockchain technology has been disrupting the financial sector and beyond, and we believe that it has the potential to transform the way businesses operate. It has the potential to revolutionize financial markets through changes in the product offering, as well as the market infrastructure. With our new Blockchain consulting services, we aim to guide our clients through the complexities of this technology and help them leverage it regardless, whether you wish to issue a digital asset, assess the impacts of the BCBS (Basel Committee on Banking Supervision) Crypto Standard on your capital requirements or understand how crypto assets impact your existing treasury and risk management and governance processes.

Our services

Our Blockchain consulting services will cover a range of topics, including education, proof of concepts, strategy consulting, governance, treasury, risk assessment and ESG. We understand that every client has unique needs, and we will work closely with them to tailor our services to their specific requirements. Possible topics of interest for your organisation may include:

Proof of concept

We help clients develop proof of concepts to test the feasibility of Blockchain solutions. Our team of experts will work with clients to design and build prototypes that can be tested in real-world scenarios. We support from the idea to the implementation.

Strategy

Our strategic Blockchain advise provides valuable guidance to clients. We jointly work with our clients to develop Blockchain strategies that align with their overall business goals and help them prioritize their Blockchain initiatives as part of our Blockchain Strategy Explorer. The Blockchain Strategy Explorer is a guided, in-person 1-day workshop free of charge, to improve your Blockchain knowledge and define your Blockchain strategy.

Treasury

Blockchain and the exposure to crypto assets impact not only the front office but also treasurers. Zanders provides the advice as well as the tools to thoroughly integrate crypto assets into your daily operations. Furthermore, we jointly develop strategies that make best use of this new asset class.

Risk management

With the onset of the BCBS Crypto Standard on 1st January 2025, the capital requirements for holding digital as well as crypto assets is more clearly defined. We support financial institutions in assessing the impact of this regulatory change on capital and developing a suitable strategy.

Governance

Governance is a critical component of any Blockchain implementation. We help clients establish governance frameworks that ensure that their Blockchain strategies are secure, compliant, and aligned with best-market practices.

Environmental, Social and Governance (ESG)

The importance of ESG considerations is growing in the business world. We help clients evaluate the environmental and social impact of their Blockchain solutions and ensure that they are in line with their ESG objectives. Among other things, we play a key role in increasing the transparency of carbon markets by providing advice on the tokenization of carbon credits.

Education

Our education services help clients gain a deeper understanding of Blockchain technology, its potential applications, and its limitations. We provide training sessions and workshops that will enable clients to make informed decisions about whether to implement Blockchain solutions.

Meet the team

Zanders already has a well-positioned, diversified blockchain team in place, consisting of blockchain developers, blockchain experts and business experts in their respective fields. In the following you will find a brief introduction of four of our lead Blockchain consultants.

Do you need support or help in the field of Blockchain, Digital Assets or Web3?

We are thrilled to offer Blockchain consulting services and look forward to working with our clients to help them leverage this technology to transform their businesses. If you are interested in learning more about our services, please contact us directly.

Artificial intelligence (AI) has rapidly emerged as one of the most transformative technologies of the 21st century, revolutionizing everything – from healthcare and transportation to finance and entertainment.

Late last year, ChatGPT emerged online as the next phase in this fast-growing and exciting technological space. Many of us tried it out already, and I have yet to meet anyone who is not left amazed by its capacity in such an infant stage. Where to from here though? And how will this type of technology interweave with the systems we use today, such as SAP?

Artificial Intelligence versus Machine Learning

Anyone familiar with the functionalities of SAP is aware of its intelligent ’machine learning’ capabilities. This system looks for patterns in the user’s behavior and creates recommendations and shortcuts to optimize the experience and relieve labour-intensive and repetitive clearing processes. Artificial Intelligence, however, would revolutionize the experience entirely. For example, Microsoft is currently developing AI integrated with Excel which will negate the requirement for users to remember different formulas or spend hours putting together various graphs. Soon, it will be possible to input a request to the application; it will know where to source data from and will create the analysis automatically.

If we were to translate this to SAP, we could be looking at a world where T-Codes are no longer needed and where the user can ask the system a question or request a task to be performed. For example, instead of going about creating an invoice or needing to explain to management why a forecast isn’t aligned, we can ask the system to do it for us. Answering the questions will become more efficient, if the right questions are asked…

The future of analysis and development

Technologies like ChatGPT and future AI systems are set to transform the typical workflow of treasury professionals as well as wider business analysis across the world. Predictive analysis will allow businesses to make even more informed and intelligent decisions through improved models. While SAP already utilizes data upload from market sources such as Reuters and Bloomberg, we can expect to see a more intelligent system providing users with risk models, investment recommendations and better-informed risk models.

These help treasurers and companies at large make more accurate and strategic decisions regarding cash management and borrowing. There’s also less capacity for error through the assistance of AI; treasurers will be able to utilize automated next level financial reporting tools, saving organizations time and also ensuring regulatory requirements are abided by. Finally, treasurers will get to work with greater cash management optimization, a fundamental part of their roles; allowing businesses to keep borrowing to a minimum and ensuring cash is available when its needed.

A better experience for clients

This additional reduction in repetitive tasks will provide more time for solving complex tasks and establishing better relationships with clients. It should also provide the space for more innovative and expanded analysis. The social experience between consultants and clients will also become even more important; whereas computers will explain things very directly, the empathetic and open-minded consultant will be able to provide solutions in a manner that will be easier to digest. Trust in new technology, particularly among the ever-prudent treasury community, will also remain pivotal. It’s hard to foresee a future where a Head of Treasury will take a response from a computer that they do not agree with and just move on.

Where are we right now with ChatGPT and SAP?

It is without a doubt that the future of treasury technology and SAP in particular is exciting. It will be up to the leaders of organizations to work collaboratively with consultants to ensure such benefits afforded by advancements in AI will be taken advantage of.

For now, though, we are still in the infant stages of what is an exponentially growing piece of tech. The limitations of ChatGPT and its potential for collaboration with SAP focus on privacy and trust. OpenAI is quite open (excuse the pun) about the fact that one should not enter delicate data into the system as it cannot guarantee that such information’s integrity and privacy can be maintained. Furthermore, it is based on the data from the internet of 2021 – so therefore, it is somewhat out of date.

This is a developing story, not a settled one. The future has not happened, rather it is happening and as many are saying: We will not be replaced by AI – we will be replaced by those that embrace AI.

How should corporate treasury business stakeholders and project owners deal with the transitions of SAP Treasury as their treasury management system (TMS) and its surrounding treasury interfaces and solutions?

This article may help SAP system owners re-think or change their approach towards bespoke custom solutions in the system.

Over the past 14 years, my colleagues and I have dealt with five types of SAP Treasury transitions:

- From fully custom/in-house coded TMS to SAP TMS.

- From an outdated version of SAP to a newer version of SAP (for example: ECC to S/4HANA).

- From an outdated version of non-SAP TMS to SAP S/4HANA

- A split of the existing SAP TMS system into two SAP TMS, due to the business carve out.

- A merge of SAP TMS system with the main SAP ERP system.

Any type of transition has its own specific focus points during the project’s design phase. Almost every project’s primary goal is to enhance the TMS functionality; improve the user experience using a better level of business process automation and improve the security level of TMS.

Meeting business needs

Often Corporate Treasury requires support and expertise in designing the future business process and how the SAP Treasury system and architecture can meet business needs. One of the biggest challenges here is to find a trade-off between the different business requirements and the standard capabilities of SAP and its interfaces.

One of the main drivers of the custom requirements is hidden in the existing user experience. The end users/stakeholders got used to the old TMS functionality and behaviour, which is not the same in the new SAP system.

An experienced and independent consultant would first recommend leveraging the TMS standard functionality and proposing solutions to meet the business requirements with minimum custom functionality. In this case, the consultants often run TMS DEMO sessions in the new SAP Treasury; pre-configure the TMS and provide proof-of–concept solutions to provide evidence of certain complex functionality that can be aligned with standards.

Why is standard functionality important?

There are six reasons why we think the standard functionality is so important:

- It is supplied out–of–the–box and pre-designed by the system provider. Consequently, less time is needed to design the business process compared to design bespoke solutions.

- It is used by other clients and the system provider already analyzed the user experience of the solution. Hence, there is a higher level of quality assurance.

- SAP supports its own products and any enhancement of the TMS must be done by the system provider with minimum regression impact (impact on the current and working functionality).

- A client can raise SAP expertise internally or hire an external consultant to support the known functionality. There is no dependency on the knowledge of custom functionality.

- It provides easier business process standardization and scaling among different countries/regions.

- It helps to find treasury employees with known SAP Treasury experience, the knowledge can be taken from the market.

Nevertheless, it is quite hard to drop custom bespoke solutions; sometimes it must be applied in the design and implemented for the clients.

Sometimes custom solutions are needed

There are some reasons to implement custom solutions in a treasury system’s architecture:

- Strict and complex client requirements which cannot be met by standard functionality. There is no workaround in the standard. The most common example is cut-off time logic for POBO payments or calculation of internal FX rate types, among others.

- Standard functionality is not yet released to clients. However, it is crucial for a client to get it as soon as possible.

- Custom SAP functionality is already in place but needs to be enhanced.

Recommendations for the custom solutions

If a custom solution is inevitable, we have a couple of best practices.

Firstly, avoid the hardcoding of multiple conditions in the ABAP code. Instead, move the maintenance of the conditions to either custom or standard tables which can be supported by functional SAP support personnel or even by business users. Once a minor change in the conditions is needed there will be no need for a developer.

Secondly, leverage the use of SAP functional modules, programs, BAPIs and BADI etc. This makes the custom code more stable and leaves it less exposed to regression risks during the next system upgrade.

Also, avoid replacing significant pieces of the standard functionality with custom-developed ones which do not bring significant improvements. Supporting such SAP TMS becomes complex and expensive.

To conclude

We recommend that you minimize the volume of the custom solutions during TMS systems implementation. A good balance should be found between business requirements versus SAP standard functionality.

SAP continuously improves its solutions in response to customer feedback, changes in financial standards, regulatory requirements, technology trends, etc. Therefore, it is important to conduct the TMS audit from time to time to see if old and custom functionality can be scrapped since there is standard functionality already available.

If you need an audit of your treasury systems, have challenges with custom solutions or need help with the system design, please feel free to approach us. We have extensive experience in enhancing treasury technology and improving treasury functions.

Sustainability poses risks and offers opportunities for the financial sector.

The Federal Council in Switzerland wants to make sure that the Swiss financial sector will play a leading role in sustainability. To help accomplish this, it published an action plan in December for the period 2022-2025. Furthermore, the Swiss supervisory authority FINMA issued additional guidance on how financial institutions need to account for sustainability in their strategy, governance, risk management and disclosure. In this article we provide an overview of recent developments in the area of sustainability in Switzerland that are relevant for Swiss financial institutions.

Key takeaways:

- In November 2022, a law was approved that requires all Swiss firms above a minimum size (hence including financial institutions) to disclose climate-related information in line with the recommendations from the Task Force for Climate-related Financial Disclosures (TCFD) as of 1 January 2024. This comes on top of the existing law that came into force on 1 January 2022, requiring all firms to disclose more broadly their management of risks to the environment, social engagement, employee interests, human rights and avoidance of corruption (for the first time as part of their annual disclosure over 2023).

- In January 2023, Swiss supervisory authority FINMA published additional guidance in which it highlights its expectation that banks and insurance companies in Switzerland proactively engage with the recent guidance and recommendations issued by the BCBS and IAIS. FINMA will intensify its supervision of the measures that institutions are taking to address climate risks and it will expand this to cover a larger number of institutions (current focus is on the largest institutions, those in FINMA categories 1 and 2). In November 2022, FINMA also published recommendations for improvements of disclosures about climate-related financial risks by category 1 and 2 institutions to satisfy existing climate-related disclosure rules, which came into effect on 1 July 2021.

- In December 2022, the Swiss Federal Council (‘Bundesrat’) published its action plan ‘Sustainable Finance in Switzerland – Areas for action for a leading sustainable financial centre 2022-2025’. The action plan contains 15 initiatives to improve the availability of comprehensive and comparable sustainability data for the full Swiss economy, enhance transparency in the financial sector with respect to climate and biodiversity risks, promote impact investments and green bonds, and support international initiatives for the pricing of environmental damage.

Disclosure requirements in line with the TCFD

From 1 January 2024, all firms above a minimum size1 are legally required to disclose climate-related information in line with the recommendations from the Task Force for Climate-related Financial Disclosures (TCFD) (see media release). An overview of the TCFD disclosure recommendations can be found in this separate article.

This law provides details on climate-related reporting requirements in relation to a law that entered into force on 1 January 20222. This earlier law requires firms to disclose their management of risks in relation to climate change and the environment, social engagement, employee interests, human rights and avoidance of corruption. Firms have to report on this for the first time as part of their annual disclosure over 2023, at the latest by end of June 2024. This law is based on, and in some aspects extends, the EU directive 2014/95 on Corporate Social Responsibility (CSR) reporting from 20143.In addition, this law requires firms that import and/or process minerals from conflict or high-risk regions as well as firms which offer products or services for which the use of child labour in its supply chain is likely, to establish and report on due-diligence measures that have been implemented to manage these risks in line with international agreements.

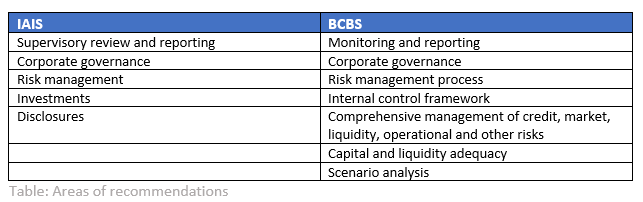

FINMA: Guidance with respect to the management of climate risks

FINMA issued additional guidance for the management of climate risks by banks and insurance companies in January 20234. This guidance follows the publication of documents by international supervisory bodies in the financial sector, specifically:

- ‘Application paper on the Supervision of Climate-related Risks in the Insurance Sector’ by the International Association of Insurance Supervisors (IAIS) in May 2021 (See IAIS)

- ‘Principles for the effective management and supervision of climate-related financial risks’ by the Basel Committee on Banking Supervision (BCBS) in June 2022 (See BCBS Principles and for a summary, see our recent article)

- ‘Frequently asked questions’ by the BCBS in December 2022 (See BCBS FAQ), intended to facilitate a globally uniform interpretation of the existing Pillar 1 standards in relation to climate risk5.

In the guidance, FINMA reiterates that climate risks in the form of transition, physical, legal and reputational risks should not be seen as separate risk categories, but as risk drivers for existing risk categories. It further emphasizes that banks and insurance companies are expected to implement the recommendations as contained in the above papers by the BCBS and IAIS. The areas of the recommendations are summarized in the table below.

In its supervision of climate-related risks, FINMA is currently focusing on the institutions in FINMA categories 1 (currently UBS and Credit Suisse, no insurance companies) and 2 (currently Raiffeisen, PostFinance and the Zürcher Kantonalbank (ZKB) as well as five insurance companies). FINMA is also gathering initial experiences with climate scenario analysis. Over time, FINMA intends to generally intensify its supervision of the measures that institutions are taking to address climate risks and it will expand this to cover a larger number of institutions.

Institutions in supervisory categories 1 and 2 were already subject to climate-related disclosure rules from FINMA as of 1 July 2021, as embedded in the disclosure circulars 2016/1 (for banks) and 2016/2 (for insurers). The required disclosure covers:

- The governance structure in place to identify, assess, measure and monitor climate-related financial risks

- The impact of climate-related financial risks on the business and risk strategy as well as on the existing risk categories in the short, medium and long term

- Risk management structures and processes to identify, assess and manage climate-related financial risks

- Quantitative information (metrics and targets) employed, including the measurement methodologies used

In November 2022, FINMA issued an evaluation of climate-related disclosures by these institutions in their 2021 annual reports against the disclosure rules. FINMA concludes that the institutions largely met the disclosure obligations but observes that it is still difficult for readers to get a clear picture about the effective relevance of climate-related financial risks for the individual institutions. According to FINMA, it proved difficult to find the specific disclosures on climate-related financial risks in the annual and/or other (e.g., sustainability) reports and it expects institutions to more clearly present this. Furthermore, FINMA suggests the following improvements:

- More specific information on how climate risk is managed as part of the overall governance structure. This should include internal reporting of climate-related financial risks, which FINMA views as a part of embedding them in the internal governance

- More detailed information on how climate-related risks impact the business and risk strategy, including the results of a materiality assessment and differentiation of short-, medium- and long-term impact

- More transparent information about the risk management structures and processes in place to identify, assess and manage climate-related financial risks

- Clarification of the connection between climate-related financial risks and the metrics and targets that are disclosed, and which (sub)portfolios are covered by the metrics

FINMA notes that the disclosures did not give sufficient transparency about the criteria and assessment methods by institutions to evaluate the materiality of climate-related financial risks.

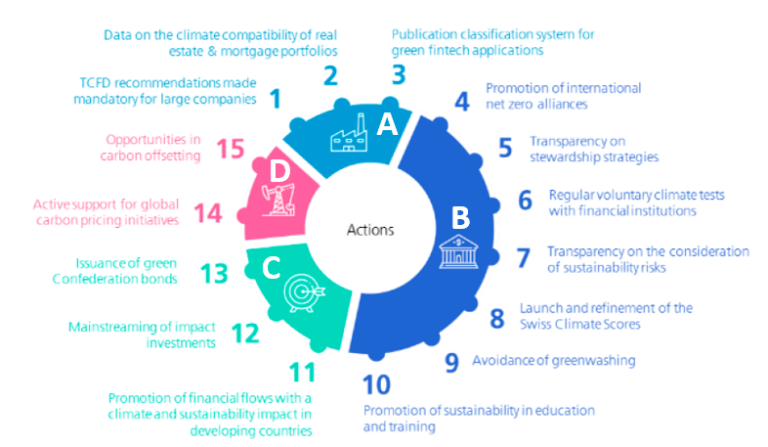

Swiss Federal Council: Sustainable Finance Action plan 2022-20256

The Sustainable Finance Action plan 2022-2025 of the Swiss Federal Council (“Bundesrat”) is written against the background of fulfilling the 17 UN Sustainable Development Goals (SDGs) by 2030. However, the focus is on risks and opportunities in relation to the mitigation of climate change in line with the Paris Agreement and of biodiversity loss. The action plan consists of 15 measures in four main areas:

A: Sustainability data from all sectors of the economy

B: Transparency in the financial sector

C: Impact investments and green bonds

D: Pricing of environmental damage

An overview of the individual actions, grouped by main area, is shown in the following chart.

Source: Swiss Federal Council, Sustainable Finance in Switzerland – Areas for action for a leading sustainable financial centre, 2022–2025, 16 December 2022 (media release)

Below we summarize each of the 15 actions on which the Swiss government will focus, following the numbering in the graph above. Some of the actions will benefit investors and involve additional effort from financial institutions (such as those leading to additional rules or disclosure requirements in actions 1, 5, 7, 8 and 9) while others aim to benefit financial institutions (such as actions 2, 3 and 10). Some actions will affect or benefit society at large (actions 6 and 11 to 15).

A – Sustainability data from all sectors of the economy

1. This action corresponds to the law with climate-related financial disclosure requirements according to the TCFD recommendations, which we described earlier in this article. In addition, the Federal Council will continue to follow and participate in international discussions regarding biodiversity-related financial disclosures.

2. The Swiss government will increase the availability of data about the climate-friendliness of buildings in Switzerland (CO2 emissions, energy efficiency and alignment with the Swiss climate goals) in the Gebäude- und Wohnungsregister (GWR)

3. Support the introduction of a green fintech classification system (see website), which can help existing players in the Swiss financial sector to obtain access to and/or process sustainability related data in a more efficient manner.

B- Transparency in the financial sector

4. The Swiss government encourages financial institutions to join international Net-Zero-Alliances. Furthermore, it collaborates in the international Climate Data Steering Committee (CDSC) to establish a database to create transparency about the commitment of reduction in greenhouse gas emissions of individual financial institutions.

5. In December 2022, the Federal Council recommended that financial institutions and pension funds publish information on how their client engagement strategy and the exercise of equity voting rights aligns with the own net-zero strategy.

6. The government will continue to conduct regular, voluntary climate tests of the financial sector, to provide transparency how the financial sector as a whole aligns with achieving the goals of the Paris agreement (results of the 2022 test can be found on this website).

7. Already in 2020, the Federal Council recommended that financial institutions publish the methods and strategies employed for taking account of climate and environmental risks when managing clients’ assets, in accordance with the existing legal duties of loyalty and due diligence.

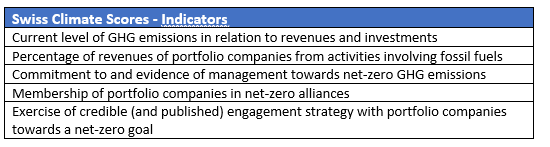

8. In June 2022, the Federal Council recommended that financial institutions use comparable and meaningful information about alignment of financial investments and client portfolios with global (net-zero) climate goals. To support this, it introduced the ‘Swiss Climate Scores’ (see Climate Scores website). These Swiss Climate Scores comprise indicators for both the current and prospective alignment with global (net-zero) climate goals, which are summarized in the table below.

9. Establish rules to avoid greenwashing of financial products and services, ensuring that products and services that are labeled as sustainable are aligned with, or contribute to the achievement of at least one specific sustainability goal.

10. Promote sustainable finance education

C. Impact investments and green bonds

11. Promote impact investments in developing countries, for example by establishing the ‘Sustainable Development Goals (SDG) Impact Finance initiative’ in 2021 and the goals of the ‘Swiss Investment Fund for Emerging Markets (SIFEM) 2021-2024’.

12. Examine, in collaboration with the industry and FINMA, how financial market legislation can be amended to promote the expansion of impact investments.

13. Issue green Swiss Confederation bonds.

D – Pricing of environmental damage

14. Active support of multi-lateral initiatives to establish an equitable global carbon price.

15. Investigate what role the federal government can play to exploit opportunities for the Swiss financial market in the area of CO2-compensation.

In conclusion

Pressure on firms in Switzerland is increasing to be more transparent on how climate and environmental risks are identified, assessed and managed as part of the regular course of business. Zanders has supported various financial institutions on climate and environmental risk-related topics in the EU as they need to adhere to detailed expectations from the European Central Bank (ECB) and the European Union (EU). If you want to learn more, please contact us or call at +41 44 577 70 10.

Footnotes

[1] At least 500 FTE and a balance sheet total of at least CHF 20 million and/or revenues of at least CHF 40 million on a consolidated basis

[2] See media release.

[3] Within the EU, this is generally referred to as the Non-Financial Reporting Directive (NFRD). On 5 January 2023 the Corporate Sustainability Reporting Directive (CSRD) entered into force, succeeding the NFRD (details can be found here). The CSRD extends the scope of the companies covered to all large and all listed companies, requires the audit (assurance) of reported information and strengthens the standardisation of reported information by empowering the Commission to adopt sustainability reporting standards.

[5] The EBA published a discussion paper on the inclusion of environmental risks in Pillar 1 capital requirements, see EBA and for a summary EBA summary https://zandersgroup.com/en/latest-insights/are-climate-change-risks-properly-captured-in-the-prudential-framework/.

[6] See media release

The recommendations for the disclosure of climate-related financial information by the Task Force for Climate-related Financial Disclosures (TCFD), published in 2017, have become the de-facto disclosure standards world-wide.

An increasing number of policy makers and regulators have embedded the recommendations in industry guidance and laws. In this article we summarize the TCFD recommendations, taking into account the additional guidance that has been provided by the TCFD since the original recommendations were published.

Key takeaway:We recommend that firms begin collecting data and amend internal processes that enable them to disclose climate-related information in line with the recommendations of the Task Force for Climate-related Financial Disclosures (TCFD)

Background

The Task Force for Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in December 2015 to develop climate-related disclosures that “could promote more informed investment, credit [or lending], and insurance underwriting decisions” and, in turn, “would enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks.” The TCFD finalized its recommendations in June 20171 and, based on the subsequent experience, published implementation guidance in 20212.

In line with this goal, the recommendations and implementation guidance are intended for all financial and non-financial organizations with public debt or equity. However, the TCFD encourages all organizations to implement the recommendations. An increasing number of firms are doing so and indicate explicitly as part of their annual report or financial filing where they have disclosed information in relation to individual TCFD recommendations3.

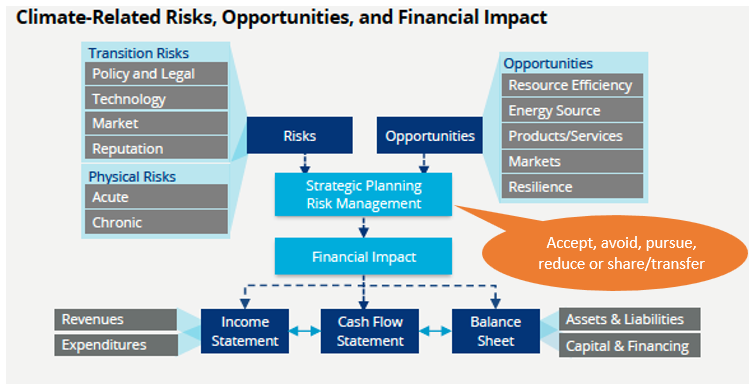

Climate-related risks and opportunities

To be able to disclose relevant climate-related information, an organization first needs to understand its exposure to climate-related risks and the opportunities that the execution of the Paris Agreement offers. Hence, it needs to evaluate the potential negative impacts of climate change on its own operations and the full value chain (covering both physical and transition risks) as well as the opportunities it offers for new products, services and markets. Subsequently, the impact of the identified risks and opportunities on revenues, expenses, assets and liabilities, and capital and financing needs to be assessed. This is summarized in the following chart.

Source: TCFD, Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, October 2021, page 9.

Appendix 1 of the TCFD implementation guidance provides examples how climate-related risks and opportunities can impact the financial statements.

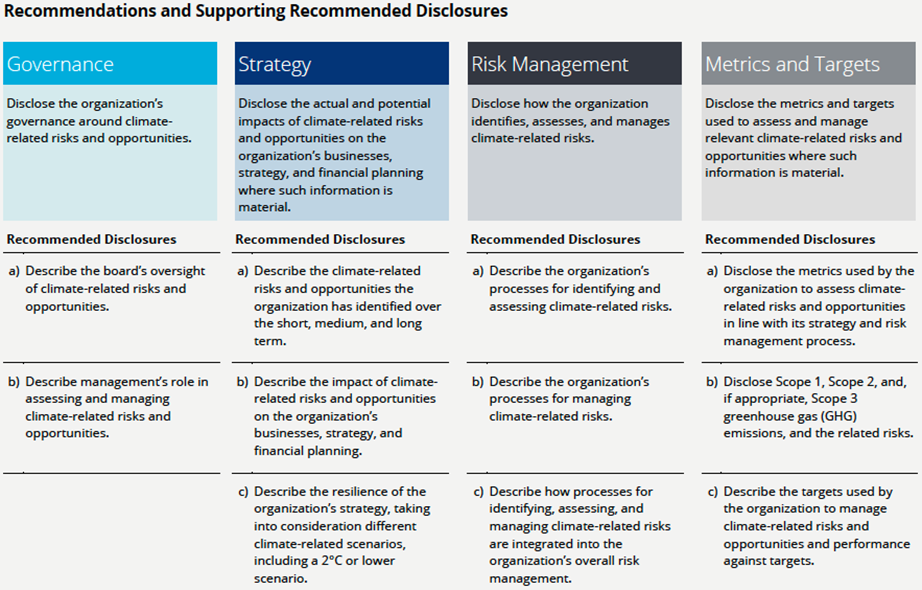

The TCFD Recommendations

The TCFD has issued 11 recommendations in four main areas: Governance, Strategy, Risk Management, and Metrics and Targets. These are summarized in the table below.

Source: TCFD, Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, October 2021, page 15.

For banks, insurance companies, asset owners, asset managers and non-financial industries that are more likely to be financially impacted by climate-related risks4, the TCFD provides additional guidance for some of the recommended disclosures.

For banks, the additional guidance entails:

- Describe significant concentrations of credit exposure to carbon-related assets through the lending and financial intermediary business (Strategy – sub a).

- Characterize their climate-related risks in the context of traditional banking industry risk categories such as credit risk, market risk, liquidity risk, and operational risk (Risk Management – sub a).

- Disclose GHG emissions for their lending and other financial intermediary business activities where data and methodologies allow, calculated in line with the Global GHG Accounting and Reporting Standard for the Financial Industry developed by the Partnership for Carbon Accounting Financials (PCAF Standard) or a comparable methodology (Metrics and Targets – sub b).

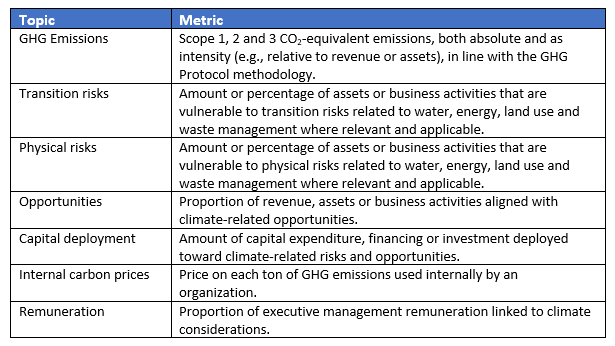

Metrics and targets: Additional guidance

For the metrics, the TCFD provides the following suggestions for all organizations:

Targets can be established by specifying the planned reduction or increase in each of the metrics over a chosen time horizon, including a comparison to regulatory requirements, market constraints or other goals.

In conclusion

As the TCFD recommendations are increasingly used as basis for climate-related disclosure standards in national laws and regulatory guidance, firms are advised to start collecting data and amend internal processes that enable them to disclose climate-related information in line with these recommendations. Zanders has supported various financial institutions on climate-related topics that have a bearing on the TCFD disclosure recommendations. If you want to learn more, please do not hesitate to contact us or call at +41 44 577 70 10.

Footnotes

[1] TCFD, Recommendations of the Task Force on Climate-related Financial Disclosures, June 2017, see TCFD Recommendations

[2] TCFD, Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures, October 2021, see TCFD Publications

[3] TCFD, 2022 Status Report, October 2022, see TCFD Publications

[4] Comprising the following sectors: energy, transportation, materials and buildings, and agriculture, food and forest products.

[5] TCFD, Guidance on Metrics, Targets and Transition Plans, October 2021, see TCFD Publications

Markets have been confronted with a sharp increase in interest rates over the last months, resulting in a material change in level and steepness of the yield curve.

Today’s interest rates are positive, the yield curve relatively flat and, in some currencies, even (slightly) inverse. The rise in interest rates poses a significant challenge for banks. This challenge involves managing the impact that rising rates have on the bank’s IRRBB key risk metrics as well as new EBA regulation related to supervisory outlier tests (SOTs) for IRRBB.

Banks’ economic values of equity (EVE) are most likely negatively affected by the rise in rates. The impact is dependent on the duration of equity taken by the bank; the higher the equity duration, the larger the decline in EVE when rates rise (and hence a higher EVE risk). On the other side, choosing a high equity duration would lock in consistent income over a longer period of time (lower earnings risk), whereas a low equity duration results in earnings fluctuating with market rates (high earnings risk). As a result, eliminating both EVE risk and earnings risk at the same time is hard to achieve. Selecting the appropriate equity duration (or more in detail, key rate durations) is a balancing act between acceptable levels of EVE risk versus earnings risk. This decision depends on the bank’s risk appetite, internal risk limits and regulatory limits (SOT limits). Finally, due to EBA’s introduction of the NII SOT (supervisory outlier test on earnings risk), banks will need to put more emphasis on earnings risk, by assessing the impact of mitigation measures on the size of earnings risk relative to capital.

Levers to consider

Since today’s rate environment is materially different from years past, banks should re-evaluate their ALM strategy and, in particular, actively manage residual interest rate risk going forward. For banks, the following levers are important to consider:

- Adapting the interest rate risk limit framework to the new reality. This includes an assessment whether or not it is necessary to amend the overall equity duration and corresponding key rate durations. Especially, the introduction of the NII SOT by EBA will incentivize banks to amend existing limits on earnings risk or set new ones. The preferred target equity duration and corresponding key rate duration profile will be the result of a study where the impact of alternative equity durations is assessed against the bank’s risk appetite, and EVE and earnings risk limits. Once decided, it will be necessary to [i] adapt the hedge (derivative overlay) according to the new equity duration and key rate duration profile set as targets and [ii] manage the overlay over time in such a way that the realized key rate duration profile remains within the limits set around the target key rate profile and equity duration. Since the risk limit framework is part of the broader ALM framework, the ALM framework could be subject to a review as well.

- Reassessing key behavioral assumptions in the banking book. Although behavioral models are reviewed periodically, banks should consider recalibrating the behavioral models, especially after a shift in paradigm from negative to positive interest rates. Since behavioral assumptions are used to forecast cashflows, they should be set in a forward looking way (possibly using an expert overlay) and thus reflect the new rate environment. In this way, banks will understand how their behavioral models for mortgage pre-payments and non-maturing deposits impact the IRRBB key metrics and resulting equity duration going forward. Amendments in behavioral models can alter the size and structure of a derivative overlay.

- Brushing up the product palette and reviewing the range of banking products. Banking products that have not been attractive in a low and/or negative interest rate environment during the past years could very well become more attractive again for clients in a different (high) interest rate environment. At certain interest rate levels and steepness of the yield curve, clients could favor floating rate over fixed term instruments, short-term over long-term instruments, or vice versa. Volume shifts between banking products can gradually alter the balance sheet composition over time and materially change the interest rate risk profile of the banking book. Therefore, banks should consider adapting their product palette (and corresponding price setting) to the new interest rate environment. Also, banks should consider offering alternative banking products to clients to be able to benefit from risk offsets between assets and liabilities. This can be done by e.g. refurbishing specific products that have been on the shelf for a while now.

- Managing the duration of the liquidity buffer portfolio (more) actively in conjunction with the desired interest rate risk profile set by the revised ALM strategy. Investments in bonds with maturities consistent with the ALM strategy can bring the equity duration closer to the desired level and reduce the size of a potential derivative overlay.

- Strengthening the risk system capabilities to be able to provide management the requested transparency in a timely manner. It requires scenario analyses to determine the impact of strategic ALM decisions on the key risk metrics, both internal and regulatory risk limits and SOTs as well as other balance sheet metrics (e.g. capital and capital ratios). Scenario analyses include the roll-over of the bank’s balance sheet and hedges for a certain period (e.g. 1-5 years) under various scenarios regarding market rate, client rate (commercial margins) and balance sheet assumptions.

How can Zanders support banks in meeting these challenges?

Zanders is a trusted advisor in helping banks review their ALM/hedge strategy. Drawing on expert knowledge in ALM, we help banks conduct strategic ALM studies and holistic balance sheet management assessments using our proprietary tooling. These typically include impact studies of:

- alternative hedges (derivative overlays);

- changes in key behavioral assumptions;

- changes in balance sheet composition or

- other possible measures to mitigate the residual interest rate risk.

Using our holistic approach, we provide transparency and support banks in understanding the impact on future EVE risk, earnings (NII) and earnings risk, as well as other key metrics such as capital ratios, leverage, liquidity and funding (LCR and NSFR) ratios under different scenarios.

Are you interested in Strategic ALM and Holistic Balance Sheet Management? Contact Jaap Karelse, Erik Vijlbrief (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.