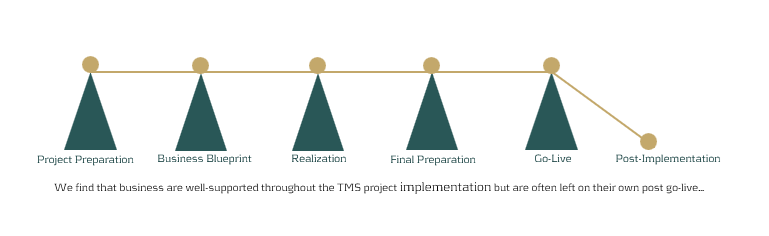

But what happens after implementation, when the project team has packed up and handed over the reins to the employees and support staff?

The first months after a system implementation can be some of the most challenging to a business and its people. Learning a new system is like learning any new skill – it requires time and effort to become familiar with the new ways of working, and to be completely comfortable again performing tasks. Previous processes, even if they were not the most efficient, were no doubt second nature to system users and many would have been experts in working their way through what needed to be done to get accurate results. New, improved processes can initially take longer as the user learns how to step through the unfamiliar system. This is a normal part of adopting a new landscape and can be expected. However, employee frustration is often high during this period, as more mental effort is required to perform day-to-day tasks and avoid errors. And when mistakes are made, it often takes more time to resolve them because the process for doing so is unfamiliar.

High-risk period for the company

With an SAP system, the complexity is often great, given the flexibility and available options that it offers. New users of SAP Treasury Management Software may take on average around 12 – 18 months to feel comfortable enough to perform their day-to-day operations, with minimal errors made. This can be a high-risk period for the company, both in terms of staff retention as well as in the mistakes made. Staff morale can dip due to the changes, frustrations and steep learning curve and errors can be difficult to work through and correct.

In-house support staff are often also still learning the new technology and are generally not able to provide the quick turnaround times required for efficient error management right from the start. When the issue is a critical one, the cost of a slow support cycle can be high, and business reputation may even be at stake.

While the benefits of a new implementation are absolutely worthwhile, businesses need to ensure that they do not underestimate the challenges that arise during the months after a system go-live.

Experts to reduce risks

What we have seen is that especially during the critical post-implementation period – and even long afterward – companies can benefit and reduce risks by having experts at their disposal to offer support, and even additional training. This provides a level of relief to staff as they know that they can reach out to someone who has the knowledge needed to move forward and help them resolve errors effectively.

Noticing these challenges regularly across our clients has led Zanders to set up a dedicated support desk. Our Treasury Technology Support (TTS) service can meet your needs and help reduce the risks faced. While we have a large number of highly skilled SAP professionals as part of the Zanders group, we are not just SAP experts. We have a wide pool of treasury experts with both functional & technical knowledge. This is important because it means we are able to offer support across your entire treasury system landscape. So whether it be your businesses inbound services, the multitude of interfaces that you run, the SAP processes that take place, or the delivery of messages and payments to third parties and customers, the Zanders TTS team can help you. We don’t just offer vendor support, but rather are ready to support and resolve whatever the issue is, at any point in your treasury landscape.

As the leading independent treasury consultancy globally, we can fill the gaps where your company demands it and help to mitigate that key person risk. If you are experiencing these challenges or can see how these risks may impact your business that is already in the midst of a treasury system implementation, contact Warren Epstein for a chat about how we can work together to ensure the long-term success of your system investment.