A guide to optimize SAP Treasury business partner design and maintenance

In SAP Treasury, business partners represent counterparties with whom a corporation engages in treasury transactions, including banks, financial institutions, and internal subsidiaries.

Additionally, business partners are essential in SAP for recording information related to securities issues, such as shares and funds.

The SAP Treasury Business Partner (BP) serves as a fundamental treasury master data object, utilized for managing relationships with both external and internal counterparties across a variety of financial transactions; including FX, MM, derivatives, and securities. The BP master data encompasses crucial details such as names, addresses, contact information, bank details, country codes, credit ratings, settlement information, authorizations, withholding tax specifics, and more.

Treasury BPs are integral and mandatory components within other SAP Treasury objects, including financial instruments, cash management, in-house cash, and risk analysis. As a result, the proper design and accurate creation of BPs are pivotal to the successful implementation of SAP Treasury functionality. The creation of BPs represents a critical step in the project implementation plan.

Therefore, we aim to highlight key specifics for professionally designing BPs and maintaining them within the SAP Treasury system. The following section will outline the key focus areas where consultants need to align with business users to ensure the smooth and seamless creation and maintenance of BPs.

Structure of the BPs:

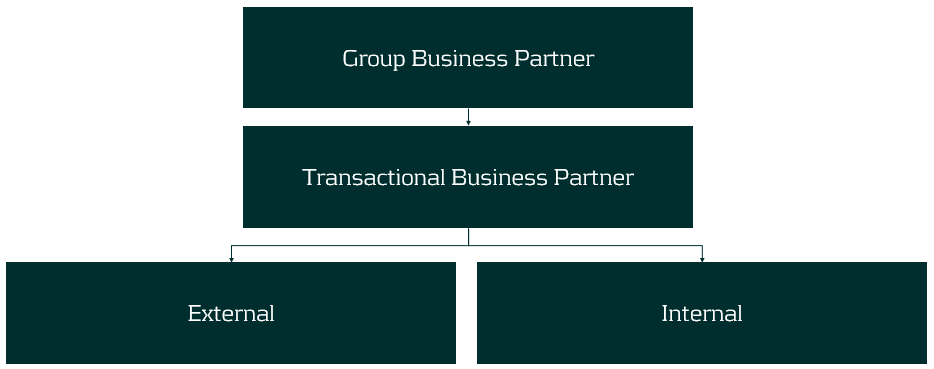

The structure of BPs may vary depending on a corporation's specific requirements. Below is the most common structure of treasury BPs:

Group BP – represents a parent company, such as the headquarters of a bank group or corporate entity. Typically, this level of BP is not directly involved in trading processes, meaning no deals are created with this BP. Instead, these BPs are used for: a. reflecting credit ratings, b. limiting utilization in the credit risk analyzer, c. reporting purposes, etc.

Transactional BP – represents a direct counterparty used for booking deals. Transactional BPs can be divided into two types:

- External BPs – represent banks, financial institutions, and security issuers.

- Internal BPs – represent subsidiaries of a company.

Naming convention of BPs

It is important to define a naming convention for the different types of BPs, and once defined, it is recommended to adhere to the blueprint design to maintain the integrity of the data in SAP.

Group BP ID: Should have a meaningful ID that most business users can understand. Ideally, the IDs should be of the same length. For example: ABN AMRO Group = ABNAMR or ABNGRP, Citibank Group = CITGRP or CITIBNK.

External BP ID: Should also have a meaningful ID, with the addition of the counterparty's location. For example: ABN AMRO Amsterdam – ABNAMS, Citibank London – CITLON, etc.

Internal BP ID: The main recommendation here is to align the BP ID with the company code number. For example, if the company code of the subsidiary is 1111, then its BP ID should be 1111. However, it is not always possible to follow this simple rule due to the complexity of the ERP and SAP Treasury landscape. Nonetheless, this simple rule can help both business and IT teams find straightforward solutions in SAP Treasury.

The length of the BP IDs should be consistent within each BP type.

Maintenance of Treasury BPs

1. BP Creation:

Business partners are created in SAP using the t-code BP. During the creation process, various details are entered to establish the master data record. This includes basic information such as name, address, contact details, as well as specific financial data such as bank account information, settlement instructions, WHT, authorizations, credit rating, tax residency country, etc.

Consider implementing an automated tool for creating Treasury BPs. We recommend leveraging SAP migration cockpit, SAP scripting, etc. At Zanders we have a pre-developed solution to create complex Treasury BPs which covers both SAP ECC and most recent version of SAP S/4 HANA.

2. BP Amendment:

Regular updates to BP master data are crucial to ensure accuracy. Changes in addresses, contact information, or payment details should be promptly recorded in SAP.

3. BP Release:

Treasury BPs must be validated before use. This validation is carried out in SAP through a release workflow procedure. We highly recommend activating such a release for the creation and amendment of BPs, and nominating a person to release a BP who is not authorized to create/amend a BP.

BP amendments are often carried out by the Back Office or Master Data team, while BP release is handled by a Middle Office officer.

4. BP Hierarchies:

Business partners can have relationships as described, and the system allows for the maintenance of these relationships, ensuring that accurate links are established between various entities involved in financial transactions.

5. Alignment:

During the Treasury BP design phase, it is important to consider that BPs will be utilized by other teams in a form of Vendors, Customers, or Employees. SAP AP/AR/HR teams may apply different conditions to a BP, which can have an impact on Treasury functions. For instance, the HR team may require bank details of employees to be hidden, and this requirement should be reflected in the Treasury BP roles. Additionally, clearing Treasury identification types or making AP/AR reconciliation GL accounts mandatory for Treasury roles could also be necessary.

Transparent and effective communication, as well as clear data ownership, are essential in defining the design of the BPs.

Conclusion

The design and implementation of BPs require expertise and close alignment with treasury business users to meet all requirements and consider other SAP streams.

At Zanders, we have a strong team of experienced SAP consultants who can assist you in designing BP master data, developing tools to create/amend the BPs meeting strict treasury segregation of duties and the clients IT rules and procedures.

ISO 20022 XML version 9 – So what’s new?

In SAP Treasury, business partners represent counterparties with whom a corporation engages in treasury transactions, including banks, financial institutions, and internal subsidiaries.

But the adoption of ISO 20022 XML messaging goes beyond SWIFT’s adoption in the interbank financial messaging space – SWIFT are currently estimating that by 2025, 80% of the RTGS (real time gross settlement) volumes will be ISO 20022 based with all reserve currencies either live or having declared a live date. What this means is that ISO 20022 XML is becoming the global language of payments. In this fourth article in the ISO 20022 series, Zanders experts Eliane Eysackers and Mark Sutton provide some valuable insights around what the version 9 payment message offers the corporate community in terms of richer functionality.

A quick recap on the ISO maintenance process?

So, XML version 9. What we are referencing is the pain.001.001.09 customer credit transfer initiation message from the ISO 2019 annual maintenance release. Now at this point, some people reading this article will be thinking they are currently using XML version 3 and now we talking about XML version 9. The logical question is whether version 9 is the latest message and actually, we expect version 12 to be released in 2024. So whilst ISO has an annual maintenance release process, the financial industry and all the associated key stakeholders will be aligning on the XML version 9 message from the ISO 2019 maintenance release. This version is expected to replace XML version 3 as the de-facto standard in the corporate to bank financial messaging space.

What new functionality is available with the version 9 payment message?

Comparing the current XML version 3 with the latest XML version 9 industry standard, there are a number of new tags/features which make the message design more relevant to the current digital transformation of the payment’s ecosystem. We look at the main changes below:

- Proxy: A new field has been introduced to support a proxy or tokenisation as its sometimes called. The relevance of this field is primarily linked to the new faster payment rails and open banking models, where consumers want to provide a mobile phone number or email address to mask the real bank account details and facilitate the payment transfer. The use of the proxy is becoming more widely used across Asia with the India (Unified Payments Interface) instant payment scheme being the first clearing system to adopt this logic. With the rise of instant clearing systems across the world, we are starting to see a much greater use of proxy, with countries like Australia (NPP), Indonesia (BI-FAST), Malaysia (DuitNow), Singapore (FAST) and Thailand (Promptpay) all adopting this feature.

- The Legal Entity Identifier (LEI): This is a 20-character, alpha-numeric code developed by the ISO. It connects to key reference information that enables clear and unique identification of legal entities participating in financial transactions. Each LEI contains information about an entity’s ownership structure and thus answers the questions of 'who is who’ and ‘who owns whom’. Simply put, the publicly available LEI data pool can be regarded as a global directory, which greatly enhances transparency in the global marketplace. The first country to require the LEI as part of the payment data is India, but the expectation is more local clearing system’s will require this identifier from a compliance perspective.

- Unique End-to-end Transaction Reference (commonly known as a UETR): This is a string of 36 unique characters featured in all payment instruction messages carried over the SWIFT network. UETRs are designed to act as a single source of truth for a payment and provide complete transparency for all parties in a payment chain, as well as enable functionality from SWIFT gpi (global payments innovation)1, such as the payment Tracker.

- Gender neutral term: This new field has been added as a name prefix.

- Requested Execution Date: The requested execution date now includes a data and time option to provide some additional flexibility.

- Structured Address Block: The structured address block has been updated to include the Building Name.

In Summary

Whilst there is no requirement for the corporate community to migrate onto the XML version 9 message, corporate treasury should now have the SWIFT ISO 20022 XML migration on their own radar in addition to understanding the broader global market infrastructure adoption of ISO 20022. This will ensure corporate treasury can make timely and informed decisions around any future migration plan.

Notes:

- SWIFT gpi is a set of standards and rules that enable banks to offer faster, more transparent, and more reliable cross-border payments to their customers.

The implications of the EMIR Refit

In SAP Treasury, business partners represent counterparties with whom a corporation engages in treasury transactions, including banks, financial institutions, and internal subsidiaries.

The EMIR Refit was originally introduced with the goal of simplifying regulations, and these new requirements took effect in 2019. Following the EMIR Refit, there has been a subsequent round of amendments and updated technical guidelines. In this article, we highlight the key changes.

ESMA has published the final reporting guidelines for the updated EMIR refit to take effect on 29 April 2024 (Europe) and 30 September 2024 (UK). These changes, while strivinging to streamline and standardise the reporting across Trade repositories, will add some initial challenges in setting up the new report and reporting format.

Although a significant number of corporates rely on the financial counterparty to report on their behalf, these changes can still cause a major headache for corporates that continue reporting by themselves or need to report internal trades.

Key changes

The first major change concerns the number of fields that can be reported on. Currently there are 129 reportable fields, under the updated legislation there is a withdrawal of 15 and 89 new fields. This brings the new report to a hefty 203 reportable fields.

There will be an introduction of more counterparty-specific fields. These fields will require a deeper understanding of and communication with all counterparties. New counterparty data that will be required includes a Clearing Threshold and Corporate Sector.

The way that these fields will be reported is under huge review. The updated legislation will remove the CSV file, a business staple due to its ease of creation and flexibility, and replace the file with an XML submission using ISO 20022 standards. This move to XML will give corporates the headache of building the necessary XML file. One benefit of the XML format is that it will make moving between Trade Repositories easier as there will be a uniform file specification.

Introducing UPI

Another major change concerns the introduction of a Unique Product Identifier (UPI). The UPI is aimed at reducing the misreporting of products, ISINs, CFI codes, and other classifications. The UPI will be controlled and issued by the Derivatives Service Bureau (DSB). With a central database of identifiers, this should reduce misreporting. It is also hoped that the use of a centrally managed UPI will lead to a reduction in the number of reportable fields in the future . A downside to this change is that companies will need to sign up with the DSB and a fee will be charged for each UPI. There is a general consensus that with the introduction of the UPI, the UTI is likely to be phased out and removed in the future.

One easily missed detail on the new requirements is the necessity to update all outstanding trades to the new reporting format and level of detail, within 6 months of the go-live. This can be problematic for firms that don’t have the necessary data points for the historic trades and will require a review to bring these trades up to the required reporting standard.

In summary, there are large changes in the number of fields needing to be reported, much more granularity required from dealing counterparties, and a change of file type to XML.

Reporting validations and final report can be found on the ESMA website.

With our experience in EMIR and EMIR Refit legislation we can help with the transition to the new reporting requirements.

Please contact Keith Tolfrey or Wilco Noteboom for further insights.