Royal FloraHolland has been on a journey to optimize their cash management processes.

With a complex landscape consisting of two SAP systems and several banks, the choice was made to implement SWIFT’s Alliance Lite 2 functionality.

This new standardized approach to bank connectivity has enabled Royal FloraHolland to connect with new banks, and in addition, the embedded payment approval workflow within AL2 provides the opportunity for Royal FloraHolland to carry out a final control before releasing payment and collection files to their partner banks. Unfortunately, this final control process was highly dependent on manual activities, where files were retrieved from folders within SAP environments and subsequently uploaded into AL2. Despite these payment and collection files being authorized after being uploaded into AL2, the fact that they are downloaded to a user’s personal desktop has always been a risk from an audit and control perspective. Royal FloraHolland wanted to mitigate the risk of human error and remove the vulnerability of the files in transit.

Considerations

After carrying out a short assessment of available solutions on the market, ranging from payment hub providers to full blown SWIFT Service Bureaus, Royal FloraHolland decided to explore options towards developing a solution in house. This was motivated by the fact that Royal FloraHolland had already invested in a generic bank connectivity solution. Their requirements were simple; namely that payment and collection files must be transferred to AL2 in a secure manner without any human intervention. In this context, the minimum security requirements must not allow following:

- Files to be manipulated in the transit between SAP and AL2

- The injection of files from sources other than the (production) SAP system

Solution

SWIFT Autoclient is a SWIFT solution that allows clients to automatically upload/download files to/from AL2. Royal FloraHolland was already using Autoclient to automatically download their bank statements from AL2, however they were not currently leveraging on the automatic file upload capabilities offered by Autoclient. When using the upload functionality, there are a few things that should be considered.

Firstly, it is important to consider the vulnerability of files in transit. Autoclient uploads files automatically to SWIFT AL2 once they are placed in the configured source directory. To avoid the risk of processing files that have either been manipulated or have originated from a non-trusted source system, Autoclient offers the option to secure files using LAU (Local Authentication). This method ensures a secure transfer of (payment) files between backend applications and Autoclient by calculating an electronic signature over the file. This signature is then transferred together with the file to Autoclient and verified. Only files that have been successfully verified will be transferred into AL2. This method requires a symmetric key infrastructure, whereby the secret key used to calculate the electronic signature is the same key used to verify the signature, meaning there is a requirement to maintain the secret key in both the source (SAP) application and in Autoclient. Since this deviates from SAP standard functionality, a bespoke development was required, alongside the additional logic to calculate the LAU signature.

Secondly, the routing of outgoing payment files needs to be managed. When uploading payment files to AL2 there is a requirement to transfer the relevant parameters for FileAct traffic. Normally, this can be achieved by using the Autoclient configuration options, however, when using LAU, SWIFT recommends its customers to provide the FileAct parameters together with a payment file. To fulfil this requirement a transaction was built in SAP to maintain these parameters. A clear advantage of this transaction is that the connection to new partner banks can now be managed fully via configuration in the SAP systems. There is no immediate requirement for further updates in Autoclient or AL2 as the parameter files supplied already contain all required routing information.

A third hurdle to overcome is the approval workflow within AL2. By default, AL2 will deliver files that are uploaded via Autoclient directly to partner banks. Any verification and authorization steps in AL2 will be bypassed. Royal FloraHolland wanted an additional authentication workflow to be active in AL2, which included files uploaded via Autoclient. As this requirement deviates from the standard functionality offered by AL2, a change request was raised to SWIFT, who developed and implemented this logic.

Implementation

The new solution was developed such that there was no impact on the existing file transfer process. This allowed Royal FloraHolland to perform a dry run in the production system using a limited number of payments, to ensure that the new solution is working as designed.

Conclusion

Royal FloraHolland is now running their payments and collections in an automated way. Not only has this reduced the workload burden for the AP department but has increased confidence that payments arriving in AL2 are from a trusted source.

Analyzing data from a treasury management system and ensuring it is up to date and accurate is key to making effective decisions for any corporate treasurer.

Over recent years, SAP has added an array of products in the data warehousing, reporting and analytics space to assist decision-making as well as address some of the historical weaknesses in its reporting capabilities.

These more recent SAP tools focus on delivering key business drivers in the reporting space – such as agility, flexibility, independence from IT, data processing, intelligent analysis (using artificial intelligence), and data centralization – thereby addressing many of the previous frustrations that business users experienced with getting the necessary information out of their SAP systems to make sound business decisions. Previously, reporting within SAP was often limited, inflexible and required a reliance on IT to develop custom reports and/or data models. But with more options, choosing the most appropriate reporting landscape design can seem overwhelming to the treasury executive and it’s easy to get lost in the technical jargon.

The appropriate tool for your unique business design

When it comes to treasury analytics solutions offered by SAP, there are among others embedded Fiori analytical apps, SAP Analytics Cloud, BW4/HANA and the new Data Warehouse Cloud. It may be difficult to get a clear understanding of what each tool offers and for what purposes to use each. The question then is whether to invest in all tools or which one(s) to choose to meet our reporting needs. Additionally, there may be uncertainty too around what is offered to customers using SAP S/4HANA Cloud versus those customers who run SAP S/4HANA Cloud, private edition (and on premise deployments).

The answer about how to structure your SAP reporting architecture depends on your unique business design and reporting requirements, and more specifically what questions you need answered by your data. Here we will give a brief overview of the functionality of the main tools and what to consider when making system selection decisions. Note, the below information speaks more to customers who run the on-premise version of SAP S/4HANA, although we do mention what is offered on the cloud, where relevant.

SAP S/4HANA Fiori Analytical Apps

SAP S/4HANA Finance for treasury and risk management comes standard with analytical Fiori apps for daily reporting as well as Dashboard reporting. With your daily reporting apps, you will be able to display treasury position flows, analyze the treasury position, use the Cash Flow Analyzer as well as display the treasury posting journal. These apps assist the treasury executive to see the details and results of what has taken place over a given period within the organization. There are also currently four dashboard-type Fiori apps which give an overview of different key areas, namely Foreign Exchange Overview, Interest Rate Overview, Market Data Overview, and Bank Relationship Overview.

Without paying any additional license fees, the above apps give the treasury executive a great starting point with which to review current positions but may not be sufficient to provide the information you want to see and how you want to see it.

SAP Analytics Cloud

SAP Analytics Cloud is SAP’s solution for data visualization, offering business intelligence, planning and predictive analytics in a single solution for all modules, providing a broader, deeper and more flexible analysis of the organization’s operations than the embedded analytical Fiori apps can.

Although the SAP Analytics Cloud OEM version is delivered embedded into Treasury Management for SAP S/4HANA Cloud, customers with the SAP S/4HANA Cloud, private edition, or an on-premise version of Treasury Management will need an additional license to get access to SAP Analytics Cloud functionality. However, it is worth noting that this license is for the full-use SAP Analytics Cloud Enterprise edition, which comes with more features and functionalities than the embedded version.

In terms of Treasury Management, the Treasury Executive Dashboard is the main offering within SAP Analytics Cloud. This dashboard is based on a preconfigured data model that offers real-time insights into the treasury operations across eight tab strips. Areas that can be reported on are Liquidity, Cash management, Bank relationship, Indebtedness, Counterparty risk, Market risk, Bank guarantee and Market overview. The dashboard provides visual overviews of the underlying data and allows for drill-down to see the detail. Customizing the layout is also possible.

With the full-use Enterprise version of SAP Analytics Cloud, there is the possibility of creating more dashboards (called Stories) according to business reporting needs. Business Content is also delivered out the box with the full version which means the creation of new dashboards is accelerated as the groundwork has already been done by SAP or one of their business partners.

Another feature of SAP Analytics Cloud worth mentioning is its predictive capabilities. Historical data is analyzed to identify trends and patterns, and these are then used to predict a potential future outcome, further adding to the tools at the executive’s disposal.

SAP Analytics Cloud is designed to be set up and used by the business user with minimal IT intervention. Dashboards are responsive and user-friendly, with a large degree of flexibility in terms of layout and design.

SAP BW/4HANA

SAP BW/4HANA is SAP’s next generation data warehousing solution designed to run exclusively on the SAP HANA database. The key areas of focus for SAP BW∕4HANA are data modeling, data procurement, analysis and planning. An SAP customer needs to license this product and it runs on a separate instance.

SAP BW/4HANA is not an upgrade of SAP BW but a widely rewritten solution designed to reduce complexity and effort around data warehousing as well as increasing speed and agility, offering advanced UIs.

Data from multiple sources across the enterprise can be imported and stored centrally in the SAP BW∕4HANA Enterprise Data Warehouse. This data can be transformed and cleaned up, ready for analysis. SAP BW/4HANA provides a single source of truth, handling large data volumes at speed for complex organizations. SAP BW/4HANA has been designed to create reports on current, historical, and external data from multiple SAP and non-SAP sources. The data modeling capabilities are also much more powerful than SAP Analytics Cloud offers as a standalone solution.

A note here that SAP has recently released the Data Warehouse Cloud. This is intended as a data warehousing solution for SAP S/4HANA Cloud customers and is not seen as a direct replacement for BW/4HANA. However, the approaches for supporting Self-Service BI, the “SAP BW Bridge capabilities”, or the inclusion of CDS views from SAP S/4HANA make it a good candidate for a hybrid approach at least.

Selecting the right solution

SAP believes that there are four main drivers of the value of data – Span (data from anywhere), Volume (data of any size), Quality (data of any kind) and Usage (data for anyone). They have focused on ensuring that value is maximized for organizations by offering solutions for each driver. The SAP HANA database ensures that a vast volume of data can be handled at high speed, SAP BW/4HANA has been designed so that high volumes of data of any kind can be consolidated for analysis and SAP Analytics Cloud delivers a single solution for visual, easy-to-use analytics across the business.

Customers that have SAP S/4HANA Treasury in their on-premise deployment with minimal data sources could supplement their SAP S/4HANA Treasury system with SAP Analytics Cloud alone. This is ideal when the main reporting needs are operational and real-time and would allow treasury executives to easily access the information they need to optimize their portfolios for liquidity and risk, giving them the additional flexibility and ability to design required reports.

Where the data volumes are large and from a diverse range of sources, a combination of SAP BW4/HANA and SAP Analytics Cloud could be better. The latter has been optimized to work with SAP BW/4HANA as a source and this allows customers to get the powerful, interactive visualizations of SAP Analytics Cloud using the immense data volume capabilities of SAP BW/4HANA. Together, these two products, alongside your SAP S/4HANA Treasury system, give up-to-date, broad, easy-to-read information at a glance to ensure the treasury executive can be proactive and responsive, making the best possible decisions around liquidity, funding and risk management across the entire enterprise. SAP BW4/HANA can of course be implemented without SAP Analytics Cloud, as other BI tools can be used, but the advantages of SAP Analytics Cloud are the highly visual design, flexibility and most importantly not needing to rely on IT to design reports.

To conclude

Knowing what your options are and which would suit your current and future system landscapes is where Zanders can come in, providing sound guidance and ensuring you are able to make the most of any investment to analyze data and make decisions. We can assist treasury executives by ensuring the customer has the right mix of reporting solutions, weighing up total cost of ownership against the data reporting requirements of the organization.

Everyone understands the importance of data in an organization. After all, data is the new oil in terms of its value to a corporate treasury and indeed the wider organization. However, not everyone is aware of how best to utilize data. This article will tell you.

Developing a data strategy depends on using the various types of payment, market, cashflow, bank and risk data available to a treasury, and then considering the time implications of past historical data, present and future models, to better inform decision-making. We provide a roadmap and ‘how to’ guide to becoming a data-driven organization.

Why does this aim matter? Well, in this age of digitization, almost every aspect of the business has a digital footprint. Some significantly more than the others. This presents a unique opportunity where potentially all information can be reliably processed to take tactical and strategic decisions from a position of knowledge. Good data can facilitate hedging, forecasting and other key corporate activities. Having said all that, care must also be taken to not drown in the data lake1 and become over-burdened with useless information. Take the example of Amazon in 2006 when it reported that cross-selling attributed for 35% of their revenue2. This strategy looked at data from shopping carts and recommended other items that may be of interest to the consumer. The uplift in sales was achieved only because Amazon made the best use of their data.

Treasury is no exception. It too can become data-driven thanks to its access to multiple functions and information flows. There are numerous ways to access and assess multiple sets of data (see Figure 1), thereby finding solutions to some of the perennial problems facing any organization that wants to mitigate or harness risk, study behavior, or optimize its finances and cashflow to better shape its future.

Time is money

The practical business use cases that can be realized by harnessing data in the Treasury often revolve around mastering the time function. Cash optimization, pooling for interest and so on often depend on a good understanding of time – even risk hedging strategies can depend on the seasons, for instance, if we’re talking about energy usage.

When we look at the same set of data from a time perspective, it can be used for three different purposes:

I. Understand the ‘The Past’ – to determine what transpired,

II. Ascertain ‘The Present’ situation,

III. Predict ‘The Future’ based on probable scenarios and business projections.

I – The Past

“Study the past if you would define the future”

Confucius

The data in an organization is the undeniable proof of what transpired in the past. This fact makes it ideal to perform analysis through Key Performance Indicators (KPIs), perform statistical analysis on bank wallet distribution & fee costs, and it can also help to find the root cause of any irregularities in the payments arena. Harnessing historical data can also positively impact hedging strategies.

II – The Present

“The future depends on what we do in the present”

M Gandhi

Data when analyzed in real-time can keep stakeholders updated and more importantly provide a substantial basis for taking better informed tactical decisions. Things like exposure, limits & exceptions management, intra-day cash visibility or near real-time insight/access to global cash positions all benefit, as does payment statuses which are particularly important for day-to-day treasury operations.

III – The Future

“The best way to predict the future is to create it.”

Abraham Lincoln

There are various areas where an organization would like to know how it would perform under changing conditions. Simulating outcomes and running future probable scenarios can help firms prepare better for the near and long-term future.

These forecast analyses broadly fall under two categories:

Historical data: assumes that history repeats itself. Predictive analytics on forecast models therefore deliver results.

Probabilistic modeling: this creates scenarios for the future based on the best available knowledge in the present.

Some of the more standard uses of forecasting capabilities include:

- risk scenarios analysis,

- sensitivity analysis,

- stress testing,

- analysis of tax implications on cash management structures across countries,

- & collateral management based on predictive cash forecasting, adjusted for different currencies.

Working capital forecasting is also relevant, but has typically been a complex process. The predication accuracy can be improved by analyzing historical trends and business projections of variables like receivables, liabilities, payments, collections, sales, and so on. These can feed the forecasting algorithms. In conjunction with analysis of cash requirements in each business through studying the trends in key variables like balances, intercompany payments and receipts, variance between forecasts and actuals, this approach can lead to more accurate working capital management.

How to become a data-driven organization

“Data is a precious thing and will last longer than the systems themselves.”

Tim Berners-Lee

There can be many uses of data. Some may not be linked directly to the workings of the treasury or may not even have immediate tangible benefits, although they might in the future for comparative purposes. That is why data is like a gold mine that is waiting to be explored. However, accessing it and making it usable is a challenging proposition. It needs a roadmap.

The most important thing that can be done in the beginning is to perform a gap analysis of the data ecosystem in an organization and to develop a data strategy, which would embed importance of data into the organization’s culture. This would then act as a catalyst for treasury and organizational transformation to reach the target state of being data-driven.

The below roadmap offers a path to corporates that want to consistently make the best use of one of their most critical and under-appreciated resources – namely, data.

We have seen examples like Amazon and countless others where organizations have become data- driven and are reaping the benefits. The same can be said about some of the best treasury departments we at Zanders have interacted with. They are already creating substantial value by analyzing and making the optimum use of their digital footprint. The best part is that they are still on their journey to find better uses of data and have never stopped innovating.

The only thing that one should be asking now is: “Do we have opportunities to look at our digital footprint and create value (like Amazon did), and how soon can we act on it?”

References:

What will the next year bring for corporate treasury?

Now that we have passed and are still in an uncertain period, it is time to discover opportunities to reposition and prepare for new challenges and developments. How should you, as a treasurer, prepare for another unpredictable year? What can your company, and the treasury organization specifically, do to add value by recognizing the trends? How can Treasury contribute to dealing with current challenges in global supply chains?

While much about what 2022 will hold is uncertain, there are a few trends that will definitely play an important role. In this article we explore three main topics to navigate through the new environment and which are crucial to guide your treasury plan for the coming year.

Foresee the accelerating winds of change within the payments landscape

Innovation within the payments industry is closely linked to the continued digitization of commercial and consumer transactions. There are three topics worth mentioning when discussing the main points of attention for corporate treasury within the global payment landscape, being: (1) integration of e-commerce, (2) rise of alternative payment instruments, and (3) further payment standardization.

Integration of e-commerce into corporate treasury is an important topic for many treasurers. Consumers are driving the significant rise in the usage of alternative payments methods, like digital wallets (e-wallets), mobile payments, and ‘buy now, pay later’ solutions. Chinese consumers are leading the way with digital wallets which now account for over 72% of e-commerce purchases . Additionally, 56 countries are now providing real-time payment rails and the rising use of APIs promises to deliver a frictionless experience for more consumer payments. As a result, one of the important actions for Treasury in 2022, is to ensure that Treasury is linked into the different e-commerce platforms in the group in a similar fashion to how Treasury is responsible for managing traditional payments and bank relationships. Treasury should be the guardian of a safe payments infrastructure (including e-commerce payments) performed by reliable counterparties that are compliant with international regulation.

In terms of the rise of alternative instruments, we see the introduction of new digital coins, aimed at reducing volatility compared to the ‘traditional’ cryptos. This includes governments looking at the possibility of launching their own central bank digital currencies (CBDCs) which leverages the underlying distributed ledger technology as well as the introduction of so-called stablecoins, which are pegged to the value of an underlying asset. While the Bahamas was the world’s first CBDC with the launch of the Sand Dollar in October 2020, China is currently taking the lead with around 70 million digital Yuan transactions reported since the start of its pilot, which initially covered 4 cities. According to Atlantic Council, there are now 81 countries considering CBDCs, including the Federal Reserve, the European Central bank, the Bank of Japan and the Bank of England. While the future remains uncertain, these developments could lead to more mainstream use cases for digital currencies. This would have a potential impact on the payment formats we use, timing of payments and the role of traditional (network) banks. While use cases are limited at this moment, treasurers should be aware of the potential material impact on the payments landscape.

When it comes to payments standardization, API adoption is starting to accelerate, which will have a profound impact on both corporate treasury and financial shared service centers through the acceleration of information and processes. However, the lack of standardization within the industry appears to be causing the primary drag on adoption. This will become a foundational technology for real-time treasury, as real time balance and transactional information will provide immediate visibility and enable faster, more informed decisions to be made.

The final payments innovations on the horizon are a combination of global messaging and infrastructure projects. First, there is the planned SWIFT adoption of a selection of the ISO20022 XML messages included in the 2019 annual standards release. While this will initially be adopted within the banking community as part of the publicized MT-MX migration, the expectation is that banks will look for corporates to migrate at some point to take advantage of the more structured data opportunities and, if the CGI-MP is successful, greater alignment around the implementation within the banking sector. Moving onto the country level infrastructure, the UK is progressing its RTGS renewal program which will be underpinned by the adoption of ISO 20022 XML messaging. In addition, Hong Kong and Singapore are also building new RTGS payment rails underpinned by ISO 20022. Within the Nordics, there is P27, which aims to establish the first integrated region for domestic and cross-border payments in multiple currencies.

Stay ahead of new global tax regimes

The BEPS initiative impacted Treasury structures and the pricing of financial transactions in recent years. For example, thin capitalization rules, limitations to interest deductions and transfer pricing guidance have initiated multinationals to rethink their intercompany finance practices.

More specifically, the final OECD transfer pricing guidelines for financial transactions had a major impact on the internal corporate finance function of corporate treasuries. Numerous corporates revisited their pricing framework for intercompany loans, financial guarantees, cash pools and in-house banks in order to prevent issues during tax audits and possible transfer pricing adjustments.

We observe that more scrutiny is placed on the ‘at arm’s length’ pricing of treasury transactions and expects this to continue in 2022. It is thus advisable for treasurers to ensure that their intercompany lending framework is consistent, transparent and compliant with the latest transfer pricing guidelines. Especially since the simplified practice of using one group credit spread for all in-house bank participants is not compliant with the OECD guidelines. Therefore, as the burden of compliance increases, corporates are being pushed to look for solutions which can support them in automating this onerous process whilst still be fully compliant.

Lastly, treasurers should be aware of the latest development in international taxation: the global minimum tax. The G20 and all OECD member countries agreed on 8 October 2021 that multinationals will have to pay a minimum global tax of 15%. As the scope and the details of the tax reform are not clear yet, treasurers are advised to be aware of the topic and align with the internal tax team in order to identify the potential business impact. Treasury and tax can collaboratively serve as a strategic advisor towards their organization.

Seize the strategic opportunity in ESG

When talking about sustainability within treasury, many treasurers’ first port of call is to investigate a sustainable financing framework, either via green or social financing. ESG (environmental, social and governance) considerations play an important role in the external financing and the internal capital allocation process. In the long run, companies that have not implemented an ESG strategy may be deprived from fresh capital. This particular case is becoming more apparent within certain industries, like polluting industries or the so-called sin stocks (gambling, alcohol, tobacco, and weapons industry), where the transition from Greenium to a Brown money penalty may be more present than in other industries. However, there is more than just green or social financing. The topic around ESG is currently gaining momentum. ESG considerations are essential for long-term success; it is no longer just a necessity, but also a strategic opportunity.

So how should Treasury drive the ESG agenda? There are numerous innovative ways for Treasury to incorporate ESG into its strategy. For example, in addition to including ESG factors in the financing documentation or SCF programs, Treasury may incorporate ESG elements in the internal capital allocation process too. This can be done by adding ESG-related risk factors to the weighted average cost of capital (WACC) or internal hurdle investment rates for its capital allocation decisions. By having an ESG-adjusted WACC, one can evaluate projects by considering the ESG impact of an investment. By adjusting the WACC to, for example, the level of CO2 that is emitted by a project, the capital allocation process favors projects with low CO2 emissions. Another example of how Treasury can contribute to the company’s ESG goals is to encourage new and existing partners (e.g. banks or vendors) to take sustainable measures, by embedding ESG requirements into selections processes.

A corporate reaps the most benefits from its ESG policy when initiatives are mapped to the right KPIs to track the sustainable performance over time. KPI’s should be SMART, forward looking and focus on material themes. For Treasury, an example of such a metric is the percentage of suppliers rewarded with preferred supply chain finance (SCF) terms because of their ESG performance. To enlarge the impact of an ESG policy even more, and increase market transparency, KPIs should be benchmarked against industry standards.

Another way to increase market transparency is to maintain a corporate’s records by getting an external verification of its sustainable performance. This is enabled by the EU taxonomy model to avoid greenwashing.

Are you ready for your treasury journey?

2022 promises to be another exiting year with many opportunities to drive the Treasury function forward. The three main topics described in this article highlight the longer-term trend of Treasury moving closer to the business. The changing role of Treasury towards a comprehensive value-added center towards the business often requires a transformation in the Treasury organization. Zanders looks forward to discussing these and other trends with you and to support you on your treasury journey in 2022!

References

1) 2021 Global Payments Report by Worldpay from FIS

2) Common Global Implementation – Market Practice Group (formed October 2009)

Despite the tremendous push towards fully automating trade confirmations between banks and corporates in recent years, many transactions are still confirmed manually.

Manual confirmations are slow and error-prone, putting both sides of the trade at risk. In addition, many international regulations such as EMIR and Dodd-Frank have demanded an increase in automation.

Corporate treasurers often use SWIFT to standardize their confirmation messages. SWIFT is a cooperative that connects the financial community by providing highly secure financial messaging services that eliminate manual processing and makes inefficient paper confirmations redundant. More than 11,000 financial institutions, corporations, and other financial entities use SWIFT to exchange confirmations (SWIFT, 2019).

This article will explore several ways to confirm foreign exchange, money market, and currency option settlements through different solutions connected to SAP.

SWIFT Connectivity

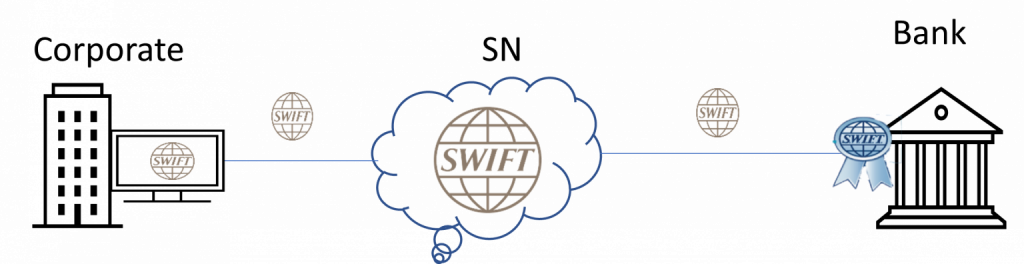

Over the last several years, the SWIFT Network has experienced growing popularity with corporates of all sizes, stretching from large corporates with a high volume of transactions to small-to-medium corporates with a lower volume of transactions. As a result, corporates have several options when deciding on a connectivity solution:

- Direct in-house connectivity, where access to the SWIFT Alliance Gateway (SAG) is managed in-house by your IT (Information Technology) department. However, this solution is not recommended by SWIFT due to its high complexity and requirement for specialist SWIFT knowledge.

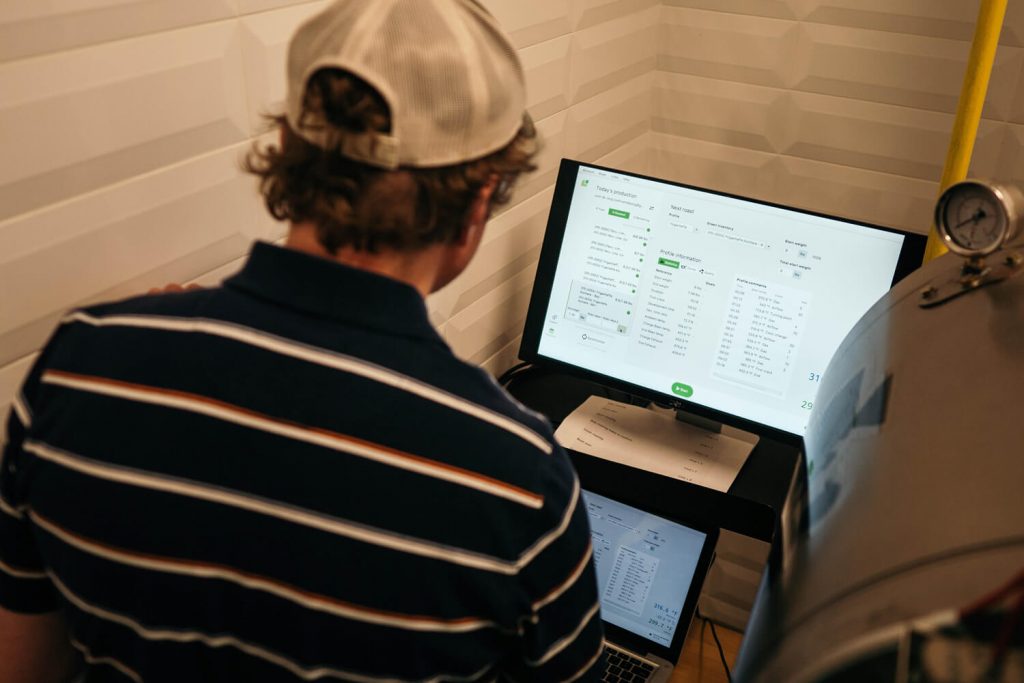

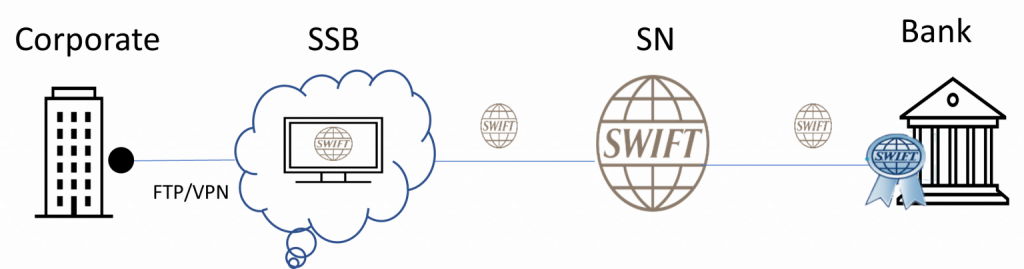

Figure 1: Direct Connectivity (SWIFT, 2019)

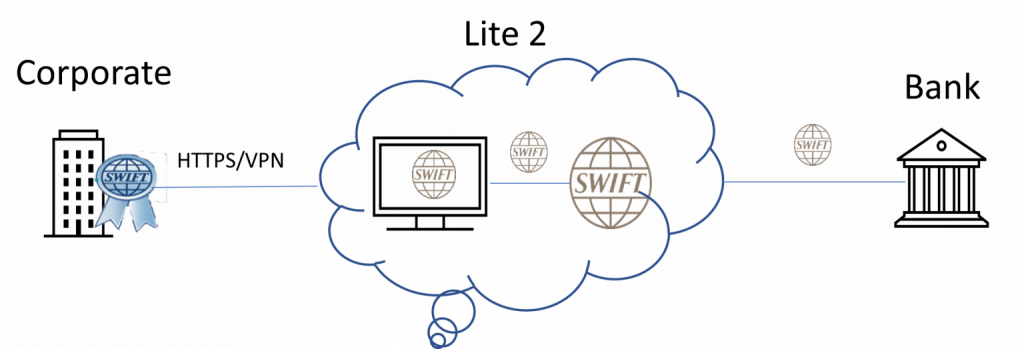

2. Alliance Lite2 is a packaged offering from SWIFT providing connectivity through a web browser or the embedded Lite2 for Business Applications (L2BA). Alliance Lite2 offers a simple, secure, cloud-based SWIFT connection. It connects to SWIFT through HTTPS and enables users to access the Alliance Lite 2 GUI. Since 2015, 61% of new corporate customers have opted for Alliance Lite2 (SWIFT, 2019).

Figure 2: Alliance Lite 2 (SWIFT, 2019)

3. SWIFT Service Bureaus (SSBs) provide a connection to the SWIFT network without the need to have an in-house IT department managing and maintaining the SWIFT connectivity. Furthermore, using an SSB can eliminate the need to undertake extra audit and compliance procedures. SSB providers vary in price but tend to be less expensive compared to direct in-house connectivity. It is still important to mention that initial investment is needed to set up the connectivity solution.

Figure 3: Swift Service Bureau (SWIFT, 2019)

4. Finastra Fusion Confirmation Matching Service (CMS) supports a hosted SWIFT connectivity through a Software as a Service (SaaS) application. It provides a confirmation matching solution for FX, Money Market, FX Options etc. This requires no upfront investment in infrastructure or implementation from the corporates availing of their services. It is directly hosted and managed and maintained by Finastra. Their File Transfer Service (FTS) is a secure process of moving messages between Misys CMS and clients ERP or TMS. FTS picks up and transfers files from the client to Misys CMS, converting the files to match trade data. After which, a matched message status is sent back to the client’s SAP TMS (Finastra, 2021).

Trading Platforms

Trading platforms such as 360T, Bloomberg and FXall offer automated back-office trade processing with SWIFT confirmation messages and trade matching.

The service allows corporate treasurers and banks to exchange deal confirmations directly on the trading platform. Messages are sent via the SWIFT networks directly to and from the banks, with the outgoing (incoming confirmation) and incoming messages (bankside confirmation) being automatically processed on the platform.

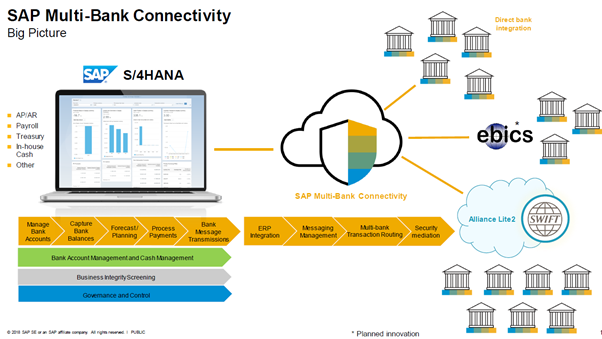

SAP Multi-Bank Connectivity

SAP Multi-Bank Connectivity (MBC) is SAP’s offering of a SWIFT connection embedded within Business Applications. This cloud-based solution offers a multi-bank digital channel between SAP and partner banks. In addition, SAP MBC is being provided as a SaaS solution by SAP.

A SWIFT Service provider is not needed for SAP customers to send confirmations messages through the SWIFT network, as SWIFT services are given by SAP through an embedded version of Alliance Lite 2. This streamlines trade confirmations for the TRM module, as message statuses are automatically updated directly in SAP. Moreover, the integration platform offers connectivity to partner banks through EBICS and Host-to-Host connection.

Figure 4: SAP MBC (SAP SE, 2018)

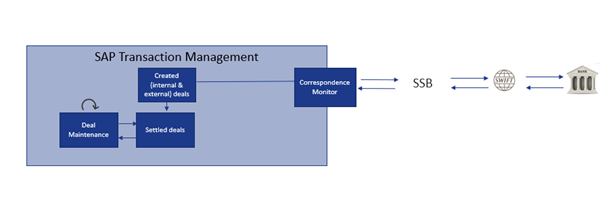

SAP Correspondence Monitor

This framework in SAP is an excellent tool to manage all correspondence objects. For example, back-office users can view incoming and outgoing messages and resend those messages previously failed to send. In addition, the monitor provides a historical overview of all the deals that have previously been confirmed.

Furthermore, it also allows you to view PDF messages that have been sent out, for example, to your internal counterparties. Through the t-code, technical users can customize messages when their requirements are not covered by standard functionality. For example, previously, SAP TRM did not offer MT305s as a standard message format. The user could then reconfigure standard functionality to fit different message types not provided in the standard TRM Module.

Below is an example of a corporates SAP TMS connected to the SWIFT network through a SWIFT Service Bureau.

Figure 5: SAP Confirmation Connectivity

Conclusion

SWIFT Service Bureaus and Alliance Lite2 have been the most popular choice in sending out confirmations to and from the bank, with over 50% of all corporates accessing SWIFT through either connection. However, the offering of SAP Multi-Bank Connectivity is especially attractive to those corporates with a technology roadmap leading towards SAP as a key ERP provider. Nowadays, many corporates are transitioning towards their S/4 HANA transformations journey and are looking at their SWIFT connectivity options. Therefore, SAP Multi-Bank Connectivity is likely to compare favorably to SWIFT Service Bureaus in the coming years.

References

1) Finastra. (2021). From https://www.finastra.com/sites/default/files/file/2021-09/Confirmation-Matching-Service_FS_GL3800_FINAL.pdf

2) SAP SE. (2018). SAP Multi-Bank Connectivity.

3) SWIFT. (2019). S4C Workshop., (p. 95). Cape Town.

Founded in 1949, ASICS is a global sports brand on a mission to champion the benefits of movement on the body, and the mind.

It’s why the company is called ASICS which stands for ‘Anima Sana In Corpore Sano’, or a ‘sound mind in a sound body’. In 2020, ASICS had a turnover of 328,784 million yen. With subsidiaries all over the world, ASICS wanted to standardize and make its treasury operations more efficient.

Global Mindset

In 2017, to further optimize their treasury function, ASICS Europe decided to implement the treasury management functionality of SAP. Besides the SAP Treasury and Risk Management (TRM) module, ASICS Europe also implemented SAP Cash Management (CM), SAP In-House Cash (IHC) as well as the SAP Bank Communication Manager (BCM).

With this came the decision to set up a new company code that will separate the treasury and commercial activities within ASICS Europe BV (AEB) as the tax ruling for AEB only allows this company to provide services and do business in Europe. In addition, the new company code (ASICS Europe Treasury) ensured global reach and provided cost savings and standardization as ASICS foresees treasury activities in Europe, Japan, and the Americas.

The Realization

ASICS soon realized that the original plan to service their entities in other regions with the IHB created in Europe would not go as planned. Instead, the different regions would be supported with a local solution. Therefore, splitting into two company codes became irrelevant.

Further, after using SAP TRM, CM, IHC and BCM for a few years, ASICS discovered that creating a legal entity administered in two different company codes was time consuming while executing their day-to-day processes, which were as follows:

- Consolidation of accounting entries: The accounting of the core business processes (i.e., commercial/sales) took place in AEB. The accounting of the treasury and IHC process took place in AEB Treasury. To form a consolidated set of books, the accounting entries needed to be consolidated into AEB. This required manual work as ledger entries were replicated from AEB Treasury into AEB through a manual entry process.

- Internal deal mirroring: At ASICS Europe (and subsidiaries), any FX exposure is hedged externally by AEB Treasury. It is subsequently internally delivered to the correct company code (AEB) by entering an internal deal contract. The internal deal needs to be entered manually but is automatically mirrored in the other company code (AEB Treasury). However, this process of manually entering the deal for the internal side soon was labor-intensive, which needed to be avoided.

Solution

To solve the shortcomings mentioned above, Zanders proposed various alternatives. After conducting a few workshops with the Treasury Department, it was decided to discontinue all the current processes (TRM, IHC, GL accounting) in the company code representing ASICS Europe Treasury and re-implement it in company code representing AEB. Accordingly, the company code representing ASICS Europe Treasury was discontinued, and all GL accounting now takes place in company code representing AEB. Hence, a single company code for the single legal entity. This saved treasurers time on labor-intensive activities, such as replicating accounting entries into company code representing AEB. Further, as internal dealing only occurred between company codes representing AEB and AEB treasury, ASICS would no longer have to use the internal dealing functionality by merging the two company codes. Removal of these activities would make the processes more efficient.

Zanders and ASICS identified that the proposed solution would require high implementation effort. It would also lose the flexibility to quickly split the TRM and IHC processes into a new legal entity. However, as the pros outweighed the cons, ASICS decided to go ahead with the merging of the two company codes.

The project started with Zanders updating the decision forms, configuration, and master data conversion documents created in 2017 during the SAP TRM and IHC implementation project, which reflected the changes, risks, and implications of migration.

After which, Zanders performed the configuration and unit testing of the new functionality in a development system, ensuring that it would not disrupt the treasurers’ daily activities while the project was ongoing. In addition, Zanders performed comprehensive unit testing to ensure all scenarios are included and using “My Standards” to ensure the payment structure is intact and still valid. Once Zanders updated the configuration in the system, the previous configuration documents were also updated to reflect the new changes in the system.

Moreover, once the treasury team signed the documents, ASICS business users performed a user acceptance (UAT) test to familiarize themselves with the new way of working.

In addition, Zanders guided ASICS stakeholders to prepare an extensive cutover plan detailing step by step activities that would need to be performed by the team. Finally, the team executed rigorous cutover rehearsals, ensuring no significant issues were encountered during the go live.

Take a step back

ASICS took a great deal to investigate their current processes and see what was working and what was not. A decision might be logical now, but it doesn’t mean it will still be in the future. ASICS showed how you can still move forward even when taking a step back, improving their processes and making them more efficient. Eugène Tjemkes, Head of Global Business Transformation Finance at ASICS adds: “I am very pleased with Zanders. They took care of everything that needed to be picked up. We have chosen a partner who really knows what it is all about."

LyondellBasell – Business Case

LyondellBasell, headquartered in the Netherlands, is one of the largest plastics, chemicals and refining companies in the world. With its global presence and significant operations in the United States, the company has been affected by the IBOR reform. The Treasury team was well aware of this impact and proactively approached the transition away from the IBOR rates in order to be ready ahead of time.

While it was a global and multi-functional project, one of the first goals was to ensure the TMS readiness for the calculation with alternative reference rates and the new discounting methodologies. As part of the action plan, the LyondellBasell (LYB) Treasury team (supported by procurement and IT) issued an RfP in Q4 2020 with the aim to get external support for (a) the required system changes, (b) to provide business support for initial transition plans and (c) to adhere to the best-in-class ambition of the company.

Preparing for the transition

LYB selected Zanders as implementation partner and right after the selection the project kicked off in January 2021. Urszula Chwala, was the Treasury Lead for LYB and she outlines why LYB initiated the project earlier than many other corporates: “The project team was already busy since the beginning of 2020. We analyzed the potential global impact of the IBOR reform to LYB. Amongst other impacts we were aware that LYB’s SAP Treasury Management System was highly customized, especially in the area of SAP In-house Cash. As such, we wanted to make sure that we would be ready for the transition to support our business and to enable all teams at LYB to move forward with changes on financial, commercial and legal matters.” Urszula also further comments on the RfP process: “We were looking into the third party that had both technical and business knowledge related to the IBOR reform and could bridge the gap between LYB IT and the Treasury department.”

Appreciated approach

LYB is using SAP ECC EHP8 as their treasury system and as such the standard functionality developed by SAP to support daily compound interest calculation could be implemented. On the Zanders side, SAP consultant Aleksei Abakumov, Adela Kozelova (who fulfilled the role of the business expert and project manager) and Anuja Naiknavare in the role of support consultant have been closely working with LYB’s Treasury and IT teams throughout the project.

“Zanders made this project as easy as it could be. What I really appreciated was the approach taken by Zanders team. They have taken all the suggestions from us and tested them and then came up with additional suggestions as well. The Zanders team was thinking with us, taking our best interest in mind. They supported us in every detail and removed concerns and roadblocks. Zanders also acted as business alliance in the project to ensure that all business requirements are now fully translated into the technical solution,” Urszula says.

A new functionality

In order to achieve system readiness, the project included configuration and diligent testing of a new data feed source which was required as a base to enable the daily average compound, the simple compound interest calculation and the new evaluation type with enhanced discounting curves. Considering the uncertainty, the availability of the new alternative reference rates, market conventions and the exact timing, the project’s aim was to make sure that the system would be able to support different variations of interest calculation. The project went successfully live in May 2021.

Urszula outlines different challenges encountered in the project: “Technically the biggest challenge was finding the right market data feed for the new rates. The challenge was finding the source and, making it available in SAP and test all scenarios. For the actual transactions, the system is a lot more flexible with respect to entering transactions, which makes a deal capture more complex. But Aleksei has supported the team a lot in navigating through the new functionality and we are confident to enter new deals with overnight risk-free rates. On the business side, the market clarity, especially with regards to market conventions, is still challenging the business cutover.”

Transactions

On the transition side, Treasury was cautiously managing the exposure to the IBOR reform by refraining from entering variable interest rate referencing transactions over the last two years. As a result, there is no need to cutover of any existing transaction. However, there are few intercompany loans that will mature by the end of this year and some of them might be replaced by the deals referencing to the overnight risk-free rates. Having strong presence in the United States, the exposure to the USD LIBOR is considerably higher than to the GBP and CHF LIBOR ceasing at the end of this year. Therefore, the major transition is only expected over the next year, closer to the cessation of the USD LIBOR.

Urszula elaborates on the business transition: “Understanding the logic of how new instruments are going to work gives me a piece of mind for the transition. LYB never meant to be an early adopter of the change. Switching intercompany loans as first seems to be the best approach for us, because there are no corresponding derivatives needed for these products. Also, there is no dependency on the external counterparties, which makes the transition easier.”

Really achieved

LYB and Zanders are currently working on a follow-up project for the cash flow aggregation of interest in SAP. This need emerged from the new daily compounding functionality, which by default creates daily cash flow postings that are difficult to reconcile with the interest settlements. A user-friendly solution to aggregate these daily cash flows has been defined and configured and is currently being validated by the end users. This is the last step for LYB to be ready to create a first deal with daily compounding interest calculation in the system.

Urszula concludes: “The change is coming so you can choose either to embrace it or to postpone it. We decided to embrace it now. The greatest achievement of this project is that the project was executed within original timelines, without major issues and it gave the whole Treasury team confidence that the system will perform well. What needed to be achieved was really achieved. The complete solution is already implemented for the technical side.”

One of the key finance related challenges that most corporates currently face is the IBOR reform.

How can SAP technology support organizations with the consequences of IBOR reform? In this article we outline the SAP enhancements relating to the IBOR reform, discuss how to implement these enhancements, and pinpoint specific areas of attention based on our most recent SAP projects on IBOR reform implementation.

SAP provides a roadmap to support interest rate benchmark reforms. SAP has developed a standard solution to support the daily compounding interest calculation with overnight risk-free rates, which have become the new interest rate benchmarks like for example for USD, GBP and CHF currencies. This standard solution has been included in different versions of SAP: from ECC EHP8 to most recent versions of S/4 HANA.

The SAP solution consists of a set of composite SAP notes that need to be installed. It is recommended to install the SAP notes as a part of the support pack. There are three core SAP composite notes to install:

- 2939657 (common basis for TRM and CML)

- 2932789 (RFR in TRM)

- 2880124 (for CML)

Additional SAP notes and/or activation of business functions may be required, especially if implementation takes place in SAP ECC. The implementation of the SAP notes is the first and the core step, but SAP also requires an update of the configuration objects.

Transaction management

The following five points should be followed for transaction management:

1) Activation of the parallel condition of the cash flow calculation.

This activation is done on the level of a respective product type. The following product categories are supported:

- Money market deals (product category 550 and 580)

- Bonds (product category 040)

- SWAP (product category 620)

SAP recommends the creation of the new product types. It is also possible to do the activation by extending the configuration of the existing product types without any issues. However, we would still recommend executing prove-of-concept prior to amending existing product types to ensure there is no regression effect or dumps in the specific SAP environment.

Activation of parallel conditions will enable the following enhancements in SAP:

- New interest conditions (Compound interest calculation and Average compound interest calculation) with spread components that can be calculated linearly or compounded.

- Updated interest cash flow calculation according to the new interest conditions (new FiMa).

- Parallel interest conditions (spread is linear and maintained as separate flow in the deal).

- New fields and functionalities in the deal maintenance (Weighting, Lookback, Lockout periods etc).

Please note that SAP may require extra business function activation to enable selection of cash flow calculation in SPRO (such as FIN_TRM_INS_LOCBR).

2) For the Interest rate swaps the below notes should be installed:

- 2971185 (Risk-Free Rates for Interest Rate Swaps: Collective Note)

- 2973302 – Business Function: Interest Rate Swap Enhancements (FIN_TRM_IR)

It is strongly recommended to install and run report ZSAP_FTR_IRSWAP_NOTES which will indicate if any SAP note or business function is missing or invalid.

3) Amendment of the field selection for the respective condition types.

With the changes there are more fields to be created, therefore field selection needs to be changed accordingly.

4) There are new fields to be created in the deals, therefore you should consider if changes are required in the field selection in Transaction manager.

5) In the case where mirror deals are configured, you should validate that the conditions (interest calculation type of nominal interest and date structure) in the mirror deals are properly mirrored. Activation of the business function FIN-TRM-MME may be required.

Yield Curve Framework

Creation of the new yield curves where the new grid points should represent the reference interest rates based on the overnight risk-free rates. IBOR reform might result in a need for a corporate to change methodology for mark-to-market calculations of the financial instruments. New discounting yield curves will be required for the net present value calculation of FX contracts and interest rate derivatives. New yield curves might also be required for projecting future cash flows for interest rate derivatives in the mark-to-market calculations.

Creation of new yield curves (and evaluation types) requires thorough attention and input from Treasury and Accounting teams and it should be signed off by the auditor. This configuration also requires good communication with market data providers in order to retrieve correct data for the additional data feed.

Market Risk Analyzer

Creation of the new evaluation types. This is required to enable cash flow discounting to be based on the new yield curves. It is not recommended to amend existing calculation types for the audit purposes.

Market data feed

New reference interest rates in SAP. It is essential to have the new set of risk-free-rates as well as IBOR fallback rates, adjusted or term rates received from your market data provider. The scope here fully depends on the existing active deals, your migration approach, and alignment with your financial counterparties.

Treasury Accounting

Changes in assignment of the update types for accrual/deferral. An additional grouping term is required to be added for the respective update types.

In case there is a business need to aggregate daily cash flows, changes to the flow types for the nominal interest are required. With compound interest calculation, SAP calculates and posts interest cash flows daily, while interest settlement occurs based on the terms of the deal. Hence, daily flows (e.g. 30 flows for a monthly settlements) need to be reconciled with a single settlement at the settlement date. This daily cash flow maintenance and reconciliation may lead to extra workload for the back office/accounting team. Therefore, businesses might prefer to aggregate (net) these daily cash flows. A new flow type and derivation rule may be configured to support this requirement. This would be an update of the existing accounting, which represents a potential regression impact.

SAP IHC interest conditions

Consider changes in the IHC interest conditions for debit/credit balances in case a variable reference interest rate based in RFR is applied. Please note that SAP IHC does not support compounding of the interest for the daily balancing.

Reports

We also recommend executing a round of regression testing of SAP TRM. The new functionality potentially can impact your reports’ variants and layouts, therefore potential regression updates are required. Please validate if the fields showing variable interest rates are properly populated with the data, especially the collective processing report for OTC interest rate instrument (TI92).

Custom functionality and SAP queries

It is important to review your bespoke functionalities in SAP, which are related to TRM, MRA, Market data feed etc. Additionally, it is worthwhile to validate your SAP queries for Treasury, especially the ones designed for month end purposes: NPVs, Accrual/Deferral calculation etc. Pay attention to table TRLIT_AD_TRANS and how the table is updated.

IBOR reform and Zanders

Zanders is closely following all IBOR reform related regulations and latest developments. We have also developed a proprietary methodology to support our clients in this regulatory transition, with several projects already successfully completed.

Given our expertise in treasury management, valuations and treasury technology, we are well equipped to support financial and nonfinancial organizations in the IBOR reform from both a functional and a technological perspective. We assist our clients throughout the entire project, from the impact assessment to roadmap definition, and finally the transition itself. Functional support could include definition of the new reference rates, definition of the new yield curves for discounting and projecting future cash flows, formulation of the business cutover plan, support in the new interest calculation methodologies and new market conventions, changing procedures and other many other activities.

Traditionally the SAP Treasury functionality has been heavily focused on accounting, reporting, and monitoring of treasury transactions that have already been executed. But now, pre-trade processes can be optimized with SAP Trade Platform Integration (TPI).

In any SAP Treasury implementation, conversation will eventually turn to the integration of external systems and providers for efficient straight-through processing of data and the additional controls it provides. SAP has introduced the TPI functionality to manage one of the more challenging of these interfaces which is the integration between SAP and the external trade platforms.

The general outline for any trade integration solution would contain the following high-level components:

- The ability to collect the trade requirements in the form of FX orders from all relevant sources.

- A trade dashboard for the dealers to view and manage all requested orders.

- Ability to send the FX orders to an external trade platform for trade execution.

- Capturing of the executed trade in the treasury module, ensuring that the FX order data is also recorded to identify the purpose of the FX transaction.

There are many levels of complexity of how each of these components have been developed in the past for different organizations, from the simplest Excel templates to the most complex bespoke modules with live interfaces to manage the end-to-end trading needs.

The choice of how much an organization would want to invest in these complex solutions would depend on the volume, importance of the trading function, need for enhanced control around trading, and the level of enriched data to be recorded automatically on the deals. Now, with a standard alternative available from SAP, an extensive business case may no longer be necessary to incorporate the more complex of these requirements, as the improved controls and efficiency of processing data is available with less risk and investment than previously considered.

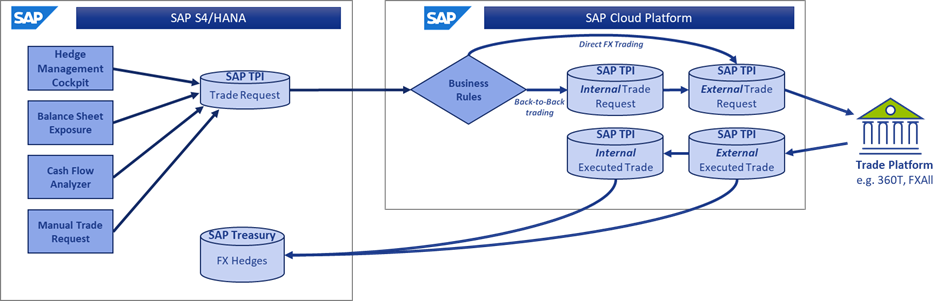

The solution can be broadly defined under the SAP S/4 HANA functionality and the SAP Cloud Platform (SCP) functionality as seen below.

Figure 1

SAP S/4 HANA – Trade Platform Integration

The S/4 HANA functionality covers the first of the components mentioned before. Here SAP has introduced an entirely new database in the SAP environment to manage and control Trade Requests – the SAP equivalents of FX orders.

These Trade Requests may be created automatically off the back of other SAP tools such as Cash Management, Hedge Management Cockpit, Balance Sheet Hedging or simply from manual requests. The resulting Trade Request contains the same data categorizations that apply to a deal in TRM, such as portfolio, characteristics, internal references, and other fields normally found under Administration. All of this data collected prior to trading will be carried to the actual deal once executed, ensuring the dealers will not be responsible for accurately capturing this information on the deal that may not be relevant to them but necessary for further processing.

The clear benefit of this new integration is that it bridges the gap between the determination of trade requirements from Cash Management or FX risk reporting, and the dealers who are to execute and fulfil the trades. This allows the information related to the purpose of the trade (e.g.; the portfolio, exposure position, profit center, etc.) to be allocated to the Trade Request and subsequently to the executed trade automatically without the need of any manual enrichment.

Specially within the context of the Hedge Management Cockpit, this is very useful in the further automatic assignment of trades to hedge relationships, as the purpose of the trade is carried throughout the process.

SAP Cloud Platform – Trade Platform Integration

While the database in S/4 HANA remains the central transaction data source throughout the process, the functionality in SCP provides a set of tools for the dealers to manage the trades requests as needed.

This begins with some business rules to help differentiate how the trades will be fulfilled, either directly externally with a bank counterparty or internally via the treasury center.

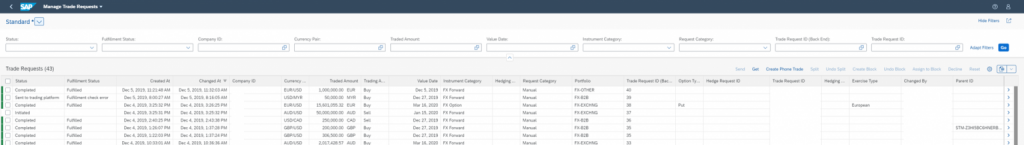

All the external trades now can be found on the central Trade Request dashboard “Manage Trade Requests”, which acts as an order book from where the dealers/front office have a clear view on all deal requests that are been triggered from different areas of the organization and where in addition to being able to manage all the trade requests centrally, the status of each trade request is available to ensure no duplicate trading.

Figure 2

Figure 3

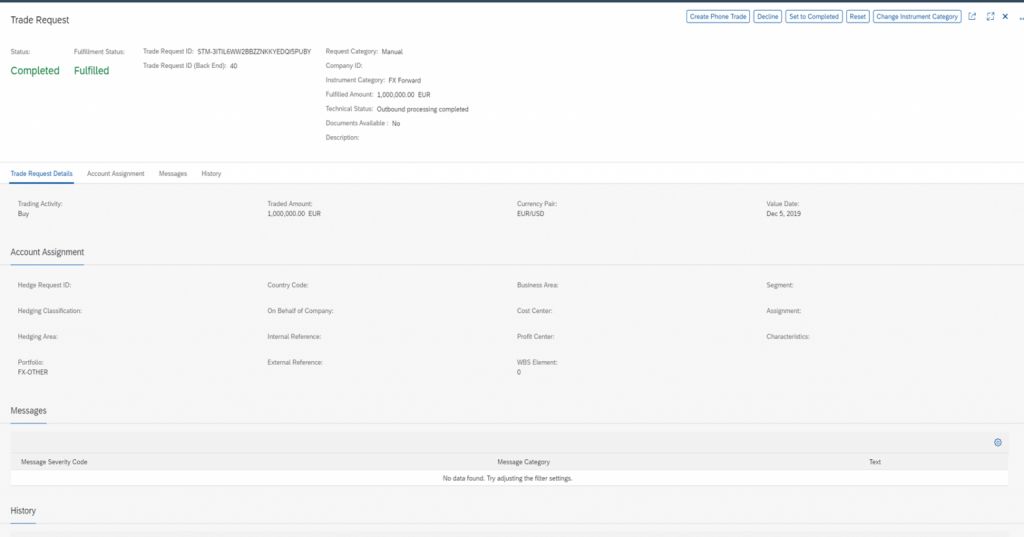

From the dashboard, a dealer can choose to group trades into a block, split the trades and edit them as necessary or alternatively the Trade Requests may be cancelled or manually traded as a “Phone Trade”.

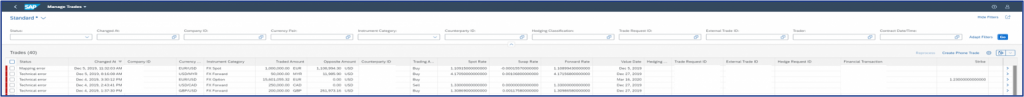

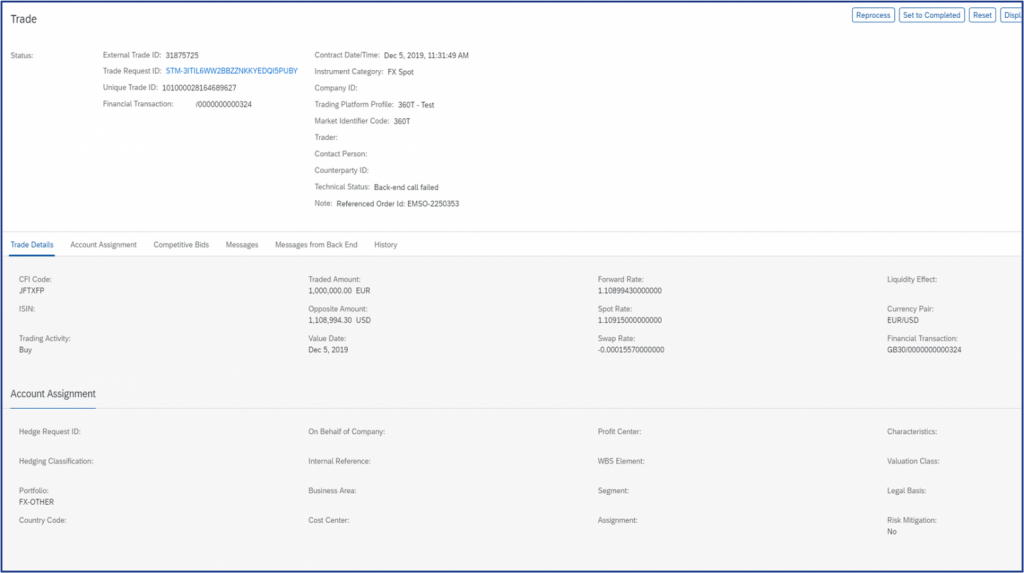

The Send function on the dashboard will trigger the interface to the external trade platform for the selected trade requests taking into account the split and block trade requirements. The requests will then be executed and fulfilled on the external platform where the executed trade details such as rate and counterparty are captured back in the application, which in turns triggers the automatic creation of the FX deal in SAP S/4 HANA. The executed trade details can then be displayed on SCP application “Manage Trades”.

Figure 4

Figure 5

Internal trade requests can be automatically fulfilled at a price determined by the business rules defined by the users. This includes pricing based on the associated external deal rate (back-to-back scenario) with a commission, or pricing based on market data with a commission element.

The deals captured in SAP S/4 HANA whether internal or external, all contain the enriched data with all the originating information relating to the trade request, so that the FX deal itself accurately reflects the purpose of the position for further reporting.

Future SAP Roadmap

Although initially only the FX instruments were included in scope, SAP is now extending the ability to execute Money Market Fund purchases and sales through the platform including the associated dividend and rebate flows. This is another step to truly set up the TPI function as a central trade location for front office to operate from, covering not only FX risk requirements, but also the management of cash investment transacting.

Credit risk management is also now on the table, with pre-trade credit risk analyzer information integrated to the TPI application so that counterparty limits may be checked pre-trade to give the opportunity to exclude certain counterparties from quotation. This is certainly an improvement on the historical functionality of SAP TRM where a breach would only be noted after the deal has already been executed.

Conclusion

The recent SAP advancements in the area of TPI provide many opportunities for an organization to incorporate additional control, efficiency and transparency to the dealing process, not only for the front office, but also for the rest of the treasury team. While dealers benefit from a central platform where they can best execute the trades, middle office can get immediate feedback on their FX exposure positions as the deal immediately reflects with the correct characteristics, while the cash management team benefits from a simple ability to request and monitor the FX and investment decisions that have been sent to the dealers. The accounting team stands to benefit greatly as the accounting parameters on the deal are no longer the domain of a front office trader, but rather can be determined by the purpose of the original trade request which dictates the accounting treatment, including the automatic assignment to hedge relationships.

The SAP TPI solution therefore optimizes not only the dealers’ execution role, but also ties together the preceding and dependent processes into one fully straight through process that will benefit the whole treasury organization.

The provision of market data to support not only an organization’s treasury function but the wider business functions can become a time-consuming and potentially complex exercise.

It is no longer just about the source of market data, questions such as integration, validation, storage, consistency and distribution within an organization need to be considered. In this article we will look at some of the considerations when deciding on how to source market data and how in-built applications can reduce risk and cost while improving automation.

Which Market Data Vendor?

There are multiple market data vendors, either directly providing data or consolidating (normalizing) data from multiple sources before making it available to clients. To choose a market data vendor, an organization must firstly understand what the requirements are and this is not only based on the Treasury requirements but wider business and IT requirements:

- What data and when should it be delivered?

- IT capabilities to develop and maintain an interface or leverage inbuilt third party/core application capabilities

- Data validation and distribution

Integration

Market data vendors can provide data using multiple methods, from Excel downloads to a simple file transfer to integrated APIs to import data directly into its applications. The level of integration is driven by the market data requirements, for example, a few FX rates once a month will not justify a level of integration above importing an Excel spreadsheet or even manually entering the rates. However, most organizations require large data sets, sourced on a timely basis and validated without the need for manual intervention.

The way an organization integrates market data will, in some way, depend on the IT strategy and in-house capabilities. Some IT functions have strong in-house development teams capable of building and maintaining APIs to retrieve and import the market data, others will prefer to have the market data integration managed by a third party application. There are costs associated with both options but leveraging the inbuilt capabilities of an application that is already part of the organizations IT landscape can reduce not only the complexity of loading market data but long-term costs of maintaining the solution.

SAP and some top tier TMS applications act as a market data vendor by providing an inbuilt market data interface to access market data. SAP’s Market Rates Management module provides standard integration to both Refinitiv (formerly Thomson Reuters) as well as a more generic option for loading rates from other sources. The key benefit of SAP’s Market Rates Management is that it allows an organization to define its data requirements and import the data from a single source under a single contract while reducing the IT overhead as the module will fall under existing SAP support structures.

Validation and Distribution

Having correct and precise market data is crucial in almost every treasury process while business processes require a consistent data set across all platforms and operations. Market data validation has grown increasingly important, historically, manual, Excel-based or fully bespoke system processes have been used to validate market data, providing a very limited audit trail, introducing user errors and the potential to impact financial postings should an error not be identified. Automated data validation uses rules-based processes executed once the market data has been received that identify, remove, or flag inaccurate or anomalous information, delivering a clean dataset, ensuring the accuracy of the market data in the receiving applications/systems is correct and identical.

The distribution of validated market data to all systems and applications that require it needs to be considered when selecting a market data provider and integration solutions. There may be license implications in distributing data to multiple systems and applications which can increase the recurring costs while the options to distribute the data have the similar IT considerations as the initial integration but potentially on a larger scale, depending on how many different systems and applications require the data. As with the integration to the market data vendor, the ability to leverage 3rd party applications can reduce the costs and complexity of market data distribution.

We can support the validation and distribution process with a tool: Zanders Market Data Platform. This Zanders Inside solution, powered by Brisken, builds a bridge between the market databases and the enterprise application landscape of companies. In this way, the Market Data Platform takes away the operational risks of the market data process. The Market Data Platform runs on the SAP Cloud Platform infrastructure to ensure a secure cloud computing environment to integrate data and business processes to meet all your market data needs.

How does the Market Data Platform work?

The Market Data Platform has many functionalities. First, the platform retrieves the market data from the selected sources. Also, the platform is the source of truth for historical market data, and all activities are logged in the audit center. Subsequently calculations and market data validations are performed. Finally, the hub distributes the market data across the company’s system landscape at the right time and in the right format. The platform can directly be linked to SAP through the cloud connector, and connections to other treasury management systems are also possible, for example with IT2 or with text files. The added value of the Market Data Platform versus other solutions such as SAP Market Rates Management is the additional validation of data e.g., checking completeness and accuracy of the received data on the platform before distributing it for use.

The Zanders Market Data Platform is the solution for your market data validation processes. Would you like to learn more on this new initiative or receive a free demo of our solution? Do not hesitate to reach out to us!