Bank connectivity – Making the right choices

In this article we explore some methods to connect corporate ERP or treasury systems with partner banks. In addition, it explores some trends on how SWIFT is accessed and covers SAP’s Multi-Bank Connectivity tool.

Bank connectivity options

Within the space of bank connectivity, there is a range of choices that corporates face when deciding the best way to integrate banks towards their ERP or treasury platforms.

E-banking

The most historic option, with users logging into online banking platforms to extract bank reporting and initiate payments. Banking platforms have evolved, with some offering electronic statement download (which can be readily imported into ERPs), and payment status monitoring. Whilst a readily available, easy-to-use solution, it has issues with controls and requires separate platforms for each bank.

SWIFT

SWIFT provides global coverage to a wide range of banks. It is seen as the global standard in bank connectivity, and from a bank perspective we have seen the membership increase.

There are two channels available:

| Channel | Message Types |

| FIN | SWIFT MT Messages – e.g. MT101, MT940 |

| FileACT | Any Message Type – typically ISO20022 |

SWIFT FileAct is suited to AP Payments, as ISO20022 message standards permit high volumes of payments in files. SWIFT FIN is more commonly used for treasury integration, due to the historic use of SWIFT MT messages. As ISO20022 is more widely adopted, SWIFT FileAct will become the default choice for messaging channel.

A useful tool to identify if your partner banks are onboard is SWIFT’s Readiness Portal.

EBICS

Originally developed as a financial messaging transmission vehicle for Germany, EBICS has been later extended to France and Switzerland. It provides wide coverage of banks within these countries, but is not in use outside of these countries.

It generally has a lower total cost of ownership than SWIFT. The geographic restrictions mean that this is commonly used for corporates who have strong focus in the German, French or Swiss Market. For corporates operating on a global basis, EBICS does not tend to provide the bank coverage that is required.

Host-to-host (H2H)

H2H connections are direct connections from a corporate’s integration system towards a specific bank.

H2H connections are most suitable where corporates engage with a single core bank who can support local services and branch coverage in all relevant markets. These can have a lower total cost of ownership compared to using SWIFT, but this solution has a level of bank lock-in.

Direct to clearing house (UK BACS)

Within the UK, the primary clearing house is BACS, which ensures settlements of payments between debtor and creditor banks.

It is common practice in the UK for corporates to make payment instructions & direct debit instructions directly to the local clearing house BACS, where the partner bank acts as a sponsor. This requires a BACS service bureau who can act as a gateway into the BACS network. This is commonly known as “direct transmission”.

An alternative to this transfer method is “indirect transmission” where payments and direct debits are sent to the partner bank, via any of the preceding methods before being submitted to BACS itself.

API connectivity

Triggered by the PSD2 initiative, banks are now offering API connectivity.

One of the issues with API connectivity is that modern API design is targeted towards JSON formats, whilst ISO20022 is an xml-based schema. Due to low levels of standardization across different banks and countries, this has meant that ERPs and treasury platforms may require bespoke functionality to cater for these bank-specific APIs.

It is likely that these will become the future of bank connectivity, but will require some level of standardization, which could possibly come under the SWIFT umbrella.

Access to SWIFT

Connectivity of corporates to the SWIFT network has expanded over the last years from the largest corporates with high volumes of bank connections, to small-to-medium corporates with lower volumes of bank connections. To access the global SWIFT network, there are 4 main options that corporates can leverage:

- In-house – SAG

SWIFT Alliance Gateway (SAG) was the standard connection offered to corporates. It requires specialist SWIFT knowledge and has high complexity. This is no longer encouraged by SWIFT. - Outsourced – SSB

SWIFT Service Bureaus (SSBs) remove the complexities of establishing the connection to the SWIFT network. SSBs certified by SWIFT manage the hardware and access configuration. Nowadays approximately 50% of all corporates access SWIFT through a SSB. - In-house – Alliance Lite 2

SWIFT introduced Alliance Lite2 to enable smaller corporates to connect to the network. SWIFT proprietary software, installed locally, in combination with a hard token, transfers messages to the SWIFT network. Since each transmission may require an approval, this option is not fit for corporates with high payment volumes/STP-rates. - Outsourced – Alliance Lite2 embedded within Business Application

Applications (L2BA) Since 2012, SWIFT has offered Alliance Lite2 including business applications for treasury management systems, bank connectivity providers and in-house banking/payment factory providers. Even though this option is relatively new, it gained popularity very quickly, with corporates looking to externalize bank connectivity whilst keeping total cost of ownership to a minimum.

For corporates having joined SWIFT since January 2018, 64% have opted for the SWIFT Cloud Alliance Lite 2 options. It is likely that the adoption of the embedded Alliance Lite 2 is behind this trend.

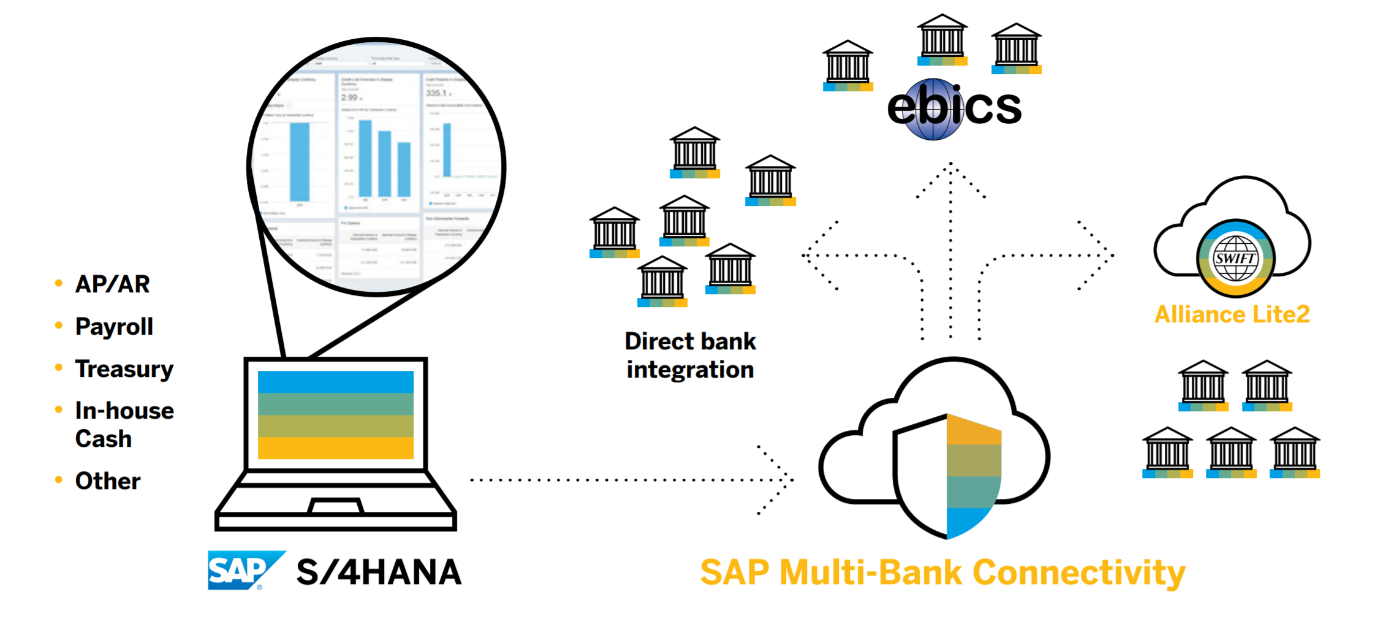

SAP Multi-Bank Connectivity

SAP Multi-Bank Connectivity (MBC) is SAP’s offering of a SWIFT connection embedded within Business Applications. SAP MBC is offered as a software-as-a-service solution by SAP. This is a revived form of SAP’s Financial Services network, which was launched in 2015, but with an enhanced offering such as integrated SWIFT connection.

Embedded within the SAP Cloud Platform, it provides capability for exchange of financial messaging with partner banks. As well as connectivity to the SWIFT network through an embedded version of Alliance Lite 2, this integration platform offers connectivity to partner banks through EBICS and H2H connections.

From a technical perspective, SAP MBC can perform transmissions using SFTP, REST, SOAP and AS2. We have seen evidence of corporate group IT policies dictating preferred transmission methods, so it is important that bank connectivity tools accommodate these. The platform has 99% up-time, and various failover mechanisms in place.

SAP MBC is particularly relevant to those corporates who are looking to move towards SAP as a strategic software vendor. With many corporates embarking on S/4 HANA transformation, it is a popular consideration.

We expect to see this offering as strong competition to SWIFT Service Bureaus going forward, especially where corporates are not leveraging the value-add services that SSBs offer.