Biodiversity risks scoring: a quantitative approach

Explore how Zanders’ scoring methodology quantifies biodiversity risks, enabling financial institutions to safeguard portfolios from environmental and transition impacts.

Addressing biodiversity (loss) is not only relevant from an impact perspective; it is also quickly becoming a necessity for financial institutions to safeguard their portfolios against financial risks stemming from habitat destruction, deforestation, invasive species and/or diseases.

In a previous article, published in November 2023, Zanders introduced the concept of biodiversity risks, explained how it can pose a risk for financial institutions, and discussed the expectations from regulators.1 In addition, we touched upon our initial ideas to introduce biodiversity risks in the risk management framework. One of the suggestions was for financial institutions to start assessing the materiality of biodiversity risk, for example by classifying exposures based on sector or location. In this article, we describe Zanders’ approach for classifying biodiversity risks in more detail. More specifically, we explore the concepts behind the assessment of biodiversity risks, and we present key insights into methodologies for classifying the impact of biodiversity risks; including a use case.

Understanding biodiversity risks

Biodiversity risks can be related to physical risk and/or transition risk events. Biodiversity physical risks results from environmental decay, either event-driven or resulting from longer-term patterns. Biodiversity transition risks results from developments aimed at preventing or restoring damage to nature. These risks are driven by impacts and dependencies that an undertaking has on natural resources and ecosystem services. The definition of impacts and dependencies and its relation to physical and transitional risks is explained below:

- Companies impact natural assets through their business operations and output. For example, the production process of an oil company in a biodiversity sensitive area could lead to biodiversity loss. Impacts are mainly related to transition risk as sectors and economic activities that have a strong negative impact on environmental factors are likely to be the first affected by a change in policies, legal charges, or market changes related to preventing or restoring damage to nature.

- On the other hand, companies are dependent on certain ecosystem services. For example, agricultural companies are dependent on ecosystem services such as water and pollination. Dependencies are mainly related to physical risk as companies with a high dependency will take the biggest hit from a disruption or decay of the ecosystem service caused by e.g. an oil spill or pests.

For banks, the impacts and dependencies of their own operations and of their counterparties can impact traditional financial (credit, liquidity, and market) and non-financial (operational and business) risks. In our biodiversity classification methodology, we assess both impacts and dependencies as indicators for physical and transition risk. This is further described in the next section.

Zanders’ biodiversity classification methodology

An important starting point for climate-related and environmental (C&E) risk management is the risk identification and materiality assessment. For C&E risks, and biodiversity in particular, obtaining data is a challenge. A quantitative assessment of materiality is therefore difficult to achieve. To address this, Zanders has developed a data driven classification methodology. By classifying the biodiversity impact and dependencies of exposures based on the sector and location of the counterparty, scores that quantify the portfolio’s physical and transition risks related to biodiversity are calculated. These scores are based on the databases of Exploring Natural Capital Opportunities, Risks and Exposure (ENCORE) and the World Wide Fund for Nature (WWF).

Sector classification

The sector classification methodology is developed based on the ENCORE database. ENCORE is a public database that is recognized by global initiatives such as Taskforce on Nature-related Financial Disclosures (TNFD) and Partnership for Biodiversity Accounting Financials (PBAF). ENCORE is a key tool for the “Evaluate” phase of the TNFD LEAP approach (Locate, Evaluate, Assess and Prepare).

ENCORE was developed specifically for financial institutions with the goal to assist them in performing a high-level but data-driven scan of their exposures’ impacts and dependencies. The scanning is made across multiple dimensions of the ecosystem, including biodiversity-related environmental drivers. ENCORE evaluates the potential reliance on ecosystem services2 and the changes of impacts drivers3 on natural capital assets4. It does so by assigning scores to different levels of a sector classification (sector, subindustry and production process). These scores are assigned for 11 impact drivers and 21 ecosystem services. ENCORE provides a score ranging from Very Low to Very High for a broad range of production processes, sub-sectors and sectors.

To compute the sector scores, ENCORE does not offer a methodology for aggregating scores for impacts drivers and ecosystem services. Therefore, ENCORE does not provide an overall dependency and impact per sector, sub-industry, or production process. However, Zanders has created a methodology to calculate a final aggregated impact and dependency score. The result of this aggregation is a single impact and a single dependency score for each ENCORE sector, sub-industry or production process. In addition, an overall impacts and dependencies scores are computed for the portfolio, based on its sector distribution. In both cases, scores range from 0 (no impact/dependency) to 5 (very high impact or dependency).

Location classification

The location scoring methodology is developed based on the WWF Biodiversity Risk Filter (hereafter called WWF BRF).5 The WWF BRF is a public tool that supports a location-specific analysis of physical- and transition-related biodiversity risks.

The WWF BRF consists of a set of 33 biodiversity indicators: 20 related to physical risks and 13 related to reputational risks, which are provided at country, but also on a more granular regional level. These indicators are aggregated by the tool itself, which ultimately provides one single scape physical risk and scape reputational risk per location.

To compute overall location scores, the WWF BRF does not offer a methodology for aggregating scores for countries and determine the overall transition risk (based on the scape reputational risk scores) and physical risk (based on the scape physical risk scores). However, Zanders has created a methodology to calculate a final aggregated transition and physical risk score for the portfolio, based on its geographical distribution. The result of this aggregation is a single transition and physical risk score for the portfolio, ranging from 0 (no risk) to 5 (very high risk).

Use case: RI&MA for biodiversity risks in a bank portfolio

In this section, we present a use case of classifying biodiversity risks for the portfolio of a fictional financial institution, using the sector and location scoring methodologies developed by Zanders.

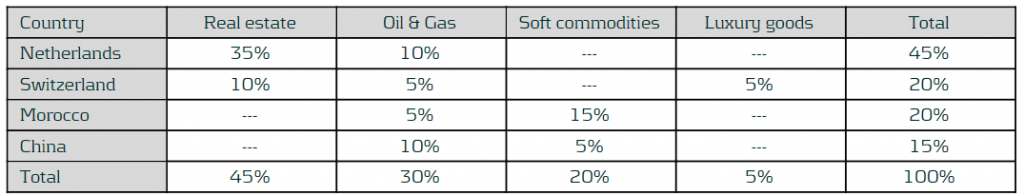

The exposures of this financial institution are concentrated in four sectors: Real estate, Oil & Gas, Soft commodities and Luxury goods. Moreover, the operations of these sectors are located across four different countries: the Netherlands, Switzerland, Morocco and China. The following matrix shows the percentage of exposures of the financial institution for each combination of sector and country:

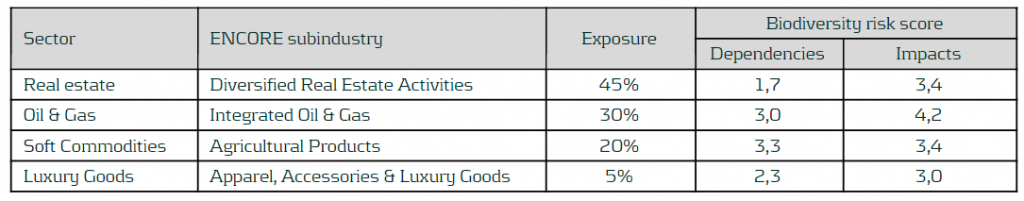

ENCORE provides scores for 11 ecosystem services and 21 impacts drivers. Those related to biodiversity risks are transformed to a range from 0 to 5. After that, biodiversity ecosystem services and biodiversity impacts drivers are aggregated into an overall biodiversity impacts and dependencies scores, respectively. The following table shows the mapping between the sectors in the portfolio and the corresponding sub-industry in the ENCORE database, including the aggregated biodiversity impacts and dependencies scores computed for those sub-industries. The mapping is done at sub-industry level, since it is the level of granularity of the ENCORE sector classification that better fits the sectors defined in the fictional portfolio. In addition, the overall impacts and dependencies scores are computed, by taking the weighted average sized by the sector distribution of the portfolio. This leads to scores of 3.8 and 2.4 for the impacts and dependencies scores, respectively.

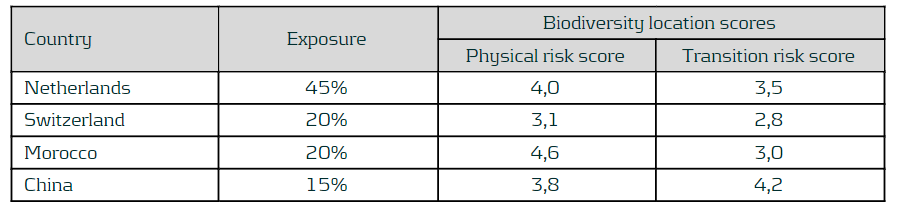

The WWF BRF provides biodiversity indicators at country level. It already provides an aggregated score for physical risk (namely, scape physical score) and for transition risk (namely, scape reputational risk score), so no further aggregation is needed. Therefore, the corresponding scores for the four countries within the bank portfolio are selected. As the last step, the location scores are transformed to a range similar to the sector scores, i.e., from 0 (no physical/transition risk) to 5 (very high physical/transition risk). The results are shown in the following table. In addition, the overall impacts and dependencies scores are computed, by taking the weighted average sized by the geographical distribution of the portfolio. This leads to scores of 3.9 and 3.3 for the physical and transition risk scores, respectively.

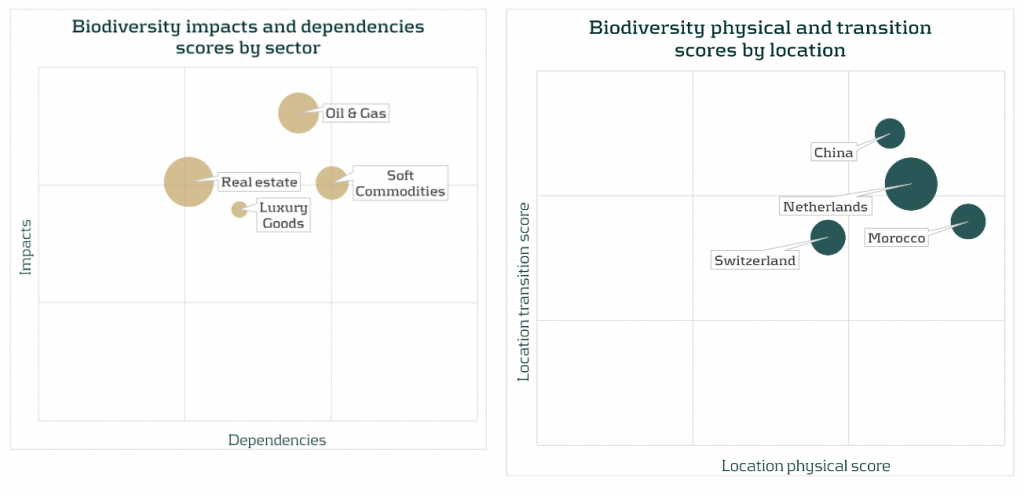

Results of the sector and location scores can be displayed for a better understanding and to enable comparison between sectors and countries. Bubble charts, such as the ones show below, present the sectors and location scores together with the size of the exposures in the portfolio (by the size of each bubble).

Combined with the size of the exposures, the results suggest that biodiversity-related physical and transition risks could result in financial risks for Soft commodities and Oil & Gas. This is due to high impacts and dependencies and their relevant size in the portfolio. Moreover, despite a low dependencies score, biodiversity risks could also impact the Real estate sector due to a combination of its high impact score and the high sector concentration (45% of the portfolio). From a location perspective, exposures located in China could face high biodiversity transition risks, while exposures located in Morocco are the most vulnerable to biodiversity physical risks. In addition, relatively high scores for both physical and transition risk scores for Netherlands, combined with the large size of these exposures in the portfolio, could also lead to additional financial risk.’

These results, combined with other information such as loan maturities, identified transmission channels, or expert inputs, can be used to inform the materiality of biodiversity risks.

Conclusion

Assessing the materiality of biodiversity risks is crucial for financial institutions in order to understand the risks and opportunities in their loan portfolios. In this article, Zanders has presented its approach for an initial quantification of biodiversity risks. Curious to learn how Zanders can support your financial institutions with the identification and quantification of biodiversity risks and the integration into the risk frameworks? Please reach out to Marije Wiersma, Iryna Fedenko or Miguel Manzanares.

- https://zandersgroup.com/en/insights/blog/biodiversity-risks-and-opportunities-for-financial-institutions-explained ↩︎

- In accordance with ENCORE, ecosystem services are the links between nature and business. Each of these services represent a benefit that nature provides to enable or facilitate business production processes. ↩︎

- In accordance with ENCORE AND Natural Capital Protocol (2016), an impacts driver is a measurable quantity of a natural resource that is used as an input to production or a measurable non-product output of business activity. ↩︎

- In accordance with ENCORE, natural capital assets are specific elements within nature that provide the goods and services that the economy depends on. ↩︎

- The WWF also provides a similar tool, the WWF Water Risk Filter, which could be used as to assess specific water-related environmental risks. ↩︎