BCBS Principles for the effective management of climate-related financial risks

Climate change presents risks to the banking system.

These risks stem from the transition towards a low carbon economy and from the physical risks of damages due to extreme weather events. To address climate-related financial risks within the banking sector, the Basel Committee on Banking Supervision (BCBS) established a high-level Task Force on Climate-related Financial Risks in 2020. It contributes to the BCBS’s mandate to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial stability.

Both the BCBS’s Core principles for effective banking supervision1 and the Supervisory Review and Evaluation Process (SREP) within the existing Basel Framework are considered sufficiently broad and flexible to accommodate additional supervisory responses to climate-related financial risks. It was felt, however, that supervisors and banks could benefit from the publication of the Principles for the effective management and supervision of climate-related financial risks2. Through this publication, the BCBS seeks to promote a principles-based approach to improving risk management and supervisory practices regarding climate-related financial risks. The document contains principles directed to banks and principles directed to supervisory authorities. In this article, we present an overview of the principles directed to banks.

The BCBS published a draft of their Principles in November 2021. During the consultation phase, which lasted until February 2022, banks and supervisors could provide feedback. The BCBS incorporated their feedback in the final version of the Principles that were published in June 2022.

Principles for the management of climate-related financial risks

In total, twelve bank-focused principles are presented and grouped in eight categories. Each of the eight categories is briefly discussed below:

Corporate governance – Principles 1 to 3

The principles related to corporate governance state that banks first need to understand and assess the potential impact of climate risks on all fields they operate in. Subsequently, appropriate policies, procedures and controls need to be implemented to ensure effective management of the identified risks. Furthermore, roles and responsibilities need to be clearly defined and assigned throughout the bank. To successfully manage climate-related risks, banks should ensure an adequate understanding of climate-related financial risks and as well as adequate resources and skills at all relevant functions and business units within the bank. Finally, the board and senior management should ensure that all climate-related strategies are consistent with the bank’s stated goals and objectives.

Internal control framework – Principle 4

The fourth principle within the internal control framework subcategory requires banks to include clear definitions and assignment of climate-related responsibilities and reporting lines across all three lines of defense. Further requirements are then presented for each line of defense.

Capital and liquidity adequacy – Principle 5

After the identification and quantification of the climate-related financial risks, these risks need to be incorporated into banks’ Internal Capital (and Liquidity) Adequacy Assessment Process (ICLAAP). Banks should provide insights in which climate-related financial risks affect their capital and liquidity position. In addition, physical and transition risks relevant to a bank’s business model assessed as material over relevant time horizons, should be incorporated into their stress testing programs in order to evaluate the bank’s financial position under severe but plausible scenarios. Furthermore, the described incorporation in the ICLAAP to handle such financial risks, should be done iteratively and progressively, as the methodologies and data used to analyze these risks continue to mature over time.

Risk management process – Principle 6

The sixth principle connects to the previous one, as it states that a bank needs to identify, monitor and manage all climate-related financial risks that could materially impair their financial condition, including their capital resources and liquidity positions. The bank’s risk management framework should be comprehensive with respect to the (material) climate-related financial risks they are exposed to. Clear definitions and thresholds should be set for materiality. These need to be monitored closely and adjusted, if necessary, as climate-related risks are evolving.

Management monitoring and reporting – Principle 7

After ensuring that the risk framework is comprehensive, banks need to implement the monitoring and reporting of climate-related financial risks in a timely manner to facilitate effective decision-making. To achieve such reporting, a good data infrastructure should be in place at the bank. This allows it to identify, collect, cleanse, and centralize the data necessary to assess material climate-related financial risks. Furthermore, banks should actively collect additional data from clients and counterparties in order to develop a better understanding of their client’s transition strategies and risk profiles.

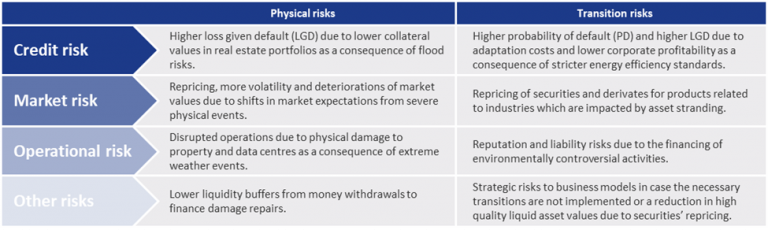

Management of credit, market, liquidity, operational risk – Principles 8 to 11

Banks should understand the impact of climate-related risk drivers on their credit risk profiles, market positions, liquidity risk profiles and operational risks. Clearly articulated credit policies and processes to identify, measure, evaluate, monitor, report and control or mitigate the impacts of material climate-related risk drivers on banks’ credit risk exposures should be in place. From a market risk perspective, banks should consider the potential losses in their portfolios due to climate-related risks. On the business operation and strategy side of banking activities, the impact of climate-related risks also plays a large role. For example, physical risks have to be taken into account when drafting business continuity plans. After understanding the different risks and their impacts, a range of risk mitigation options to control or mitigate climate-related financial risks need to be considered.

Scenario analysis – Principle 12

The final principle states that banks need to use scenario analysis to assess the resilience of their business models and strategies to a range of plausible climate-related pathways, and to determine the impact of climate-related risk drivers on their overall risk profile. Scenario analysis should reflect the overall relevant climate-related financial risks for banks, including both physical and transition risks. This analysis should be performed for different time horizons, both short- and long-term, and should be highly dynamic.

Changes to the BCBS risk framework draft and related publications

The final Principles have not changed much compared to the November 2021 consultation document. The most important changes are that the first principle, concerning corporate governance of banks, and the fifth principle, concerning capital and liquidity adequacy, have been extended. The corporate governance principle, for example, now also includes that banks should ensure that their internal strategies and risk appetite statements are consistent with any publicly communicated climate-related strategies and commitments. The capital and liquidity adequacy principle now includes a section requiring banks to incorporate material climate-related financial risks in their stress testing programs.

These twelve bank-focused principles, providing banks guidance on effective risk management of climate-related financial risks, can also be linked to the initiatives of other regulators such as the ECB. In November 2020, for example, the ECB provided a guide that describes how it expects institutions to consider climate-related and environmental risks, when formulating and implementing their business strategy, governance and risk management frameworks (the ECB expectations). These ECB expectations are in line with the BCBS Principles (and often more elaborate).

Zanders has gained relevant experience in implementing the ECB expectations at several Dutch banks. This experience ranges from risk identification and materiality assessments to the quantification of climate-related risks, ESG data frameworks, model validations, and scenario analysis. Please reach out to us if your bank is seeking support in implementing the BCBS Principles.

References

1) Basel Committee on Banking Supervision (2012). Core Principles for Effective Banking Supervision.

2) Basel Committee on Banking Supervision (2022). Principles for the effective management and supervision of climate-related financial risks.

Regulatory timelines ESG Risk Management

Climate change presents risks to the banking system.

In the below overview, we present an overview of the main ESG-related publications from the European Commission (EC), the European Central Bank (ECB), and the European Banking Authority (EBA).

This is complemented by the most important timelines that are stipulated in these regulations and guidelines. Additional regulations and guidelines that are expected for the next couple of years are also highlighted.

If you want to discuss any of them, don’t hesitate to reach out to our subject matter experts.

The ECB published the results of its climate risk stress test

On Friday 8 July, the European Central Bank (ECB) published the results of the climate risk stress test that was performed in the first half of this year.

In total 104 banks participated in the stress test that was intended as a learning exercise, for the ECB and the participating banks alike. In this article we provide a brief overview of the main results.

The ECB’s goal with the climate risk stress test was to assess the progress banks have made in developing climate risk stress-testing frameworks and the corresponding projections, as well as understanding the exposures of banks with respect to both transition and physical climate change risks. The stress test therefore consisted of three modules: 1) a qualitative questionnaire to assess the bank’s climate risk stress testing capabilities, 2) two climate risk metrics showing the sensitivity of the banks’ income to transition risk and their exposure to carbon emission-intensive industries, and 3) constrained bottom-up stress test projections for four scenarios specified by the ECB1. The third module only had to be completed by 41 directly supervised banks to limit the burden for some of the smaller banks included in the climate risk stress test.

An understatement of the true risk

The constrained bottom-up stress test projections show that the combined market and credit risk losses for the 41 banks in the sample amount to approximately EUR 70 billion in the short-term disorderly transition scenario. The ECB emphasizes that this probably is an understatement of the true risk, because it does not consider the scenarios underlying the stress test to be ‘adverse’. Second round economic effects from climate risk changes have, for example, not been factored in. Furthermore, only a third of the total exposures of the 41 banks were in scope and, on top of that, the ECB considers the banks’ modeling capabilities to be ‘rudimentary’ in this stage: they report that around 60% of the banks do not yet have a well-integrated climate risk stress testing framework in place, and they expect that it will take several years before banks achieve this. Even though banks are not meeting the ECB’s expectations yet, the ECB does conclude that banks have made considerable progress with respect to their climate stress testing capabilities.

Be aware of clients’ transition plans

A further analysis of the results shows that the share of interest income related to the 22 most carbon-intensive industries amounts to more than 60% of the total non-financial corporate interest income (on average for the banks in the sample). Interestingly, this is higher than the share of these sectors (around 54%) in the EU economy in terms of gross added value. The ECB argues that banks should be very much aware of the transition plans of their clients to manage potential future transition risks in their portfolio. The exposure to physical risks is much more varied across the sample of banks. It primarily depends on the geographical location of their lending portfolios’ assets.

The ECB points out that only a few banks account for climate risk in their credit risk models. In many cases, the credit risk parameters are fairly insensitive to the climate change scenarios used in the stress test. They also report that only one in five banks factor climate risk into their loan origination processes. A final point of attention is data availability. In many cases, proxies instead of actual counterparty data have been used to measure (for example) greenhouse gas emissions, especially for Scope 3. Consequently, the ECB is also promoting a higher level of customer engagement to improve in this area.

Many deficiencies, data gaps and inconsistencies

The outcome of the climate risk stress test will not have direct implications for a bank’s capital requirements, but it will be considered from a qualitative point of view as part of the Supervisory Review and Evaluation Process (SREP). This will be complemented by the results from the ongoing thematic review that is focused on the way banks consider climate-related and environmental risks into their risk management frameworks. The combination will indicate to the ECB how well a bank is meeting the expectations laid down in the ‘Guide on climate-related and environmental risks’ that was published by the ECB in November 2020.

The ECB notes that the exercise revealed many deficiencies, data gaps and inconsistencies across institutions and expects banks to make substantial further progress in the coming years. Furthermore, the ECB concludes that banks need to increase customer engagement to obtain relevant company-level information on greenhouse gas emissions, as well as to invest further in the methodological assumptions that are used to arrive at proxies.

If you are looking for support with the integration of Environmental, Social, and Governance risk factors into your existing risk frameworks, please reach out to us.

Notes

1) See our earlier article on the ECB’s climate stress test methodology for more details.

Integrating ESG risks into a bank’s credit risk framework

Climate change presents risks to the banking system.

The last three to four years have seen a rapid increase in the number of publications and guidance from regulators and industry bodies. Environmental risk is currently receiving the most attention, triggered by the alarming reports from the Intergovernmental Panel on Climate Change (IPCC). These reports show that it is a formidable, global challenge to shift to a sustainable economy in order to reduce environmental impact.

Zanders’ view

Zanders believes that banks have an important role to play in this transition. Banks can provide financing to corporates and households to help them mitigate or adapt to climate change, and they can support the development of new products such as sustainability-linked derivatives. At the same time, banks need to integrate ESG risk factors into their existing risk processes to prepare for the new risks that may arise in the future. Banks and regulators so far have mostly focused on credit risk.

We believe that the nature and materiality of ESG risks for the bank and its counterparties should be fully understood, before making appropriate adjustments to risk models such as rating, pricing, and capital models. This assessment allows ESG risks to be appropriately integrated into the credit risk framework. To perform this assessment, banks may consider the following four steps:

- Step 1: Identification. A bank can identify the possible transmission channels via which ESG risk factors can impact the credit risk profile of the bank. This can be through direct exposures, or indirectly via the credit risk profile of the bank’s counterparties. This can for example be done on portfolio or sector level.

- Step 2: Materiality. The materiality of the identified ESG risk factors can be assessed by assigning them scores on impact and likelihood. This process can be supported by identifying (quantitative) internal and external sources from the Network for Greening the Financial System (NGFS), governmental bodies, or ESG data providers.

- Step 3: Metrics. For the material ESG risk factors, relevant and feasible metrics may be identified. By setting limits in line with the Risk Appetite Statement (RAS) of the bank, or in line with external benchmarks (e.g., a climate science-based emission path that follows the Paris Agreement), the exposure can be managed.

- Step 4: Verification. Because of the many qualitative aspects of the aforementioned steps, it is important to verify the outcomes of the assessment with portfolio and credit risk experts.

Key insights

Prior to the roundtable, Zanders performed a survey to understand the progress that Dutch banks are marking with the integration of ESG risks into their credit risk framework, and the challenges they are facing.

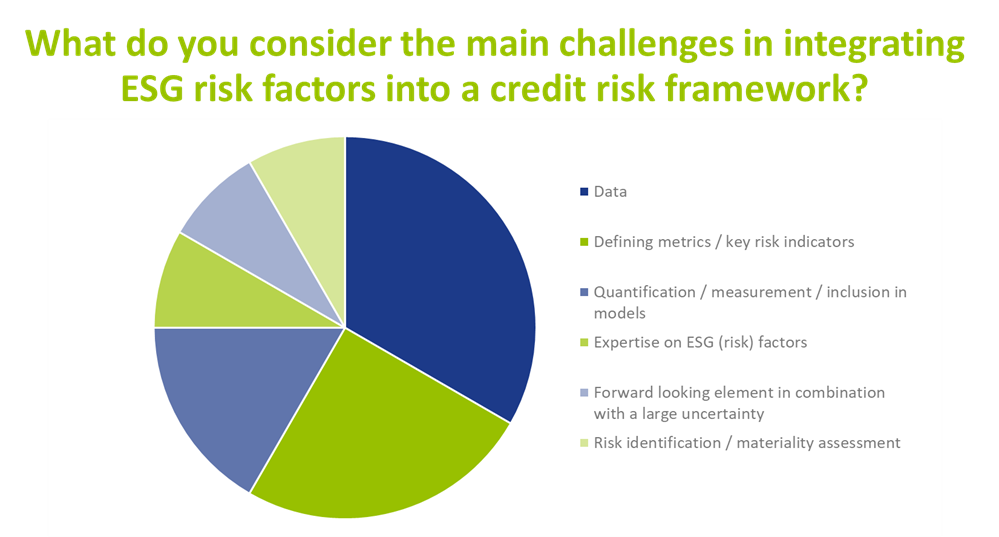

Currently, when it comes to incorporating ESG risks in the credit risk framework, banks are mainly focusing their attention on risk identification, the materiality assessment, risk metric definition and disclosures. The survey also reveals that the level of maturity with respect to ESG risk mitigation and risk limits differs significantly per bank. Nevertheless, the participating banks agreed that within one to three years, ESG risk factors are expected to be integrated in the key credit risk management processes, such as risk appetite setting, loan origination, pricing, and credit risk modeling. Data availability, defining metrics and the quantification of ESG risks were identified by banks as key challenges when integrating ESG in credit risk processes, as illustrated in the graph below.

In addition to the challenges mentioned above, discussion between participating banks revealed the following insights:

- Insight 1: Focus of ESG initiatives is on environmental factors. Most banks have started integrating environmental factors into their credit risk management processes. In contrast, efforts for integrating social and governance factors are far less advanced. Participants in the roundtable agreed that progress still has to be made in the area of data, definitions, and guidelines, before social and governance factors can be incorporated in a way that is similar to the approach for environmental factors.

- Insight 2: ESG adjustments to risk models may lead to double counting. The financial market still needs to gain more understanding to what extent ESG risk factor will manifest itself via existing risk drivers. For example, ESG factors such as energy label or flood risk may already be reflected in market prices for residential real estate. In that case, these ESG factors will automatically manifest itself via the existing LGD models and separate model adjustments for ESG may lead to double counting of ESG impact. Research so far shows mixed signals on this. For example, an analysis of housing prices by researchers from Tilburg University in 2021 has shown that there is indeed a price difference between similar houses with different energy labels. On the other hand, no unambiguous pricing differentiation was found as part of a historical house price analysis by economists from ABN AMRO in 2022 between similar houses with different flood risks. Participating banks agreed that further research and guidance from banks and the regulators is necessary on this topic.

- Insight 3: ESG factors may be incorporated in pricing. An outcome of incorporating ESG in a credit risk framework could be that price differentiation is introduced between loans that face high versus low climate risk. For example, consideration could be given to charging higher rates to corporates in polluting sectors or ones without an adequate plan to deal with the effects of climate change. Or to charge higher rates for residential mortgages with a low energy label or for the ones that are located in a flood-prone area. Participating banks agreed that in theory, price differentiation makes sense and most of them are investigating this option as a risk mitigating strategy. Nevertheless, some participants noted that, even if they would be able to perfectly quantify these risks in terms of price add-ons, they were not sure if and how (e.g., for which risk drivers and which portfolios) they would implement this. Other mitigating measures are also available, such as providing construction deposits to clients for making their homes more sustainable.

Conclusion

Most participating banks have made efforts to include ESG risk factors in their credit risk management processes. Nevertheless, many efforts are still required to comply with all regulatory expectations regarding this topic. Not only efforts by the banks themselves but also from researchers, regulators, and the financial market in general.

Zanders has already supported several banks and asset managers with the challenges related to integrating ESG risks into the risk organization. If you are interested in discussing how we can help your organization, please reach out to Sjoerd Blijlevens or Marije Wiersma.

Climate change risk

On Friday 8 July, the European Central Bank (ECB) published the results of the climate risk stress test that was performed in the first half of this year.

The Working Group II contribution to the IPCC’s Sixth Assessment Report states that “climate change is a grave and mounting threat to our wellbeing and a healthy planet”. It is a formidable, global challenge to transition to a sustainable economy before time is running out. Banks have an important role to play in this transition. By stepping up to this role now, banks will be better prepared for the future, and reap the benefits along the way.

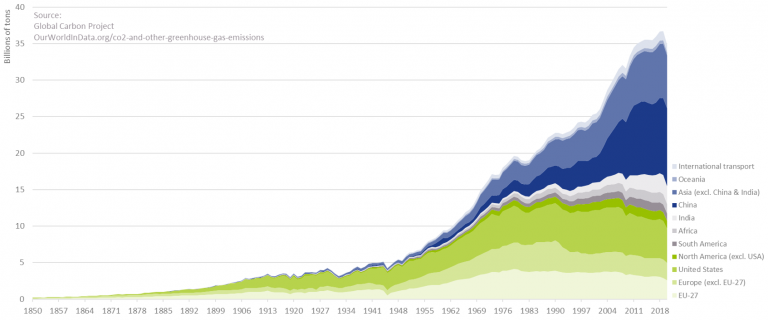

In the Paris Agreement (or COP21), adopted in December 2015, 196 parties agreed to limit global warming to well below 2.0°C, and preferably to no more than 1.5°C. To prevent irreversible impacts to our climate, the IPCC stresses that the increase in global temperature (relative to the pre-industrial era) needs to remain below 1.5°C. To achieve this target, a rapid and unprecedented decrease in the emission of greenhouse gasses (GHG) is required. With CO2 emissions still on the rise, as depicted in Figure 1, the challenge at hand has increased considerably in the past decade.

Figure 1 – Annual CO2 emissions from fossil fuels.

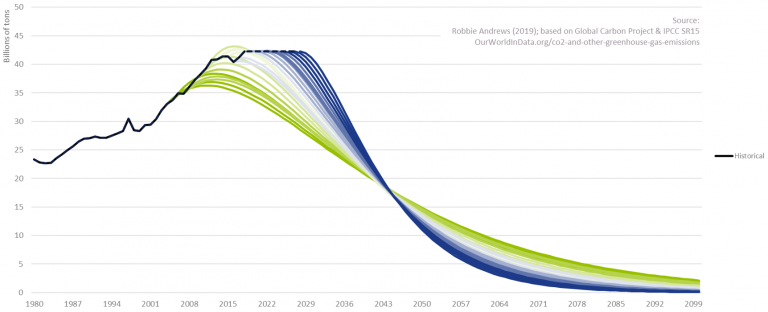

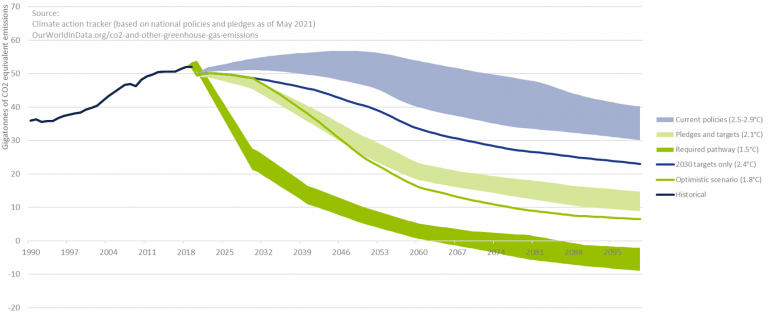

To further illustrate this, Figure 2 depicts for several starting years a possible pathway in CO2 reductions to ensure global warming does not exceed 2.0°C. Even under the assumption that CO2 emissions have already peaked, it becomes clear that the required speed of CO2 reductions is rapidly increasing with every year of inaction. We are a long way from limiting global warming to 2.0°C. This even holds under the assumption that all countries’ pledges to reduce GHG emissions will be achieved, as can be observed in Figure 3.

To quote the IPCC Working Group II co-chair Hans-Otto Pörtner: “Any further delay in concerted anticipatory global action on adaptation and mitigation will miss a brief and rapidly closing window of opportunity to secure a livable and sustainable future for all.”

Figure 2 – CO2 reduction need to limit global warming.

Figure 3 – Global GHG emissions and warming scenario’s.

The role of banks in the transition – and the opportunities it offers

Historically, banks have been instrumental to the proper functioning of the economy. In their role as financial intermediaries, they bring together savers and borrowers, support investment, and play an important role in facilitating payments and transactions. Now, banks have the opportunity to become instrumental to the proper functioning of the planet. By allocating their available capital to ‘green’ loans and investments at the expense of their ‘brown’ counterparts, banks can play a pivotal role in the transition to a sustainable economy. Banks are in the extraordinary position to make a fundamentally positive contribution to society. And even better, it comes with new opportunities.

The transition to a sustainable economy requires huge investments. It ranges from investments in climate change adaption to investments in GHG emission reductions: this covers for example investments in flood risk warning systems and financing a radical change in our energy mix from fossil-fuel based sources (like coal and natural gas) to clean energy sources (like solar and wind power). According to the Net Zero by 2050 Report from the International Energy Agency (IEA)2, the annual investments in the energy sector alone will increase from the current USD 2.3 trillion to USD 5.0 trillion by 2030. Hence, across sectors, the increase in annual investments could easily be USD 3.0 to 4.0 trillion. As much as 70% of this investment may need to be financed by the private sector (including banks and other financial institutions)3. To put this in perspective, the total outstanding credit to non-financial corporates currently stands at USD 86.3 trillion4. Assuming an average loan maturity of 5 years, this would translate to a 12-16% increase in loans and investments by banks on a global level. Hence, the transition to a sustainable economy will open up a large market for banks through direct investments and financing provided to corporates and households.

The transition to a sustainable economy is also triggering product development. The Climate Bonds Initiative (CBI) for example reports that the combined issuance of Environmental, Social, and Governance (ESG) bonds, sustainability-linked bonds and transition debt reached almost USD 500 billion in 2021H1, representing a 59% year-on-year growth rate. Other initiatives include the introduction of ‘green’ exchange-traded funds (ETFs) and sustainability-linked derivatives. The latter first appeared in 2019 and they provide an incentive for companies to achieve sustainable performance targets. If targets are met, a company is for example eligible for a more attractive interest coupon. Again, this is creating an interesting market for banks.

By embracing the transition, with all the opportunities that it offers, banks are also bracing themselves for the future. Banks that adopt climate change-resilient business models and integrate climate risk management into their risk frameworks will be much better positioned than banks that do not. They will be less exposed to climate-related risks, ranging from physical and transition risks to risks stemming from a reputational perspective or litigation, also justifying lower capital requirements. The early adaptors of today will be the leaders of tomorrow.

A roadmap supporting the transition

How should a bank approach this transition? As depicted in Figure 4, we identify four important steps: target setting, measurement and reporting, strategy and risk framework, and engaging with clients.

Figure 4 – The roadmap supporting the transition to a sustainable economy.

Target setting

The starting point for each transition is to set GHG emission targets in alignment with emission pathways that have been established by climate science. One important initiative that can support banks in setting these targets is the Science Based Targets initiative (SBTi). This organization supports companies to set targets in line with the goals of the Paris Agreement. Unlike many other companies, the majority of a bank’s GHG emissions are outside their direct control. They can influence, however, their so-called financed emissions, which are the GHG emissions coming from their lending and investment portfolios. The SBTi has developed a framework for banks that reflects this. It encourages banks to use the Absolute Contraction approach that requires a 2.5% (for a well-below 2.0°C target) or 4.2% (for a 1.5°C target) annual reduction in GHG emissions. A clear emission pathway guides banks in the subsequent steps of the transition process.

Measurement and reporting

With targets in place, the next important step for a bank is to determine their level of GHG emissions: both for scope 1 and 2 (the GHG emissions they control) and for scope 3 (the financed emissions). Important initiatives for the quantification of the financed emissions are the Paris Agreement Capital Transition Assessment (PACTA) and the Platform Carbon Accounting Financials (PCAF). PCAF is a Dutch initiative to deliver a global, standardized GHG accounting and reporting approach for financial institutions (building on the GHG Protocol). PACTA enables banks to measure the alignment of financial portfolios with climate scenarios.

By keeping track of the level of GHG emissions on an annual basis, banks can assess whether they are following their selected emission pathway. Reporting, in line with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), will contribute to a greater understanding of climate risks with their investors and other stakeholders.

Strategy and risk framework

Setting targets and measuring the current level of GHG emissions are necessary but not sufficient conditions to achieve a successful transition. Climate change risk needs to be fully integrated into a bank’s strategy and its risk framework. To assess the climate change-resilience of a bank’s strategy, a logical first step is to understand which climate change risks are material to the organization (e.g., by composing a materiality matrix). Subsequently, studying the transmission channels of these risks using scenario analysis and/or stress testing creates an understanding of what parts of the business model and lending portfolio are most exposed. This could lead to general changes in a bank’s positioning, but these risks should also be factored into the bank’s existing risk framework. Examples are the loan origination process, capital calculations, and risk reporting.

Engaging with clients

A fourth step in the game plan to successfully support the transition is for a bank to actively engage with its clients. A dialogue is required to align the bank’s GHG emission targets with those of its clients. This extends to discussing changes in the operations and/or business model of a client to align with a sustainable economy. This also may include timely announcing that certain economic activities will no longer be financed, and by financing client’s initiatives to mitigate or adapt to climate change: e.g., financing wind turbines for clients with energy- or carbon-intensive production processes (like cement or aluminium) or financing the move of production locations to less flood-prone areas.

Conclusion

Banks are uniquely positioned to play a pivotal role in the transition to a sustainable economy. The transition is already providing a wide range of opportunities for banks, from large financing needs to the introduction of green bonds and sustainability-linked derivatives. At the same time, it is of paramount importance for banks to adopt a climate change-resilient strategy and to integrate climate change risk into their risk frameworks. With our extensive track record in financial and non-financial risk management at financial institutions, Zanders stands ready to support you with this ambitious, yet rewarding challenge.

ESG risk management and Zanders

Zanders is currently supporting several clients with the identification, measurement, and management of ESG risks. For a start, we are supporting a large Dutch bank with the identification of ESG risk factors that have a material impact on the credit risk profile of its portfolio of corporate loans. The material risk factors are then integrated in the bank’s existing credit risk framework to ensure a proper management of this new risk type.

We are supporting other banking clients with the quantification of climate change risk. In one case, we are determining climate change risk-adjusted Probabilities of Default (PDs). Using expected future emissions and carbon prices based on the climate change scenarios of the Network for Greening the Financial System (NGFS), company specific shocks based on carbon prices and country specific shocks on GDP level are determined. These shocked levels are then used to determine the impact on the forecasted PDs. In another case, we are investigating the potential impact of floods and droughts on the collateral value of a portfolio of residential mortgage loans.

We also gained experience with the data challenges involved in the typical ESG project: e.g., we are supporting an asset manager with integrating and harmonizing ESG data from a range of vendors, which is underlying their internally developed ESG scores. We also support them with embedding these scores in the investment process.

With our extensive track record in financial and non-financial risk management at financial institutions in general, and our more recent ESG experience, Zanders stands ready to support you with the ambitious, yet rewarding challenge to adopt a climate change-resilient strategy and to integrate climate change risk in your existing risk frameworks.

Foot notes:

1 The IPCC Working Group II contribution: Climate Change 2022: Impacts, Adaptation and Vulnerability.

2 The IEA report, Net Zero by 2050.

3 See the Net Zero Financing roadmaps from the UN, ‘Race to Zero’ and the ‘Glasgow Financial Alliance for Net Zero’ (GFANZ).

4 Based on the statistics of the Bank for International Settlements (BIS) per 2021-Q3.

5 The Climate Bonds Initiative’s Sustainable Debt Highlights H1 2021.

EBA’s binding standards on Pillar 3 disclosures on ESG risks

Climate change presents risks to the banking system.

This publication fits nicely into the ‘horizon priority’ of the EBA1 to provide tools to banks to measure and manage ESG-related risks. In this article we present a brief overview of the way the ITS have been developed, what qualitative and quantitative disclosures are required, what timelines and transitional measures apply – and where the largest challenges arise. By requiring banks to disclose information on their exposure to ESG-related risks and the actions they take to mitigate those risks – for example by supporting their clients and counterparties in the adaptation process – the EBA wants to contribute to a transition to a more sustainable economy. The Pillar 3 disclosure requirements apply to large institutions with securities traded on a regulated market of an EU member state.

In an earlier report2, the EBA defined ESG-related risks as “the risks of any negative financial impact on the institution stemming from the current or prospective impacts of ESG factors on its counterparties or invested assets”. Hence, the focus is not on the direct impact of ESG factors on the institution, but on the indirect impact through the exposure of counterparties and invested assets to ESG-related risks. The EBA report also provides examples for typical ESG-related factors.

While the ITS have been streamlined and simplified compared to the consultation paper published in March 2021, there are plenty of challenges remaining for banks to implement these standards.

Development of the ITS

The EBA has been mandated to develop the ITS on P3 disclosures on ESG risks in Article 434a of the Capital Requirements Regulation (CRR). The EBA has opted for a sequential approach, with an initial focus on climate change-related risks. This is further narrowed down by only considering the banking book. The short maturity and fast revolving positions in the trading book are out of scope for now. The scope of the ITS will be extended to included other environmental risks (like loss of biodiversity), and social and governance risks, in later stages.

In the development of the ITS, the EBA has strived for alignment with several other regulations and initiatives on climate-related disclosures that apply to banks. The most notable ones are listed below (and in Figure 1):

Figure 1 – Overview of related regulations and initiatives considered in the development of the ITS

- Capital Requirements Directive and Regulation (CRD and CRR): article 98(8) of the CRD3 mandated the EBA to publish the EBA report on Management and Supervision of ESG risks, which includes the split of climate change-related risks in physical and transition risks. Article 434a of the CRR4 mandated the EBA to develop the draft ITS to specify the ESG disclosure requirements described in article 449a.

- EBA report on Management and Supervision of ESG risks2: the report provides common definitions of ESG risks and contains proposals on how to include ESG risks in the risk frameworks of banks, covering its identification, assessment, and management. It also discusses the way to include ESG risks in the supervisory review process.

- Task Force on Climate-related Financial Disclosures (TCFD)5: the Financial Stability Board’s TFCD has published recommendations on climate-related disclosures. The metrics and Key Performance Indicators (KPIs) included in the ITS have been aligned with the TCFD recommendations.

- Taxonomy Regulation6: the European Union’s common classification system of environmentally sustainable economic activities is underpinning the main KPIs introduced in the ITS.

- Climate Benchmark Regulation (CBR)7: In the CBR, two types of climate benchmarks were introduced (‘EU Climate Transition’ and ‘EU Paris-aligned’ benchmarks) and ESG disclosures for all other benchmarks (excluding interest rate and currency benchmarks) were required.

- Non-Financial Reporting Directive (NFRD)8: the NFRD introduces ESG disclosure obligations for large companies, which include climate-related information.

- Corporate Sustainability Reporting Directive (CSRD)9: a proposal by the European Commission to extend the scope of the NFRD to also include all companies listed on regulated markets (except listed micro-enterprises). One of the ITS’s KPIs, the Green Asset Ratio (GAR) is directly linked to the scope of the NFRD/CSRD.

- Sustainable Finance Disclosure Regulation (SFDR)10: the SFDR lays down sustainability disclosure obligations for manufacturers of financial products and financial advisers towards end-investors. It applies to banks that provide portfolio management investment advice services.

Compared to the consultation paper for the ITS, several changes have been made to the required templates. Some templates have been combined (e.g., templates #1 and #2 from the consultation paper have been combined into template #1 of the final draft ITS) and several templates have been reorganized and trimmed down (e.g., the requirement to report exposures to top EU or top national polluters has been removed).

Quantitative disclosures

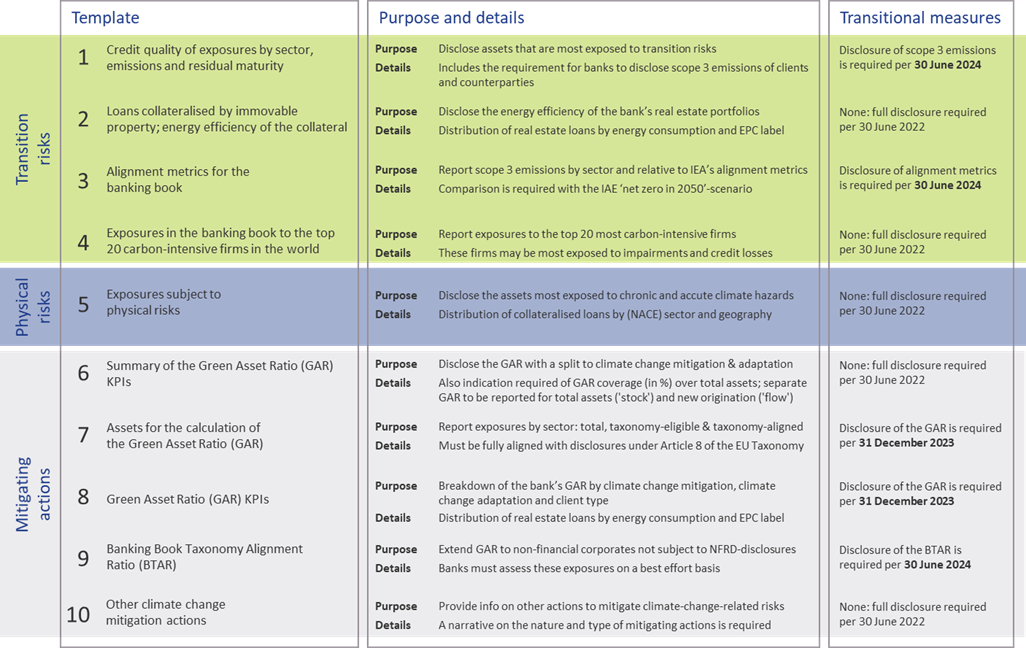

The ITS on P3 disclosure on ESG risks introduce ten templates on quantitative disclosures. These can be grouped in four templates on transition risks, one on physical risks, and five on mitigating actions:

- Transition risks

Two of the required templates are relatively straightforward. Banks need to report the energy efficiency of real estate collateral in the loan portfolio (#2) and report their aggregate exposure to the top 20 of the most carbon-intensive firms in the world (#4).

The main challenge for banks though will be in completing the other two templates:- Template #1 requires banks to disclose the gross carrying amount of loans and advances provided to non-financial corporates, classified by NACE sector codes and residual maturities. It is also required to report on the counterparties’ scope 1, 2, and 3 greenhouse gas (GHG) emissions. Reflecting the challenge in reporting on scope 3 emissions, a transitional measure is in place. Full reporting needs to be in place by June 2024. Until then, banks need to report their available estimates (if any) and explain the methodologies and data sources they intend to use.

- In the last template (#3), banks also need to report scope 3 emissions, but relate these to the alignment metrics defined by the International Energy Agency (IEA) for the ‘net zero by 2050’ scenario. For this scenario, a target for a CO2 intensity metric is defined for 2030. By calculating the distance to this target, it becomes clear how banks are progressing (over time) towards supporting a sustainable economy. A similar transitional measure applies as for template #1.

- Physical risks

In template #5, banks are required to disclose how their banking book positions are exposed to physical risks, i.e., “chronic and acute climate-related hazards”. The exposures need to be reported by residual maturity and by NACE sector codes and should reflect exposure to risks like heat waves, droughts, floods, hurricanes, and wildfires. Specialized databases need to be consulted to compile a detailed understanding of these exposures. To support their submissions, banks further need to compile a narrative that explains the methodologies they used. - Mitigating actions

The final set of templates covers quantitative information on the actions a bank takes to mitigate or adapt to climate change risks.- Templates #6-8 all relate to the GAR, which indicates what part of the bank’s banking book is aligned with the EU’s Taxonomy:

- In template #7, banks need to report the outstanding banking book exposures to different types of clients/issuers, as well as the amount of these exposures that are taxonomy-eligible (that is, to sectors included in the EU Taxonomy) and taxonomy-aligned (that is, taxonomy-eligible exposures financing activities that contribute to climate change mitigation or adaptation). Based on this information, the bank’s GAR can be determined.

- In template #8, a GAR needs to be reported for the exposures to each type of client/issuer distinguished in template #7, with a distinction between a GAR for the full outstanding stock of exposures per client/issuer type, and a GAR for newly originated (‘flow’) exposures.

- Template #6 contains a summary of the GARs from templates #7 and #8.

In these templates, the numerator of the GAR only includes exposures to non-financial corporations that are required to publish non-financial information under the NFRD. Any exposures to other corporate counterparties therefore are considered 0% Taxonomy-aligned.

- The main challenge in this group of templates is in template #9. To incentivize banks to support all of their counterparties to transition to a more sustainable business model, and to collect ESG data on these counterparties, the EBA introduces the Banking Book Taxonomy Alignment Ratio (BTAR). In this metric, the numerator does include the exposures to counterparties that are not subject to NFRD disclosure obligations. The BTAR ratios obtained from the information in template #9 therefore complement the GAR ratios obtained in templates #7 and #8.

- In the final template (#10), banks have the opportunity to include any other climate change mitigating actions that are not covered by the EU Taxonomy. They can for example report on their use of green or sustainable bonds and loans.

- Templates #6-8 all relate to the GAR, which indicates what part of the bank’s banking book is aligned with the EU’s Taxonomy:

An overview of the templates for quantitative disclosures in presented in Figure 2.

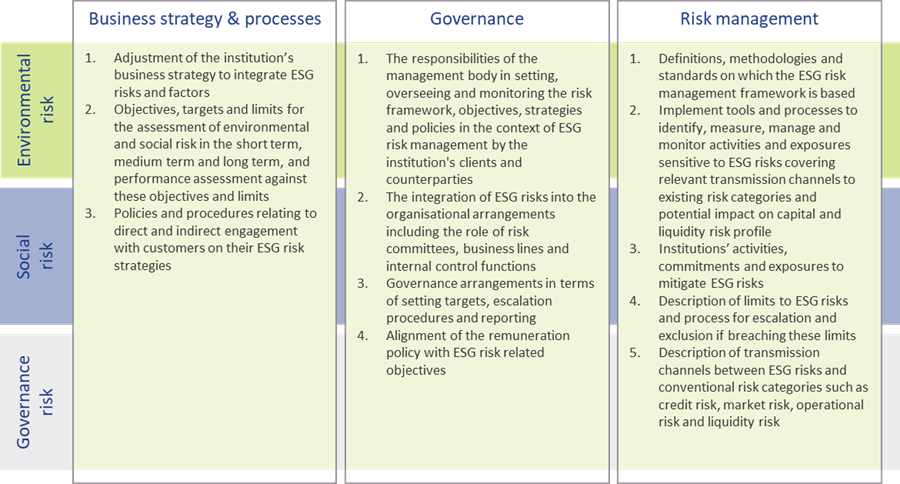

Qualitative disclosures

In the ITS on P3 disclosures on ESG risks, three tables are included for qualitative disclosures. The EBA has aligned these tables with their Report on Management and Supervision of ESG risks11. The three tables are set up for qualitative information on environmental, social, and governance risks, respectively. For each of these topics, banks need to address three aspects: on business strategy and processes, governance, and risk management. An overview of the required disclosures is presented in Figure 3.

Figure 3 – Overview of qualitative ESG disclosures (based on templates & section 2.3.2 of the EBA ITS on P3 disclosures on ESG risks)

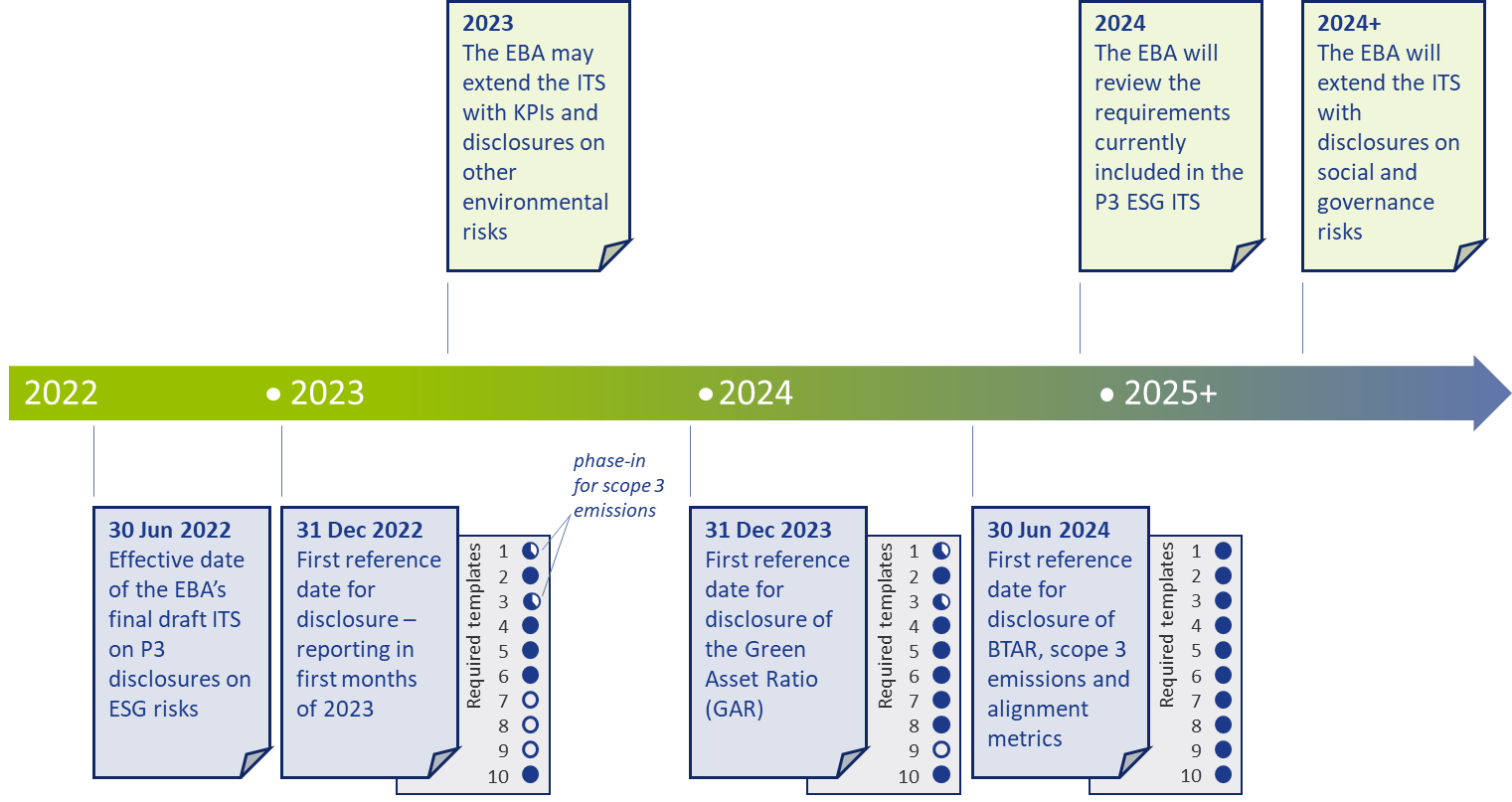

Timelines and transitional measures

The ITS on P3 disclosure on ESG risks become effective per 30 June 2022 for large institutions that have securities traded on a regulated market of an EU member state. A semi-annual disclosure is required, but the first disclosure is annual. Consequently, based on 31 December 2022 data, the first reporting will take place in the first quarter of 2023.

The EBA has introduced a number of transitional measures. These can be summarized as follows:

- The reporting of information on the GAR is only required as of 31 December 2023.

- The reporting of information on the BTAR, the bank’s financed scope 3 emissions, and the alignment metrics is only required as of June 2024.

The EBA has further indicated in the ITS that they will conduct a review of the ITS’s requirements during 2024. They may then also extend the ITS with other environmental risks (other than the climate change-related risks in the current version). The EU Taxonomy is expected to cover a broader range of environmental risks by the end of 2022. Sometime after 2024, it is expected that the EBA will further extend the ITS by including disclosure requirements on social and governance risks.

An overview of the main timelines and transitional measures is presented in Figure 4.

Figure 4 – Overview of the main timelines and transitional measures for the ESG disclosures

Conclusion

Society, and consequently banks too, are increasingly facing risks stemming from changes in our climate. In recent years, supervisory authorities have stepped up by introducing more and more guidance and regulation to create transparency about climate change risk, and more broadly ESG risks. The publication of the ITS on P3 disclosures on ESG risks by the EBA marks an important milestone. It offers banks the opportunity to disseminate a constructive and positive role in the transition to a sustainable economy.

Nonetheless, implementing the disclosure requirements will be a challenge. Developing detailed assessments of the physical risks to which their asset portfolio is exposed and to estimate the scope 3 emissions of their clients and counterparties (‘financed emissions’) will not be straightforward. For their largest counterparties, banks will be able to profit from the NFRD disclosure obligations, but especially in Europe a bank’s portfolio typically has many exposures to small- and medium-sized enterprises. Meeting the disclosure requirements introduced by the EBA will require timely and intensive discussions with a substantial part of the bank’s counterparties.

Banks also need to provide detailed information on how ESG risks are reflected in the bank’s strategy and governance and incorporated in the risk management framework. With our extensive knowledge on market risk, credit risk, liquidity risk, and business risk, Zanders is well equipped to support banks with integrating the identification, measurement, and management of climate change-related risks into existing risk frameworks. For more information, please contact Pieter Klaassen or Sjoerd Blijlevens via +31 88 991 02 00.

References

- See the EBA 2022 Work Programme.

- The EBA’s Report on Management and Supervision of ESG risks for credit institutions and investment firms, published in June 2021.

- See the EBA’s interactive Single Rulebook.

- See Regulation (EU) 2019/876.

- See the TCFD’s Final Report on Recommendations of the Task Force on Climate-related Financial Disclosures published in June 2017.

- See the EBA’s response to EC Call for Advice on Article 8 Taxonomy Regulation.

- See Regulation (EU) 2019/2089.

- See Directive 2014/95/EU.

- See the European Commission’s Proposal for a Corporate Sustainability Reporting Directive.

- See Regulation (EU) 2019/2088.

- The EBA report can be found here.

The EBA expects banks to expand their CSRBB framework

Climate change presents risks to the banking system.

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

This new update is triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers

- The first consultation paper1 describes the update of the IRRBB Guidelines themselves.

- The second paper2 concerns the introduction of a standardized approach (SA) which should be applied when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII). Read our analysis on this consultation paper here »

In this article we focus on the first consultation paper. The update of the IRRBB Guidelines can be split up in three topics and each will be discussed in further detail:

- Additional criteria for the assessment and monitoring of the credit spread risk arising from non-trading book activities (CSRBB)

- The criteria for non-satisfactory IRRBB internal systems

- A general update of the existing IRBBB Guidelines

CSRBB

The 2018 IRRBB Guidelines introduced the obligation for banks to monitor CSRBB. However, the publication did not describe how to do this. In the updated consultation paper the EBA defines the measurement of CSRBB as a separate risk class in more detail. The general governance related aspects such as (management) responsibilities, IT systems and internal reporting framework are separately defined for CSRBB, but are similar to those for IRRBB.

Also similar to IRRBB is that banks must express their risk appetite for CSRBB both from an NII as well as an economic value perspective.

The EBA defines CSRBB as:

“The risk driven by changes of the market price for credit risk, for liquidity and for potentially other characteristics of credit-risky instruments, which is not captured by IRRBB or by expected credit/(jump-to-) default risk. CSRBB captures the risk of an instrument’s changing spread while assuming the same level of creditworthiness, i.e. how the credit spread is moving within a certain rating/PD range.”

EBA

Compared to the previous definition, rating/PD migrations are explicitly excluded from CSRBB. Including idiosyncratic spreads could lead to double counting since these are generally covered by a credit risk framework. However, the guidelines give some flexibility to include idiosyncratic spreads, as long as the results are more conservative than when idiosyncratic spreads are excluded. This is because, based on the Quantitative Impact Study of December 2020 (QIS 2020), banks indicated to find it difficult to separate the idiosyncratic spreads from the credit spread.

Also, the scope of CSRBB has changed from the current IRRBB Guidelines. All assets, liabilities and off-balance-sheet items in the banking book that are sensitive to credit spread changes are within the scope of CSRBB whereas the 2018 IRRBB Guidelines focused only on the asset side. Based on the results of the QIS 2020, the EBA concluded that most of the exposures to CSRBB are debt securities which are accounted for at fair value (via Profit and Loss or Other Comprehensive Income). However, this does not rule out that other assets or liabilities could be exposed to CSRBB. It is stated that banks cannot ex-ante exclude positions from the scope of CSRBB. Any potential exclusion of instruments from the scope of CSRBB must be based on the absence of sensitivity to credit spread risk and appropriately documented. At a minimum, banks must include assets accounted at fair value in their scope.

We believe that the obligation to report CSRBB for all assets accounted for at fair value will be challenging for exposures that do not have quoted market prices. Without a deep liquid market, it will be difficult to establish the credits spread risk (even when idiosyncratic risk is included).

Another possible candidate to be included in the scope of CSRBB is the issued funding on the liability side of the banking book, especially in a NII context. When market spreads increase, this could become harmful when the wholesale funding needs to be rolled over against higher credit spread without being able to increase client interest on the asset side. Similar to IRRBB, the exposure to this risk depends on the repricing gap of the assets and liabilities. In this case, however, swaps cannot be used as hedge.

Other products such as consumer loans, mortgages, and consumer deposits, which are typically accounted for at amortized cost, are less likely to be included. This is also stated by the BCBS standards. The BCBS states that the margin (administrative rate) is under absolute control of the bank and hence not impacted by credit spreads. However, it is unclear whether this is sufficient to rule these products out of scope.

Non-satisfactory IRRBB internal systems

The EBA is mandated to specify the criteria for determining an IRRBB internal system as non-satisfactory. The EBA has identified specific items for this that should be considered. At a minimum, banks should have implemented their internal system in compliance with the IRRBB Guidelines, taking into account the principle of proportionality. More specifically:

- Such a system must cover all material interest rate risk components (gap risk, basis risk, option risk).

- The system should capture all material risks for significant assets, liabilities and off-balance sheet type instruments (e.g. non-maturing deposits, loans, and options).

- All estimated parameters must be sufficiently back tested and reviewed, considering the nature, scale and complexity of the bank.

- The internal system must comply with the model governance and the minimum required validation, review and control of IRRBB exposures as detailed by the IRRBB guidelines.

- Competent authorities may require banks to use the standardized approach3 if the internal systems are deemed non-satisfactory.

General update of existing IRRBB Guidelines

Major parts of the guidelines for managing IRRBB have not changed. In the section on IRRBB stress testing, however, a new article (#103) for products with significant repricing restrictions (e.g. an explicit floor on non-maturing deposits – NMDs) is introduced. As part of their stress testing, banks should consider the impact when these products are replaced with contracts with similar characteristics, even under a run-off assumption. The exact intention of this article is unclear. For NII-purposes it is common practice to roll over products with similar characteristics (or use another balance sheet development assumption). Our interpretation of this article is that banks are expected to measure the risk of continued repricing restrictions in an economic value perspective when the maturity of those funding sources is smaller than the maturity of the asset portfolio. This may for example materialize when banks roll over NMDs that are subject to a legally imposed floor.

Another update is the restriction on the maximum weighted average repricing maturity of five years for NMDs. This cap was prescribed for the EVE SOT and is now included for the internal measurement of IRRBB. We believe that the impact of this will be limited since only a few banks will have separate NMD models for internal measurement and the SOT.

Finally, some minor additions have been included in the guidelines. For example, the guidelines emphasize multiple times that when diversification assumptions are used for the measurement of IRRBB, these must be appropriately stressed and validated.

Conclusion

It is expected that the final guidelines will not deviate significantly from the consultation paper. Banks can therefore start preparing for these new expectations. For the measurement of IRRBB, limited changes are introduced in the consultation. Although the exact intention of the EBA is unclear to us, it is interesting to notice that the updated IRRBB Guidelines include the expectation that banks pay special attention in their stress tests to products with significant repricing restrictions. Furthermore, banks must invest in their CSRBB measurement. For their entire banking book, banks need to assess whether market wide credit spread changes will have an impact on an NII and/or economic value perspective. The scope of CSRBB measurement may need to be extended to include the funding issued by the bank. And to conclude, the obligation to measure CSRBB for fair value assets that do not have quoted market prices will be a challenge for banks.

References

The EBA faces banks with a new supervisory outlier test on net interest income

Climate change presents risks to the banking system.

In this article, we focus on one of these consultation papers, which concerns updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

The new updates are triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers:

- The first consultation paper1 describes an update of the IRRBB Guidelines themselves. The main changes are the specification of criteria to identify “non-satisfactory internal models for IRRBB management” and the specification of criteria to assess and monitor Credit Spread Risk in the Banking Book (CSRBB). Read our analysis on this consultation paper here »

- The second paper2 concerns the introduction of a standardized approach (SA) which should be used when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a Simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

Please note that we recently also published an article about the new disclosure requirements for IRRBB which is closely related to this topic.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Replacement of the 20% SOT for EVE

The first part of the amended Article 98 (5) concerns the replacement of the original 20% SOT by the 15% SOT. While many banks are probably already targeting levels below 15%, we expect that this change will limit the maneuvering capabilities of banks as they will likely choose to implement a management buffer. Note that not only the threshold is lower (15% instead of 20%), but also the denominator (Tier 1 capital instead of own funds). Furthermore, the worst outcome of all six supervisory scenarios should be used, as opposed to worst outcome of just the two parallel ones. Combined, this leads to a significant reduction in the EVE risk to which a bank may be exposed.

Some other noteworthy updates to the SOT for EVE that are not directly related to the CRD amendment are listed below:

- The post-shock interest floor decreases from -100 to -150 basis points and it increases to 0% over a 50-year instead of a 20-year period.

- In the calibration of the interest rate shocks for currencies for which the shocks have not been prescribed, the most recent 16-year period should be used (instead of the 2000-2015 period which is still underlying the shocks for the other currencies).

- When aggregating the results over currencies, some additional offsetting (80% as opposed to 50%) is granted in case of Exchange Rate Mechanism (ERM) II currencies with a formally agreed fluctuation band narrower than the standard band of +/-15%. Currently, only positions in the Denmark Krona (DKK) qualify for this treatment.

Introduction of the SOT for NII

The second part of the amended Article 98 (5) concerns the introduction of an entirely new SOT. It is aimed at measuring the potential decline in NII for two standard interest rate shock scenarios. Compared to the SOT for EVE, the SOT for NII requires many more modeling assumptions, in particular to determine the expected balance sheet development. The consultation paper provides clarity on the approach the EBA wants to take but two decisions are explicitly consulted.

The SOT for NII compares the NII for a baseline scenario with the NII in a shocked scenario over a one-year horizon. The two shocks that need to be applied are the two instantaneous parallel shocks that are also used in the SOT for EVE. Furthermore, the same requirements that are specified for the SOT for EVE apply, for example the use of the floor and the aggregation approach. The two exceptions are the requirements to use a constant balance sheet assumption (as opposed to a run-off balance sheet) and to include commercial margins and other spread components in the calculations. The commercial margins of new instruments should equal the prevailing levels (as opposed to historical ones).

The two decisions for which the EBA is seeking input are:

The scope/definition of NII

In its narrowest definition, the SOT will focus on the difference between interest income and interest expenses. The EBA, however, also considers using a broader definition where the effect of market value changes of instruments accounted for at Fair Value (∆FV) is added, and possibly also interest rate sensitive fees and commissions.

The definition of the SOT’s threshold

Article 98 (5) requires the EBA to specify what is considered a ‘large decline’ in NII, in which case the competent authorities are entitled to exercise their supervisory powers. This first requires a metric. The EBA is consulting two:

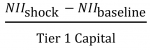

- The first metric is calculating the change in NII (the difference between the shocked and baseline NII) relative to the Tier 1 Capital:

- The second metric is calculating the change in NII relative to the baseline scenario, after correcting for administrative expenses that can be allocated to NII:

- where α is the historical share of NII relative to the operating income as reported based on FINREP input.

The pros of the narrow definition of NII are improved comparability and ease of computation, where the main pro of the broader definition is that it achieves a more comprehensive picture, which is also more in line with the EBA IRRBB Guidelines. With respect to the metrics, the first (capital-based) metric is the simplest and it is comparable to the approach taken for the SOT for EVE. The second metric is close to a P&L-based metric and the EBA argues that its main advantage is that “it takes into account both the business model and cost structure of a bank in the assessment of the continuity of the business operations”. It does involve, however, the application of some assumptions on determining the α parameter.

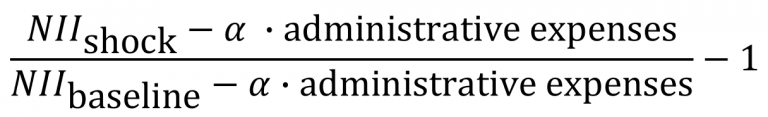

Thresholds for the four possible combinations

For each of the four possible combinations (definition of NII and specification of the metric), the EBA has determined, using data from the December 2020 Quantitative Impact Study (QIS), what the corresponding thresholds should be. Their starting point has been to make the SOT for NII as stringent as the SOT for EVE. Effectively, they reverse engineered the threshold to achieve a similar number of outliers under both measures. We expect that the proposed threshold for any of the four possible combinations will not be constraining for the majority of banks. The resulting proposed thresholds are included in the table below:

Table 1 – Comparison of the proposed thresholds for each combination of metric and scope

The impact of including Fair Value changes seems arbitrary as it increases the threshold for the capital-based metric and decreases the threshold for the P&L-based metric. Also, from a comparability and computational perspective, the narrow definition of NII may be preferred. Furthermore, the capital-based metric is less intuitive for NII than it is for EVE, and consequently, the P&L-based one may be preferred. It is also noted in the consultation paper that if the shocked NII after the correction for administrative expenses (the numerator) is negative, it will also be considered an outlier.

Conclusion

In the past years, many banks have invested heavily in their IRRBB framework following the 2018 update of the IRRBB Guidelines. Once again, an investment is required. Even though there are not many surprises in the proposed updates related to the SOTs, small and large banks alike will need to carefully assess how the changes to the existing SOT and the introduction of the new SOT will impact their interest rate risk management. Banks still have the opportunity to respond to all three consultation papers until 4 April 2022.

References

How can banks manage climate-related and environmental financial risks

On Friday 8 July, the European Central Bank (ECB) published the results of the climate risk stress test that was performed in the first half of this year.

As the financial sector is key for the transition towards a low-carbon and more circular economy, financial institutions have to deal with climate-related and environmental financial risks (C&E risks). At the same time, the increased importance of these C&E risks also presents new business opportunities for the financial sector. Therefore, to support banks in their self-assessment and action plans, Zanders developed a Scan & Plan Solution on C&E risks.

According to the 2021 World Economic Forum Global Risk Report1, extreme weather, climate action failure, human environmental damage and biodiversity loss are ranked as four of the top five global risks by highest likelihood and four of the six global risks with the largest impact. It is not surprising that over the past years, numerous articles on C&E risks have been published and many initiatives have been taken to identify, measure and manage these risks. The Paris Agreement2, the United Nations 2030 Agenda for Sustainable Development3 and more recently the European Green Deal4 are the main examples of international governmental responses to address C&E risks.

The financial sector is considered key for the transition towards a low-carbon and more circular economy. This is illustrated by the fact that the European Central Bank (ECB) has identified climate-related risks as a key risk driver for the euro area banking system in their Single Supervisory Mechanism Risk Map5. At the same time, the increased importance of C&E risks also presents new business opportunities for the financial sector, such as providing sustainable financing solutions and offering new financial instruments that facilitate C&E risk management. To illustrate, the UN’s Intergovernmental Panel on Climate Change6 (IPCC) estimates that the required investment for alignment with the Paris Agreement would be at least $3.5tn per year until 2050 for the energy sector alone.

To address C&E risks, the ECB published a Guide on climate-related and environmental risks7 for banks that describes the ECB’s supervisory expectations related to risk management and disclosure. Banks are required by the ECB to perform a self-assessment with respect to the supervisory expectations and to draft an action plan in 2021. The self-assessments and plans will subsequently be reviewed and challenged by the ECB as part of the supervisory dialogue. In 2022, the ECB will conduct a full supervisory review of bank’s practices related to C&E risks.

The Zanders Scan & Plan Solution provides clear insights into gaps with the ECB expectations and proposes practical actions that are tailored to a bank’s nature, scale and complexity. This article provides a brief explanation of C&E risks, outlines a few specific ECB supervisory expectations and elaborates on the Solution.

Definition of C&E risk

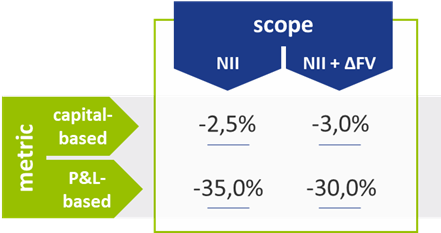

Financial risks from climate and environmental change arise from two primary risk categories:

- Physical risks. The first risk category concerns physical risks caused by acute (direct events) or chronic (longer-term events which cause gradual deterioration) C&E events. Examples of acute events are floods, wildfires and heatwaves, whereas chronic events relate to the likes of rising sea levels, acidity and biodiversity losses, for example.

- Transition risks. The second risk category comprises transition risks resulting from the process of moving towards a low-carbon economy. Changes in policy, regulation, technology, market sentiment and consumer sentiment could destabilize markets, tighten financial conditions and lead to procyclicality of losses.

These two risk categories are distinct from other risk categories in the following aspects: 1) they have a correlated and non-linear impact on all business lines, sectors and geographies, 2) they have a long-term nature and 3) the future impact is largely dependent on short-term actions. The risk categories are, among others, drivers of credit, market and operational risk, as shown in Figure 1.

Figure 1: Examples of the impact of physical risks and transition risks on traditional risk types from the ECB Guide on climate-related and environmental risks.

ECB Supervisory Expectations

In the Guide on climate-related and environmental risks7, published in November 2020, the ECB explains that banks are expected to reflect C&E risks as drivers of existing risk categories (e.g., credit risk, market risk, operational risk) rather than as a separate risk type. This indicates that not only efforts should be made by banks to develop risk management practices related to C&E risks but that these practices should also be integrated in existing risk management frameworks, models and policies.

The ECB Guide covers four main areas. First, in relation to ‘business models and strategy’, the ECB expects banks to understand the impact of C&E risks on their business environment and integrate C&E risks in their business strategy. Secondly, the guide addresses ‘governance and risk appetite’. The ECB expects a bank’s management to include C&E risks in the risk appetite framework, assign responsibilities related to C&E risks to the three lines of defense and establish internal reporting. Thirdly, in relation to ‘risk management’, the ECB expects that banks integrate C&E risks into their existing risk management framework. Finally, regarding ‘disclosures’, the ECB expects banks to disclose meaningful information and metrics on C&E risks. The four above-mentioned areas are covered in 13 expectations, which are in turn further divided in 46 sub-expectations. Banks are required by the ECB to perform a self-assessment with respect to the supervisory expectations and to draft an action plan in 2021. The self-assessments and plans will subsequently be reviewed and challenged by the ECB as part of the supervisory dialogue. The ECB recommends National Competent Authorities, in their supervision of less significant institutions, to apply these expectations proportionate to the nature, scale and complexity of the bank’s activities.

Zanders has thoroughly analyzed all (sub)-expectations and has highlighted a few specific expectations including possible actions below.

Expectation 4.2: Institutions are expected to develop appropriate key risk indicators (KRI) and set appropriate limits for effectively managing climate-related and environmental risks in line with their regular monitoring and escalation arrangements.

Here, the ECB expects institutions to monitor and report their exposures to C&E risks based on current data and forward-looking estimations. In addition, institutions are expected to assign quantitative metrics to C&E risks. It is however acknowledged that, since definitions, taxonomies and methodologies are still under development, qualitative metric or proxy data can be used as long as specific quantitative metrics are not yet available. The ECB deems that the metrics should reflect the long-term nature of climate change, and explicitly consider different paths for temperature and greenhouse gas emissions. Finally, the ECB expects institutions to define limits on the metrics based on the risk appetite regarding C&E risks.

This expectation has various elements to it, and Zanders has defined as the most important and first step to identify the internal and external data availability related to C&E risks. If the data availability allows it, an institution should set up quantitative metrics and limits on these metrics that reflect C&E risks. A first step to achieve this would be to define several firmwide KRIs, for example by limiting the carbon emission of the whole portfolio in line with the Paris Agreement2 or other (inter)national climate agreements. These KRIs can then be cascaded down to business lines and/or portfolios, such as limiting the exposure to specific sectors with large carbon footprints or substantial use of water. If the current data availability does not allow for quantitative metrics, the bank should identify which data is still lacking and assess ways to collect this data from internal data sources or external data providers in the course of time. In the meantime, qualitative metrics or proxies could be developed such as a qualitative score for the sophistication of the climate strategy of large corporates in the portfolio.

Should a bank already have some metrics in place, Zanders advises to evaluate if these metrics sufficiently cover all material physical and transition C&E risks that the bank is expected to face and if there are ways to increase the sophistication of these metrics, for example by including forward-looking estimations. Finally, Zanders advises banks to create a monitoring procedure to ensure that these metrics and their limits are evaluated regularly.

Expectation 8.1: Climate-related and environmental risks are expected to be included in all relevant stages of the credit-granting process and credit processing.

In this expectation, the ECB underlines that banks should identify and assess material factors that affect the default risk of loan exposures. The quality of the client’s own management of C&E risks may be taken into account in this case. In addition, banks are expected to consider changes in the credit risk profiles based on sectors and geographical areas.