EBA’s binding standards on Pillar 3 disclosures on ESG risks

On 24 January 2022, the European Banking Authority (EBA) published its final draft Implementing Technical Standards (ITS) on Pillar 3 (P3) disclosures on Environmental, Social and Governance (ESG) risks.

This publication fits nicely into the ‘horizon priority’ of the EBA to provide tools to banks to measure and manage ESG-related risks. In this article we present a brief overview of the way the ITS have been developed, what qualitative and quantitative disclosures are required, what timelines and transitional measures apply – and where the largest challenges arise.

By requiring banks to disclose information on their exposure to ESG-related risks and the actions they take to mitigate those risks – for example by supporting their clients and counterparties in the adaptation process – the EBA wants to contribute to a transition to a more sustainable economy. The Pillar 3 disclosure requirements apply to large institutions with securities traded on a regulated market of an EU member state.

In an earlier report2, the EBA defined ESG-related risks as “the risks of any negative financial impact on the institution stemming from the current or prospective impacts of ESG factors on its counterparties or invested assets”. Hence, the focus is not on the direct impact of ESG factors on the institution, but on the indirect impact through the exposure of counterparties and invested assets to ESG-related risks. The EBA report also provides examples for typical ESG-related factors.

While the ITS have been streamlined and simplified compared to the consultation paper published in March 2021, there are plenty of challenges remaining for banks to implement these standards.

Development of the ITS

The EBA has been mandated to develop the ITS on P3 disclosures on ESG risks in Article 434a of the Capital Requirements Regulation (CRR). The EBA has opted for a sequential approach, with an initial focus on climate change-related risks. This is further narrowed down by only considering the banking book. The short maturity and fast revolving positions in the trading book are out of scope for now. The scope of the ITS will be extended to included other environmental risks (like loss of biodiversity), and social and governance risks, in later stages.

In the development of the ITS, the EBA has strived for alignment with several other regulations and initiatives on climate-related disclosures that apply to banks. The most notable ones are listed below (and in Figure 1):

Figure 1 – Overview of related regulations and initiatives considered in the development of the ITS

- Capital Requirements Directive and Regulation (CRD and CRR): article 98(8) of the CRD3 mandated the EBA to publish the EBA report on Management and Supervision of ESG risks, which includes the split of climate change-related risks in physical and transition risks. Article 434a of the CRR4 mandated the EBA to develop the draft ITS to specify the ESG disclosure requirements described in article 449a.

- EBA report on Management and Supervision of ESG risks2: the report provides common definitions of ESG risks and contains proposals on how to include ESG risks in the risk frameworks of banks, covering its identification, assessment, and management. It also discusses the way to include ESG risks in the supervisory review process.

- Task Force on Climate-related Financial Disclosures (TCFD)5: the Financial Stability Board’s TFCD has published recommendations on climate-related disclosures. The metrics and Key Performance Indicators (KPIs) included in the ITS have been aligned with the TCFD recommendations.

- Taxonomy Regulation6: the European Union’s common classification system of environmentally sustainable economic activities is underpinning the main KPIs introduced in the ITS.

- Climate Benchmark Regulation (CBR)7: In the CBR, two types of climate benchmarks were introduced (‘EU Climate Transition’ and ‘EU Paris-aligned’ benchmarks) and ESG disclosures for all other benchmarks (excluding interest rate and currency benchmarks) were required.

- Non-Financial Reporting Directive (NFRD)8: the NFRD introduces ESG disclosure obligations for large companies, which include climate-related information.

- Corporate Sustainability Reporting Directive (CSRD)9: a proposal by the European Commission to extend the scope of the NFRD to also include all companies listed on regulated markets (except listed micro-enterprises). One of the ITS’s KPIs, the Green Asset Ratio (GAR) is directly linked to the scope of the NFRD/CSRD.

- Sustainable Finance Disclosure Regulation (SFDR)10: the SFDR lays down sustainability disclosure obligations for manufacturers of financial products and financial advisers towards end-investors. It applies to banks that provide portfolio management investment advice services.

Compared to the consultation paper for the ITS, several changes have been made to the required templates. Some templates have been combined (e.g., templates #1 and #2 from the consultation paper have been combined into template #1 of the final draft ITS) and several templates have been reorganized and trimmed down (e.g., the requirement to report exposures to top EU or top national polluters has been removed).

Quantitative disclosures

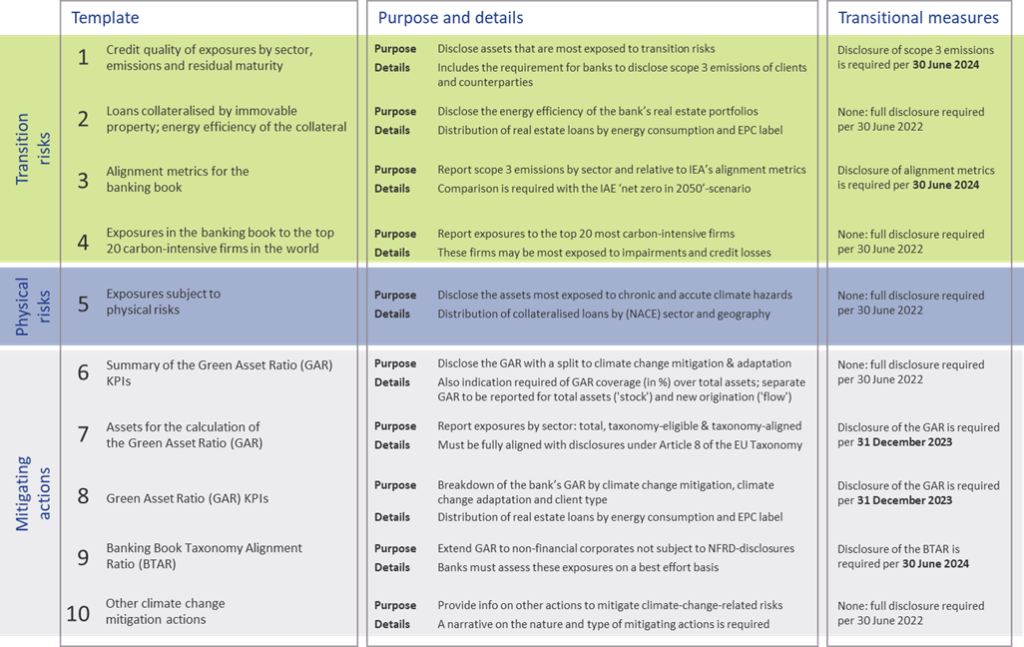

The ITS on P3 disclosure on ESG risks introduce ten templates on quantitative disclosures. These can be grouped in four templates on transition risks, one on physical risks, and five on mitigating actions:

- Transition risks

Two of the required templates are relatively straightforward. Banks need to report the energy efficiency of real estate collateral in the loan portfolio (#2) and report their aggregate exposure to the top 20 of the most carbon-intensive firms in the world (#4).

The main challenge for banks though will be in completing the other two templates:- Template #1 requires banks to disclose the gross carrying amount of loans and advances provided to non-financial corporates, classified by NACE sector codes and residual maturities. It is also required to report on the counterparties’ scope 1, 2, and 3 greenhouse gas (GHG) emissions. Reflecting the challenge in reporting on scope 3 emissions, a transitional measure is in place. Full reporting needs to be in place by June 2024. Until then, banks need to report their available estimates (if any) and explain the methodologies and data sources they intend to use.

- In the last template (#3), banks also need to report scope 3 emissions, but relate these to the alignment metrics defined by the International Energy Agency (IEA) for the ‘net zero by 2050’ scenario. For this scenario, a target for a CO2 intensity metric is defined for 2030. By calculating the distance to this target, it becomes clear how banks are progressing (over time) towards supporting a sustainable economy. A similar transitional measure applies as for template #1.

- Physical risks

In template #5, banks are required to disclose how their banking book positions are exposed to physical risks, i.e., “chronic and acute climate-related hazards”. The exposures need to be reported by residual maturity and by NACE sector codes and should reflect exposure to risks like heat waves, droughts, floods, hurricanes, and wildfires. Specialized databases need to be consulted to compile a detailed understanding of these exposures. To support their submissions, banks further need to compile a narrative that explains the methodologies they used. - Mitigating actions

The final set of templates covers quantitative information on the actions a bank takes to mitigate or adapt to climate change risks.- Templates #6-8 all relate to the GAR, which indicates what part of the bank’s banking book is aligned with the EU’s Taxonomy:

- In template #7, banks need to report the outstanding banking book exposures to different types of clients/issuers, as well as the amount of these exposures that are taxonomy-eligible (that is, to sectors included in the EU Taxonomy) and taxonomy-aligned (that is, taxonomy-eligible exposures financing activities that contribute to climate change mitigation or adaptation). Based on this information, the bank’s GAR can be determined.

- In template #8, a GAR needs to be reported for the exposures to each type of client/issuer distinguished in template #7, with a distinction between a GAR for the full outstanding stock of exposures per client/issuer type, and a GAR for newly originated (‘flow’) exposures.

- Template #6 contains a summary of the GARs from templates #7 and #8.

In these templates, the numerator of the GAR only includes exposures to non-financial corporations that are required to publish non-financial information under the NFRD. Any exposures to other corporate counterparties therefore are considered 0% Taxonomy-aligned.

- The main challenge in this group of templates is in template #9. To incentivize banks to support all of their counterparties to transition to a more sustainable business model, and to collect ESG data on these counterparties, the EBA introduces the Banking Book Taxonomy Alignment Ratio (BTAR). In this metric, the numerator does include the exposures to counterparties that are not subject to NFRD disclosure obligations. The BTAR ratios obtained from the information in template #9 therefore complement the GAR ratios obtained in templates #7 and #8.

- In the final template (#10), banks have the opportunity to include any other climate change mitigating actions that are not covered by the EU Taxonomy. They can for example report on their use of green or sustainable bonds and loans.

- Templates #6-8 all relate to the GAR, which indicates what part of the bank’s banking book is aligned with the EU’s Taxonomy:

An overview of the templates for quantitative disclosures in presented in Figure 2.

Figure 2 – Overview of the required quantitative ESG disclosures

Qualitative disclosures

In the ITS on P3 disclosures on ESG risks, three tables are included for qualitative disclosures. The EBA has aligned these tables with their Report on Management and Supervision of ESG risks11. The three tables are set up for qualitative information on environmental, social, and governance risks, respectively. For each of these topics, banks need to address three aspects: on business strategy and processes, governance, and risk management. An overview of the required disclosures is presented in Figure 3.

Figure 3 – Overview of qualitative ESG disclosures (based on templates & section 2.3.2 of the EBA ITS on P3 disclosures on ESG risks)

Timelines and transitional measures

The ITS on P3 disclosure on ESG risks become effective per 30 June 2022 for large institutions that have securities traded on a regulated market of an EU member state. A semi-annual disclosure is required, but the first disclosure is annual. Consequently, based on 31 December 2022 data, the first reporting will take place in the first quarter of 2023.

The EBA has introduced a number of transitional measures. These can be summarized as follows:

- The reporting of information on the GAR is only required as of 31 December 2023.

- The reporting of information on the BTAR, the bank’s financed scope 3 emissions, and the alignment metrics is only required as of June 2024.

The EBA has further indicated in the ITS that they will conduct a review of the ITS’s requirements during 2024. They may then also extend the ITS with other environmental risks (other than the climate change-related risks in the current version). The EU Taxonomy is expected to cover a broader range of environmental risks by the end of 2022. Sometime after 2024, it is expected that the EBA will further extend the ITS by including disclosure requirements on social and governance risks.

An overview of the main timelines and transitional measures is presented in Figure 4.

Figure 4 – Overview of the main timelines and transitional measures for the ESG disclosures

Conclusion

Society, and consequently banks too, are increasingly facing risks stemming from changes in our climate. In recent years, supervisory authorities have stepped up by introducing more and more guidance and regulation to create transparency about climate change risk, and more broadly ESG risks. The publication of the ITS on P3 disclosures on ESG risks by the EBA marks an important milestone. It offers banks the opportunity to disseminate a constructive and positive role in the transition to a sustainable economy.

Nonetheless, implementing the disclosure requirements will be a challenge. Developing detailed assessments of the physical risks to which their asset portfolio is exposed and to estimate the scope 3 emissions of their clients and counterparties (‘financed emissions’) will not be straightforward. For their largest counterparties, banks will be able to profit from the NFRD disclosure obligations, but especially in Europe a bank’s portfolio typically has many exposures to small- and medium-sized enterprises. Meeting the disclosure requirements introduced by the EBA will require timely and intensive discussions with a substantial part of the bank’s counterparties.

Banks also need to provide detailed information on how ESG risks are reflected in the bank’s strategy and governance and incorporated in the risk management framework. With our extensive knowledge on market risk, credit risk, liquidity risk, and business risk, Zanders is well equipped to support banks with integrating the identification, measurement, and management of climate change-related risks into existing risk frameworks. For more information, please contact Pieter Klaassen or Sjoerd Blijlevens via +31 88 991 02 00.

References

1) See the EBA 2022 Work Programme.

2) The EBA’s Report on Management and Supervision of ESG risks for credit institutions and investment firms, published in June 2021.

3) See the EBA’s interactive Single Rulebook.

4) See Regulation (EU) 2019/876.

5) See the TCFD’s Final Report on Recommendations of the Task Force on Climate-related Financial Disclosures published in June 2017.

6) See the EBA’s response to EC Call for Advice on Article 8 Taxonomy Regulation.

7) See Regulation (EU) 2019/2089.

8) See Directive 2014/95/EU.

9) See the European Commission’s Proposal for a Corporate Sustainability Reporting Directive.

10) See Regulation (EU) 2019/2088.

11) The EBA report can be found here.

The EBA expects banks to expand their CSRBB framework

On 24 January 2022, the European Banking Authority (EBA) published its final draft Implementing Technical Standards (ITS) on Pillar 3 (P3) disclosures on Environmental, Social and Governance (ESG) risks.

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

This new update is triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers

- The first consultation paper1 describes the update of the IRRBB Guidelines themselves.

- The second paper2 concerns the introduction of a standardized approach (SA) which should be applied when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII). Read our analysis on this consultation paper here »

In this article we focus on the first consultation paper. The update of the IRRBB Guidelines can be split up in three topics and each will be discussed in further detail:

- Additional criteria for the assessment and monitoring of the credit spread risk arising from non-trading book activities (CSRBB)

- The criteria for non-satisfactory IRRBB internal systems

- A general update of the existing IRBBB Guidelines

CSRBB

The 2018 IRRBB Guidelines introduced the obligation for banks to monitor CSRBB. However, the publication did not describe how to do this. In the updated consultation paper the EBA defines the measurement of CSRBB as a separate risk class in more detail. The general governance related aspects such as (management) responsibilities, IT systems and internal reporting framework are separately defined for CSRBB, but are similar to those for IRRBB.

Also similar to IRRBB is that banks must express their risk appetite for CSRBB both from an NII as well as an economic value perspective.

The EBA defines CSRBB as:

“The risk driven by changes of the market price for credit risk, for liquidity and for potentially other characteristics of credit-risky instruments, which is not captured by IRRBB or by expected credit/(jump-to-) default risk. CSRBB captures the risk of an instrument’s changing spread while assuming the same level of creditworthiness, i.e. how the credit spread is moving within a certain rating/PD range.”

EBA

Compared to the previous definition, rating/PD migrations are explicitly excluded from CSRBB. Including idiosyncratic spreads could lead to double counting since these are generally covered by a credit risk framework. However, the guidelines give some flexibility to include idiosyncratic spreads, as long as the results are more conservative than when idiosyncratic spreads are excluded. This is because, based on the Quantitative Impact Study of December 2020 (QIS 2020), banks indicated to find it difficult to separate the idiosyncratic spreads from the credit spread.

Also, the scope of CSRBB has changed from the current IRRBB Guidelines. All assets, liabilities and off-balance-sheet items in the banking book that are sensitive to credit spread changes are within the scope of CSRBB whereas the 2018 IRRBB Guidelines focused only on the asset side. Based on the results of the QIS 2020, the EBA concluded that most of the exposures to CSRBB are debt securities which are accounted for at fair value (via Profit and Loss or Other Comprehensive Income). However, this does not rule out that other assets or liabilities could be exposed to CSRBB. It is stated that banks cannot ex-ante exclude positions from the scope of CSRBB. Any potential exclusion of instruments from the scope of CSRBB must be based on the absence of sensitivity to credit spread risk and appropriately documented. At a minimum, banks must include assets accounted at fair value in their scope.

We believe that the obligation to report CSRBB for all assets accounted for at fair value will be challenging for exposures that do not have quoted market prices. Without a deep liquid market, it will be difficult to establish the credits spread risk (even when idiosyncratic risk is included).

Another possible candidate to be included in the scope of CSRBB is the issued funding on the liability side of the banking book, especially in a NII context. When market spreads increase, this could become harmful when the wholesale funding needs to be rolled over against higher credit spread without being able to increase client interest on the asset side. Similar to IRRBB, the exposure to this risk depends on the repricing gap of the assets and liabilities. In this case, however, swaps cannot be used as hedge.

Other products such as consumer loans, mortgages, and consumer deposits, which are typically accounted for at amortized cost, are less likely to be included. This is also stated by the BCBS standards. The BCBS states that the margin (administrative rate) is under absolute control of the bank and hence not impacted by credit spreads. However, it is unclear whether this is sufficient to rule these products out of scope.

Non-satisfactory IRRBB internal systems

The EBA is mandated to specify the criteria for determining an IRRBB internal system as non-satisfactory. The EBA has identified specific items for this that should be considered. At a minimum, banks should have implemented their internal system in compliance with the IRRBB Guidelines, taking into account the principle of proportionality. More specifically:

- Such a system must cover all material interest rate risk components (gap risk, basis risk, option risk).

- The system should capture all material risks for significant assets, liabilities and off-balance sheet type instruments (e.g. non-maturing deposits, loans, and options).

- All estimated parameters must be sufficiently back tested and reviewed, considering the nature, scale and complexity of the bank.

- The internal system must comply with the model governance and the minimum required validation, review and control of IRRBB exposures as detailed by the IRRBB guidelines.

- Competent authorities may require banks to use the standardized approach3 if the internal systems are deemed non-satisfactory.

General update of existing IRRBB Guidelines

Major parts of the guidelines for managing IRRBB have not changed. In the section on IRRBB stress testing, however, a new article (#103) for products with significant repricing restrictions (e.g. an explicit floor on non-maturing deposits – NMDs) is introduced. As part of their stress testing, banks should consider the impact when these products are replaced with contracts with similar characteristics, even under a run-off assumption. The exact intention of this article is unclear. For NII-purposes it is common practice to roll over products with similar characteristics (or use another balance sheet development assumption). Our interpretation of this article is that banks are expected to measure the risk of continued repricing restrictions in an economic value perspective when the maturity of those funding sources is smaller than the maturity of the asset portfolio. This may for example materialize when banks roll over NMDs that are subject to a legally imposed floor.

Another update is the restriction on the maximum weighted average repricing maturity of five years for NMDs. This cap was prescribed for the EVE SOT and is now included for the internal measurement of IRRBB. We believe that the impact of this will be limited since only a few banks will have separate NMD models for internal measurement and the SOT.

Finally, some minor additions have been included in the guidelines. For example, the guidelines emphasize multiple times that when diversification assumptions are used for the measurement of IRRBB, these must be appropriately stressed and validated.

Conclusion

It is expected that the final guidelines will not deviate significantly from the consultation paper. Banks can therefore start preparing for these new expectations. For the measurement of IRRBB, limited changes are introduced in the consultation. Although the exact intention of the EBA is unclear to us, it is interesting to notice that the updated IRRBB Guidelines include the expectation that banks pay special attention in their stress tests to products with significant repricing restrictions. Furthermore, banks must invest in their CSRBB measurement. For their entire banking book, banks need to assess whether market wide credit spread changes will have an impact on an NII and/or economic value perspective. The scope of CSRBB measurement may need to be extended to include the funding issued by the bank. And to conclude, the obligation to measure CSRBB for fair value assets that do not have quoted market prices will be a challenge for banks.

References

The EBA faces banks with a new supervisory outlier test on net interest income

On 24 January 2022, the European Banking Authority (EBA) published its final draft Implementing Technical Standards (ITS) on Pillar 3 (P3) disclosures on Environmental, Social and Governance (ESG) risks.

In this article, we focus on one of these consultation papers, which concerns updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

The new updates are triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers:

- The first consultation paper1 describes an update of the IRRBB Guidelines themselves. The main changes are the specification of criteria to identify “non-satisfactory internal models for IRRBB management” and the specification of criteria to assess and monitor Credit Spread Risk in the Banking Book (CSRBB). Read our analysis on this consultation paper here »

- The second paper2 concerns the introduction of a standardized approach (SA) which should be used when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a Simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

Please note that we recently also published an article about the new disclosure requirements for IRRBB which is closely related to this topic.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

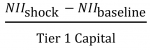

Replacement of the 20% SOT for EVE

The first part of the amended Article 98 (5) concerns the replacement of the original 20% SOT by the 15% SOT. While many banks are probably already targeting levels below 15%, we expect that this change will limit the maneuvering capabilities of banks as they will likely choose to implement a management buffer. Note that not only the threshold is lower (15% instead of 20%), but also the denominator (Tier 1 capital instead of own funds). Furthermore, the worst outcome of all six supervisory scenarios should be used, as opposed to worst outcome of just the two parallel ones. Combined, this leads to a significant reduction in the EVE risk to which a bank may be exposed.

Some other noteworthy updates to the SOT for EVE that are not directly related to the CRD amendment are listed below:

- The post-shock interest floor decreases from -100 to -150 basis points and it increases to 0% over a 50-year instead of a 20-year period.

- In the calibration of the interest rate shocks for currencies for which the shocks have not been prescribed, the most recent 16-year period should be used (instead of the 2000-2015 period which is still underlying the shocks for the other currencies).

- When aggregating the results over currencies, some additional offsetting (80% as opposed to 50%) is granted in case of Exchange Rate Mechanism (ERM) II currencies with a formally agreed fluctuation band narrower than the standard band of +/-15%. Currently, only positions in the Denmark Krona (DKK) qualify for this treatment.

Introduction of the SOT for NII

The second part of the amended Article 98 (5) concerns the introduction of an entirely new SOT. It is aimed at measuring the potential decline in NII for two standard interest rate shock scenarios. Compared to the SOT for EVE, the SOT for NII requires many more modeling assumptions, in particular to determine the expected balance sheet development. The consultation paper provides clarity on the approach the EBA wants to take but two decisions are explicitly consulted.

The SOT for NII compares the NII for a baseline scenario with the NII in a shocked scenario over a one-year horizon. The two shocks that need to be applied are the two instantaneous parallel shocks that are also used in the SOT for EVE. Furthermore, the same requirements that are specified for the SOT for EVE apply, for example the use of the floor and the aggregation approach. The two exceptions are the requirements to use a constant balance sheet assumption (as opposed to a run-off balance sheet) and to include commercial margins and other spread components in the calculations. The commercial margins of new instruments should equal the prevailing levels (as opposed to historical ones).

The two decisions for which the EBA is seeking input are:

The scope/definition of NII

In its narrowest definition, the SOT will focus on the difference between interest income and interest expenses. The EBA, however, also considers using a broader definition where the effect of market value changes of instruments accounted for at Fair Value (∆FV) is added, and possibly also interest rate sensitive fees and commissions.

The definition of the SOT’s threshold

Article 98 (5) requires the EBA to specify what is considered a ‘large decline’ in NII, in which case the competent authorities are entitled to exercise their supervisory powers. This first requires a metric. The EBA is consulting two:

- The first metric is calculating the change in NII (the difference between the shocked and baseline NII) relative to the Tier 1 Capital:

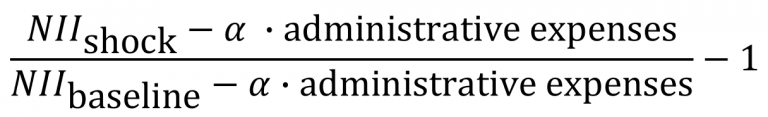

- The second metric is calculating the change in NII relative to the baseline scenario, after correcting for administrative expenses that can be allocated to NII:

- where α is the historical share of NII relative to the operating income as reported based on FINREP input.

The pros of the narrow definition of NII are improved comparability and ease of computation, where the main pro of the broader definition is that it achieves a more comprehensive picture, which is also more in line with the EBA IRRBB Guidelines. With respect to the metrics, the first (capital-based) metric is the simplest and it is comparable to the approach taken for the SOT for EVE. The second metric is close to a P&L-based metric and the EBA argues that its main advantage is that “it takes into account both the business model and cost structure of a bank in the assessment of the continuity of the business operations”. It does involve, however, the application of some assumptions on determining the α parameter.

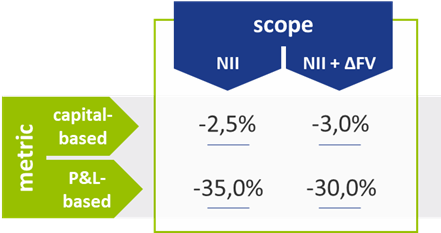

Thresholds for the four possible combinations

For each of the four possible combinations (definition of NII and specification of the metric), the EBA has determined, using data from the December 2020 Quantitative Impact Study (QIS), what the corresponding thresholds should be. Their starting point has been to make the SOT for NII as stringent as the SOT for EVE. Effectively, they reverse engineered the threshold to achieve a similar number of outliers under both measures. We expect that the proposed threshold for any of the four possible combinations will not be constraining for the majority of banks. The resulting proposed thresholds are included in the table below:

Table 1 – Comparison of the proposed thresholds for each combination of metric and scope

The impact of including Fair Value changes seems arbitrary as it increases the threshold for the capital-based metric and decreases the threshold for the P&L-based metric. Also, from a comparability and computational perspective, the narrow definition of NII may be preferred. Furthermore, the capital-based metric is less intuitive for NII than it is for EVE, and consequently, the P&L-based one may be preferred. It is also noted in the consultation paper that if the shocked NII after the correction for administrative expenses (the numerator) is negative, it will also be considered an outlier.

Conclusion

In the past years, many banks have invested heavily in their IRRBB framework following the 2018 update of the IRRBB Guidelines. Once again, an investment is required. Even though there are not many surprises in the proposed updates related to the SOTs, small and large banks alike will need to carefully assess how the changes to the existing SOT and the introduction of the new SOT will impact their interest rate risk management. Banks still have the opportunity to respond to all three consultation papers until 4 April 2022.

References

The usage of proxies under FRTB

Learn how banks can reduce capital charges under FRTB by using proxies, external data, and customized risk factor bucketing to minimize non-modellable risk factors (NMRFs).

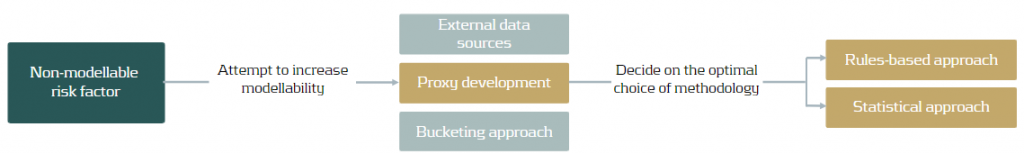

Non-modellable risk factors (NMRFs) have been shown to be one of the largest contributors to capital charges under FRTB. The use of proxies is one of the methods that banks can employ to increase the modellability of risk factors and reduce the number of NMRFs. Other potential methods for improving the modellability of risk factors is using external data sources and modifying risk factor bucketing approaches.

Proxies and FRTB

A proxy is utilised when there is an insufficient historical data for a risk factor. A lack of historical data increases the likelihood of the risk factor failing the Risk Factor Eligibility Test (RFET). Consequently, using proxies ensures that the number of NMRFs is reduced and capital charges are kept to a minimum. Although the use of proxies is allowed, regulation states that their usage must be limited, and they must have sufficiently similar characteristics to the risk factors which they represent.

Banks must be ready to provide evidence to regulators that their chosen proxies are conceptually and empirically sound. Despite the potential reduction in capital, developing proxy methodologies can be time-consuming and require considerable ongoing monitoring. There are two main approaches which are used to develop proxies: rules-based and statistical.

Proxy decomposition

FRTB regulation allows NMRFs to be decomposed into modellable components and a residual basis, which must be capitalised as non-modellable. For example, credit spreads for small issuers which are not highly liquid can be decomposed into a liquid credit spread index component, which is classed as modellable, and a non-modellable basis or spread.

To test modellability using the RFET, 12-months of data is required for the proxy and basis components. If the basis between the proxy and the risk factor has not been identified and properly capitalised, only the proxy representation of the risk factor can be used in the Risk Theoretical P&L (RTPL). However, if the capital requirement for a basis is determined, either: (i) the proxy risk factor and the basis; or (ii) the original risk factor itself can be included in the RTPL.

Banks should aim to produce preliminary analysis on the cost benefits of proxy development – does the cost and effort of developing proxies outweigh the capital which could be saved by increasing risk factor modellability? For example, proxies which are highly volatile may also result in increasing NMRF capital charges.

Approaches for the development of proxies

Both rules-based and statistical approaches to developing proxies require considerable effort. Banks should aim to develop statistical approaches as they have been shown to be more accurate and also more efficient in reducing capital requirements for banks.

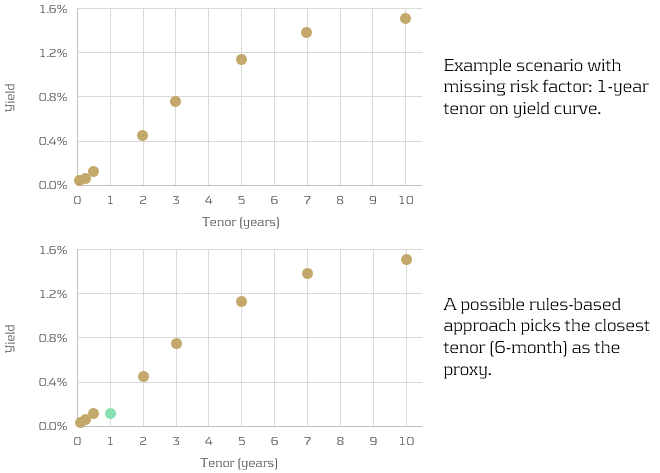

Rules-based approach

Rules-based approaches are more simplistic, however are less accurate than the statistical approaches. They find the “closest fit” modellable risk factor using somewhat more qualitative methods. For example, picking the closest tenor on a yield curve (see below), using relevant indices or ETFs, or limiting the search for proxies to the same sector as the underlying risk factor.

Similarly, longer tenor points (which may not be traded as frequently) can be decomposed into shorter-tenor points and cross-tenor basis spread.

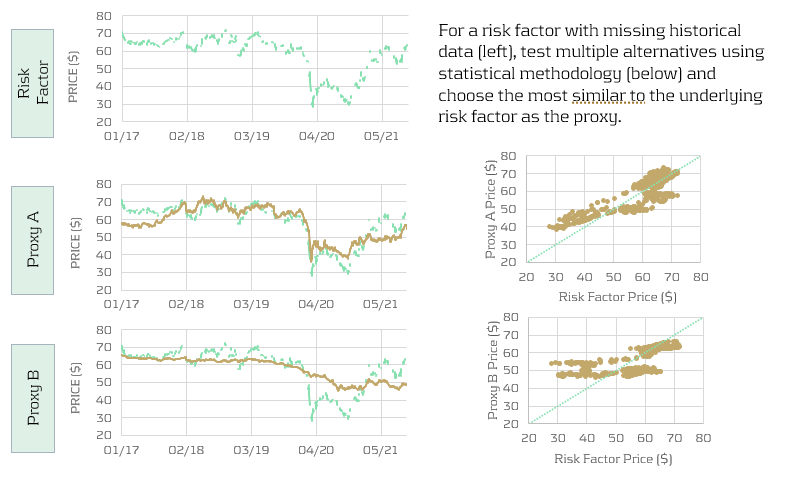

Statistical approach

Statistical approaches are more quantitate and more accurate than the rules-based approaches. However, this inevitably comes with computational expense. A large number of candidates are tested using the chosen statistical methodology and the closest is picked (see below).

For example, a regression approach could be used to identify which of the candidates are most correlated with the underlying risk factor. Studies have shown that statistical approaches not only produce the more accurate proxies, but can also reduce capital charges by almost twice as much as simpler rules-based approaches.

Conclusion

Risk factor modellability is a considerable concern for banks as it has a direct impact on the size of their capital charges. Inevitably, reducing the number of NMRFs is a key aim for all IMA banks. In this article, we show that developing proxies is one of the strategies that banks can use to minimise the amount of NMRFs in their models. Furthermore, we describe the two main approaches for developing proxies: rules-based and statistical. Although rules-based approaches are less complicated to develop, statistical approaches show much better accuracy and hence have the potential to better reduce capital charges.

How can treasury become a sustainable function?

Learn how banks can reduce capital charges under FRTB by using proxies, external data, and customized risk factor bucketing to minimize non-modellable risk factors (NMRFs).

One of the key subjects in this re-assessment is the implementation of tangible and transparent Environment, Social, and Governance (ESG) factors into the business.

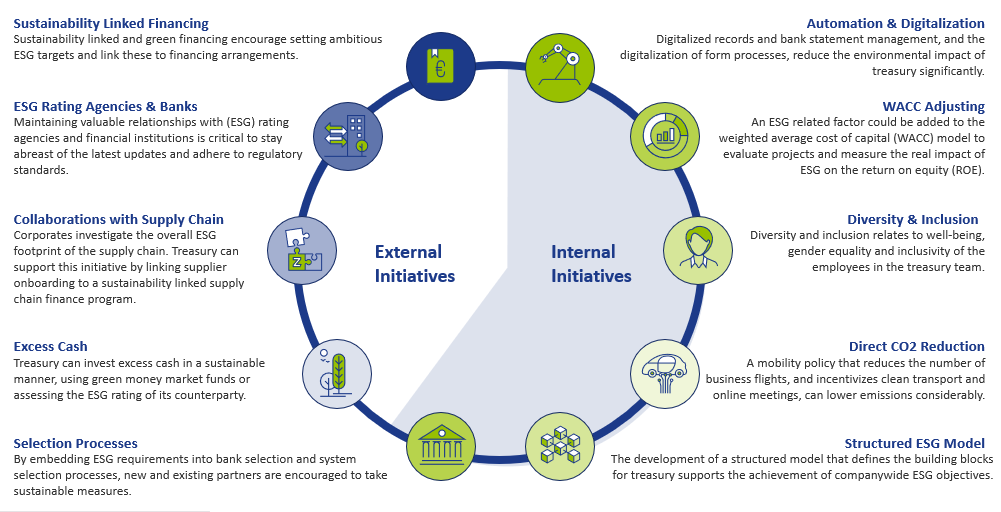

Treasury can drive sustainability throughout the company from two perspectives, namely through initiatives within the Treasury function and initiatives promoted by external stakeholders, such as banks, investors, or its clients. When considering sustainability, many treasurers first port of call is to investigate realizing sustainable financing framework. This is driven by the high supply of money earmarked for sustainable goals. However, besides this external focus, Treasury can strive to make its own operations more sustainable and, as a result, actively contribute to company-wide ESG objectives.

Figure 1: ESG initiatives in scope for Treasury

Treasury holds a unique position within the company because of the cooperation it has with business areas and the interaction with external stakeholders. Treasury can leverage this position to drive ESG developments throughout the company, stay informed of latest updates and adhere to regulatory standards. This article shows how Treasury can become a sustainable support function in its own right, highlights various initiatives within and outside the Treasury department and marks the benefits for Treasury – on top of realising ESG targets.

Internal initiatives

Automation and digitalization drive certain environmental initiatives within the Treasury department. Full digitalized records and bank statement management and the digitalization of form processes reduce the adverse environmental impact of the Treasury department. Besides reducing Treasury’s environmental footprint, digitalization improves efficiency of the Treasury team. By reducing the number of manual, cumbersome operational activities, time can be spent on value-adding activities rather than operational tasks.

Another great example of how Treasury can contribute to the ESG goals of the company, is to incorporate ESG elements in the capital allocation process. This can be done by adding ESG related risk factors to the weighted average cost of capital (WACC) or hurdle investment rates. By having an ESG linked WACC, one can evaluate projects by measuring the real impact of ESG on the required return on equity (ROE). By adjusting the WACC to, for example, the level of CO2 that is emitted by a project, the capital allocation process favours projects with low CO2 emissions.

An additional internal initiative is the design of a mobility policy with the objective to lower CO2 emissions. On one hand, this relates to decreasing the amount of business trips made by the Treasury department itself. On the other hand, it relates to the reduction of business travel by stakeholders of treasury such as bankers, advisors and system vendors. A framework that offsets the added value of a real-life meeting against the CO2 emission is an example of a measure that supports CO2 reduction on both sides. Such a framework supports determination whether the meeting takes place online or in person.

Furthermore, embedding ESG requirements into bank selection, system selection and maintenance processes is a valuable way of encouraging new and existing partners to undertake ESG related measures.

When it comes to social contributions, the focus could be on the diversity and inclusion of the Treasury department, which includes well-being, gender equality and inclusivity of the employees. Pursuing these policies can increase the attractiveness of the organization when hiring talent and make it easier to retain talent within the company, which is also beneficial to the Treasury function.

The development of a structured model that defines the building blocks for Treasury to support the achievement of companywide ESG objectives is a governance initiative that Treasury could undertake. An example of such a model is the Zanders Treasury and Risk Maturity Model, which can be integrated in any organization. This framework supports Treasury in keeping track of its ESG footprint and its contribution to company-wide sustainable objectives. In addition, the Zanders sustainability dashboard provides information on metrics and benchmarks that can be applied to track the progress of several ESG related goals for Treasury. Some examples of these are provided in our ‘Integration of ESG in treasury’ article.

External initiatives

Besides actions taken within the Treasury department, Treasury can boost company-wide ESG performance by leveraging their collaboration with external stakeholders. One of these external initiatives is sustainability linked financing, which is a great tool to encourage the setting of ambitious, company-wide ESG targets and link these to financing arrangements. Examples of sustainability linked financing products include green loans and bonds, sustainability-linked loans, and social bonds. To structure sustainability-linked financing products, corporates often benefit from the guidance of external parties when setting KPIs and ambitious targets and linking these to the existing sustainability strategy. Besides Treasury’s strong relationships with banks, retaining good relationships with (ESG) rating agencies and financial institutions is critical to stay abreast of the latest updates and adhere to regulatory standards. Additionally, investing excess cash in a sustainable manner, using green money market funds or assessing the ESG rating of counterparties, is an effective way of supporting sustainability.

Apart from financing instruments, Treasury can drive the ESG strategy throughout the organization in other ways. Treasury can seek collaborations with business partners to comply with ESG targets, which is another effective manner to achieve ESG related goals throughout the supply chain. An increasing number of corporates is looking to reduce the carbon footprint of their supply chain, for which collaboration is essential. Treasury can support this initiative by linking supplier onboarding on its supply chain finance program to the sustainability performance of suppliers.

To conclude

As developments in ESG are rapidly unfold9ing, Zanders has started an initiative to continuously update our clients to stay ahead of the latest trends. Through the knowledge and network that we have built over the years, we will regularly inform our clients on ESG trends via articles on the news page on our website. The first article will be devoted to the revision of the Sustainability Linked Loan Principles (SLLP) by the Loan Market Association (LMA) and its American and Asian equivalents.

We are keen to hear which topics you would like to see covered. Feel free to reach out to Joris van den Beld or Sander van Tol if you have any questions or want to address ESG topics that are on your agenda.

Impact of climate change on financial institutions

Learn how banks can reduce capital charges under FRTB by using proxies, external data, and customized risk factor bucketing to minimize non-modellable risk factors (NMRFs).

The Bank of England is even of the opinion that climate change represents the tragedy of the horizon: “by the time it is clear that climate change is creating risks that we want to reduce, it may already be too late to act” [1]. This article provides a summary of the type of financial risks resulting from climate change, various initiatives within the financial industry relating to the shift towards a low-carbon economy, and an outlook for the assessment of climate change risks in the future.

At the December 2015 Paris Agreement conference, strict measures to limit the rise in global temperatures were agreed upon. By signing the Paris Agreement, governments from all over the world committed themselves to paving a more sustainable path for the planet and the economy. If no action is taken and the emission of greenhouse gasses is not reduced, research finds that per 2100, the temperature will have increased by 3°C to 5°C2.. Climate change affects the availability of resources, the supply and demand for products and services and the performance of physical assets. Worldwide economic costs from natural disasters already exceeded the 30-year average of USD 140 billion per annum in seven out of the last ten years. Extreme weather circumstances influence health and damage infrastructure and private properties, thereby reducing wealth and limiting productivity. According to Frank Elderson, Executive Director at the DNB, this can disrupt economic activity and trade, lead to resource shortages and shift capital from more productive uses to reconstruction and replacement3.

According to the Bank of England, financial risks from climate change come down to two primary risk factors4:

Increasing concerns about climate change has led to a shift in the perception of climate risk among companies and investors. Where in the past analysis of climate-related issues was limited to sectors directly linked to fossil fuels and carbon emissions, it is currently being recognized that climate-related risk exposures concern all sectors, including financials. Banks are particularly vulnerable to climate-related risks as they are tied to every market sector through their lending practices.

Financial risks

- Physical risks. The first risk factor concerns physical risks caused by climate and weather-related events such as droughts and a sea level rise. Potential consequences are large financial losses due to damage to property, land and infrastructure. This could lead to impairment of asset values and borrowers’ creditworthiness. For example, as of January 2019, Dutch financial institutions have EUR 97 billion invested in companies active in areas with water scarcity5. These institutions can face distress if the water scarcity turns into water shortages. Another consequence of extreme climate and weather-related events is the increase in insurance claims: in the US alone, the insurance industry paid out USD 135 billion from natural catastrophes in 2017, almost three times higher than the annual average of USD 49 billion.

- Transition risks. The second risk factor comprises transition risks resulting from the process of moving towards a low-carbon economy. Revaluation of assets because of changes in policy, technology and sentiment could destabilize markets, tighten financial conditions and lead to procyclicality of losses. The impact of the transition is not limited to energy companies: transportation, agriculture, real estate and infrastructure companies are also affected. An example of transition risk is a decrease in financial return from stocks of energy companies if the energy transition undermines the value of oil stocks. Another example is a decrease in the value of real estate due to higher sustainability requirements.

These two climate-related risk factors increase credit risk, market risk and operational risk and have distinctive elements from other risk factors that lead to a number of unique challenges. Firstly, financial risks from physical and transition risk factors may be more far-reaching in breadth and magnitude than other types of risks as they are relevant to virtually all business lines, sectors and geographies, and little diversification is present. Secondly, there is uncertainty in timing of when financial risks may be realized. The possibility exists that the risk impact falls outside of current business planning horizons. Thirdly, despite the uncertainty surrounding the exact impact of climate change risks, combinations of physical and transition risk factors do lead to financial risk. Finally, the magnitude of the future impact is largely dependent on short-term actions.

Initiatives

Many parties in the financial sector acknowledge that although the main responsibility for ensuring the success of the Paris Agreement and limiting climate change lies with governments, central banks and supervisors also have responsibilities. Consequently, climate change and the inherent financial risks are increasingly receiving attention, which is evidenced by the various recent initiatives related to this topic.

Banks and regulators

The Network of Central Banks and Supervisors for Greening the Financial System (NGFS) is an international cooperation between central banks and regulators6. NGFS aims to increase the financial sector’s efforts to achieve the Paris climate goals, for example by raising capital for green and low-carbon investments. NGFS additionally maps out what is needed for climate risk management. DNB and central banks and regulators of China, Germany, France, Mexico, Singapore, UK and Sweden were involved from the start of NGFS in 2017. The ECB, EBA, EIB and EIOPA are currently also part of the network. In the first progress report of October 2018, NGFS acknowledged that regulators and central banks increased their efforts to understand and estimate the extent of climate and environmental risks. They also noted, however, that there is still a long way to go.

In their first comprehensive report of April 2019, NGFS drafted the following six recommendations for central banks, supervisors, policymakers and financial institutions, which reflect best practices to support the Paris Agreement7:

- Integrating climate-related risks into financial stability monitoring and micro-supervision;

- Integrating sustainability factors into own-portfolio management;

- Bridging the data gaps by public authorities by making relevant data to Climate Risk Assessment (CRA) publicly available in a data repository;

- Building awareness and intellectual capacity and encouraging technical assistance and knowledge sharing;

- Achieving robust and internationally consistent climate and environment-related disclosure;

- Supporting the development of a taxonomy of economic activities.

All these recommendations require the joint action of central banks and supervisors. They aim to integrate and implement earlier identified needs and best practices to ensure a smooth transition towards a greener financial system and a low-carbon economy. Recommendations 1 and 5, which are two of the main recommendations, require further substantiation.

- The first recommendation consists of two parts. Firstly, it entails investigating climate-related financial risks in the financial system. This can be achieved by (i) mapping physical and transition risk channels to key risk indicators, (ii) performing scenario analysis of multiple plausible future scenarios to quantify the risks across the financial system and provide insight in the extent of disruption to current business models in multiple sectors and (iii) assessing how to include the consequences of climate change in macroeconomic forecasting and stability monitoring. Secondly, it underlines the need to integrate climate-related risks into prudential supervision, including engaging with financial firms and setting supervisory expectations to guide financial firms.

- The fifth recommendation stresses the importance of a robust and internationally consistent climate and environmental disclosure framework. NGFS supports the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD8) and urges financial institutions and companies that issue public debt or equity to align their disclosures with these recommendations. To encourage this, NGFS emphasizes the need for policymakers and supervisors to take actions in order to achieve a broader application of the TCFD recommendations and the growth of an internationally consistent environmental disclosure framework.

Future deliverables of NGFS consist of drafting a handbook on climate and environmental risk management, voluntary guidelines on scenario-based climate change risk analysis and best practices for including sustainability criteria into central banks’ portfolio management.

Asset managers

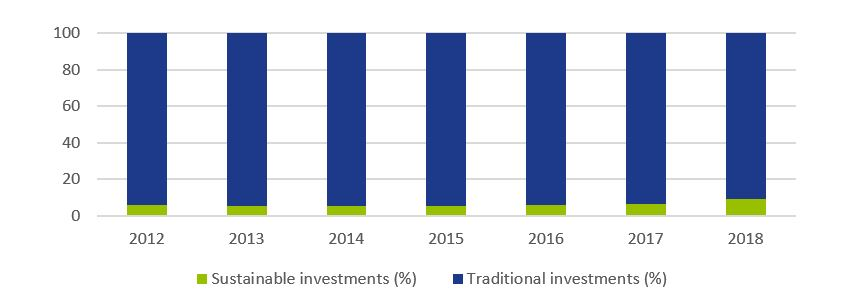

To achieve the climate goals of the Paris Agreement, €180 billion is required on an annual basis5. It is not possible to acquire such a large amount from the public sector alone and currently only a fraction of investor capital is being invested sustainably. Research from Morningstar shows that 11.6% of investor capital in the stock market and 5.6% in the bond market is invested sustainably9. Figure 1 shows that even though the percentage of capital invested in sustainable investment funds (stocks and bonds) is growing in recent years, it is still worryingly low.

Figure 1: Percentage of invested capital in Europe in traditional and sustainable investment funds (shares and bonds). Source: Morningstar [9].

The current levels of investment are not enough to support an environmentally and socially sustainable economic system. As a result, the European Commission (EC) has raised four initiatives through the Technical Expert Group on sustainable finance (TEG) that are designed to increase sustainable financing10. The first initiative is the issuance of two kinds of green (low-carbon) benchmarks. Offering funds or trackers on these indices would lead to an increase in cash flows towards sustainable companies. Secondly, an EU taxonomy for climate change mitigation and climate change adaptation has been developed. Thirdly, to enable investors to determine to what extent each investment is aligned with the climate goals, a list of economic activities that contribute to the execution of the Paris Agreement has been drafted. Finally, new disclosure requirements should enhance visibility of how investment firms integrated sustainability into their investment policy and create awareness of the climate risks the investors are exposed to.

Insurance firms

Within the insurance sector, the Prudential Regulation Authority (PRA) requires insurers to follow a strategic approach to manage the financial risks from climate change. To support this, in July 2018, the Bank of England (BoE) formed a joint working group focusing on providing practical assistance on the assessment of financial risks resulting from climate changes. In May 2019, the working group issued a six-stage framework that helps insurers in assessing, managing and reporting physical climate risk exposure due to extreme weather events11. Practical guidance is provided in the form of several case studies, illustrating how considering the financial impacts can better inform risk management decisions.

Authorities

Another initiative is the Climate Financial Risk Forum (CFRF), a joint initiative of the PRA and the Financial Conduct Authority (FCA)12. The forum consists of senior representatives of the UK financial sector from banks, insurers and asset managers. CFRF aims to build capacity and share best practices across financial regulators and the industry to enhance responses to the financial climate change risks. The forum set up four working groups focusing on risk management, scenario analysis, disclosure and innovation. The purpose of these working groups, which consist of CFRF members as well as other experts such as academia, is to provide practical guidance on each of the four focus areas.

Current status and outlook

On 5 June 2019, the TCFD published a Status Report assessing a disclosure review on the extent to which 1,100 companies included information aligned with these TCFD recommendations in their 2018 reports. The report also assessed a survey on companies’ efforts to live up to TCFD recommendations and users’ opinion on the usefulness of climate-related disclosures for decision-making13. Based on the disclosure review and the survey, TCFD concluded that, while some of the results were encouraging, not enough companies are disclosing climate change-linked financial information that is useful for decision-making. More specifically, it was found that:

- “Disclosure of climate-related financial information has increased, but is still insufficient for investors;

- More clarity is needed on the potential financial impact of climate-related issues on companies;

- Of companies using scenarios, the majority do not disclose information on the resilience of their strategies;

- Mainstreaming climate-related issues requires the involvement of multiple functions.”

Further, the BoE finds that despite the progress, there is still a long way to go: while many banks are incorporating the most immediate physical risks to their business models and assess exposures to transition risks, many of them are not there yet in their identification and measurement of the financial risks. They stress that governments, financial firms, central banks and supervisors should work together internationally and domestically, private sector and public sector, to achieve a smooth transition to a low-carbon economy. Mark Carney, Governor of the BoE, is optimistic and argues that, conditional on the amount of effort, it should possible to manage the financial climate risks in an orderly, effective and productive manner4.

With respect to the future, Frank Elderson made the following claim: “Now that European banking supervision has entered a more mature phase, we need to retain a forward-looking strategy and develop a long-term vision. Focusing on greening the financial system must be a part of this.”3.

References

1 https://www.bankofengland.co.uk/-/media/boe/files/speech/2019/avoiding-the-storm-climate-change-and-the-financial-system-speech-by-sarah-breeden.pdf

2 https://public.wmo.int/en/media/press-release/wmo-climate-statement-past-4-years-warmest-record

3 https://www.bankingsupervision.europa.eu/press/interviews/date/2019/html/ssm.in190515~d1ab906d59.en.html

4 https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/report/transition-in-thinking-the-impact-of-climate-change-on-the-uk-banking-sector.pdf

5 https://fd.nl/achtergrond/1294617/beleggers-moeten-met-de-billen-bloot-over-klimaatrisico-s

6 https://www.dnb.nl/over-dnb/samenwerking/network-greening-financial-system/index.jsp

7 https://www.banque-france.fr/sites/default/files/media/2019/04/17/ngfs_first_comprehensive_report_-_17042019_0.pdf

8 https://www.fsb-tcfd.org/publications/final-recommendations-report/

9 http://www.morningstar.nl/nl/

10 https://ec.europa.eu/info/publications/sustainable-finance-technical-expert-group_en

11 https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/2019/a-framework-for-assessing-financial-impacts-of-physical-climate-change.pdf

12 https://www.bankofengland.co.uk/news/2019/march/first-meeting-of-the-pra-and-fca-joint-climate-financial-risk-forum

13 https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-2017-TCFD-Report-11052018.pdf

FRTB: Improving the Modellability of Risk Factors

Learn how banks can reduce capital charges under FRTB by using proxies, external data, and customized risk factor bucketing to minimize non-modellable risk factors (NMRFs).

Under the FRTB internal models approach (IMA), the capital calculation of risk factors is dependent on whether the risk factor is modellable. Insufficient data will result in more non-modellable risk factors (NMRFs), significantly increasing associated capital charges.

NMRFs

Risk factor modellability and NMRFs

The modellability of risk factors is a new concept which was introduced under FRTB and is based on the liquidity of each risk factor. Modellability is measured using the number of ‘real prices’ which are available for each risk factor. Real prices are transaction prices from the institution itself, verifiable prices for transactions between arms-length parties, prices from committed quotes, and prices from third party vendors.

For a risk factor to be classed as modellable, it must have a minimum of 24 real prices per year, no 90-day period with less than four prices, and a minimum of 100 real prices in the last 12 months (with a maximum of one real price per day). The Risk Factor Eligibility Test (RFET), outlined in FRTB, is the process which determines modellability and is performed quarterly. The results of the RFET determine, for each risk factor, whether the capital requirements are calculated by expected shortfall or stressed scenarios.

Consequences of NMRFs for banks

Modellable risk factors are capitalised via expected shortfall calculations which allow for diversification benefits. Conversely, capital for NMRFs is calculated via stressed scenarios which result in larger capital charges. This is due to longer liquidity horizons and more prudent assumptions used for aggregation. Although it is expected that a low proportion of risk factors will be classified as non-modellable, research shows that they can account for over 30% of total capital requirements.

There are multiple techniques that banks can use to reduce the number and impact of NMRFs, including the use of external data, developing proxies, and modifying the parameterisation of risk factor curves and surfaces. As well as focusing on reducing the number of NMRFs, banks will also need to develop early warning systems and automated reporting infrastructures to monitor the modellability of risk factors. These tools help to track and predict modellability issues, reducing the likelihood that risk factors will fail the RFET and increase capital requirements.

Methods for reducing the number of NMRFs

Banks should focus on reducing their NMRFs as they are associated with significantly higher capital charges. There are multiple approaches which can be taken to increase the likelihood that a risk factor passes the RFET and is classed as modellable.

Enhancing internal data

The simplest way for banks to reduce NMRFs is by increasing the amount of data available to them. Augmenting internal data with external data increases the number of real prices available for the RFET and reduces the likelihood of NMRFs. Banks can purchase additional data from external data vendors and data pooling services to increase the size and quality of datasets.

It is important for banks to initially investigate their internal data and understand where the gaps are. As data providers vary in which services and information they provide, banks should not only focus on the types and quantity of data available. For example, they should also consider data integrity, user interfaces, governance, and security. Many data providers also offer FRTB-specific metadata, such as flags for RFET liquidity passes or fails.

Finally, once a data provider has been chosen, additional effort will be required to resolve discrepancies between internal and external data and ensure that the external data follows the same internal standards.

Creating risk factor proxies

Proxies can be developed to reduce the number or magnitude of NMRFs, however, regulation states that their use must be limited. Proxies are developed using either statistical or rules-based approaches.

Rules-based approaches are simplistic, yet generally less accurate. They find the “closest fit” modellable risk factor using more qualitative methods, e.g. using the closest tenor on the interest rate curve. Alternatively, more accurate approaches model the relationship between the NMRF and modellable risk factors using statistical methods. Once a proxy is determined, it is classified as modellable and only the basis between it and the NMRF is required to be capitalised using stressed scenarios.

Determining proxies can be time-consuming as it requires exploratory work with uncertain outcomes. Additional ongoing effort will also be required by validation and monitoring units to ensure the relationship holds and the regulator is satisfied.

Developing own bucketing approach

Instead of using the prescribed bucketing approach, banks can use their own approach to maximise the number of real price observations for each risk factor.

For example, if a risk model requires a volatility surface to price, there are multiple ways this can be parametrised. One method could be to split the surface into a 5x5 grid, creating 25 buckets that would each require sufficient real price observations to be classified as modellable. Conversely, the bank could instead split the surface into a 2x2 grid, resulting in only four buckets. The same number of real price observations would then need to be allocated between significantly less buckets, decreasing the chances of a risk factor being a NMRF.

It should be noted that the choice of bucketing approach affects other aspects of FRTB. Profit and Loss Attribution (PLA) uses the same buckets of risk factors as chosen for the RFET. Increasing the number of buckets may increase the chances of passing PLA, however, also increases the likelihood of risk factors failing the RFET and being classed as NMRFs.

Conclusion

In this article, we have described several potential methods for reducing the number of NMRFs. Although some of the suggested methods may be more cost effective or easier to implement than others, banks will most likely, in practice, need to implement a combination of these strategies in parallel. The modellability of risk factors is clearly an important part of the FRTB regulation for banks as it has a direct impact on required capital. Banks should begin to develop strategies for reducing the number of NMRFs as early as possible if they are to minimise the required capital when FRTB goes live.

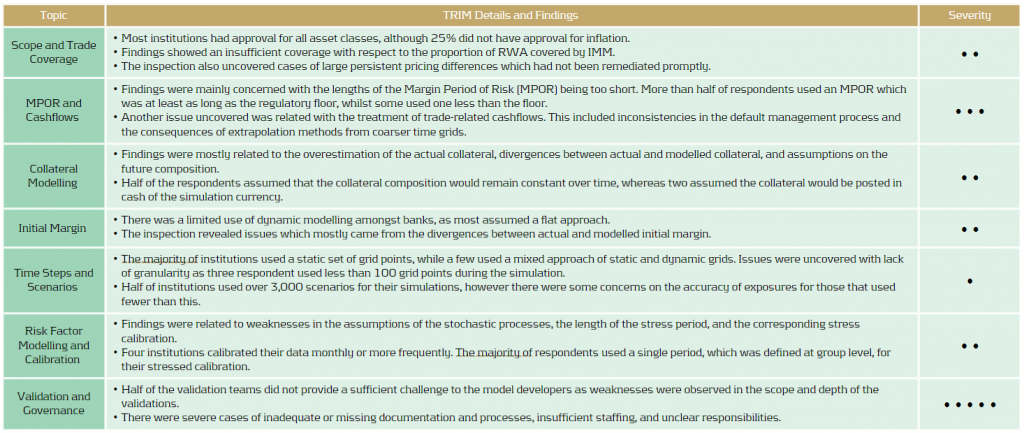

Targeted Review of Internal Models (TRIM): Review of observations and findings for Traded Risk

Discover the significant deficiencies uncovered by the EBA’s TRIM on-site inspections and how banks must swiftly address these to ensure compliance and mitigate risk.

The EBA has recently published the findings and observations from their TRIM on-site inspections. A significant number of deficiencies were identified and are required to be remediated by institutions in a timely fashion.

Since the Global Financial Crisis 2007-09, concerns have been raised regarding the complexity and variability of the models used by institutions to calculate their regulatory capital requirements. The lack of transparency behind the modelling approaches made it increasingly difficult for regulators to assess whether all risks had been appropriately and consistently captured.

The TRIM project was a large-scale multi-year supervisory initiative launched by the ECB at the beginning of 2016. The project aimed to confirm the adequacy and appropriateness of approved Pillar I internal models used by Significant Institutions (SIs) in euro area countries. This ensured their compliance with regulatory requirements and aimed to harmonise supervisory practices relating to internal models.

TRIM executed 200 on-site internal model investigations across 65 SIs from over 10 different countries. Over 5,800 deficiencies were identified. Findings were defined as deficiencies which required immediate supervisory attention. They were categorised depending on the actual or potential impact on the institution’s financial situation, the levels of own funds and own funds requirements, internal governance, risk control, and management.

The findings have been followed up with 253 binding supervisory decisions which request that the SIs mitigate these shortcomings within a timely fashion. Immediate action was required for findings that were deemed to take a significant time to address.

Assessment of Market Risk

TRIM assessed the VaR/sVaR models of 31 institutions. The majority of severe findings concerned the general features of the VaR and sVaR modelling methodology, such as data quality and risk factor modelling.

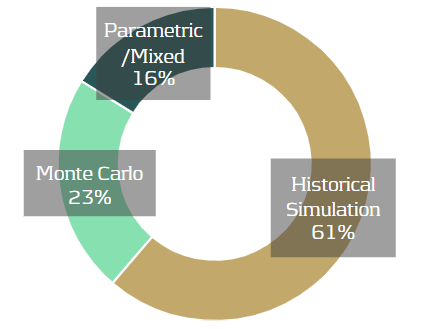

19 out of 31 institutions used historical simulation, seven used Monte Carlo, and the remainder used either a parametric or mixed approach. 17 of the historical simulation institutions, and five using Monte Carlo, used full revaluation for most instruments. Most other institutions used a sensitivities-based pricing approach.

VaR/sVaR Methodology

Data: Issues with data cleansing, processing and validation were seen in many institutions and, on many occasions, data processes were poorly documented.

Risk Factors: In many cases, risk factors were missing or inadequately modelled. There was also insufficient justification or assessment of assumptions related to risk factor modelling.

Pricing: Institutions frequently had inadequate pricing methods for particular products, leading to a failure for the internal model to adequately capture all material price risks. In several cases, validation activities regarding the adequacy of pricing methods in the VaR model were insufficient or missing.

RNIME: Approximately two-thirds of the institutions had an identification process for risks not in model engines (RNIMEs). For ten of these institutions, this directly led to an RNIME add-on to the VaR or to the capital requirements.

Regulatory Backtesting

Period and Business Days: There was a lack of clear definitions of business and non-business days at most institutions. In many cases, this meant that institutions were trading on local holidays without adequate risk monitoring and without considering those days in the P&L and/or the VaR.

APL: Many institutions had no clear definition of fees, commissions or net interest income (NII), which must be excluded from the actual P&L (APL). Several institutions had issues with the treatment of fair value or other adjustments, which were either not documented, not determined correctly, or were not properly considered in the APL. Incorrect treatment of CVAs and DVAs and inconsistent treatment of the passage of time (theta) effect were also seen.

HPL: An insufficient alignment of pricing functions, market data, and parametrisation between the economic P&L (EPL) and the hypothetical P&L (HPL), as well as the inconsistent treatment of the theta effect in the HPL and the VaR, was seen in many institutions.

Internal Validation and Internal Backtesting

Methodology: In several cases, the internal backtesting methodology was considered inadequate or the levels of backtesting were not sufficient.

Hypothetical Backtesting: The required backtesting on hypothetical portfolios was either not carried or was only carried out to a very limited extent

IRC Methodology

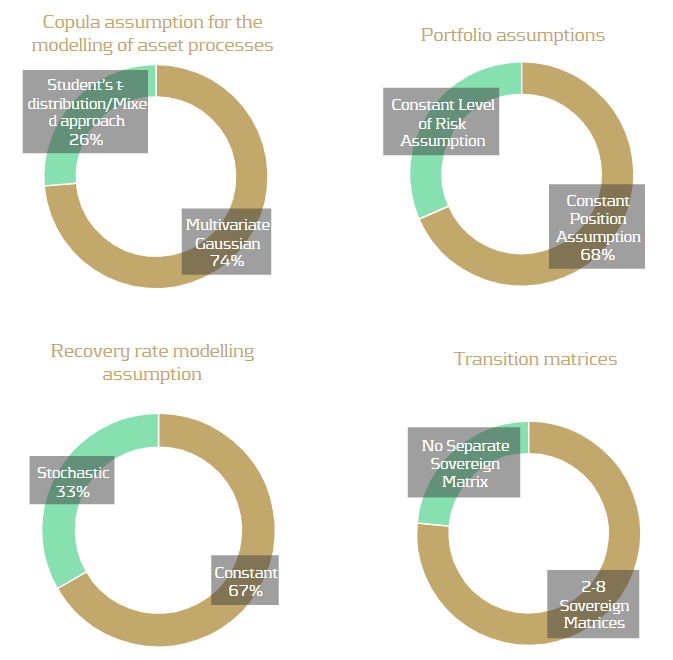

TRIM assessed the IRC models of 17 institutions, reviewing a total of 19 IRC models. A total of 120 findings were identified and over 80% of institutions that used IRC models received at least one high-severity finding in relation to their IRC model. All institutions used a Monte Carlo simulation method, with 82% applying a weekly calculation. Most institutions obtained rates from external rating agency data. Others estimated rates from IRB models or directly from their front office function. As IRC lacks a prescriptive approach, the choice of modelling approaches between institutes exhibited a variety of modelling assumptions, as illustrated below.

Recovery rates: The use of unjustified or inaccurate Recovery Rates (RR) and Probability of Defaults (PD) values were the cause of most findings. PDs close to or equal to zero without justification was a common issue, which typically arose for the modelling of sovereign obligors with high credit quality. 58% of models assumed PDs lower than one basis point, typically for sovereigns with very good ratings but sometimes also for corporates. The inconsistent assignment of PDs and RRs, or cases of manual assignment without a fully documented process, also contributed to common findings.

Modellingapproach: The lack of adequate modelling justifications presented many findings, including copula assumptions, risk factor choice, and correlation assumptions. Poor quality data and the lack of sufficient validation raised many findings for the correlation calibration.

Assessment of Counterparty Credit Risk

Eight banks faced on-site inspections under TRIM for counterparty credit risk. Whilst the majority of investigations resulted in findings of low materiality, there were severe weaknesses identified within validation units and overall governance frameworks.

Conclusion

Based on the findings and responses, it is clear that TRIM has successfully highlighted several shortcomings across the banks. As is often the case, many issues seem to be somewhat systemic problems which are seen in a large number of the institutions. The issues and findings have ranged from fundamental problems, such as missing risk factors, to more complicated problems related to inadequate modelling methodologies. As such, the remediation of these findings will also range from low to high effort. The SIs will need to mitigate the shortcomings in a timely fashion, with some more complicated or impactful findings potentially taking a considerable time to remediate.

FRTB: Harnessing Synergies Between Regulations

Learn how banks can reduce capital charges under FRTB by using proxies, external data, and customized risk factor bucketing to minimize non-modellable risk factors (NMRFs).

Regulatory Landscape

Despite a delay of one year, many banks are struggling to be ready for FRTB in January 2023. Alongside the FRTB timeline, banks are also preparing for other important regulatory requirements and deadlines which share commonalities in implementation. We introduce several of these below.

SIMM

Initial Margin (IM) is the value of collateral required to open a position with a bank, exchange or broker. The Standard Initial Margin Model (SIMM), published by ISDA, sets a market standard for calculating IMs. SIMM provides margin requirements for financial firms when trading non-centrally cleared derivatives.

BCBS 239

BCBS 239, published by the Basel Committee on Banking Supervision, aims to enhance banks’ risk data aggregation capabilities and internal risk reporting practices. It focuses on areas such as data governance, accuracy, completeness and timeliness. The standard outlines 14 principles, although their high-level nature means that they are open to interpretation.

SA-CVA

Credit Valuation Adjustment (CVA) is a type of value adjustment and represents the market value of the counterparty credit risk for a transaction. FRTB splits CVA into two main approaches: BA-CVA, for smaller banks with less sophisticated trading activities, and SA-CVA, for larger banks with designated CVA risk management desks.

IBOR