IFRS 9 – Annual Report Study

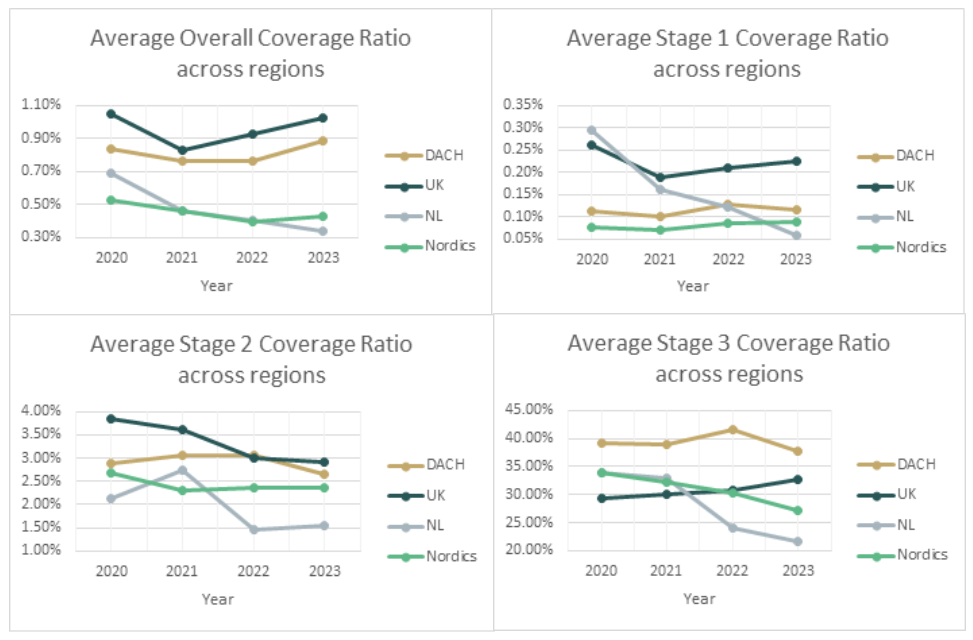

Zanders has conducted an annual report study for IFRS 9 results across 4 different European markets. These regions are the Nordics, the Netherlands, DACH and the UK.

First, these regions were analyzed independently such that common trends and differences could be noted within. These results were aggregated for each region such that these regions could be compared with each other. The results show that within European regions the year-on-year trends are similar between banks, but that across these regions the trends do differ across the years. Because the systemic macroeconomic trends the last years were similar between regions (Covid-19 and the war in Ukraine ), it shows that there are significant cultural differences in how ECLs are modelled. This shows that there is a need for alignment between European regions for which Zanders can assist. Namely, we have a presence in each of these regions and are actively monitoring development in the area of IFRS 9 (also see our previous research on IFRS 9).

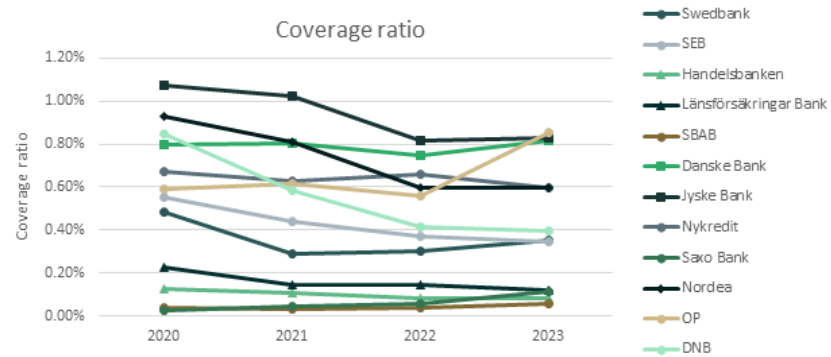

Nordics

The overall coverage ratios for most of the Danish, Swedish, Norwegian and Finnish banks1 (Nordic region) showed a slightly decreasing trend from 2020 to 2023, except for OP, which had a significant absolute increment of 0.25% to 0.86% in 2023 compared with the previous three years due to an increase in the stage 2 coverage ratio and a higher Stage 1 to 2 ratio. OP also had the highest overall coverage ratio among the sampled banks. The decreasing trend in the overall coverage ratio was primarily attributed to the decline in the Stage 3 coverage ratio.

On the other hand, the change in the Stage 1 coverage ratio was relatively stable over the years, with an absolute difference of less than 0.09% between the maximum and minimum values across the four-year period. The Stage 2 coverage ratio exhibited a similar trend across banks, except for Jyske Bank, which showed a volatile pattern, with an absolute difference of over 3% between the maximum and minimum values throughout the four years, peaking at 4.74% in 2023. In addition, the overall and the Stage 3 coverage ratios varied from 0.06% to 0.86% and 16.3% to 45.6% across banks in 2023.

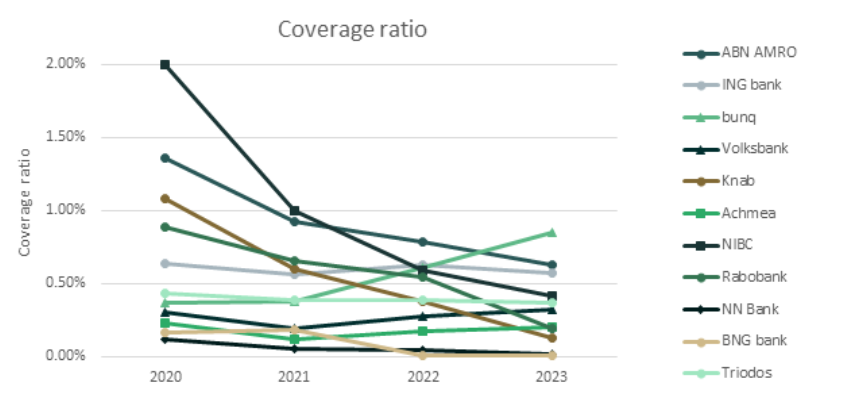

Netherlands

There was a slight decrease in the overall ECL results for the Dutch market2 over the four-year study period (also see the previous research on the Dutch market). This was primarily driven by an improved macroeconomic outlook and a further reversal of manual overlays that were applied during the COVID-19 period (e.g., ABN AMRO).

Compared with 2022, larger banks (Rabobank and ABN AMRO) showed a decrease in the overall coverage ratio with a higher weight given to the up scenario. In contrast, smaller banks tended to have a higher coverage ratio due to shifting more weight from the up scenario to the base scenario or changes in the underlying models.

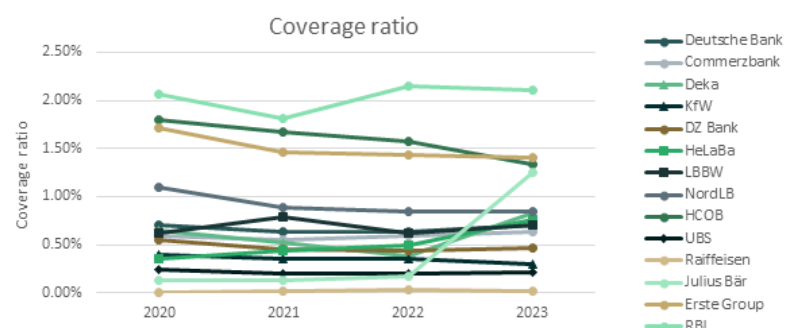

DACH

For the German, Austrian and Swiss region (DACH),3 a relatively stable trend was observed in the overall coverage ratio from 2020 to 2022, which was then countered by a sharp upward trend from 2022 to 2023. Among the banks noted, RBI stood out from its peers in reporting significantly higher overall, Stage 2 and Stage 3 coverage ratios during the study period. RBI is one of Austria's leading corporate and investment banks, operating in Central and Eastern European markets. In some Eastern European countries, Stage 2 loans remain exceptionally high, at 15 to 20 percent, leading to large overall and Stage 2 coverage ratios.

Compared to 2022, the increase in the overall coverage ratio can be attributed to higher Stage 2 coverage ratios for half of the sampled banks. Julius Bär also experienced an exceptionally high stage 3 coverage ratio of up to 93% in 2023, primarily from its Lombard loan portfolio.

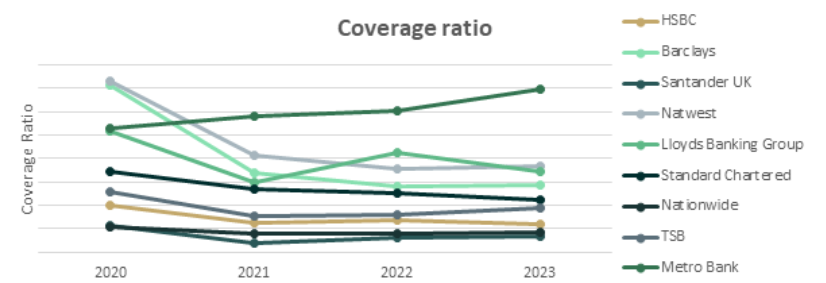

UK

During the benchmarking period from 2020 to 2023, most UK banks4 reported a decrease in the overall coverage ratio from 2020 to 2021. Then the overall coverage ratio stabilized for the remaining two years, except for one of the sampled banks, whose coverage ratio had been increasing since 2021 and recorded the second-highest overall coverage ratio in 2024 (i.e. 1.6% vs. the median of 0.8% for all sampled UK banks).

The highest coverage ratio of all years is from Monzo. As a relatively new digital bank focused on expanding, Monzo has significantly expanded its lending in recent years, with a doubling of the gross carrying amount in the latest reporting period. However, their overall coverage ratios remained high, at around 14% to 14.6% over the past two years. In the figure below (and the figures at the end of the article), Monzo has been excluded, as it individually inflated the results and rendered the other results unreadable.

Across regions

In general, all regions showed a decrease in the overall ECL coverage ratio during the initial benchmarking period, from 2020 to 2021. Compared to 2020, the coverage ratio in the most recent year has decreased, except for the DACH region, where the overall coverage ratio has reached a level comparable to that of the UK, due to a significant increase in Stage 2 numbers. The UK has the highest overall, as well as Stage 1 and Stage 2 coverage ratios, while the DACH region has the highest Stage 3 coverage ratios (i.e., the highest LGD).

In short, this shows that both the UK and DACH region demonstrate a higher overall coverage ratio, which seems to be consistent throughout all the years from 2020 onwards. Even the lowest reported average coverage ratio for the DACH region, 0.76% in 2021 is higher than the highest reported value for the Netherlands, 0.69% in 2020. As the values differ greatly between regions while the macroeconomic occurrences were similar (Covid-19, Ukraine war), it could be noted that this must be caused by significant differences in how the ECLs are modelled. And as markets are not aligned how to model ECL, it is worthwhile to further investigate how European regions can learn from each other in modelling ECL.

As Zanders has a presence in each of these regions and is in constant contact with many of the active banks in those regions, we are the best strategic partner to help improving your IFRS 9 modelling. Whether it is an independent validation of an existing model of if help is needed with the (re)development of new IFRS 9 models, we can help clients achieve the optimal accuracy with regards to their ECL estimates.

If you wish to learn more about IFRS 9 please contact Kasper Wijshoff.

- The Nordic banks that were included in the analysis were the following: Swedbank, SEB, Handelsbanken, Länsförsäkringar Bank, SBAB, Danske Bank, Jyske Bank, Nykredit, Nordea, OP, DNB. ↩︎

- The Dutch banks that were included in the analysis were the following: ABN AMRO, ING bank, bunq, Volksbank, Knab, Achmea, NIBC, Rabobank, NN Bank, BNG bank, Triodos. ↩︎

- The banks in the DACH region that were included in the analysis were the following: Deutsche Bank, Commerzbank, Deka, KfW, DZ Bank, HeLaBa, LBBW, NordLB, HCOB, UBS, Julius Bär, Erste Group, RBI. ↩︎

- The banks in the UK that were included in the analysis were the following: HSBC, Barclays, Santander UK, Natwest, Lloyds Banking Group, Standard Chartered, Monzo, Nationwide, TSB, Metro Bank, Close Brothers, Atom Bank, Revolut. ↩︎

Exploring IFRS 9 Best Practices: Insights from Leading European Banks

A comprehensive summary of a recent webinar on diverse modelling techniques and shared challenges in expected credit losses

Across the whole of Europe, banks apply different techniques to model their IFRS9 Expected Credit Losses on a best estimate basis. The diverse spectrum of modelling techniques raises the question: what can we learn from each other, such that we all can improve our own IFRS 9 frameworks? For this purpose, Zanders hosted a webinar on the topic of IFRS 9 on the 29th of May 2024. This webinar was in the form of a panel discussion which was led by Martijn de Groot and tried to discuss the differences and similarities by covering four different topics. Each topic was discussed by one panelist, who were Pieter de Boer (ABN AMRO, Netherlands), Tobia Fasciati (UBS, Switzerland), Dimitar Kiryazov (Santander, UK), and Jakob Lavröd (Handelsbanken, Sweden).

The webinar showed that there are significant differences with regards to current IFRS 9 issues between European banks. An example of this is the lingering effect of the COVID-19 pandemic, which is more prominent in some countries than others. We also saw that each bank is working on developing adaptable and resilient models to handle extreme economic scenarios, but that it remains a work in progress. Furthermore, the panel agreed on the fact that SICR remains a difficult metric to model, and, therefore, no significant changes are to be expected on SICR models.

Covid-19 and data quality

The first topic covered the COVID-19 period and data quality. The poll question revealed widespread issues with managing shifts in their IFRS 9 model resulting from the COVID-19 developments. Pieter highlighted that many banks, especially in the Netherlands, have to deal with distorted data due to (strong) government support measures. He said this resulted in large shifts of macroeconomic variables, but no significant change in the observed default rate. This caused the historical data not to be representative for the current economic environment and thereby distorting the relationship between economic drivers and credit risk. One possible solution is to exclude the COVID-19 period, but this will result in the loss of data. However, including the COVID-19 period has a significant impact on the modelling relations. He also touched on the inclusion of dummy variables, but the exact manner on how to do so remains difficult.

Dimitar echoed these concerns, which are also present in the UK. He proposed using the COVID-19 period as an out-of-sample validation to assess model performance without government interventions. He also talked about the problems with the boundaries of IFRS 9 models. Namely, he questioned whether models remain reliable when data exceeds extreme values. Furthermore, he mentioned it also has implications for stress testing, as COVID-19 is a real life stress scenario, and we might need to think about other modelling techniques, such as regime-switching models.

Jakob found the dummy variable approach interesting and also suggested the Kalman filter or a dummy variable that can change over time. He pointed out that we need to determine whether the long term trend is disturbed or if we can converge back to this trend. He also mentioned the need for a common data pipeline, which can also be used for IRB models. Pieter and Tobia agreed, but stressed that this is difficult since IFRS 9 models include macroeconomic variables and are typically more complex than IRB.

Significant Increase in Credit Risk

The second topic covered the significant increase in credit risk (SICR). Jakob discussed the complexity of assessing SICR and the lack of comprehensive guidance. He stressed the importance of looking at the origination, which could give an indication on the additional risk that can be sustained before deeming a SICR.

Tobia pointed out that it is very difficult to calibrate, and almost impossible to backtest SICR. Dimitar also touched on the subject and mentioned that the SICR remains an accounting concept that has significant implications for the P&L. The UK has very little regulations on this subject, and only requires banks to have sufficient staging criteria. Because of these reasons, he mentioned that he does not see the industry converging anytime soon. He said it is going to take regulators to incentivize banks to do so. Dimitar, Jakob, and Tobia also touched upon collective SICR, but all agreed this is difficult to do in practice.

Post Model Adjustments

The third topic covered post model adjustments (PMAs). The results from the poll question implied that most banks still have PMAs in place for their IFRS 9 provisions. Dimitar responded that the level of PMAs has mostly reverted back to the long term equilibrium in the UK. He stated that regulators are forcing banks to reevaluate PMAs by requiring them to identify the root cause. Next to this, banks are also required to have a strategy in place when these PMAs are reevaluated or retired, and how they should be integrated in the model risk management cycle. Dimitar further argued that before COVID-19, PMAs were solely used to account for idiosyncratic risk, but they stayed around for longer than anticipated. They were also used as a countercyclicality, which is unexpected since IFRS 9 estimations are considered to be procyclical. In the UK, banks are now building PMA frameworks which most likely will evolve over the coming years.

Jakob stressed that we should work with PMAs on a parameter level rather than on ECL level to ensure more precise adjustments. He also mentioned that it is important to look at what comes before the modelling, so the weights of the scenarios. At Handelsbanken, they first look at smaller portfolios with smaller modelling efforts. For the larger portfolios, PMAs tend to play less of a role. Pieter added that PMAs can be used to account for emerging risks, such as climate and environmental risks, that are not yet present in the data. He also stressed that it is difficult to find a balance between auditors, who prefer best estimate provisions, and the regulator, who prefers higher provisions.

Linking IFRS 9 with Stress Testing Models

The final topic links IFRS 9 and stress testing. The poll revealed that most participants use the same models for both. Tobia discussed that at UBS the IFRS 9 model was incorporated into their stress testing framework early on. He pointed out the flexibility when integrating forecasts of ECL in stress testing. Furthermore, he stated that IFRS 9 models could cope with stress given that the main challenge lies in the scenario definition. This is in contrast with others that have been arguing that IFRS 9 models potentially do not work well under stress. Tobia also mentioned that IFRS 9 stress testing and traditional stress testing need to have aligned assumptions before integrating both models in each other.

Jakob agreed and talked about the perfect foresight assumption, which suggests that there is no need for additional scenarios and just puts a weight of 100% on the stressed scenario. He also added that IFRS 9 requires a non-zero ECL, but a highly collateralized portfolio could result in zero ECL. Stress testing can help to obtain a loss somewhere in the portfolio, and gives valuable insights on identifying when you would take a loss.

Pieter pointed out that IFRS 9 models differ in the number of macroeconomic variables typically used. When you are stress testing variables that are not present in your IFRS 9 model, this could become very complicated. He stressed that the purpose of both models is different, and therefore integrating both can be challenging. Dimitar said that the range of macroeconomic scenarios considered for IFRS 9 is not so far off from regulatory mandated stress scenarios in terms of severity. However, he agreed with Pieter that there are different types of recessions that you can choose to simulate through your IFRS 9 scenarios versus what a regulator has identified as systemic risk for an industry. He said you need to consider whether you are comfortable relying on your impairment models for that specific scenario.

This topic concluded the webinar on differences and similarities across European countries regarding IFRS 9. We would like to thank the panelists for the interesting discussion and insights, and the more than 100 participants for joining this webinar.

Interested to learn more? Contact Kasper Wijshoff, Michiel Harmsen or Polly Wong for questions on IFRS 9.

Six years after the introduction of IFRS 9: Where do we stand?

A comprehensive summary of a recent webinar on diverse modelling techniques and shared challenges in expected credit losses

We touch upon the main difficulties experienced by financial institutions in the Netherlands based on a combination of project experience, results of a survey, main attention points from the eyes of the regulator and observations from publicly available annual reports. Interested to learn more about the IFRS 9 framework components banks struggle with the most and whether these challenges can be easily solved? Find out in the remainder of this article.

Introduction

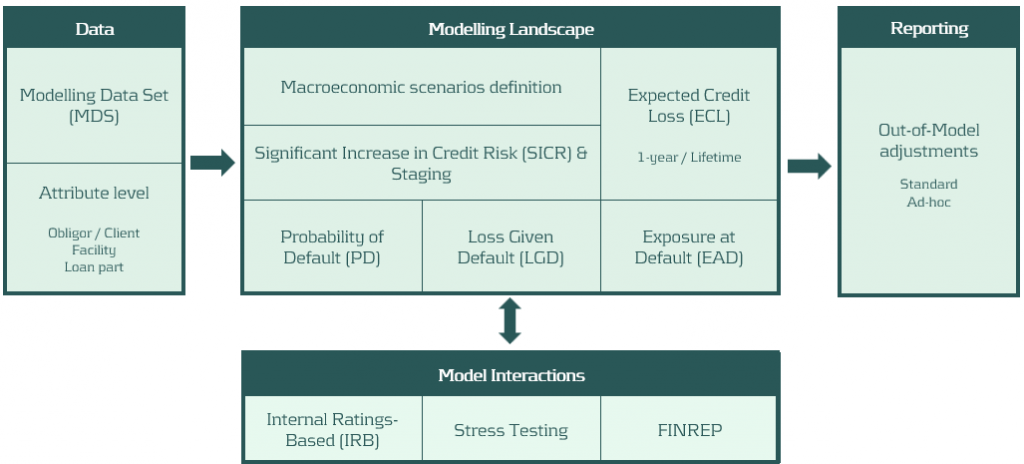

The main objective of this article is to provide insight into market practices and common challenges within the IFRS 9 landscape of Dutch financial institutions. In this light, Zanders conducted a survey amongst Dutch financial institutions. Six main IFRS 9 framework components form the basis of the survey: data quality, model components (PD, LGD, EAD), SICR & staging, macroeconomic scenarios, out-of-model adjustments and the relation between IFRS 9 and other models within the bank. An example of a full IFRS 9 framework overview is presented in Figure 1. The questionnaire was followed up by a roundtable in which the most noticeable results from the survey were discussed with the participants.

Besides the survey, the IFRS 9 monitoring report published by the European Banking Authority (IFRS 9 Monitoring report, EBA (November 2023)) provides insights into the key IFRS 9 attention points from a regulatory perspective (e.g. as identified by EBA). In this article, we discuss the key differences between the difficulties experienced by banks versus attention points highlighted in the monitoring report. Lastly, this article uses publicly available information from annual reports to illustrate the diverging modelling practices and model behavior amongst market peers.

Figure 1: IFRS 9 framework overview.

Survey

The IFRS 9 survey held in Q4 2023 was centered around the six framework components as stated in the introduction section and which are graphically presented in Figure 1. The participating banks were asked in which areas of the framework they experience difficulties. Consequently, each area was explored deeper by means of questions directly related to each area.

All participating banks except one indicate difficulties in the areas of data quality and out-of-model adjustments (e.g. overlays). For data quality, changing policies (e.g. Definition of Default, loan quality assessment), limited loss realizations for LGD (as well as limited detail of the loss realization data) and dealing with unrepresentative data from the Covid-19 period are examples of reasons for the difficulties experienced in this area. With regards to out-of-model adjustments, it becomes apparent that many banks struggle with pressure from the regulator and audit, triggering banks to find an escape in overlays on the IFRS 9 model outcomes. Overlays are applied on a wide variety of topics, in various ways (e.g. calculated, constant, periodic, expert based, etc.) and sometimes constitute the majority of the total provisions. Altogether, this illustrates the need to have out-of-model adjustments in place that are sufficiently qualitatively substantiated and, whenever possible, are applied on the model component level. At the same time, we are of the opinion that out-of-model adjustments are sometimes over-used to make up for model deficiencies. Especially when out-of-model adjustments constitute the majority of the total provisions, compliance of the model with the IFRS 9 best-estimate principle should be questioned.

Surprisingly, only one third of the respondents experiences difficulties in the framework areas that came into existence with the introduction of IFRS 9; SICR & staging and macroeconomic scenarios. A possible explanation for this is that the responsibility for these framework areas is often distributed across multiple departments. Macroeconomic predictions and scenario weights are usually determined by a separate macroeconomic scenario department or committee, and staging assessments are often placed outside the scope of IFRS 9 modelling teams. From a governance perspective, we are of the opinion that more alignment over the full IFRS 9 provisioning chain is desired.

Want to know more about the survey results? Download our white paper.

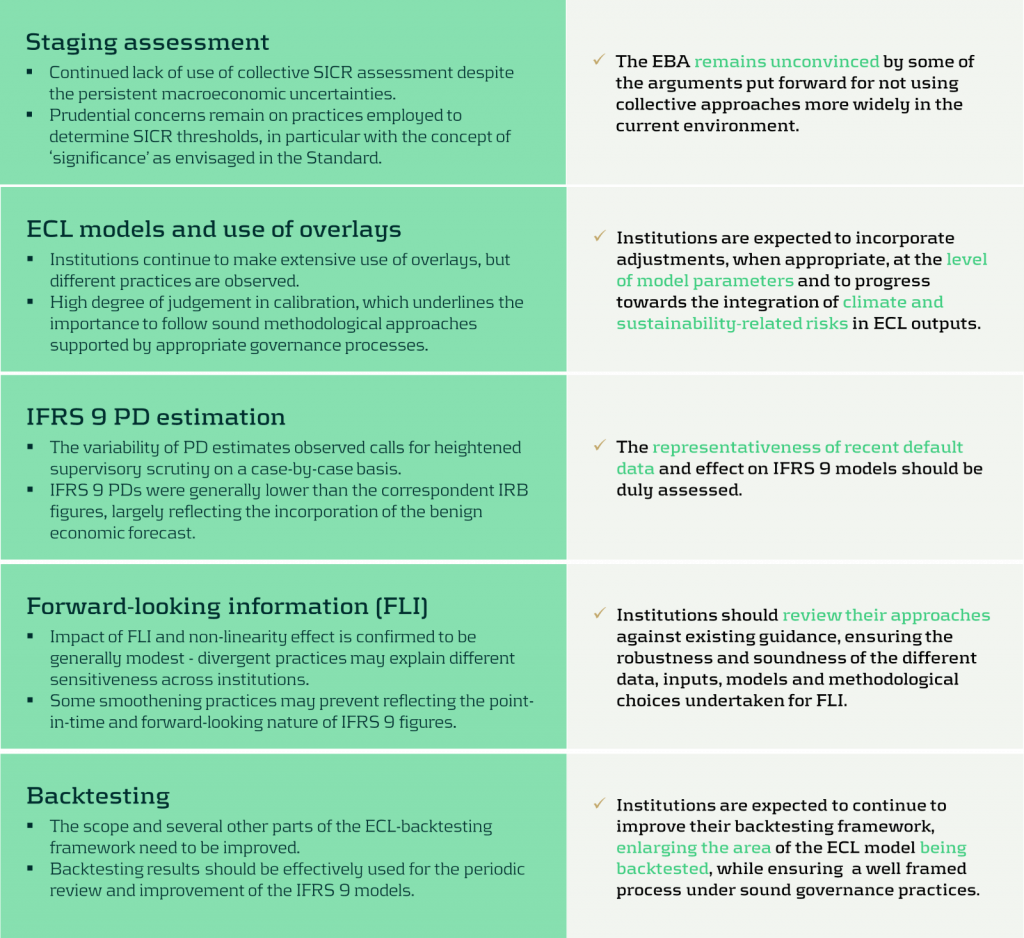

Regulatory view

The EBA published a monitoring report in November 2023 on the current status of the IFRS 9 model landscape (IFRS 9 Monitoring report, EBA (November 2023)). In this report the EBA highlights several takeaways, which are shown in Figure 2. One of these takeaways is the manner in which SICR is modelled at the moment. The EBA is not convinced that non-collective approaches are more suitable than collective approaches. In the results of the survey however, it was shown that most respondents did not indicate SICR as one of the main challenges in their IFRS 9 landscape. This raises the question whether banks in the Netherlands are aware of the EBA’s remark on the current SICR approaches, or whether Dutch banks are outliers when it comes to the SICR modelling approaches.

Furthermore, the report indicates that out-of-model adjustments should be applied on the model parameter level and not on the outcome level. During the roundtable it was discussed that several participants recognize this desire from the regulator, but that they still apply it on the outcome level because the available data only allows for this level. This discrepancy could lead to further scrutiny from the regulator in the near future.

Figure 2: Key takeaways from the IFRS 9 monitoring report (EBA, 2023).

Annual report study

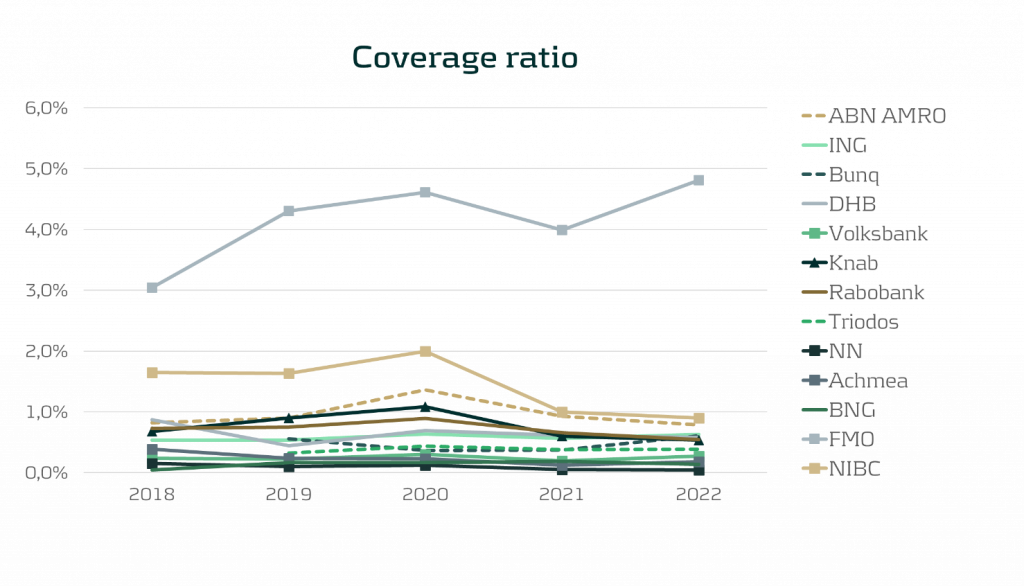

In the Dutch banking market, a variety of modelling practices is observed when it comes to IFRS 9 models for calculating credit loss provisions. Besides gaining insights into these IFRS 9 modelling practices via a survey, annual reports are analyzed to identify potential differences (or similarities) from information that is publicly available.

One of the observations from comparing annual reports is that no common level is observed for the Provisioning Coverage Ratio (PCR), i.e. the percentage of funds set aside for covering losses due to bad debts. Characteristics such as portfolio type/composition and loan maturity likely explain these differences. In 2020, almost all banks show an increase in the PCR due to increased allowances in response to the Covid-19 pandemic. Note that this was not necessarily caused by models picking up changing macroeconomic dynamics, but because of model overlays. PCR levels stabilized again in 2021 and 2022.

Figure 3: Coverage ratio over the years 2018 till 2022 . All results were gathered from public annual reports.

Although not all banks report macroeconomic scenario weights in their annual reports, it is worth noting that large differences exist in the scenario weights of banks that do report these figures. Especially weights assigned to the up and down scenarios vary significantly. In 2022, the weight percentage for the base scenario is generally between 40% and 60% (one bank uses a weight of 30%), whereas the weight percentage for the down scenario ranges from 20% to 60%. For the up scenario, percentage weights differ from 2% to 30%. It must be noted that the scenario weights cannot be judged without considering the actual scenario definitions/severity. Nonetheless, the wide variety in scenario weight percentages as well as large differences in the development of these scenario weights over time raises questions on the accuracy of macroeconomic predictions. In addition, it also complicates the comparability of IFRS 9 figures amongst banks.

What can Zanders offer?

We combine deep credit risk modelling expertise with relevant experience in regulation and programming:

- A Risk Advisory Team consisting of 75+ consultants with quantitative backgrounds (e.g. Econometrics and Physics);

- Strong knowledge of IFRS 9 models and developments in the IFRS 9 landscape;

- Extensive experience with calibration, implementation and validation of IFRS 9 models;

- We offer ready-to-use Expected Credit Loss models, Credit Risk Academy modules and expert sessions that can be tailored to the needs of your organization.

Interested to learn more? Contact Kasper Wijshoff or Michiel Harmsen for questions on IFRS 9.