The 2023 Banking Turmoil

Take-aways for bank risk management, supervision and regulation

Early October, the Basel Committee on Banking Supervision (BCBS) published a report[1] on the 2023 banking turmoil that involved the failure of several US banks as well as Credit Suisse. The report draws lessons for banking regulation and supervision which may ultimately lead to changes in banking regulation as well as supervisory practices. In this article we summarize the main findings of the report[2]. Based on the report’s assessment, the most material consequences for banks, in our view, could be in the following areas:

- Reparameterization of the LCR calculation and/or introduction of additional liquidity metrics

- Inclusion of assets accounted for at amortized cost at their fair value in the determination of regulatory capital

- Implementation of extended disclosure requirements for a bank's interest rate exposure and liquidity position

- More intensive supervision of smaller banks, especially those experiencing fast growth and concentration in specific client segments

- Application of the full Basel III Accord and the Basel IRRBB framework to a larger group of banks

Bank failures and underlying causes

The BCBS report first describes in some detail the events that led to the failure of each of the following banks in the spring of 2023:

- Silicon Valley Bank (SVB)

- Signature Bank of New York (SBNY)

- First Republic Bank (FRB)

- Credit Suisse (CS)

While each failure involved various bank-specific factors, the BCBS report highlights common features (with the relevant banks indicated in brackets).

- Long-term unsustainable business models (all), in part due to remuneration incentives for short-term profits

- Governance and risk management did not keep up with fast growth in recent years (SVB, SBNY, FRC)

- Ineffective oversight of risks by the board and management (all)

- Overreliance on uninsured customer deposits, which are more likely to be withdrawn in a stress situation (SVB, SBNY, FRC)

- Unprecedented speed of deposit withdrawals through online banking (all)

- Investment of short-term deposits in long-term assets without adequate interest-rate hedges (SVB, FRC)

- Failure to assess whether designated assets qualified as eligible collateral for borrowing at the central bank (SVB, SBNY)

- Client concentration risk in specific sectors and on both asset and liability side of the balance sheet (SVB, SBNY, FRC)

- Too much leniency by supervisors to address supervisory findings (SVB, SBNY, CS)

- Incomplete implementation of the Basel Framework: SVB, SBNY and FRB were not subject to the liquidity coverage ratio (LCR) of the Basel III Accord and the BCBS standard on interest rate risk in the banking book (IRRBB)

Of the four failed banks, only Credit Suisse was subject to the LCR requirements of the Basel III Accord, in relation to which the BCBS report includes the following observations:

- A substantial part of the available high quality liquid assets (HQLA) at CS was needed for purposes other than covering deposit outflows under stress, in contrast to the assumptions made in the LCR calculation

- The bank hesitated to make use of the LCR buffer and to access emergency liquidity so as to avoid negative signalling to the market

Although not part of the BCBS report, these observations could lead to modifications to the LCR regulation in the future.

Lessons for supervision

With respect to supervisory practices, the BCBS report identifies various lessons learned and raises a few questions, divided into four main areas:

1. Bank’s business models

- Importance of forward-looking assessment of a bank’s capital and liquidity adequacy because accounting measures (on which regulatory capital and liquidity measures are based) mostly are not forward-looking in nature

- A focus on a bank’s risk-adjusted profitability

- Proactive engagement with ‘outlier banks’, e.g., banks that experienced fast growth and have concentrated funding sources or exposures

- Consideration of the impact of changes in the external environment, such as market conditions (including interest rates) and regulatory changes (including implementation of Basel III)

2. Bank’s governance and risk management

- Board composition, relevant experience and independent challenge of management

- Independence and empowerment of risk management and internal audit functions

- Establishment of an enterprise-wide risk culture and its embedding in corporate and business processes.

- Senior management remuneration incentives

3.Liquidity supervision

- Do the existing metrics (LCR, NSFR) and supervisory review suffice to identify start of material liquidity outflows?

- Should the monitoring frequency of metrics be increased (e.g., weekly for business as usual and daily or even intra-day in times of stress)?

- Monitoring of concentration risks (clients as well as funding sources)

- Are sources of liquidity transferable within the legal entity structure and freely available in times of stress?

- Testing of contingency funding plans

4. Supervisory judgment

- Supplement rules-based regulation with supervisory judgment in order to intervene pro-actively when identifying risks that could threaten the bank’s safety and soundness. However, the report acknowledges that a supervisor may not be able to enforce (pre-emptive) action as long as an institution satisfies all minimum requirements. This will also depend on local legislative and regulatory frameworks

Lessons for regulation

In addition, the BCBS report identifies various potential enhancement to the design and implementation of bank regulation in four main areas:

1. Liquidity standards

- Consideration of daily operational and intra-day liquidity requirements in the LCR, based on the observation that a material part of the HQLA of CS was used for this purpose but this is not taken into account in the determination of the LCR

- Recalibration of deposit outflows in the calculation of LCR and NSFR, based on the observation that actual outflow rates at the failed banks significantly exceeded assumed outflows in the LCR and NSFR calculations

- Introduction of additional liquidity metrics such as a 5-day forward liquidity position, survival period and/or non-risk based liquidity metrics that do not rely on run-off assumptions (similar to the role of the leverage ratio in the capital framework)

2. IRRBB

- Implementation of the Basel standard on IRRBB, which did not apply to the US banks, could have made the interest rate risk exposures transparent and initiated timely action by management or regulatory intervention.

- More granular disclosure, covering for example positions with and without hedging, contractual maturities of banking book positions and modelling assumptions

3. Definition of regulatory capital

- Reflect unrealised gains and losses on assets that are accounted for at amortised cost (AC) in regulatory capital, analogous to the treatment of assets that are classified as available-for-sale (AFS). This is supported by the observation that unrealised losses on fixed-income assets held at amortised cost, resulting from to the sharp rise in interest rates, was an important driver of the failure of several US banks when these assets were sold to create liquidity and unrealised losses turned into realised losses. The BCBS report includes the following considerations in this respect:

- If AC assets can be repo-ed to create liquidity instead of being sold, then there is no negative impact on the financial statement

- Treating unrealised gains and losses on AC assets in the same way as AFS assets will create additional volatility in earnings and capital

- The determination of HQLA in the LCR regulation requires that assets are measured at no more than market value. However, this does not prevent the negative capital impact described above

- Reconsideration of the role, definition and transparency of additional Tier-1 (AT1) instruments, considering the discussion following the write-off of AT1 instruments as part of the take-over of CS by UBS

4. Application of the Basel framework

- Broadening the application of the full Basel III framework beyond internationally active banks and/or developing complementary approaches to identify risks at domestic banks that could pose a threat to cross-border financial stability. The events in the spring of this year have demonstrated that distress at relatively small banks that are not subject to the (full) Basel III regulation can trigger broader and cross-border systemic concerns and contagion effects.

- Prudent application of the ‘proportionality’ principle to domestic banks, based on the observation that financial distress at such banks can have cross-border financial stability effects

- Harmonization of approaches that aim to ensure that sufficient capital and liquidity is available at individual legal entity level within banking groups

Conclusion

The BCBS report identifies common shortcomings in bank risk management practices and governance at the four banks that failed during the 2023 banking turmoil and summarizes key take-aways for bank supervision and regulation.

The identified shortcomings in bank risk management include gaps in the management of traditional banking risks (interest rate, liquidity and concentration risks), failure to appreciate the interrelation between individual risks, unsustainable business models driven by short-term incentives at the expense of appropriate risk management, poor risk culture, ineffective senior management and board oversight as well as a failure to adequately respond to supervisory feedback and recommendations.

Key take-aways for effective supervision include enforcing prompt action by banks in response to supervisory findings, actively monitoring and assessing potential implications of structural changes to the banking system, and maintaining effective cross-border supervisory cooperation.

Key lessons for regulatory standards include the importance of full and consistent implementation of Basel standards as well as potential enhancements of the Basel III liquidity standards, the regulatory treatment of interest rate risk in the banking book, the treatment of assets that are accounted for at amortised cost within regulatory capital and the role of additional Tier-1 capital instruments.

The BCBS report is intended as a starting point for discussion among banking regulators and supervisors about possible changes to banking regulation and supervisory practices. For those interested in engaging in discussions related to the insights and recommendations in the BCBS report, please feel free to contact Pieter Klaassen.

[1] Report on the 2023 banking turmoil (bis.org) (accessed on October 19, 2023)

[2] Although recognized as relevant in relation to the banking turmoil, the BCBS report explicitly excludes from its consideration the role and design of deposit guarantee schemes, the effectiveness of resolution arrangements, the use and design of central bank lending facilities and FX swap lines, and public support measures in banking crises.

Why developing a non-maturing deposit model should be the top priority for banks in the Nordics

Take-aways for bank risk management, supervision and regulation

First and foremost, the long period of low and even negative swap rates was followed by strongly rising rates and a volatile market, which impacted the behavior of both customers and banks themselves. At the same time, regulatory developments, initiated by EBA’s new IRRBB guidelines, have shifted the banks’ focus to managing their earnings and earnings risk, rather than economic value risks.

Non-maturing deposits (NMDs) are of particular interest in this respect, given the uncertainty regarding the future pricing strategy and volume developments involved in these products. Moreover, as NMDs are generally modeled with a rather short maturity, the portfolio plays a significant role in the stability of the NII, making this portfolio even more relevant to evaluate in light of the newly introduced Supervisory Outlier Test (SOT) limits on earnings risk (more specific NII), or the local equivalent.

How does this affect IRRBB management at banks?

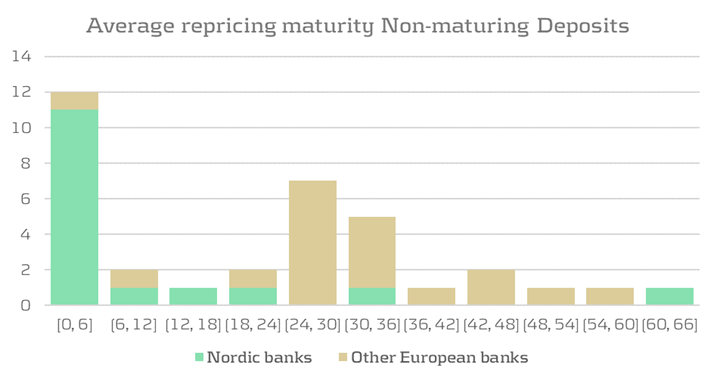

The exact impact of these developments is also heavily dependent on the bank’s local market, and corresponding laws and regulation, as well as the balance sheet composition of the bank. In Nordics countries, banks are affected more heavily, given that loans and mortgages generally have shorter maturities, as compared to other Western European countries like Germany and the Netherlands. This yields a smaller maturity mismatch with on-demand deposits at the liability side, such that a natural hedge exists to some extent within the balance sheet. Earlier on, this effect, combined with the rather stable markets, made active ALM, including IRRBB management, less urgent. The incentive to accurately model NMDs was therefore limited, so most banks simply replicate this funding overnight, while banks in other European countries tend to use a longer maturity, as illustrated by figure 1.

{Figure 1: Difference in average repricing maturity of NMDs between Nordic banks and other European banks, based on Pillar 3 IRRBBA and IRRBB1 disclosures from 2022 annual reports}

While the natural hedge already (partially) mitigates the risks from a value perspective to a large extent, investing the full NMDs portfolio overnight leads to relatively high NII volatility, thereby potentially violating regulatory limitations. The return on overnight investments will directly reflect any changes in the market rates, while deposit rates in reality are usually somewhat slower to include such developments. Although the resulting asymmetry between the investment return and deposit rate to be paid to customers yields a positive result under rising interest rates, it can reduce profits when interest rates start to fall.

Historically, banks in the Nordics experienced less flexibility in the modeling of NMDs, due to regulatory guidelines being somewhat stricter than EBA guidelines. For instance, Sweden’s Finansinspektionen (FI) required banks to replicate these positions overnight. However, relatively recently, the FI updated its regulations (FI dnr 19-4434), allowing banks to somewhat extend the duration of the investment profile, for a limited portion of the portfolio, and up to a maturity of one year. This results in flexibility to update the investment profile to better reflect the expected repricing speed of deposit rates, which could lead to improved NII stability. Additionally, besides applying these revised NMD models for managing banking book risks, they can, when approved, also be used for effective and consistent capital charge calculations under Pillar 2.

How can these developments be properly managed?

Even though the recent market developments create additional challenges in IRRBB management for banks, they also provide opportunities. The margin on deposit products for banks is currently improving, since only part of the interest rate rises is passed through to customers. The increased interest rates also mean that more advanced NMD models, with longer maturity profiles, can have a positive impact on the P&L, while simultaneously improving the interest rate risk management.

In such a rare win-win situation, it is more advantageous than ever to prioritize NMD modeling. In reassessing the interest rate risk management approach towards NMDs, banks should explicitly balance the tradeoff between value and earnings stability when making conceptual choices. These conceptual choices should align with the overall IRBBB strategy, as well as the intended use of the model, to ensure the risk in the portfolio is properly managed.

In weighing these conceptual alternatives, it is essential to take portfolio-specific characteristics into account. This requires an analysis of historical behavior, and an interpretation of how representative this information is. If behavior is expected to change, a common approach is to supplement historical data with expert expectations of forward-looking scenarios to develop a model that reflects both. Periodically reassessing the conceptual choices ensures a proper model lifecycle of NMD portfolios. This is crucial for accurate measurement of interest rate risk as well as for staying competitive in the current market environment.

Would you like to hear more? Contact Bas van Oers for questions on developing a non-maturing deposit model.

Roundtable ‘Climate Scenario Design & Stress Testing’ recap

On Thursday 15 June 2023, Zanders hosted a roundtable on ‘Climate Scenario Design & Stress Testing’. This article discusses our view on the topic and highlights key insights from the roundtable.

On Thursday 15 June 2023, Zanders hosted a roundtable on ‘Climate Scenario Design & Stress Testing’. In our head office in Utrecht, we welcomed risk managers from several Dutch banks. This article discusses our view on the topic and highlights key insights from the roundtable.

In recent years, many banks took their first steps in the integration of climate and environmental (C&E) risks into their risk management frameworks. The initial work on climate-related risk modeling often took the form of scenario analysis and stress testing. For example, as part of the Internal Capital Adequacy Assessment Process (ICAAP) or by participating in the 2022 Climate Stress Test by the European Central Bank (ECB). To comply with the ECB’s expectations on C&E risks, banks are actively exploring methodologies and data sources for adequate climate scenario design and stress testing. The ECB requires that banks will meet their expectations on this topic by 31 December 2024.

Our view

We believe that banks should start early with climate stress testing, but in a manageable and pragmatic way. Banks can then improve their methodologies and extend their scope over time. This allows for a gradual development of knowledge, data and methodologies within all relevant Risk teams. Zanders has identified the following steps in the process of climate scenario design and stress testing:

- Step 1: Scenario selection

A bank has to select appropriate (climate) scenarios based on the bank’s climate risk materiality assessment. Important to consider in this phase is the purpose for which the scenarios will be used, whether the scenarios are in line with scientific pathways, and whether they account for different policy outcomes (like an early or late transition to a sustainable economy).

- Step 2: Scope and variable definition

An appropriate scope must then be selected and appropriate variables defined. For example, banks need to determine which portfolios to take in scope, which time horizons to include, select the granularity of the output, the right level of stress, and which climate- and macro-economic variables to consider.

- Step 3: Methodology

Then, the bank needs to develop methodologies to calculate the impact of the scenarios. There are no one-size-fits-all approaches and often a combination of different qualitative and quantitative methodologies is needed. We recommend that the climate stress test approach be initially simple and to focus on material exposures.

- Step 4: Results

It is important to use the results of the scenario analysis in the relevant risk and business processes. The results can be used for the bank’s risk appetite and strategy. The results can also help to create awareness and understanding among internal stakeholders, and support external disclosures and compliance.

- Step 5: Stress testing framework

Finally, banks should establish minimum standards for climate scenario design and stress testing. This framework should include, amongst others, policies and processes for data collection from different sources, how adequate knowledge and resources are ensured, and how the scenarios are kept up-to-date with the latest market developments.

Key insights

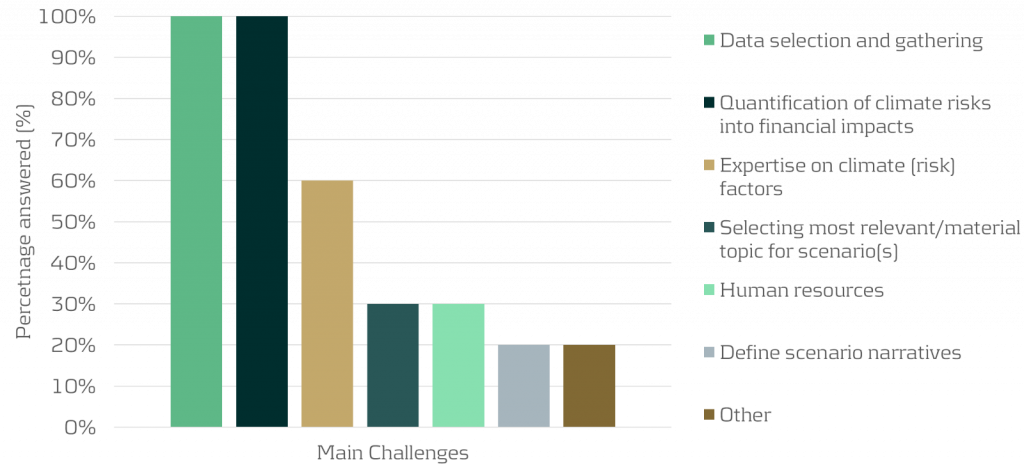

Prior to the roundtable, participants filled in a survey related to the progress, scope and challenges on climate risk stress testing. The key insights presented below are based on the results of this survey, together with the outcomes of the discussion thereafter.

The financial sector has advanced with several aspects around integrating climate risks in risk management over the past year. This was recognized by all participants, as they had all performed some form of climate risk stress testing. The scope of the stress testing, however, was relatively limited in some cases. For example, all participants considered credit risk in their climate risk scenario with many also including market risk. Only a limited number of participants took other risk types into account.

Furthermore, all participants assessed the short-term impact (up to 3 years) of the climate scenarios, whereas only around 40% and 10% assessed the impact on the medium term (3 to 10 years) and long term (>10 years), respectively. This is probably related to the fact that all participants used climate scenarios in their ICAAP, which typically covers a three-year horizon. The second most mentioned use for the climate scenarios, after the ICAAP, was the risk identification & materiality analysis. A smaller percentage of participants also used the climate scenarios for business strategy setting, ILAAP and portfolio management.

The two topics that were unanimously mentioned as the main challenges in climate risk stress testing are data selection and gathering, and the quantification of climate risks into financial impacts, as shown in the graph below:

- Insight 1: Assessing impact of climate risk beyond the short-term very much increases the complexity and uncertainty of the exercise

The participants indicated that climate stress testing beyond the short-term horizon (beyond 3 to 5 years) is very difficult. Beyond that horizon, the complexity of the (climate) scenarios increases materially due to uncertainties of clients’ transition plans, the bank’s own transition plan and climate strategy (e.g., related to pricing and client acceptance policies), and climate policies and actions from governments and regulators. Taking the transition plans of clients into account on a granular level is especially difficult when there is a large number of counterparties. There are no clear solutions to this. Some ideas that take longer-term effects into account were floated, such as adjusting the current valuation of various assets by translating future climate impact on assets into a net present value of impact or by taking climate impacts into account in the long-term macro-economic scenarios of IFRS9 models.

- Insight 2: Whether to use a top-down or bottom-up approach depends on the circumstances

It was discussed whether a bottom-up stress test for climate scenarios is preferable to a top-down stress test. The consensus was that this depends on the circumstances, for example:- Physical risks are asset- and location-specific; one street may flood but not the next. So, in that case a bottom-up assessment may be necessary for a more granular approach. On the other hand, for transition risks, less granularity might be sufficient as transition policies are defined on national or even supranational level, and trends and developments often materialize on sector-level. In those cases, a top-down type of analysis could be sufficient.

- If the climate stress test is used to get a general overview of where risks are concentrated, a top-down analysis may be appropriate. However, if it is used to steer clients, a more granular, bottom-up approach may be needed.

- A bottom-up approach could also be more suitable for longer-term scenarios as it allows to include counterparty-specific transition plans. For more short-term scenarios, a sector average may be sufficient, considering that there will be less transition during this period.

- Insight 3: Translating the results of climate risk stress testing into concrete actions is challenging

The results of the stress test can be used to further integrate climate risk into risk management processes such as materiality assessment, risk appetite, pricing, and client acceptance. Most participants, however, were still hesitant to link any binding actions to the results, such as setting risk limits (e.g., limiting exposures to a certain sector), adjusting client acceptance, or amending pricing policies. However, the ECB does require banks to consider climate impacts in these processes. The most mentioned uses of the climate risk stress testing results were risk identification & materiality assessments and risk monitoring.

Conclusion

Most banks have taken first steps in relation to climate scenario design and stress testing. However, many challenges still remain, for example around data selection and quantification methodologies. Efforts by banks, regulators and the market in general are required to overcome these challenges.

Zanders has already supported several banks with climate scenario design and stress testing. This includes the creation of a climate scenario design framework, the definition of climate scenarios, and by quantifying climate risk impacts for the ICAAP. Next to that, we have performed research on modeling approaches that can be used to quantify the impact of transition and physical risks. If you are interested to know how we can help your organization with this, please reach out to Marije Wiersma.

Performance of Dutch banks in the 2023 EBA stress test

Take-aways for bank risk management, supervision and regulation

Seventy banks have been considered, which is an increase of twenty banks compared to the previous exercise. The portfolios of the participating banks contain around three quarters of all EU banking assets (Euro and non-Euro).

Interested in how the four Dutch banks participating in this EBA stress test exercise performed? In this short note we compare them with the EU average as represented in the results published [1].

General comments

The general conclusion from the EU wide stress test results is that EU banks seem sufficiently capitalized. We quote the main 5 points as highlighted in the EBA press release [1]:

- The results of the 2023 EU-wide stress test show that European banks remain resilient under an adverse scenario which combines a severe EU and global recession, increasing interest rates and higher credit spreads.

- This resilience of EU banks partly reflects a solid capital position at the start of the exercise, with an average fully-loaded CET1 ratio of 15% which allows banks to withstand the capital depletion under the adverse scenario.

- The capital depletion under the adverse stress test scenario is 459 bps, resulting in a fully loaded CET1 ratio at the end of the scenario of 10.4%. Higher earnings and better asset quality at the beginning of the 2023 both help moderate capital depletion under the adverse scenario.

- Despite combined losses of EUR 496bn, EU banks remain sufficiently apitalized to continue to support the economy also in times of severe stress.

- The high current level of macroeconomic uncertainty shows however the importance of remaining vigilant and that both supervisors and banks should be prepared for a possible worsening of economic conditions.

For further details we refer to the full EBA report [1].

Dutch banks

Making the case for transparency across the banking sector, the EBA has released a detailed breakdown of relevant figures for each individual bank. We use some of this data to gain further insight into the performance of the main Dutch banks versus the EU average.

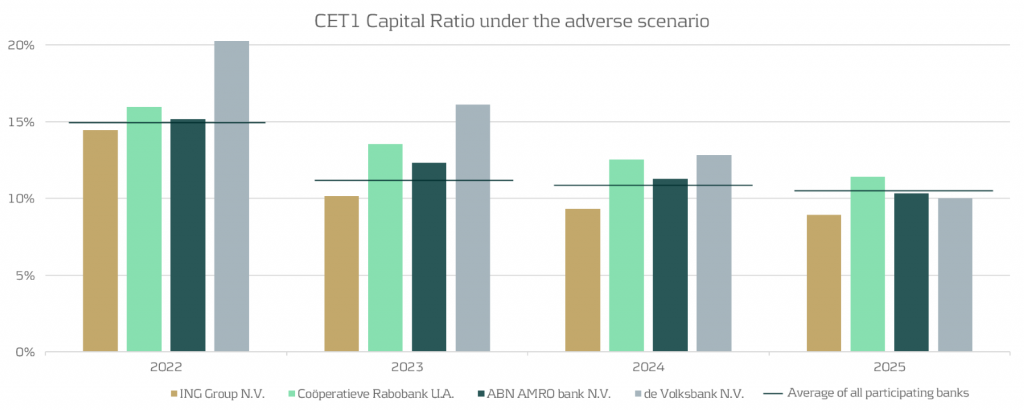

CET1 ratios

Using the data presented by EBA [2], we display the evolution of the fully loaded CET1 ratio for the four banks versus the average over all EU banks in the figure below. The four Dutch banks are: ING, Rabobank, ABN AMRO and de Volksbank, ordered by size.

From the figure, we observe the following:

- Compared to the average EU-wide CET1 ratio (indicated by the horizontal lines in the graph above), it can be observed that three out of four of the banks are very close to the EU average.

- For the average EU wide CET1 ratio we observe a significant drop from year 1 to year 2, while for the Dutch banks the impact of the stress is more spread out over the full scenario horizon.

- The impact after year 4 of the stress horizon is more severe than the EU average for three out of four of the Dutch banks.

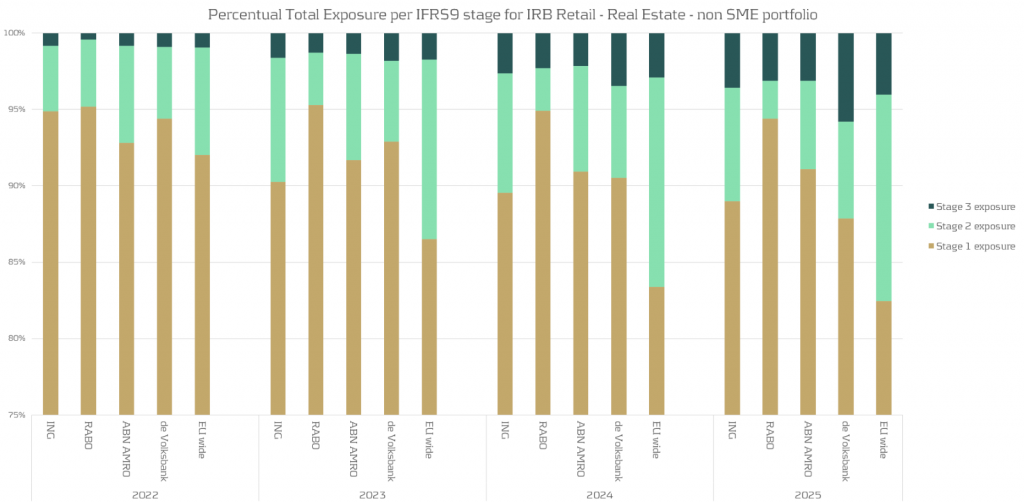

Evolution of retail mortgages during adverse scenario

The most important product the four Dutch banks have in common are the retail mortgages. We look at the evolution of the retail mortgage portfolios of the Dutch banks compared to the EU average. Using EBA data provided [2], we summarize this in the following chart:

Based on the analysis above , we observe:

- There is a noticeable variation between the banks regarding the migrations between the IFRS stages.

- Compared to the EU average there are much less mortgages with a significant increase in credit risk (migrations to IFRS stage 2) for the Dutch banks. For some banks the percentage of loans in stage 2 is stable or even decreases.

Conclusion

This short note gives some indication of specifics of the 2023 EBA stress applied to the four main Dutch banks.

Should you wish to go deeper into this subject, Zanders has both the expertise and track record to assist financial organisations with all aspects of stress testing. Please get in touch.

References

BIS and DNB urge swift transformation to Basel III

Take-aways for bank risk management, supervision and regulation

The European Commission welcomes the political agreement reached on the “banking package” which implements Basel III standards, making EU banks more resilient and addressing sustainability risks. The package also strengthens supervision and provides tools for EU banks. Beyond the implementation of Basel III standards, the package also contains a number of standards on crypto currencies and contributes to Europe’s transition to climate neutrality. The new rules are expected to apply from 2025, but certain elements will be phased in over a longer period.

The Bank for International Settlements (BIS) has emphasized the importance of a swift transformation to the new Basel III rules. The implementation of the rules has already been delayed several times. Also the Dutch Central Bank (DNB) recently stated that the implementation of Basel III is crucial. They noted that the implementation of Basel III would help to address the risks posed by climate change, which are becoming increasingly important for the banking sector.

Forbearance: banks need to gear up

Take-aways for bank risk management, supervision and regulation

Forbearance involves providing concessions to borrowers who may struggle to repay their loans, aiming to return them to a sustainable repayment path. The analyses revealed areas for improvement, including the proper identification of clients in financial difficulties, granting appropriate and sustainable measures, and establishing robust monitoring processes for forborne exposures. Effective forbearance frameworks and efficient processes are crucial, particularly in the current economic environment, to prepare for potential increases in distressed debt and refinancing risk. These measures not only support viable distressed debtors but also mitigate losses for banks and the economy.

Europe sets out vision for a digital euro

Take-aways for bank risk management, supervision and regulation

At the start of March, the Bank for International Settlements (BIS) in conjunction with several central banks concluded Project Icebreaker in which the potential benefits and challenges of using retail central bank digital currencies (CBDC) in international payments were studied. At the end of March, the European Banking Federation (EBF) published a vision paper on a Digital Euro Ecosystem, stating that a retail digital euro, a wholesale CBDC and bank-issued money tokens could all play a role in enabling innovation, supporting customer needs and ensuring that Europe stays at the forefront of digital finance. The digital euro should add value to consumers, mitigate ex-ante the accompanying risks, and be appropriately designed in close cooperation with the private sector.

At the end of April, the ECB stated in their latest progress report that a digital euro could be made available via existing banking apps or via a dedicated Eurosystem app. The digital euro would be accessible to Euro area citizens (and non-Euro area citizens with a Euro area-based payment service provider) in its initial release. In further releases, other areas could have access too, while also functionalities with other CBDCs are potentially provisioned. Finally, a paper produced for the European Parliament suggested that the digital euro system should not limit users’ holdings, arguing that the risks to financial stability of people deserting conventional banks are overstated. Holdings could be limited if the digital euro is intended for day-to-day transactions only. A final decision on issuing a digital euro has yet to be made, with the launch coming in 2026 at the earliest.

Meanwhile the EU has approved the world’s first comprehensive crypto rules, aiming to protect investors and combat money laundering. Expected to roll out in 2024, the rules put pressure on other countries to follow suit. Related to this, IOSCO, the global standard setter for securities markets, has issued detailed recommendations for regulating crypto assets, aiming to enhance client protection and align crypto trading with public market standards. With support from its board, IOSCO intends to address investor protection and market integrity risks.

Regulatory responses to the strong increase in the interest rate environment

Take-aways for bank risk management, supervision and regulation

The new threshold is set at a 5% decline of Tier 1 capital, replacing the previous level of 2.5%. The EBA plans to review and update the threshold regularly and may revise the methodology in the longer term. The NII SOT is an additional metric in the supervisory review of institutions’ exposures to interest rate risk in the banking book (IRRBB). The EBA states that a breach would not lead to automatic supervisory measures. Integrating the threshold into institutions’ internal systems would not necessarily require recalibration actions.

This increase in the threshold is not deemed sufficient, however, by the banking sector. According to Risk.net, the sector proposes a 7.5% limit. The EBA has calibrated the limit such that the number of banks violating the Economic Value of Equity (EVE) SOT should be similar as for the NII SOT. The sector claims that a 7.5% NII SOT will ensure this, as the original 2.5% was estimated in a low interest rate environment. The new threshold must still be approved by the European Commission (EC). Without this approval, the status of both the SOT for Economic Value of Equity (EVE) and NII is unclear.

Meanwhile, the European Central Bank (ECB) has started to analyse the unrealized losses that banks (could) face due to the recent interest rate movements. The ECB has requested banks to provide detailed information on their interest rate risk models and how they are affected by rising rates. The ECB states that it will use, among other, the results of the ongoing stress test to analyze the resilience of the banks.

In the broader context of banking supervision, the Financial Stability Institute (FSI) of the Bank for International Settlements (BIS) has highlighted the impact of rapid interest rate hikes on banks’ solvency and liquidity positions. Banks’ accounting choices, balance sheet characteristics, and business models play a role in how these effects are experienced. While Pillar 1 sets baseline requirements, rising interest rates and declining asset values expose vulnerabilities that require robust supervision under Pillar 2. Supervisors need to assess risks such as IRRBB and unsustainable business models. Market turmoil has emphasized the need for additional measures, both quantitative and qualitative, to address bank-specific vulnerabilities and enhance risk management. Implementing Pillar 2 consistently across jurisdictions is a challenge, however, that may require further guidance.

Zanders listed on Swift Customer Security Programme (CSP) Assessment Providers directory

We are excited to announce that Zanders has been listed on the Swift Customer Security Programme (CSP) Assessment Providers directory*.

The CSP helps reinforce the controls protecting participants from cyberattack and ensures their effectivity and that they adhere to the current Swift security requirements.

*Swift does not certify, warrant, endorse or recommend any service provider listed in its directory and Swift customers are not required to use providers listed in the directory.

Swift Customer Security Programme

A new attestation must be submitted at least once a year between July and December, and also any time a change in architecture or compliance status occurs. Customer attestation and independent assessment of the CSCF v2023 version is now open and valid until 31 December 2023. July 2023 also marks the release of Swifts CSCF v2024 for early consultation, which is valid until 31 December 2024.

Swift introduced the Customer Security Programme to promote cybersecurity amongst its customers with the core component of the CSP being the Customer Security Controls Framework (CSCF). Independent assessment has been introduced as a prerequisite for attestation to enhance the integrity, consistency, and accuracy of attestations. Each year, Swift releases an updated version of the CSCF that needs to be attested to with support of an independent assessment.

The Attestation is a declaration of compliance with the Swift Customer Security Controls Policy and is submitted via the Swift KYC-SA tool. Dependent on the Swift Architecture used, the number of controls to be implemented vary; of which certain are mandatory, and others advisory.

Further details on the Swift CSCF can be found on their website:

- https://www.swift.com/myswift/customer-security-programme-csp

- https://www.swift.com/myswift/customer-security-programme-csp/find-external-support/directory-csp-assessment-providers

Our services

Do you have arrangements in place to complete the independent assessment required to support the attestation?

Zanders has experience with and can support the completion of an independent external assessment of your compliance to the Swift Customer Security Control Framework that can then be used to fully complete and sign-off the Swift attestation for this year.

With an extensive track record of designing and deploying bank integrations, our intricate knowledge of treasury systems across both IT architecture as well as business processes positions us well to be a trusted independent assessor. We draw on past projects and assessments to ask the right questions during the assessment phase, aligning our customers with the framework provided by Swift.

The Swift attestation can also form part of a wider initiative to further optimise your banking landscape, whether that be increasing the use of Swift within your organisation, bank rationalization or improving your existing processes. The availability of your published attestation and its possible consultation with counterparties (upon request) helps equally in performing day-to-day risk management.

Approach

Planning

We start with rigorous planning of the assessment project, developing a scope of work and planning resources accordingly. Our team of experts will work with clients to formulate an Impact Assessment based on the most recent version of the Swift Customer Security Controls Framework.

Architecture Classification

A key part of our support will be working with the client to formulate a comprehensive overview of the system architecture and identify the applicable controls dictated by the CSCF.

Perform Assessment

Using our wide-ranging experience, we will test the individual controls against specific scenarios designed to root out any weaknesses and document evidence of their compliance or where they can be improved.

Independent Assessment Report

Based on the evidence collected, we will prepare an Independent Assessment report which includes status of the compliance against individual controls, baselining them against the CSCF and recommendations for improvement areas within the system architecture.

Post Assessment Activities

Once completed, the Independent Assessment report will support you with the submission of the Attestation in line with the requirements of the CSCF version in force, which is required annually by Swift. In tandem, Zanders can deliver a plan for implementation of the recommendations within the report to ensure compliance with current and future years’ attestations. Swift expects controls compliance annually, together with the submission of the attestation by 31 December at the latest, in order to avoid being reported to your supervisor. Non-compliant status is visible to your counterparties.

Do you need support with your Swift CSP Independent Assessment?

We are thrilled to offer a Swift CSP Independent Assessment service and look forward to supporting our clients with their attestations, continuing their commitment to protecting the integrity of the Swift network, and in doing so supporting their businesses too. If you are interested in learning more about our services, please contact us directly below.

Get performance now

- Contact me

You are currently viewing a placeholder content from HubSpot. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information

Cryptocurrencies and Blockchain: Navigating Risk, Compliance, and Future Opportunities in Corporate Treasury

Take-aways for bank risk management, supervision and regulation

As a result of the growing importance of this transformative technology and its applications, various regulatory initiatives and frameworks have emerged, such as Markets in Crypto-Assets Regulation (MiCAR), the Distributed Ledger Technology (DLT) Pilot Regime, and the Basel Committee on Banking Supervision (BCBS) crypto standard were launched, demonstrating the growing importance and adoption at both a global and national level. Given these trends, treasuries will be impacted by Blockchain one way or the other – if they aren’t already.

With the advent of cryptocurrencies and digital assets, it is important for treasurers to understand the issues at hand and have a strategy in place to deal with them. Based on our experience, typical questions that a treasurer faces are how to deal with the volatility of cryptocurrencies, how cryptocurrencies impact FX management, the accounting treatment for cryptocurrencies as well as KYC considerations. These developments are summarized in this article.

FX Risk Management and Volatility

History has shown that cryptocurrencies such as Bitcoin and Ether are highly volatile assets, which implies that the Euro value of 1 BTC can fluctuate significantly. Based on our experience, treasurers opt to sell their cryptocurrencies as quickly as possible in order to convert them into fiat currency – the currencies that they are familiar and which their cost basis is typically in. However, other solutions exist such as hedging positions via derivatives traded on regulated financial markets or conversions into so-called stablecoins1.

Accounting Treatment and Regulatory Compliance

Cryptocurrencies, including stablecoins, require careful accounting treatment and compliance with regulations. In most cases cryptocurrencies are classified as “intangible assets” under IFRS. For broker-traders they are, however, classified as inventory, depending on the circumstances. Inventory is measured at the lower of cost and net realizable value, while intangible assets are measured at cost or revaluation. Under GAAP, most cryptocurrencies are treated as indefinite-lived intangible assets and are impaired when the fair value falls below the carrying value. These impairments cannot be reversed. CBDCs, however, are not considered cryptocurrencies. Similarly, and the classification of stablecoins depends on their status as financial assets or instruments.

KYC/KYT Considerations

The adoption of cryptocurrencies and Blockchain technology introduces challenges for corporate treasurers in verifying counterparties and tracking transactions. When it comes to B2C transactions, treasurers may need to implement KYC (Know Your Customer) processes to verify the age and identity of individuals, ensuring compliance with age restrictions and preventing under-aged purchases, among other regulatory requirements. Whilst the process differs for B2B (business-to-business) transactions, the need for KYC exists nevertheless. However in the B2B space, the KYC process is less likely to be made more complex by transactions done in cryptocurrencies, since the parties involved are typically well-established companies or organizations with known identities and reputations.

Central Bank Digital Currencies

(CBDCs) are emerging as potential alternatives to privately issued stablecoins and other cryptocurrencies. Central banks, including the European Central Bank and the Peoples Banks of China, are actively exploring the development of CBDCs. These currencies, backed by central banks, introduce a new dimension to the financial landscape and will be another arrow in the quiver of end-customers – along with cash, credit and debit cards or PayPal. Corporate treasurers must prepare for the potential implications and opportunities that CBDCs may bring, such as changes in payment options, governance processes, and working capital management.

Adapting to the Future

Corporate treasurers should proactively prepare for the impact of cryptocurrencies and Blockchain technology on their business operations. This includes educating themselves on the basics of cryptocurrencies, stablecoins, and CBDCs, and investigating how these assets can be integrated into their treasury functions. Understanding the infrastructure, processes, and potential hedging strategies is crucial for treasurers to make informed decisions regarding their balance sheets. Furthermore, treasurers must evaluate the impact of new payment options on working capital and adjust their strategies accordingly.

Zanders understands the importance of keeping up with emerging technologies and trends, which is why we offer a comprehensive range of Blockchain services. Our Blockchain offering covers supporting our clients in developing their Blockchain strategy including developing proofs of concept, cryptocurrency integration into Corporate Treasury, support on vendor selection as well as regulatory advice. For decades Zanders has helped corporate treasurers navigate the choppy seas of change and disruption. We are ready to support you during this new era of disruption, so reach out to us today.

Meet the team

Zanders already has a well-positioned, diversified Blockchain team in place, consisting of Blockchain developers, Blockchain experts and business experts in their respective fields. In the following you will find a brief introduction of our lead Blockchain consultants.