Updated IRRBB guidelines pose new challenges for banks

On 31 October 2017, the European Banking Authority (EBA) published a consultation paper on the update of its ‘Guidelines on the management of interest rate risk arising from non-trading book activities’.

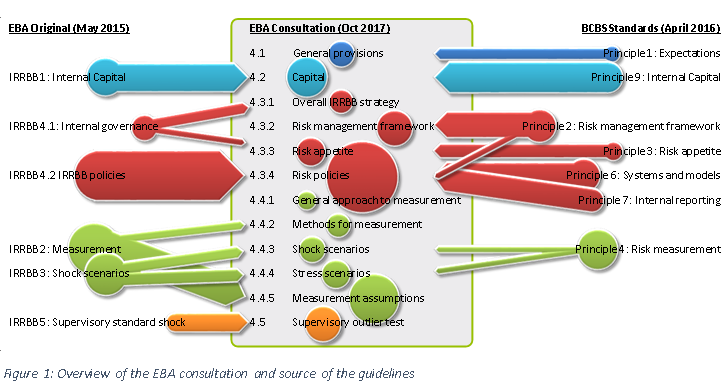

This long-awaited update for the management of Interest Rate Risk in the Banking Book (IRRBB) builds on the original guidelines published in May 2015. It also effectively is the translation to European law of the IRRBB Standards published by the Basel Committee on Banking Supervision (BCBS) in April 2016. Market participants had until 31 January 2018 to put forward their feedback on the updated guidelines. After completion, the guidelines will apply from 31 December 2018. Certain aspects of the BCBS standards from April 2016 are not addressed in the updated EBA guidelines. The EBA is still working on a number of technical standards as part of the ongoing CRD and CRR revision in which they for example will prescribe disclosure requirements and the standardised approach for IRRBB.These technical standards will be published separately at a later stage.

Compared to the 2015 version, the guidelines have increased in size significantly. As published in our infographic, the guidelines contain over 40% new articles, which originate partly from the BCBS standards, but also contain some new guidelines. This article discusses the three main changes introduced in the consultation. First of all, the major overhaul of the supervisory outlier test. Next, the strong increase in the guidance on governance and model risk management. And finally, the shift EBA requires from the more traditional Net Interest Income (NII) metrics to a true earnings-based approach. The article concludes with an overview of the main comments provided by market participants in response to the consultation.

Supervisory outlier test

The existing supervisory outlier test (SOT) measures how the Economic Value of Equity (EVE) responds to an instantaneous +/- 200 basis points parallel yield curve shift. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

In the BCBS standards, a different SOT definition was proposed, introducing a 15% trigger compared to Tier 1 capital in combination with six interest rate scenarios that also include non-parallel shocks. The EBA has decided to implement both SOTs. The combination of more scenarios and an additional trigger level will restrict the maneuvering capabilities of banks, even though the new SOT is considered an ‘early warning signal’ only.

In an attempt to further improve the comparability of results between banks, the EBA has strengthened the guidance for the calculation of the SOTs. This covers both scoping requirements (e.g. non-performing loans and pension obligations and pension plan assets now need to be included) and measurement requirements (e.g. lowering the zero interest rate floor, now ranging from -150 basis points for overnight positions to zero basis points for 30 years and more).

One of new measurement requirements for the calculation of the SOT, is particularly noteworthy. The EBA guidelines require the use of risk-free discounting for the calculation of the SOT. With respect to the cash flows, it is up to banks to decide whether or not they want to include the commercial margin and other spread components. This level of flexibility should primarily be interpreted as an escape route in case banks are not able to strip the commercial margins from their cash flows. From an interest rate risk management perspective it is clear that alignment between discounting and cash flows is preferable. The interesting development in the guidelines is that a bank can only choose to use stripped cash flows in the SOT calculation if this is consistent with the way the bank manages and hedges IRRBB. In this way, aiming for alignment between discounting and cash flows for the SOT may have large consequences, depending on the choices a bank has made for the internal management of IRRBB.

Governance and model risk management

The section in the updated guidelines on governance has significantly increased in size compared to the original version. It includes new guidelines on the risk management framework, risk appetite and model governance. These may seem new, but on close inspection, the majority of these added guidelines are direct copies of the BCBS standards, as can also be seen in Figure 1. This figure provides a graphical overview of the main areas in the EBA consultation and how the original EBA guidelines and BCBS standards have been incorporated in the consultation. While the guidelines on the risk management framework and risk appetite can be considered a more detailed explanation of the original guidelines, the main addition is on model risk management. This requires institutions to set up a model governance, not only for any behavioural models, but for all IRRBB measurement methods that traditionally have not always been in scope of a model governance.

Where the majority of the original EBA guidelines have been transferred to the consultation, sometimes with more detail, some of the BCBS standards have not been included at all. This is especially true for ‘Principle 5: Behavioral optionalities’ and ‘Principle 8: IRRBB Disclosure’. Guidelines on Behavioral optionalities were already far more detailed in the original EBA guidelines and therefore the BCBS standards were not incorporated in the EBA consultation. The guidelines on IRRBB Disclosure have not been included as these will be addressed in the separate reporting technical standards mentioned earlier.

From NII to earnings

One of the main additions to the guidelines, which didn’t originate from the original guidelines nor from the BCBS standards, is the requirement to also include market value changes in earnings metrics. This change will require banks to start modeling a true IFRS Profit & Loss at Risk and take into account the increase or reduction in total earnings and capital. Traditionally, earnings metrics just focus on NII and ignore any interest rate sensitivity in other areas of the Profit and Loss (P&L) account. It will have a significant impact on the modeling of earnings measures, as the accounting treatment of instruments will start to determine how the measure will be impacted. Although this seems a logical extension of an earnings metric, it presents significant challenges especially in the area of derivatives used for hedge accounting and instruments in an Available-for-Sale portfolio, for which only coupon payments were included up till now. Adding market value movements of these instruments introduces the risk of double counting and therefore requires a clear definition of how the interest rate sensitivity impacts the P&L. Integrating these effects in a forward looking calculation will pose challenges to the implementation in systems.

Consultation responses

In total, 19 organizations responded to the consultation. Some of them responded to the 16 questions in the consultation, while others chose to add a more general response to the consultation.

One of the main critiques is around the inclusion of CSRBB in the scope of IRRBB. Especially the lack of a proper definition (currently defined as “any kind of spread risk that is not IRRBB or credit risk”) and the inclusion in an IRRBB context is commented on by the respondents. The general response is to remove CSRBB from the scope of the IRRBB guidelines and to create separate guidelines on CSRBB instead. Another area of concern is the guidance on capital calculation. Although primarily copied from the original guidelines, this particular part of the guidelines raises a considerable number of questions. In particular, whether capital should be calculated for variability risk or loss risk and how capital for earnings risk and value risk should be integrated in a consistent framework, without duplications, remains unclear. Finally, the date of implementation is also considered challenging by a number of respondents, as a December 2018 implementation date effectively requires banks to implement all changes in six to nine months.

Conclusion

For many banks the implementation of the 2015 EBA guidelines is still a work in progress. The recent update of the guidelines poses new challenges for banks. Given the substantial number of changes compared to the previous version, the December 2018 implementation deadline will prove to be challenging. And we haven’t seen the end of it, because a number of technical standards as part of the ongoing CRD and CRR revision are still in the pipeline. This includes for example requirements to standardize the disclosure of IRRBB, which currently shows a lot of variety between various jurisdictions and will likely require a significant effort for all banks as well. As a result, IRRBB will remain on the agenda of the regulator and the management board of many banks in the years to come.

IRRBB Quick Scan

Should you want to assess your bank’s IRRBB framework, Zanders offers an IRRBB Quick Scan. Based on a review of available model documentation, risk reports and interviews with your bank’s risk specialists, the scan provides an independent and objective assessment of your bank’s IRRBB implementation relative to the new IRRBB principles and best-market practices. More information on the IRRBB Quick Scan can be found here.