In collaboration with a leading international bank, Zanders explored how machine learning can support more accurate, scalable, and decision-useful estimates of greenhouse gas (GHG) emissions intensity when disclosures fall short.

In the pursuit of climate-aligned finance, financial institutions face a critical challenge: incomplete emissions data. While disclosure frameworks such as the EBA’s Pillar 3 ESG requirements, the ECB’s climate risk guidance, and the EU Corporate Sustainability Reporting Directive (CSRD) continue to expand, their scope remains fragmented. Therefore, financial institutions must often assess climate-related financial risks and align portfolios without full visibility into counterparties’ environmental footprints.

In collaboration with a leading international bank, Zanders explored how machine learning can support more accurate, scalable, and decision-useful estimates of greenhouse gas (GHG) emissions intensity when disclosures fall short.

The Challenge: Incomplete GHG Emissions Disclosure

Current climate risk assessments rely heavily on firm-disclosed emissions. Yet, many companies, particularly small, private, or non-European, still do not report their GHG emissions. This inconsistency not only limits the accuracy of portfolio-level financed emissions metrics, but also hinders accurate net-zero alignment tracking and regulatory reporting.

To fill this gap, many financial institutions resort to sector-average proxies, such as those recommended by the Partnership for Carbon Accounting Financials (PCAF). These proxies assign emissions to non-reporting firms based on average industry and regional emission intensities. While widely adopted, this approach introduces substantial bias, as it overlooks firm-specific drivers such as energy use, capital intensity, or geographic differences. The result is a blind spot: portfolio assessment loses the very granularity needed to distinguish leaders from laggards in the low-carbon transition.

Predicting Emissions Intensity with Machine Learning

The main objective of the study focused on testing various supervised ML models to estimate Scope 1 and 2 GHG emissions intensity based on a variety of financial firm-level characteristics. Leveraging an unbalanced panel dataset covering worldwide public and private companies from 2021 to 2025, models were trained to learn from disclosed emissions and predict missing values with greater granularity. The dataset was split into approximately 80 % training and 20 % testing subsets, ensuring that observations from the same company (across different years) did not appear in both sets to prevent information leakage.

Two models were introduced:

- Model 1, a baseline that includes financial and sectoral indicators widely available for banks, such as assets turnover; property, plant and equipment (PPE); earnings before interest and taxes (EBIT); and industry classification.

- Model 2, an extended model that incorporates more advanced and less common variables such as Refinitiv ESG score; energy consumption; and earnings quality rankings.

These predictors were selected based on both academic relevance and practical availability in financial databases such as LSEG Workspace (previous Refinitiv Eikon) and S&P.

In both Model 1 and Model 2 settings, three algorithms were compared: k-Nearest Neighbours (k-NN), Decision Trees, and Random Forests, chosen for their interpretability and practicality in low-data environments. To assess whether machine learning provides a meaningful improvement over traditional sector-average proxies, both the ML models and PCAF sector-average proxy estimates were examined on a common test set. Unification of this comparison allowed for quantifying the overall predictive gains and evaluating the implications for climate-aligned decision-making in finance.

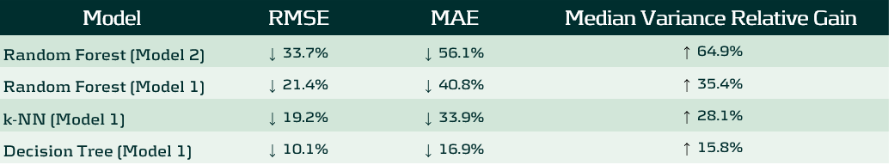

Models performance was evaluated using standard regression metrics including Root Mean Squared Error (RMSE), and Mean Absolute Error (MAE), ensuring consistency across models and comparison with the baseline. Beyond standard error metrics, performance was also assessed through variance recovery (reported further as Median Variance Relative Gain). This measure captures how effectively each model restores firm-level differentiation in GHG emissions intensity lost under sector-average proxies.

The entire framework was designed to balance predictive accuracy with implementation realism, aiming to improve GHG coverage for financial institutions without relying on black-box techniques or data-heavy infrastructure.

What the Models Revealed

Under each model and method, machine learning substantially outperformed the traditional PCAF proxy approach:

The Random Forest version of Model 2 emerged as the strongest performer, reducing RMSE by roughly one-third, MAE by more than a half and recovering nearly 65% of the intra-sectoral variance lost under sector-average proxies. Model 1, created for banking sector usage, scored a second place under the same Random Forest algorithm, reducing RMSE by 21% and MAE by 41%. This means that the algorithm can effectively differentiate firms within the same industry, being a critical step for a realistic transition-risk modeling or portfolio creation.

Feature importance analysis showed that Energy Use Total, PPE / Total Assets, Asset Turnover and Sector were consistently dominant predictors, confirming that emissions intensity depends jointly on operational efficiency and capital structure. However, the study also tested a transfer learning approach, where models trained only on high-disclosure sectors with sufficient reporting coverage were applied to low-disclosure sectors, unseen during training. The results showed a substantial decline in accuracy, suggesting that emission patterns are highly sector specific. In practice, this means that for ML models to exceed sector-average proxies in the GHG emission estimation context, models should be trained on datasets that include all sectors, rather than relying on samples limited to a few well-disclosing industries.

Why This Matters

More accurate emissions estimation directly supports key pillars of sustainable finance. It enhances portfolio alignment assessments, scenario analysis, and climate risk disclosure under frameworks such as Task Force on Climate-related Financial Disclosures (TCFD) and the EU Corporate Sustainability Reporting Directive (CSRD). Moreover, improved firm-level granularity enables financial institutions to better understand which clients are leading or lagging in the transition to a low-carbon economy.

By replacing rigid proxies with data-driven predictions, financial institutions can move one step closer to climate data maturity, where decisions are no longer held back by disclosure gaps but empowered by intelligent estimation.

What Zanders Can Do

As regulatory expectations tighten and data coverage remains incomplete, financial institutions need solutions that are both technically rigorous and operationally feasible. Whether addressing climate-related credit exposures, integrating ESG into portfolio construction, or navigating disclosure obligations, institutions must adopt frameworks that are adaptive, data-driven, and aligned with supervisory standards.

By combining quantitative modeling expertise, climate risk analytics, and regulatory knowledge, Zanders helps institutions move beyond generic estimates and static proxies.

Want to find out more about how we can support you in building practical ESG risk management solutions? Our ESG experts will be happy to assist you. Visit the Zanders ESG page to know more.

Get ESG support

Talk to an expert about your ESG risk management strategy and see how we can help.

Contact

As ESG regulation moves from voluntary disclosure to in-depth integration, European banks must adapt their ways of working to establish credible transition plans.

Over the past decade, regulatory expectations on European banks’ ESG frameworks have evolved from voluntary disclosure initiatives to detailed operational requirements. While certain regulations such as CSRD and CSDDD have been watered down as part of the Omnibus Directive, EUs climate goals and Climate Law remain intact. The EBA Guidelines on the management of ESG risks will come into force in January 2026, mandating all but the smallest banks to submit annual plans demonstrating how they will reduce their portfolio emissions in time to meet internal and external targets.

Ironically, amidst a slower-than-expected decarbonization in society in general, and with several American and international banks retreating from their climate commitments (and the ensuing collapse of the Net Zero Banking Alliance), it is European banks that are exposed to the largest compliance and reputational risks.

In our experience, many banks may have underestimated the far-reaching impact of the new Guidelines. Unlike previous regulatory guidance, including ECBs Guide on climate-related and environmental risks, what is now required is the complete integration of ESG risks and targets into banks’ ways of working: risk management, client engagement, operations, pricing, and business strategy.

Below we outline the four areas we think will prove the most challenging for banks to implement.

Key challenges

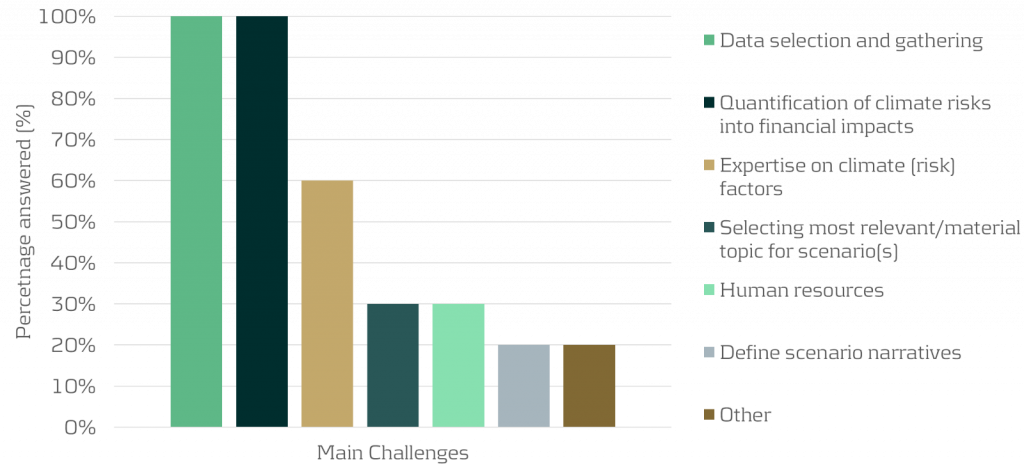

- Data availability and processes

Banks are required to have in place a structured data environment to enable assessment of ESG risks, with the explicitly stated aim that most of the data should be sourced at the client- and asset level. The Guidelines list a number of metrics that large institutions must define and monitor, including:

- Financed emissions (Scope 1-3)

- Portfolio metrics of clients that are, or are projected to be, misaligned with emission targets

- A breakdown of portfolios secured by real estate according to the level of energy efficiency

- Metrics related to dependencies and impacts on ecosystem services, in particular water

- Metrics related to ESG-related reputational and legal risks (via the banks’ exposures)

Some of these data are already collected and reported by banks, such as financed emissions. But even those metrics rely largely on proxies and assumptions. Even among PCAF member banks the variation in reported emission intensities is significant - and in many cases inexplicable. For many other metrics the data to construct them is either missing or has not even been defined.

Banks need to accelerate their ESG data strategy and decide, for the short- and medium, which data to collect directly from clients andwhich to source from external providers, and the data gaps for which there are no viable alternatives but to use proxies. In turn, for each of these categories there will be many choices to make with implications for quality, timeliness, and costs. In parallel, but informed by the data strategy, the bank needs to decide on – and invest in - their future data infrastructure, which may take years to realize. One obvious case is the need to connect real estate characteristics, such as LTV, flood exposure, energy rating, and insurance coverage with clients’ financial data as well as outputs from climate scenario models.

2. Models and Methods

The Guidelines require banks to map ESG risk drivers to traditional risk categories and – if they are material - embed the risks in several processes: collateral valuation, ICAAP, stress testing, underwriting, and pricing.

The first step in this exercise is to determine which risk drivers are material, and for which risk types. In the end, for most banks, physical and transition risks stemming from climate change will likely prove the most material for credit risk, but ECBs expectations as to the rigor of the materiality assessment - to substantiate such a conclusion - are increasing. For example, banks need to have methodologies in place to assess how and whether social and governance failures in client firms may result in both financial as well as reputational and legal risks.

Even for key risk drivers such as flood risk, banks face a significant challenge in quantifying how and with which probability this will translate into credit risk. It necessitates a number of assumptions such as the response in real estate prices and insurance costs/availability, as well as government policy and disaster funds, flood protection work, and much more. Limited or absent historical data together with the changing nature of risks related to climate change make this kind of model development very different from traditional risk modeling in banks (such as IRB model) and necessitates new expertise.

And while there are several useful publicly available models, in particular by the Net Greening of the Financial System, there is still a lot of work to be done to adapt those scenarios to individual banks’ portfolios and business models.

3. Client engagement and risk assessment

EBA expects climate and environmental risks to be factored into client selection, due diligence, covenants and pricing based, for a start, on an evaluation of counterparties’ transition readiness and resilience to physical risks. Even for large clients that are reporting under CSRD, a lot of the data required to perform these assessments will have to be collected directly as part of the onboarding process.

Although many banks have separate ESG advisory units that support client executives, these are often there to identify opportunities for sustainable products and loans and are not trained to assess and quantify clients’ risks. In the end, it is client executives and credit committees that must stand over the ESG risk assessment and its impact on credit scores, pricing and loan conditions. To save costs and time for client-facing staff, they should be equipped with practical and user-friendly tools and systems that support them in collecting and organizing relevant ESG data.

Worse, for most SME and retail customers there is no dedicated account manager, the on-boarding and credit process is largely automated. Banks should develop a risk-based sourcing strategy that, at least initially, uses sector-level proxies for the majority of firms while collecting individual data from those that have been designated as high-risk clients. Again, a number of choices have to be made when developing such a framework to ensure it is purposeful.

4. Governance and steering

What we deem most pressing for banks is to decide on their governance to triage and drive progress on the vast array of requirements. It will require strong leadership and a project committee with sufficient seniority to make crucial, and potentially costly decisions. Elaborate RACIs will be of little use if those assigned ownership are found too low in the bank’s hierarchy.

While the exact division of responsibilities will depend on each bank’s structure and governance model, it is clear that the actual transition plan(s) should be owned by the first line (and subsequently validated by second line), and tie into existing business planning and strategic process. At the same time, the transition plan will be part of the annual ICAAP submission, which is a second-line responsibility, and the bank’s ESG strategy should be reflected in the business resilience test . Hence, these first- and second-line processes must be aligned.

The Board and CEO should set the bank’s ESG strategy and ensure that these expectations are actionable. Little progress is to be expected if C-suite members do not have clear KPIs and KRIs tied to the delivery of the bank’s transition plan. Quantitative targets may be based on, in addition to financed emissions, the energy efficiency profile of the mortgage book, sustainability-linked bond issuance, and the funding of low-carbon power production. Such targets may necessitate difficult trade-offs, including tighter origination criteria, off-boarding of high-risk clients, and larger discounts for green loans.

Purposeful implementation strategy

To succeed in this potentially daunting endeavour banks should adopt a pragmatic implementation approach, balancing costs against compliance risks. The ECB and local supervisors are fully aware that banks need considerable time to get all prerequisites in place, and the scope and detail of transition plans must be allowed to evolve over years.

However, while early transition plans cannot be expected to present the ultimate answers to either data, methodological or governance challenges, , banks should be able to demonstrate their capacity to achieve essential climate and environmental objectives. Quantitative targets, in particular regarding a bank’s financed emissions, must be achievable.

Finally, underscored by recent legal cases, any claims related to the bank’s “green” credentials must be based on evidence. The heightened compliance and legal risks mean that it is timely to review the bank’s public as well as non-public ESG commitments, benchmark them against peers, and make an honest assessment of the costs and resources necessary to fulfil them.

Want to find out more about how Zanders can assist your bank in developing your ESG strategy and meet regulatory expectations?

Reach out to our Partner Lars Frisell, our ESG and risk management expert, for tailored guidance.

As regulators raise the bar on climate risk management, banks are now facing a new and complex expectation: climate reverse stress testing.

We’ve spoken to many banks recently, and the message is clear: developing and implementing a climate reverse stress testing (RST) framework will be a significant challenge, particularly as it is a completely new regulatory expectation for climate risk from the PRA. Most banks are already familiar with RST in the context of credit, market, and liquidity risks. But extending this practice to climate introduces a different level of complexity.

Until now, climate quantitative analysis has centered on standard stress testing and scenario analysis, asking what could happen under different climate pathways. Reverse stress testing flips the question: what climate pathway could push your business model to the point of failure?

You may have already fallen into the trap of believing these common myths; if so, it’s time to rethink your position:

- “Our institution is not exposed to climate risk.” The PRA is unlikely to accept this - climate risk is systemic. It manifests as transition risk (such as carbon taxes or shifts in consumer expectations) and physical risk (both acute climate events and chronic changes). These drivers affect almost every portfolio: credit exposures like commercial loans and mortgages, market positions in bonds and equities, and even operational resilience. Hence, it is highly likely that your institution is already exposed to climate risk factors, directly or indirectly.

- “Rain alone could never cause us to fail.” This could be true if it weren’t for the fact that risks don’t occur in isolation. Rainfall, carbon prices, GDP slowdown, and interest rate rises can interact in complex and non-linear ways to push an institution towards failure. Although a single risk factor might need to reach an extreme tail event to cause failure, multiple risk factors acting together don’t need to be extreme to push a firm to the brink. Plausible domino effects can occur - for example, in a mortgage portfolio, heavier rainfall increases flood risk, lowering property values and weakening collateral. At the same time, a rise in carbon prices lifts household energy bills, cutting disposable income and pushing up default probabilities. Higher PDs, combined with weaker collateral driving LGDs higher, can accelerate capital erosion towards the failure point.

- “The failure points are so extreme, there’s no benefit in analyzing them.” A failure point doesn’t have to mean the bank has collapsed entirely. In practice, it could be something completely plausible, such as the CET1 falling below 11% or liquidity buffers dropping under regulatory requirements. These are thresholds that banks already monitor as part of business-as-usual.

- “What’s the benefit of RST? We already run standard stress tests.” RST forces firms to confront and explore extreme, and yet plausible, critical scenarios they might otherwise avoid. It can uncover vulnerabilities that remain hidden in conventional stress testing.

We recommend that you should prepare for the following key challenges:

- Defining failure points: Deciding exactly what a failure would look like is not straightforward and is the first challenge. Most firms will base the breaking point on a regulatory capital measure such as CET1. From there, they need to identify the internal drivers (PD, LGD, credit spreads, liquidity buffers etc) that would cause it to erode.

- Deriving transmission channels: The next critical step is mapping which climate variables (such as carbon price, rainfall, and temperature shocks) could realistically impact those internal drivers. For example, in mortgage portfolios, heavier rainfall could reduce property values and raise insurance costs, leading not only to higher LGDs but also higher PDs.

- Developing supporting models: In many cases, deriving the relationships between the different drivers requires additional supporting models. For example, firms may need to develop models to measure and assess the relationship between rainfall and LGD/PD.

- Quantification of the narrative: Over time, the PRA is likely to require qualitative insights to evolve into quantified relationships between climate drivers, bank risk factors, and failure points. It’s not just about establishing a link between rainfall or carbon prices and LGD/PD, but defining potential levels of the risk factors that could push the bank to failure.

- Embedding outcomes: RST results need to feed into firm-wide processes and systems, including governance, reporting, and ongoing monitoring. At this stage, RST stops being just a regulatory expectation and becomes a proactive tool for managing risk.

At Zanders, we can support you in developing climate RST frameworks that are:

- Proportionate: from plausible qualitative narratives to quantification models, aligned to your portfolio exposure to climate risk.

- Scalable: solutions that evolve along with your firm’s climate risk journey.

- Strategic: we guide you through achieving regulatory compliance while always keeping an eye on your long-term business objectives.

How far are you with planning and self-assessment for climate RST at your firm? Our advice: don’t wait until the updated Supervisory Statement is published by the PRA to planning (or start putting in place a plan for) for a climate RST framework. Starting early will make the process smoother and ensure you are well-positioned and prepared when regulatory scrutiny will inevitably materialize.

We would be delighted to share our insights and discuss how we can support your climate risk journey. Please reach out to the Zanders UK climate risk modeling team (Polly Wong, Nikolas Kontogiannis, Hardial Kalsi, Paolo Vareschi).

Since its launch just over a decade ago, Nationaal Warmtefonds has grown from a niche financing platform to a driving force in promoting residential energy efficiency across the Netherlands. Over the last five years, our partnership has deepened and developed, with Zanders reshaping its support to adapt to every operational challenge and growth stage.

Nationaal Warmtefonds was established in 2013 as an experimental fund backed by the Dutch government to help homeowners make their houses more energy efficient. Today, it's a key player in the Netherlands’ climate ambitions, granting over 1.8 billion euro of loans and helping more than 130.000 households make their homes more sustainable.

From cautious beginnings

In the early stages, Nationaal Warmtefonds-backed loans were only offered to homeowners who could afford traditional credit. But in 2015, the Paris Agreement was signed, setting new international climate targets and raising action on energy efficiency to a national priority. This sparked a rapid extension of the fund’s mandate. Notably, the decision was made to expand from financially stable owners to provide access to funding to households with lower incomes. This led to a surge in the scale and impact of the fund.

“Initially the fund grew steadily – in the first year we financed €5 million,” says Ernst Jan Boers, Chairman of Nationaal Warmtefonds. “But within five years, we were doing €150 million a year and it became clear we had to reshape ourselves. The fund was expected to double in size and to support this growth, we needed more than just a loan administrator – we needed the full second and third lines.”

As Nationaal Warmtefonds’ objectives became more ambitious, so did the need for specialist risk management, compliance, and treasury functions. These were services beyond the capabilities of the organization and its existing administrative providers. So, five years ago, the fund set out to find an advisor that could support their growth strategy. This led them to Zanders.

“In the early stages, it was about managing the funds with boots on the ground,” says Ernst Jan.

Zanders offered treasury knowledge, but they were also willing to do the day-to-day work – and the same applied for compliance and risk. We needed a role that we called ‘fund director’ and Zanders filled that position.

Ernst Jan Boers, Chairman of Nationaal Warmtefonds

Tasked with managing the fund, coordinating with other service providers, and supporting the board, the Zanders team was quickly embedded into day-to-day operations, providing advice and hands-on support across risk, compliance, and treasury. And as the fund rapidly grew to over €400 million a year, Zanders’ role also expanded as it helped the fund navigate growth and the challenges it presented.

Navigating the challenges of fund expansion

A strengthening moment in the partnership came with the near collapse of a large, multi-million-euro eco-renovation of an apartment building, involving more than 180 homeowners. When the construction firm went bankrupt mid-way through the build, the future of the project plunged into uncertainty. Zanders played an important role in enabling the project to proceed – mediating between homeowners, authorities, and internal credit committees, while also designing a financial restructuring plan. With this hands-on, credit management, Zanders helped Nationaal Warmtefonds not only rescue the project (it was ultimately completed to almost zero-emission standards) but also reshape future governance and credit approval processes to reduce risk going forward.

Large, high-stakes projects like this highlighted how fast the fund was evolving and how far its role had expanded beyond its original scope.

“We started with a lifetime from 3 to 6 years for the fund,” Ernst Jan reflects. “But if you look at the scale of the transition and how embedded we’ve become in the national climate effort, we’ll likely be doing this work through to 2050.”

The impact of this growth is that the somewhat short-term nature of Nationaal Warmtefonds’ operational structure was no longer sufficient to manage the growing complexity and scale of its role.

“About a two years ago, things were moving so fast and we realized it was time to become a real organization,” admits Ernst Jan. “Up until that point, we had a board of just four people, each working only one or two days a week. Everything was outsourced – risk, finance, and loan administration. We had good controls, but no one on payroll, and not even a physical office. We were becoming too big for that model and, more importantly, we realized we’re not temporary – we’re actually here to stay.”

At this point Nationaal Warmtefonds decided to insource key service providers, and at the same time, the board transitioned from a part-time structure to working three to four days a week.

“As part of this shift, the role of fund director was no longer needed in the same way,” says Ernst Jan.

Zanders continues to support us – especially in areas like risk, compliance, and treasury – but the nature of the support has changed again. It's now more advisory and less operational, because we’ve built the internal structure to handle much of it ourselves.

Ernst Jan Boers, Chairman of Nationaal Warmtefonds

This marks a new, more consultancy-driven era for our partnership, where Zanders empowers Nationaal Warmtefonds with the expertise, guidance and strategic support to continue to grow the fund and proactively manage risk.

Flexible foundations for the future

From providing hands-on crisis management during complex projects to shifting towards a more advisory role as internal capacity grew, Zanders’ support for Nationaal Warmtefonds has evolved in line with the fund’s growth and changing needs. This flexibility has been crucial in navigating the challenges of rapidly scaling the fund as climate action has climbed the national agenda.

Looking to the future, as the energy transition deepens and new challenges arise, our partnership will keep adapting, continually re-balancing operational support with strategic advice to ensure Nationaal Warmtefonds is positioned to respond effectively and continue to drive forward the energy transition in the Netherlands.

To find out more about how we can support the growth strategy of your business and fund, please contact Eva de Lange.

Explore how Zanders’ scoring methodology quantifies biodiversity risks, enabling financial institutions to safeguard portfolios from environmental and transition impacts.

Addressing biodiversity (loss) is not only relevant from an impact perspective; it is also quickly becoming a necessity for financial institutions to safeguard their portfolios against financial risks stemming from habitat destruction, deforestation, invasive species and/or diseases.

In a previous article, published in November 2023, Zanders introduced the concept of biodiversity risks, explained how it can pose a risk for financial institutions, and discussed the expectations from regulators.1 In addition, we touched upon our initial ideas to introduce biodiversity risks in the risk management framework. One of the suggestions was for financial institutions to start assessing the materiality of biodiversity risk, for example by classifying exposures based on sector or location. In this article, we describe Zanders’ approach for classifying biodiversity risks in more detail. More specifically, we explore the concepts behind the assessment of biodiversity risks, and we present key insights into methodologies for classifying the impact of biodiversity risks; including a use case.

Understanding biodiversity risks

Biodiversity risks can be related to physical risk and/or transition risk events. Biodiversity physical risks results from environmental decay, either event-driven or resulting from longer-term patterns. Biodiversity transition risks results from developments aimed at preventing or restoring damage to nature. These risks are driven by impacts and dependencies that an undertaking has on natural resources and ecosystem services. The definition of impacts and dependencies and its relation to physical and transitional risks is explained below:

- Companies impact natural assets through their business operations and output. For example, the production process of an oil company in a biodiversity sensitive area could lead to biodiversity loss. Impacts are mainly related to transition risk as sectors and economic activities that have a strong negative impact on environmental factors are likely to be the first affected by a change in policies, legal charges, or market changes related to preventing or restoring damage to nature.

- On the other hand, companies are dependent on certain ecosystem services. For example, agricultural companies are dependent on ecosystem services such as water and pollination. Dependencies are mainly related to physical risk as companies with a high dependency will take the biggest hit from a disruption or decay of the ecosystem service caused by e.g. an oil spill or pests.

For banks, the impacts and dependencies of their own operations and of their counterparties can impact traditional financial (credit, liquidity, and market) and non-financial (operational and business) risks. In our biodiversity classification methodology, we assess both impacts and dependencies as indicators for physical and transition risk. This is further described in the next section.

Zanders’ biodiversity classification methodology

An important starting point for climate-related and environmental (C&E) risk management is the risk identification and materiality assessment. For C&E risks, and biodiversity in particular, obtaining data is a challenge. A quantitative assessment of materiality is therefore difficult to achieve. To address this, Zanders has developed a data driven classification methodology. By classifying the biodiversity impact and dependencies of exposures based on the sector and location of the counterparty, scores that quantify the portfolio’s physical and transition risks related to biodiversity are calculated. These scores are based on the databases of Exploring Natural Capital Opportunities, Risks and Exposure (ENCORE) and the World Wide Fund for Nature (WWF).

Sector classification

The sector classification methodology is developed based on the ENCORE database. ENCORE is a public database that is recognized by global initiatives such as Taskforce on Nature-related Financial Disclosures (TNFD) and Partnership for Biodiversity Accounting Financials (PBAF). ENCORE is a key tool for the “Evaluate” phase of the TNFD LEAP approach (Locate, Evaluate, Assess and Prepare).

ENCORE was developed specifically for financial institutions with the goal to assist them in performing a high-level but data-driven scan of their exposures’ impacts and dependencies. The scanning is made across multiple dimensions of the ecosystem, including biodiversity-related environmental drivers. ENCORE evaluates the potential reliance on ecosystem services2 and the changes of impacts drivers3 on natural capital assets4. It does so by assigning scores to different levels of a sector classification (sector, subindustry and production process). These scores are assigned for 11 impact drivers and 21 ecosystem services. ENCORE provides a score ranging from Very Low to Very High for a broad range of production processes, sub-sectors and sectors.

To compute the sector scores, ENCORE does not offer a methodology for aggregating scores for impacts drivers and ecosystem services. Therefore, ENCORE does not provide an overall dependency and impact per sector, sub-industry, or production process. However, Zanders has created a methodology to calculate a final aggregated impact and dependency score. The result of this aggregation is a single impact and a single dependency score for each ENCORE sector, sub-industry or production process. In addition, an overall impacts and dependencies scores are computed for the portfolio, based on its sector distribution. In both cases, scores range from 0 (no impact/dependency) to 5 (very high impact or dependency).

Location classification

The location scoring methodology is developed based on the WWF Biodiversity Risk Filter (hereafter called WWF BRF).5 The WWF BRF is a public tool that supports a location-specific analysis of physical- and transition-related biodiversity risks.

The WWF BRF consists of a set of 33 biodiversity indicators: 20 related to physical risks and 13 related to reputational risks, which are provided at country, but also on a more granular regional level. These indicators are aggregated by the tool itself, which ultimately provides one single scape physical risk and scape reputational risk per location.

To compute overall location scores, the WWF BRF does not offer a methodology for aggregating scores for countries and determine the overall transition risk (based on the scape reputational risk scores) and physical risk (based on the scape physical risk scores). However, Zanders has created a methodology to calculate a final aggregated transition and physical risk score for the portfolio, based on its geographical distribution. The result of this aggregation is a single transition and physical risk score for the portfolio, ranging from 0 (no risk) to 5 (very high risk).

Use case: RI&MA for biodiversity risks in a bank portfolio

In this section, we present a use case of classifying biodiversity risks for the portfolio of a fictional financial institution, using the sector and location scoring methodologies developed by Zanders.

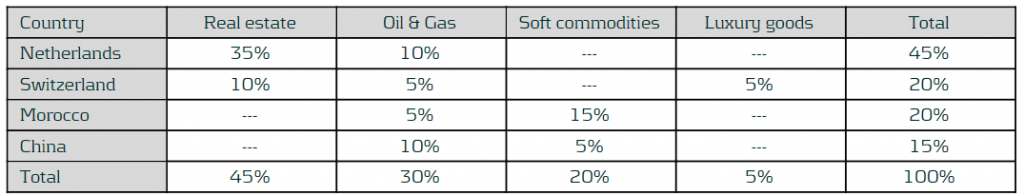

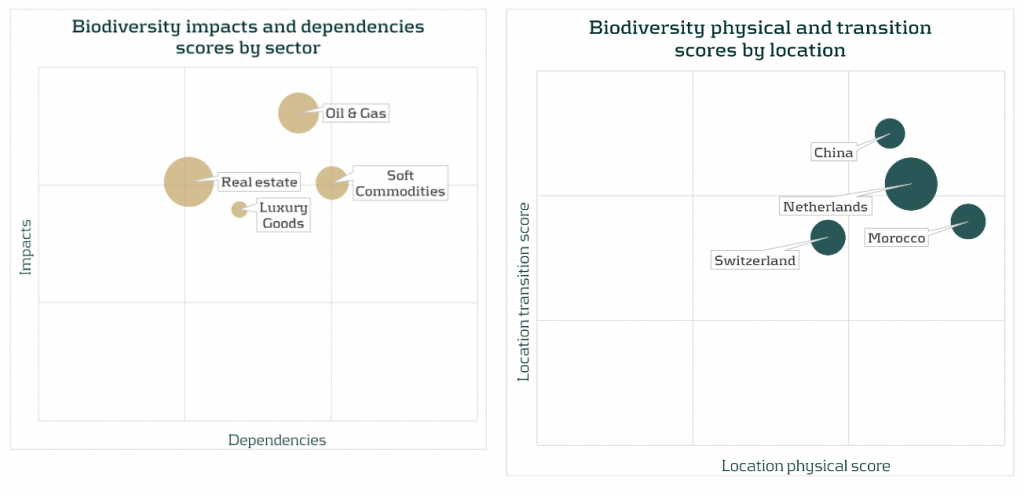

The exposures of this financial institution are concentrated in four sectors: Real estate, Oil & Gas, Soft commodities and Luxury goods. Moreover, the operations of these sectors are located across four different countries: the Netherlands, Switzerland, Morocco and China. The following matrix shows the percentage of exposures of the financial institution for each combination of sector and country:

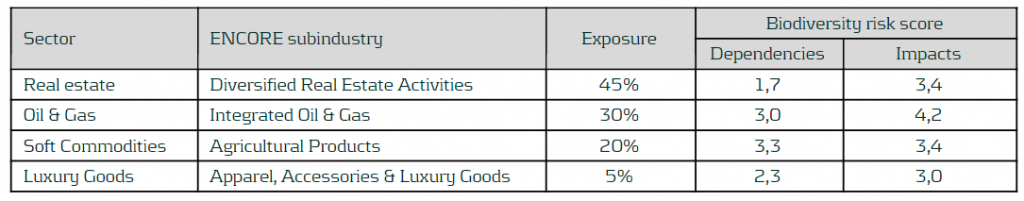

ENCORE provides scores for 11 ecosystem services and 21 impacts drivers. Those related to biodiversity risks are transformed to a range from 0 to 5. After that, biodiversity ecosystem services and biodiversity impacts drivers are aggregated into an overall biodiversity impacts and dependencies scores, respectively. The following table shows the mapping between the sectors in the portfolio and the corresponding sub-industry in the ENCORE database, including the aggregated biodiversity impacts and dependencies scores computed for those sub-industries. The mapping is done at sub-industry level, since it is the level of granularity of the ENCORE sector classification that better fits the sectors defined in the fictional portfolio. In addition, the overall impacts and dependencies scores are computed, by taking the weighted average sized by the sector distribution of the portfolio. This leads to scores of 3.8 and 2.4 for the impacts and dependencies scores, respectively.

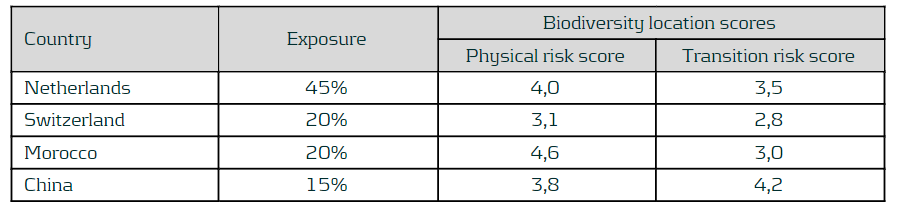

The WWF BRF provides biodiversity indicators at country level. It already provides an aggregated score for physical risk (namely, scape physical score) and for transition risk (namely, scape reputational risk score), so no further aggregation is needed. Therefore, the corresponding scores for the four countries within the bank portfolio are selected. As the last step, the location scores are transformed to a range similar to the sector scores, i.e., from 0 (no physical/transition risk) to 5 (very high physical/transition risk). The results are shown in the following table. In addition, the overall impacts and dependencies scores are computed, by taking the weighted average sized by the geographical distribution of the portfolio. This leads to scores of 3.9 and 3.3 for the physical and transition risk scores, respectively.

Results of the sector and location scores can be displayed for a better understanding and to enable comparison between sectors and countries. Bubble charts, such as the ones show below, present the sectors and location scores together with the size of the exposures in the portfolio (by the size of each bubble).

Combined with the size of the exposures, the results suggest that biodiversity-related physical and transition risks could result in financial risks for Soft commodities and Oil & Gas. This is due to high impacts and dependencies and their relevant size in the portfolio. Moreover, despite a low dependencies score, biodiversity risks could also impact the Real estate sector due to a combination of its high impact score and the high sector concentration (45% of the portfolio). From a location perspective, exposures located in China could face high biodiversity transition risks, while exposures located in Morocco are the most vulnerable to biodiversity physical risks. In addition, relatively high scores for both physical and transition risk scores for Netherlands, combined with the large size of these exposures in the portfolio, could also lead to additional financial risk.’

These results, combined with other information such as loan maturities, identified transmission channels, or expert inputs, can be used to inform the materiality of biodiversity risks.

Conclusion

Assessing the materiality of biodiversity risks is crucial for financial institutions in order to understand the risks and opportunities in their loan portfolios. In this article, Zanders has presented its approach for an initial quantification of biodiversity risks. Curious to learn how Zanders can support your financial institutions with the identification and quantification of biodiversity risks and the integration into the risk frameworks? Please reach out to Marije Wiersma, Iryna Fedenko or Miguel Manzanares.

Citations

- https://zandersgroup.com/en/insights/blog/biodiversity-risks-and-opportunities-for-financial-institutions-explained ↩︎

- In accordance with ENCORE, ecosystem services are the links between nature and business. Each of these services represent a benefit that nature provides to enable or facilitate business production processes. ↩︎

- In accordance with ENCORE AND Natural Capital Protocol (2016), an impacts driver is a measurable quantity of a natural resource that is used as an input to production or a measurable non-product output of business activity. ↩︎

- In accordance with ENCORE, natural capital assets are specific elements within nature that provide the goods and services that the economy depends on. ↩︎

- The WWF also provides a similar tool, the WWF Water Risk Filter, which could be used as to assess specific water-related environmental risks. ↩︎

This article explores the growing interest in sustainability among consumers and investors, the role of financial institutions in supporting green initiatives, and the rising concern about “greenwashing” – deceptive claims regarding environmental efforts by some financial institutions.

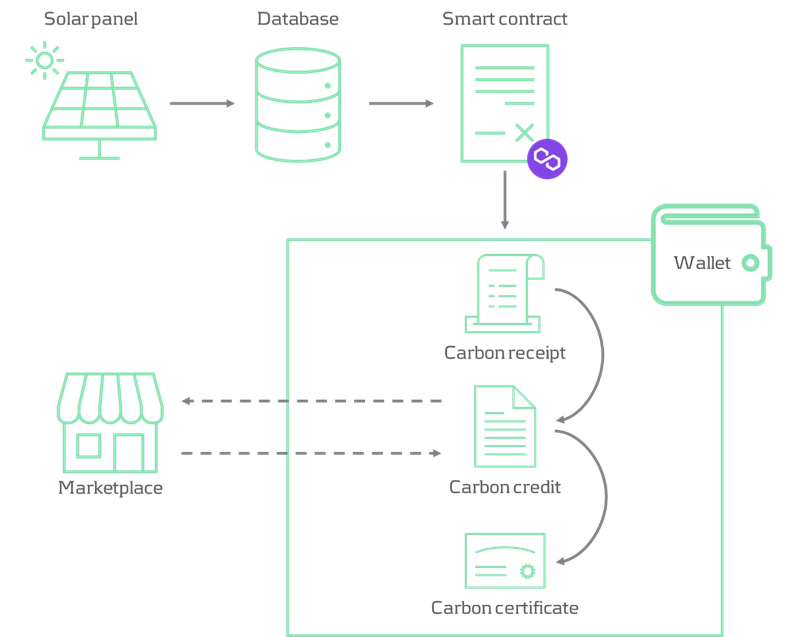

In recent years, consumers’ and investors’ interest in sustainability has been growing. Since 2015, assets under management in ESG funds have nearly tripled, the outstanding value of green bonds issued by residents of the euro area has surged eightfold, and emission-related derivatives have seen a more than sevenfold increase1.

The global push for sustainable and environmentally responsible practices has led to an increased focus on the role of financial institutions in supporting green initiatives. One of the ways financial institutions use to incentivise sustainable investments, is by designing new products, such as blue bonds to protect marine areas and other sustainability-linked bonds2, or by transitioning to funding sectors with positive sustainability impact.

However, amidst the growing wave of environmental consciousness, the credibility of "green" claims made by some financial institutions is a point of concern. This phenomenon, known as greenwashing, is gaining attention, not only within financial institutions, but also with regulators. Financial regulators, including the European Supervisory Authorities (ESAs) and UK’s Financial Conduct Authority (FCA) have taken action against potentially misleading green statements made by institutions. Despite these regulatory interventions, the persistent risk of greenwashing persists, primarily due to the absence of consistent standards governing sustainability claims and disclosures. The lack of uniform criteria poses an ongoing challenge to effectively combatting greenwashing practices within the financial landscape.

Defining Greenwashing

The ESAs describe greenwashing as “a practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants” 3.

Financial institutions, as key players in the global economy, play a crucial role in fostering sustainability. However, some have been accused of using deceptive practices to push their green image without making substantial changes. This practice may be misleading to consumers, investors, and other market participants.

In practice, greenwashing can take different forms depending on the institution. For insurance companies, the European Insurance and Occupational Pensions Authority (EIOPA) found in their Advise to the European Commission on Greenwashing4 various examples where insurers misleadingly claimed to be transitioning their underwriting activities to net zero by 2050 without any credible plans to do so. Other examples include insurance companies falsely claiming to plant trees for each life insurance policy sold but failing to fulfil this promise, or products being marketed as sustainable merely because of a positive "ESG rating," despite the rating not taking into account any actual sustainability factors and focusing solely on financial risks.

Withing the banking sector, the EBA reported5 that the most common misleading claims relate to the current approach to integrating sustainability into the business strategy, claims on the sustainability results and the real-world impact, and claims on future commitments on medium and long-term plans.

Finally, for investment companies and pension funds, the European Securities and Markets Authority (ESMA) reported6 that most the common greenwashing practices result from exaggerated claims without any proven link between and ESG metric and the real-world impact.

Key Indicators of Greenwashing:

- Vague and Ambiguous Language: Financial institutions engaging in greenwashing often use vague terms and ambiguous language in their marketing materials. This lack of clarity makes it challenging for consumers to discern the actual environmental impact of their investments.

- Lack of Transparency: Genuine commitment to sustainability involves transparency about investment choices and the environmental impact of financial products. Institutions that are less forthcoming about their practices may be concealing less-than-green investments.

- Inconsistent Policies: Greenwashing is also evident when there is a misalignment between a financial institution's sustainability claims and its actual policies and practices. Actions, or lack thereof, can speak louder than words.

The Role of Regulatory Bodies

Greenwashing poses potential reputational and financial risks for the institutions involved. Addressing greenwashing might not only improve consumer’s trust in the products and services offered by financial institutions, but also will allow customers to make informed decisions that are align with their sustainability preferences and increase the capital into products that genuinely represent a more sustainable choice and drive a positive change. Tackling greenwashing should therefore be a priority for regulatory supervisors.

The introduction of the EU’s Taxonomy Regulation and the Sustainable Finance Disclosure Regulation (SFDR) addresses the initial concerns of greenwashing within the financial sector. The Taxonomy determines which economic activities are environmentally sustainable and addresses greenwashing by enabling market participants to identify and invest in sustainable assets with more confidence. SFDR promotes openness and transparency in sustainable finance transactions and requires Financial Market Participants to share the environmental and social impact of their transactions with stakeholders. In May 2023, the ESA published their progress report on greenwashing monitoring and supervision7. The report aims to provide insights into an understanding of greenwashing and identify the specific forms it can take within banking. It also evaluates greenwashing risk within the EU banking sector and determines the extend to which it might be and issue from a regulatory perspective.

In the UK, the FCA published in November 2023 a guidance consultation on the Anti-Greenwashing Rule8. The anti-greenwashing rule is one part of a package of measures introduced through the Sustainability Disclosure Requirements (SDR). The anti-greenwashing rule requires FCA-authorised firms to ensure that any claims they make to the sustainability characteristics of their financial products and services are consistent with the actual sustainability characteristics of the product or service and are fair, clear and not misleading, and have evidence to back them up. The propose rule will come into force on 31 May 2024.

While the existing and planned regulation contributes to addressing aspects of greenwashing, several measures have not yet fully entered into application, making the impact of the frameworks not visible yet. Beyond disclosures, regulators should also focus on tightening requirements on sustainability data and ratings, and creating mandates to prevent misleading statements and unfair commercial practices.

Going forward, as regulators gain more experience to comprehensively address greenwashing, financial institutions should expect increased supervision and enforcement of sustainable finance policies aimed at preventing misleading sustainability claims.

Actions to mitigate greenwashing risk

One of the biggest challenges financial institutions faced in relation to sustainability is that scientific progress, policy development and social values are in constant evolution. What was a well-supported green initiative two years ago can potentially be considered as greenwashing today.

In the meantime that stricter regulations and guidance is in place, financial institutions should take a broad view on how to develop and communicate sustainability strategies to mitigate greenwashing risk.

Here are three ways on how to prevent greenwashing:

- Promote disclosure: financial institutions should publish comprehensive sustainability reports and disclose ESG information as part of their financial reports.

- Commit to transparency: claims about environmental aspects or performance of their products should be justified with science-based and verifiable methods. Financial institutions should be transparent about their ambitions, status, and be open about any shortcomings they identified.

- Align business practices with purpose: financial institutions should determine which climate-related and environmental risks impact business strategy in the short, medium and long term. They should reflect climate-related and environmental risks in business strategies and its implementation. In addition, they should balance sustainability ambitions with the reality of real transformation.

Zanders’ approach to managing reputational risk

Avoiding greenwashing should always be a priority for institutions. If a risk arises in this area, reputational risk management can help to limit negative effects. Due to the interdependencies between ESG, reputational, business and liquidity risk, the supervisory authorities are also increasingly focusing on this area.

In the context of reputational risk management, we recommend a holistic approach that includes both existing and new business in the analysis. In addition to identifying critical transactions from a reputational perspective, the focus is also on active stakeholder management. This requires cross-departmental cooperation between various units within the institution. In many cases, the establishment of a reputation risk management committee is key to manage that topic properly within the institution.

Conclusion

While many financial institutions genuinely strive for sustainability, the rise of greenwashing highlights the need for increased vigilance and scrutiny. Consumers, regulators, and industry stakeholders must work together to ensure that financial institutions align their actions with their environmental claims, fostering a truly sustainable and responsible financial sector.

Curious to learn more? Please contact: Elena Paniagua-Avila or Martin Ruf

Citations

- European Central Bank, Climate-related risks to fiancial stability, 2021. ↩︎

- European Central Bank, Climate-related risks to fiancial stability, 2021. ↩︎

- European Banking Authority, Progress report on greenwashing monitoring and supervision, 2023. ↩︎

- European Banking Authority, Progress report on greenwashing monitoring and supervision, 2023. ↩︎

- European Banking Authority, Progress report on greenwashing monitoring and supervision, 2023. ↩︎

- European Securities and Markets Authority, Progress report on greenwashing, 2023. ↩︎

- European Banking Authority, Progress report on greenwashing monitoring and supervision, 2023. ↩︎

- Financial Conduct Authority, Guidance on the Anti-Greenwashing rule, 2023. ↩︎

EBA publishes recommendations how to include E&S risks in the prudential framework for banks and insurers.

In October 2023, the European Banking Authority (EBA) published a report[1] with recommendations for enhancements to the Pillar 1 prudential framework to reflect environmental and social (E&S) risks, distinguishing between actions to be taken in the short term and in the medium to long term. The short-term actions are to be taken into account over the next three years as part of the implementation of the revised Capital Requirements Regulation and Capital Requirements Directive (CRR3/CRD6).

The EBA report follows a discussion paper on the same topic from May 2022[2], on which it solicited input from the financial industry. In this note, we provide an overview of the recommended actions by the EBA that relate to the prudential framework for banks. The EBA report also contains recommended actions for the prudential framework applying to investment firms, but these are not addressed here.

If the EBA’s recommendations are implemented in the prudential framework, in our view the most immediate implications for banks would be:

- When using external ratings to determine own fund requirements for credit risk under the standardized approach (SA) of Pillar 1, ensure that E&S risks are explicitly considered when evaluating the appropriateness of the external ratings as part of the due diligence requirements.

- When calculating own fund requirements for credit risk under the internal-ratings-based (IRB) approach, embed E&S risks in the rating assignment, risk quantification (for example through a margin of conservatism or the downturn component) and/or expert judgment and overrides.

- To assess E&S risks at a borrower level, establish a process to obtain and update material E&S-related information on the borrowers’ financial condition and credit facility characteristics, as part of due diligence during onboarding and ongoing monitoring of the borrowers’ risk profile.

- For IRB banks, embed E&S risks in the credit risk stress testing programs.

- Ensure that E&S risks are considered in the valuation of collateral, specifically for financial and real estate collateral.

- For market risk, embed environmental risks in trading book risk appetite, internal trading limits and the new product approval process. Furthermore, for banks aiming to use the internal model approach (IMA) of the Fundamental Review of the Trading Book (FRTB) regulation, environmental risks need to be considered in their stress testing program.

- For operational risk, identify whether E&S risks constitute triggers of operational risk losses.

We note that many of these implications align with the ECB’s expectations in the ECB Guide on climate-related and environmental risks[3].

Background

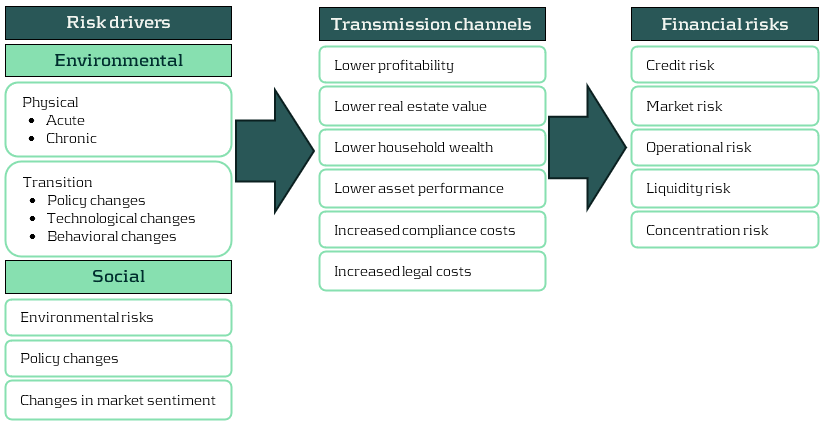

The EBA report considers both environmental and social risks, which the EBA characterizes as follows:

- As drivers of environmental risks, EBA distinguishes physical and transition (climate) risks. It does not explicitly refer in the report to other environmental risks, such as a loss of biodiversity or pollution, but in an earlier report the EBA considered these as part of chronic physical risks[4].

- EBA considers social factors to be related to the rights, well-being and interests of people and communities, including factors such as decent work, adequate living standards, inclusive and sustainable communities and societies, and human rights. As drivers of social risks, EBA distinguishes environmental factors (as materialization of physical and transition risks may change living standards and the labor market and increase social tensions, for example) as well as changes in policies and market sentiment. These may in part be driven by actions taken to meet the United Nation’s sustainable development goals (SDGs) in 2030.

In line with the ECB Guide on climate-related and environmental risks[5], the EBA does not view E&S risks as stand-alone risks, but as drivers of traditional banking risks. This is depicted in Figure 1. The report considers the impact on credit, market, operational, liquidity and concentration risks and reviews to what extent E&S risks can be reflected in capital buffers and the macro-prudential framework. It does not explicitly consider the securitization framework, although this will be implicitly affected by impacts on credit risk. The EBA does not see an impact of E&S risks on the (risk-insensitive) leverage ratio, and therefore does not consider it in the report.

Figure 1: Examples of transmission channels for environmental and social risks (source: EBA).

The EBA notes that the Pillar 1 framework has been designed to capture the possible financial impact of cyclical economic fluctuations, but not to capture the manifestation of long-term environmental risks. It is therefore important to keep the main principles that form the basis of the prudential framework in mind when contemplating adjustments to reflect E&S risks in the prudential framework. The main principles as highlighted by the EBA are summarized below.

Main principles of the prudential framework and the relation to the horizon for E&S risks

With repect to the framework in general:

- Own fund requirements are intended to cover potential unexpected losses. In contrast, expected losses are directly deducted from own funds, and are generally captured in the accounting rules through provisions, impairments, write-downs and appropriate valuation of assets.

- The purpose of own fund requirements is to ensure resilience of an institution to unexpected adverse circumstances, before appropriate mitigating actions and strategy adjustments can be implemented. Therefore, environmental factors that can affect institutions in the short to medium term are expected to be reflected in the prudential framework. However, for those with an impact in the longer term, institutions are expected to take appropriate mitigating actions in their strategy.

- The high confidence level used in the Pillar 1 framework to protect institutions from risks over the short to medium horizon may no longer be achievable and appropriate if longer horizons would be considered.

- To the extent that institutions are exposed to E&S risks in relation to their specific strategy and business model, coverage of these risks in the Pillar 2 own-fund requirements instead of Pillar 1 could be appropriate. In addition, reflection of these risks in the Pillar 2 guidance for stress testing may be considered.

With respect to the internal-ratings-based (IRB) approach for credit risk:

- The Probability of Default (PD) represents a one-year default probability, which is required to be calibrated based on long-run average (‘through-the-cycle’) default rates. As such, longer-term risk characteristics of the obligor may be taken into account.

- The Credit Conversion Factor (CCF) as an estimate of potential additional drawdowns before default naturally relates to the one-year time horizon for the PD, but is expected to reflect the situation of an economic downturn.

- The time horizon for the Loss Given Default (LGD) extends to the full maturity of the exposure and/or the collection process and its calibration is also expected to reflect the situation of an economic downturn.

In the following sections we summarize the EBA recommendations by risk type.

Credit risk

The recommendations of the EBA largely put the burden on financial institutions to take E&S risks into account in the inputs for the existing Pillar 1 framework and/or to apply conservatism or overrides to the outputs. It does not recommend to include explicit E&S risk-related elements in the determination of risk weights for rated and unrated exposures in the SA or in the risk-weight formulas of the IRB. The main reasons for not doing so are that it is not clear what common and objective E&S-related factors should be used as input, what the proper functional form would be, a lack of evidence on which the size of an adjustment could be based so that it results in proper risk differentiation, and the risk of double counting with the reflection of E&S risks in the inputs to the existing own funds calculations under Pillar 1 (external ratings in the SA and PD, LGD and CCF in the case of IRB). However, the EBA will continue to evaluate this possibility in the medium to long term. The EBA also does not recommend introducing an environment-related adjustment factor to the risk weights resulting from the existing Pillar 1 framework[6].

Recommended actions for credit risk

| Short term |

- SA) The EBA encourages rating agencies to integrate environmental and social factors as drivers in the external credit risk assessments and to provide enhanced disclosures and transparency about the rating methodologies.

- (SA) Financial institutions to explicitly consider environmental factors in the due diligence that they are required to perform when using external credit risk assessments.

- (IRB) Financial institutions to reflect E&S risks in the rating assignment, risk quantification (for example through a margin of conservatism or the downturn component) and/or expert judgment and overrides, without affecting the overall performance of the rating system. In this context:

- Quantification of risks must be based on sufficient and reliable observations;

- Overrides should be for specific, individual cases where the institution believes there is material exposure to E&S risks but it has insufficient information to quantify it. Such overrides need to be regularly assessed and challenged;

- If an institution derives PDs for internal rating grades by a mapping to a scale from a credit rating institution, it needs to consider whether the default rates associated with the external scale reflect material E&S risks.

- To assess E&S risks at a borrower level, institutions need to have a process to obtain and update material E&S-related information on the borrowers’ financial condition and on credit facility characteristics, as part of the due diligence during onboarding and ongoing monitoring of borrowers’ risk profile.

- (IRB) Financial institutions to consider E&S risks in their stress testing programs.

- (SA, IRB) Financial institutions to ensure prudent valuation of immovable property collateral, considering climate-related physical and transition risks as well as other environmental risks. The prudent valuation should be considered at origination, re-valuation and during monitoring.

| Medium to long term |

- (SA) Financial institutions to monitor that environmental factors are reflected in financial collateral valuations through market values under Pillar 1 and valuation methodologies under Pillar 2.

- (SA) The EBA to consider whether benefits from the Infrastructure Supporting Factor (ISF) should only be applied to high-quality specialized lending corporate exposures that meet strong environmental standards.

- (SA) The EBA to consider adjusting risk weights, both in general and specifically for those assigned to real estate exposures.

- (IRB) As E&S risks materialize in defaults and loss rates over time, institutions need to redevelop or recalibrate their PD and LGD estimates.

(SA = standardized approach; IRB = Internal-rating-based approach)

Market risk

Within market risk, the EBA sees the main interaction of E&S risks with the equity, credit spread and commodity markets, in which E&S risks may cause additional volatility. In line with the existing regulatory guidance, the EBA expects E&S risks not to be treated as separate risk factors but as drivers of existing risk factors, with the exception of products for which cash flows depend specifically on ESG factors (‘ESG-linked products’).

The EBA does not recommend changes at this point to the standardized approach (SA) and the internal model approach (IMA) under the FRTB regulation, which will come into effect in the EU in 2025. The primary reason is the lack of sufficient evidence on the impact of E&S risks to enable a data driven approach, which forms the basis of the FRTB.

When calculating the expected shortfall (ES) measure under the IMA based on last 12 months' market data, the materialization of E&S risks will automatically be reflected in the market data that is used. When using market data from a stress period, either to calculate ES in the IMA or to calibrate risk factor shocks for the sensitivity-based measure (SbM) at a risk class level in the SA, the reflection of E&S risks will depend on the choice of stress period. To include E&S risks fully in the IMA but avoid overlap with the (partial) presence of E&S risks in historical data, the EBA views the consideration of E&S risks in a separate ‘risk not in the model engine’ (RNIME) add-on as most promising option for the medium to long term, leveraging the framework described in the ECB Guide to internal models[7].

Recommended actions for market risk

| Short term |

- (SA, IMA) Financial institutions to consider environmental risks in relation to their trading book risk appetite, internal trading limits and new product approval.

- (IMA) Financial institutions to consider environmental risk as part of their stress testing program that is required to get internal model approval.

| Medium to long term |

- (SA, IMA) Competent authorities to consider how to treat ESG-linked products for the residual risk add-on in the SA and in the IMA.(SA) The EBA to consider including a dimension for ESG risks in the existing equity and credit spread risk classes, or including a separate environmental risk class.

- (IMA) Financial institutions to consider ESG risks when monitoring risks that are not included in the model, for which the ECB’s RNIME framework could be used as a basis.

(SA = standardized approach; IRB = Internal-rating-based approach)

Operational risk

The EBA notes that various types of operational risks can increase as a result of E&S risks, including damage to physical assets, disruption of business processes and litigation. However, the new standardized approach (SA) for operational risk in the Basel III framework, which will come into effect in the EU in 2025, does not have a forward-looking component – it only considers historical loss experience (besides business indicators). Historical losses are unlikely to fully reflect the potential future impact of E&S risks, but there is as of yet insufficient evidence and data to quantify and consider this in an amendment of the SA.

Recommended actions for operational risk

| Short term |

- Financial institutions to identify whether E&S risks constitute triggers of operational risk losses.

| Medium to long term |

- Following evidence of E&S risk factors to trigger operational risk losses, the EBA to consider whether revisions to the BCBS SA methodology are warranted.

Liquidity risk

The EBA report describes three ways in which E&S risks may affect the liquidity coverage ratio (LCR) calculation. First, liquid assets that are specifically exposed to E&S risks may become less liquid and/or decrease in value. As a consequence, they may no longer satisfy the eligibility criteria for liquid assets. If they still do, then the decrease in market value would reflect the lower liquidity and reduce the LCR. Second, contingent liabilities arising from environmentally harmful investments would need to be included as outflows in the LCR calculation, thereby lowering the LCR. Third, a decrease in credit quality of receivables that are particularly exposed to E&S risks will decrease the inflows that can be taken into account in the LCR calculation. The EBA concludes that the existing LCR framework can capture the impact of E&S risks on the definition of liquid assets, outflows and inflows, so that no amendments are needed.

Regarding the existing framework for the net stable funding ratio (NSFR), the EBA notes that a reduction in the creditworthiness and/or liquidity of loans and securities exposed to E&S risks would lead to a higher requirement for stable funding and thereby negatively impact the NSFR. In this way, the existing NSFR framework can capture the impact of E&S risks on the definition of stable assets.

In summary, the EBA does not propose changes to the LCR and NSFR frameworks in relation to E&S risks. In case of excessive exposure to E&S risks for individual institutions, it notes that supervisors can set specific liquidity or funding requirements as part of the Pillar 2 framework for LCR and NSFR.

Concentration risk

The SA and IRB of the Pillar 1 framework for credit risk assume that a bank’s loan portfolio has full diversification of name-specific (idiosyncratic) risk and is well diversified across sectors and geographies. Because of these assumptions, the framework is not able to capture concentration risks, including those arising from E&S risks. In the current framework, single-name concentration risk is separately captured in Pillar 1 using the large exposure regime. Sector and geographic concentrations are considered in the SREP process under Pillar 2.

Recommended actions for concentration risk

| Short term |

- The EBA to develop a definition of environment-related concentration risk as well as exposure-based metrics for its quantification (e.g., ratio of exposures sensitive to a given environmental risk driver in a specific geographical area or in a specific industry sector over total exposures, total capital or RWA). These metrics will be part of supervisory reporting and, when relevant, external disclosure. In addition, they should be considered as part of Pillar 2 under SREP and/or supplement Pillar 3 disclosures on ESG risks.The EBA does not recommend to change the existing large exposure regime.

| Medium to long term |

- Based on the experience obtained with initial environment-related concentration risk metrics and quantification, the EBA may consider enhanced metrics and the appropriateness to introduce it in the Pillar 1 framework.

- This would entail the design and calibration of possible limits and thresholds, add-ons or buffers, as well as the specification of possible consequences if there are breaches.

Capital buffers and macroprudential framework

An alternative to amending the calculation of capital requirements to capture E&S risks in the prudential framework would be to increase the minimum required level of capital and/or to implement ‘borrower-based measures’ (BMM). Such BMMs aim to prevent a build-up of risk concentrations, for example by setting upper bounds on loan-to-value or loan-to-income for mortgage lending. Of the various possibilities, the EBA deems the use of a systemic risk capital buffer as the most suitable, although a double counting with the inclusion of E&S risks in the calculation of capital requirements under Pillar 1 and 2 needs to be avoided.

Recommended actions for capital buffers and macroprudential framework

| Short term |

- The EBA to asses changes to the guidelines on the appropriate subsets of sectoral exposures to which a systematic risk buffer may be applied.

| Medium to long term |

- The EBA to coordinate with other ongoing initiatives and assess the most appropriate adjustments.

Conclusion

The EBA considers E&S risks as a new source of systemic risk, which may not be adequately captured in the existing prudential framework. At the same time, the EBA recognizes the challenges in assessing the impact of these risks on regulatory metrics. The challenges range from a lack of granular and comparable data, varying definitions of what is environmentally and socially sustainable, historic data not being representative of what can be expected in the future, to the high uncertainty about the probability of future materialization of E&S risks. Moreover, the time horizon considered in the existing Pillar 1 framework is much shorter than the long horizon over which environmental risks are likely to fully materialize, with an exception of short-term acute physical and transition risks.

Against this background, the EBA does not recommend concrete quantitative adjustments to the existing Pillar 1 framework at this point. Nonetheless, it does expect financial institutions to take E&S risks into account in the inputs to the existing Pillar 1 framework or to apply overrides based on expert judgment. The EBA further proposes actions that should provide more clarity over time about the drivers and materiality of E&S risks. In due time, this can provide the basis for quantitative amendments to the Pillar 1 framework.

If you are interested to discuss this topic in more detail or would like support to embed E&S risks in your organization, please contact Pieter Klaassen at [email protected] or +41 78 652 5505.

[1]EBA (2023), Report on the role of environmental and social risks in the prudential framework (link), October.

[2] EBA (2022), Discussion paper on the role of environmental risks in the prudential framework (link), May. For a summary, see the article (link) on the Zanders website.

[3] ECB (2020), Guide on climate-related and environmental risks (link), November.

[4] See section 2.3.2 in EBA (2021), Report on management and supervision of ESG risks for credit institutions and investment firms (link), June.

[5] ECB (2020), Guide on climate-related and environmental risks (link), November.

[6] In the current EU Pillar 1 framework, adjustments are included that result in lower risk weights for small- and medium-sized enterprises (SME) and infrastructure lending. As the EBA notes, these adjustments are not risk-based but have been included in the EU to support lending to SMEs and for infrastructure projects.

The 2023 Global Risk Report by the World Economic Forum investigates the potential hazards for humanity in the next decade.

In this report, biodiversity loss ranks as the fourth most pressing concern after climate change adaptation, mitigation failure, and natural disasters. For financial institutions (FIs), it is therefore a relevant risk that should be taken into account. So, how should FIs implement biodiversity risk in their risk management framework?

Despite an increasing awareness of the importance of biodiversity, human activities continue to significantly alter the ecosystems we depend on. The present rate of species going extinct is 10 to 100 times higher than the average observed over the past 10 million years, according to Partnership for Biodiversity Accounting Financials[i]. The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) reports that 75% of ecosystems have been modified by human actions, with 20% of terrestrial biomass lost, 25% under threat, and a projection of 1 million species facing extinction unless immediate action is taken. Resilience theory and planetary boundaries state that once a certain critical threshold is surpassed, the rate of change enters an exponential trajectory, leading to irreversible changes, and, as noted in a report by the Nederlandsche Bank (DNB), we are already close to that threshold[ii].

We will now explain biodiversity as a concept, why it is a significant risk for financial institutions (FIs), and how to start thinking about implementing biodiversity risk in a financial institutions’ risk management framework.

What is biodiversity?

The Convention on Biological Diversity (CBD) defines biodiversity as “the variability among living organisms from all sources including, i.a., terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part.”[iii] Humans rely on ecosystems directly and indirectly as they provide us with resources, protection and services such as cleaning our air and water.

Biodiversity both affects and is affected by climate change. For example, ecosystems such as tropical forests and peatlands consist of a diverse wildlife and act as carbon sinks that reduce the pace of climate change. At the same time, ecosystems are threatened by the accelerating change caused by human-induced global warming. The IPBES and Intergovernmental Panel on Climate Change (IPCC), in their first-ever collaboration, state that “biodiversity loss and climate change are both driven by human economic activities and mutually reinforce each other. Neither will be successfully resolved unless both are tackled together.”[iv]

Why is it relevant for financial institutions?

While financial institutions’ own operations do not materially impact biodiversity, they do have impact on biodiversity through their financing. ASN Bank, for instance, calculated that the net biodiversity impact of its financed exposure is equivalent to around 516 square kilometres of lost biodiversity – which is roughly equal to the size of the isle of Ibiza in Spain[v]. The FIs’ impact on biodiversity also leads to opportunities. The Institute Financing Nature (IFN) report estimates that the financing gap for biodiversity is close to $700 billion annually[vi]. This emphasizes the importance of directing substantial financial resources towards biodiversity-positive initiatives.

At the same time, biodiversity loss also poses risks to financial institutions.