EBA’s Revised Definition of Default

The EBA is proposing key changes to its definition of default guidelines, with implications for credit risk practices.

On July 2nd, the European Banking Authority (EBA) published a Consultation Paper proposing amendments to its 2016 Guidelines on the application of the definition of default (DoD). As part of the consultation process, open until 15 October 2025, the credit risk specialists at Zanders will submit a formal response, leveraging our extensive experience in DoD regulation and implementation.

In this article, we share our perspective on three of the EBA’s proposed amendments, focusing on the potential impact and implementation challenges for institutions:

- We expect that a shorter probation period for forbearance measures (that only alter the repayment schedule leading to a NPV loss not greater than 5%) are expected to provide incentives for banks to opt for those types of measures rather than the most sustainable ones.

- We recommend the EBA to implement EU wide DoD guidelines they considered for payment moratoria (similar to the one for Covid), whereas the EBA proposes not to. Zanders would approve permanent moratoria guidelines, as it clarifies if governmental moratoria introduced for climate risk related natural disasters should be regarded as forbearance.

- We are oncerned that the proposal to consider material arrears on non-recourse factoring exposures up to 90 (instead of 30) DPD as technical past due situations could result in an undesired increase in the percentage of IFRS stage 1 exposures migrating directly to stage 3 (impairment).

The following chapters elaborate on these three proposed amendments in more detail.

Forbearance

The first amendments addressed in the EBA’s consultation paper (CP) are related to forbearance. The supervisory authority explains that an increase of 1% threshold for a diminished financial obligation (DFO) to 5% was considered for certain forbearance measures. This follows from the European Commission’s mandate that the update of the EBA guidelines on DoD“… shall take due account of the necessity to encourage institutions to engage in proactive, preventive and meaningful debt restructuring to support obligors.”1

In the EBA’s current DoD guidelines (DoD GL), a forbearance measure leading to a 1% or more DFO results in a default classification, which could discourage institutions from applying these measures. However, the CP purposefully proposes to exclude an increase to a 5% DFO threshold, since institutions can already implement strict(er) forbearance definitions (i.e. for concession, financial difficulty) to prevent undue default classifications. Instead, the EBA proposes to shorten the probation period from 12 to 3 months for forbearance measures that: (1) only lead to suspensions or postponements and not e.g. changes to the interest rate or exposure amounts and (2) leading to less than 5% DFO loss.

This treatment will likely incentivize institutions to choose forbearance measures in scope of the shorter probation period, rather than the ones that would be optimal for a “sustainable performing repayment status” of the obligor. The latter would be in line with the EBA’s own requirements on the management of forborne exposures (Par. 125 EBA/GL/2018/06). Furthermore, the fact that the EBA does not set the “predefined limited period of time” for the measures in scope could lead to RWA variability, as some institutions may apply the shorter probation period to longer duration forbearance measures than others. For example, if Bank A sets the limited period of time to 6 months, they can apply the shorter probation period more often compared to Bank B, which sets the period of time at 3 months. Finally, it appears as if the proposal of the banking authority aims at favouring granting forbearance measures in scope to obligors with short-term (rather than structural) financial difficulties. That is, the EBA explains that the forbearance measures in scope of the shorter probation period treatment “… would most likely be viable for obligors in temporary financial difficulties”. The shorter probation period would then lead to a return to a performing status earlier for obligors to which the forbearance measures in scope are extended, which leads to a better RWA for these obligors. Alternatively, a distinct probation period (or even higher DFO threshold) could be proposed for obligors in short-term financial difficulties, as defined in Paragraph 129(A) of the EBA’s guidelines on Management of Forborne Exposures. This would also achieve the EBA’s goal, without influencing institutions’ decision about which forbearance measure to apply.

It should be mentioned that while a large RWA impact is not anticipated from the establishment of a distinct probation period, there will likely be a significant implementation burden associated with the change. This is because, as multiple forbearance measures are usually adopted in tandem, different probation periods must be traced concurrently. The implementation of this modification would need to be retroactive, though, as credit risk models will need to be recalculated using adjusted historical data in order to account for this change. In the past, retroactively modifying the probationary period has proven to be a time-consuming and expensive problem.

Legislative payment moratoria

In light of the COVID-19 crisis, the EBA published guidelines in 2020 on handling payment moratoria introduced by governments as a means of financial aid in the context of forbearance. For certain COVID-19 measures allowing e.g. a grace period in scope of the guidelines, EBA/GL/2020/02 and amendments in .../08 and …/15, would not in itself require institutions to classify the exposures as forborne.

Even though the EBA considered introducing guidelines for potential future moratoria, the CP proposes against these changes. As one of the arguments against new moratoria guidelines, the EBA remarks that moratoria in itself will not result in DFO loss of more than 1%, hence not leading to defaults. The EBA implies that introducing new moratoria guidelines would therefore be obsolete. The EBA is also worried about RWA variability that might arise if governments declare legislative moratoria for crises in their jurisdictions. That is, the EBA expects that intra-EU comparability of RWA across institutions, might be compromised.

Adding the considered guidelines describing when moratoria should lead to forbearance in the amended DoD GL is advisable, even though the EBA proposes in the CP to remove them. Zanders challenges that guidelines describing when moratoria do not lead to forbearance would not be necessary, because the 1% DFO threshold will not be met. That is, Zanders highlights moratoria guidelines would still decide when the forborne status should be assigned to exposures if moratoria are applied. This forborne status impacts the default status later on, both for performing and defaulted exposures. The reason is that if performing forborne exposures become 30 days past due within 24 months after receiving the forborne status, a defaulted status should be assigned. If the moratoria do not lead to a forborne status, these exposures should default after becoming 90 days past due on a material amount instead. Furthermore, for defaulted exposures, it is important to understand when moratoria result in the forborne status and when they do not. That is, in order for a forborne defaulted exposure to go out of default, a substantial payment and an extended cure period are needed. Zanders would therefore be in favor of EBA guidelines that specify when moratoria should result in a forborne status and when this is not necessary.

As for the RWA variability, as self-identified by the EBA, stringent criteria could be introduced prescribing what moratoria are in scope of the amended DoD GL. As described by the EBA as well, in light of climate risk related natural disasters, payment moratoria could occur more often as a governmental means of financial aid. In contrast to ad hoc rules for each specific crisis, such as observed during the COVID-19 pandemic, Zanders contends that permanently applicable moratoria instructions in the updated DoD GL will eventually lead to a more stable RWA impact when economic or natural catastrophes occur.

Days past due for non-recourse factoring

Paragraph 23(D) of the current version of the DoD guideline stipulates that in the specific situation of non-recourse factoring for which the arrears materiality threshold is breached, but none of the receivables is more than 30 days past due (DPD), should be treated as a technical past due situation. Non-recourse factoring refers to the situation where the institution (e.g. a bank) has bought receivables from its client (e.g. service provider) owed by the debtor (e.g. service consumer). The idea behind the 30 DPD is that the DPD counter might continue to increase due to a consecutive overlap in non-payments of invoices, lengthy administrative processes, and a low degree of control of the institution over the invoices.

The CP proposes to allow for up to 90 DPD to be considered technical past due situations, in correspondence to the industry requesting the EBA to be more lenient in the DoD guidelines for non-recourse factoring. This is motivated by the fact that many corporates have at least one invoice past due more than 30 days, while being rated investment grade.

Although Zanders understands corporates’ need for more leniency, allowing for up to 90 DPD to be recognized as technical past due could make stage 2 obsolete for IFRS provisioning models. That is, if material arrears on non-recourse factoring exposures should be considered technical past due for situations up to 90 DPD, the said exposures will move from 0 DPD to 91 DPD in one day. The additional lenience would break the desired flow of exposures transitioning from IFRS stage 1 (performing), first towards stage 2 (significant increase in credit risk), before going to stage 3 (credit impaired). This stage migration effect could be mitigated by another stage 2 trigger: forbearance. However, the institution cannot apply forbearance measures to a sold invoice that is due to the institution’s client, rather than due to the institution itself. Therefore, as a stage 2 trigger, forbearance cannot compensate for the lack of the30 DPD in the particular scenario of non-recourse factoring risks.

Zanders proposes to find a balance between leniency on DoD guidelines and stage migrations, by increasing the 30 days threshold. The proposed number of days should be based on an analysis of non-recourse factoring portfolios from a representative sample of supervised institutions. This analysis should then strike a balance between the average observed days past due of invoices sold on the one hand and the representativeness of IFRS stage transitions on the other hand. Zanders is convinced that amending DoD GL based on this analysis will prevent the undesired impact on IFRS provisioning models and will better fit European corporate invoicing practice.

Conclusion

In this post we analysed 3 proposed amendments from the published Consultation Paper, in which the European Banking Authority (EBA) proposes amendments to its 2016 Guidelines on the application of the definition of default (DoD). Alternatives are suggested for all 3 proposed amendments as the proposed amendments leave room for improvements .

Reach out to our experts John de Kroon and Dick de Heus, if you are interested in getting a better understanding of what the proposed amendments mean for your credit risk portfolio.

We monitor the progress of the Consultation Paper in the future. Keep a close eye on our LinkedIn and website for more information, or subscribe to our newsletters here.

- Article 178(7) CRR as amended by Regulation (EU) 2024/1623 (CRR3). ↩︎

Converging on resilience: Integrating CCR, XVA, and real-time risk management

In a world where the Fundamental Review of the Trading Book (FRTB) commands much attention, it’s easy for counterparty credit risk (CCR) to slip under the radar.

However, CCR remains an essential element in banking risk management, particularly as it converges with valuation adjustments. These changes reflect growing regulatory expectations, which were further amplified by recent cases such as Archegos. Furthermore, regulatory focus seems to be shifting, particularly in the U.S., away from the Internal Model Method (IMM) and toward standardised approaches. This article provides strategic insights for senior executives navigating the evolving CCR framework and its regulatory landscape.

Evolving trends in CCR and XVA

Counterparty credit risk (CCR) has evolved significantly, with banks now adopting a closely integrated approach with valuation adjustments (XVA) — particularly Credit Valuation Adjustment (CVA), Funding Valuation Adjustment (FVA), and Capital Valuation Adjustment (KVA) — to fully account for risk and costs in trade pricing. This trend towards blending XVA into CCR has been driven by the desire for more accurate pricing and capital decisions that reflect the true risk profile of the underlying instruments/ positions.

In addition, recent years have seen a marked increase in the use of collateral and initial margin as mitigants for CCR. While this approach is essential for managing credit exposures, it simultaneously shifts a portion of the risk profile into contingent market and liquidity risks, which, in turn, introduces requirements for real-time monitoring and enhanced data capabilities to capture both the credit and liquidity dimensions of CCR. Ultimately, this introduces additional risks and modelling challenges with respect to wrong way risk and clearing counterparty risk.

As banks continue to invest in advanced XVA models and supporting technologies, senior executives must ensure that systems are equipped to adapt to these new risk characteristics, as well as to meet growing regulatory scrutiny around collateral management and liquidity resilience.

The Internal Model Method (IMM) vs. SA-CCR

In terms of calculating CCR, approaches based on IMM and SA-CCR provide divergent paths. On one hand, IMM allows banks to tailor models to specific risks, potentially leading to capital efficiencies. SA-CCR, on the other hand, offers a standardised approach that’s straightforward yet conservative. Regulatory trends indicate a shift toward SA-CCR, especially in the U.S., where reliance on IMM is diminishing.

As banks shift towards SA-CCR for Regulatory capital and IMM is used increasingly for internal purposes, senior leaders might need to re-evaluate whether separate calibrations for CVA and IMM are warranted or if CVA data can inform IMM processes as well.

Regulatory focus on CCR: Real-time monitoring, stress testing, and resilience

Real-time monitoring and stress testing are taking centre stage following increased regulatory focus on resilience. Evolving guidelines, such as those from the Bank for International Settlements (BIS), emphasise a need for efficiency and convergence between trading and risk management systems. This means that banks must incorporate real-time risk data and dynamic monitoring to proactively manage CCR exposures and respond to changes in a timely manner.

CVA hedging and regulatory treatment under IMM

CVA hedging aims to mitigate counterparty credit spread volatility, which affects portfolio credit risk. However, current regulations limit offsetting CVA hedges against CCR exposures under IMM. This regulatory separation of capital for CVA and CCR leads to some inefficiencies, as institutions can’t fully leverage hedges to reduce overall exposure.

Ongoing BIS discussions suggest potential reforms for recognising CVA hedges within CCR frameworks, offering a chance for more dynamic risk management. Additionally, banks are exploring CCR capital management through LGD reductions using third-party financial guarantees, potentially allowing for more efficient capital use. For executives, tracking these regulatory developments could reveal opportunities for more comprehensive and capital-efficient approaches to CCR.

Leveraging advanced analytics and data integration for CCR

Emerging technologies in data analytics, artificial intelligence (AI), and scenario analysis are revolutionising CCR. Real-time data analytics provide insights into counterparty exposures but typically come at significant computational costs: high-performance computing can help mitigate this, and, if coupled with AI, enable predictive modelling and early warning systems. For senior leaders, integrating data from risk, finance, and treasury can optimise CCR insights and streamline decision-making, making risk management more responsive and aligned with compliance.

By leveraging advanced analytics, banks can respond proactively to potential CCR threats, particularly in scenarios where early intervention is critical. These technologies equip executives with the tools to not only mitigate CCR but also enhance overall risk and capital management strategies.

Strategic considerations for senior executives: Capital efficiency and resilience

Balancing capital efficiency with resilience requires careful alignment of CCR and XVA frameworks with governance and strategy. To meet both regulatory requirements and competitive pressures, executives should foster collaboration across risk, finance, and treasury functions. This alignment will enhance capital allocation, pricing strategies, and overall governance structures.

For banks facing capital constraints, third-party optimisation can be a viable strategy to manage the demands of SA-CCR. Executives should also consider refining data integration and analytics capabilities to support efficient, resilient risk management that is adaptable to regulatory shifts.

Conclusion

As counterparty credit risk re-emerges as a focal point for financial institutions, its integration with XVA, and the shifting emphasis from IMM to SA-CCR, underscore the need for proactive CCR management. For senior risk executives, adapting to this complex landscape requires striking a balance between resilience and efficiency. Embracing real-time monitoring, advanced analytics, and strategic cross-functional collaboration is crucial to building CCR frameworks that withstand regulatory scrutiny and position banks competitively.

In a financial landscape that is increasingly interconnected and volatile, an agile and resilient approach to CCR will serve as a foundation for long-term stability. At Zanders, we have significant experience implementing advanced analytics for CCR. By investing in robust CCR frameworks and staying attuned to evolving regulatory expectations, senior executives can prepare their institutions for the future of CCR and beyond thereby avoiding being left behind.

Confirmed Methodology for Credit Risk in EBA 2025 Stress Test

On November 12 2024, the confirmed methodology for the EBA 2025 stress testing exercise was published on the EBA website. This is the final version of the draft for initial consultation that was published earlier.

| The timelines for the entire exercise have been extended to accommodate the changes in scope: | |

| Launch of exercise (macro scenarios) | Second half of January 2025 |

| First submission of results to the EBA | End of April 2025 |

| Second submission to the EBA | Early June 2025 |

| Final submission to the EBA | Early July 2025 |

| Publication of results | Beginning of August 2025 |

Below we share the most significant aspects for Credit Risk and related challenges. In the coming weeks we will share separate articles to cover areas related to Market Risk, Net Interest Income & Expenses and Operational Risk.

The final methodology, along with the requirements introduced by the CRR3 poses significant challenges on the execution of the Credit Risk stress testing. Earlier we provided details on this topic and possible impacts on stress testing results, see our article: “Implications of CRR3 for the 2025 EU-wide stress test” Regarding the EBA 2025 stress test we view the following 5 points as key areas of concern:

1- The EBA stress test requires different starting points; actual and restated CRR3 figures. This raises requirements in data management, reporting and implementation of related processes.

2- The EBA stress test requires banks to report both transitional and fully loaded results under CRR3; this requires the execution of additional calculations and implementation of supporting data processes.

3- The changes in classification of assets require targeted effort on the modelling side, stress test approach and related data structures.

4- Implementation of the Standardized Approach output floor as part of the stress test logic.

5- Additional effort is needed to correctly align Pillar 1 and Pillar 2 models, in terms of development, implementation and validation.

At Zanders, we specialize in risk advisory and our consultants have participated in every single EU wide stress testing exercise, as well as a few others going back to the initial stress tests in 2009 following the Great Financial Crisis. We can support you throughout all key stages of the stress testing exercise across all areas to ensure a successful submission of the final templates.

Based on the expertise in Stress Testing we have gained over the last 15 years, our clients benefit the most from our services in these areas:

- Full gap analysis against latest set of requirements

- Review, design and implementation of data processes & relevant data quality controls

- Alignment of Pillar 2 models to Pillar 1 (including CCR3 requirements)

- Design, implementation and execution of stress testing models

- Full automation of populating EBA templates including reconciliation and data quality checks.

Contact us for more information about how we can help make this your most successful run yet. Reach out to Martijn de Groot, Partner at Zanders.

European committee accepts NII SOT while EBA published its roadmap for IRRBB

The European Committee has approved the NII SOT proposed by the EBA. Meanwhile the EBA has also published its focus areas for IRRBB in 2024 and 2025.

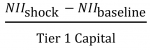

The European Committee (EC) has approved the regulatory technical standards (RTS) that include the specification of the Net Interest Income (NII) Supervisory Outlier Test (SOT). The SOT limit for the decrease in NII is set at 5% of Tier 1 capital. Since the three-month scrutiny period has ended it is expected that the final RTS will be published soon. 20 days after the publication the RTS will go into force. The acceptance of the NII SOT took longer than expected among others due to heavy pushback from the banking sector. The SOT, and the fact that some banks rely heavily on it for their internal limit framework is also one of the key topics on the heatmap IRRBB published by the European Banking Authority (EBA). The heatmap detailing its scrutiny plans for implementing interest rate risk in the banking book (IRRBB) standards across the EU. In the short to medium term (2024/Mid-2025), the focus is on

- The EBA has noted that some banks use the as an internal limit without identifying other internal limits. The EBA will explore the development of complementary indicators useful for SREP purposes and supervisory stress testing.

- The different practices on behavioral modelling of NMDs reported by the institutions.

- The variety of hedging strategies that institutions have implemented.

- Contribute to the Dynamic Risk Management project of the International Accounting Standards Board (IASB), which will replace the macro hedge accounting standard.

In the medium to long-term objectives (beyond mid-2025) the EBA mentions it will monitor the five-year cap on NMDs and CSRBB definition used by banks. No mention is made by the EBA on the consultation started by the Basel Committee on Banking Supervision, on the newly calibrated interest rate scenarios methodology and levels. In the coming weeks, Zanders will publish a series of articles on the Dynamic Risk Management project of the IASB and what implications it will have for banks. Please contact us if you have any questions on this topic or others such as NMD modelling or the internal limit framework/ risk appetite statements.

The EBA published its roadmap the implementation of Basel and starts with the first consultations

The European Committee has approved the NII SOT proposed by the EBA. Meanwhile the EBA has also published its focus areas for IRRBB in 2024 and 2025.

The European Banking Authority (EBA) published its roadmap on the Banking Package, which implements the final Basel III reforms in the European Union. This roadmap develops over four phases, and it is expected to be completed as follows:

- Phase 1: Covers 32 mandates in the areas of credit, market and operational risk, which predominantly result from the transition to Basel III. In addition, this first phase will also see the first mandates under the Capital Requirements Directive (CRD) in the area of ESG.

- Phase 2: This phase will further progress in covering Capital Requirements Regulation (CRR) mandates related to credit, operational and market risk. Furthermore, a considerable number of CRD mandates related to high EU standards in terms of governance and access to the single market with regard to third-country branches will be developed in this phase.

- Phase 3: It includes most of the remaining mandates related to regulatory products as well as a number of reports, whereby further perspectives and initial monitoring efforts regarding banking regulation implementation are worth considering.•

- Phase 4: In this last phase, a number of products, mostly consisting of reports, will be developed, providing information on the implementation progress, results and challenges.

In addition, there are some mandates that are ongoing and reoccurring and are not part of any of the four phases but will be made operational at the date of implementation in 2025. As part of phase 1, the EBA has published multiple consultation papers, which form the first step in the implementation of the Banking Package. The three main consultation papers published are:

- A public consultation on two draft ITS amending Pillar 3 disclosure requirements and supervisory reporting requirements. The suggested amendments on the reporting obligations cover a wide range of topics such as the output floor, standardized and internal ratings-based models (IRB) for credit risk, the three new approaches for own funds requirements for CVA risk and the (simplified) standardized approach for market risk.

- A public consultation launched by the EBA on the Regulatory Technical Standards (RTS) determining the conditions for an instrument with residual risk to be classified as a hedge. This consultation, on the standardized approach under the FRTB framework, focuses on the residual risk add-on (RRAO). Introduced by the Capital Requirements Regulation (CRR3), the RRAO framework allows exemptions for instruments hedging residual risks. The proposed RTS outline criteria for identifying hedges, distinguishing between non-sensitivity-based method risk factors and other reasons for RRAO charges.

- A public consultation on two draft Implementing Technical Standards (ITS) amending Pillar 3 disclosures and supervisory reporting requirements for operational risk. These revisions align with the new Capital Requirements Regulation (CRR3) and aim to consolidate reporting and disclosure requirements for operational risk and broader CRR3 changes. These consultation papers should be read in conjunction with the consultation papers on the new framework for the business indicator for operational risk, published at the same time.

Performance of Dutch banks in the 2023 EBA stress test

The European Committee has approved the NII SOT proposed by the EBA. Meanwhile the EBA has also published its focus areas for IRRBB in 2024 and 2025.

Seventy banks have been considered, which is an increase of twenty banks compared to the previous exercise. The portfolios of the participating banks contain around three quarters of all EU banking assets (Euro and non-Euro).

Interested in how the four Dutch banks participating in this EBA stress test exercise performed? In this short note we compare them with the EU average as represented in the results published [1].

General comments

The general conclusion from the EU wide stress test results is that EU banks seem sufficiently capitalized. We quote the main 5 points as highlighted in the EBA press release [1]:

- The results of the 2023 EU-wide stress test show that European banks remain resilient under an adverse scenario which combines a severe EU and global recession, increasing interest rates and higher credit spreads.

- This resilience of EU banks partly reflects a solid capital position at the start of the exercise, with an average fully-loaded CET1 ratio of 15% which allows banks to withstand the capital depletion under the adverse scenario.

- The capital depletion under the adverse stress test scenario is 459 bps, resulting in a fully loaded CET1 ratio at the end of the scenario of 10.4%. Higher earnings and better asset quality at the beginning of the 2023 both help moderate capital depletion under the adverse scenario.

- Despite combined losses of EUR 496bn, EU banks remain sufficiently apitalized to continue to support the economy also in times of severe stress.

- The high current level of macroeconomic uncertainty shows however the importance of remaining vigilant and that both supervisors and banks should be prepared for a possible worsening of economic conditions.

For further details we refer to the full EBA report [1].

Dutch banks

Making the case for transparency across the banking sector, the EBA has released a detailed breakdown of relevant figures for each individual bank. We use some of this data to gain further insight into the performance of the main Dutch banks versus the EU average.

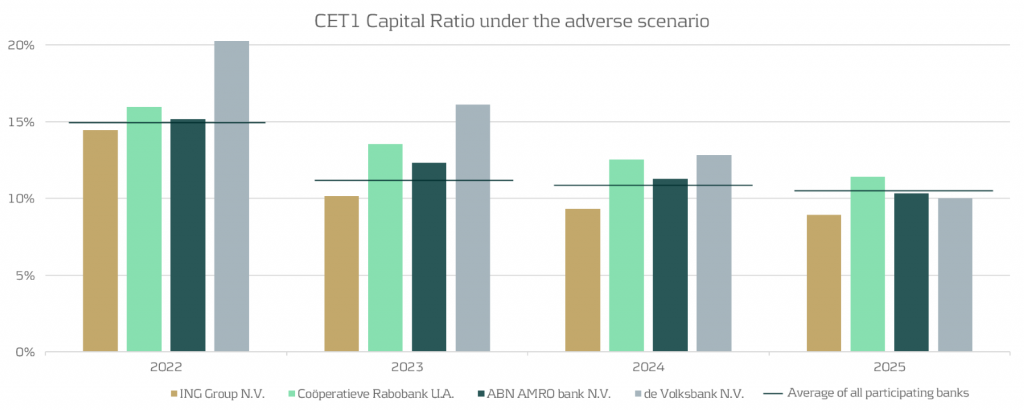

CET1 ratios

Using the data presented by EBA [2], we display the evolution of the fully loaded CET1 ratio for the four banks versus the average over all EU banks in the figure below. The four Dutch banks are: ING, Rabobank, ABN AMRO and de Volksbank, ordered by size.

From the figure, we observe the following:

- Compared to the average EU-wide CET1 ratio (indicated by the horizontal lines in the graph above), it can be observed that three out of four of the banks are very close to the EU average.

- For the average EU wide CET1 ratio we observe a significant drop from year 1 to year 2, while for the Dutch banks the impact of the stress is more spread out over the full scenario horizon.

- The impact after year 4 of the stress horizon is more severe than the EU average for three out of four of the Dutch banks.

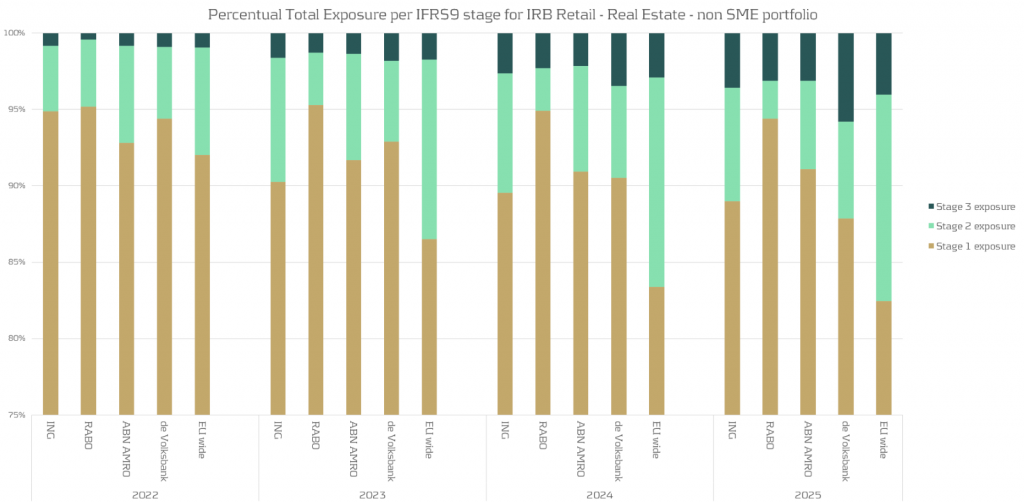

Evolution of retail mortgages during adverse scenario

The most important product the four Dutch banks have in common are the retail mortgages. We look at the evolution of the retail mortgage portfolios of the Dutch banks compared to the EU average. Using EBA data provided [2], we summarize this in the following chart:

Based on the analysis above , we observe:

- There is a noticeable variation between the banks regarding the migrations between the IFRS stages.

- Compared to the EU average there are much less mortgages with a significant increase in credit risk (migrations to IFRS stage 2) for the Dutch banks. For some banks the percentage of loans in stage 2 is stable or even decreases.

Conclusion

This short note gives some indication of specifics of the 2023 EBA stress applied to the four main Dutch banks.

Should you wish to go deeper into this subject, Zanders has both the expertise and track record to assist financial organisations with all aspects of stress testing. Please get in touch.

References

EBA’s binding standards on Pillar 3 disclosures on ESG risks

On 24 January 2022, the European Banking Authority (EBA) published its final draft Implementing Technical Standards (ITS) on Pillar 3 (P3) disclosures on Environmental, Social and Governance (ESG) risks.

This publication fits nicely into the ‘horizon priority’ of the EBA1 to provide tools to banks to measure and manage ESG-related risks. In this article we present a brief overview of the way the ITS have been developed, what qualitative and quantitative disclosures are required, what timelines and transitional measures apply – and where the largest challenges arise. By requiring banks to disclose information on their exposure to ESG-related risks and the actions they take to mitigate those risks – for example by supporting their clients and counterparties in the adaptation process – the EBA wants to contribute to a transition to a more sustainable economy. The Pillar 3 disclosure requirements apply to large institutions with securities traded on a regulated market of an EU member state.

In an earlier report2, the EBA defined ESG-related risks as “the risks of any negative financial impact on the institution stemming from the current or prospective impacts of ESG factors on its counterparties or invested assets”. Hence, the focus is not on the direct impact of ESG factors on the institution, but on the indirect impact through the exposure of counterparties and invested assets to ESG-related risks. The EBA report also provides examples for typical ESG-related factors.

While the ITS have been streamlined and simplified compared to the consultation paper published in March 2021, there are plenty of challenges remaining for banks to implement these standards.

Development of the ITS

The EBA has been mandated to develop the ITS on P3 disclosures on ESG risks in Article 434a of the Capital Requirements Regulation (CRR). The EBA has opted for a sequential approach, with an initial focus on climate change-related risks. This is further narrowed down by only considering the banking book. The short maturity and fast revolving positions in the trading book are out of scope for now. The scope of the ITS will be extended to included other environmental risks (like loss of biodiversity), and social and governance risks, in later stages.

In the development of the ITS, the EBA has strived for alignment with several other regulations and initiatives on climate-related disclosures that apply to banks. The most notable ones are listed below (and in Figure 1):

Figure 1 – Overview of related regulations and initiatives considered in the development of the ITS

- Capital Requirements Directive and Regulation (CRD and CRR): article 98(8) of the CRD3 mandated the EBA to publish the EBA report on Management and Supervision of ESG risks, which includes the split of climate change-related risks in physical and transition risks. Article 434a of the CRR4 mandated the EBA to develop the draft ITS to specify the ESG disclosure requirements described in article 449a.

- EBA report on Management and Supervision of ESG risks2: the report provides common definitions of ESG risks and contains proposals on how to include ESG risks in the risk frameworks of banks, covering its identification, assessment, and management. It also discusses the way to include ESG risks in the supervisory review process.

- Task Force on Climate-related Financial Disclosures (TCFD)5: the Financial Stability Board’s TFCD has published recommendations on climate-related disclosures. The metrics and Key Performance Indicators (KPIs) included in the ITS have been aligned with the TCFD recommendations.

- Taxonomy Regulation6: the European Union’s common classification system of environmentally sustainable economic activities is underpinning the main KPIs introduced in the ITS.

- Climate Benchmark Regulation (CBR)7: In the CBR, two types of climate benchmarks were introduced (‘EU Climate Transition’ and ‘EU Paris-aligned’ benchmarks) and ESG disclosures for all other benchmarks (excluding interest rate and currency benchmarks) were required.

- Non-Financial Reporting Directive (NFRD)8: the NFRD introduces ESG disclosure obligations for large companies, which include climate-related information.

- Corporate Sustainability Reporting Directive (CSRD)9: a proposal by the European Commission to extend the scope of the NFRD to also include all companies listed on regulated markets (except listed micro-enterprises). One of the ITS’s KPIs, the Green Asset Ratio (GAR) is directly linked to the scope of the NFRD/CSRD.

- Sustainable Finance Disclosure Regulation (SFDR)10: the SFDR lays down sustainability disclosure obligations for manufacturers of financial products and financial advisers towards end-investors. It applies to banks that provide portfolio management investment advice services.

Compared to the consultation paper for the ITS, several changes have been made to the required templates. Some templates have been combined (e.g., templates #1 and #2 from the consultation paper have been combined into template #1 of the final draft ITS) and several templates have been reorganized and trimmed down (e.g., the requirement to report exposures to top EU or top national polluters has been removed).

Quantitative disclosures

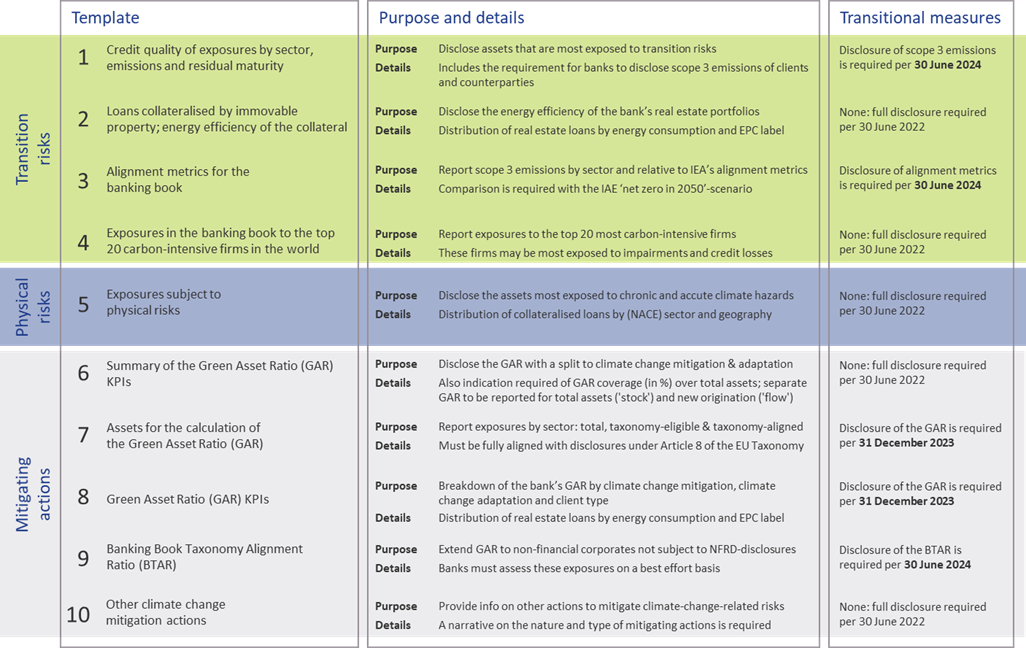

The ITS on P3 disclosure on ESG risks introduce ten templates on quantitative disclosures. These can be grouped in four templates on transition risks, one on physical risks, and five on mitigating actions:

- Transition risks

Two of the required templates are relatively straightforward. Banks need to report the energy efficiency of real estate collateral in the loan portfolio (#2) and report their aggregate exposure to the top 20 of the most carbon-intensive firms in the world (#4).

The main challenge for banks though will be in completing the other two templates:- Template #1 requires banks to disclose the gross carrying amount of loans and advances provided to non-financial corporates, classified by NACE sector codes and residual maturities. It is also required to report on the counterparties’ scope 1, 2, and 3 greenhouse gas (GHG) emissions. Reflecting the challenge in reporting on scope 3 emissions, a transitional measure is in place. Full reporting needs to be in place by June 2024. Until then, banks need to report their available estimates (if any) and explain the methodologies and data sources they intend to use.

- In the last template (#3), banks also need to report scope 3 emissions, but relate these to the alignment metrics defined by the International Energy Agency (IEA) for the ‘net zero by 2050’ scenario. For this scenario, a target for a CO2 intensity metric is defined for 2030. By calculating the distance to this target, it becomes clear how banks are progressing (over time) towards supporting a sustainable economy. A similar transitional measure applies as for template #1.

- Physical risks

In template #5, banks are required to disclose how their banking book positions are exposed to physical risks, i.e., “chronic and acute climate-related hazards”. The exposures need to be reported by residual maturity and by NACE sector codes and should reflect exposure to risks like heat waves, droughts, floods, hurricanes, and wildfires. Specialized databases need to be consulted to compile a detailed understanding of these exposures. To support their submissions, banks further need to compile a narrative that explains the methodologies they used. - Mitigating actions

The final set of templates covers quantitative information on the actions a bank takes to mitigate or adapt to climate change risks.- Templates #6-8 all relate to the GAR, which indicates what part of the bank’s banking book is aligned with the EU’s Taxonomy:

- In template #7, banks need to report the outstanding banking book exposures to different types of clients/issuers, as well as the amount of these exposures that are taxonomy-eligible (that is, to sectors included in the EU Taxonomy) and taxonomy-aligned (that is, taxonomy-eligible exposures financing activities that contribute to climate change mitigation or adaptation). Based on this information, the bank’s GAR can be determined.

- In template #8, a GAR needs to be reported for the exposures to each type of client/issuer distinguished in template #7, with a distinction between a GAR for the full outstanding stock of exposures per client/issuer type, and a GAR for newly originated (‘flow’) exposures.

- Template #6 contains a summary of the GARs from templates #7 and #8.

In these templates, the numerator of the GAR only includes exposures to non-financial corporations that are required to publish non-financial information under the NFRD. Any exposures to other corporate counterparties therefore are considered 0% Taxonomy-aligned.

- The main challenge in this group of templates is in template #9. To incentivize banks to support all of their counterparties to transition to a more sustainable business model, and to collect ESG data on these counterparties, the EBA introduces the Banking Book Taxonomy Alignment Ratio (BTAR). In this metric, the numerator does include the exposures to counterparties that are not subject to NFRD disclosure obligations. The BTAR ratios obtained from the information in template #9 therefore complement the GAR ratios obtained in templates #7 and #8.

- In the final template (#10), banks have the opportunity to include any other climate change mitigating actions that are not covered by the EU Taxonomy. They can for example report on their use of green or sustainable bonds and loans.

- Templates #6-8 all relate to the GAR, which indicates what part of the bank’s banking book is aligned with the EU’s Taxonomy:

An overview of the templates for quantitative disclosures in presented in Figure 2.

Qualitative disclosures

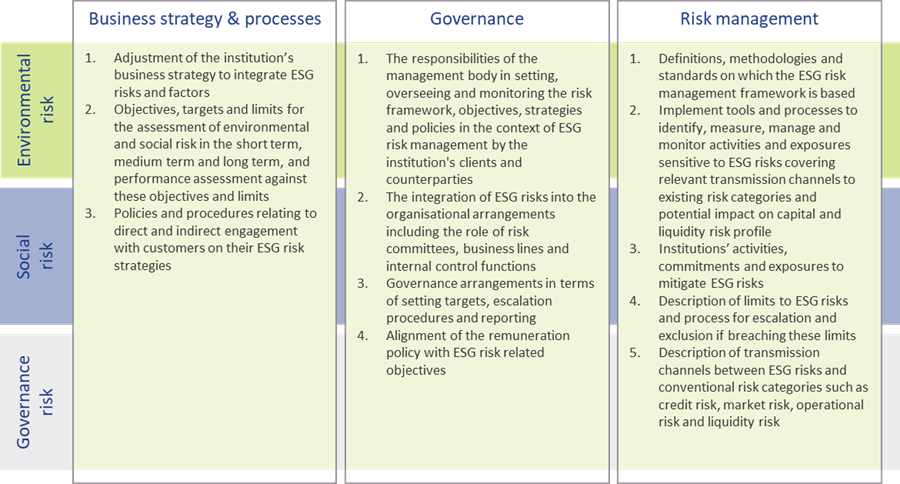

In the ITS on P3 disclosures on ESG risks, three tables are included for qualitative disclosures. The EBA has aligned these tables with their Report on Management and Supervision of ESG risks11. The three tables are set up for qualitative information on environmental, social, and governance risks, respectively. For each of these topics, banks need to address three aspects: on business strategy and processes, governance, and risk management. An overview of the required disclosures is presented in Figure 3.

Figure 3 – Overview of qualitative ESG disclosures (based on templates & section 2.3.2 of the EBA ITS on P3 disclosures on ESG risks)

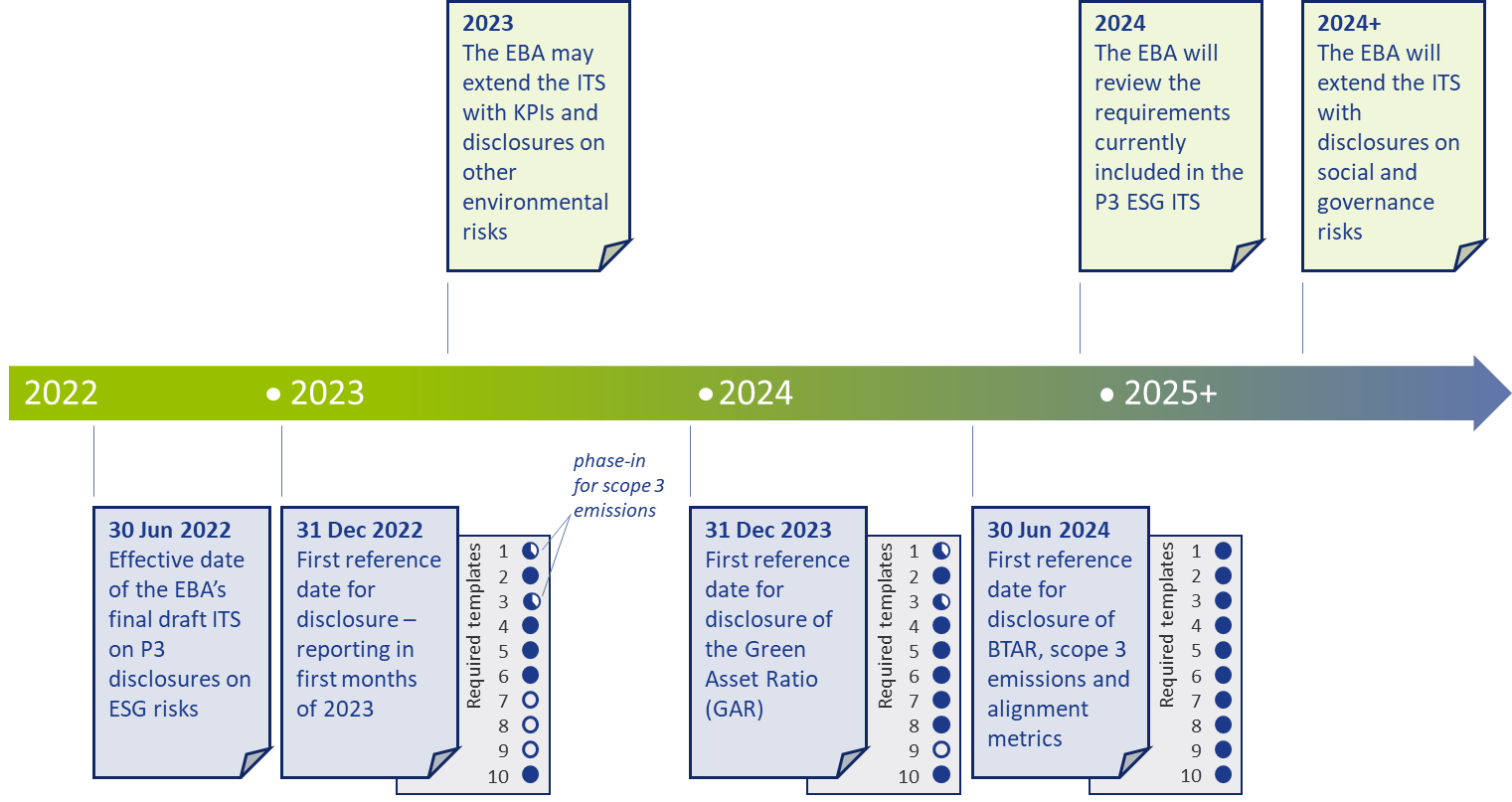

Timelines and transitional measures

The ITS on P3 disclosure on ESG risks become effective per 30 June 2022 for large institutions that have securities traded on a regulated market of an EU member state. A semi-annual disclosure is required, but the first disclosure is annual. Consequently, based on 31 December 2022 data, the first reporting will take place in the first quarter of 2023.

The EBA has introduced a number of transitional measures. These can be summarized as follows:

- The reporting of information on the GAR is only required as of 31 December 2023.

- The reporting of information on the BTAR, the bank’s financed scope 3 emissions, and the alignment metrics is only required as of June 2024.

The EBA has further indicated in the ITS that they will conduct a review of the ITS’s requirements during 2024. They may then also extend the ITS with other environmental risks (other than the climate change-related risks in the current version). The EU Taxonomy is expected to cover a broader range of environmental risks by the end of 2022. Sometime after 2024, it is expected that the EBA will further extend the ITS by including disclosure requirements on social and governance risks.

An overview of the main timelines and transitional measures is presented in Figure 4.

Figure 4 – Overview of the main timelines and transitional measures for the ESG disclosures

Conclusion

Society, and consequently banks too, are increasingly facing risks stemming from changes in our climate. In recent years, supervisory authorities have stepped up by introducing more and more guidance and regulation to create transparency about climate change risk, and more broadly ESG risks. The publication of the ITS on P3 disclosures on ESG risks by the EBA marks an important milestone. It offers banks the opportunity to disseminate a constructive and positive role in the transition to a sustainable economy.

Nonetheless, implementing the disclosure requirements will be a challenge. Developing detailed assessments of the physical risks to which their asset portfolio is exposed and to estimate the scope 3 emissions of their clients and counterparties (‘financed emissions’) will not be straightforward. For their largest counterparties, banks will be able to profit from the NFRD disclosure obligations, but especially in Europe a bank’s portfolio typically has many exposures to small- and medium-sized enterprises. Meeting the disclosure requirements introduced by the EBA will require timely and intensive discussions with a substantial part of the bank’s counterparties.

Banks also need to provide detailed information on how ESG risks are reflected in the bank’s strategy and governance and incorporated in the risk management framework. With our extensive knowledge on market risk, credit risk, liquidity risk, and business risk, Zanders is well equipped to support banks with integrating the identification, measurement, and management of climate change-related risks into existing risk frameworks. For more information, please contact Pieter Klaassen or Sjoerd Blijlevens via +31 88 991 02 00.

References

- See the EBA 2022 Work Programme.

- The EBA’s Report on Management and Supervision of ESG risks for credit institutions and investment firms, published in June 2021.

- See the EBA’s interactive Single Rulebook.

- See Regulation (EU) 2019/876.

- See the TCFD’s Final Report on Recommendations of the Task Force on Climate-related Financial Disclosures published in June 2017.

- See the EBA’s response to EC Call for Advice on Article 8 Taxonomy Regulation.

- See Regulation (EU) 2019/2089.

- See Directive 2014/95/EU.

- See the European Commission’s Proposal for a Corporate Sustainability Reporting Directive.

- See Regulation (EU) 2019/2088.

- The EBA report can be found here.

The EBA expects banks to expand their CSRBB framework

On 24 January 2022, the European Banking Authority (EBA) published its final draft Implementing Technical Standards (ITS) on Pillar 3 (P3) disclosures on Environmental, Social and Governance (ESG) risks.

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

This new update is triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers

- The first consultation paper1 describes the update of the IRRBB Guidelines themselves.

- The second paper2 concerns the introduction of a standardized approach (SA) which should be applied when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII). Read our analysis on this consultation paper here »

In this article we focus on the first consultation paper. The update of the IRRBB Guidelines can be split up in three topics and each will be discussed in further detail:

- Additional criteria for the assessment and monitoring of the credit spread risk arising from non-trading book activities (CSRBB)

- The criteria for non-satisfactory IRRBB internal systems

- A general update of the existing IRBBB Guidelines

CSRBB

The 2018 IRRBB Guidelines introduced the obligation for banks to monitor CSRBB. However, the publication did not describe how to do this. In the updated consultation paper the EBA defines the measurement of CSRBB as a separate risk class in more detail. The general governance related aspects such as (management) responsibilities, IT systems and internal reporting framework are separately defined for CSRBB, but are similar to those for IRRBB.

Also similar to IRRBB is that banks must express their risk appetite for CSRBB both from an NII as well as an economic value perspective.

The EBA defines CSRBB as:

“The risk driven by changes of the market price for credit risk, for liquidity and for potentially other characteristics of credit-risky instruments, which is not captured by IRRBB or by expected credit/(jump-to-) default risk. CSRBB captures the risk of an instrument’s changing spread while assuming the same level of creditworthiness, i.e. how the credit spread is moving within a certain rating/PD range.”

EBA

Compared to the previous definition, rating/PD migrations are explicitly excluded from CSRBB. Including idiosyncratic spreads could lead to double counting since these are generally covered by a credit risk framework. However, the guidelines give some flexibility to include idiosyncratic spreads, as long as the results are more conservative than when idiosyncratic spreads are excluded. This is because, based on the Quantitative Impact Study of December 2020 (QIS 2020), banks indicated to find it difficult to separate the idiosyncratic spreads from the credit spread.

Also, the scope of CSRBB has changed from the current IRRBB Guidelines. All assets, liabilities and off-balance-sheet items in the banking book that are sensitive to credit spread changes are within the scope of CSRBB whereas the 2018 IRRBB Guidelines focused only on the asset side. Based on the results of the QIS 2020, the EBA concluded that most of the exposures to CSRBB are debt securities which are accounted for at fair value (via Profit and Loss or Other Comprehensive Income). However, this does not rule out that other assets or liabilities could be exposed to CSRBB. It is stated that banks cannot ex-ante exclude positions from the scope of CSRBB. Any potential exclusion of instruments from the scope of CSRBB must be based on the absence of sensitivity to credit spread risk and appropriately documented. At a minimum, banks must include assets accounted at fair value in their scope.

We believe that the obligation to report CSRBB for all assets accounted for at fair value will be challenging for exposures that do not have quoted market prices. Without a deep liquid market, it will be difficult to establish the credits spread risk (even when idiosyncratic risk is included).

Another possible candidate to be included in the scope of CSRBB is the issued funding on the liability side of the banking book, especially in a NII context. When market spreads increase, this could become harmful when the wholesale funding needs to be rolled over against higher credit spread without being able to increase client interest on the asset side. Similar to IRRBB, the exposure to this risk depends on the repricing gap of the assets and liabilities. In this case, however, swaps cannot be used as hedge.

Other products such as consumer loans, mortgages, and consumer deposits, which are typically accounted for at amortized cost, are less likely to be included. This is also stated by the BCBS standards. The BCBS states that the margin (administrative rate) is under absolute control of the bank and hence not impacted by credit spreads. However, it is unclear whether this is sufficient to rule these products out of scope.

Non-satisfactory IRRBB internal systems

The EBA is mandated to specify the criteria for determining an IRRBB internal system as non-satisfactory. The EBA has identified specific items for this that should be considered. At a minimum, banks should have implemented their internal system in compliance with the IRRBB Guidelines, taking into account the principle of proportionality. More specifically:

- Such a system must cover all material interest rate risk components (gap risk, basis risk, option risk).

- The system should capture all material risks for significant assets, liabilities and off-balance sheet type instruments (e.g. non-maturing deposits, loans, and options).

- All estimated parameters must be sufficiently back tested and reviewed, considering the nature, scale and complexity of the bank.

- The internal system must comply with the model governance and the minimum required validation, review and control of IRRBB exposures as detailed by the IRRBB guidelines.

- Competent authorities may require banks to use the standardized approach3 if the internal systems are deemed non-satisfactory.

General update of existing IRRBB Guidelines

Major parts of the guidelines for managing IRRBB have not changed. In the section on IRRBB stress testing, however, a new article (#103) for products with significant repricing restrictions (e.g. an explicit floor on non-maturing deposits – NMDs) is introduced. As part of their stress testing, banks should consider the impact when these products are replaced with contracts with similar characteristics, even under a run-off assumption. The exact intention of this article is unclear. For NII-purposes it is common practice to roll over products with similar characteristics (or use another balance sheet development assumption). Our interpretation of this article is that banks are expected to measure the risk of continued repricing restrictions in an economic value perspective when the maturity of those funding sources is smaller than the maturity of the asset portfolio. This may for example materialize when banks roll over NMDs that are subject to a legally imposed floor.

Another update is the restriction on the maximum weighted average repricing maturity of five years for NMDs. This cap was prescribed for the EVE SOT and is now included for the internal measurement of IRRBB. We believe that the impact of this will be limited since only a few banks will have separate NMD models for internal measurement and the SOT.

Finally, some minor additions have been included in the guidelines. For example, the guidelines emphasize multiple times that when diversification assumptions are used for the measurement of IRRBB, these must be appropriately stressed and validated.

Conclusion

It is expected that the final guidelines will not deviate significantly from the consultation paper. Banks can therefore start preparing for these new expectations. For the measurement of IRRBB, limited changes are introduced in the consultation. Although the exact intention of the EBA is unclear to us, it is interesting to notice that the updated IRRBB Guidelines include the expectation that banks pay special attention in their stress tests to products with significant repricing restrictions. Furthermore, banks must invest in their CSRBB measurement. For their entire banking book, banks need to assess whether market wide credit spread changes will have an impact on an NII and/or economic value perspective. The scope of CSRBB measurement may need to be extended to include the funding issued by the bank. And to conclude, the obligation to measure CSRBB for fair value assets that do not have quoted market prices will be a challenge for banks.

References

The EBA faces banks with a new supervisory outlier test on net interest income

On 24 January 2022, the European Banking Authority (EBA) published its final draft Implementing Technical Standards (ITS) on Pillar 3 (P3) disclosures on Environmental, Social and Governance (ESG) risks.

In this article, we focus on one of these consultation papers, which concerns updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

The current version of the IRRBB Guidelines, published in 2018, came into force on 30 June 2019. At that time, the IRRBB Guidelines were aligned with the Standards on interest rate risk in the banking book, published by the Basel Committee on Banking Supervision (in short, the BCBS Standards) in April 2016.

The new updates are triggered by the revised Capital Requirements Regulation (CRR2) and Capital Requirements Directive (CRD5). Both documents were adopted by the Council of the EU and the European Parliament in 2019 as part of the Risk Reduction Measures package. The CRR2 and CRD5 included numerous mandates for the EBA to come up with new or adjusted technical standards and guidelines. These are now covered in three separate consultation papers:

- The first consultation paper1 describes an update of the IRRBB Guidelines themselves. The main changes are the specification of criteria to identify “non-satisfactory internal models for IRRBB management” and the specification of criteria to assess and monitor Credit Spread Risk in the Banking Book (CSRBB). Read our analysis on this consultation paper here »

- The second paper2 concerns the introduction of a standardized approach (SA) which should be used when a competent authority deems a bank’s internal model for IRRBB management non-satisfactory. It also introduces a Simplified SA for smaller and non-complex institutions.

- The third consultation paper3 offers updates to the supervisory outlier test (SOT) for the Economic Value of Equity (EVE) and the introduction of an SOT for Net Interest Income (NII).

Please note that we recently also published an article about the new disclosure requirements for IRRBB which is closely related to this topic.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Changes to the supervisory outlier test

Banks have been subject to an SOT already since the 2006 IRRBB Guidelines. The SOT is an important tool for supervisors to perform peer reviews and to compare IRRBB exposures between banks. The SOT measures how the EVE responds to an instantaneous parallel (up and down) yield curve shift of 200 basis points. Changes in EVE that exceed 20% of the institution’s own funds will trigger supervisory discussions and may lead to additional capital requirements.

Some changes to the SOT were included in the 2018 update of the IRRBB Guidelines. Next to further guidance on its calculation, the existing SOT was complemented with an additional SOT. The additional SOT was based on the same metric and guidelines, but the scenarios applied were the six standard interest rate scenarios introduced in the BCBS Standards. Also, a threshold of 15% compared to Tier 1 capital was applied. In the 2018 IRRBB Guidelines, the additional SOT was considered an ‘early warning signal’ only.

The new update of the IRRBB Guidelines includes two important SOT-related changes, which are incorporated through amendments to Article 98 (5) of the CRD: the replacement of the 20% SOT for EVE and the introduction of the SOT for NII. Both changes are discussed in more detail below.

Replacement of the 20% SOT for EVE

The first part of the amended Article 98 (5) concerns the replacement of the original 20% SOT by the 15% SOT. While many banks are probably already targeting levels below 15%, we expect that this change will limit the maneuvering capabilities of banks as they will likely choose to implement a management buffer. Note that not only the threshold is lower (15% instead of 20%), but also the denominator (Tier 1 capital instead of own funds). Furthermore, the worst outcome of all six supervisory scenarios should be used, as opposed to worst outcome of just the two parallel ones. Combined, this leads to a significant reduction in the EVE risk to which a bank may be exposed.

Some other noteworthy updates to the SOT for EVE that are not directly related to the CRD amendment are listed below:

- The post-shock interest floor decreases from -100 to -150 basis points and it increases to 0% over a 50-year instead of a 20-year period.

- In the calibration of the interest rate shocks for currencies for which the shocks have not been prescribed, the most recent 16-year period should be used (instead of the 2000-2015 period which is still underlying the shocks for the other currencies).

- When aggregating the results over currencies, some additional offsetting (80% as opposed to 50%) is granted in case of Exchange Rate Mechanism (ERM) II currencies with a formally agreed fluctuation band narrower than the standard band of +/-15%. Currently, only positions in the Denmark Krona (DKK) qualify for this treatment.

Introduction of the SOT for NII

The second part of the amended Article 98 (5) concerns the introduction of an entirely new SOT. It is aimed at measuring the potential decline in NII for two standard interest rate shock scenarios. Compared to the SOT for EVE, the SOT for NII requires many more modeling assumptions, in particular to determine the expected balance sheet development. The consultation paper provides clarity on the approach the EBA wants to take but two decisions are explicitly consulted.

The SOT for NII compares the NII for a baseline scenario with the NII in a shocked scenario over a one-year horizon. The two shocks that need to be applied are the two instantaneous parallel shocks that are also used in the SOT for EVE. Furthermore, the same requirements that are specified for the SOT for EVE apply, for example the use of the floor and the aggregation approach. The two exceptions are the requirements to use a constant balance sheet assumption (as opposed to a run-off balance sheet) and to include commercial margins and other spread components in the calculations. The commercial margins of new instruments should equal the prevailing levels (as opposed to historical ones).

The two decisions for which the EBA is seeking input are:

The scope/definition of NII

In its narrowest definition, the SOT will focus on the difference between interest income and interest expenses. The EBA, however, also considers using a broader definition where the effect of market value changes of instruments accounted for at Fair Value (∆FV) is added, and possibly also interest rate sensitive fees and commissions.

The definition of the SOT’s threshold

Article 98 (5) requires the EBA to specify what is considered a ‘large decline’ in NII, in which case the competent authorities are entitled to exercise their supervisory powers. This first requires a metric. The EBA is consulting two:

- The first metric is calculating the change in NII (the difference between the shocked and baseline NII) relative to the Tier 1 Capital:

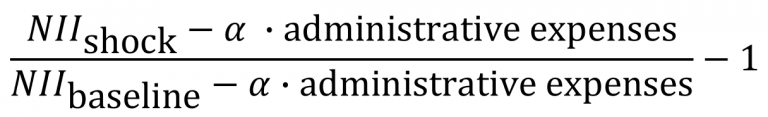

- The second metric is calculating the change in NII relative to the baseline scenario, after correcting for administrative expenses that can be allocated to NII:

- where α is the historical share of NII relative to the operating income as reported based on FINREP input.

The pros of the narrow definition of NII are improved comparability and ease of computation, where the main pro of the broader definition is that it achieves a more comprehensive picture, which is also more in line with the EBA IRRBB Guidelines. With respect to the metrics, the first (capital-based) metric is the simplest and it is comparable to the approach taken for the SOT for EVE. The second metric is close to a P&L-based metric and the EBA argues that its main advantage is that “it takes into account both the business model and cost structure of a bank in the assessment of the continuity of the business operations”. It does involve, however, the application of some assumptions on determining the α parameter.

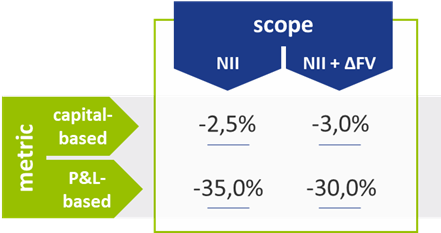

Thresholds for the four possible combinations

For each of the four possible combinations (definition of NII and specification of the metric), the EBA has determined, using data from the December 2020 Quantitative Impact Study (QIS), what the corresponding thresholds should be. Their starting point has been to make the SOT for NII as stringent as the SOT for EVE. Effectively, they reverse engineered the threshold to achieve a similar number of outliers under both measures. We expect that the proposed threshold for any of the four possible combinations will not be constraining for the majority of banks. The resulting proposed thresholds are included in the table below:

Table 1 – Comparison of the proposed thresholds for each combination of metric and scope

The impact of including Fair Value changes seems arbitrary as it increases the threshold for the capital-based metric and decreases the threshold for the P&L-based metric. Also, from a comparability and computational perspective, the narrow definition of NII may be preferred. Furthermore, the capital-based metric is less intuitive for NII than it is for EVE, and consequently, the P&L-based one may be preferred. It is also noted in the consultation paper that if the shocked NII after the correction for administrative expenses (the numerator) is negative, it will also be considered an outlier.

Conclusion

In the past years, many banks have invested heavily in their IRRBB framework following the 2018 update of the IRRBB Guidelines. Once again, an investment is required. Even though there are not many surprises in the proposed updates related to the SOTs, small and large banks alike will need to carefully assess how the changes to the existing SOT and the introduction of the new SOT will impact their interest rate risk management. Banks still have the opportunity to respond to all three consultation papers until 4 April 2022.