This paper explores vital infrastructure decisions, regulatory scrutiny, and proposes a flexible risk approach for financial institutions in crypto asset navigation by 2025.

This paper offers a straightforward analysis of the Basel Committee on Banking Supervision's standards on crypto asset exposures and their adoption by 2025. It critically assesses infrastructure risks, categorizes crypto assets for regulatory purposes, and proposes a flexible approach to managing these risks based on the blockchain network's stability. Through expert interviews, key risk drivers are identified, leading to a framework for quantifying infrastructure risks. This concise overview provides essential insights for financial institutions navigating the complex regulatory and technological landscape of crypto assets.

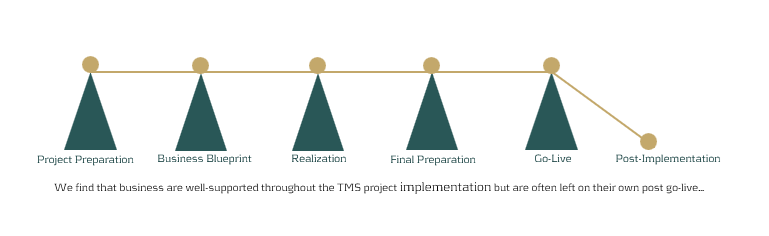

Businesses across the globe invest tens of thousands of dollars in implementing treasury management systems to achieve the accuracy, automation, speed, and reporting they require.

But what happens after implementation, when the project team has packed up and handed over the reins to the employees and support staff?

The first months after a system implementation can be some of the most challenging to a business and its people. Learning a new system is like learning any new skill – it requires time and effort to become familiar with the new ways of working, and to be completely comfortable again performing tasks. Previous processes, even if they were not the most efficient, were no doubt second nature to system users and many would have been experts in working their way through what needed to be done to get accurate results. New, improved processes can initially take longer as the user learns how to step through the unfamiliar system. This is a normal part of adopting a new landscape and can be expected. However, employee frustration is often high during this period, as more mental effort is required to perform day-to-day tasks and avoid errors. And when mistakes are made, it often takes more time to resolve them because the process for doing so is unfamiliar.

High-risk period for the company

With an SAP system, the complexity is often great, given the flexibility and available options that it offers. New users of SAP Treasury Management Software may take on average around 12 – 18 months to feel comfortable enough to perform their day-to-day operations, with minimal errors made. This can be a high-risk period for the company, both in terms of staff retention as well as in the mistakes made. Staff morale can dip due to the changes, frustrations and steep learning curve and errors can be difficult to work through and correct.

In-house support staff are often also still learning the new technology and are generally not able to provide the quick turnaround times required for efficient error management right from the start. When the issue is a critical one, the cost of a slow support cycle can be high, and business reputation may even be at stake.

While the benefits of a new implementation are absolutely worthwhile, businesses need to ensure that they do not underestimate the challenges that arise during the months after a system go-live.

Experts to reduce risks

What we have seen is that especially during the critical post-implementation period – and even long afterward – companies can benefit and reduce risks by having experts at their disposal to offer support, and even additional training. This provides a level of relief to staff as they know that they can reach out to someone who has the knowledge needed to move forward and help them resolve errors effectively.

Noticing these challenges regularly across our clients has led Zanders to set up a dedicated support desk. Our Treasury Technology Support (TTS) service can meet your needs and help reduce the risks faced. While we have a large number of highly skilled SAP professionals as part of the Zanders group, we are not just SAP experts. We have a wide pool of treasury experts with both functional & technical knowledge. This is important because it means we are able to offer support across your entire treasury system landscape. So whether it be your businesses inbound services, the multitude of interfaces that you run, the SAP processes that take place, or the delivery of messages and payments to third parties and customers, the Zanders TTS team can help you. We don’t just offer vendor support, but rather are ready to support and resolve whatever the issue is, at any point in your treasury landscape.

As the leading independent treasury consultancy globally, we can fill the gaps where your company demands it and help to mitigate that key person risk. If you are experiencing these challenges or can see how these risks may impact your business that is already in the midst of a treasury system implementation, contact Warren Epstein for a chat about how we can work together to ensure the long-term success of your system investment.

Early 2023, SAP launched its Digital Currency Hub as a pilot to explore the future of cross-border transactions using crypto or digital currencies.

In this article, we explore this stablecoin payments trial, examine the advantages of digital currencies and how they could provide a matching solution to tackle the hurdles of international transactions.

Cross-border payment challenges

While cross-border payments form an essential part of our globalized economy today, they have their own set of challenges. For example, cross-border payments often involve various intermediaries, such as banks and payment processors, which can result in significantly higher costs compared to domestic payments. The involvement of multiple parties and regulations can lead to longer processing times, often combined with a lack of transparency, making it difficult to track the progress of a transaction. This can lead to uncertainty and potential disputes, especially when dealing with unfamiliar payment systems or intermediaries. Last but not least, organizations must ensure they meet the different regulations and compliance requirements set by different countries, as failure to comply can result in penalties or delays in payment processing.

Advantages of digital currencies

Digital currencies have gained significant interest in recent years and are rapidly adopted, both globally and nationally. The impact of digital currencies on treasury is no longer a question of ‘if’ but ‘when’, as such it is important for treasurers to be prepared. While we address the latest developments, risks and opportunities in a separate article, we will now focus on the role digital currencies can play in cross-border transactions.

The notorious volatility of traditional crypto currencies, which makes them less practical in a business context, has mostly been addressed with the introduction of stablecoins and central bank digital currencies. These offer a relatively stable and safe alternative for fiat currencies and bring some significant benefits.

These digital currencies can eliminate the need for intermediaries such as banks for payment processing. By leveraging blockchain technology, they facilitate direct host-to-host transactions with the benefit of reducing transaction fees and near-instantaneous transactions across borders. Transactions are stored in a distributed ledger which provides a transparent and immutable record and can be leveraged for real-time tracking and auditing of cross-border transactions. Users can have increased visibility into the status and progress of their transactions, reducing disputes and enhancing trust. At a more advanced level, compliance measures such as KYC, KYS or AML can be directly integrated to ensure regulatory compliance.

SAP Digital Currency Hub

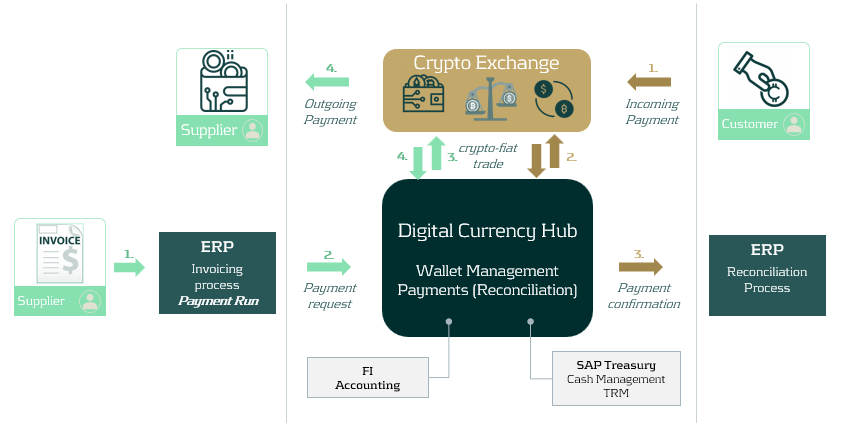

Earlier this year, SAP launched its Digital Currency Hub as a pilot to further explore the future of cross-border transactions using crypto or digital currencies. The Digital Currency Hub enables the integration of digital currencies to settle transactions with customers and suppliers. Below we provide a conceptual example of how this can work.

- Received invoices are recorded into the ERP and a payment run is executed.

- The payment request is sent to SAP Digital Currency Hub, which processes the payment and creates an outgoing payment instruction. The payment can also be entered directly in SAP Digital Currency Hub.

- The payment instruction is sent to a crypto exchange, instructing to transfer funds to the wallet of the supplier.

- The funds are received in the supplier’s wallet and the transaction is confirmed back to SAP Digital Currency Hub.

In a second example, we have a customer paying crypto to our wallet:

- The customer pays funds towards our preferred wallet address. Alternatively, a dedicated wallet per customer can be set up to facilitate reconciliation.

- Confirmation of the transaction is sent to SAP Digital Currency Hub. Alternatively, a request for payment can also be sent.

- A confirmation of the transaction is sent to the ERP where the open AR item is managed and reconciled. This can be in the form of a digital bank statement or via the use of an off-chain reference field.

Management of the wallet(s) can be done via custodial services or self-management. There are a few security aspects to consider, on which we recently published an interesting article for those keen to learn more.

While still on the roadmap, SAP Digital Currency Hub can be linked to the more traditional treasury modules such as Cash and Liquidity Management or Treasury and Risk Management. This would allow to integrate digital currency payments into the other treasury activities such as cash management, forecasting or financial risk management.

Conclusion

With the introduction of SAP Digital Currency Hub, there is a valid solution for addressing the current pain points in cross-border transactions. Although the product is still in a pilot phase and further integration with the rest of the ERP and treasury landscape needs to be built, its outlook is promising as it intends to make cross-border payments more streamlined and transparent.

The ECB has conducted in-depth assessments of banks’ forbearance processes as part of its supervisory priorities.

Forbearance involves providing concessions to borrowers who may struggle to repay their loans, aiming to return them to a sustainable repayment path. The analyses revealed areas for improvement, including the proper identification of clients in financial difficulties, granting appropriate and sustainable measures, and establishing robust monitoring processes for forborne exposures. Effective forbearance frameworks and efficient processes are crucial, particularly in the current economic environment, to prepare for potential increases in distressed debt and refinancing risk. These measures not only support viable distressed debtors but also mitigate losses for banks and the economy.

Several institutions have published their vision for a digital euro, among which the European Banking Federation (EBF), the ECB and the European Parliament.

At the start of March, the Bank for International Settlements (BIS) in conjunction with several central banks concluded Project Icebreaker in which the potential benefits and challenges of using retail central bank digital currencies (CBDC) in international payments were studied. At the end of March, the European Banking Federation (EBF) published a vision paper on a Digital Euro Ecosystem, stating that a retail digital euro, a wholesale CBDC and bank-issued money tokens could all play a role in enabling innovation, supporting customer needs and ensuring that Europe stays at the forefront of digital finance. The digital euro should add value to consumers, mitigate ex-ante the accompanying risks, and be appropriately designed in close cooperation with the private sector.

At the end of April, the ECB stated in their latest progress report that a digital euro could be made available via existing banking apps or via a dedicated Eurosystem app. The digital euro would be accessible to Euro area citizens (and non-Euro area citizens with a Euro area-based payment service provider) in its initial release. In further releases, other areas could have access too, while also functionalities with other CBDCs are potentially provisioned. Finally, a paper produced for the European Parliament suggested that the digital euro system should not limit users’ holdings, arguing that the risks to financial stability of people deserting conventional banks are overstated. Holdings could be limited if the digital euro is intended for day-to-day transactions only. A final decision on issuing a digital euro has yet to be made, with the launch coming in 2026 at the earliest.

Meanwhile the EU has approved the world’s first comprehensive crypto rules, aiming to protect investors and combat money laundering. Expected to roll out in 2024, the rules put pressure on other countries to follow suit. Related to this, IOSCO, the global standard setter for securities markets, has issued detailed recommendations for regulating crypto assets, aiming to enhance client protection and align crypto trading with public market standards. With support from its board, IOSCO intends to address investor protection and market integrity risks.

The world of finance is changing rapidly. The adoption of cryptocurrencies, digital assets or other Blockchain-based solutions by corporations is already well underway.

As a result of the growing importance of this transformative technology and its applications, various regulatory initiatives and frameworks have emerged, such as Markets in Crypto-Assets Regulation (MiCAR), the Distributed Ledger Technology (DLT) Pilot Regime, and the Basel Committee on Banking Supervision (BCBS) crypto standard were launched, demonstrating the growing importance and adoption at both a global and national level. Given these trends, treasuries will be impacted by Blockchain one way or the other – if they aren’t already.

With the advent of cryptocurrencies and digital assets, it is important for treasurers to understand the issues at hand and have a strategy in place to deal with them. Based on our experience, typical questions that a treasurer faces are how to deal with the volatility of cryptocurrencies, how cryptocurrencies impact FX management, the accounting treatment for cryptocurrencies as well as KYC considerations. These developments are summarized in this article.

FX Risk Management and Volatility

History has shown that cryptocurrencies such as Bitcoin and Ether are highly volatile assets, which implies that the Euro value of 1 BTC can fluctuate significantly. Based on our experience, treasurers opt to sell their cryptocurrencies as quickly as possible in order to convert them into fiat currency – the currencies that they are familiar and which their cost basis is typically in. However, other solutions exist such as hedging positions via derivatives traded on regulated financial markets or conversions into so-called stablecoins1.

Accounting Treatment and Regulatory Compliance

Cryptocurrencies, including stablecoins, require careful accounting treatment and compliance with regulations. In most cases cryptocurrencies are classified as “intangible assets” under IFRS. For broker-traders they are, however, classified as inventory, depending on the circumstances. Inventory is measured at the lower of cost and net realizable value, while intangible assets are measured at cost or revaluation. Under GAAP, most cryptocurrencies are treated as indefinite-lived intangible assets and are impaired when the fair value falls below the carrying value. These impairments cannot be reversed. CBDCs, however, are not considered cryptocurrencies. Similarly, and the classification of stablecoins depends on their status as financial assets or instruments.

KYC/KYT Considerations

The adoption of cryptocurrencies and Blockchain technology introduces challenges for corporate treasurers in verifying counterparties and tracking transactions. When it comes to B2C transactions, treasurers may need to implement KYC (Know Your Customer) processes to verify the age and identity of individuals, ensuring compliance with age restrictions and preventing under-aged purchases, among other regulatory requirements. Whilst the process differs for B2B (business-to-business) transactions, the need for KYC exists nevertheless. However in the B2B space, the KYC process is less likely to be made more complex by transactions done in cryptocurrencies, since the parties involved are typically well-established companies or organizations with known identities and reputations.

Central Bank Digital Currencies

(CBDCs) are emerging as potential alternatives to privately issued stablecoins and other cryptocurrencies. Central banks, including the European Central Bank and the Peoples Banks of China, are actively exploring the development of CBDCs. These currencies, backed by central banks, introduce a new dimension to the financial landscape and will be another arrow in the quiver of end-customers – along with cash, credit and debit cards or PayPal. Corporate treasurers must prepare for the potential implications and opportunities that CBDCs may bring, such as changes in payment options, governance processes, and working capital management.

Adapting to the Future

Corporate treasurers should proactively prepare for the impact of cryptocurrencies and Blockchain technology on their business operations. This includes educating themselves on the basics of cryptocurrencies, stablecoins, and CBDCs, and investigating how these assets can be integrated into their treasury functions. Understanding the infrastructure, processes, and potential hedging strategies is crucial for treasurers to make informed decisions regarding their balance sheets. Furthermore, treasurers must evaluate the impact of new payment options on working capital and adjust their strategies accordingly.

Zanders understands the importance of keeping up with emerging technologies and trends, which is why we offer a comprehensive range of Blockchain services. Our Blockchain offering covers supporting our clients in developing their Blockchain strategy including developing proofs of concept, cryptocurrency integration into Corporate Treasury, support on vendor selection as well as regulatory advice. For decades Zanders has helped corporate treasurers navigate the choppy seas of change and disruption. We are ready to support you during this new era of disruption, so reach out to us today.

Meet the team

Zanders already has a well-positioned, diversified Blockchain team in place, consisting of Blockchain developers, Blockchain experts and business experts in their respective fields. In the following you will find a brief introduction of our lead Blockchain consultants.