WACC: Practical Guide for Strategic Decision- Making – Part 8

Increasing Shareholder Value by Utilizing Tax Opportunities

The WACC is a calculation of the ‘after-tax’ cost of capital where the tax treatment for each capital component is different. In most countries, the cost of debt is tax deductible while the cost of equity isn’t, for hybrids this depends on each case.

Some countries offer beneficial tax opportunities that can result in an increase of operational cash flows or a reduction of the WACC.

This article elaborates on the impact of tax regulation on the WACC and argues that the calculation of the WACC for Belgian financing structures needs to be revised. Furthermore, this article outlines practical strategies for utilizing tax opportunities that can create shareholder value.

The eighth and last article in this series on the weighted average cost of capital (WACC) discusses how to increase shareholder value by utilizing tax opportunities. Generally, shareholder value can be created by either:

- Increasing operational cash flows, which is similar to increasing the net operating profit ‘after-tax’ (NOPAT);

- or Reducing the ‘after-tax’ WACC.

This article starts by focusing on the relationship between the WACC and tax. Best market practice is to reflect the actual environment in which a company operates, therefore, the general WACC equation needs to be revised according to local tax regulations. We will also outline strategies for utilizing tax opportunities that can create shareholder value. A reduction in the effective tax rate and in the cash taxes paid can be achieved through a number of different techniques.

Relationship Between WACC and Tax

Within their treasury and finance activities, multinational companies could trigger a number of different taxes, such as corporate income tax, capital gains tax, value-added tax, withholding tax and stamp or capital duties. Whether one or more of these taxes will be applicable depends on country specific tax regulations. This article will mainly focus on corporate tax related to the WACC. The tax treatment for the different capital components is different. In most countries, the cost of debt is tax deductible while the cost of equity isn’t (for hybrids this depends on each case).

The corporate tax rate in the general WACC equation, discussed in the first article of this series (see Part 1: Is Estimating the WACC Like Interpreting a Piece of Art?), is applicable to debt financing. It is appropriate, however, to take into consideration the fact that several countries apply thin capitalization rules that may restrict tax deductibility of interest expenses to a maximum leverage.

Furthermore, in some countries, expenses on hybrid capital could be tax deductible as well. In this case the corporate tax rate should also be applied to hybrid financing and the WACC equation should be changed accordingly.

Finally, corporate tax regulation can also have a positive impact on the cost of equity. For example, Belgium has recently introduced a system of notional interest deduction, providing a tax deduction for the cost of equity (this is discussed further in the section below: Notional Interest Deduction in Belgium).

As a result of the factors discussed above, we believe that the ‘after-tax’ capital components in the estimation of the WACC need to be revised for country specific tax regulations.

Revised WACC Formula

In other coverage of this subject, a distinction is made between the ‘after-tax’ and ‘pre-tax’ WACC, which is illustrated by the following general formula:

WACCPT = WACCAT / [1 – TC]

WACCAT : Weighted average cost of capital after-tax

WACCPT : Weighted average cost of capital pre-tax

TC : Corporate income tax rate

In this formula the ‘after-tax’ WACC is grossed-up by the corporate tax rate to generate the ‘pre-tax’ WACC. The correct corporate tax rate for estimating the WACC is the marginal tax rate for the future! If a company is profitable for a long time into the future, then the tax rate for the company will probably be the highest marginal statutory tax rate.

However, if a company is loss making then there are no profits against which to offset the interest. The effective tax rate is therefore uncertain because of volatility in operating profits and a potential loss carry back or forward. For this reason the effective tax rate may be lower than the statutory tax rate. Consequently, it may be useful to calculate multiple historical effective tax rates for a company. The effective tax rate is calculated as the actual taxes paid divided by earnings before taxes.

Best market practice is to calculate these rates for the past five to ten years. If the past historical effective rate is lower than the marginal statutory tax rate, this may be a good reason for using that lower rate in the assumptions for estimating the WACC.

This article focuses on the impact of corporate tax on the WACC but in a different way than previously discussed before. The following formula defines the ‘after-tax’ WACC as a combination of the WACC ‘without tax advantage’ and a ‘tax advantage’ component:

WACCAT = WACCWTA – TA

WACCAT : Weighted average cost of capital after-tax

WACCWTA : Weighted average cost of capital without tax advantage

TA : Tax advantage related to interest-bearing debt, common equity and/or hybrid capital

Please note that the ‘pre-tax’ WACC is not equal to the WACC ‘without tax advantage’. The main difference is the tax adjustment in the cost of equity component in the pre-tax calculation. As a result, we prefer to state the formula in a different way, which makes it easier to reflect not only tax advantages on interestbearing debt, but also potential tax advantages on common equity or hybrid capital.

The applicable tax advantage component will be different per country, depending on local tax regulations. An application of this revised WACC formula will be further explained in a case study on notional interest deduction in Belgium.

Notional Interest Deduction in Belgium

Recently, Belgium introduced a system of notional interest deduction that provides a tax deduction for the cost of equity. The ‘after-tax’ WACC formula, as mentioned earlier, can be applied to formulate the revised WACC equation in Belgium:

WACCAT = WACCWTA – TA

WACCWTA : Weighted average cost of capital without tax advantage, formulated as follows: RD x DM / [DM+EM] + RE x EM / [DM+EM] TA : Tax advantage related to interest-bearing debt and common equity, formulated as follows: TC x [RD x DM + RN x EB] / [DM+EM] TC : Corporate tax rate in Belgium

RD : Cost of interest-bearing debt

RE : Cost of common equity

RN : Notional interest deduction

DM : Market value of interest-bearing debt

EM : Market value of equity

EB : Adjusted book value of equity

The statutory corporate tax rate in Belgium is 33.99%. The revised WACC formula contains an additional tax deduction component of [RN x EB], which represents a notional interest deduction on the adjusted book value of equity. The notional interest deduction can result in an effective tax rate, for example, intercompany finance activities of around 2-6%.

The notional interest is calculated based on the annual average of the monthly published rates of the long-term Belgian government bonds (10-year OLO) of the previous year. This indicates that the real cost of equity, e.g. partly represented by distributed dividends, is not deductible but a notional risk-free component.

The adjusted book value of equity qualifies as the basis for the tax deduction. The appropriate value is calculated as the total equity in the opening balance sheet of the taxable period under Belgian GAAP, which includes retained earnings, with some adjustments to avoid double use and abuse. This indicates that the value of equity, as the basis for the tax deduction, is not the market value but is limited to an adjusted book value.

As a result, Belgium offers a beneficial tax opportunity that can result in an increase of shareholder value by reducing the ‘after-tax’ WACC. Belgium is, therefore, on the short-list for many companies seeking a tax-efficient location for their treasury and finance activities. Furthermore, the notional interest deduction enables strategies for optimizing the capital structure or developing structured finance instruments.

How to Utilize Tax Opportunities?

This article illustrates the fact that managing the ‘after-tax’ WACC is a combined strategy of minimizing the WACC ‘without tax advantages’ and, at the same time, maximizing tax advantages. A reduction in the effective tax rate and in the cash taxes paid can be achieved through a number of different techniques. Most techniques have the objective to obtain an interest deduction in one country, while the corresponding income is taxed at a lower rate in another country. This is illustrated by the following two examples.

The first example concerns a multinational company that can take advantage of a tax rate arbitrage obtained through funding an operating company from a country with a lower tax rate than the country of this operating company. For this reason, many multinational companies select a tax-efficient location for their holding or finance company and optimize their transfer prices.

Secondly, country and/or company specific hybrid capital can be structured, which would be treated differently by the country in which the borrowing company is located than it would be treated by the country in which the lending company is located. The potential advantage of this strategy is that the expense is treated as interest in the borrower’s country and is therefore deductible for tax purposes.

However, at the same time, the country in which the lender is located would treat the corresponding income either as a capital receipt, which is not taxable or it can be offset by capital losses or other items; or as dividend income, which is either exempt or covered by a credit for the foreign taxes paid. As a result, it is beneficial to optimize the capital structure and develop structured finance instruments.

There is a range of different strategies that may be used to achieve tax advantages, depending upon the particular profile of a multinational company. Choosing the strategy that will be most effective depends on a number of factors, such as the operating structure, the tax profile and the repatriation policy of a company. Whatever strategy is chosen, a number of commercial aspects will be paramount. The company will need to align its tax planning strategies with its business drivers and needs.

The following section highlights four practical strategies that illustrate how potential tax advantages and, as a consequence, an increase in shareholder value can be achieved by:

- Selecting a tax-efficient location.

- Optimizing the capital structure.

- Developing structured finance instruments.

- Optimizing transfer prices.

Selecting a tax-efficient location

Many companies have centralized their treasury and finance activities in a holding or separate finance company. Best market practice is that the holding or finance company will act as an in-house bank to all operating companies. The benefit of a finance company, in comparison to a holding, is that it is relatively easy to re-locate to a tax-efficient location. Of course, there are a number of tax issues that affect the choice of location. Selecting an appropriate jurisdiction for the holding or finance company is critical in implementing a tax-efficient group financing structure.

Before deciding to select a tax-efficient location, a number of issues must be considered. First of all, whether the group finance activities generate enough profit to merit re-locating to a low-tax jurisdiction. Secondly, re-locating activities affects the whole organization because it is required that certain activities will be carried out at the chosen location, which means that specific substance requirements, e.g. minimum number of employees, have to be met. Finally, major attention has to be paid to compliance with legal and tax regulation and a proper analysis of tax-efficient exit strategies. It is advisable to include all this information in a detailed business case to support decision-making.

When selecting an appropriate jurisdiction, several tax factors should be considered including, but not limited to, the following: The applicable taxes, the level of taxation and the availability of special group financing facilities that can reduce the effective tax rate.

- The availability of tax rulings to obtain more certainty in advance.

- Whether the jurisdiction has an expansive tax treaty network.

- Whether dividends received are subject to a participation exemption or similar exemption.

- Whether interest payments are restricted by a thin capitalization rule.

- Whether a certain controlled foreign company (CFC) rule will absorb the potential benefit of the chosen jurisdiction.

Other important factors include the financial infrastructure, the availability of skilled labor, living conditions for expatriates, logistics and communication, and the level of operating costs.

Based on the aforementioned criteria, a selection of attractive countries for locating group finance activities is listed below:

Belgium: In 2006, Belgium introduced a notional interest deduction as an alternative for the ‘Belgian Co-ordination Centres’. This regime allows taxefficient equity funding of Belgian resident companies and Belgian branches of non-resident companies. As a result, the effective tax rate may be around 2-6%.

Ireland: Ireland has introduced an attractive alternative to the previous ‘IFSC regime’ by lowering the corporate income tax rate for active trading profits to 12.5%. Several treasury and finance activities can be structured easily to generate active trading profit taxed at this low tax rate.

Switzerland: Using a Swiss finance branch structure can reduce the effective tax rate here. These structures are used by companies in Luxembourg. The benefits of this structure include low taxation at federal and cantonal level based on a favorable tax ruling – a so called tax holiday – which may reduce the effective tax rate to even less than 2%.

The Netherlands: Recently, the Netherlands proposed an optional tax regulation, the group interest box, which is a special regime for the net balance of intercompany interest within a group, taxed at a rate of 5%. This regulation should serve as a substitute for the previous ‘Dutch Finance Company’.

Optimizing the capital structure

One way to achieve tax advantages is by optimizing not only the capital structure of the holding or finance company but that of the operating companies as well. Best market practice is to take into account the following tax elements:

Thin capitalization: When a group relationship enables a company to take on higher levels of debt than a third party would lend, this is called thin capitalization. A group may decide to introduce excess debt for a number of reasons. For example, a holding or finance company may wish to extract profits tax-efficiently, or may look to increase the interest costs of an operating company to shelter taxable profits.

To restrict these situations, several countries have introduced thin capitalization rules. These rules can have a substantial impact on the deductibility of interest on intercompany loans.

Withholding tax: Interest and dividend payments can be subject to withholding tax, although in many countries dividends are exempt from withholding tax. As a result, high rates of withholding tax on interest can make traditional debt financing unattractive. However, tax treaties can reduce withholding tax. As a consequence, many companies choose a jurisdiction with a broad network of tax treaties.

Repatriation of cash: If a company has decided to centralize its group financing, then it is relevant to repatriate cash that can be used for intercompany financing. In most countries, repatriation of cash can be performed through dividends, intercompany loans or back-to-back loans. It depends on each country what will be the most tax-efficient method.

Developing structured finance instruments

Developing structured finance instruments can be interesting for funding or investment activities. Examples of structured finance instruments are:

Hybrid capital instruments: Hybrid capital combines certain elements of debt and equity. Examples are preferred equity, convertible bonds, subordinated debt and index-linked bonds. For the issuers, hybrid securities can combine the best features of both debt and equity: tax deductibility for coupon payments, reduction in the overall cost of capital and strengthening of the credit rating.

Tax sparing investment products: To encourage investments in their countries, some countries forgive all or part of the withholding taxes that would normally be paid by a company. This practice is known as tax sparing. Certain tax treaties consider spared taxes as having been paid for purposes of calculating foreign tax deductions and credits. This is, for example, the case in the tax treaty between The Netherlands with Brazil, which enables the structuring of tax-efficient investment products.

Double-dip lease constructions: A double-dip lease construction is a cross-border lease in which the different rules of the lessor’s and lessee’s countries let both parties be treated as the owner of the leased equipment for tax purposes. As a result of this, a double interest deduction is achieved, also called double dipping.

Optimizing transfer prices

Transfer pricing is generally recognized as one of the key tax issues facing multinational companies today. Transfer pricing rules are applicable on intercompany financing activities and the provision of other treasury and finance services, e.g. the operation of cash pooling arrangements or providing hedging advice.

Currently, in many countries, tax authorities require that intercompany loans have terms and conditions on an arm’s length basis and are properly documented. However, in a number of countries, it is still possible to agree on an advance tax ruling for intercompany finance conditions.

Several companies apply interest rates on intercompany loans, being the same rate as an external loan or an average rate of the borrowings of the holding or finance company. When we apply the basic condition of transfer pricing to an intercompany loan, this would require setting the interest rate of this loan equal to the rate at which the borrower could raise debt from a third party.

In certain circumstances, this may be at the same or lower rate than the holding or finance company could borrow but, in many cases, it will be higher. Therefore, whether this is a potential benefit depends on the objectives of a company. If the objective is to repatriate cash, then a higher rate may be beneficial.

Transfer pricing requires the interest rate of an intercompany loan to be backed up by third-party evidence, however, in many situations this may be difficult to obtain. Therefore, best market practice is to develop an internal credit rating model to assess the creditworthiness of operating companies.

An internal credit rating can be used to define the applicable intercompany credit spread that should be properly documented in an intercompany loan document. Furthermore, all other terms and conditions should be included in this document as well, such as, but not limited to, clauses on the definition of the benchmark interest rate, currency, repayment, default and termination.

Conclusion

This article began with a look at the relationship between the WACC and tax. Best market practice is to revise the WACC equation for local tax regulations. In addition, this article has outlined strategies for utilizing tax opportunities that can create shareholder value. A reduction in the effective tax rate, and in the cash taxes paid, can be achieved through a number of different techniques.

This eight-part series discussed the WACC from different perspectives and how shareholder value can be created by strategic decision-making in one of the following areas:

Business decisions: The type of business has, among others, a major impact on the growth potential of a company, the cyclicality of operational cash flows and the volume and profit margins of sales. This influences the WACC through the level of the unlevered beta.

Treasury and finance decisions: Activities in the area of treasury management, risk management and corporate finance can have a major impact on operational cash flows, capital structure and the WACC.

Tax decisions: Utilizing tax opportunities can create shareholder value. Potential tax advantages can be, among others, achieved by selecting a taxefficient location for treasury and finance activities, optimizing the capital structure, developing structured finance instruments and optimizing transfer prices.

Based on this overview we can conclude that the WACC is one of the most critical parameters in strategic decision-making.

WACC: Practical Guide for Strategic Decision-Making – Part 1

Increasing Shareholder Value by Utilizing Tax Opportunities

This seven-part series, authored by Zanders consultants, provides CFOs and corporate treasurers with a better understanding of the weighted average cost of capital (WACC), which is recognized as one of the most critical parameters in strategic decision-making. The series highlights strategies to optimize the capital structure and maximize shareholder value.

This article, the first in the series, describes how to estimate the weighted average cost of capital (WACC) and the issues that need to be considered when doing so.

If companies were entirely financed with equity, there would be little difficulty in determining its cost of capital: it would be the expected return required by shareholders. Most companies, however, are not wholly financed with equity. They tend to issue a variety of financing instruments, including debt, equity and hybrids. Due to this financing mix, companies usually calculate a weighted average cost of capital (WACC).

Overview of WACC Estimation

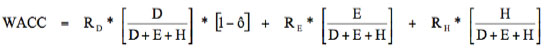

The WACC is recognized as one of the most critical parameters in strategic decision-making. It is relevant for business valuation, capital budgeting, feasibility studies and corporate finance decisions. When estimating the WACC for a company, there is a clear trade-off between theoretical purity and actual circumstances faced by a company. The decision in this context should reflect the actual environment in which a company operates. In general, the WACC is estimated using the following equation:

D: Market value of interest-bearing debt

E: Market value of common equity

H: Market value of hybrid capital

RD: Cost of interest-bearing debt

RE: Cost of common equity

RH: Cost of hybrid capital

Ô: Corporate tax rate

The estimation of the WACC is based on several key assumptions:

- It is market driven. It is the expected rate of return that the market requires to commit capital to an investment.

- It is a function of the investment, not the investor.

- It is forward looking, based on expected returns.

- The base against which the WACC is measured is market value, not book value.

- It is usually measured in nominal terms, which includes expected inflation.

- It is the link, called a discount rate, which equates expected future returns for the life of the investment with the present value of the investment at a given date.

The WACC seems easier to estimate than it really is. Just as two people will rarely interpret a piece of art the same way, neither will two people calculate the same WACC. Even if two people do reach the same WACC, all the other applied judgments and valuation methods are likely to ensure that each has a different opinion regarding the components that comprise the company value.

Therefore, the following sections of this article will discuss the different WACC components in more detail. Errors that are frequently encountered in practice will be highlighted as well as best market practice as a guide for estimating the WACC.

Capital Structure

The first step in developing an estimate of the WACC is to determine the capital structure for the company or project that is being valued. This provides the market value weights for the WACC formula. Best market practice is to define a target capital structure and this is for several reasons.

First, the current capital structure may not reflect the capital structure that is expected to prevail over the life of the business.

The second reason for using a target capital structure is that it solves the potential problem of circularity involved in estimating the WACC, which arises when calculating the WACC for private companies. For instance, we need to know market value weights to determine the WACC but we cannot know the market value weights without knowing what the market value is in the first place.

To develop a target capital structure, a combination of three approaches is suggested:

1. Estimate the current capital structure.

A capital structure can comprise three categories of financing: interest-bearing debt, common equity and hybrid capital. The best approach for estimating the current ‘market value-based’ capital structure is to identify the values of the capital structure elements directly from their prices in the marketplace, if available. For equity, market prices are available for public companies, but it is more difficult to identify the market value of equity for private companies, business units and also for illiquid stocks.

The same applies for public debt, such as bonds, where the market value can be identified from available market prices. In the case of private debt, however, such as bank loans and private placements, the current value needs to be calculated. (For discussion about the difficulties of calculating the market value of hybrid capital, please refer to the third article in this series on the WACC.) The conclusion is that estimating the current capital structure based on market values could be difficult when market prices are not available. The next approach could assist in solving this difficulty, by estimating a target capital structure based on information from comparable companies.

2. Review the capital structure of comparable companies.

In addition to estimating the market value-based capital structure currently and over time, it is useful to review the capital structures of comparable companies as well.

There are two reasons for this. First, comparing the capital structure of the company with those of similar companies will help to understand if the current estimate of the capital structure is unusual. It is perfectly acceptable that the company’s capital structure is different, but it is important to understand the reasons behind this.

The second reason is a more practical one because in some cases it is not possible to estimate the current financing mix for the company. For privately held companies, a market-based estimate of the current value of equity is not available.

3. Review senior management’s approach to financing.

It is important to discuss the company’s capital structure policy with senior management to determine their explicit or implicit target capital structure for the company and its businesses.

This discussion could give an explanation why a company’s capital structure may be different from comparable companies. For instance, is the company by philosophy more aggressive or innovative in the use of debt financing? Or is the current capital structure only a temporary deviation from a more conservative target?

Often companies finance acquisitions with debt they plan to amortize rapidly or refinance with equity in the near future. Alternatively, there could be a difference in the company’s cash flow or asset intensity, which results in a target capital structure that is fundamentally different from comparable companies.

Corporate Tax Rate

The WACC is a calculation of the ‘after tax’ cost of capital. The tax treatment for the different capital components – such as interest-bearing debt, common equity and hybrid capital – is different. The corporate tax rate in the earlier mentioned WACC equation is applicable to debt financing because in most countries interest expense on debt is a tax-deductible expense to a company.

It is appropriate, however, to take into consideration the fact that several countries apply thin capitalization rules that may limit tax deductibility of interest expenses to a maximum leverage.

Furthermore, in some countries, expenses on hybrid capital could be tax deductible as well. In that case the corporate tax rate should also be applied to hybrid financing and the WACC equation should be changed accordingly. (For more information on hybrid capital please refer to the third article of this series on the WACC.)

Finally, corporate tax can also have a positive impact on the cost of equity. An example is Belgium, which recently introduced a system of notional interest deduction, providing a tax deduction for the cost of equity. This system will be further explained in the fifth article of this series, which elaborates on the impact of notional interest deduction on the WACC. In other words, the calculation of the WACC for Belgian financing structures needs to be revised.

The main conclusion is that the application of the corporate tax rate in the WACC equation will differ per country. As mentioned before, when estimating the WACC for a company, there is a clear trade-off between theoretical purity and actual circumstances faced by the company. Best market practice is to reflect the actual environment in which a company operates. Therefore the WACC equation needs to be revised accordingly.

Cost of Interest-bearing Debt

The cost of interest-bearing debt can be estimated using the following equation:

RD = RF + DRP

RD: Cost of interest-bearing debt

RF: Risk-free rate

DRP: Debt risk premium

The category of interest-bearing debt consists of short-term debt, long-term debt and leases. Many companies have floating-rate debt, as an original issue or artificially created by interest rate derivatives. If floating-rate debt has no cap or floor, then it is best market practice to use the long-term debt interest rate. This is because the short-term rate will be rolled over and the geometric average of the expected short-term rates is equal to the long-term rate.

The cost of debt is calculated using the marginal cost of debt, i.e. the cost the company would incur for additional borrowing, or refinancing its existing interest-bearing debt. This cost is a combination of the risk-free rate and a debt risk premium. Credit ratings are the primary determinants of the debt risk premium. (More information on the relationship between the WACC, shareholder value and credit ratings can be read in the second article of this series on the WACC.)

The risk-free rate is the theoretical rate of return attributed to an investment with zero risk. The risk-free rate represents the interest that an investor would expect from an absolutely risk-free investment over a specified period of time. In theory, the risk-free rate is the minimum return an investor should expect for any investment.

In practice, however, the risk-free rate does not technically exist, since even the safest investments carry a very small amount of risk. Therefore best market practice for WACC estimations is to use the yield on a 10-year government bond as a proxy for the risk-free rate.

Estimating the WACC can be a challenging exercise, however, because a risk-free government bond is not always available in emerging markets. (This will be discussed further in article seven of this series.)

The cost of debt is the yield-to-maturity on publicly traded bonds of the company. Failing availability of that, the rates of interest charged by banks on recent loans to the company would also serve as a good cost of debt. When using yield-to-maturity to estimate the cost of debt it is important to make a distinction between investment and non-investment grade debt. Investment grade debt has a credit rating greater than or equal to BBB- (Standard & Poor’s). For investment grade debt, the risk of bankruptcy is relatively low.

Therefore, yield-to-maturity is usually a reasonable estimate of the opportunity cost. The coupon rate, which is the historical cost of debt, is irrelevant for determining the current cost of debt. Best market practice is to use the most current market rate on debt of equivalent risk. A reasonable proxy for the risk of debt is a credit rating.

When dealing with debt that is less than investment grade, pay attention to the difference between the expected yield-to-maturity and the promised yield-to-maturity. The latter assumes that all payments (coupon and principal) will be made as promised by the issuer. Therefore it is necessary to compute the expected yield-to-maturity, not the quoted, promised yield. This can be done based on the current market price of a low-grade bond and estimates of its expected default rate and value in default.

If the necessary data is not available, use the yield-to-maturity of BBB-rated debt, which reduces most of the effects of the differences between promised and expected yields.

Leases, both capital and operating, are substitutes for other types of debt. In many cases it is reasonable to assume that their opportunity cost is the same as for the company’s other long-term debt. Since capital leases are already shown as debt on the balance sheet, their market value can be estimated just like other debt.

Operating leases should also be treated like other forms of debt. As a practical matter, if operating leases are not significant, it could be decided not to treat them as debt. They can be left out of the capital structure and the lease payments could be treated as an operating cost.

Cost of Common Equity

For estimating the opportunity cost of common equity, best market practice is to use the expanded version of the capital asset pricing model (CAPM). The equation for the cost of equity is as follows:

RE = RF + [βL * MRP] + SRP

RE: Cost of common equity

RF: Risk-free rate

βL: Levered beta of equity

MRP: Market risk premium

SRP: Specific risk premium

The market risk premium is the extra return that the stock market provides over the risk-free rate to compensate for market risk. The estimate of the historically derived market risk premium is about 5 per cent. This estimate depends on how much history is used. Structural changes in the economy and markets, however, suggest that more recent data provides a better basis for predicting the future. Therefore, best market practice is to use data from the second half of the last century. This is a sufficiently long period to achieve statistical reliability, while avoiding the potentially less relevant market returns.

The historically derived market risk premium can be benchmarked against the implied market risk premium of today’s market capitalization and earnings. This can be done under different assumptions for future earnings growth and reinvestment. Recent studies show an implied market risk premium of 5-5.5 per cent, which is comparable to the historical derived estimate.

Beta is the measurement for the systematic risk of a company and is typically the regression coefficient between historical dividend-adjusted stock returns and market returns. For decades, investors were only concerned with one factor, beta, in their portfolio selection. Beta was considered to explain most of a portfolio’s return.

This one-factor model, otherwise known as standard CAPM, implies that there is a linear relationship between a company’s expected return and its corresponding beta. Beta is not the only determinant of stock returns though so CAPM has been expanded to include two other key risk factors that together better explain stock performance: market capitalization and book-to-market (BtM) value.

Recent empirical studies indicate that three risk factors – market (beta), size (market capitalization) and price (BtM value) – explain 96 per cent of historical equity performance. These three-factor models go further than CAPM to include the fact that two particular types of stocks outperform markets on a regular basis: small caps and value stocks (high BtM value).

The approach to estimate beta depends on whether the company’s equity is traded or not. Therefore the beta of a company can be estimated in two ways. The first and preferred solution for public companies is to use direct estimation, based on historical returns for the company in question.

The second way is to use indirect estimation. This solution is mainly applicable to business units and private companies, but also for illiquid stocks or public companies with very little useful historical data. This estimation is based on betas from comparable companies, which are used to construct an industry beta. When constructing the industry beta, it is important to ‘unlever’ the company betas and then apply the leverage of the specific company.

Best market practice is to incorporate a specific risk premium for small caps and value stocks when estimating the cost of equity. As mentioned earlier, this premium may be applicable to a specific company, based on its market capitalization and BtM value.

Cost of Hybrid Capital

Hybrids are financial instruments that combine certain elements of debt and equity, such as preferred equity, convertible bonds and subordinated debt. WACC estimations are complicated by the introduction of hybrid capital into the capital structure.

This is most easily resolved through an effective split of the instrument’s value into debt and equity to reflect the true debt-equity mix. (The fifth article of this series describes how issuing hybrids can optimize the WACC. The article outlines how hybrids are analyzed on their impact on shareholder value, but they are also analyzed from the perspective of treatment by accountants/IFRS and rating agencies.)

Conclusion

There are many ways to make errors both in estimating the WACC and applying it in practice and this article discussed the different WACC components in more detail. Attention was given to some of the errors frequently encountered in practice. Best market practice was provided as a guide for estimating the WACC while more practical guidance on estimation and application of the WACC will be discussed in the rest of the articles in this series.

Let’s return to the analogy at the beginning of this article. Is estimating the WACC comparable to interpreting a piece of art?

Again, just as two people will rarely interpret a piece of art the same way, neither will two people calculate the same WACC. The key message of this article is that both are based on assumptions before reaching a final estimation or interpretation.

The more time you spend on defining good assumptions for estimating the WACC, the better the quality of business valuation, capital budgeting and other financial decision-making will be. It is like discovering the real value of art; it all starts with a good interpretation.