Current carbon offset processes are opaque and rely on centralized players; blockchain technology can provide improvements by assuring transparency and decentralization.

Carbon offset processes are currently dominated by private actors providing legitimacy for the market. The two largest of these, Verra and Gold Standard, provide auditing services, carbon registries and a marketplace to sell carbon offsets, making them ubiquitous in the whole process. Due to this opacity and centralisation, the business models of the existing companies was criticised regarding its validity and the actual benefit for climate action. By buying an offset in the traditional manner, the buyer must place trust in these players and their business models. Alternative solutions that would enhance the transparency of the process as well as provide decentralised marketplaces are thus called for.

The conventional process

Carbon offsets are certificates or credits that represent a reduction or removal of greenhouse gas emissions from the atmosphere. Offset markets work by having companies and organizations voluntarily pay for carbon offsetting projects. Reasons for partaking in voluntary carbon markets vary from increased awareness of corporate responsibility to a belief that emissions legislation is inevitable, and it is thus better to partake earlier.

Some industries also suffer prohibitively expensive barriers for lowering their emissions, or simply can’t reduce them because of the nature of their business. These industries can instead benefit from carbon offsets, as they manage to lower overall carbon emissions while still staying in business. Environmental organisations run climate-friendly projects and offer certificate-based investments for companies or individuals who therefore can reduce their own carbon footprint. By purchasing such certificates, they invest in these projects and their actual or future reduction of emissions. However, on a global scale, it is not enough to simply lower our carbon footprint to negate the effects of climate change. Emissions would in practice have to be negative, so that even a target of 1,5-degree Celsius warming could be met. This is also remedied by carbon credits, as they offer us a chance of removing carbon from the atmosphere. In the current process, companies looking to take part in the offsetting market will at some point run into the aforementioned behemoths and therefore an opaque form of purchasing carbon offsets.

The blockchain approach

A blockchain is a secure and decentralised database or ledger which is shared among the nodes of a computer network. Therefore, this technology can offer a valid contribution addressing the opacity and centralisation of the traditional procedure. The intention of the first blockchain approaches were the distribution of digital information in a shared ledger that is agreed on jointly and updated in a transparent manner. The information is recorded in blocks and added to the chain irreversibly, thus preventing the alteration, deletion and irregular inclusion of data.

In the recent years, tokenization of (physical) assets and the creation of a digital version that is stored on the blockchain gained more interest. By utilizing blockchain technology, asset ownership can be tokenized, which enables fractional ownership, reduces intermediaries, and provides a secure and transparent ledger. This not only increases liquidity but also expands access to previously illiquid assets (like carbon offsets). The blockchain ledger allows for real-time settlement of transactions, increasing efficiency and reducing the risk of fraud. Additionally, tokens can be programmed to include certain rules and restrictions, such as limiting the number of tokens that can be issued or specifying how they can be traded, which can provide greater transparency and control over the asset.

Blockchain-based carbon offset process

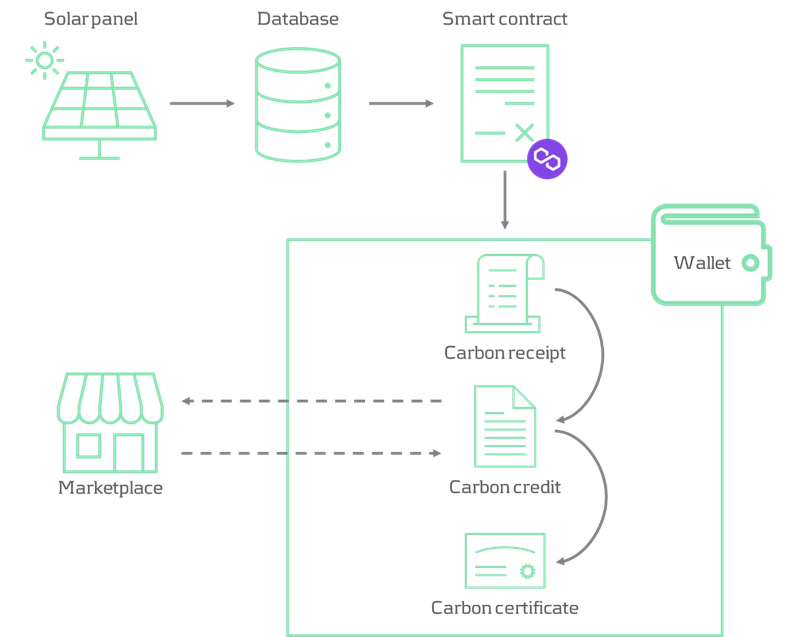

The tokenisation process for carbon credits begins with the identification of a project that either captures or helps to avoid carbon creation. In this example, the focus is on carbon avoidance through solar panels. The generation of solar electricity is considered an offset, as alternative energy use would emit carbon dioxide, whereas solar power does not.

The solar panels provide information regarding their electricity generation, from which a figure is derived that represents the amount of carbon avoided and fed into a smart contract. A smart contract is a self-executing application that exist on the blockchain and performs actions based on its underlying code. In the blockchain-based carbon offset process, smart contracts convert the different tokens and send them to the owner’s wallet. The tokens used within the process are compliant with the ERC-721 Non-Fungible Token (NFT) standard, which represents a unique token that is distinguishable from others and cannot be exchanged for other units of the same asset. A practical example is a work of art that, even if replicated, is always slightly different.

In the first stage of the process, the owner claims a carbon receipt, based on the amount of carbon avoided by the solar panel. Thereby the aggregated amount of carbon avoided (also stored in a database just for replication purposes) is sent to the smart contract, which issues a carbon receipt of the corresponding figure to the owner. Carbon receipts can further be exchanged for a uniform amount of carbon credits (e.g. 5 kg, 10 kg, 15 kg) by interacting with the second smart contract. Carbon credits are designed to be traded on the decentralised marketplace, where the price is determined by the supply and demand of its participants. Ultimately, carbon credits can be exchanged for carbon certificates indicating the certificate owner and the amount of carbon offset. Comparable with a university diploma, carbon certificates are tied to the address of the owner that initiated the exchange and are therefore non-tradable. Figure 1 illustrates the process of the described blockchain-based carbon offset solution:

Figure 1: Process flow of a blockchain-based carbon offset solution

Conclusion

The outlined blockchain-based carbon offset process was developed by Zanders’ blockchain team in a proof of concept. It was designed as an approach to reduce dependence on central players and a transparent method of issuing carbon credits. The smart contracts that the platform interacts with are implemented on the Mumbai test network of the public Polygon blockchain, which allows for fast transaction processing and minimal fees. The PoC is up and running, tokenizing the carbon savings generated by one of our colleagues photovoltaic system, and can be showcased in a demo. However, there are some clear optimisations to the process that should be considered for a larger scale (commercial) setup.

If you're interested in exploring the concept and benefits of a blockchain-based carbon offset process involving decentralised issuance and exchange of digital assets, or if you would like to see a demo, you can contact Robert Richter or Justus Schleicher.

The world of finance is changing rapidly. The adoption of cryptocurrencies, digital assets or other Blockchain-based solutions by corporations is already well underway.

As a result of the growing importance of this transformative technology and its applications, various regulatory initiatives and frameworks have emerged, such as Markets in Crypto-Assets Regulation (MiCAR), the Distributed Ledger Technology (DLT) Pilot Regime, and the Basel Committee on Banking Supervision (BCBS) crypto standard were launched, demonstrating the growing importance and adoption at both a global and national level. Given these trends, treasuries will be impacted by Blockchain one way or the other – if they aren’t already.

With the advent of cryptocurrencies and digital assets, it is important for treasurers to understand the issues at hand and have a strategy in place to deal with them. Based on our experience, typical questions that a treasurer faces are how to deal with the volatility of cryptocurrencies, how cryptocurrencies impact FX management, the accounting treatment for cryptocurrencies as well as KYC considerations. These developments are summarized in this article.

FX Risk Management and Volatility

History has shown that cryptocurrencies such as Bitcoin and Ether are highly volatile assets, which implies that the Euro value of 1 BTC can fluctuate significantly. Based on our experience, treasurers opt to sell their cryptocurrencies as quickly as possible in order to convert them into fiat currency – the currencies that they are familiar and which their cost basis is typically in. However, other solutions exist such as hedging positions via derivatives traded on regulated financial markets or conversions into so-called stablecoins1.

Accounting Treatment and Regulatory Compliance

Cryptocurrencies, including stablecoins, require careful accounting treatment and compliance with regulations. In most cases cryptocurrencies are classified as “intangible assets” under IFRS. For broker-traders they are, however, classified as inventory, depending on the circumstances. Inventory is measured at the lower of cost and net realizable value, while intangible assets are measured at cost or revaluation. Under GAAP, most cryptocurrencies are treated as indefinite-lived intangible assets and are impaired when the fair value falls below the carrying value. These impairments cannot be reversed. CBDCs, however, are not considered cryptocurrencies. Similarly, and the classification of stablecoins depends on their status as financial assets or instruments.

KYC/KYT Considerations

The adoption of cryptocurrencies and Blockchain technology introduces challenges for corporate treasurers in verifying counterparties and tracking transactions. When it comes to B2C transactions, treasurers may need to implement KYC (Know Your Customer) processes to verify the age and identity of individuals, ensuring compliance with age restrictions and preventing under-aged purchases, among other regulatory requirements. Whilst the process differs for B2B (business-to-business) transactions, the need for KYC exists nevertheless. However in the B2B space, the KYC process is less likely to be made more complex by transactions done in cryptocurrencies, since the parties involved are typically well-established companies or organizations with known identities and reputations.

Central Bank Digital Currencies

(CBDCs) are emerging as potential alternatives to privately issued stablecoins and other cryptocurrencies. Central banks, including the European Central Bank and the Peoples Banks of China, are actively exploring the development of CBDCs. These currencies, backed by central banks, introduce a new dimension to the financial landscape and will be another arrow in the quiver of end-customers – along with cash, credit and debit cards or PayPal. Corporate treasurers must prepare for the potential implications and opportunities that CBDCs may bring, such as changes in payment options, governance processes, and working capital management.

Adapting to the Future

Corporate treasurers should proactively prepare for the impact of cryptocurrencies and Blockchain technology on their business operations. This includes educating themselves on the basics of cryptocurrencies, stablecoins, and CBDCs, and investigating how these assets can be integrated into their treasury functions. Understanding the infrastructure, processes, and potential hedging strategies is crucial for treasurers to make informed decisions regarding their balance sheets. Furthermore, treasurers must evaluate the impact of new payment options on working capital and adjust their strategies accordingly.

Zanders understands the importance of keeping up with emerging technologies and trends, which is why we offer a comprehensive range of Blockchain services. Our Blockchain offering covers supporting our clients in developing their Blockchain strategy including developing proofs of concept, cryptocurrency integration into Corporate Treasury, support on vendor selection as well as regulatory advice. For decades Zanders has helped corporate treasurers navigate the choppy seas of change and disruption. We are ready to support you during this new era of disruption, so reach out to us today.

Meet the team

Zanders already has a well-positioned, diversified Blockchain team in place, consisting of Blockchain developers, Blockchain experts and business experts in their respective fields. In the following you will find a brief introduction of our lead Blockchain consultants.