Learn more about automating VaR attribution with Component VaR (CVaR), and how it can enhance efficiency and accuracy by replacing traditional, labor-intensive manual processes.

VaR has been one of the most widely used risk measures in banks for decades. However, due to the non-additive nature of VaR, explaining the causes of changes to VaR has always been challenging. VaR attribution techniques seek to identify the individual contributions, from specific positions, assets or risk factors to the portfolio-level VaR. For larger portfolios with many risk factors, the process can be complicated, time-consuming and computationally expensive.

In this article, we discuss some of the challenges with VaR attribution and describe some of the common methods for successful and efficient attribution. We also share insights into our own approach to performing VaR attribution, alongside our experience with delivering successful attribution frameworks for our clients.

The challenge of VaR attribution

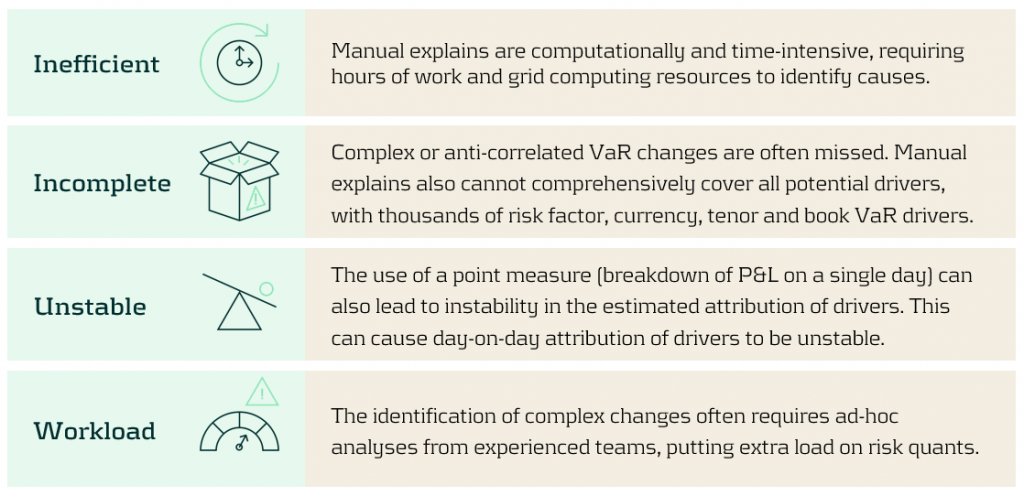

Providing attribution for changes in VaR due to day-on-day market moves and model changes is a common task for risk teams. The typical attribution approach is a manual investigation, drilling down into the data to isolate and identify VaR drivers. However, this can be a complex and time-consuming process, with thousands of potential factors that need to be analysed. This, compounded by the non-additive nature of VaR, can lead to attributions that may be incorrect or incomplete.

How is a manual explain performed?

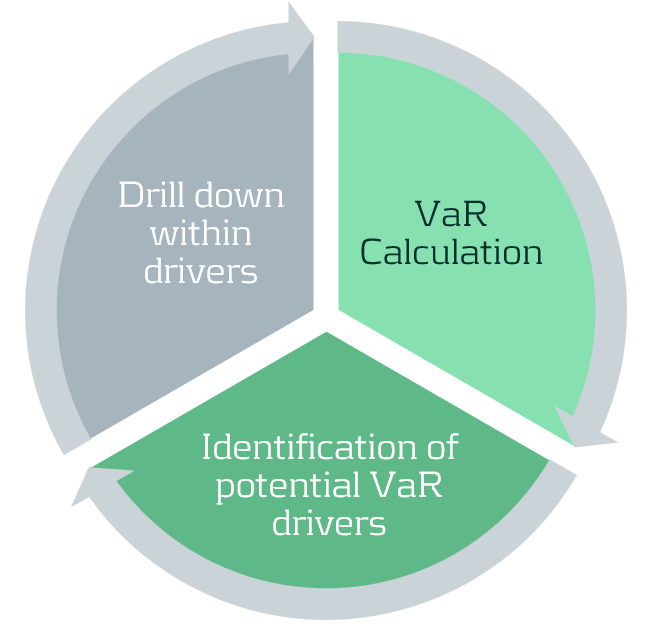

The manual explain is a common approach to attributing changes in VaR, which is often performed by inefficient ad-hoc analyses. A manual explain is an iterative approach where VaR is computed at increasingly higher granularities until VaR drivers can be isolated. This iterative drill-down is both computationally and time inefficient, often taking many iterations and hours of processing to isolate VaR drivers with sufficient granularity.

What problems are there with manual VaR explains?

There are several problems teams face when conducting manual VaR explains:

Our approach to performing VaR attribution

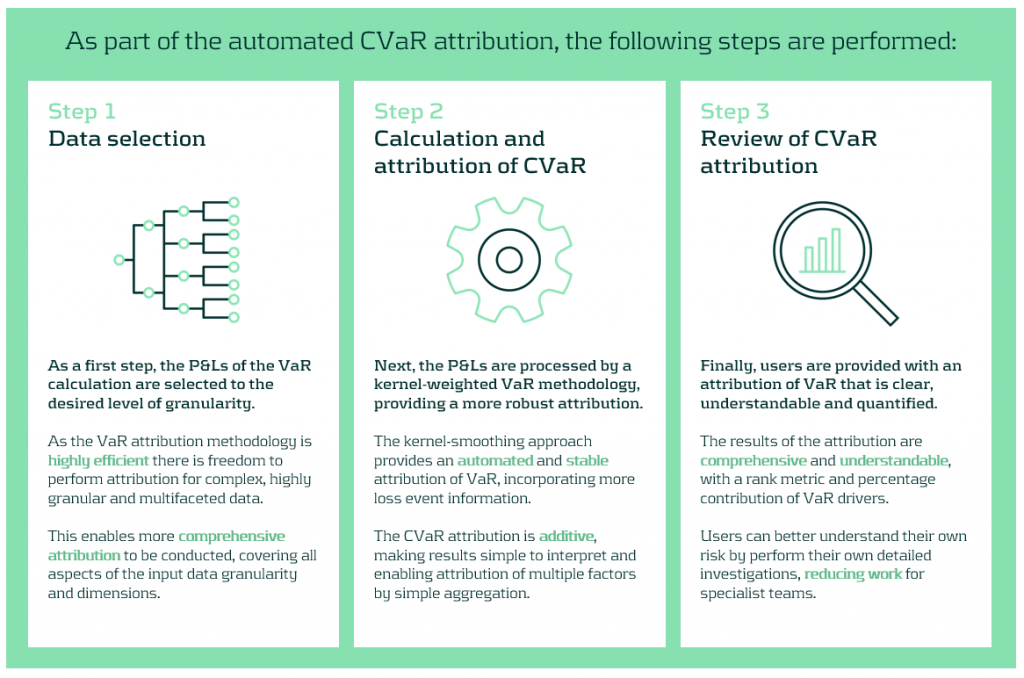

We propose an automated attribution approach to improve the efficiency and coverage of VaR explains. Our component VaR (CVaR) explain approach replaces the iterative and manual explain process with an automated process with three main steps.

First, risk P&Ls are selected at the desired level of granularity for attribution. This can cover a large number of dimensions at high granularity. Next, the data are analysed by a kernel-smoothed algorithm, which increases the stability and automates the attribution of VaR. Finally, users are provided with a comprehensive set of attribution results, enabling users to investigate their risk, determining and quantifying their core VaR drivers.

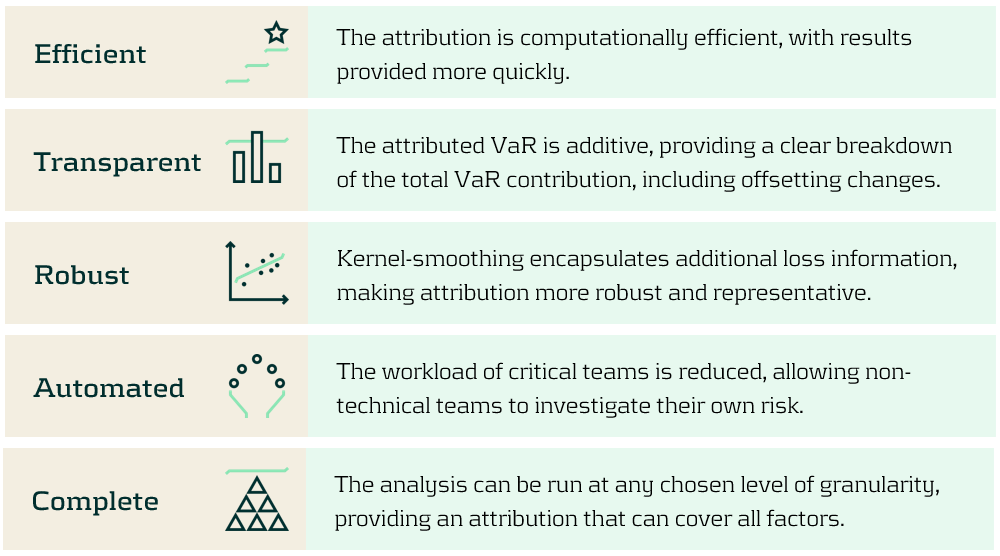

Benefits of the CVaR attribution methodology

CVaR attribution empowers users, enabling them to conduct their own VaR attribution analyses. This accelerates attribution for VaR and other percentile-based models, reducing the workload of specialised teams. The benefits our automated CVaR attribution methodology provides are presented below:

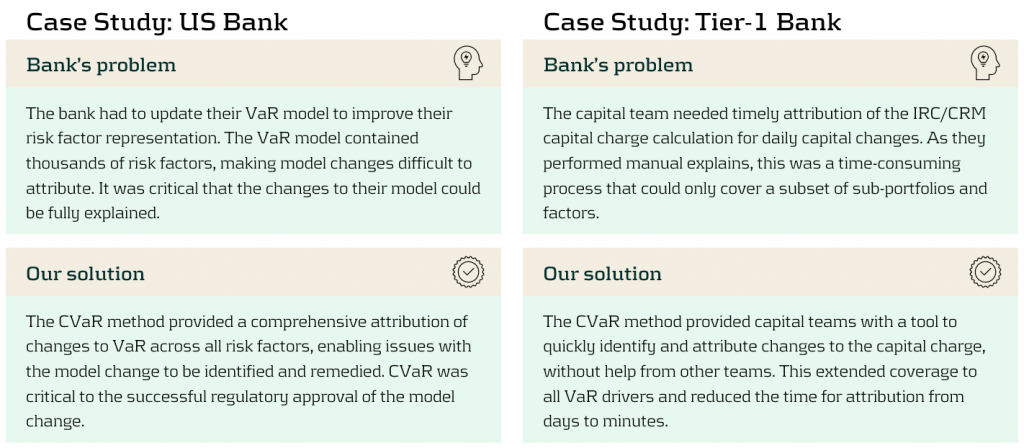

Zanders’ experiences with CVaR

We have implemented CVaR attribution for several large and complex VaR models, greatly improving efficiency and speed.

Conclusion

Although VaR attribution offers vital insights into the origins and drivers of risk, it is often complex and computationally demanding, particularly for large portfolios. Traditional manual methods are both time-consuming and inefficient. To address these challenges, we have proposed an automated CVaR attribution approach, which enhances efficiency, reduces workload, and provides timely and detailed risk driver insights. Our case studies demonstrate clear improvements in the coverage of VaR drivers and overall speed, enabling better risk management.

For more information on this topic, contact Dilbagh Kalsi (Partner) or Mark Baber (Senior Manager).