Market Insights

Market Information Wednesday 17 April 2024

The UK labour market is showing signs of cooling with core wage increases slowing down and unemployment rates rising, but concerns persist due to sustained high wage growth and increasing workforce inactivity, raising doubts about near-term interest rate cuts by the Bank of England.

Global recession risks have largely been mitigated, but the global economy is expected to experience only modest growth, according to German government sources citing upcoming International Monetary Fund forecasts; structural reforms are deemed necessary due to unsatisfactorily low growth projections for the medium term.

Canada’s annual inflation rate slightly increased to 2.9% in March, fueled by rising fuel costs, while core inflation measures showed signs of easing for the third consecutive month, suggesting the possibility of a mid-year interest rate cut by the Bank of Canada if these trends continue.

The 6M Euribor decreased with 5 basis points to 3.82% compared to previous business day. The 10Y Swap increased with 6 basis points to 2.81% compared to previous business day.

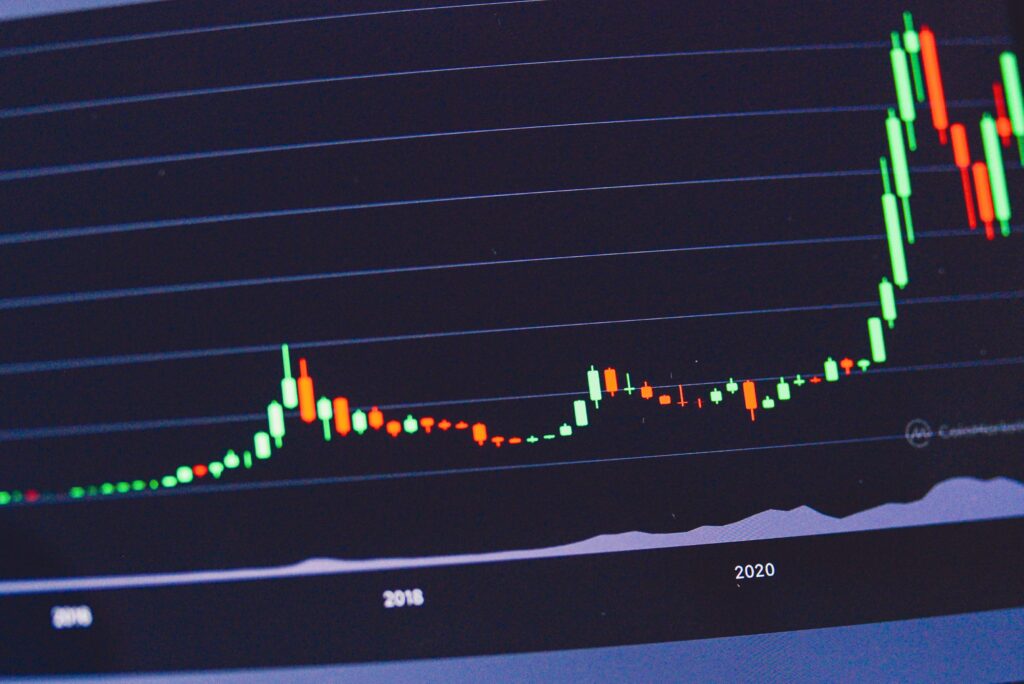

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.