Market Insights

Market Information Tuesday 5 February 2024

The Netherlands raised 2.39 billion euros with two short-term loans, the Ministry of Finance reported on Monday. The first loan, maturing on June 27, 2024, offers a yield of 3.75 percent, raising 1.29 billion euros. The outstanding amount is 3.77 billion euros. The second loan, maturing on August 29, 2024, raised 1.11 billion euros, also offering a yield of 3.75 percent. The initial target for both auctions was set at 1.0 to 1.5 billion euros. Subscriptions totalled 1.95 billion euros for the reopening and 1.40 billion euros for the new loan.

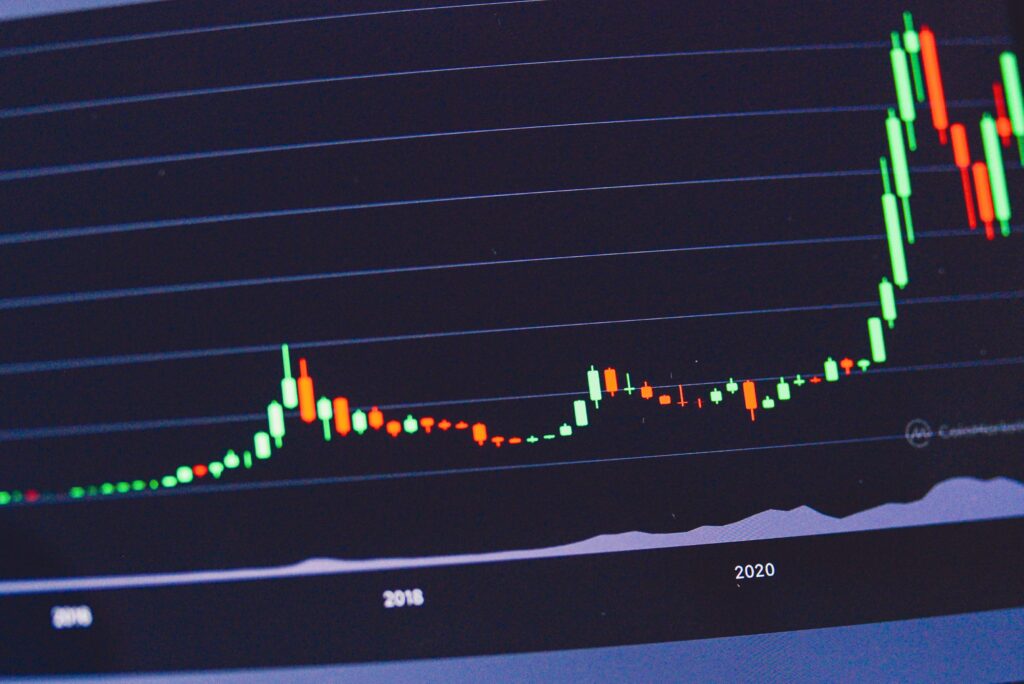

Bitcoin surged to a two-year high on Monday, surpassing $65,000 as a wave of investment brought it within reach of record levels. It reached a peak of $65,537 early in Europe, having already hit a new two-year high in Asian trading. Currently up 4% at $65,045, Bitcoin hit a record $68,999.99 in November 2021. The cryptocurrency, with the largest market value, has risen by 50% this year, with a significant portion of the increase occurring in recent weeks as inflows into U.S.-listed bitcoin funds surged.

At the start of the National People’s Congress, Premier Li Qiang announced an increase in defence spending by over 7%. Additionally, Beijing will issue $139 billion in long-term government bonds to support the economy. Notably, Li’s language regarding the intended reunification with Taiwan differed during the assembly. The main points shared by Chinese Premier Li Qiang during the opening of the National People’s Congress included an economic growth target of around 5%, increased defence spending, reduced energy consumption, and billions allocated to bolster the economy. The assembly, known as “The Two Sessions,” gathered around three thousand delegates in Beijing to discuss new plans, laws, and budgets for the upcoming week.

The 6M Euribor is unchanged at 3.91% compared to previous business day. The 10Y Swap decreased with 2 basis points to 2.70% compared to previous business day.

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.