Market Insights

Market Information Wednesday 17 January 2024

The Empire State Index, which measures industrial activity in the New York region, unexpectedly plunged from 14.5 positive to 43.7 negative in January, marking the lowest level since May 2020. Economists had, on average, anticipated a decline to 4.0 negative.

The ZEW index, a key German economic sentiment indicator reflecting the expectations of institutional investors, saw a rise from 12.8 to 15.2 in January, signalling a more optimistic economic outlook. Nevertheless, the current situation index dipped slightly from -77.1 in December to -77.3 in January.

On Tuesday, the oil price showed some volatility, ultimately declining by 0.4 percent to settle at $72.40 per barrel of West Texas Intermediate. Analysts point to instability in the Red Sea but emphasize that significant supply disruptions are needed to drive a substantial increase in oil prices. The OPEC monthly report and the weekly oil inventories in the U.S. are now seen as the next focal points for the market.

The 6M Euribor decreased with 3 basis points to 3.87% compared to previous business day. The 10Y Swap increased with 3 basis points to 2.65% compared to previous business day.

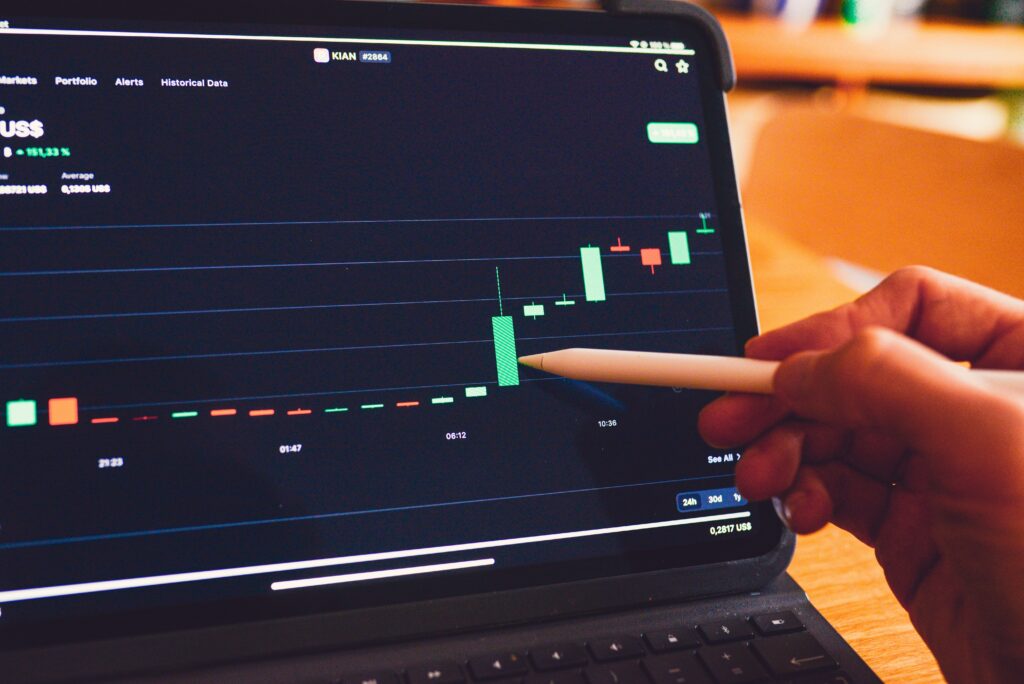

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.