Market Insights

Market Information Tuesday 15 April 2025

South Korea unveiled a 33 trillion won ($23.12B) support package to bolster its semiconductor sector amid rising U.S. tariff threats. The plan includes infrastructure subsidies, expanded low-interest loans, and R&D investments to safeguard key exporters like Samsung and SK Hynix. With semiconductors making up over 20% of exports, the move aims to maintain competitiveness as U.S. trade policy uncertainty grows.

UK retail sales rose 1.1% in March, driven by warm weather and seasonal events like Mother’s Day, but underlying economic pressures are mounting. While spending on gardening and DIY surged, high inflation, rising taxes, and weak big-ticket purchases indicate cautious consumer behavior. Businesses face squeezed margins as a looming price war and government cost hikes weigh on investment and hiring.

Americans are increasingly worried about job security, with a New York Fed survey showing a 44% perceived chance of higher unemployment within a year — the highest since April 2020. Despite continued job growth, rising near-term inflation expectations (3.6%) and uncertainty over U.S. trade policy may dampen consumer spending and economic momentum. Long-term inflation views remain stable, offering some reassurance.

The 6M Euribor increased with 5 basis points to 2.24% compared to previous business day. The 10Y Swap decreased with 7 basis points to 2.50% compared to previous business day.

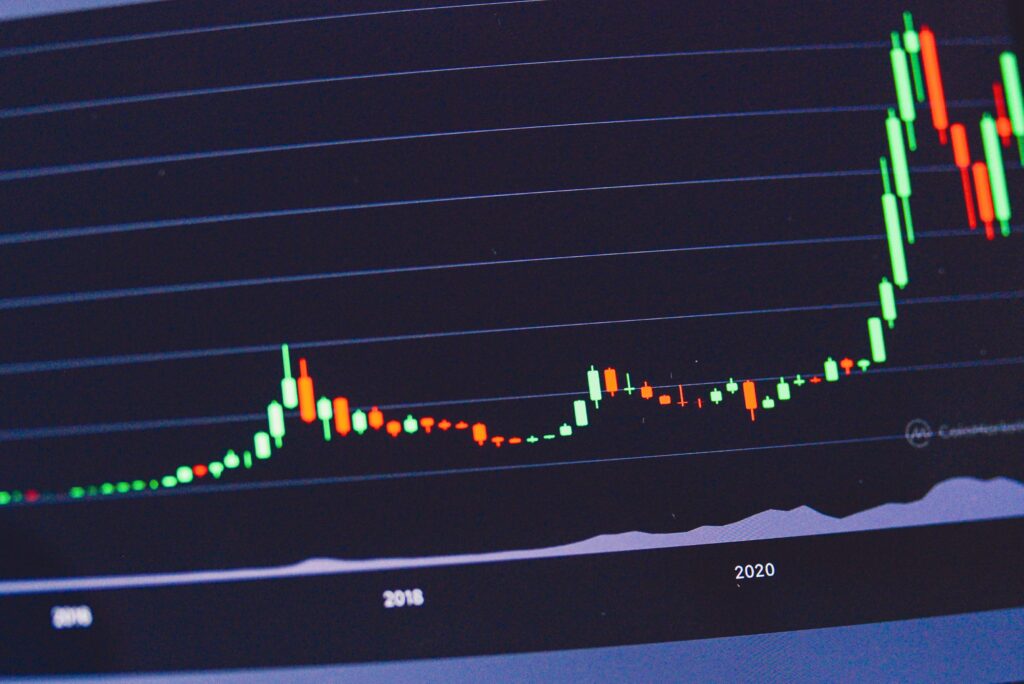

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.