Market Insights

Market Information Monday 9 December 2024

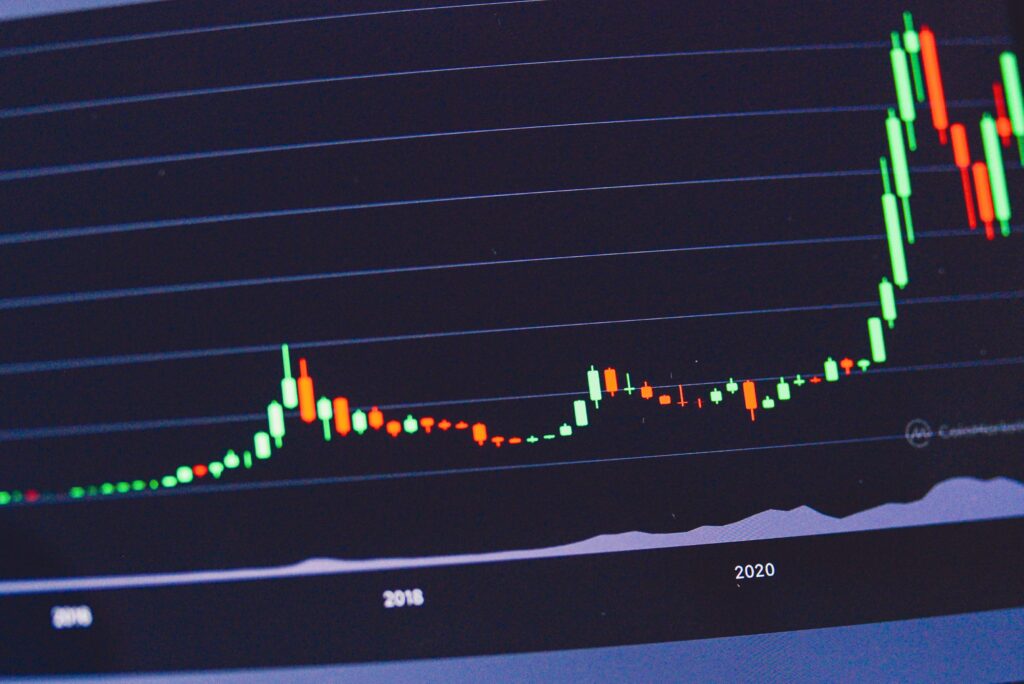

U.S. stocks rose Friday, with the Nasdaq gaining 0.8% and tech giants like Amazon and Apple hitting highs, while the S&P 500 rose 0.3%. The November jobs report showed 227,000 new jobs, boosting expectations for a Fed rate cut in December, despite unemployment ticking up to 4.2%. Bitcoin surged past $101,000, fueled by optimism around crypto-friendly policies from the incoming administration.

Despite the collapse of the French government, investors saw a rebound as the CAC 40 Index gained 2.8% this week, buoyed by short-covering and optimism about relative political stability. Bonds rallied, narrowing French-German yield spreads to the lowest in two weeks, while the euro stabilized around $1.05. Speculation over tax hikes and budget delivery further fueled market confidence.

President Vladimir Putin eased payment rules for Russian gas, allowing foreign buyers to use banks other than Gazprombank for ruble conversions, mitigating supply concerns amid U.S. sanctions. This new mechanism aims to maintain gas flows to Europe despite sanctions but adds complexity, requiring cooperative banks and alternative settlement methods. While European gas prices showed initial relief, stakeholders remain cautious about the decree’s broader implications.

The 6M Euribor increased with 1 basis point to 2.64% compared to previous business day. The 10Y Swap decreased with 1 basis point to 2.12% compared to previous business day.

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.