We explore six common challenges facing treasuries today and how Zanders’ Treasury Business Services could help you to ride out the storm.

In brief

- Despite an upturn in the economic outlook, uncertainty remains ingrained into business operations today.

- As a result, most corporate treasuries are experiencing operational challenges that are beyond their control.

- Treasuries that adapt by embedding more resilience and flexibility into their operations will be the ones that forge ahead.

- Zanders created Treasury Business Services to provide a customizable suite of niche expertise and flexible resourcing options for treasuries.

Treasuries today are expected to adapt faster than ever to challenges that are largely beyond their control. Here we outline the six most pressing issues affecting treasuries today that you not only need to be aware of, but also proactively planning for.

The financial headwinds that have weighed down on investment activity, liquidity, and returns in recent times are gradually easing. And while optimism is creeping back into our outlooks, it’s not necessarily an end to uncertainty for treasury teams. That appears to be here to stay. Talent shortages, a more transient workforce, an expanding treasury role, large-scale digitalization, the lingering impact of recent global crises and unexpected opportunities too. Deeply engrained uncertainty means there are a lot of plates to keep spinning when you’re running a treasury function today. The following six challenges are making this balancing act more arduous for the corporate treasurer, emphasizing the urgent need to build greater resilience and agility into their operations.

1. Peak load scenarios where performance is non-negotiable

There are situations where treasury simply must deliver. Period. Even when it does not have the resources. M&A and IT-related projects are good examples but there are many more. When these peak load scenarios occur, treasuries need to be prepared to handle them in a fast, flexible, and efficient way.

2. Demand for specialist treasury IT knowledge

A 2023 Treasury Technology survey found 53% of respondents were already using a TMS and a further 16% planned to implement within the next two years. It’s undeniable that technology now commands a dominant role in treasury processes, with investment in ERPs, TMSs, payment factories and e-banking portals a priority across the industry. However, the talent to implement and manage these complex IT systems is scarce, and costly to recruit and retain. And even when someone with the right skills and experience is identified and convinced to join, it often becomes apparent that a dedicated full-time employee might be excessive for the requirements of the role. This makes it even more difficult to fill this critical skills gap effectively and cost-efficiently.

3. The paradox of lowering labor costs while delivering more

Treasury has never been a department with a high headcount, but it’s still not immune to company-wide edicts to reduce labor expenditure. In this cost-cutting environment, the best most treasuries can hope for is a cap on their existing headcount. So, while treasuries are increasingly called on to deliver more and faster, they’re required to perform this expanded role without increasing headcount.

4. The evolution from a cost center to a performance-oriented business partner

Like the rest of your company, treasury must show a tangible contribution to the improvement of productivity and performance. This was the subject of our recent white paper – Treasury 4.x, the Age of Productivity, Performance & Steering. There are lots of ways to enable treasury to transition into this new more value-driven role – from introducing more automation, improving methodologies, and increasing use of data, to outsourcing certain activities. But all this comes with additional demands on budget, skills, and resources.

5. The talent pool isn’t sufficient to keep treasuries today afloat

The 2023 Association for Financial Professionals (AFP) Compensation Report suggests it has become increasingly difficult to fill open treasury positions. According to the survey, almost 60% of treasury and finance professionals said their organization was tackling a talent shortage. There are many reasons given for this. A competitive job market is certainly a dominant cause (as stated by 73% of organizations in the survey). But treasury is also facing a dearth of candidates with the necessary skills for their roles (indicated by 47% of organizations in the survey). As a result, treasury talent shortages are not only due to the general demographic challenges affecting all companies but also because treasury remains underrepresented in the higher education system.

6. A continually expanding treasury agenda

ESG, increased regulatory demands, the burden of administering digital payments – a constantly shifting treasury landscape not only requires additional resources but also niche skillsets and significant cross-departmental collaboration. In addition, the unprecedented challenges businesses have faced in recent years have placed a spotlight on treasury management as a critical resource for businesses. In 2022, an AFP survey found 35-43% treasury professionals were reporting a consistent increase in communication between treasury and the CFO. Further to this, a 2023 TIS survey found almost 50% of treasury professionals have become strategic partners with the CFO. This is further fueling an expanded and more complex treasury agenda, creating another pressure on skillsets and resources.

Uncertainty meets its match

These challenges are triggering uncertainty in treasuries. Do you have the resources and skill profiles you need? How can you give your team more bandwidth to deliver a constantly expanding treasury role? Who is going to manage the TMS you’ve just implemented? And what would happen if you unexpectedly lost a member of your team? We created our Treasury Business Services solution to support you as you maneuver uncertainty, enabling you to execute rapid performance improvements when you need them most.

TBS is a special unit of Zanders offering a wide range of niche treasury expertise and flexible resourcing options to treasuries. From running your treasury-IT platform and covering routine back-office tasks, to taking care of highly specialized activities and filling your temporary resource needs – our service is deliberately broad to give you optimal flexibility and more control to shape the support you need.

To find out more contact Carsten Jäkel.

Historical data is losing its edge. How can banks rely on forward-looking scenarios to future-proof non-maturing deposit models?

After a long period of negative policy rates within Europe, the past two years marked a period with multiple hikes of the overnight rate by central banks in Europe, such as the European Central Bank (ECB), in an effort to combat the high inflation levels in Europe. These increases led to tumult in the financial markets and caused banks to adjust the pricing of consumer products to reflect the new circumstances. These developments have given rise to a variety of challenges in modeling non-maturing deposits (NMDs). While accurate and robust models for non-maturing deposits are now more important than ever. These models generally consist of multiple building blocks, which together provide a full picture on the expected portfolio behavior. One of these building blocks is the calibration approach for parametrizing the relevant model elements, which is covered in this blog post.

One of the main puzzles risk modelers currently face is the definition of the expected repricing profile of non-maturing deposits. This repricing profile is essential for proper risk management of the portfolio. Moreover, banks need to substantiate modeling choices and subsequent parametrization of the models to both internal and external validation and regulatory bodies. Traditionally, banks used historically observed relationships between behavioral deposit components and their drivers for the parametrization. Because of the significant change in market circumstances, historical data has lost (part of) its forecasting power. As an alternative, many banks are now considering the use of forward-looking scenario analysis instead of, or in addition to, historical data.

The problem with using historical observations

In many European markets, the degree to which customer deposit rates track market rates (repricing) has decreased over the last decade. Repricing first decreased because banks were hesitant to lower rates below zero. And currently we still observe slower repricing when compared to past rising interest cycles, since interest rate hikes were not directly reflected in deposit rates. Therefore, the long period of low and even negative interest rates creates a bias in the historical data available for calibration, making the information less representative. Especially since the historical data does not cover all parts of the economic cycle. On the other hand, the historical data still contains relevant information on client and pricing behavior, such that fully ignoring observed behavior also does not seem sensible.

Therefore, to overcome these issues, Risk and ALM managers should analyze to what extent the historically repricing behavior is still representative for the coming years and whether it aligns with the banks’ current pricing strategy. Here, it could be beneficial for banks to challenge model forecasts by expectations following from economic rationale. Given the strategic relevance of the topic, and the impact of the portfolio on the total balance sheet, the bank’s senior management is typically highly involved in this process.

Improving models through forward looking information

Common sense and understanding deposit model dynamics are an integral part of the modeling process. Best practice deposit modeling includes forming a comprehensive set of possible (interest rate) scenarios for the future. To create a proper representation of all possible future market developments, both downward and upward scenarios should be included. The slope of the interest rate scenarios can be adjusted to reflect gradual changes over time, or sudden steepening or flattening of the curve. Pricing experts should be consulted to determine the expected deposit rate developments over time for each of the interest rate scenarios. Deposit model parameters should be chosen in such a way that its estimations on average provide the best fit for the scenario analysis.

When going through this process in your organization, be aware that the effects of consulting pricing experts go both ways. Risk and ALM managers will improve deposit models by using forward-looking business opinions and the business’ understanding of the market will improve through model forecasts.

Trying to define the most suitable calibration approach for your NMD model?

Would you like to know more about the challenges related to the calibration of NMD models based on historical data? Or would you like a comprehensive overview of the relevant considerations when applying forward-looking information in the calibration process?

Read our whitepaper on this topic: 'A comprehensive overview of deposit modeling concepts'

A webinar by SAP and Zanders explored optimizing treasury processes with SAP S/4HANA, focusing on enhanced cash management, automation, and compliance.

On the 22nd of August, SAP and Zanders hosted a webinar on the topic of optimizing your treasury processes with SAP S/4HANA, with the focus on how to benefit from S/4HANA for the cash & banking processes at a corporate. In this article, we summarize the main topics discussed during this webinar. The speakers came from both SAP, the software supplier of SAP S/4HANA, and from Zanders, which is providing advisory services in Treasury, Risk and Finance.

The ever-evolving Treasury landscape demands modern solutions to address complex challenges such as real-time visibility, regulatory compliance, and efficient cash management. Recognizing this need, the webinar offered an informative platform to discuss how SAP S/4HANA can be a game-changer for Treasury operations and, in specific, to bring efficiency and security to cash & banking processes.

To set the stage, the pressing issues faced by today's Treasury departments are navigating an increasingly complex regulatory environment, achieving real-time cash visibility, automating repetitive tasks, and managing banking communications efficiently. This introduction underscored the indispensable role that a robust technology platform like SAP S/4HANA can play in overcoming these challenges. The maintenance of consistent bank master data was given as an example of how challenging this management can be with a scattered ERP landscape.

Available below: Webinar Slides & Recording.

SAP S/4HANA: A New Era in Treasury Management

SAP S/4HANA, a next-generation enterprise resource planning (ERP) suite, stands out by offering integrated modules designed to handle various facets of treasury management, thus providing a consolidated view of financial data and enabling a single source of truth.

SAP S/4HANA's Treasury and Risk Management capabilities encompass cash management, financial risk management, payment processing, and liquidity forecasting. These tools are critical for a contemporary Treasury function looking to enhance visibility and control over financial operations.

Streamlined Cash Management

The core of the webinar focused on how SAP S/4HANA revolutionizes cash management. Real-time data analytics and predictive modeling were emphasized as the cornerstones of the platform’s cash management capabilities. The session elaborated on:

- Enhanced Cash Positioning: SAP S/4HANA provides real-time cash positioning, allowing Treasury departments to track cash flows across multiple bank accounts instantly. With the development of the new Fiori app, instant balances can be retrieved directly into the Cash Management Dashboard. This immediate visibility helps in making informed decisions regarding investments or borrowing needs.

- Liquidity Planning and Forecasting: By leveraging historical data and machine learning algorithms, SAP S/4HANA can provide accurate liquidity forecasts. The use of advanced analytics ensures you can anticipate cash shortages and surpluses well ahead of time, thereby optimizing working capital.

Efficient Banking Communications & Payment Processing

Managing communications with multiple banking partners can be a daunting task. SAP S/4HANA’s capabilities in automating and streamlining these communications through seamless integration. In addition to this integration, SAP S/4HANA facilitates efficient payment processing by consolidating payment requests and transmitting them to relevant banks through secure channels. This integration not only accelerates transaction execution but also ensures compliance with global payment standards.

Security and Compliance

Data security and compliance with regulatory standards are pivotal in Treasury operations. The experts detailed SAP S/4HANA’s robust security protocols and compliance tools designed to safeguard sensitive financial information. The features highlighted were:

- Data Encryption: End-to-end data encryption ensures that financial data remains secure both in transit and at rest. This is critical for protecting against data breaches and unauthorized access.

- Compliance Monitoring: The platform includes built-in compliance monitoring tools that help organizations adhere to regulatory requirements. Automated compliance checks and audit trails ensure that all Treasury activities are conducted within the legal framework.

S/4HANA sidecar for C&B processes

But how to make use of all these new functionalities in a scattered landscape corporates often have and how to efficiently execute such a project. By integrating with existing ERP systems, the sidecar facilitates centralized bank statement processing, automatic reconciliation, and efficient payment processing. Without disrupting the core functionality in the underlying ERP systems, it supports bank account and cash management, as well as Treasury operations. The sidecar's scalability and enhanced data insights help businesses optimize cash utilization, maintain compliance, and make informed financial decisions, ultimately leading to more streamlined and efficient cash and banking operations. The sidecar allows for a step-stone approach supporting an ultimate full migration to S/4HANA. This was explained again by a business case on how users can now update the posting rules themselves in S/4HANA, supported by AI, running in the background, making suggestions for an improved posting rule.

Conclusion & Next Steps

The webinar concluded with a strong message: SAP S/4HANA provides a transformative solution for Treasury departments striving to enhance their cash and banking processes. By leveraging its comprehensive suite of tools, organizations can achieve greater efficiency, enhanced security, and improved strategic insight into their financial operations.

To explore further how SAP S/4HANA can support your Treasury processes, we encourage you to reach out for personalized consultations. Embrace the future of treasury management with SAP S/4HANA and elevate your cash and banking operations to unprecedented levels of efficiency and control. If you want to further discuss how to make use of SAP S/4HANA or to discuss deployment options and how to get there, please contact Eliane Eysackers.

Model software is essential for financial risk management.

Banks perform data analytics, statistical modeling, and automate financial processes using model software, making model software essential for financial risk management.

Why banks are recently moving their model software to open-source1:

- Volume dependent costs: Open-source comes with flexible storage space and computation power and corresponding costs and capacity.

- Popularity: Graduates are often trained in open-source software, whereas the pool of skilled professionals in some specific software is decreasing.

- Customization: You can tailor it exactly to your own needs. Nothing more, nothing less.

- Collaboration: Required level of version control and collaboration with other software available within the bank.

- Performance: Customization and flexibility allow for enhanced performance.

Often there is a need to reconsider the model software solution the Bank is using; open-source solutions are cost effective and can be set up in such a way that both internal and external (e.g. regulatory) requirements are satisfied.

How Zanders can support in moving to open-source model software.

Proper implementation of open-source model software is compliant with regulation.

- Replication of historical situations is possible via version control, containerization and release notes within the open-source model software. Allowing third parties to replicate historical model outcomes and model development steps.

- Governance setup via open-source ensures that everything is auditable and is released in a governed way; this can be done through releases pipelines and by setting roles and responsibilities for software users.

- This ensures that the model goes from development to production only after governed review and approval by the correct stakeholders.

Migration to open-source software is achievable.

- The open-source model software is first implemented including governance (release processes and roles and responsibilities).

- Then all current (data and) models are refactored from the current model software to the new one.

- Only after an extensive period of successful (shadow) testing the migration to the new model software is completed.

Zanders has a wealth of experience performing these exercises at several major banks, often in parallel to (or combined with) model change projects. Hence, if you have interest, we will be happy to share some further insights into our latest experiences/solutions in this specific area.

Therefore, we welcome you to reach out to Ward Broeders (Senior Manager).

Citations

- 80% of Dutch banks are currently using either Python or R-Studio as model software. ↩︎

In the high-stakes world of private equity, where the pressure to deliver exceptional returns is relentless, the playbook is evolving.

In the high-stakes world of private equity, where the pressure to deliver exceptional returns is relentless, the playbook is evolving. Gone are the days when financial engineering—relying heavily on leveraged buyouts and cost-cutting—was the silver bullet for value creation. Today, the narrative is shifting toward a more sustainable, operationally driven approach, with treasury and finance optimization emerging as pivotal levers in this transformation.

In this article, we blend fictional examples, use cases and other real-world examples to vividly illustrate key concepts and drive our points home.

The Disconnect Between Promised and Delivered Operational Value

Limited Partners (LPs) are becoming more discerning in their investment decisions, increasingly demanding more than just financial returns. They expect General Partners (GPs) to deliver on promises of operational improvements that go beyond mere financial engineering. However, there is often a significant disconnect between the operational value creation promised by GPs and the reality, which frequently relies too heavily on short-term financial tactics.

A report by McKinsey highlights that while 60% of GPs claim to focus on operational improvements, only 40% of LPs feel that these efforts significantly impact portfolio performance. This gap between intention and execution underscores the need for GPs to align their value creation strategies with LP expectations. LPs are particularly focused on consistent investment strategies, strong management teams, and robust operational processes that drive sustainable growth. They view genuine operational value creation as the cornerstone of a repeatable and sustainable investment strategy, offering reassurance that future fund generations will perform consistently.

Treasury: The Unsung Hero of Value Creation

Treasury functions, once seen as mere back-office operations, are increasingly recognized as crucial drivers of value in private equity. These functions—ranging from cash management to financial risk mitigation—are the lifeblood of any portfolio company.

The evolution of treasury functions, now known as Treasury 4.x, has transformed them into pivotal drivers of value. These modernized treasury roles—encompassing advanced cash management and risk mitigation—now align financial operations with broader strategic goals, leveraging technology and data analytics to optimize performance.

Yet, many firms struggleto appreciate just how much inefficiencies in these areas can erode value. Poor liquidity management, fragmented cash operations, and outdated financial processes can strangle a company's ability to invest in growth and hamstring its potential to capitalize on market opportunities.

Consider the example of a mid-sized European manufacturing firm acquired by a private equity investor. Initially, the focus was solely on scaling revenue by entering new markets. However, it soon became apparent that fragmented treasury operations were hemorrhaging resources, particularly due to decentralized cash management systems across multiple jurisdictions.

By centralizing these operations into a single source of truth, like a treasury management system (TMS), the company was able to cut down on redundant processes, improve visibility and central control on cash, reduce external borrowing cost and cash related operational costs by 20%. This freed up capital that was then reinvested into R&D and expansion efforts, positioning the firm to seize new growth opportunities with agility.

Cash Flow Forecasting: The Financial Crystal Ball

In the realm of private equity, where every dollar counts, cash flow forecasting is not just a routine exercise—it’s a strategic imperative. Accurate cash flow forecasting provides a clear window into a company's financial future, offering transparency that is invaluable for both internal decision-makers and external stakeholders, especially Limited Partners (LPs) who demand rigorous insights into their investments.

Take, for example, a mid-market technology firm backed by private equity, poised to launch a groundbreaking product. Initially, the firm’s cash flow forecasts were rudimentary, lacking the sophistication needed to anticipate the working capital needs for the product launch phase. As a result, the company nearly ran into a liquidity crisis that could have delayed the launch.

By overhauling its cash flow forecasting processes and incorporating scenario analysis, the company was able to better anticipate cash needs, secure bridge financing, and ensure a successful product rollout, which ultimately boosted investor confidence.

Navigating Financial Risks in a Volatile World

In today’s unpredictable economic landscape, managing financial risks such as currency fluctuations and interest rate spikes is more critical than ever. As private equity firms increasingly engage in cross-border acquisitions, the exposure to foreign exchange risk has become a significant concern. Similarly, the current high-interest-rate environment complicates debt management, adding layers of complexity to financial operations.

Consider a global consumer goods company within a private equity portfolio, operating in regions with volatile currencies like Brazil or South Africa. Without a robust FX hedging strategy, the company was previously exposed to unpredictable swings in cash flows due to exchange rate fluctuations, which affected its ability to meet debt obligations denominated in foreign currencies.

By implementing a comprehensive FX hedging strategy, including the use of natural hedges, the firm was able to lock in favorable exchange rates, stabilize its cash flows, and protect its margins. This not only ensured financial stability but also allowed the company to reinvest profits into expanding its footprint in emerging markets.

Treasury in M&A: A Crucial Integration Component

Treasury management is often the linchpin in the success or failure of mergers and acquisitions (M&A). The ability to seamlessly integrate treasury operations is essential for realizing the synergies promised by a merger. Failure to do so can lead to significant financial inefficiencies, eroding the anticipated value.

A cautionary tale can be seen in General Electric’s acquisition of Alstom Power, where unforeseen integration challenges led to substantial restructuring costs. The treasury teams faced difficulties in aligning the cash management systems and integrating different financial cultures, which delayed synergies realization and led to missed financial targets.

Conversely, in another M&A scenario involving the merger of two mid-sized logistics firms, a pre-emptive focus on treasury integration—such as harmonizing cash pooling arrangements and consolidating banking relationships—enabled the new entity to achieve cost synergies ahead of schedule, saving millions in operational expenses and improving free cash flow.

Streamlined Treasury and Finance: Driving Strategic Value and Returns in Private Equity

Streamlined treasury and finance operations are crucial for maximizing value in private equity. These enhancements go beyond cost savings, improving a company's agility and resilience by ensuring financial resources are available precisely when needed. This empowers portfolio companies to seize growth opportunities while driving cost savings and better resource utilization through operational efficiency. Optimizing cash management and liquidity also enables companies to better navigate market volatility, reducing risks such as poor cash flow forecasting.

Enhanced transparency and real-time data visibility lead to more informed decision-making, aligning with long-term value creation strategies. This not only strengthens investor confidence but also prepares companies for successful exits by making them more attractive to potential buyers. Improved free cash flow directly boosts the money-on-money multiple, enhancing financial outcomes for private equity investors.

Conclusion

In today’s private equity landscape, the strategic importance of treasury and finance optimization is undeniable. The era of relying solely on financial engineering is over. A comprehensive approach that includes robust treasury management and operational efficiency is now essential for driving sustainable growth and maximizing value. By addressing treasury inefficiencies, private equity firms can unlock significant value, ensuring portfolio companies have the financial health to thrive. This approach meets the rising expectations of Limited Partners, setting the stage for long-term success and profitable exits.

If you're interested in delving deeper into the benefits of strategic treasury management for private equity firms, you can contact Job Wolters.

Explore how Basel IV reforms and enhanced due diligence requirements will transform regulatory capital assessments for credit risk, fostering a more resilient and informed financial sector.

The Basel IV reforms, which are set to be implemented on 1 January 2025 via amendments to the EU Capital Requirement Regulation, have introduced changes to the Standardized Approach for credit risk (SA-CR). The Basel framework is implemented in the European Union mainly through the Capital Requirements Regulation (CRR3) and Capital Requirements Directive (CRD6). The CRR3 changes are designed to address shortcomings in the existing prudential standards, by among other items, introducing a framework with greater risk sensitivity and reducing the reliance on external ratings. Action by banks is required to remain compliant with the CRR. Overall, the share of RWEA derived through an external credit rating in the EU-27 remains limited, representing less than 10% of the total RWEA under the SA with the CRR.

Introduction

The Basel Committee on Banking Supervision (BCBS) identified the excessive dependence on external credit ratings as a flaw within the Standardised Approach (SA), observing that firms frequently used these ratings to compute Risk-Weighted Assets (RWAs) without adequately understanding the associated risks of their exposures. To address this issue, regulators have implemented changes aimed to reduce the mechanical reliance on external credit ratings and to encourage firms to use external credit ratings in a more informed manner. The objective is to diminish the chances of underestimating financial risks in order to further build a more resilient financial industry. Overall, the share of Risk Weighted Assets (RWA) derived through an external credit rating remains limited, and in Europe it represents less than 10% of the total RWA under the SA.

The concept of due diligence is pivotal in the regulatory framework. It refers to the rigorous process financial institutions are expected to undertake to understand and assess the risks associated with their exposures fully. Regulators promote due diligence to ensure that banks do not solely rely on external assessments, such as credit ratings, but instead conduct their own comprehensive analysis.

The due diligence is a process performed by banks with the aim of understanding the risk profile and characteristics of their counterparties at origination and thereafter on a regular basis (at least annually). This includes assessing the appropriateness of risk weights, especially when using external ratings. The level of due diligence should match the size and complexity of the bank's activities. Banks must evaluate the operating and financial performance of counterparties, using internal credit analysis or third-party analytics as necessary, and regularly access counterparty information. Climate-related financial risks should also be considered, and due diligence must be conducted both at the solo entity level and consolidated level.

Banks must establish effective internal policies, processes, systems, and controls to ensure correct risk weight assignment to counterparties. They should be able to prove to supervisors that their due diligence is appropriate. Supervisors are responsible for reviewing these analyses and taking action if due diligence is not properly performed.

Banks should have methodologies to assess credit risk for individual borrowers and at the portfolio level, considering both rated and unrated exposures. They must ensure that risk weights under the Standardised Approach reflect the inherent risk. If a bank identifies that an exposure, especially an unrated one, has higher inherent risk than implied by its assigned risk weight, it should factor this higher risk into its overall capital adequacy evaluation.

Banks need to ensure they have an adequate understanding of their counterparties’ risk profiles and characteristics. The diligent monitoring of counterparties is applicable to all exposures under the SA. Banks would need to take reasonable and adequate steps to assess the operating and financial condition of each counterparty.

Rating System

The external credit assessment institutions (ECAIs) are credit rating agencies recognised by National supervisors. The External Credit ECAIs play a significant role in the SA through the mapping of each of their credit assessments to the corresponding risk weights. Supervisors will be responsible for assigning an eligible ECAI’s credit risk assessments to the risk weights available under the SA. The mapping of credit assessments should reflect the long-term default rate.

Exposures to banks, exposures to securities firms and other financial institutions and exposures to corporates will be risk-weighted based on the following hierarchy External Credit Risk Assessment Approach (ECRA) and the Standardised Credit Risk Assessment Approach (SCRA).

ECRA: Used in jurisdictions allowing external ratings. If an external rating is from an unrecognized or non-nominated ECAI, the exposure is considered unrated. Also, banks must perform due diligence to ensure ratings reflect counterparty creditworthiness and assign higher risk weights if due diligence reveals greater risk than the rating suggests.

SCRA: Used where external ratings are not allowed. Applies to all bank exposures in these jurisdictions and unrated exposures in jurisdictions allowing external ratings. Banks classify exposures into three grades:

- Grade A: Adequate capacity to meet obligations in a timely manner.

- Grade B: Substantial credit risk, such as repayment capacities that are dependent on stable or favourable economic or business conditions.

- Grade C: Higher credit risk, where the counterparty has material default risks and limited margins of safety

The CRR Final Agreement includes a new article (Article 495e) that allows competent authorities to permit institutions to use an ECAI credit assessment assuming implicit government support until December 31, 2029, despite the provisions of Article 138, point (g).

In cases where external credit ratings are used for risk-weighting purposes, due diligence should be used to assess whether the risk weight applied is appropriate and prudent.

If the due diligence assessment suggests an exposure has higher risk characteristics than implied by the risk weight assigned to the relevant Credit Quality Step (CQS) of an exposure, the bank would assign the risk weight at least one higher than the CQS indicated by the counterparty’s external credit rating.

Criticisms to this approach are:

- Banks are mandated to use nominated ECAI ratings consistently for all exposures in an asset class, requiring banks to carry out a due diligence on each and every ECAI rating goes against the principle of consistent use of these ratings.

- When banks apply the output floor, ECAI ratings act as a backstop to internal ratings. In case the due diligence would imply the need to assign a high-risk weight, the output floor could no longer be used consistently across banks to compare capital requirements.

Implementation Challenges

The regulation requires the bank to conduct due diligence to ensure a comprehensive understanding, both at origination and on a regular basis (at least annually), of the risk profile and characteristics of their counterparties. The challenges associated with implementing this regulation can be grouped into three primary categories: governance, business processes, and systems & data.

Governance

The existing governance framework must be enhanced to reflect the new responsibilities imposed by the regulation. This involves integrating the due diligence requirements into the overall governance structure, ensuring that accountability and oversight mechanisms are clearly defined. Additionally, it is crucial to establish clear lines of communication and decision-making processes to manage the new regulatory obligations effectively.

Business Process

A new business process for conducting due diligence must be designed and implemented, tailored to the size and complexity of the exposures. This process should address gaps in existing internal thresholds, controls, and policies. It is essential to establish comprehensive procedures that cover the identification, assessment, and monitoring of counterparties' risk profiles. This includes setting clear criteria for due diligence, defining roles and responsibilities, and ensuring that all relevant staff are adequately trained.

Systems & Data

The implementation of the regulation requires access to accurate and comprehensive data necessary for the rating system. Challenges may arise from missing or unavailable data, which are critical for assessing counterparties' risk profiles. Furthermore, reliance on manual solutions may not be feasible given the complexity and volume of data required. Therefore, it is imperative to develop robust data management systems that can capture, store, and analyse the necessary information efficiently. This may involve investing in new technology and infrastructure to automate data collection and analysis processes, ensuring data integrity and consistency.

Overall, addressing these implementation challenges requires a coordinated effort across the organization, with a focus on enhancing governance frameworks, developing comprehensive business processes, and investing in advanced systems and data management solutions.

How can Zanders help?

As a trusted advisor, we built a track record of implementing CRR3 throughout a heterogeneous group of financial institutions. This provides us with an overview of how different entities in the industry deal with the different implementation challenges presented above.

Zanders has been engaged to provide project management for these Basel IV implementation projects. By leveraging the expertise of Zanders' subject matter experts, we ensure an efficient and insightful gap analysis tailored to your bank's specific needs. Based on this analysis, combined with our extensive experience, we deliver customized strategic advice to our clients, impacting multiple departments within the bank. Furthermore, as an independent advisor, we always strive to challenge the status quo and align all stakeholders effectively.

In-depth Portfolio Analysis: Our initial step involves conducting a thorough portfolio scan to identify exposures to both currently unrated institutions and those that rely solely on government ratings. This analysis will help in understanding the extent of the challenge and planning the necessary adjustments in your credit risk framework.

Development of Tailored Models: Drawing from our extensive experience and industry benchmarks, Zanders will collaborate with your project team to devise a range of potential solutions. Each solution will be detailed with a clear overview of the required time, effort, potential impact on Risk-Weighted Assets (RWA), and the specific steps needed for implementation. Our approach will ensure that you have all the necessary information to make informed strategic decisions.

Robust Solutions for Achieving Compliance: Our proprietary Credit Risk Suite cloud platform offers banks robust tools to independently assess and monitor the credit quality of corporate and financial exposures (externally rated or not) as well as determine the relevant ECRA and SCRA ratings.

Strategic Decision-Making Support: Zanders will support your Management Team (MT) in the decision-making process by providing expert advice and impact analysis for each proposed solution. This support aims to equip your MT with the insights needed to choose the most appropriate strategy for your institution.

Implementation Guidance: Once a decision has been made, Zanders will guide your institution through the specific actions required to implement the chosen solution effectively. Our team will provide ongoing support and ensure that the implementation is aligned with both regulatory requirements and your institution’s strategic objectives.

Continuous Adaptation and Optimization: In response to the dynamic regulatory landscape and your bank's evolving needs, Zanders remains committed to advising and adjusting strategies as needed. Whether it's through developing an internal rating methodology, imposing new lending restrictions, or reconsidering business relations with unrated institutions, we ensure that your solutions are sustainable and compliant.

Independent and Innovative Thinking: As an independent advisor, Zanders continuously challenges the status quo, pushing for innovative solutions that not only comply with regulatory demands but also enhance your competitive edge. Our independent stance ensures that our advice is unbiased and wholly in your best interest.

By partnering with Zanders, you gain access to a team of dedicated professionals who are committed to ensuring your successful navigation through the regulatory complexities of Basel IV and CRR3. Our expertise and tailored approaches enable your institution to manage and mitigate risks efficiently while aligning with the strategic goals and operational realities of your bank. Reach out to Tim Neijs or Marco Zamboni for further comments or questions.

REFERENCE

[1] BCBS, The Basel Framework, Basel https://www.bis.org/basel_framework

[2] Regulation (EU) No 575/2013

[3] Directive 2013/36/EU

[4] EBA Roadmap on strengthening the prudential framework

[5] EBA REPORT ON RELIANCE ON EXTERNAL CREDIT RATINGS

An overview of how the new CRR3 regulation impacts banks’ capital requirements for credit risk and its implications for the 2025 EU-wide stress test, based on EBA’s findings.

With the introduction of the updated Capital Requirements Regulation (CRR3), which has entered into force on 9 July 2024, the European Union's financial landscape is poised for significant changes. The 2025 EU-wide stress test will be a major assessment to measure the resilience of banks under these new regulations. This article summarizes the estimated impact of CRR3 on banks’ capital requirements for credit risk based on the results of a monitoring exercise executed by the EBA in 2022. Furthermore, this article comments on the potential impact of CRR3 to the upcoming stress test, specifically from a credit risk perspective, and describes the potential implications for the banking sector.

The CRR3 regulation, which is the implementation of the Basel III reforms (also known as Basel IV) into European law, introduces substantial updates to the existing framework [1], including increased capital requirements, enhanced risk assessment procedures and stricter reporting standards. Focusing on credit risk, the most significant changes include:

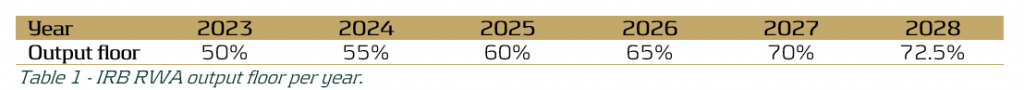

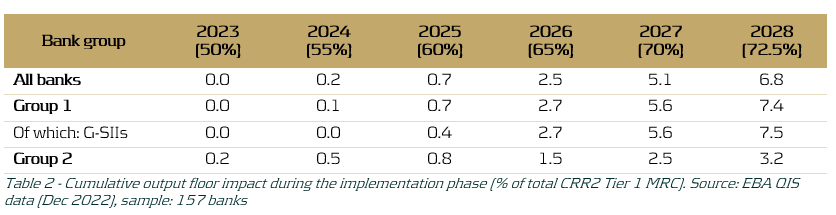

- The phased increase of the existing output floor to internally modelled capital requirements, limiting the benefit of internal models in 2028 to 72.5% of the Risk Weighted Assets (RWA) calculated under the Standardised Approach (SA), see Table 1. This floor is applied on consolidated level, i.e. on the combined RWA of all credit, market and operational risk.

- A revised SA to enhance robustness and risk sensitivity, via more granular risk weights and the introduction of new asset classes.1

- Limiting the application of the Advanced Internal Ratings Based (A-IRB) approach to specific asset classes. Additionally, new asset classes have been introduced.2

After the launch of CRR3 in January 2025, 68 banks from the EU and Norway, including 54 from the Euro area, will participate in the 2025 EU-wide stress test, thus covering 75% of the EU banking sector [2]. In light of this exercise, the EBA recently published their consultative draft of the 2025 EU-wide Stress Test Methodological Note [3], which reflects the regulatory landscape shaped by CRR3. During this forward-looking exercise the resilience of EU banks in the face of adverse economic conditions will be tested within the adjusted regulatory framework, providing essential data for the 2025 Supervisory Review and Evaluation Process (SREP).

The consequences of the updated regulatory framework are an important topic for banks. The changes in the final framework aim to restore credibility in the calculation of RWAs and improve the comparability of banks' capital ratios by aligning definitions and taxonomies between the SA and IRB approaches. To assess the impact of CRR3 on the capital requirements and whether this results in the achievement of this aim, the EBA executed a monitoring exercise in 2022 to quantify the impact of the new regulations, and published the results (refer to the report in [4]).

For this monitoring exercise the EBA used a sample of 157 banks, including 58 Group 1 banks (large and internationally active banks), of which 8 are classified as a Global Systemically Important Institution (G-SII), and 99 Group 2 banks. Group 1 banks are defined as banks that have Tier 1 capital in excess of EUR 3 billion and are internationally active. All other banks are labelled as Group 2 banks. In the report the results are separated per group and per risk type.

Looking at the impact on the credit risk capital requirements specifically caused by the revised SA and the limitations on the application of IRB, the EBA found that the median increase of current Tier 1 Minimum Required Capital3 (hereafter “MRC”) is approximately 3.2% over all portfolios, i.e. SA and IRB approach portfolios. Furthermore, the median impact on current Tier 1 MRC for SA portfolios is approximately 2.1% and for IRB portfolios is 0.5% (see [4], page 31). This impact can be mainly attributed to the introduction of new (sub) asset classes with higher risk weights on average. The largest increases are expected for ‘equities’, ‘equity investment in funds’ and ‘subordinated debt and capital instruments other than equity’. Under adverse scenarios the impact of more granular risk weights may be magnified due to a larger share of exposures having lower credit ratings. This may result in additional impact on RWA.

The revised SA results in more risk-sensitive capital requirements predictions over the forecast horizon due to the more granular risk weights and newly introduced asset classes. This in turn allows banks to more clearly identify their risk profile and provides the EBA with a better overview of the performance of the banking sector as a whole under adverse economic conditions. Additionally, the impact on RWA caused by the gradual increase of the output floor, as shown in Table 1, was estimated. As shown in Table 2, it was found that the gradual elevation of the output floor increasingly affects the MRC throughout the phase-in period (2023-2028).

Table 2 demonstrates that the impact is minimal in the first three years of the phase-in period, but grows significantly in the last three years of the phase-in period, with an average estimated 7.5% increase in Tier 1 MRC for G-SIIs in 2028. The larger increase in Tier 1 MRC for Group 1 banks, and G-SIIs in particular, as compared to Group 2 banks may be explained by the fact that larger banks more often employ an IRB approach and are thus more heavily impacted by an increased IRB floor, relative to their smaller counterparts. The expected impact on Group 1 banks is especially interesting in the context of the EU-wide stress test, since for the regulatory stress test only the 68 largest banks in Europe participate. Assuming that banks need to employ an increasing version of the output floor for their projections during the 2025 EU-wide stress test, this could lead to significant increases in capital requirements in the last years of the forecast horizon of the RWA projections. These increases may not be fully attributed to the adverse effects of the provided macroeconomic scenarios.

Conversely, it is good to note that a transition cap has been introduced by the Basel III reforms and adopted in CRR3. This cap puts a limit on the incremental increase of the output floor impact on total RWAs. The transitional period cap is set at 25% of a bank’s year-to-year increase in RWAs and may be exercised at the discretion of supervisors on a national level (see [5]). As a consequence, this may limit the observed increase in RWA during the execution of the 2025 EU-wide stress test.

In conclusion, the implementation of CRR3 and its adoption into the 2025 EU-wide stress test methodology may have a significant impact on the stress test results, mainly due to the gradual increase in the IRB output floor but also because of changes in the SA and IRB approaches. However, this effect may be partly mitigated by the transitional 25% cap on year-on-year incremental RWA due to the output floor increase. Additionally, the 2025 EU-wide stress test will provide a comprehensive view of the impact of CRR3, including the closer alignment between the SA and the IRB approaches, on the development of capital requirements in the banking sector under adverse conditions.

References:

- final_report_on_amendments_to_the_its_on_supervisory_reporting-crr3_crd6.pdf (europa.eu)

- The EBA starts dialogue with the banking industry on 2025 EU-Wide stress test methodology | European Banking Authority (europa.eu)

- 2025 EU-wide stress test - Methodological Note.pdf (europa.eu)

- Basel III monitoring report as of December 2022.pdf (europa.eu)

- Basel III: Finalising post-crisis reforms (bis.org)

Citations

- This includes the addition of the ‘Subordinated debt exposures’ asset class, as well as an additional branch of specialized lending exposures within the corporates asset class. Furthermore, a more detailed breakdown of exposures secured by mortgages on immovable property and acquisition, development and construction financing? has been introduced. ↩︎

- For in detailed information on the added asset classes and limited application of IRB refer to paragraph 25 of the report in [1]. ↩︎

- Tier 1 capital refers to the core capital held in a bank's reserves. It includes high-quality capital, predominantly in the form of shares and retained earnings that can absorb losses. The Tier 1 MRC is the minimum capital required to satisfy the regulatory Tier 1 capital ratio (ratio of a bank's core capital to its total RWA) determined by Basel and is an important metric the EBA uses to measure a bank’s health. ↩︎

Defining the challenges that prevent increased Treasury participation in the commodity risk management strategy and operations and proposing a framework to address these challenges.

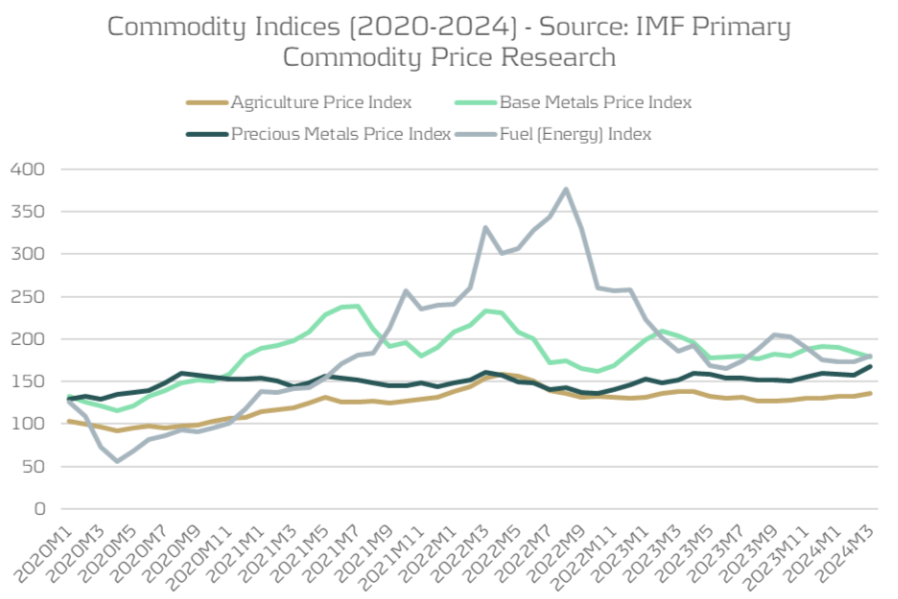

The heightened fluctuations observed in the commodity and energy markets from 2021 to 2022 have brought Treasury's role in managing these risks into sharper focus. While commodity prices stabilized in 2023 and have remained steady in 2024, the ongoing economic uncertainty and geopolitical landscape ensures that these risks continue to command attention. Building a commodity risk framework that is in-line with the organization’s objectives and unique exposure to different commodity risks is Treasury’s key function, but it must align with an over-arching holistic risk management approach.

Figure 1: Commodity index prices (Source: IMF Primary Commodity Price Research)

Traditionally, when treasury has been involved in commodity risk management, the focus is on the execution of commodity derivatives hedging. However, rarely did that translate into a commodity risk management framework that is fully integrated into the treasury operations and strategy of a corporate, particularly in comparison to the common frameworks applied for FX and interest rate risk.

On the surface it seems curious that corporates would have strict guidelines on hedging FX transaction risk, while applying a less stringent set of guidelines when managing material commodity positions. This is especially so when the expectation is often that the risk bearing capacity and risk appetite of a company should be no different when comparing exposure types.

The reality though is that commodity risk management for corporates is far more diverse in nature than other market risks, where the business case, ownership of tasks, and hedging strategy bring new challenges to the treasury environment. To overcome these challenges, we need to address them and understand them better.

Risk management framework

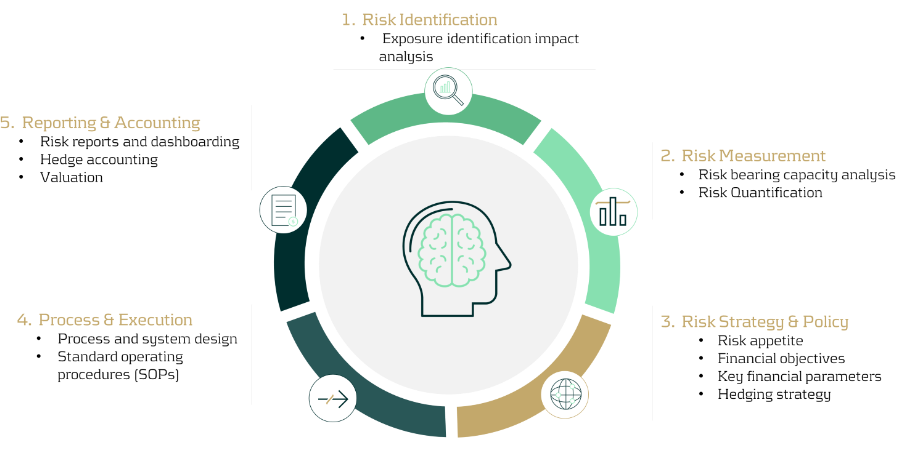

To first identify all the challenges, we need to analyze a typical market risk management framework, encompassing the identification, monitoring and mitigation aspects, in order to find the complexities specifically related to commodity risk management.

Figure 2: Zanders’ Commodity Risk Management Framework.

In the typical framework that Zanders’ advocates, the first step is always to gain understanding through:

- Identification: Establish the commodity exposure profile by identifying all possible sources of commodity exposure, classifying their likelihood and impact on the organization, and then prioritizing them accordingly.

- Measurement: Risk quantification and measurement refers to the quantitative analysis of the exposure profile, assessing the probability of market events occurring and quantifying the potential impact of the commodity price movements on financial parameters using common techniques such as sensitivity analysis, scenario analysis, or simulation analysis (pertaining to cashflow at risk, value at risk, etcetera).

- Strategy & Policy: With a clear understanding of the existing risk profile, the objectives of the risk management framework can be defined, giving special consideration to the specific goals of procurement teams when formulating the strategy and policy. The hedging strategy can then be developed in alignment with the established financial risk management objectives.

- Process & Execution: This phase directly follows the development of the hedging strategy, defining the toolbox for hedging and clearly allocating roles and responsibilities.

- Monitoring & Reporting: All activities should be supported by consistent monitoring and reporting, exception handling capabilities, and risk assessments shared across departments.

We will discuss each of these areas next in-depth and start to consider how teams of various skillsets can be combined to provide organizations with a best practice approach to commodity risk management.

Exposure identification & measurement is crucial

A recent Zanders survey and subsequent whitepaper revealed that the primary challenge most corporations face in risk management processes is data visibility and risk identification. Furthermore, identifying commodity risks is significantly more nuanced compared to understanding more straightforward risks such as counterparty or interest rate exposures.

Where the same categorization of exposures between transaction and economic risk apply to commodities (see boxout), there are additional layers of categorization that should be considered, especially in regard to transaction risk.

Transactions and economic risks affect a company's cash flows.

While transaction risk represents the future and known cash flows,

Economic risk represents the future (but unknown) cash flows.

Direct exposures: Certain risks may be viewed as direct exposures, where the commodity serves as a necessary input within the manufacturing supply chain, making it crucial for operations. In this scenario, financial pricing is not the only consideration for hedging, but also securing the delivery of the commodity itself to avoid any disruption to operations. While the financial risk component of this scenario sits nicely within the treasury scope of expertise, the physical or delivery component requires the expertise of the procurement team. Cross-departmental cooperation is therefore vital.

Indirect exposures: These exposures may be more closely aligned to FX exposures, where the risk is incurred only in a financial capacity, but no consideration is needed of physical delivery aspects. This is commonly experienced explicitly with indexation on the pricing conditions with suppliers, or implicitly with an understanding that the supplier may adjust the fixed price based on market conditions.

As with any market risk, it is important to maintain the relationship with procurement teams to ensure that the exposure identifications and assumptions used remain true

Indirect exposures may provide a little more independence for treasury teams in exercising the hedging decision from an operational perspective, particularly with strong systems support, reporting on and capturing the commodity indexation on the contracts, and analyzing how fixed price contracts are correlating with market movements. However, as with any market risk, it is important to maintain the relationship with procurement teams to ensure that the exposure identifications and assumptions used remain true.

Only once an accurate understanding of the nature and characteristics of the underlying exposures has been achieved can the hedging objectives be defined, leading to the creation of the strategy and policy element in the framework.

Strategy & Policy

Where all the same financial objectives of financial risk management such as ‘predictability’ and ‘stability’ are equally applicable to commodity risk management, additional non-financial objectives may need to be considered for commodities, such as ensuring delivery of commodity materials.

In addition, as the commodity risk is normally incurred as a core element of the operational processes, the objective of the hedging policy may be more closely aligned to creating stability at a product or component level and incorporated into the product costing processes. This is in comparison to FX where the impact from FX risk on operations falls lower in priority and the financial objectives at group or business unit level take central focus.

The exposure identification for each commodity type may reveal vastly different characteristics, and consequently the strategic objectives of hedging may differ by commodity and even at component level. This will require unique knowledge in each area, further confirming that a partnership approach with procurement teams is needed to adequately create effective strategy and policy guidelines.

Process and Execution

When a strategy is in place, the toolbox of hedging instruments available to the organization must be defined. For commodities, this is not only limited to financial derivatives executed by treasury and offsetting natural hedges. Strategic initiatives to reduce the volume of commodity exposure through manufacturing processes, and negotiations with suppliers to fix commodity prices within the contract are only a small sample of additional tools that should be explored.

Both treasury and procurement expertise is required throughout the commodity risk management Processing and Execution steps. This creates a challenge in defining a set of roles and responsibilities that correctly allocate resources against the tasks where the respective treasury and procurement subject matter experts can best utilize their knowledge.

As best practice, Treasury should be recognized as the financial market risk experts, ideally positioned to thoroughly comprehend the impact of commodity market movements on financial performance. The Treasury function should manage risk within a comprehensive, holistic risk framework through the execution of offsetting financial derivatives. Treasurers can use the same skillset and knowledge that they already use to manage FX and IR risks.

Procurement teams on the other hand will always have greater understanding of the true nature of commodity exposures, as well as an understanding of the supplier’s appetite and willingness to support an organizations’ hedging objectives. Apart from procurements understanding of the exposure, they may also face the largest impact from commodity price movements. Importantly, the sourcing and delivery of the actual underlying commodities and ensuring sufficient raw material stock for business operations would also remain the responsibility of procurement teams, as opposed to treasury who will always focus on price risk.

Clearly both stakeholders have a role to play, with neither providing an obvious reason to be the sole owner of tasks operating in isolation of the other. For simplicity purposes, some corporates have distinctly drawn a line between the procurement and treasury processes, often with procurement as the dominant driver. In this common workaround, Treasury is often only used for the hedging execution of derivatives, leaving the exposure identification, impact analysis and strategic decision-making with the procurement team. This allocation of separate responsibilities limits the potential of treasury to add value in the area of their expertise and limits their ability to innovate and create an improved end-to-end process. Operating in isolation also segregates commodity risk from a greater holistic risk framework approach, which the treasury may be trying to achieve for the organization.

One alternative to allocating tasks departmentally and distinctly would be to find a bridge between the stakeholders in the form of a specialized commodity and procurement risk team with treasury and procurement acting together in partnership. Through this specialized team, procurement objectives and exposure analysis may be combined with treasury risk management knowledge to ensure the most appropriate resources perform each task in-line with the objectives. This may not always be possible with the available resources, but variations of this blended approach are possible with less intrusive changes to the organizational structure.

Conclusion

With treasury trends pointing towards adopting a holistic view of risk management, together with a backdrop of global economic uncertainty and geopolitical instability, it may be time to face the challenges limiting Treasury’s role in commodity risk management and set up a framework that addresses these challenges. Treasury’s closer involvement should best utilize the talent in an organization, gain transparency to the exposures and risk profile in times of uncertainty and enable agile end-to-end decision-making with improved coordination between teams.

These advantages carry substantial potential value in fortifying commodity risk management practices to uphold operational stability across diverse commodity market conditions.

Learn more about automating VaR attribution with Component VaR (CVaR), and how it can enhance efficiency and accuracy by replacing traditional, labor-intensive manual processes.

VaR has been one of the most widely used risk measures in banks for decades. However, due to the non-additive nature of VaR, explaining the causes of changes to VaR has always been challenging. VaR attribution techniques seek to identify the individual contributions, from specific positions, assets or risk factors to the portfolio-level VaR. For larger portfolios with many risk factors, the process can be complicated, time-consuming and computationally expensive.

In this article, we discuss some of the challenges with VaR attribution and describe some of the common methods for successful and efficient attribution. We also share insights into our own approach to performing VaR attribution, alongside our experience with delivering successful attribution frameworks for our clients.

The challenge of VaR attribution

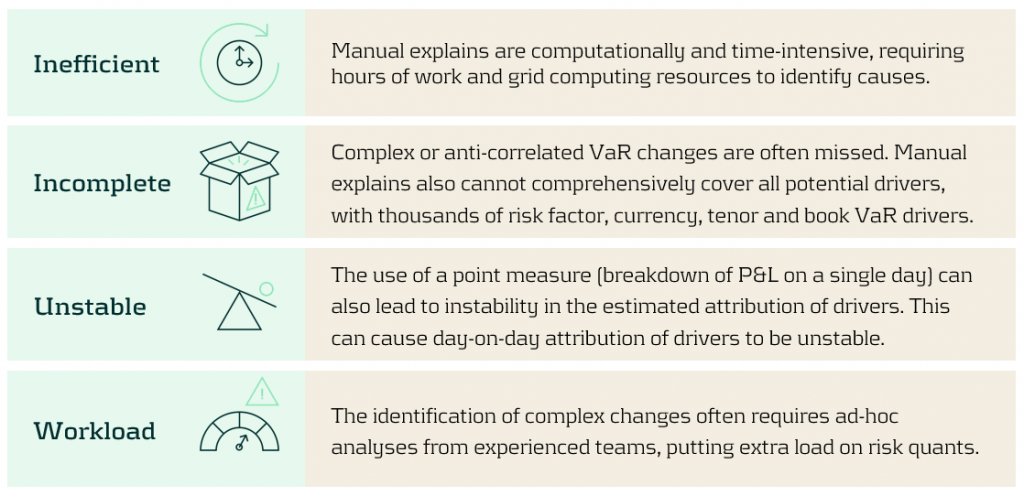

Providing attribution for changes in VaR due to day-on-day market moves and model changes is a common task for risk teams. The typical attribution approach is a manual investigation, drilling down into the data to isolate and identify VaR drivers. However, this can be a complex and time-consuming process, with thousands of potential factors that need to be analysed. This, compounded by the non-additive nature of VaR, can lead to attributions that may be incorrect or incomplete.

How is a manual explain performed?

The manual explain is a common approach to attributing changes in VaR, which is often performed by inefficient ad-hoc analyses. A manual explain is an iterative approach where VaR is computed at increasingly higher granularities until VaR drivers can be isolated. This iterative drill-down is both computationally and time inefficient, often taking many iterations and hours of processing to isolate VaR drivers with sufficient granularity.

What problems are there with manual VaR explains?

There are several problems teams face when conducting manual VaR explains:

Our approach to performing VaR attribution

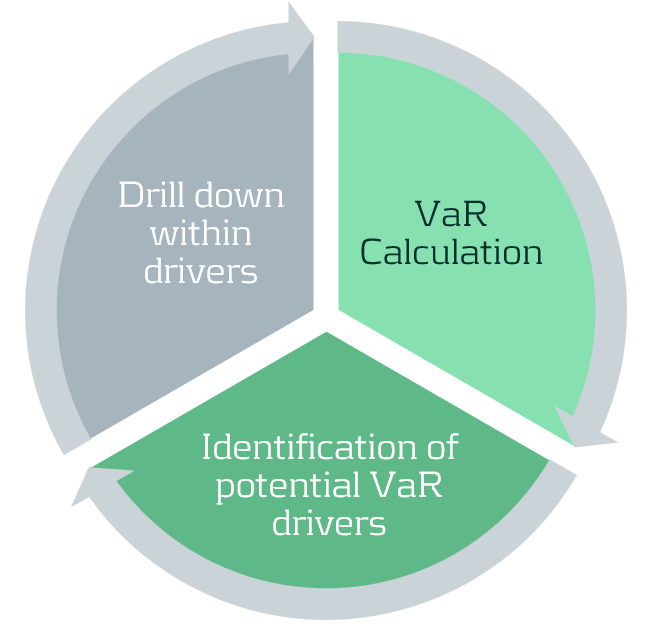

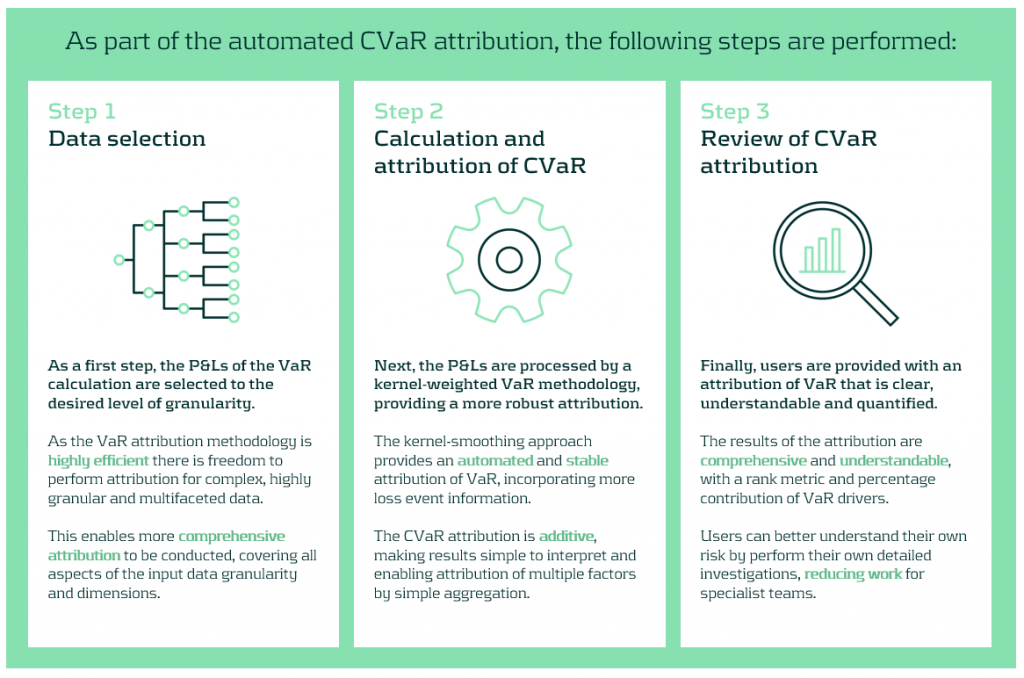

We propose an automated attribution approach to improve the efficiency and coverage of VaR explains. Our component VaR (CVaR) explain approach replaces the iterative and manual explain process with an automated process with three main steps.

First, risk P&Ls are selected at the desired level of granularity for attribution. This can cover a large number of dimensions at high granularity. Next, the data are analysed by a kernel-smoothed algorithm, which increases the stability and automates the attribution of VaR. Finally, users are provided with a comprehensive set of attribution results, enabling users to investigate their risk, determining and quantifying their core VaR drivers.

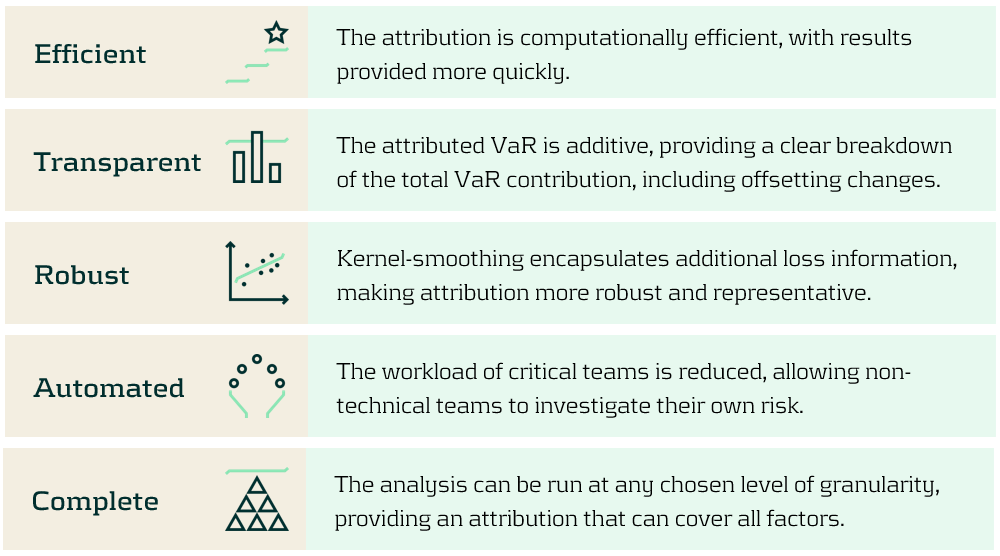

Benefits of the CVaR attribution methodology

CVaR attribution empowers users, enabling them to conduct their own VaR attribution analyses. This accelerates attribution for VaR and other percentile-based models, reducing the workload of specialised teams. The benefits our automated CVaR attribution methodology provides are presented below:

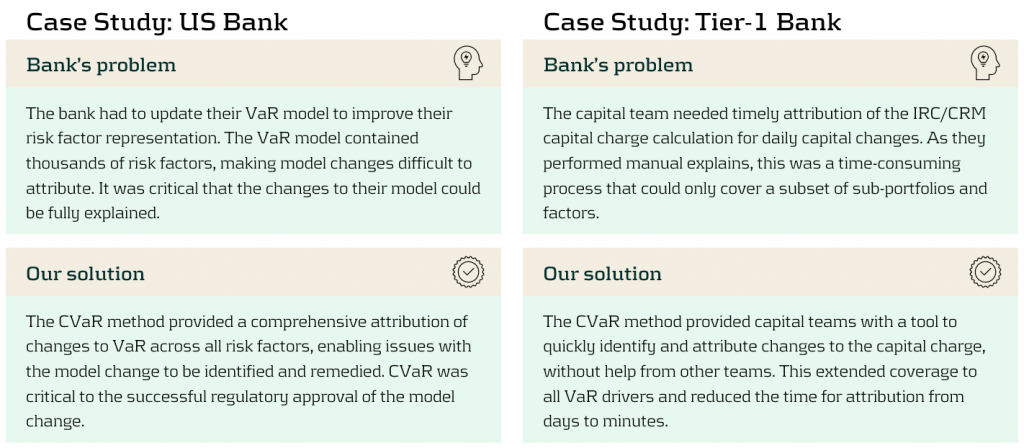

Zanders’ experiences with CVaR

We have implemented CVaR attribution for several large and complex VaR models, greatly improving efficiency and speed.

Conclusion

Although VaR attribution offers vital insights into the origins and drivers of risk, it is often complex and computationally demanding, particularly for large portfolios. Traditional manual methods are both time-consuming and inefficient. To address these challenges, we have proposed an automated CVaR attribution approach, which enhances efficiency, reduces workload, and provides timely and detailed risk driver insights. Our case studies demonstrate clear improvements in the coverage of VaR drivers and overall speed, enabling better risk management.

For more information on this topic, contact Dilbagh Kalsi (Partner) or Mark Baber (Senior Manager).

Covid-19 exposed flaws in banks’ risk models, prompting regulatory exemptions, while new EBA guidelines aim to identify and manage future extreme market stresses.

The Covid-19 pandemic triggered unprecedented market volatility, causing widespread failures in banks' internal risk models. These backtesting failures threatened to increase capital requirements and restrict the use of advanced models. To avoid a potentially dangerous feedback loop from the lower liquidity, regulators responded by granting temporary exemptions for certain pandemic-related model exceptions. To act faster to future crises and reduce unreasonable increases to banks’ capital requirements, more recent regulation directly comments on when and how similar exemptions may be imposed.

Although FRTB regulation briefly comments on such situations of market stress, where exemptions may be imposed for backtesting and profit and loss attribution (PLA), it provides very little explanation of how banks can prove to the regulators that such a scenario has occurred. On 28th June, the EBA published its final draft technical standards on extraordinary circumstances for continuing the use of internal models for market risk. These standards discuss the EBA’s take on these exemptions and provide some guidelines on which indicators can be used to identify periods of extreme market stresses.

Background and the BCBS

In the Basel III standards, the Basel Committee on Banking Supervision (BCBS) briefly comment on rare occasions of cross-border financial market stress or regime shifts (hereby called extreme stresses) where, due to exceptional circumstances, banks may fail backtesting and the PLA test. In addition to backtesting overages, banks often see an increasing mismatch between Front Office and Risk P&L during periods of extreme stresses, causing trading desks to fail PLA.

The BCBS comment that one potential supervisory response could be to allow the failing desks to continue using the internal models approach (IMA), however only if the banks models are updated to adequately handle the extreme stresses. The BCBS make it clear that the regulators will only consider the most extraordinary and systemic circumstances. The regulation does not, however, give any indication of what analysis banks can provide as evidence for the extreme stresses which are causing the backtesting or PLA failures.

The EBA’s standards

The EBA’s conditions for extraordinary circumstances, based on the BCBS regulation, provide some more guidance. Similar to the BCBS, the EBA’s main conditions are that a significant cross-border financial market stress has been observed or a major regime shift has taken place. They also agree that such scenarios would lead to poor outcomes of backtesting or PLA that do not relate to deficiencies in the internal model itself.

To assess whether the above conditions have been met, the EBA will consider the following criteria:

- Analysis of volatility indices (such as the VIX and the VSTOXX), and indicators of realised volatilities, which are deemed to be appropriate to capture the extreme stresses,

- Review of the above volatility analysis to check whether they are comparable to, or more extreme than, those observed during COVID-19 or the global financial crisis,

- Assessment of the speed at which the extreme stresses took place,

- Analysis of correlations and correlation indicators, which adequately capture the extreme stresses, and whether a significant and sudden change of them occurred,

- Analysis of how statistical characteristics during the period of extreme stresses differ to those during the reference period used for the calibration of the VaR model.

The granularity of the criteria

The EBA make it clear that the standards do not provide an exhaustive list of suitable indicators to automatically trigger the recognition of the extreme stresses. This is because they believe that cases of extreme stresses are very unique and would not be able to be universally captured using a small set of prescribed indicators.

They mention that defining a very specific set of indicators would potentially lead to banks developing automated or quasi-automated triggering mechanisms for the extreme stresses. When applied to many market scenarios, this may lead to a large number of unnecessary triggers due the specificity of the prescribed indicators. As such, the EBA advise that the analysis should take a more general approach, taking into consideration the uniqueness of each extreme stress scenario.

Responses to questions

The publication also summarises responses to the original Consultation Paper EBA/CP/2023/19. The responses discuss several different indicators or factors, on top of the suggested volatility indices, that could be used to identify the extreme stresses:

- The responses highlight the importance of correlation indicators. This is because stress periods are characterised by dislocations in the market, which can show increased correlations and heightened systemic risk.

- They also mention the use of liquidity indicators. This could include jumps of the risk-free rates (RFRs) or index swap (OIS) indicators. These liquidity indicators could be used to identify regime shifts by benchmarking against situations of significant cross-border market stress (for example, a liquidity crisis).

- Unusual deviations in the markets may also be strong indicators of the extreme stresses. For example, there could be a rapid widening of spreads between emerging and developed markets triggered by regional debt crisis. Unusual deviations between cash and derivatives markets or large difference between futures/forward and spot prices could also indicate extreme stresses.

- They suggest that restrictions on trading or delivery of financial instruments/commodities may be indicative of extreme stresses. For example, the restrictions faced by the Russian ruble due to the Russia-Ukraine war.

- Finally, the responses highlighted that an unusual amount of backtesting overages, for example more than 2 in a month, could also be a useful indicator.

Zanders recommends

It’s important that banks are prepared for potential extreme stress scenarios in the future. To achieve this, we recommend the following:

- Develop a holistic set of indicators and metrics that capture signs of potential extreme stresses,

- Use early warning signals to preempt potential upcoming periods of stress,

- Benchmark the indicators and metrics against what was observed during the great financial crisis and Covid-19,

- Create suitable reporting frameworks to ensure the knowledge gathered from the above points is shared with relevant teams, supporting early remediation of issues.

Conclusion

During extreme stresses such as Covid-19 and the global financial crisis, banks’ internal models can fail, not because of modeling issues but due to systemic market issues. Under FRTB, the BCBS show that they recognise this and, in these rare situations, may provide exemptions. The EBA’s recently published technical standards provide better guidance on which indicators can be used to identify these periods of extreme stresses. Although they do not lay out a prescriptive and definitive set of indicators, the technical standards provide a starting point for banks to develop suitable monitoring frameworks.

For more information on this topic, contact Dilbagh Kalsi (Partner) or Hardial Kalsi (Manager).