For banks, using variable savings as a source of financing differs fundamentally from ‘professional’ sources of financing.

For banks, using variable savings as a source of financing differs fundamentally from ‘professional’ sources of financing. What risks are involved and how do you determine the return? With capital market financing, such as bond financing, the redemption is known in advance and the interest coupon is fixed for a longer period of time. Financing using variable savings differs from this on two points: the client can withdraw the money at any given time and the bank has the right to adjust the interest rate when it wants to. An essential question here is: why would a bank opt to use savings for financing rather than other sources of financing? The answer to this question is not a simple one, but has to do with the relationship between risk and return.

DETERMINING RETURNS ON THE SAVINGS PORTFOLIO

How do you determine the yield on savings? In order to get as accurate an estimate as possible of the return on a balance sheet instrument, the client rate for a product is often compared to what is called the internal benchmark price, also referred to as the ‘funds transfer price’ (FTP). For savings, the FTP represents the theoretical yield achieved from investing these funds. The difference between the theoretical yield and the actual costs (which includes not only the costs of paying interest on savings, but also the operating/IT costs, for instance) can be regarded as the return on the savings. Calculating this theoretical yield is not a simple task, however. It is often based on a notional investment portfolio, with the same interest rate and liquidity periods as the savings. These periods reflect the interest rate and liquidity characteristics of the savings.

"By ensuring that the expected outflow of savings coincides with the expected influx from investments, the liquidity requirements can be satisfied in the future as well."

MANAGING MARGIN RISK

The question that now arises is: what risks do the savings pose for the bank? Fluctuating market interest rates have an impact on both the yields on the investments and the interest costs on the savings. Although the bank has the right to set its own interest rate, there is a great deal of dependency since banks often follow the interest rate of the market (i.e., their competitors) in order to retain their volume of savings. The bank is therefore exposed to margin risk if the income from the investments does not keep pace with the savings rate offered to clients.

The risk-free interest rate is often the biggest driver behind these kinds of movements on the market for savings interest. The dependency between the savings interest and risk-free interest is indicated using the (estimated) interest rate period. This information makes it possible to mitigate the margin risk in two ways. The interest rate period of the investment portfolio can be aligned with the savings, which causes this income to respond to the interest-free interest rate to the same degree as the costs of paying the savings interest rate. It is also possible to enter into interest rate swaps to influence the interest rate period of the investments.

ASSESSING LIQUIDITY RISK

The liquidity risk of savings manifests if clients withdraw their money and the bank does not have enough cash/liquid investments to comply with these withdrawals. By ensuring that the expected outflow of savings coincides with the expected influx from investments, the liquidity requirements can be satisfied in the future as well. Consequently a bank will be less likely to find itself forced to raise financing or sell illiquid investments in crisis situations. A bank also maintains liquidity buffers for its liquidity requirements in the short term; the regulator requires it to do this by means of the LCR (Liquidity Coverage Ratio) requirement. Since it is expensive to maintain liquidity buffers, a bank aims for a prudent liquidity buffer, but one that is as low as possible. It is also essential for the bank to determine the liquidity period (how long savings remain in the client’s account). It must do this in order to manage the liquidity risk, but also to determine the right level of cash buffers, which improves the return. Savings modeling is a must In order to get the right insight into savings - and to manage them - it is essential to determine both the interest rate period and liquidity period of those savings. It is only with this information that management can gain insight into how the return on savings relates to the margin and liquidity risk.

Regulators are also putting increasing pressure on banks to have better insight into savings. In interest rate risk management, for instance, DNB requires that the interest rate risk of savings be properly substantiated. There is also increasing attention to this from the standpoint of liquidity risk management, for instance as part of the ILAAP (Internal Liquidity Adequacy Assessment Process). Modeling of savings is therefore an absolute must for banks.

GROWING INTEREST IN SAVINGS

At the end of 2012, approximately EUR 950 million of the total of EUR 2.7 billion on Dutch banks’ balance sheets was financed with private savings. EUR 545 million of this comes from Dutch households and businesses. Given the fact that the credit extended to this sector totals EUR 997 million, the Dutch funding gap is the highest of all the euro-zone countries except for Ireland. Since the start of the financial crisis in 2008, there have been two developments that have contributed to the growing interest in savings on the part of banks. First of all, after the collapse of the (inter-bank) money and capital markets, banks had to seek out alternative stable sources of financing. Secondly, compared to other forms of financing, savings have secured a relatively favourable position in the liquidity regulations under Basel III. This culminated in a price war on the savings market in 2010.

Credit rating agencies and the credit ratings they publish have been the subject of a lot of debate over the years. While they provide valuable insight in the creditworthiness of companies, they have been criticized for assigning high ratings to package sub-prime mortgages, for not being representative when a sudden crisis hits and the effect they have on creating ‘self fulfilling prophecies’ in times of economic downturn.

For all the criticism that rating models and credit rating agencies have had through the years, they are still the most pragmatic and realistic approach for assessing default risk for your counterparties. Of course, the quality of the assessment depends to a large extent on the quality of the model used to determine the credit rating, capturing both the quantitative and qualitative factors determining counterparty credit risk. A sound credit rating model strikes a balance between these two aspects. Relying too much on quantitative outcomes ignores valuable ‘unstructured’ information, whereas an expert judgement based approach ignores the value of empirical data, and their explanatory power.

In this white paper we will outline some best practice approaches to assessing default risk of a company through a credit rating. We will explore the ratios that are crucial factors in the model and provide guidance for the expert judgement aspects of the model.

Zanders has applied these best practices while designing several Credit Rating models for many years. These models are already being used at over 400 companies and have been tested both in practice and against empirical data. Do you want to know more about our Credit Rating models, click here.

Credit ratings and their applications

Credit ratings are widely used throughout the financial industry, for a variety of applications. This includes the corporate finance, risk and treasury domains and beyond. While it is hardly ever a sole factor driving management decisions, the availability of a point estimation to describe something as complex as counterparty credit risk has proven a very useful piece of information for making informed decisions, without the need for a full due diligence into the books of the counterparty.

Some of the specific use cases are:

- Internal assessment of the creditworthiness of counterparties

- Transparency of the creditworthiness of counterparties

- Monitoring trends in the quality of credit portfolios

- Monitoring concentration risk

- Performance measurement

- Determination of risk-adjusted credit approval levels and frequency of credit reviews

- Formulation of credit policies, risk appetite, collateral policies, etc.

- Loan pricing based on Risk Adjusted Return on Capital (RAROC) and Economic Profit (EP)

- Arm’s length pricing of intercompany transactions, in line with OECD guidelines

- Regulatory Capital (RC) and Economic Capital (EC) calculations

- Expected Credit Loss (ECL) IFRS 9 calculations

- Active Credit Portfolio Management on both portfolio and (individual) counterparty level

Credit rating philosophy

A fundamental starting point when applying credit ratings, is the credit rating philosophy that is followed. In general, two distinct approaches are recognized:

- Through-the-Cycle (TtC) rating systems measure default risk of a counterparty by taking permanent factors, like a full economic cycle, into account based on a worst-case scenario. TtC ratings change only if there is a fundamental change in the counterparty’s situation and outlook. The models employed for the public ratings published by e.g. S&P, Fitch and Moody’s are generally more TtC focused. They tend to assign more weight to qualitative features and incorporate longer trends in the financial ratios, both of which increase stability over time.

- Point-in-Time (PiT) rating systems measure default risk of a counterparty taking current, temporary factors into account. PiT ratings tend to adjust quickly to changes in the (financial) conditions of a counterparty and/or its economic environment. PiT models are more suited for shorter term risk assessments, like Expected Credit Losses. They are more focused on financial ratios, thereby capturing the more dynamic variables. Furthermore, they incorporate a shorter trend which adjusts faster over time. Most models incorporate a blend between the two approaches, acknowledging that both short term and long term effects may impact creditworthiness.

Rating methodology

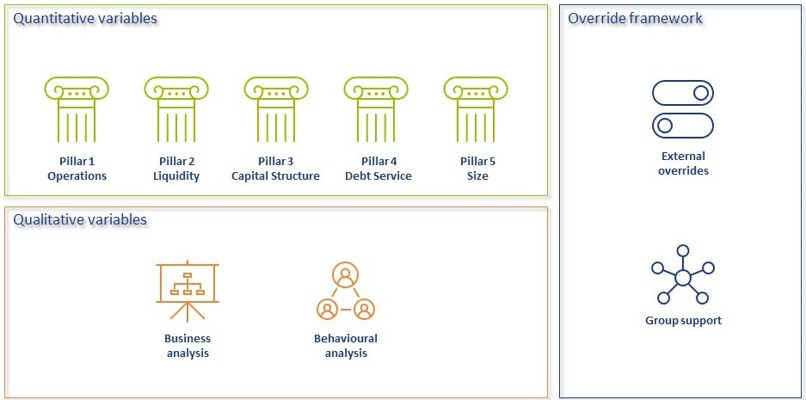

Modeling credit ratings is very complex, due to the wide variety of events and exposures that companies are exposed to. Operational risk, liquidity risk, poor management, a perishing business model, an external negative event, failing governments and technological innovation can all have very significant influence on the creditworthiness of companies in the short and long run. Most credit rating models therefore distinguish a range of different factors that are modelled separately and then combined into a single credit rating. The exact factors will differ per rating model. The overview below presents the factors included the Corporate Rating Model, which is used in some of the cloud-based solutions of the Zanders applications.

The remainder of this article will detail the different factors, explaining the rationale behind including them.

Quantitative factors

Quantitative risk factors are crucial to credit rating models, as they are ‘objective’ and therefore generate a large degree of comparability between different companies. Their objective nature also makes them easier to incorporate in a model on a large scale. While financials alone do not tell the whole story about a company, accounting standards have developed over time to provide a more and more comparable view of the financial state of a company, making them a more and more thrustworthy source for determining creditworthiness. To better enable comparisons of companies with different sizes, financials are often represented as ratios.

Financial Ratios

Financial ratios are being used for credit risk analyses throughout the financial industry and present the basic characteristics of companies. A number of these ratios represent (directly or indirectly) creditworthiness. Zanders’ Corporate Credit Rating model uses the most common of these financial ratios, which can be categorised in five pillars:

Pillar 1 - Operations

The Operations pillar consists of variables that consider the profitability and ability of a company to influence its profitability. Earnings power is a main determinant of the success or failure of a company. It measures the ability of a company to create economic value and the ability to give risk protection to its creditors. Recurrent profitability is a main line of defense against debtor-, market-, operational- and business risk losses.

Turnover Growth

Turnover growth is defined as the annual percentage change in Turnover, expressed as a percentage. It indicates the growth rate of a company. Both very low and very high values tend to indicate low credit quality. For low turnover growth this is clear. High turnover growth can be an indication for a risky business strategy or a start-up company with a business model that has not been tested over time.

Gross Margin

Gross margin is defined as Gross profit divided by Turnover, expressed as a percentage. The gross margin indicates the profitability of a company. It measures how much a company earns, taking into consideration the costs that it incurs for producing its products and/or services. A higher Gross margin implies a lower default probability.

Operating Margin

Operating margin is defined as Earnings before Interest and Taxes (EBIT) divided by Turnover, expressed as a percentage. This ratio indicates the profitability of the company. Operating margin is a measurement of what proportion of a company's revenue is left over after paying for variable costs of production such as wages, raw materials, etc. A healthy Operating margin is required for a company to be able to pay for its fixed costs, such as interest on debt. A higher Operating margin implies a lower default probability.

Return on Sales

Return on sales is defined as P/L for period (Net income) divided by Turnover, expressed as a percentage. Return on sales = P/L for period (Net income) / Turnover x 100%. Return on sales indicates how much profit, net of all expenses, is being produced per pound of sales. Return on sales is also known as net profit margin. A higher Return on sales implies a lower default probability.

Return on Capital Employed

Return on capital employed (ROCE) is defined as Earnings before Interest and Taxes (EBIT) divided by Total assets minus Current liabilities, expressed as a percentage. This ratio indicates how successful management has been in generating profits (before Financing costs) with all of the cash resources provided to them which carry a cost, i.e. equity plus debt. It is a basic measure of the overall performance, combining margins and efficiency in asset utilization. A higher ROCE implies a lower default probability.

Pillar 2 - Liquidity

The Liquidity pillar assesses the ability of a company to become liquid in the short-term. Illiquidity is almost always a direct cause of a failure, while a strong liquidity helps a company to remain sufficiently funded in times of distress. The liquidity pillar consists of variables that consider the ability of a company to convert an asset into cash quickly and without any price discount to meet its obligations.

Current Ratio

Current ratio is defined as Current assets, including Cash and Cash equivalents, divided by Current liabilities, expressed as a number. This ratio is a rough indication of a firm's ability to service its current obligations. Generally, the higher the Current ratio, the greater the cushion between current obligations and a firm's ability to pay them. A stronger ratio reflects a numerical superiority of Current assets over Current liabilities. However, the composition and quality of Current assets are a critical factor in the analysis of an individual firm's liquidity, which is why the current ratio assessment should be considered in conjunction with the overall liquidity assessment. A higher Current ratio implies a lower default probability.

Quick Ratio

The Quick ratio (also known as the Acid test ratio) is defined as Current assets, including Cash and Cash equivalents, minus Stock divided by Current liabilities, expressed as a number. The ratio indicates the degree to which a company's Current liabilities are covered by the most liquid Current assets. It is a refinement of the Current ratio and is a more conservative measure of liquidity. Generally, any value of less than 1 to 1 implies a reciprocal dependency on inventory or other current assets to liquidate short-term debt. A higher Quick ratio implies a lower default probability.

Stock Days

Stock days is defined as the average Stock during the year times the number of days in a year divided by the Cost of goods sold, expressed as a number. This ratio indicates the average length of time that units are in stock. A low ratio is a sign of good liquidity or superior merchandising. A high ratio can be a sign of poor liquidity, possible overstocking, obsolescence, or, in contrast to these negative interpretations, a planned stock build-up in the case of material shortages. A higher Stock days ratio implies a higher default probability.

Debtor Days

Debtor days is defined as the average Debtors during the year times the number of days in a year divided by Turnover. Debtor days indicates the average number of days that trade debtors are outstanding. Generally, the greater number of days outstanding, the greater the probability of delinquencies in trade debtors and the more cash resources are absorbed. If a company's debtors appear to be turning slower than the industry, further research is needed and the quality of the debtors should be examined closely. A higher Debtors days ratio implies a higher default probability.

Creditor Days

Creditor days is defined as the average Creditors during the year as a fraction of the Cost of goods sold times the number of days in a year. It indicates the average length of time the company's trade debt is outstanding. If a company's Creditors days appear to be turning more slowly than the industry, then the company may be experiencing cash shortages, disputing invoices with suppliers, enjoying extended terms, or deliberately expanding its trade credit. The ratio comparison of company to industry suggests the existence of these or other causes. A higher Creditors days ratio implies a higher default probability.

Pillar 3 - Capital Structure

The Capital pillar considers how a company is financed. Capital should be sufficient to cover expected and unexpected losses. Strong capital levels provide management with financial flexibility to take advantage of certain acquisition opportunities or allow discontinuation of business lines with associated write offs.

Gearing

Gearing is defined as Total debt divided by Tangible net worth, expressed as a percentage. It indicates the company’s reliance on (often expensive) interest bearing debt. In smaller companies, it also highlights the owners' stake in the business relative to the banks. A higher Gearing ratio implies a higher default probability.

Solvency

Solvency is defined as Tangible net worth (Shareholder funds – Intangibles) divided by Total assets – Intangibles, expressed as a percentage. It indicates the financial leverage of a company, i.e. it measures how much a company is relying on creditors to fund assets. The lower the ratio, the greater the financial risk. The amount of risk considered acceptable for a company depends on the nature of the business and the skills of its management, the liquidity of the assets and speed of the asset conversion cycle, and the stability of revenues and cash flows. A higher Solvency ratio implies a lower default probability.

Pillar 4 - Debt Service

The debt service pillar considers the capability of a company to meet its financial obligations in the form of debt. It ties the debt obligation a company has to its earnings potential.

Total Debt / EBITDA

The debt service pillar considers the capability of a company to meet its financial obligations. This ratio is defined as Total debt divided by Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA). Total debt comprises Loans + Noncurrent liabilities. It indicates the total debt run-off period by showing the number of years it would take to repay all of the company's interest-bearing debt from operating profit adjusted for Depreciation and Amortization. However, EBITDA should not, of course, be considered as cash available to pay off debt. A higher Debt service ratio implies a higher default probability.

Interest Coverage Ratio

Interest coverage ratio is defined as Earnings before interest and taxes (EBIT) divided by interest expenses (Gross and Capitalized). It indicates the firm's ability to meet interest payments from earnings. A high ratio indicates that the borrower should have little difficulty in meeting the interest obligations of loans. This ratio also serves as an indicator of a firm's ability to service current debt and its capacity for taking on additional debt. A higher Interest coverage ratio implies a lower default probability.

Pillar 5 - Size

In general, the larger a company is, the less vulnerable the company is, as there is, usually, more diversification in turnover. Turnover is considered the best indicator of size. In general, turnover is related to vulnerability. The higher the turnover, the less vulnerable a company (generally) is.

Ratio Scoring and Mapping

While these financial ratios provide some very useful information regarding the current state of a company, it is difficult to assess them on a stand-alone basis. They are only useful in a credit rating determination if we can compare them to the same ratios for a group of peers. Ratio scoring deals with the process of translating the financials to a score that gives an indication of the relative creditworthiness of a company against its peers.

The ratios are assessed against a peer group of companies. This provides more discriminatory power during the calibration process and hence a better estimation of the risk that a company will default. Research has shown that there are two factors that are most fundamental when determining a comparable peer group. These two factors are industry type and size. The financial ratios tend to behave ‘most alike’ within these segmentations. The industry type is a good way to separate, for example, companies with a lot of tangible assets on their balance sheet (e.g. retail) versus companies with very few tangible assets (e.g. service based industries). The size reflects that larger companies are generally more robust and less likely to default in the short to medium term, as compared to smaller, less mature companies.

Since ratios tend to behave differently over different industries and sizes, the ratio value score has to be calibrated for each peer group segment.

When scoring a ratio, both the latest value and the long-term trend should be taken into account. The trend reflects whether a company’s financials are improving or deteriorating over time, which may be an indication of their long-term perspective. Hence, trends are also taken into account as a separate factor in the scoring function.

To arrive to a total score, a set of weights needs to be determined, which indicates the relative importance of the different components. This total score is then mapped to a ordinal rating scale, which usually runs from AAA (excellent creditworthiness) to D (defaulted) to indicate the creditworthiness. Note that at this stage, the rating only incorporates the quantitative factors. It will serve as a starting point to include the qualitative factors and the overrides.

"A sound credit rating model strikes a balance between quantitative and qualitative aspects. Relying too much on quantitative outcomes ignores valuable ‘unstructured’ information, whereas an expert judgement based approach ignores the value of empirical data, and their explanatory power."

Qualitative Factors

Qualitative factors are crucial to include in the model. They capture the ‘softer’ criteria underlying creditworthiness. They relate, among others, to the track record, management capabilities, accounting standards and access to capital of a company. These can be hard to capture in concrete criteria, and they will differ between different credit rating models.

Note that due to their qualitative nature, these factors will rely more on expert opinion and industry insights. Furthermore, some of these factors will affect larger companies more than smaller companies and vice versa. In larger companies, management structures are far more complex, track records will tend to be more extensive and access to capital is a more prominent consideration.

All factors are generally assigned an ordinal scoring scale and relative weights, to arrive at a total score for the qualitative part of the assessment.

A categorisation can be made between business analysis and behavioural analysis.

Business Analysis

Business analysis deals with all aspects of a company that relate to the way they operate in the markets. Some of the factors that can be included in a credit rating model are the following:

Years in Same Business

Companies that have operated in the same line of business for a prolonged period of time have increased credibility of staying around for the foreseeable future. Their business model is sound enough to generate stable financials.

Customer Risk

Customer risk is an assessment to what extent a company is dependent on one or a small group of customers for their turnover. A large customer taking its business to a competitor can have a significant impact on such a company.

Accounting Risk

The companies internal accounting standards are generally a good indicator of the quality of management and internal controls. Recent or frequent incidents, delayed annual reports and a lack of detail are clear red flags.

Track record with Corporate

This is mostly relevant for counterparties with whom a standing relationship exists. The track record of previous years is useful first hand experience to take into account when assessing the creditworthiness.

Continuity of Management

A company that has been under the same management for an extended period of time tends to reflect a stable company, with few internal struggles. Furthermore, this reflects a positive assessment of management by the shareholders.

Operating Activities Area

Companies operating on a global scale are generally more diversified and therefore less affected by most political and regulatory risks. This reflects well in their credit rating. Additionally, companies that serve a large market have a solid base that provides some security against adverse events.

Access to Capital

Access to capital is a crucial element of the qualitative assessment. Companies with a good access to the capital markets can raise debt and equity as needed. An actively traded stock, a public rating and frequent and recent debt issuances are all signals that a company has access to capital.

Behavioral Analysis

Behavioural analysis aims to incorporate prior behaviour of a company in the credit rating. A separation can be made between external and internal indicators

External indicators

External indicators are all information that can be acquired from external parties, relating to the behaviour of a company where it comes to honouring obligations. This could be a credit rapport from a credit rating agency, payment details from a bank, public news items, etcetera.

Internal Indicators

Internal indicators concern all prior interactions you have had with a company. This includes payment delay, litigation, breaches of financial covenants etcetera.

Override Framework

Many models allow for an override of the credit rating resulting from the prior analysis. This is a more discretionary step, which should be properly substantiated and documented. Overrides generally only allow for adjusting the credit rating with one notch upward, while downward adjustment can be more sizable.

Overrides can be made due to a variety of reasons, which is generally carefully separated in the model. Reasons for overrides generally include adjusting for country risk, industry adjustments, company specific risk and group support.

It should be noted that some overrides are mandated by governing bodies. As an example, the OECD prescribes the overrides to be applied based on a country risk mapping table, for the purpose of arm’s length pricing of intercompany contracts.

Combining all the factors and considerations mentioned in this article, applying weights and scoring functions and applying overrides, a final credit rating results.

Model Quality and Fit

The model quality determines whether the model is appropriate to be used in a practical setting. From a statistical modeling perspective, a lot of considerations can be made with regard to model quality, which are outside of the scope of this article, so we will stick to a high level consideration here.

The AUC (area under the ROC curve) metric is one of the most popular metrics to quantify the model fit (note this is not necessarily the same as the model quality, just as correlation does not equal causation). The AUC metric indicates, very simply put, the number of correct and incorrect predictions and plots them in a graph. The area under that graph then indicates the explanatory power of the model. A more extensive guide to the AUC metric can be found here.

Alternative Modeling Approaches

The model structure described above is one specific way to model credit ratings. While models may widely vary, most of these components would typically be included. During recent years, there has been an increase in the use of payment data, which is disclosed through the PSD2 regulation. This can provide a more up-to-date overview of the state of the company and can definitely be considered as an additional factor in the analysis. However, the main disadvantage of this approach is that it requires explicit approval from the counterparty to use the data, which makes it more challenging to apply on a portfolio basis.

Another approach is a purely machine learning based modeling approach. If applied well, this will give the best model in terms of the AUC (area under the curve) metric, which measures the explanatory power of the model. One major disadvantage of this approach, however, is that the interpretability of the resulting model is very limited. This is something that is generally not preferred by auditors and regulatory bodies as the primary model for creditworthiness. In practice, we see these models most often as challenger models, to benchmark the explanatory power of models based on economic rationale. They can serve to spot deficiencies in the explanatory power of existing models and trigger a re-assessment of the factors included in these models. In some cases, they may also be used to create additional comfort regarding the inclusion of some factors.

Furthermore, the degree to which the model depends on expert opinion is to a large extent dependent on the data available to the model developer. Most notably, the financials and historical default data of a representative group of companies is needed to properly fit the model to the empirical data. Since this data can be hard to come by, many credit rating models are based more on expert opinion than actual quantitative data. Our Corporate Credit Rating model was calibrated on a database containing the financials and default data of an extensive set of companies. This provides a solid quantitative basis for the model outcomes.

Closing Remarks

Model credit risk and credit ratings is a complex affair. Zanders provides advice, standardized and customizable models and software solutions to tackle these challenges. Do you want to learn more about credit rating modeling? Reach out for a free consultation. Looking for a tailor made and flexible solution to become IFRS 9 compliant, find out about our Condor Credit Risk Suite, the IFRS9 compliance solution.

The European Central Bank (ECB) recently completed another important step in the supervisory process to assess the management of climate-related and environmental (C&E) risks by European banks. On 2 November, they published the results of their thematic review on C&E risks performed earlier this year.

This review1 followed the initial publication of expectations on C&E risks in their November 2020 Guide on C&E risks (the Guide)2 and the self-assessment performed by European banks in 2021 on the ECB’s request. The scope of the thematic review included 186 banks with a total balance sheet size of EUR 25 trillion: 107 significant institutions (SIs) supervised by the ECB and 79 less significant institutions (LSIs) supervised by national competent authorities.

In this article, we provide an overview of the main conclusions of the thematic review and of the main focus areas related to the management of C&E risk for banks that we expect for 2023.

Main results

The thematic review shows that European banks have progressed with the integration of C&E risks into their business strategy, governance, and risk management frameworks. This matters, because the review shows that C&E risks are real. Depending on the time horizon, 70% to 80% of all banks consider C&E risks to be material for their portfolios. About 75% of all banks expect material impacts on their credit risk. To a lesser extent, material impacts are expected on strategic and reputational risks (about 50%), and on market and liquidity risks (about 25%). In the short term, banks are most concerned with transition risks, while the relevance of physical risks is clearly increasing with the time horizon.

The ECB concludes, however, that the management of C&E risks still is on a relatively basic and general level. For example, banks have updated their governance, assigning responsibility for the management of C&E risks to the Management Board. Many have also set up dedicated committees for these risk types and/or assigned responsibility within the organisation in other ways. Further, over 90% of all banks have at least performed a basic risk identification and materiality assessment to understand how their portfolios are exposed to C&E risks. In many cases, this has led to the introduction of Key Performance Indicators (KPIs) and Key Risk Indicators (KRIs), and the (often qualitative) integration of C&E risks into their business strategy and Internal Capital Adequacy Assessment Process (ICAAP).

According to the ECB, the work performed so far is not sufficient though. The ECB observes gaps in the risk identification and materiality assessment at almost all banks. In 60% of the cases, these are deemed major. Of all banks, 10% is yet to start with this process. Improvements are also required with respect to data collection. Only a small selection of banks (about 15%) is systematically collecting data that is sufficiently granular and forward-looking to support processes like risk identification, stress testing and reporting. In most cases, banks rely to a large extent on the use of proxies.

Even if banks have progressed well with the identification of C&E risks, the ECB concludes that this awareness has not been translated effectively into policies and targets by more than half of the banks. The high-level KPIs and KRIs for example, are not cascaded down to business lines or individual portfolios, non-restrictive targets are set, or relevant counterparties are excluded from a policy’s scope. Furthermore, the ECB finds that banks are significantly underestimating the level of skilled resources required for a proper management of C&E risks.

The ECB has set deadlines tailored to each bank that they supervise. As part of the publication of the results of the thematic review, however, they shared the minimum milestones European banks need to adhere to:

- By the end of March 2023, banks need to have a sound and comprehensive materiality assessment in place, including a robust scanning of the business environment.

- By the end of 2023, banks need to manage C&E risks with an institution-wide approach covering business strategy, governance and risk appetite, as well as risk management, including credit, operational, market and liquidity risk management.

- By the end of 2024, banks need to be fully aligned with all supervisory expectations, including having in place a sound integration of C&E risks in their stress testing framework and ICAAP.

Focus areas 2023

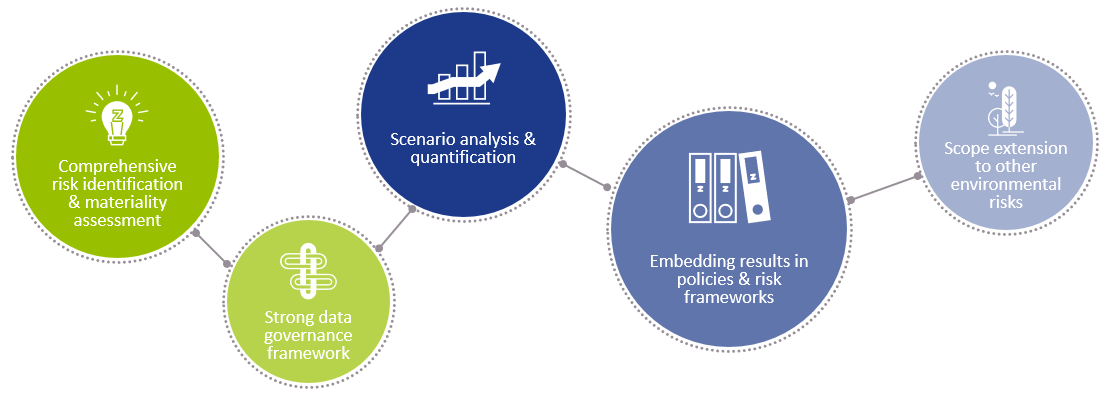

Based on the results of the ECB’s thematic review and our conversations with clients, we see five focus areas related to the management of C&E risks for banks in 2023.

- Comprehensive risk identification and materiality assessment: The ECB is clear about its expectations that banks should complete their risk identification and materiality assessment in the first quarter of 2023. More importantly, they expect this process to be comprehensive. For a start, a bank should assess all its material business lines (or portfolios) and cover all relevant regions and geographies the bank is active in. A step-wise approach can be used, as long as the full scope is covered in the end. Further, the analysis should cover a wide range of physical and transition risks. It is not sufficient to investigate the impact of a limited set of risk factors. Finally, the analysis needs to be performed for different time horizons: the short, medium, and long term.

- Strong data governance framework: To take the next step in the management of C&E risks, a robust and structured process to collect data is required. For the analyses performed by banks so far, it may have sufficed to extensively use proxies. More is needed, however, to fully meet the expectations described in the ECB’s Guide. Data needs to be collected on a granular level: to be able to properly measure and report on C&E risks, banks need to understand the risks on counterparty, facility, and/or asset level. A first step would be to compile a complete overview of the bank’s data requirements. A bank would need to synthesize all data requirements stemming from processes like risk identification, credit granting, risk modeling, and disclosure to ensure a sufficiently granular (and future-proof) data collection process is designed. Such a process will have to source data from internal systems, but also from a bank’s counterparties and most likely external data vendors. A structured approach exploits potential overlapping data requirements and prevents inconsistencies in definitions.

- Scenario analysis and quantification: With improved data comes the possibility to perform more sophisticated scenario analysis and to quantify C&E risks. About a quarter of all banks are already employing advanced and/or forward-looking quantification methods; for example to inform the ICAAP, to perform scenario analysis, or to reflect C&E risks into internal ratings-based (PD and LGD) models. Most banks expect that it will take one to three years to truly advance in this area. In 2023, however, banks should already focus on improving their scenario analysis (and stress testing) capabilities, and take the first steps towards integrating C&E risks into their credit risk modeling.

- Embedding results into policies and risk management frameworks: In 2023, banks will need to “walk the talk”, to paraphrase the ECB. The improved understanding of how physical and transitions risks may impact the risk profile of the bank needs to be translated into actionable policies and become part of the risk management framework. Overall targets need to align with scientific pathways, high-level Risk Appetite Statements on C&E risks need to be cascaded down to the lower business line levels, controls need to be implemented accordingly, product offerings need to be reviewed, and a dialogue with clients needs to be initiated – including clear steps if and how a bank will continue the relationship if the client’s transition is not meeting expectations.

- Scope extension to other environmental risks: Attention from banks and supervisors alike has mostly focussed on climate risks so far. Other environmental risks, like loss of biodiversity, pollution and water scarcity have received less attention. Now that some progress has been achieved in the area of climate risk, banks should increase efforts for these other risk types. Initiatives like the Partnership for Biodiversity Accounting Financials (PBAF, a sister-initiative of PCAF, which is focussed on financed emissions) and the Taskforce on Nature-related Financial Disclosures (TNFD) can be useful to progress with this.

Since the management of C&E risks is a new field of expertise, many banks are (re)inventing the wheel. Much can be learned from other banks though. To facilitate this, the ECB published, together with the results of the thematic review, an overview of good practices they observed among SIs3. This document can be a useful source of inspiration for banks. De Nederlandsche Bank (DNB, the Dutch central bank) published a similar document, based on their observations among Dutch LSIs4.

Conclusion

Banks have worked hard in 2022 to advance their management of C&E risks. Much work remains, however. With the clear milestones communicated by the ECB, banks have their work cut out for them. And this is not a voluntary effort, as the 30 institutions where the ECB imposed binding qualitative requirements as part of the Supervisory Review and Evaluation Process (SREP) know. For some, supervisory exercises were even reflected in SREP scores, impacting their Pillar 2 capital requirements.

To achieve sufficient progress, we believe that banks should focus on the five areas described in the previous section: risk identification, data collection, scenario analysis and quantification, integration of C&E risks into policies and risk frameworks, and a scope extension to broader environmental risks. By combining our extensive experience with the ‘classical’ risk types with our track record on C&E risks, Zanders is well-positioned to support your organization.

References

1) ECB – Walking the talk – Banks gearing up to manage risks from climate change and environmental degradation – link

2) ECB – Guide on climate-related and environmental risks – Supervisory expectations relating to risk management and disclosure – link

3) ECB – Good practices for climate-related and environmental risk management – Observations from the 2022 thematic review – link

4) DNB – Guide to managing climate and environmental risks – link

Are you overwhelmed by the sheer volume of different Treasury Technology Systems on the market?

Do you have difficulties setting out your treasury technology requirements (both from a functional as well as IT perspective), or matching those to the latest capabilities of a modern Treasury Systems? Are you wishing for a technology selection process that is less cumbersome and time consuming? If you said ‘yes’ to any of these, then we might have the solution for you!

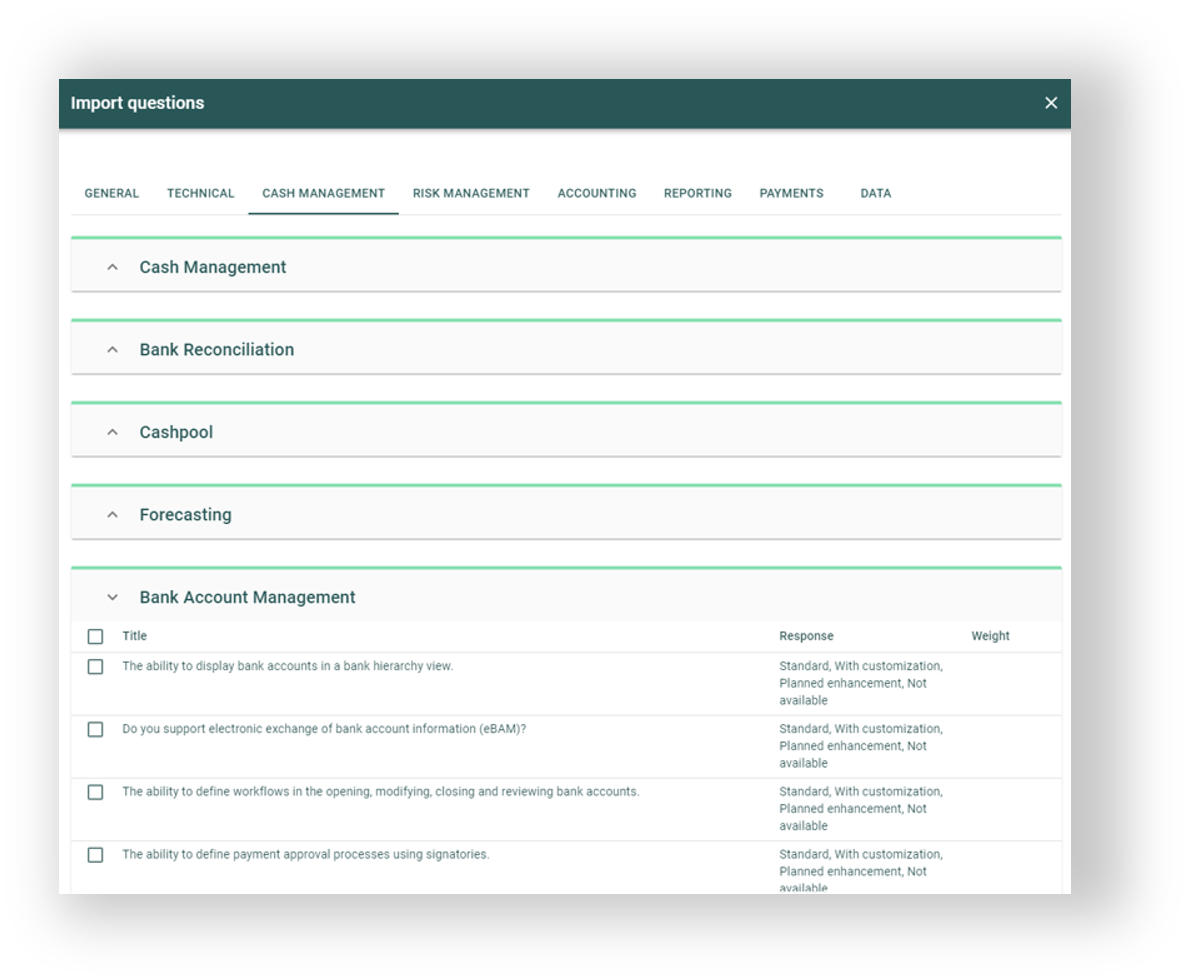

Introducing Zanders’ Treasury Technology Selection Service powered by Tech-Select, our proprietary cloud-based Treasury Technology Selection tool designed to give you an easier, quicker way to select a new treasury system that best supportis your specific needs, or to evaluate your current system against other alternatives. For over 30 years, Zanders has been helping organizations globally to select treasury management systems and other related treasury technology. As an independent and unbiased expert, we have built extensive experience into how best to assist our clients to select, implement and deploy the most appropriate solution for their technology needs – it is this insight that drove us to develop a system to modernize the commonly used RfP process.

Zanders Tech-Select is the driving force behind our Treasury Technology Selection Service and accelerates your treasury system selection project by addressing the traditional challenges faced by organizations when choosing treasury technology solutions and introduces several other benefits as follows:

- Provides a broad overview of the systems market, giving you access to a wider range of potential vendors that can provide systems supporting your needs, and the most up-to-date insights on their current capabilities and new product developments

- Allows you to easily identify and define your functional needs, short-list suitable vendors, and automatically create and issue your RfP, by providing access to our comprehensive library of functional and technical requirements alongside our curated database of vendors, system functionality and capabilities

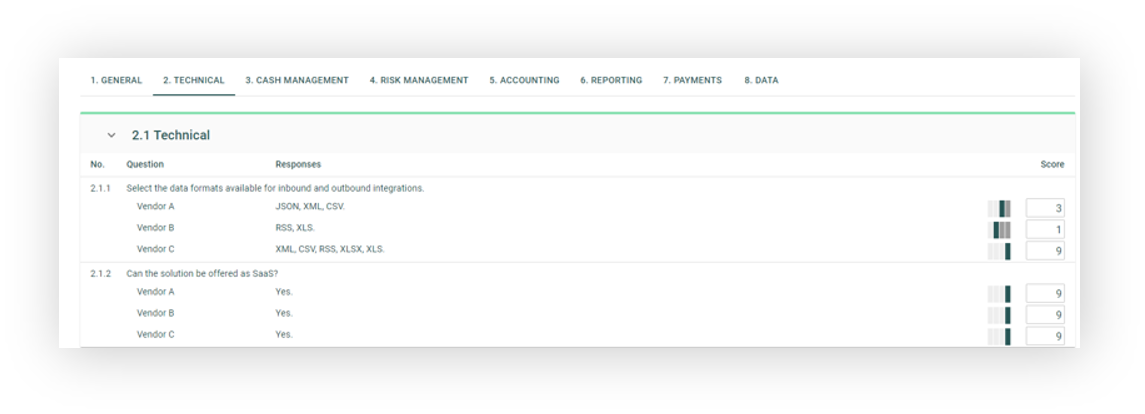

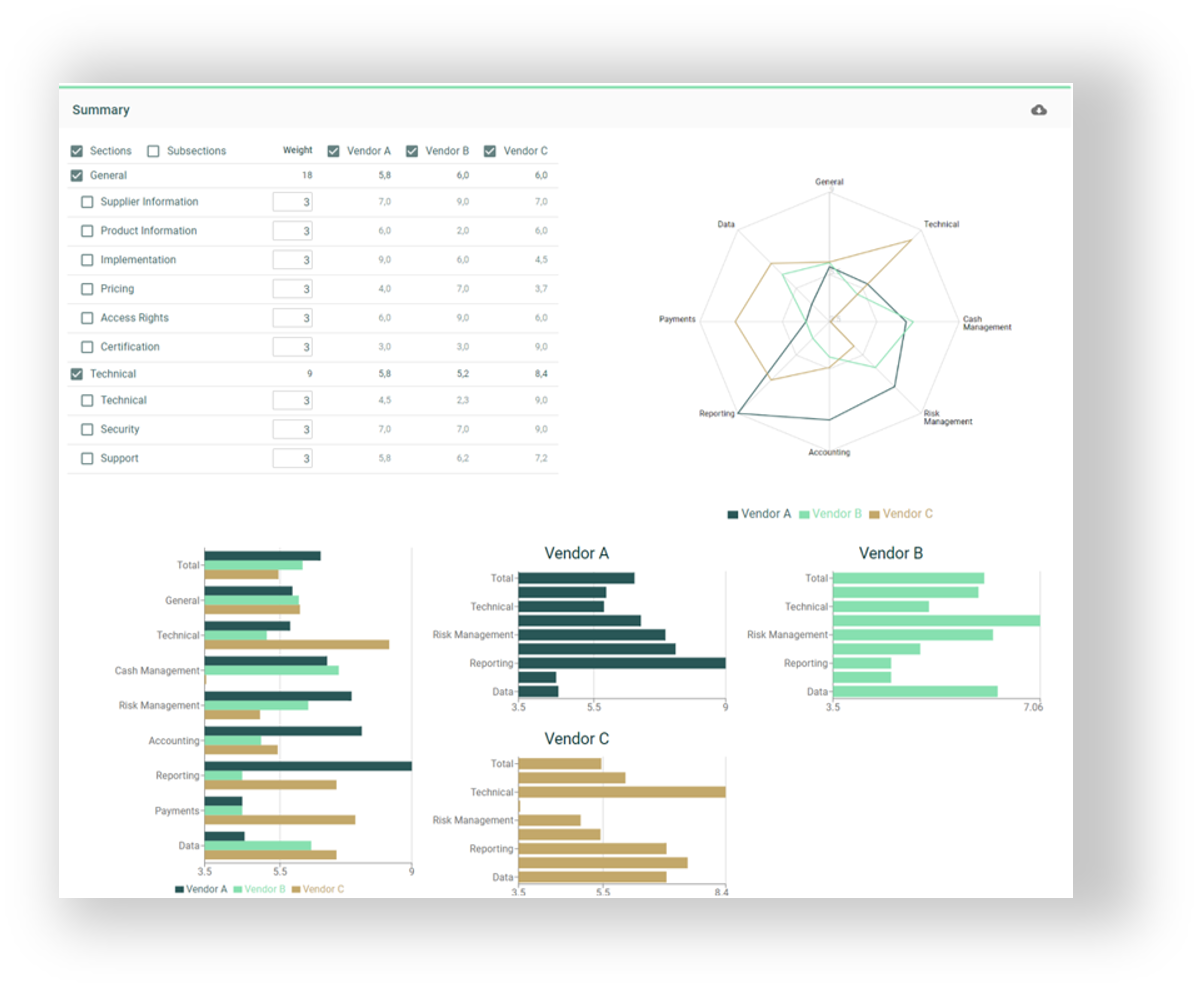

- Facilitates and accelerates multi-user assessment and evaluation of vendor responses, by utilizing workflows for scoring, the ability to assess user scoring differences, and the opportunity to determine final scores for each vendor

- Helps you to understand key differentiators between services and functionality on offer from each vendor, using our pre-defined results analytics and drilldowns

- Helps to streamline and accelerate the RfP process from end-to-end within a single cloud-based platform, removing the need for multiple emails, spreadsheets or complex scoring models, and

- Reduces the resource and time investment required to engage with multiple vendors, freeing you to focus on key analysis and value-add activities

Let’s take a deeper look at how Zanders Tech-Select achieves this:

- Once you’ve chosen from Zanders Tech-Select’s comprehensive library of functional and technical requirements, these are matched to our curated database of system functionality and capabilities in order to present you with a shortlist of systems and vendors that are suited to your specific needs. You can then select which of those vendors you would like to invite for your RfP process, utilise our templates to create cover letters and other attachments, and specify deadlines for acknowledgement, Q&As and final responses.

- When you are ready to launch your RfP, you simply click the ‘Issue’ button to automatically generate RfP invite emails quickly and easily to all chosen vendors. Once they receive the invite, vendors can use Zanders Tech-Select to access all document attachments, view your requirements, ask any questions, and respond to the RfP.

- Once vendors have completed submitting their RfP responses, multiple users from your treasury, finance, IT and procurement teams can use Zanders Tech-Select to independently compare each vendor’s responses to each requirement in a consolidated view, and can assign scores to each. When all users have completed their scoring, the system automatically consolidates their scores and provides you with the opportunity to review and moderate the final scores before moving forwards to analyze the results.

- At the final stage, Zanders Tech-Select’s interactive results analytics provide you with several ways to view and drill down into your results. Simply hover over data points to see more detailed information, check or uncheck to include or exclude vendors, sections and subsections, or most importantly click on specific scores to drilldown and quickly understand the reasons behind any scoring differences between vendors.

Based on experience from our clients, Zanders’ Treasury Technology Selection Service powered by Tech-Select drastically improves the current RfP processes many corporates are using today.

Zanders is unique in offering a system selection solution that includes an extensive library of the most common technology requirements alongside pre-populated and curated responses from over 90% of the leading treasury systems currently on the market. The structured, end-to-end process helps to streamline and automate your selection project and is applicable to a wide variety of use cases, enabling a consistent approach to vendor selection based on objective and rigorous evaluation.

Zanders Tech-Select uniquely provides the most efficient, thorough and cost-effective digital selection service within the treasury space, with Zanders experts to guide you throughout. If you would like to find out more about how Zanders can help to streamline your next technology or service selection process, get in touch now.

Article updated in May 2024

With year-end approaching quickly it is a natural moment to look back, zoom-out a bit and look forward to the coming year(s). Last year was, for most treasurers, a bumpy road. We witnessed another year with uncertainty and volatility in the financial markets due to the residual effects of the pandemic; the impact of the War in Ukraine; and rising inflation, interest rates and commodity prices. In this context, Corporate Treasuries are continuously facing internal and external challenges, and therefore need to operate in an increasingly complex and uncertain environment. Based on these challenges, we have identified four main Treasury themes for the year 2023 which are interlinked with each other and will be addressed in more detail in this article:

- Digital Treasury

- Fit for Future Treasury Teams

- Financial Resilience

- Increasing Treasury remit

Digital Treasury

Implementing and deploying fit-for-purpose technology in the Treasury function continues to be one of the main themes for Treasurers. The importance of embracing technology, with the aim to become a Digital Treasury function, stems from both internal and external drivers. Due to the strategic position of Treasury within the broader Finance function, different factors (like new regulations, volatility in financial markets, political decision making and economic instability, et cetera) lead to a broader and more complex remit. At the same time, treasurers are expected to implement cost reduction programs while simultaneously facing increasing performance requirements, and the expectation to present accurate and real-time transparency on liquidity, cash flows and exposures. Technology is the key enabler for a future proof value adding Treasury organization including to effectively manage the change in Treasury’s traditional tasks (e.g. requirement for real-time liquidity and exposure data) as well as new tasks (e.g. include ESG Financing, broader working capital responsibility or new B2C payment methods).

A Digital Treasury or Treasury 4.0 as it is often called is defined by certain characteristics:

- Treasury Target Operating Model which is ‘fit for purpose’, this means a formalized governance structure and mandate for the Treasury function in combination with the organizational structure in which ‘virtual’ centralization is achieved by means of technology.

- Fully integrated and automated Treasury operations to reach the highest degree of Straight Through Processing (STP) were possible, which effectively leads to a Manage by Exception (MBE) structure.

- Utilize exponential technology in a standardized way with a clear focus on the additional benefits of this new technology. Deploying exponential technology, like blockchain, AI, robotics, et cetera, should be a means to an end and not a goal in itself for Treasury.

- Enable a ‘Real-time’ Treasury by having real-time data available, process payments on a real-time basis and have access to real-time liquidity.

- Build a resilient Treasury framework of both governance, methodology and technology components to allow Treasury reacting to different scenarios and to anticipate them.

- Shift focus on the full financial supply chain and working capital management by expanding process design and data flow beyond the core Treasury activities.

By embedding Treasury into the financial supply chain regarding processes and data it enables Treasury to work in multiple unforeseen scenarios and make informed decisions based on analytics. When we talk about Treasury data and analytics the “ABCD of Digital Treasury” is paramount, which are:

- Artificial Intelligence (AI) & Application Programming interfaces (APIs)

- Blockchain & distributed ledger technology

- Cloud computing

- Data & advanced data analytics.

As part of the Treasury transformation towards a Digital Treasury, there should be a clear focus on deliverables and output to ensure these are fully aligned with CFO and other business partners expectations. Given the trend of increased focus on performance, it is key to utilize the power of technology which enable Treasury to elevate the quality of deliverables and output. For example, AI can be used to adjust forecasted cash flows based upon the historical patterns behind actuals and forecast variances as well as assisting in decision making in the area of foreign exchange risk or commodity price risk management.

The concept of real-time Treasury has become one of the hottest topics in Treasury over the last few years. The availability of real-time data, payments and liquidity can take away many inefficiencies in Treasury’s day-to-day operations. Thanks to growing adoption of exponential technologies such as APIs and Blockchain, Treasury teams can access external real-time data in a speedy and precise manner. Being able to obtain data from all relevant sources in real-time reduces the manual work, decreases the possibility of errors, and improves the decision-making capabilities of Treasury teams. Rather than having to wait and be constraint by bank cut-off times and end of day processing, Treasury teams can operate more efficiently by achieving actual real-time visibility from faster payments to settlements.

In the pursuit of a better payment system, real-time payments have been evolving and creating a safer, more efficient, and accessible environment. Numerous countries have been creating new payment rails and upgrading their infrastructure to support secure real-time payments. We are seeing blockchain technology challenging the existing payment solutions such as SWIFT to enable real-time payments with extended data and enhanced tracking and tracing at a lower cost.

Real-time payments give rise to the need of real-time liquidity. Banks might offer a solution that enables to leverage liquidity across multiple accounts (without the need to have intraday limits). So, if a bank account requires liquidity to make payments, the bank will look across other bank accounts to check whether other liquidity can be used to cover the payment need.

Enabling the ‘Real-time’ requires Treasury to have a resilient and automated technology landscape. Identifying the requirements and then selecting the technology provider(s is the key component to automated ‘real-time’ functionalities.

Fit for Future Treasury Teams

The most crucial asset of any Treasury organisation is its people. Building a Treasury team that can (a) quickly adapt to new circumstances, (b) understand the added value of the Treasury function for the business, and (c) leverage the use of technology, is a key differentiator when it comes to Treasury. The ability of an organisation to successfully deploy technology stems from aligning three interlinked forces:

- Translating business requirements into functional technology requirements;

- Understanding full capabilities of the new technology;

- Availability and development of functional, technical and change management skills within the team to drive successful implementation of new processes and activities.

Training, retaining the talent and maximizing the business partnering skills is the key to create a fit for future Treasury team. In the recent years, we observe many organisations struggle with building a high-quality talent pipeline and lack of succession planning when it comes to their Treasury functions. This combined with the widening ‘skill gaps’ created by the digitisation of Treasury, puts organisations in a very challenging position. For 2023, we expect companies to focus on developing and managing talent of individuals with digital acumen, ability to interpret data, and ability make forward-looking decisions. This can be done via training and upskilling of current staff, the revision of strategic positions to diminish key-person risk, implementing a broader finance rotation program in which technology plays a central role and lastly entering into strategic partnerships with external expertise and resource partners.

Financial Resilience

Financial Resilience is the ability of an organization to financially withstand and recover from diverse types of unexpected events, for example, external shocks. Coping with financial shocks means, for a Treasury, to have the analytical skills to devise both short-term and long-term strategies to measure and manage the impact of external shocks on the financial side of the organization. Financial resilience requires strategically planning ahead and putting preventive strategies in place, including amongst others detailed analysis of corporate finance strategies, pro-actively creating access to funding sources, and defining alternative risk transfer strategies.

After many years of low interest rates and inflation, treasurers had not to worry too much about interest rate risks (except for the negative yields on their investments). Given the recent interest rate increases by the central banks and the expectation that central banks will further increase interest rates to combat the high inflationary market, interest rate risk is back on the agenda for Treasurers! Treasurers should not only analyse the direct impact of increasing interest rates on the financial expense line, but should also consider how the increasing interest rates, in combination with the increasing commodity prices and volatile FX market impact the full supply chain. There are many (Zombie) companies out there which are on the brink of collapse given the current volatile financial markets in combination with ending government COVID-19 support programs. It is vital for a company to have a clear view on its risk bearing capacity; to which extent is the company able to absorb financial headwinds like increased interest rates, adverse movements in commodity and FX rates and potential defaults of key suppliers and/or customers. Traditional risk management measurement techniques, which consider the linear impact of a change in a single risk factor to a single line item in the financial statements (e.g. financial results), are not suitable in an environment of complexity and uncertainty. Treasurers should upskill their financial risk management practice by challenging the assumptions used in current measurement techniques, like scenario analysis. For example, it was not expected and not in line with economic theory that real interest rates would move below zero, which contradicts the current market conditions of high inflation rates accompanied with disproportionate increases in the nominal interest rate. As guardians of the company’s financial risks, Treasurers should expect the unexpected!

Increasing Treasury remit

Given the critical role of Treasury within an organization, we have already seen (for many years) an increase in the Treasury remit. As strategic partner to the CFO and the business, Treasury’s skills are leveraged for more and more activities. To continue the financial resilience trend, working capital management is a key example of Treasury’s increasing remit in many organizations, which stems from the risk capabilities within Treasury. Treasury is not only involved in securing that the company is resilient for financial market movements but is also acting as a business partner for both procurement and the commercial team to analyse how the full supply chain can be made more resilient. Potential hiccups in the physical supply chain as well as the impact of defaulting suppliers or customers can have a detrimental effect on working capital. Many treasuries have an increased focus on working capital management and evaluate how strategic and critical customers and suppliers can be supported via supply chain finance programs to strengthen the supply chain and thereby the position of the company.

Another key trend which is increasing the remit of Treasury, is the movement towards Environmental, Social and Governance (ESG) proof organizations. Treasurers are the trailblazers in sustainable funding and now need to work with accounting and ESG teams for the necessary reporting. Impact can also be expected in the banking relationship. The European Central Bank (ECB) and European Banking Authority (EBA) are rapidly increasing the pressure on banks to integrate ESG risks into their risk frameworks. For example, the ECB published their expectations with respect to the management of climate-related and environmental risks in 2020 and they are now requiring banks to achieve full compliance by the end of 2024. Among others, banks need to assess to what extent their counterparties are exposed to physical (e.g. floods and droughts) or transition risks (e.g. changes in regulation or consumer sentiment). These factors then need to be integrated in the loan origination process. Apart from the potential impact on the pricing of loans and facilities, corporates can also expect a more data-intensive process. Detailed data on emissions and the geographical location of production facilities may be requested.

Conclusion

To conclude, 2023 is expected to be another exciting year for Treasury professionals! The combination of the expanding Treasury remit, challenging labour market and continuing uncertainties in financial and geopolitical markets give rise to create clear and actionable analysis and advice towards the CFO and other business partners. The transformation towards a Digital Treasury is the path which enables Treasury to deliver in an environment which is increasingly focusing on performance while at the same time becoming more complex. We are optimistic for the future and look forward to collaborating with many of you on this exciting journey! For now, Zanders would like to wish you wonderful holidays with friends and family and a great start of the new year!

The recent decade has brought notable developments in both ERP and treasury management system (TMS) markets.

On one hand, the trend towards ERP system consolidation has progressed, most companies have centralized all their global entities and processes in a single environment with unique master data. At the same time, the trend towards cloud solutions has brought innovation and increased competition also to the TMS area. In this context, we are often asked: should the treasury function follow into the centralized ERP solution as well, or does a separate TMS instance have its justification?

Nowadays, all established TMS solutions are also available in the cloud or have disappeared from the market. The cloud technology brings disruption to the TMS market – high scalability of the cloud solutions has brought a number of new players to the global market – originally regional leaders seek to expand their footprint in other regions, some of them challenging the traditional market leaders. Established cloud TMS providers expand their functional covering in a very high pace and at relatively low marginal costs, which leads to increased competition in both functional capabilities and pricing.

In the segment of companies with more than USD 1 billion revenue, SAP occupies a special position among both ERP and TMS vendors (see numbers here) – it offers both a leading ERP system and a TMS with very broad functional coverage.

Benefit areas

In what areas can you find the benefits from integrating the TMS into ERP? We list them for you.

- Process integration

Treasury is usually involved closely in the following three cross-functional processes, with the following implications:

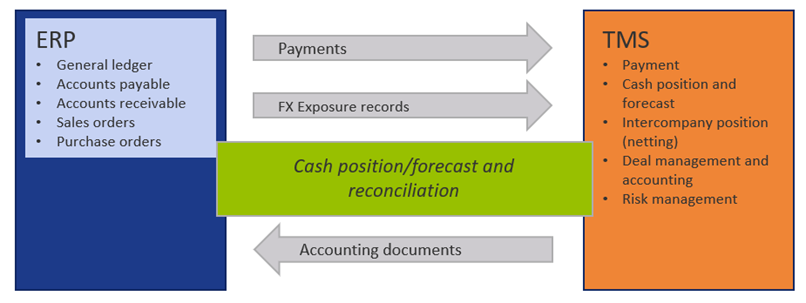

(a) Cash management

Short- and mid-term cash forecast reflects accounts payable and accounts receivable, but purchase and sales orders can also be used to enrich the report. Even when commercial accounts are cash-pooled to treasury accounts, expected movements on these accounts can be used to plan cash pool movements on treasury accounts.

(b) Payments

Various levels of integration can be found among the companies. While some leave execution of commercial payments locally, others implement payments factories to warehouse all types of payments centrally. Screening against payment frauds and sanction breach is facilitated with centralized payment flow. Centralized, well-maintained bank master used at payment origination helps to avoid the risk of declined payments.

(c) Exposure hedging

FX and commodity hedging activities are usually centralized with the treasury team.

In case FX or commodity exposure arises from individual purchase and sales orders or contracts, the treasury team needs tools to be directly involved in the exposure identification and hedge effectiveness controlling.

- System integration

Streamlined processes described above have implications for the required system integration. Depending on frequency and criticality of the data flows, different integration approaches can be considered.

All TMS on the market support file integration with the ERP systems in a reasonable way. They are also often very strong in supporting API integration with trading platforms and bank connectivity providers, but usually lag behind in API integration with the ERPs. Claims of available API integration need to be always critically reviewed on their maturity. API integration is preferred.

What are the benefits of API-based integration?

- It offers real-time process integration between the systems and empowers treasury to be tightly integrated in the cross-functional processes. It can be important when intraday cash positions are followed, payments are executed daily or exposure needs to be hedged continuously.

- It keeps the data flow responsibility with the users. Interfaces often fail because of master data are not aligned between the participating systems. If message cannot be delivered because of this reason, user receives the error message immediately and can initiate corrective actions. On the other hand, file-based interfaces are usually monitored by IT and errors resolution needs to be coordinated with multiple parties, requiring more effort and time.

Figure 1 Usual data flow between ERP and TMS

- Parallel maintenance of master data

Integration flows require harmonization decisions in the area of master data. Financial master data (G/L accounts, cost centers, cost elements) are involved as well as bank master data and payment beneficiaries (vendors). TMS systems rarely offer an interface to automatically synchronize the master data with the ERP system – dual manual maintenance is assumed. Using one of the systems as leading system for the respective master data (e.g. bank masters) is usually not an available option.

- Redundant capabilities

Both the ERP and TMS systems need to cover certain functionalities for different purpose. ERP to support payments and cash management in purchase-to-pay and order-to-cash, while TMS supports the same in treasury process. Both systems need to cover creation of payment formats, reconciliation of electronic bank statement, update of cash position for their area. These functionalities need to be maintained in parallel, or specific solution defined, to avoid the redundancy.

Conclusion

So, should the treasury function follow into the centralized ERP solution as well, or does a separate TMS instance have its justification? The answer to this question depends strongly on your business model and the degree of functional centralization. If functional centralization and streamlined business operations across your global entities is important in your business, you are probably already very advanced in ERP centralization as well. You can expect benefits from integrating the treasury function into such system setup.

On the other hand, if the above does not apply, you may benefit from the rich choice of various TMS solutions available at competitive prices to fit your specific needs.

Every business runs differently. We are happy to support you in your specific situation.

Rapid advancements in technology and globalization often require cutting- edge payment solutions for corporates with a diverse footprint, but be sure to bake in anti-fraud measures.

Payment fraud originating from within or outside an organization must be guarded against. Read on to learn how SAP Advanced Payment Management (APM) and Business Integrity Screening (BIS) can help.

Compliance requirements, audit needs and external factors like embargos, sanctions imposed by governments, and so on are additional imperatives for corporates and financial institutions (FIs) that want to secure their end-to-end payment lifecycle. Protection must be provided from the time of triggering a payment – or even before – until payment reaches the intended recipient.

In an increasingly digitized world with multiple cybersecurity threats, it is becoming even more important that the payment process is robust and ably supported by a strong technology infrastructure that provides security, speed, and efficiency.

Challenge for Corporates

The reality for many corporates is that they have multiple enterprise resource planning (ERP) systems – SAP or from other vendors – implemented over a period of time, or they have multiple systems due to merger and acquisition (M&A) activity in the past. Such corporates end up having lots of multi-banking relationships with different processes across the entire company, and different systems or banking portals for making payments. In an ideal world, moving to a single system with focused banking relationships, centralized treasury management and harmonized global processes is the end game that every company wants to achieve. But the process to get there is long.

SAP S/4 HANA

Companies using, or moving, to SAP as their primary ERP often aim for a single instance of the S/4 HANA landscape to get a single version of truth, but they may approach it in different ways. The journey most often is long and complex. But payment risk has to be mitigated sooner, rather than later.

Companies can adopt different strategies like ‘Central Finance’, ‘Treasury First’ or centralization of payments through a Payment Factory (PF) solution to enable certain quicker wins and security for the treasury and finance organization.

Advanced Payment Management Functionality

SAP introduced APM in 2019 to help payment centralization, visibility and oversight for those using its systems. APM alongside In-House Bank is its payment factory solution. SAP has continuously upgraded it since, with appropriate functionalities including anti-fraud measures available to users now.

APM allows for centralization of payments originating from any system – be it SAP or non-SAP – and facilitates:

- Data enrichment,

- Data validations,

- Conversions to bank specific file formats where needed,

- Batching, along with adding an approval mechanism by integrating with SAP’s Bank

- Communication Management option and by using a secured single channel of communication to all banks like SAP’s Multi-Bank Connectivity.

These measures enable treasury to have central and near-real time visibility of all payments going out, allowing corporate treasurers to put controls and checks in place through a robust payment approval mechanism.

Having a strong and auditable payment approval process governed by a unified system will enable reductions in payment fraud. However, payment approval alone is somewhat of a reactive mechanism and relies on a human touch that can sometimes become time consuming, labor-intensive and prone to errors, which can potentially miss some transactions when done on a large scale. A more advanced way of managing payment risk efficiently is through an exception-based procedure, where only absolutely required payments go through a human touch, with low-risk transactions filtered through an automated rules engine that allows for targeted attention on high-risk payments.

The need for Business Integrity Screening

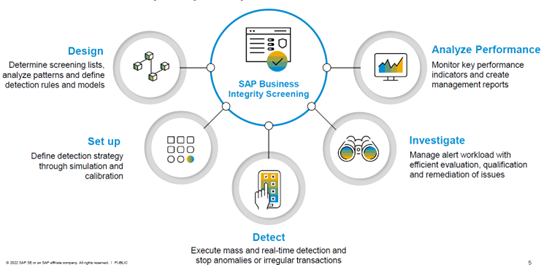

SAP Business Integrity Screening (BIS) is a solution that complements the payment engine of S/4 HANA, including the advanced payment management (APM) function. BIS is a SAP solution that can be enabled on S/4 HANA. At a high level, it is a rules-based engine designed to detect anomalies and third-party risk. It uses data to predict and prevent future occurrences of fraud risk.

By virtue of being on S/4 HANA, BIS handles large volumes of payments, processing through real-time simulations. SAP BIS also integrates with different process areas like master data management, invoice processing, payment execution (payment runs), and with APM for payments originating from other systems. This helps fraud prevention at a much earlier stage.

The below Figure 1 picture depicts a few of the features of BIS where a set of rules can be defined for different scenarios with certain SAP provided out-of-box rules – for example, identified risk factors might include:

- Supplier invoice and payment execution stages, like vendor invoices or banks accounts in high-risk countries,

- One-time vendors,

- Payments made too early,

- Changes to vendor banking details just before a payment cycle,

- Duplicate invoices,

- Manual payments, and so on.

Figure 1: SAP’s Business Integrity Screening (BIS) Key Features

Source: SAP.

BIS has a highly flexible detection and screening strategy for business partners where new rules can be added and it can make composite rule scenarios, resulting in an overall risk score being awarded. For example, a weighted score may be determined based on individual Rules like:

- Payment value banding.

- Consecutive payments to the same beneficiary.

- Beneficiary address in an ‘at risk’ country.

Using the power of S/4 HANA, every payment is processed through all the rules and strategies defined to detect anomalies as early as possible, with real-time alert mechanisms providing further security. Implementations can leverage out-of-the-box rules and create new rules based on internal knowledge to refine anti-fraud measures going forward. BIS also has powerful analytics through the SAP Analytics Cloud solution for evaluating the performance of each strategy and rule, enabling refinements to be made.

BIS & APM Integration

For customers operating a single system environment, BIS was previously integrated with Payment Run functionality. With a multi-ERP Payment Factory landscape, BIS now integrates directly with APM. This means payments across the enterprise can be routed through screening for exception-based handling.

BIS combined with APM has two possibilities (as of writing this article):

- online screening for individual items,

- or batch screening for larger volumes of payments.

Rules can be set based on the size of payments as well – for example, Low value payments can be set for batch screening, while high value transactions can be set for online screening.

In the current release BIS 1.5 (FPS00), there are pre-defined scenarios specifically for APM. These check recipient bank accounts – for example, in high-risk countries and so on – and business partner (payee) bona fides for sanction screening/embargo checks at the payment order/payment item level. Custom scenarios can be created, and further custom code enhancements built within SAP-provided enhancement points.

While screening online, APM payment orders are validated through BIS detection rules. Payments without any anomalies or risk scores below threshold are automatically approved and processed for further normal processing through APM outbound processing. Payments which are suspicious will be ‘parked’ in BIS for user intervention to either release the payment – remembering, it could be a false positive scenario – or for blocking.

Any blocked payment in BIS automatically moves the APM payment order to the Exception Handling queue within Advanced Payment Management for further processing – for example, taking corrective actions in source systems, validating internal processes, contacting the vendor, cancelling/reversing a payment, and so on.

End-to-End Payment Fraud Prevention

There are different solutions available to cater to the specific needs of corporates across the payment lifecycle. A key first step is to centralize payments where Advanced Payment Management can help. A key benefit of Payment Centralization in a corporate landscape is the opportunity to initiate centralized payment screening and fraud prevention using BIS.

The integration between BIS and the APM Payment Factory enables effective payment fraud and sanction screening detection across the whole payment landscape. Adding Bank Communication Management for further approval control on an exceptions-basis will ensure a robust and automated payment process mechanism, with a strong focus on automated payment fraud prevention.

Once the payment process is secured, the next step is having secure connectivity to banks. This is where solutions like the SAP Multi-Bank Connectivity option can help.

If you are interested in any of the topics mentioned, or Sanction Screening & Fraud Detection more generally, we at Zanders encourage you to reach out to us via the ‘Get In Touch’ button. You can read more about Bank Connectivity Solutions & Advanced Payment Management: APM in our earlier articles.

Setting up a complete stand-alone treasury function from scratch is one of the most comprehensive activities for any Treasurer.

Having to do this as part of a transaction where part of an existing business is being sold adds a major challenging element: time.