Explore how ridge backtesting addresses the intricate challenges of Expected Shortfall (ES) backtesting, offering a robust and insightful approach for modern risk management.

Challenges with backtesting Expected Shortfall

Recent regulations are increasingly moving toward the use of Expected Shortfall (ES) as a measure to capture risk. Although ES fixes many issues with VaR, there are challenges when it comes to backtesting.

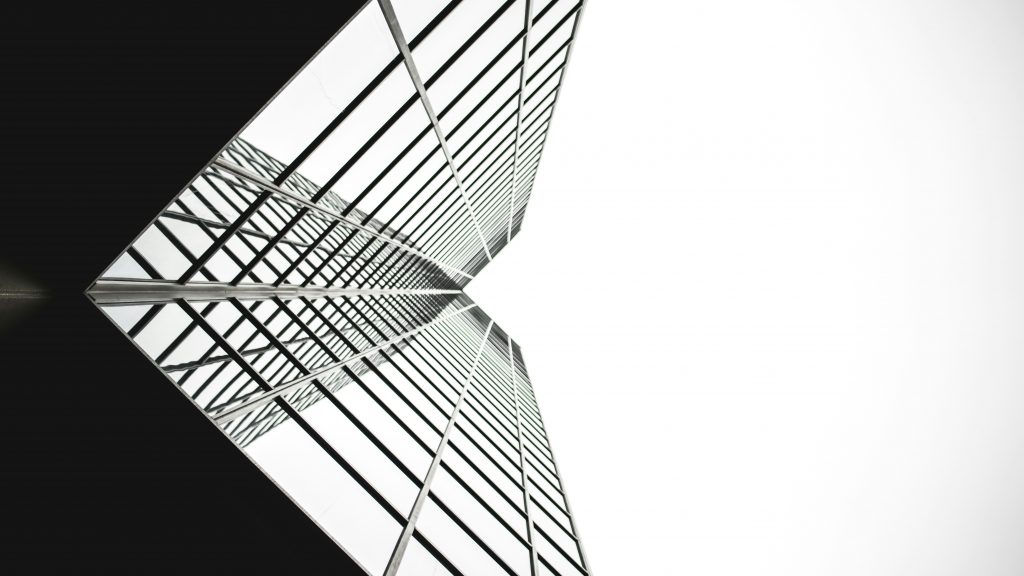

Although VaR has been widely-used for decades, its shortcomings have prompted the switch to ES. Firstly, as a percentile measure, VaR does not adequately capture tail risk. Unlike VaR, which gives the maximum expected portfolio loss in a given time period and at a specific confidence level, ES gives the average of all potential losses greater than VaR (see figure 1). Consequently, unlike Var, ES can capture a range of tail scenarios. Secondly, VaR is not sub-additive. ES, however, is sub-additive, which makes it better at accounting for diversification and performing attribution. As such, more recent regulation, such as FRTB, is replacing the use of VaR with ES as a risk measure.

Figure 1: Comparison of VaR and ES

Elicitability is a necessary mathematical condition for backtestability. As ES is non-elicitable, unlike VaR, ES backtesting methods have been a topic of debate for over a decade. Backtesting and validating ES estimates is problematic – how can a daily ES estimate, which is a function of a probability distribution, be compared with a realised loss, which is a single loss from within that distribution? Many existing attempts at backtesting have relied on approximations of ES, which inevitably introduces error into the calculations.

The three main issues with ES backtesting can be summarised as follows:

- Transparency

- Without reliable techniques for backtesting ES, banks struggle to have transparency on the performance of their models. This is particularly problematic for regulatory compliance, such as FRTB.

- Sensitivity

- Existing VaR and ES backtesting techniques are not sensitive to the magnitude of the overages. Instead, these techniques, such as the Traffic Light Test (TLT), only consider the frequency of overages that occur.

- Stability

- As ES is conditional on VaR, any errors in VaR calculation lead to errors in ES. Many existing ES backtesting methodologies are highly sensitive to errors in the underlying VaR calculations.

Ridge Backtesting: A solution to ES backtesting

One often-cited solution to the ES backtesting problem is the ridge backtesting approach. This method allows non-elicitable functions, such as ES, to be backtested in a manner that is stable with regards to errors in the underlying VaR estimations. Unlike traditional VaR backtesting methods, it is also sensitive to the magnitude of the overages and not just their frequency.

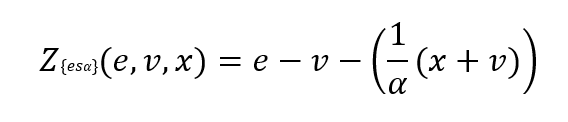

The ridge backtesting test statistic is defined as:

where 𝑣 is the VaR estimation, 𝑒 is the expected shortfall prediction, 𝑥 is the portfolio loss and 𝛼 is the confidence level for the VaR estimation.

The value of the ridge backtesting test statistic provides information on whether the model is over or underpredicting the ES. The technique also allows for two types of backtesting; absolute and relative. Absolute backtesting is denominated in monetary terms and describes the absolute error between predicted and realised ES. Relative backtesting is dimensionless and describes the relative error between predicted and realised ES. This can be particularly useful when comparing the ES of multiple portfolios. The ridge backtesting result can be mapped to the existing Basel TLT RAG zones, enabling efficient integration into existing risk frameworks.

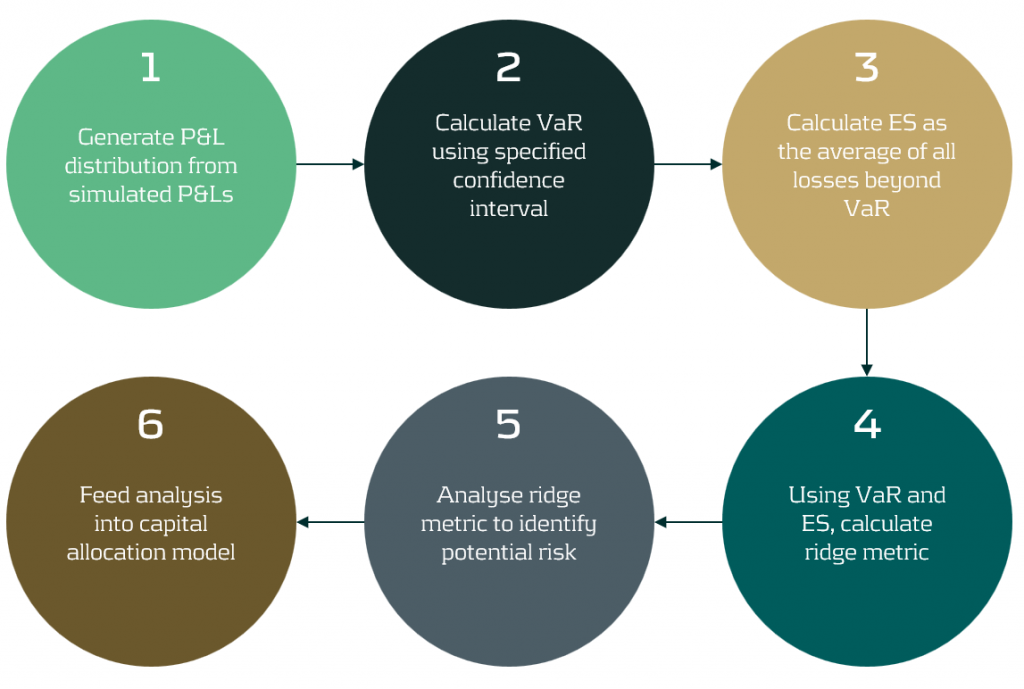

Figure 2: The ridge backtesting methodology

Sensitivity to Overage Magnitude

Unlike VaR backtesting, which does not distinguish between overages of different magnitudes, a major advantage of ES ridge backtesting is that it is sensitive to the size of each overage. This allows for better risk management as it identifies periods with large overages and also periods with high frequency of overages.

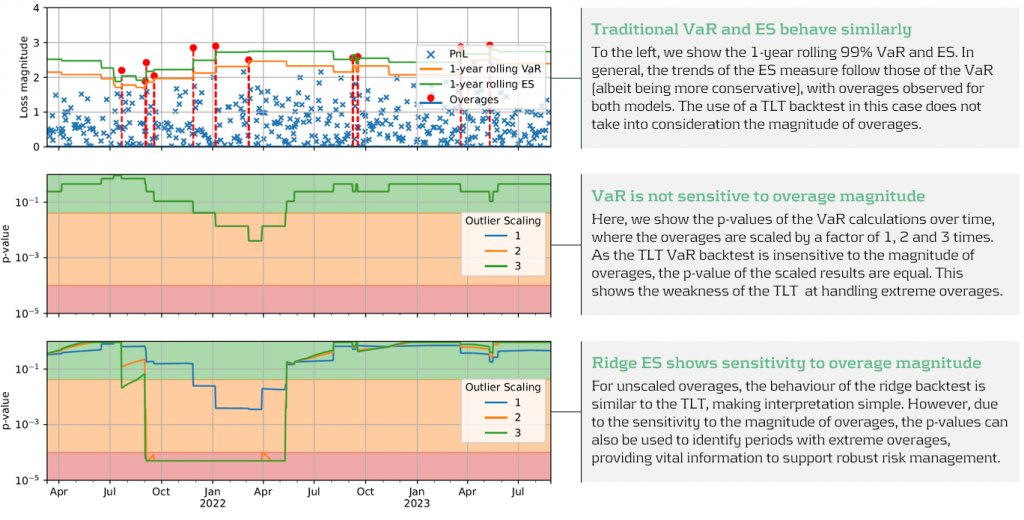

Below, in figure 3, we demonstrate the effectiveness of the ridge backtest by comparing it against a traditional VaR backtest. A scenario was constructed with P&Ls sampled from a Normal distribution, from which a 1-year 99% VaR and ES were computed. The sensitivity of ridge backtesting to overage magnitude is demonstrated by applying a range of scaling factors, increasing the size of overages by factors of 1, 2 and 3. The results show that unlike the traditional TLT, which is sensitive only to overage frequency, the ridge backtesting technique is effective at identifying both the frequency and magnitude of tail events. This enables risk managers to react more quickly to volatile markets, regime changes and mismodeling of their risk models.

Figure 3: Demonstration of ridge backtesting’s sensitivity to overage magnitude.

The Benefits of Ridge Backtesting

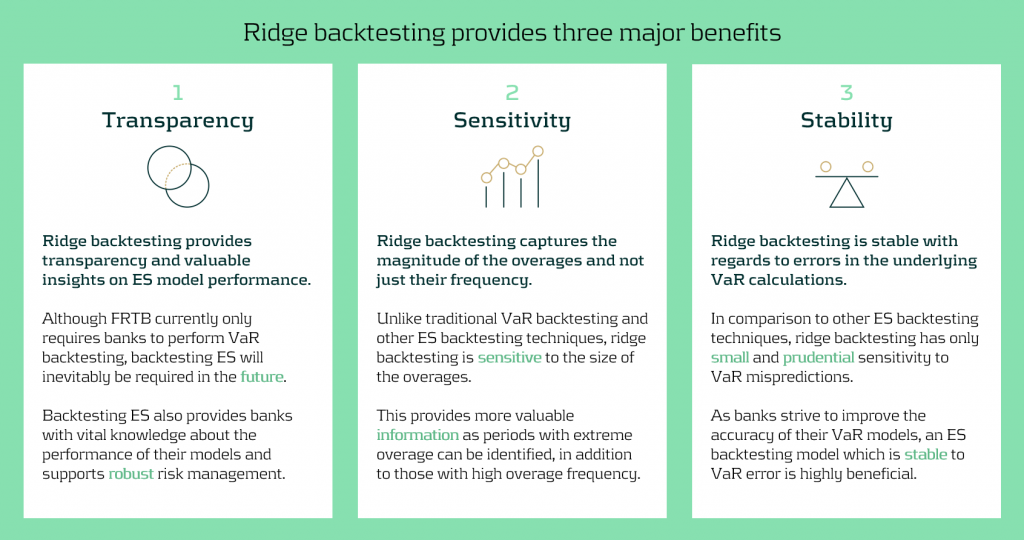

Rapidly changing regulation and market regimes require banks enhance their risk management capabilities to be more reactive and robust. In addition to being a robust method for backtesting ES, ridge backtesting provides several other benefits over alternative backtesting techniques, providing banks with metrics that are sensitive and stable.

Despite the introduction of ES as a regulatory requirement for banks choosing the internal models approach (IMA), regulators currently do not require banks to backtest their ES models. This leaves a gap in banks’ risk management frameworks, highlighting the necessity for a reliable ES backtesting technique. Despite this, banks are being driven to implement ES backtesting methodologies to be compliant with future regulation and to strengthen their risk management frameworks to develop a comprehensive understanding of their risk.

Ridge backtesting gives banks transparency to the performance of their ES models and a greater reactivity to extreme events. It provides increased sensitivity over existing backtesting methodologies, providing information on both overage frequency and magnitude. The method also exhibits stability to any underlying VaR mismodeling.

In figure 4 below, we summarise the three major benefits of ridge backtesting.

Figure 4: The three major benefits of ridge backtesting.

Conclusion

The lack of regulatory control and guidance on backtesting ES is an obvious concern for both regulators and banks. Failure to backtest their ES models means that banks are not able to accurately monitor the reliability of their ES estimates. Although the complexities of backtesting ES has been a topic of ongoing debate, we have shown in this article that ridge backtesting provides a robust and informative solution. As it is sensitive to the magnitude of overages, it provides a clear benefit in comparison to traditional VaR TLT backtests that are only sensitive to overage frequency. Although it is not a regulatory requirement, regulators are starting to discuss and recommend ES backtesting. For example, the PRA, EBA and FED have all recommended ES backtesting in some of their latest publications. However, despite the fact that regulation currently only requires banks to perform VaR backtesting, banks should strive to implement ES backtesting as it supports better risk management.

For more information on this topic, contact Dilbagh Kalsi (Partner) or Hardial Kalsi (Manager).

A comprehensive summary of a recent webinar on diverse modeling techniques and shared challenges in expected credit losses

Across the whole of Europe, banks apply different techniques to model their IFRS9 Expected Credit Losses on a best estimate basis. The diverse spectrum of modeling techniques raises the question: what can we learn from each other, such that we all can improve our own IFRS 9 frameworks? For this purpose, Zanders hosted a webinar on the topic of IFRS 9 on the 29th of May 2024. This webinar was in the form of a panel discussion which was led by Martijn de Groot and tried to discuss the differences and similarities by covering four different topics. Each topic was discussed by one panelist, who were Pieter de Boer (ABN AMRO, Netherlands), Tobia Fasciati (UBS, Switzerland), Dimitar Kiryazov (Santander, UK), and Jakob Lavröd (Handelsbanken, Sweden).

The webinar showed that there are significant differences with regards to current IFRS 9 issues between European banks. An example of this is the lingering effect of the COVID-19 pandemic, which is more prominent in some countries than others. We also saw that each bank is working on developing adaptable and resilient models to handle extreme economic scenarios, but that it remains a work in progress. Furthermore, the panel agreed on the fact that SICR remains a difficult metric to model, and, therefore, no significant changes are to be expected on SICR models.

Covid-19 and data quality

The first topic covered the COVID-19 period and data quality. The poll question revealed widespread issues with managing shifts in their IFRS 9 model resulting from the COVID-19 developments. Pieter highlighted that many banks, especially in the Netherlands, have to deal with distorted data due to (strong) government support measures. He said this resulted in large shifts of macroeconomic variables, but no significant change in the observed default rate. This caused the historical data not to be representative for the current economic environment and thereby distorting the relationship between economic drivers and credit risk. One possible solution is to exclude the COVID-19 period, but this will result in the loss of data. However, including the COVID-19 period has a significant impact on the modeling relations. He also touched on the inclusion of dummy variables, but the exact manner on how to do so remains difficult.

Dimitar echoed these concerns, which are also present in the UK. He proposed using the COVID-19 period as an out-of-sample validation to assess model performance without government interventions. He also talked about the problems with the boundaries of IFRS 9 models. Namely, he questioned whether models remain reliable when data exceeds extreme values. Furthermore, he mentioned it also has implications for stress testing, as COVID-19 is a real life stress scenario, and we might need to think about other modeling techniques, such as regime-switching models.

Jakob found the dummy variable approach interesting and also suggested the Kalman filter or a dummy variable that can change over time. He pointed out that we need to determine whether the long term trend is disturbed or if we can converge back to this trend. He also mentioned the need for a common data pipeline, which can also be used for IRB models. Pieter and Tobia agreed, but stressed that this is difficult since IFRS 9 models include macroeconomic variables and are typically more complex than IRB.

Significant Increase in Credit Risk

The second topic covered the significant increase in credit risk (SICR). Jakob discussed the complexity of assessing SICR and the lack of comprehensive guidance. He stressed the importance of looking at the origination, which could give an indication on the additional risk that can be sustained before deeming a SICR.

Tobia pointed out that it is very difficult to calibrate, and almost impossible to backtest SICR. Dimitar also touched on the subject and mentioned that the SICR remains an accounting concept that has significant implications for the P&L. The UK has very little regulations on this subject, and only requires banks to have sufficient staging criteria. Because of these reasons, he mentioned that he does not see the industry converging anytime soon. He said it is going to take regulators to incentivize banks to do so. Dimitar, Jakob, and Tobia also touched upon collective SICR, but all agreed this is difficult to do in practice.

Post Model Adjustments

The third topic covered post model adjustments (PMAs). The results from the poll question implied that most banks still have PMAs in place for their IFRS 9 provisions. Dimitar responded that the level of PMAs has mostly reverted back to the long term equilibrium in the UK. He stated that regulators are forcing banks to reevaluate PMAs by requiring them to identify the root cause. Next to this, banks are also required to have a strategy in place when these PMAs are reevaluated or retired, and how they should be integrated in the model risk management cycle. Dimitar further argued that before COVID-19, PMAs were solely used to account for idiosyncratic risk, but they stayed around for longer than anticipated. They were also used as a countercyclicality, which is unexpected since IFRS 9 estimations are considered to be procyclical. In the UK, banks are now building PMA frameworks which most likely will evolve over the coming years.

Jakob stressed that we should work with PMAs on a parameter level rather than on ECL level to ensure more precise adjustments. He also mentioned that it is important to look at what comes before the modeling, so the weights of the scenarios. At Handelsbanken, they first look at smaller portfolios with smaller modeling efforts. For the larger portfolios, PMAs tend to play less of a role. Pieter added that PMAs can be used to account for emerging risks, such as climate and environmental risks, that are not yet present in the data. He also stressed that it is difficult to find a balance between auditors, who prefer best estimate provisions, and the regulator, who prefers higher provisions.

Linking IFRS 9 with Stress Testing Models

The final topic links IFRS 9 and stress testing. The poll revealed that most participants use the same models for both. Tobia discussed that at UBS the IFRS 9 model was incorporated into their stress testing framework early on. He pointed out the flexibility when integrating forecasts of ECL in stress testing. Furthermore, he stated that IFRS 9 models could cope with stress given that the main challenge lies in the scenario definition. This is in contrast with others that have been arguing that IFRS 9 models potentially do not work well under stress. Tobia also mentioned that IFRS 9 stress testing and traditional stress testing need to have aligned assumptions before integrating both models in each other.

Jakob agreed and talked about the perfect foresight assumption, which suggests that there is no need for additional scenarios and just puts a weight of 100% on the stressed scenario. He also added that IFRS 9 requires a non-zero ECL, but a highly collateralized portfolio could result in zero ECL. Stress testing can help to obtain a loss somewhere in the portfolio, and gives valuable insights on identifying when you would take a loss.

Pieter pointed out that IFRS 9 models differ in the number of macroeconomic variables typically used. When you are stress testing variables that are not present in your IFRS 9 model, this could become very complicated. He stressed that the purpose of both models is different, and therefore integrating both can be challenging. Dimitar said that the range of macroeconomic scenarios considered for IFRS 9 is not so far off from regulatory mandated stress scenarios in terms of severity. However, he agreed with Pieter that there are different types of recessions that you can choose to simulate through your IFRS 9 scenarios versus what a regulator has identified as systemic risk for an industry. He said you need to consider whether you are comfortable relying on your impairment models for that specific scenario.

This topic concluded the webinar on differences and similarities across European countries regarding IFRS 9. We would like to thank the panelists for the interesting discussion and insights, and the more than 100 participants for joining this webinar.

Interested to learn more? Contact Kasper Wijshoff, Michiel Harmsen or Polly Wong for questions on IFRS 9.

Unlock Treasury Efficiency: Exploring SAP’s GROW and RISE Cloud Solutions

As organizations continue to adapt to the rapidly changing business landscape, one of the most pivotal shifts is the migration of enterprise resource planning (ERP) systems to the cloud. The evolution of treasury operations is a prime example of how cloud-based solutions are revolutionizing the way businesses manage their financial assets. This article dives into the nuances between SAP’s GROW (public cloud) and RISE (private cloud) products, particularly focusing on their impact on treasury operations.

The "GROW" product targets new clients who want to quickly leverage the public cloud's scalability and standard processes. In contrast, the "RISE" product is designed for existing SAP clients aiming to migrate their current systems efficiently into the private cloud.

Public Cloud vs. Private Cloud

The public cloud, exemplified by SAP's "GROW" package, operates on a shared infrastructure hosted by providers such as SAP, Alibaba, or AWS. Public cloud services are scalable, reliable, and flexible, offering key business applications and storage managed by the cloud service providers. Upgrades are mandatory and occur on a six-month release cycle. All configuration is conducted through SAP Fiori, making this solution particularly appealing to upper mid-market net new customers seeking to operate using industry-standard processes and maintain scalable operations.

In contrast, the private cloud model, exemplified by the “RISE” package, is used exclusively by a single business or organization and must be hosted at SAP or an SAP-approved hyperscaler of their choice. The private cloud offers enhanced control and security, catering to specific business needs with personalized services and infrastructure according to customer preferences. It provides configuration flexibility through both SAP Fiori and the SAP GUI. This solution is mostly preferred by large enterprises, and many customers are moving from ECC to S/4HANA due to its customizability and heightened security.

Key Differences in Cloud Approaches

Distinguishing between public and private cloud methodologies involves examining factors like control, cost, security, scalability, upgrades, configuration & customization, and migration. Each factor plays a crucial role in determining which cloud strategy aligns with an organization's vision for treasury operations.

- Control: The private cloud model emphasizes control, giving organizations exclusive command over security and data configurations. The public cloud is managed by external providers, offering less control but relieving the organization from day-to-day cloud management.

- Cost: Both the public and private cloud operate on a subscription model. However, managing a private cloud infrastructure requires significant upfront investment and a dedicated IT team for ongoing maintenance, updates, and monitoring, making it a time-consuming and resource-intensive option. Making the public cloud potentially a more cost-effective option for organizations.

- Security: Both GROW and RISE are hosted by SAP or hyperscalers, offering strong security measures. There is no significant difference in security levels between the two models.

- Scalability: The public cloud offers unmatched scalability, allowing businesses to respond quickly to increased demands without the need for physical hardware changes. Private clouds can also be scaled, but this usually requires additional hardware or software and IT support, making them less dynamic.

- Upgrades: the public cloud requires mandatory upgrades every six months, whereas the private cloud allows organizations to dictate the cadence of system updates, such as opting for upgrades every five years or as needed.

- Configuration and Customization: in the public cloud configuration is more limited with fewer BAdIs and APIs available, and no modifications allowed. The private cloud allows for extensive configuration through IMG and permits SAP code modification, providing greater flexibility and control.

- Migration: the public cloud supports only greenfield implementation, which means only current positions can be migrated, not historical transactions. The private cloud offers migration programs from ECC, allowing historical data to be transferred.

Impact on Treasury Operations

The impact of SAP’s GROW (public cloud) and RISE (private cloud) solutions on treasury operations largely hinges on the degree of tailoring required by an organization’s treasury processes. If your treasury processes require minimal or no tailoring, both public and private cloud options could be suitable. However, if your treasury processes are tailored and structured around specific needs, only the private cloud remains a viable option.

In the private cloud, you can add custom code, modify SAP code, and access a wider range of configuration options, providing greater flexibility and control. In contrast, the public cloud does not allow for SAP code modification but does offer limited custom code through cloud BADI and extensibility. Additionally, the public cloud emphasizes efficiency and user accessibility through a unified interface (SAP Fiori), simplifying setup with self-service elements and expert oversight. The private cloud, on the other hand, employs a detailed system customization approach (using SAP Fiori & GUI), appealing to companies seeking granular control.

Another important consideration is the mandatory upgrades in the public cloud every six months, requiring you to test SAP functionalities for each activated scope item where an update has occurred, which could be strenuous. The advantage is that your system will always run on the latest functionality. This is not the case in the private cloud, where you have more control over system updates. With the private cloud, organizations can dictate the cadence of system updates (e.g., opting for yearly upgrades), the type of updates (e.g., focusing on security patches or functional upgrades), and the level of updates (e.g., maintaining the system one level below the latest is often used).

To accurately assess the impact on your treasury activities, consider the current stage of your company's lifecycle and identify where and when customization is needed for your treasury operations. For example, legacy companies with entrenched processes may find the rigidity of public cloud functionality challenging. In contrast, new companies without established processes can greatly benefit from the pre-delivered set of best practices in the public cloud, providing an excellent starting point to accelerate implementation.

Factors Influencing Choices

Organizations choose between public and private cloud options based on factors like size, compliance, operational complexity, and the degree of entrenched processes. Larger companies may prefer private clouds for enhanced security and customization capabilities. Startups to mid-size enterprises may favor the flexibility and cost-effectiveness of public clouds during rapid growth. Additionally, companies might opt for a hybrid approach, incorporating elements of both cloud models. For instance, a Treasury Sidecar might be deployed on the public cloud to leverage scalability and innovation while maintaining the main ERP system on-premise or on the private cloud for greater control and customization. This hybrid strategy allows organizations to tailor their infrastructure to meet specific operational needs while maximizing the advantages of both cloud environments.

Conclusion

Migrating ERP systems to the cloud can significantly enhance treasury operations with distinct options through SAP's public and private cloud solutions. Public clouds offer scalable, cost-effective solutions ideal for medium-to upper-medium-market enterprises with standard processes or without pre-existing processes. They emphasize efficiency, user accessibility, and mandatory upgrades every six months. In contrast, private clouds provide enhanced control, security, and customization, catering to larger enterprises with specific regulatory needs and the ability to modify SAP code.

Choosing the right cloud model for treasury operations depends on an organization's current and future customization needs. If minimal customization is required, either option could be suitable. However, for customized treasury processes, the private cloud is preferable. The decision should consider the company's lifecycle stage, with public clouds favoring rapid growth and cost efficiency and private clouds offering long-term control and security.

It is also important to note that SAP continues to offer on-premise solutions for organizations that require or prefer traditional deployment methods. This article focuses on cloud solutions, but on-premises remains a viable option for businesses that prioritize complete control over their infrastructure and have the necessary resources to manage it independently.

If you need help thinking through your decision, we at Zanders would be happy to assist you.

Are you leveraging the SAP Credit Risk Analyzer to its full potential?

While many business and SAP users are familiar with its core functionalities, such as limit management applying different limit types and the core functionality of attributable amount determination, several less known SAP standard features can enhance your credit risk management processes.

In this article, we will explore these hidden gems, such as Group Business Partners and the ways to manage the limit utilizations using manual reservations and collateral.

Group Business Partner Use

One of the powerful yet often overlooked features of the SAP Credit Risk Analyzer is the ability to use Group Business Partners (BP). This functionality allows you to manage credit and settlement risk at a bank group level rather than at an individual transactional BP level. By consolidating credit and settlement exposure for related entities under a single group business partner, you can gain a holistic view of the risks associated with an entire banking group. This is particularly beneficial for organizations dealing with banking corporations globally and allocating a certain amount of credit/settlement exposure to banking groups. It is important to note that credit ratings are often reflected at the group bank level. Therefore, the use of Group BPs can be extended even further with the inclusion of credit ratings, such as S&P, Fitch, etc.

Configuration: Define the business partner relationship by selecting the proper relationship category (e.g., Subsidiary of) and setting the Attribute Direction to "Also count transactions from Partner 1 towards Partner 2," where Partner 2 is the group BP.

Master Data: Group BPs can be defined in the SAP Business Partner master data (t-code BP). Ensure that all related local transactional BPs are added in the relationship to the appropriate group business partner. Make sure the validity period of the BP relationship is valid. Risk limits are created using the group BP instead of the transactional BP.

Reporting: Limit utilization (t-code TBLB) is consolidated at the group BP level. Detailed utilization lines show the transactional BP, which can be used to build multiple report variants to break down the limit utilization by transactional BP (per country, region, etc.).

Having explored the benefits of using Group Business Partners, another feature that offers significant flexibility in managing credit risk is the use of manual reservations and collateral contracts.

Use of Manual Reservations

Manual reservations in the SAP Credit Risk Analyzer provide an additional layer of flexibility in managing limit utilization. This feature allows risk managers to manually add a portion of the credit/settlement utilization for specific purposes or transactions, ensuring that critical operations are not hindered by unexpected credit or settlement exposure. It is often used as a workaround for issues such as market data problems, when SAP is not able to calculate the NPV, or for complex financial instruments not yet supported in the Treasury Risk Management (TRM) or Credit Risk Analyzer (CRA) settings.

Configuration: Apart from basic settings in the limit management, no extra settings are required in SAP standard, making the use of reservations simpler.

Master data: Use transaction codes such as TLR1 to TLR3 to create, change, and display the reservations, and TLR4 to collectively process them. Define the reservation amount, specify the validity period, and assign it to the relevant business partner, transaction, limit product group, portfolio, etc. Prior to saving the reservation, check in which limits your reservation will be reflected to avoid having any idle or misused reservations in SAP.

While manual reservations provide a significant boost to flexibility in limit management, another critical aspect of credit risk management is the handling of collateral.

Collateral

Collateral agreements are a fundamental aspect of credit risk management, providing security against potential defaults. The SAP Credit Risk Analyzer offers functionality for managing collateral agreements, enabling corporates to track and value collateral effectively. This ensures that the collateral provided is sufficient to cover the exposure, thus reducing the risk of loss.

SAP TRM supports two levels of collateral agreements:

- Single-transaction-related collateral

- Collateral agreements.

Both levels are used to reduce the risk at the level of attributable amounts, thereby reducing the utilization of limits.

Single-transaction-related collateral: SAP distinguishes three types of collateral value categories:

- Percentual collateralization

- Collateralization using a collateral amount

- Collateralization using securities

Configuration: configure collateral types and collateral priorities, define collateral valuation rules, and set up the netting group.

Master Data: Use t-code KLSI01_CFM to create collateral provisions at the appropriate level and value. Then, this provision ID can be added to the financial object.

Reporting: both manual reservations and collateral agreements are visible in the limit utilization report as stand- alone utilization items.

By leveraging these advanced features, businesses can significantly enhance their risk management processes.

Conclusion

The SAP Credit Risk Analyzer is a comprehensive tool that offers much more than meets the eye. By leveraging its hidden functionalities, such as Group Business Partner use, manual reservations, and collateral agreements, businesses can significantly enhance their credit risk management processes. These features not only provide greater flexibility and control but also ensure a more holistic and robust approach to managing credit risk. As organizations continue to navigate the complexities of the financial landscape, unlocking the full potential of the SAP Credit Risk Analyzer can be a game-changer in achieving effective risk management.

If you have questions or are keen to see the functionality in our Zanders SAP Demo system, please feel free to contact Aleksei Abakumov or any Zanders SAP consultant.

We explore how the Bayesian Gaussian Process Classifier (GPC) injects much needed agility and interpretability into default modeling.

In brief:

- Prevailing uncertainty in geopolitical, economic and regulatory environments demands a more dynamic approach to default modeling.

- Traditional methods such as logistic regression fail to address the non-linear characteristics of credit risk.

- Score-based models can be cumbersome to calibrate with expertise and can lack the insight of human wisdom.

- Machine learning lacks the interpretability expected in a world where transparency is paramount.

- Using the Bayesian Gaussian Process Classifier defines lending parameters in a more holistic way, sharpening a bank’s ability to approve creditworthy borrowers and reject proposals from counterparties that are at a high risk of default.

Historically high levels of economic volatility, persistent geopolitical unrest, a fast-evolving regulatory environment – a perpetual stream of disruption is highlighting the limitations and vulnerabilities in many credit risk approaches. In an era where uncertainty persists, predicting risk of default is becoming increasingly complex, and banks are increasingly seeking a modeling approach that incorporates more flexibility, interpretability, and efficiency.

While logistic regression remains the market standard, the evolution of the digital treasury is arming risk managers with a more varied toolkit of methodologies, including those powered by machine learning. This article focuses on the Bayesian Gaussian Process Classifier (GPC) and the merits it offers compared to machine learning, score-based models, and logistic regression.

A non-parametric alternative to logistic regression

The days of approaching credit risk in a linear, one-dimensional fashion are numbered. In today’s fast paced and uncertain world, to remain resilient to rising credit risk, banks have no choice other than to consider all directions at once. With the GPC approach, the linear combination of explanatory variables is replaced by a function, which is iteratively updated by applying Bayes’ rule (see Bayesian Classification With Gaussian Processes for further detail).

For default modeling, a multivariate Gaussian distribution is used, hence forsaking linearity. This allows the GPC to parallel machine learning (ML) methodologies, specifically in terms of flexibility to incorporate a variety of data types and variables and capability to capture complex patterns hidden within financial datasets.

A model enriched by expert wisdom

Another way GPC shows similar characteristics to machine learning is in how it loosens the rigid assumptions that are characteristic of many traditional approaches, including logistic regression and score-based models. To explain, one example is the score-based Corporate Rating Model (CRM) developed by Zanders. This is the go-to model of Zanders to assess the creditworthiness of corporate counterparties. However, calibrating this model and embedding the opinion of Zanders’ corporate rating experts is a time-consuming task. The GPC approach streamlines this process significantly, delivering both greater cost- and time-efficiencies. The incorporation of prior beliefs via Bayesian inference permits the integration of expert knowledge into the model, allowing it to reflect predetermined views on the importance of certain variables. As a result, the efficiency gains achieved through the GPC approach don’t come at the cost of expert wisdom.

Enabling explainable lending decisions

As well as our go-to CRM, Zanders also houses machine learning approaches to default modeling. Although this generates successful outcomes, with machine learning, the rationale behind a credit decision is not explicitly explained. In today’s volatile environment, an unexplainable solution can fall short of stakeholder and regulator expectations – they increasingly want to understand the reasoning behind lending decisions at a forensic level.

Unlike the often ‘black-box’ nature of ML models, with GPC, the path to a decision or solution is both transparent and explainable. Firstly, the GPC model’s hyperparameters provide insights into the relevance and interplay of explanatory variables with the predicted outcome. In addition, the Bayesian framework sheds light on the uncertainty surrounding each hyperparameter. This offers a posterior distribution that quantifies confidence in these parameter estimates. This aspect adds substantial risk assessment value, contrary to the typical point estimate outputs from score-based models or deterministic ML predictions. In short, an essential advantage of the GPC over other approaches is its ability to generate outcomes that withstand the scrutiny of stakeholders and regulators.

A more holistic approach to probability of default modeling

In summary, if risk managers are to tackle the mounting complexity of evaluating probability of default, they need to approach it non-linearly and in a way that’s explainable at every level of the process. This is throwing the spotlight onto more holistic approaches, such as the Gaussian Process Classifier. Using this methodology allows for the incorporation of expert intuition as an additional layer to empirical evidence. It is transparent and accelerates calibration without forsaking performance. This presents an approach that not only incorporates the full complexity of credit risk but also adheres to the demands for model interpretability within the financial sector.

Are you interested in how you could use GPC to enhance your approach to default modeling? Contact Kyle Gartner for more information.

Commodity risk management has become a top CFO priority in some companies recently. Mastering commodity risk requires an integrated approach across business functions. SAP’s comprehensive solution can make a difference.

The recent periods of commodity price volatility have brought commodity risk management to the spotlight in numerous companies, where commodities constitute a substantial component of the final product, but pricing arrangements prevented a substantial hit of the bottom line in the past calm periods.

Understanding Commodity Risk Management is ingrained in the individual steps of the whole value chain, encompassing various business functions with different responsibilities. Purchasing is responsible for negotiating with the suppliers: the sales or pricing department negotiates the conditions with the customers; and Treasury is responsible for negotiating with the banks to secure financing and eventually hedge the commodity risk on the derivatives market. Controlling should have clarity about the complete value chain flow and make sure the margin is protected. Commodity risk management should be a top item on the CFO's list nowadays.

SAP's Solution: A Comprehensive Overview

Each of these functions need to be supported with adequate information system functionality and integrated well together, bridging the physical supply chain flows with financial risk management.

SAP, as the leading provider of both ERP and Treasury and risk management systems, offers numerous functionalities to cover the individual parts of the process. The current solution is the result of almost two decades of functional evolution. The first functionalities were released in 2008 on the ECC 6.04 version to support commodity price risk in the metal business. The current portfolio supports industry solutions for agriculture, oil, and gas, as well as the metal business. Support for power trading is considered for the future. In the recent releases of S/4HANA, many components have been redeveloped to reflect the experience from the existing client implementations, to better cover the trading and hedging workflow, and to leverage the most recent SAP technological innovations, like HANA database and the ABAP RESTful Application Programming Model (RAP).

Functionalities of SAP Commodity Management

Let us take you on a quick journey through the available functionalities.

The SAP Commodity Management solution covers commodity procurement and commodity sales in an end-to-end process, feeding the data for commodity risk positions to support commodity risk management as a dedicated function. In the logistics process, it offers both contracts and orders with commodity pricing components, which can directly be captured through the integrated Commodity Price Engine (CPE). In some commodity markets, products need to be invoiced before the final price is determined based on market prices. For this scenario, provisional and differential invoicing are available in the solution.

The CPE allows users to define complex formulas based on various commodity market prices (futures or spot prices from various quotation sources), currency exchange translation rules, quality and delivery condition surcharges, and rounding rules. The CPE conditions control how the formula results are calculated from term results, e.g., sum, the highest value, provisional versus final term. Compound pricing conditions can be replicated using routines: Splitting routines define how the formula quantity will be split into multiple terms, while Combination routines define how multiple terms will be combined together to get the final values.

Pricing conditions from active contracts and orders for physical delivery of commodities constitute the physical exposure position. Whether in procurement, in a dedicated commodity risk management department, or in the treasury department, real-time recognition and management of the company’s commodity risk positions rely on accurate and reliable data sources and evaluation functionalities. This is provided by the SAP Commodity Risk Management solution. Leveraging the mature functionalities and components of the Treasury and Risk Management module, it allows for managing paper trades to hedge the determined physical commodity risk position. Namely, listed and OTC commodity derivatives are supported. In the OTC area, swaps, forwards, and options, including the Asian variants with average pricing periods, are well covered. These instruments fully integrate into the front office, back office, and accounting functionalities of the existing mature treasury module, allowing for integrated and seamless processing. The positions in the paper deals can be included within the existing Credit Risk Analyser for counterparty risk limit evaluation as well as in the Market Risk Analyser for complex market risk calculations and simulations.

Managing Commodity Exposures

Physical commodity exposure and paper deals are bundled together via the harmonized commodity master data Derivative Contract Specification (DCS), representing individual commodities traded on specific exchanges or spot markets. It allows for translating the volume information of the physical commodity to traded paper contracts and price quotation sources.

In companies with extensive derivative positions, broker statement reconciliation can be automated via the recent product SAP Broker Reconciliation for Commodity Derivatives. This cloud-based solution is natively integrated into the SAP backend to retrieve the derivative positions. It allows for the automatic import of electronic brokers' statements and automates the reconciliation process to investigate and resolve deviations with less human intervention.

To support centralized hedging with listed derivatives, the Derivative Order and Trade execution component has been introduced. It supports a workflow in which an internal organizational unit raises a Commodity Order request, which in turn is reviewed and then fully or partially fulfilled by the trader in the external market.

Innovations in SAP Commodity Management

Significant innovations were released in the S/4HANA 2022 version.

The Commodity Hedge Cockpit supports the trader view and hedging workflow.

In the area of OTC derivatives (namely commodity swaps and commodity forwards), the internal trading and hedging workflow can be supported by Commodity Price Risk Hedge Accounting. It allows for separating various hedging programs through Commodity Hedging areas and defining various Commodity Hedge books. Within the Hedge books, Hedge specifications allow for the definition of rules for concluding financial trades to hedge commodity price exposures, e.g., by defining delivery period rules, hedge quotas, and rules for order utilization sequence. Individual trade orders are defined within the Hedge specification. Intercompany (on behalf of) trading is supported by the automatic creation of intercompany mirror deals, if applicable.

Settings under the hedge book allow for automatically designating cash flow hedge relationships in accordance with IFRS 9 principles, documenting the hedge relationships, running effectiveness checks, using valuation functions, and generating hedge accounting entries. All these functions are integrated into the existing hedge accounting functionalities for FX risk available in SAP Treasury and Risk Management.

The underlying physical commodity exposure can be uploaded as planned data reflecting the planned demand or supply from supply chain functions. The resulting commodity exposure can be further managed (revised, rejected, released), or additional commodity exposure data can be manually entered. If the physical commodity exposure leads to FX exposure, it can be handed over to the Treasury team via the automated creation of Raw exposures in Exposure Management 2.0.

Modelled deals allow for capturing hypothetical deals with no impact on financial accounting. They allow for evaluating commodity price risk for use cases like exposure impact from production forecasts, mark-to-intent for an inventory position (time, location, product), and capturing inter-strategy or late/backdated deals.

Even though a separate team can be responsible for commodity risk management (front office) - and it usually is - bundling together the back office and accounting operations under an integrated middle and back office team can help to substantially streamline the daily operations.

Last but not least, the physical commodity business is usually financed by trade finance instruments. SAP has integrated Letters-of-Credit, as well as Guarantees into the Treasury module and enhanced the functionality greatly in 2016.

All-in-all, every commodity-driven business, upstream or downstream, consumer or producer, works under different setups and business arrangements. The wide variety of available functionalities allows us to define the right solution for every constellation. Especially with commodity management functionalities active in the supply chain modules of the ERP system, SAP commodity risk management can offer a lot of efficiencies in an integrated and streamlined solution. We are happy to accompany you on the journey of defining the best solution for your enterprise.

We investigate different model options for prepayments, among which survival analysis

In brief

- Prepayment modeling can help institutions successfully prepare for and navigate a rise in prepayments due to changes in the financial landscape.

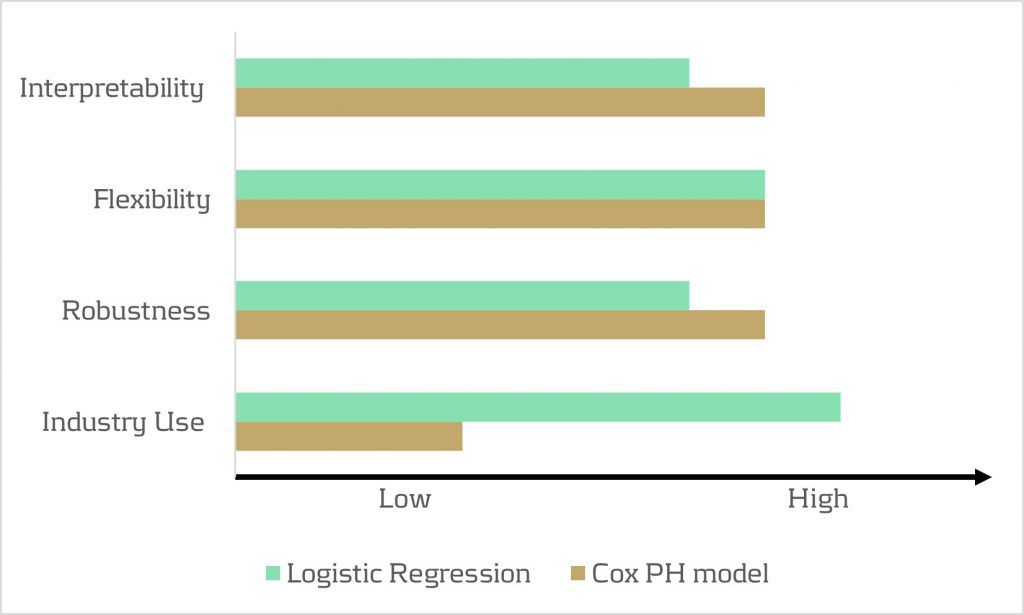

- Two important prepayment modeling types are highlighted and compared: logistic regression vs Cox Proportional Hazard.

- Although the Cox Proportional Hazard model is theoretically preferred under specific conditions, the logical regression is preferred in practice under many scenarios.

The borrowers' option to prepay on their loan induces uncertainty for lenders. How can lenders protect themselves against this uncertainty? Various prepayment modeling approaches can be selected, with option risk and survival analyses being the main alternatives under discussion.

Prepayment options in financial products spell danger for institutions. They inject uncertainty into mortgage portfolios and threaten fixed-rate products with volatile cashflows. To safeguard against losses and stabilize income, institutions must master precise prepayment modeling.

This article delves into the nuances and options regarding the modeling of mortgage prepayments (a cornerstone of Asset Liability Management (ALM)) with a specific focus on survival models.

Understanding the influences on prepayment dynamics

Prepayments are triggered by a range of factors – everything from refinancing opportunities to life changes, such as selling a house due to divorce or moving. These motivations can be grouped into three overarching categories: refinancing factors, macroeconomic factors, and loan-specific factors.

- Refinancing factors

This encompasses key financial drivers (such as interest rates, mortgage rates and penalties) and loan-specific information (including interest rate reset dates and the interest rate differential for the customer). Additionally, the historical momentum of rates and the steepness of the yield curve play crucial roles in shaping refinancing motivations. - Macro-economic factors

The overall state of the economy and the conditions of the housing market are pivotal forces on a borrower's inclination to exercise prepayment options. Furthermore, seasonality adds another layer of variability, with prepayments being notably higher in certain months. For example, in December, when clients have additional funds due to payment of year-end bonusses and holiday budgets. - Loan-specific factors

The age of the mortgage, type of mortgage, and the nature of the property all contribute to prepayment behavior. The seasoning effect, where the probability of prepayment increases with the age of the mortgage, stands out as a paramount factor.

These factors intricately weave together, shaping the landscape in which customers make decisions regarding prepayments. Prepayment modeling plays a vital role in helping institutions to predict the impact of these factors on prepayment behavior.

The evolution of prepayment modeling

Research on prepayment modeling originated in the 1980s and initially centered around option-theoretic models that assume rational customer behavior. Over time, empirical models that cater for customer irrationality have emerged and gained prominence. These models aim to capture the more nuanced behavior of customers by explaining the relationship between prepayment rates and various other factors. In this article, we highlight two important types of prepayment models: logistic regression and Cox Proportional Hazard (Survival Model).

Logistic regression

Logistic regression, specifically its logit or probit variant, is widely employed in prepayment analysis. This is largely because it caters for the binary nature of the dependent variable indicating the occurrence of prepayment events and it moreover flexible. That is, the model can incorporate mortgage-specific and overall economic factors as regressors and can handle time-varying factors and a mix of continuous and categorical variables.

Once the logistic regression model is fitted to historical data, its application involves inputting the characteristics of a new mortgage and relevant economic factors. The model’s output provides the probability of the mortgage undergoing prepayment. This approach is already prevalent in banking practices, and frequently employed in areas such as default modeling and credit scoring. Consequently, it’s favored by many practitioners for prepayment modeling.

Despite its widespread use, the model has drawbacks. While its familiarity in banking scenarios offers simplicity in implementation, it lacks the interpretability characteristic of the Proportional Hazard model discussed below. Furthermore, in terms of robustness, a minimal drawback is that any month-on-month change in results can be caused by numerous factors, which all affect each other.

Cox Proportional Hazard (Survival model)

The Cox Proportional Hazard (PH) model, developed by Sir David Cox in 1972, is one of the most popular models in survival analysis. It consists of two core parts:

- Survival time. With the Cox PH model, the variable of interest is the time to event. As the model stems from medical sciences, this event is typically defined as death. The time variable is referred to as survival time because it’s the time a subject has survived over some follow-up period.

- Hazard rate. This is the distribution of the survival time and is used to predict the probability of the event occurring in the next small-time interval, given that the event has not occurred beforehand. This hazard rate is modelled based on the baseline hazard (the time development of the hazard rate of an average patient) and a multiplier (the effect of patient-specific variables, such as age and gender). An important property of the model is that the baseline hazard is an unspecified function.

To explain how this works in the context of prepayment modeling for mortgages:

- The event of interest is the prepayment of a mortgage.

- The hazard rate is the probability of a prepayment occurring in the next month, given that the mortgage has not been prepaid beforehand. Since the model estimates hazard rates of individual mortgages, it’s modelled using loan-level data.

- The baseline hazard is the typical prepayment behavior of a mortgage over time and captures the seasoning effect of the mortgage.

- The multiplier of the hazard rate is based on mortgage-specific variables, such as the interest rate differential and seasonality.

For full prepayments, where the mortgage is terminated after the event, the Cox PH model applies in its primary format. However, partial prepayments (where the event is recurring) require an extended version, known as the recurrent event PH model. As a result, when using the Cox PH model, , the modeling of partial and full prepayments should be conducted separately, using slightly different models.

The attractiveness of the Cox PH model is due to several features:

- The interpretability of the model. The model makes it possible to quantify the influence of various factors on the likelihood of prepayment in an intuitive way.

- The flexibility of the model. The model offers the flexibility to handle time-varying factors and a mix of continuous and categorical variables, as well as the ability to incorporate recurrent events.

- The multiplier means the hazard rate can’t be negative. The exponential nature of mortgage-specific variables ensures non-negative estimated hazard rates.

Despite the advantages listed above presenting a compelling theoretical case for using the Cox PH model, it faces limited adoption in practical prepayment modeling by banks. This is primarily due to its perceived complexity and unfamiliarity. In addition, when loan-level data is unavailable, the Cox PH model is no longer an option for prepayment modeling.

Logistic regression vs Cox Proportional Hazard

In scenarios with individual survival time data and censored observations, the Cox PH model is theoretically preferred over logistic regression. This preference arises because the Cox PH model leverages this additional information, whereas logistic regression focuses solely on binary outcomes, disregarding survival time and censoring.

However, practical considerations also come into play. Research shows that in certain cases, the logistic regression model closely approximates the results of the Cox PH model, particularly when hazard rates are low. Given that prepayments in the Netherlands are around 3-10% and associated hazard rates tend to be low, the performance gap between logistic regression and the Cox PH model is minimal in practice for this application. Also, the necessity to create a different PH model for full and partial prepayment adds an additional burden on ALM teams.

In conclusion, when faced with the absence of loan-level data, the logistic regression model emerges as a pragmatic choice for prepayment modeling. Despite the theoretical preference for the Cox PH model under specific conditions, the real-world performance similarities, coupled with the familiarity and simplicity of logistic regression, provide a practical advantage in many scenarios.

How can Zanders support?

Zanders is a thought leader on IRRBB-related topics. We enable banks to achieve both regulatory compliance and strategic risk goals by offering support from strategy to implementation. This includes risk identification, formulating a risk strategy, setting up an IRRBB governance and framework, and policy or risk appetite statements. Moreover, we have an extensive track record in IRRBB and behavioral models such as prepayment models, hedging strategies, and calculating risk metrics, both from model development and model validation perspectives.

Are you interested in IRRBB-related topics such as prepayments? Contact Jaap Karelse, Erik Vijlbrief, Petra van Meel (Netherlands, Belgium and Nordic countries) or Martijn Wycisk (DACH region) for more information.

Mergers, divestments, and other M&A activities reshape Treasury management, posing strategic challenges for Treasurers as they navigate disentanglement and build Treasury functions for stand-alone companies.

The corporate landscape is continuously reshaped by strategic realignments such as mergers, divestments, and other M&A activities, wherein a company divests a portion of its business or acquires other businesses to refocus its operations or unlock shareholder value. These transactions greatly affect Treasury management, influencing cash flow, banking structures, financial risk management, financing, and technology. This article explores the challenges Treasurers face during the disentanglement or carve-out process, emphasizing the need for strategic realignment of Treasury activities and focusing on the Treasury perspective of a divesting company. It acknowledges the transitional complexities that arise and the demand for agile response strategies to safeguard against financial instability. We will have a look at the special carve-out situation of building a Treasury function for a stand-alone company in a second part of this article.

Treasury Challenges in Carve-Out Situations

In the dynamic world of corporate restructuring, carve-outs present both a new frontier of opportunity and a multifaceted challenge for Treasurers. While divesting a part of an organization can streamline focus and potentially increase shareholder value, it can place unique pressures on treasury management to reassess and realign financial strategies.

When a corporation decides to execute a carve-out, the Treasury immediately takes on the critical task of separating financial operations and managing transitional service agreements. From the perspective of the divesting company, preserving liquidity and ensuring compliance with financial covenants is a key priority. This intricate division process demands the disentanglement of complex cash flows, re-evaluation and unwinding of cash pooling and internal as well as external debt structures, as well as a review of financial risk and investment policies. Such an endeavour requires rigorous planning and flawless execution to ensure that operational continuity is maintained. Additionally, it requires going into the details, such as the allocation of planning objects (e.g., vendor contracts, machines, vehicles) to the right business for purposes of liquidity forecasting.

Our experience shows that factors like company revenue, industry complexity, and operating countries affect the volume and frequency of treasury transactions. This can increase complexity and workload, especially for intricate transactions. An interesting remark is that carve-out transactions also impact the remaining group. Potentially, the geographic footprint is smaller, or the number of individual business models within the group is less than before – with a significant impact on Treasury.

The Role of Technology in Carve-Outs

A key component in the disentanglement process is represented by Treasury technology. In evaluating treasury technology during a carve-out, scrutiny of the landscape and meticulous planning are paramount to ensuring a smooth transition. The systems must not only handle specific needs such as segmenting data, independent entity reporting, and tracking discrete cash flows and risks, but they must also facilitate a seamless detachment and swift reconfiguration for the newly autonomous entities in the course of the disentanglement of a business. It is essential that these systems support operational independence and continuity with minimal disruptions during the restructuring process.

Implementing the right technology for the new entity, e.g., to cover stand-alone requirements, is crucial. It must meet current transaction needs and be robust enough to handle future demands. Given our breadth of experience across various technological domains and in various M&A scenarios, we have enriched many discussions on which solutions possess the adaptability and scalability necessary to accommodate the evolving needs of a redefined business. 'Right-sizing' the systems, structures, and processes, tailored specifically to the unique contours of the carved-out entity, is a decisive factor for laying the groundwork for sustainable success post-divestiture.

Strategic Realignment for Treasury

Any M&A transaction significantly changes the Treasury Process Map for both the remaining group and the carved-out entity. It has inherited risk and different risk types. We think that Treasury should deal with operational risks first, such as filling resource needs and/or stabilizing business operations. The resource issue requires an analysis of the available employees and their specific skill sets. Onboarding interim resources and back-filling resource gaps until the onboarding of dedicated new staff are alternative options to cover shortfalls.

The operational issue focuses on the impact on cash management and payment operations. Treasury needs to assess the impact on the existing banking and cash management structure and on liquidity as funds received by one entity are required by another. Bank relationships are foundational to Treasury operations and must be revisited and sometimes reinvented. Treasuries must work diligently to maintain trust and communication with old and new banking partners, articulating changes in the company's profile, needs, objectives, and strategies. Beyond negotiation and administration, the process often entails renegotiating terms and ensuring that the newly formed entity's financial needs will continue to be met effectively. The technical and operational ability to execute and receive payments through the company’s (new) bank accounts is a core requirement, which needs to be at the top of the list of priorities. Next, centralization of liquidity and cash structures is essential to avoid cash drag if inflows cannot be invested and/or concentrated in a relatively short time.

Treasury may also deal with different types of financial risk, such as interest rate or foreign exchange exposures. The financial risk management perspective is a crucial one for companies, but in the context of carve-out activities, it is often a second-order priority (depending on the financial risk profile of a company). However, proper identification and assessment of financial risk shall always be a top priority in a disentanglement process. Process implementation can be approached following the establishment of sound business and treasury processes if there is no significant financial risk.

If your organization is contemplating or in the midst of a carve-out, contact Zanders for support. Our consultative expertise in Treasury is your asset in ensuring financial stability and strategic advantage during and post-carve-out. Let Zanders be your partner in transforming challenges into successes.

Explore the crucial role of treasury in value creation and financial performance in private equity.

The evolving economic landscape has placed a spotlight on the critical role of treasury in value creation. Our latest roundtable, themed ‘Treasury’s Role in Value Creation,’ delved into the challenges and strategies private equity firms must navigate to enhance financial performance and prepare for successful exits. This event gathered industry leaders to discuss the expectations from treasury functions, the integration of post-merger processes, and the use of innovative technologies to drive growth. Read more as we explore the insights and key takeaways from this engaging and timely discussion, offering a roadmap for treasurers to elevate their impact within portfolio companies.

Roundtable theme: Treasury’s Role in Value Creation

The roundtable’s theme, ‘Treasury’s Role in Value Creation,’ was chosen to address the pressing economic and operational challenges that resulted in longer holding periods and slowed exits in 2023. In this context, private equity firms are increasingly focusing on growth and optimization strategies to drive long-term financial performance improvements, positioning their portfolio companies for successful exits once deal markets rebound. Key questions explored included: What is expected from the treasury function? How can treasurers navigate priorities and challenges to deliver productivity, financial performance, and value-added analysis to their company and PE sponsor? How can successful treasury post-merger integration be achieved in a buy & build scenario? And how should one prepare for an exit?

Key Insights and Strategic Directions

One of the significant discussion points was the value of cash management as a directly measurable lever of value creation. The panel emphasized the importance of focusing on free cash flow, EBITDA, and debt levels, which form the backbone of a successful investment. These metrics are crucial during due diligence, as they are scrutinized by Limited Partners (LPs). The consensus advocated for a focus on organic growth and business transformation over multiple expansions, which can signal stability and long-term value to LPs, and therefore add significant value to PE firms.

Moreover, it was discussed that, LPs intensely evaluate the financial models of portfolio companies, focusing on recurring revenue, Capex, margins, and debt levels. These factors often determine the soundness of an investment. The robustness of financial operations and the sophistication of the technologies employed are crucial in investment decisions, underscoring the important role of treasury in due diligence.

Enhancing ‘Buy and Build’ Strategies

Effective cash management was highlighted as a key factor influencing the success of ‘buy and build’ strategies, which involve acquiring companies and then integrating and growing them to enhance value. Effective cash management ensures the necessary liquidity and financial oversight during the integration and growth phases. An attendee noted that firms often "buy but forget to build." Quantifying the impact of effective treasury management is essential to addressing this gap.

A way of realizing operational improvements is through increased automation. Despite some pushback from PE firms on automating treasury functions, there are instances where sponsors are willing to invest in technologies to support the treasury function. For instance, an attendee mentioned receiving a sponsor’s support to invest in technology that will improve cash flow forecasting. Additionally, the approach to value creation at the portfolio company level depends on the sponsor's type and level of commitment.

The use of Artificial Intelligence (AI) in search of value creation was also discussed. Notably, various tangible use cases for AI in Treasury are envisaged. One example highlighted was ASML’s use of AI for forecasting optimization. Even though the large chip-manufacturer is not PE-owned, ASML’s use of AI for forecasting optimization served as a prime example in the discussion. In 2023, ASML implemented an AI-powered material intake forecast model to enhance the effectiveness and efficiency of its purchase FX hedging program1. This sharpened focus on FX risk management is a visible trend across private market firms. Deploying more sophisticated tools to increase FX hedging effectiveness at the PE fund or portfolio company level is an area worth exploring.

Looking Ahead

We reflect on a successful inaugural edition of the Private Equity Roundtable. We learned that effective cash management is crucial for value creation, focusing on free cash flow, EBITDA, and debt levels to ensure liquidity and financial oversight, particularly in ‘buy and build’ strategies. Moreover, automation and technology investments in treasury functions, such as improved cash flow forecasting, are essential for operational improvements and enhancing value creation in portfolio companies. After the event, participants shared that the event added significant value to their roles as treasurers of PE-owned companies. The positive feedback energizes us to organize similar sessions in other countries.

Is your company about to be or already owned by private equity? We can share our experiences regarding the added complexities of being a treasurer for a PE-owned company. For further information, you can reach out to Pieter Kraak.

As businesses continue to face challenges and uncertainty, it’s time to pick up the pace of change. And to do this corporate treasury requires a new roadmap.

This article highlights key points mentioned in our whitepaper: Treasury 4.x - The age of productivity, performance and steering. You can download the full whitepaper here.

Summary: Resilience amid uncertainty

Tectonic geopolitical shifts leading to fragile supply chains, inflation, volatility on financial markets and adoption of business models, fundamental demographic changes leading to capacity and skill shortages on relevant labor markets – a perpetual stream of disruption is pushing businesses to their limits, highlighting vulnerabilities in operations, challenging productivity, and leading to damaging financial consequences. Never has there been a greater need for CFOs to call on their corporate treasury for help steering their business through the persistent market and economic volatility. This is accelerating the urgency to advance the role of treasury to perform this broadened mandate. This is where Treasury 4.x steps in.

Productivity. Performance. Steering.

Treasury deserves a well-recognized place at the CFO's table - not at the edge, but right in the middle. Treasury 4.x recognizes the measurable impact treasury has in navigating uncertainty and driving corporate success. It also outlines what needs to happen to enable treasury to fulfil this strategic potential, focusing on three key areas:

1. Increasing productivity: Personnel, capital, and data – these three factors of production are the source of sizeable opportunities to drive up efficiency, escape an endless spiral of cost-cutting programs and maintain necessary budgets. This can be achieved by investing in highly efficient, IT-supported decision-making processes and further amplified with analytics and AI. Another option is outsourcing activities that require highly specialized expert knowledge but don’t need to be constantly available. It’s also possible to reduce the personnel factor of production through substitution with the data factor of production (in this context knowledge) and the optimization of the capital factor of production. We explain this in detail in Chapter 4 – Unlocking the power of productivity.

2. Performance enhancements: Currency and commodity price risk management, corporate financing, interest rate risk management, cash and liquidity management and, an old classic, working capital management – it’s possible to make improvements across almost all treasury processes to achieve enhanced financial results. Working capital management is of particular importance as it’s synonymous with the focus on cash and therefore, the continuous optimization of processes which are driving liquidity. We unpick each of these performance elements in Chapter 5 – The quest for peak performance.

3. Steering success: Ideologically, the door has opened for the treasurer into the CFO’s room. But many uncertainties remain around how this role and relationship will work in practice, with persistent questions around the nature and scope of the function’s involvement in corporate management and decision-making. In this document, we outline the case for making treasury’s contribution to decision-making parameters available at an early stage, before investment and financing decisions are made. The concept of Enterprise Liquidity Performance Management (ELPM) provides a more holistic approach to liquidity management and long-needed orientation. This recognizes and accounts for cross-function dependencies and how these impact the balance sheet, income statement and cash flow. Also, the topic of company ratings bears further opportunities for treasury involvement and value-add: through optimization of both tactical and strategic measures in processes such as financing, cash management, financial risk management and working capital management. These are the core subjects we debate in Chapter 6 – The definition of successful steering.

The foundations for a more strategic treasury have been in place for years as part of a concept which is named Treasury 4.0 . But now, as businesses continue to face challenges and uncertainty, it’s time to pick up the pace of change. And to do this corporate treasury requires a new roadmap.