Market Insights

Market Information Friday 20 September 2024

US bank stocks surged following the Federal Reserve rate cut, as investors anticipate improved earnings, despite short-term pressure on net interest income. Moody’s warns of initial challenges but predicts longer-term gains for banks as deposit costs adjust and economic growth extends. Regional banks may benefit most from increased demand in commercial real estate as rates decline.

ING, one of the largest banks in the Netherlands, has announced it will halt all new financing for pure-play upstream oil and gas companies developing new fields, as well as financing for new LNG export terminals after 2025. This move aligns with ING’s commitment to accelerating the global transition to a low-carbon economy. Other major European banks, including Barclays, HSBC, and BNP Paribas, have also imposed similar restrictions, while North American regional banks continue to lend to the fossil fuel industry.

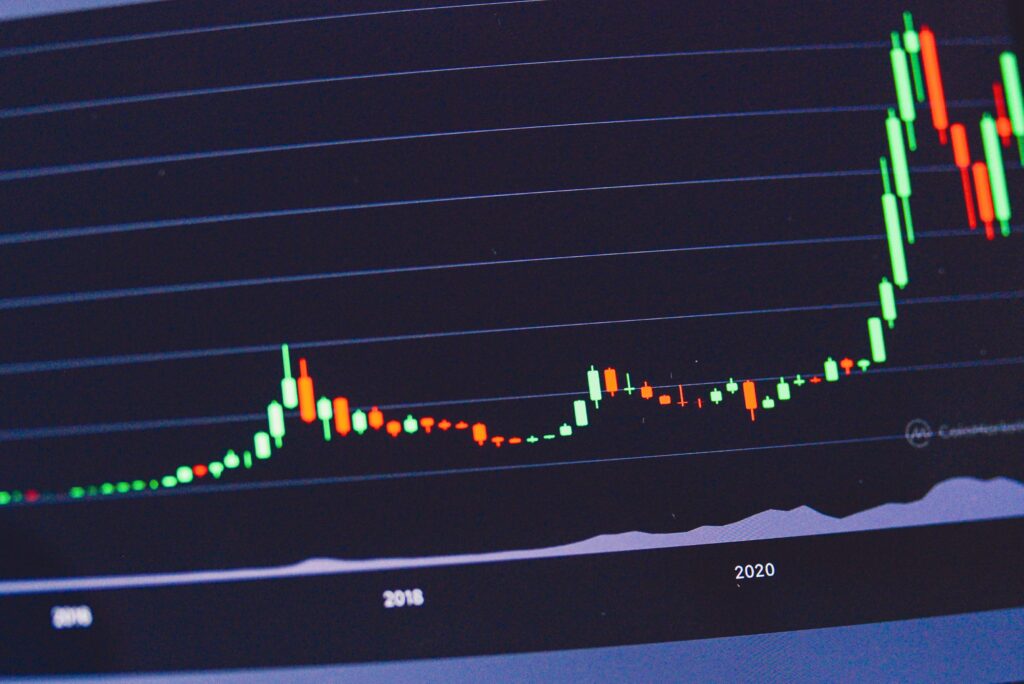

Bitcoin surged to a three-week high, rising nearly 5%, as global equities rallied following the Federal Reserve’s 50-basis-point interest rate cut. Traders see the aggressive start to monetary easing as positive for risky assets like Bitcoin, though Fed Chair Jerome Powell signaled future moves would depend on economic data. The correlation between crypto and traditional markets has grown, influenced by broader macroeconomic factors.

The 6M Euribor decreased with 3 basis points to 3.24% compared to previous business day. The 10Y Swap decreased with 3 basis points to 2.45% compared to previous business day.

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.