Market Insights

Market Information Tuesday 14 January 2025

The U.S. dollar hit a two-year high on Monday after a strong jobs report reduced expectations for Fed rate cuts. Investors await inflation data and Fed speeches, considering potential policy changes under President-elect Trump. The euro and British pound reached multi-year lows, while China’s yuan slightly strengthened amid defensive measures, and Japan’s yen showed resilience with potential rate hikes.

Oil reached a five-month peak as supply concerns arose from U.S. sanctions on Russian crude. WTI and Brent prices increased, driven by colder weather and falling stockpiles. Analysts expect Brent to average $73 by 2025, with OPEC+ planning to boost production. Major importers like China and India are cautious dealing with Russian oil.

Tech stocks fell Monday as investors took profits, with Nasdaq down 0.38% and Palantir sliding 3.4%. Sectoral rotation saw shifts to non-tech stocks like Amgen, while interest in AI remains strong thanks to demand indicated by TSMC and Foxconn earnings. Rising rates pressure tech stocks more than value stocks, influencing market dynamics.

The 6M Euribor decreased with 1 basis point to 2.64% compared to previous business day. The 10Y Swap increased with 1 basis point to 2.57% compared to previous business day.

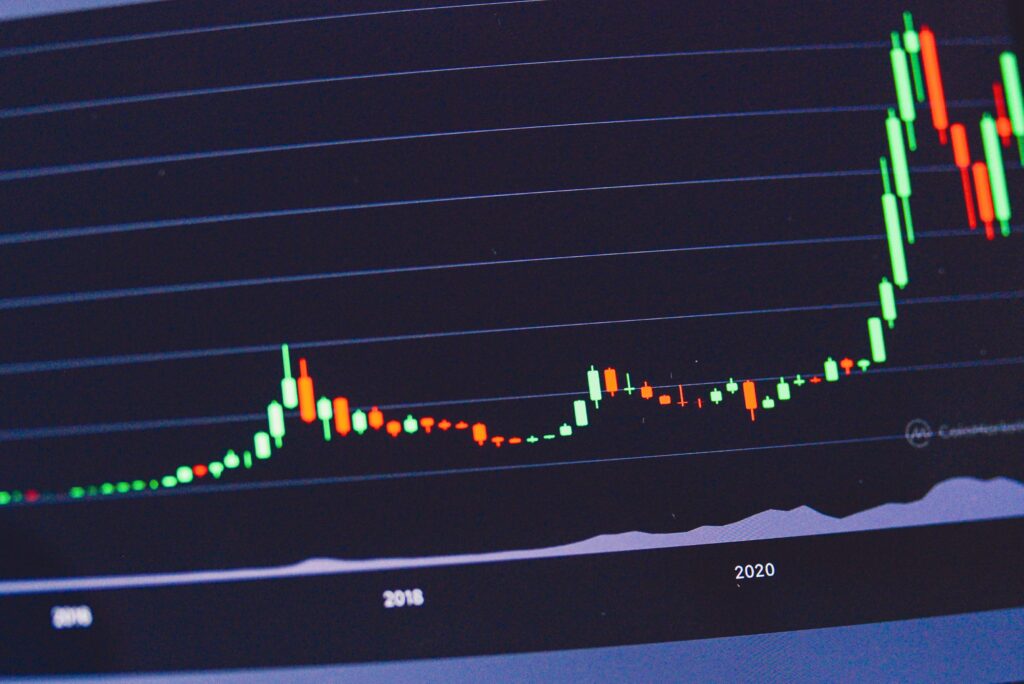

In the attachment, today’s market data on money and capital market rates as well as other rates are presented.